Hong Kong / PRC / Asia Pacific

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FIDELITY SALEM STREET TRUST Form NPORT-P Filed 2021-03-17

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-17 | Period of Report: 2021-01-31 SEC Accession No. 0001752724-21-055741 (HTML Version on secdatabase.com) FILER FIDELITY SALEM STREET TRUST Mailing Address Business Address 245 SUMMER STREET 245 SUMMER STREET CIK:35315| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0430 BOSTON MA 02210 BOSTON MA 02210 Type: NPORT-P | Act: 40 | File No.: 811-02105 | Film No.: 21749300 617-563-7000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Quarterly Holdings Report for Fidelity® SAI Emerging Markets Low Volatility Index Fund January 31, 2021 Offered exclusively to certain clients of the Adviser or its affiliates - not available for sale to the general public. Fidelity SAI is a product name of Fidelity® funds dedicated to certain programs affiliated with Strategic Advisers LLC. MLV-QTLY-0321 1.9892172.102 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks - 99.3% Shares Value Bailiwick of Jersey - 0.6% WNS Holdings Ltd. sponsored ADR (a) 133,901 $8,995,469 Bermuda - 1.3% China Resource Gas Group Ltd. 2,526,000 12,640,996 Shenzhen International Holdings Ltd. 3,307,714 5,452,241 TOTAL BERMUDA 18,093,237 Brazil - 0.2% Atacadao SA 902,600 3,140,970 Cayman Islands - 17.1% Anta Sports Products Ltd. 1,584,000 26,211,872 Bosideng International Holdings Ltd. 9,214,000 4,088,113 China Biologic Products Holdings, Inc. (a) 33,383 3,934,187 Hansoh Pharmaceutical Group Co. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Annual Report on the Performance of Portfolio Companies, IX November 2016

Annual report on the performance of portfolio companies, IX November 2016 Annual report on the performance of portfolio companies, IX 1 Annual report on the performance of portfolio companies, IX - November 2016 Contents The report comprises four sections: 1 2 3 4 Objectives Summary Detailed Basis of and fact base findings findings findings P3 P13 P17 P45 Annual report on the performance of portfolio companies, IX - November 2016 Foreword This is the ninth annual report The report comprises information and analysis With a large number of portfolio companies, on the performance of portfolio to assess the potential effect of Private Equity a high rate of compliance, and nine years of ownership on several measures of performance information, this report provides comprehensive companies, a group of large, of the portfolio companies. This year, the and detailed information on the effect of Private Equity (PE) - owned UK report covers 60 portfolio companies as at 31 Private Equity ownership on many measures of businesses that met defined December 2015 (2014:62), as well as a further performance of an independently determined 69 portfolio companies that have been owned group of large, UK businesses. criteria at the time of acquisition. and exited since 2005. The findings are based Its publication is one of the steps on aggregated information provided on the This report has been prepared by EY at the portfolio companies by the Private Equity firms request of the BVCA and the PERG. The BVCA adopted by the Private Equity has supported EY in its work, particularly by industry following the publication that own them — covering the entire period of Private Equity ownership. -

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

STOXX Hong Kong All Shares 50 Last Updated: 01.10.2015

STOXX Hong Kong All Shares 50 Last Updated: 01.10.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 79.6 1 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 59.3 2 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 55.8 3 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 49.6 4 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 36.3 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 29.3 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 23.2 7 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 23.1 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 22.6 9 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 18.5 10 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 11 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 15.2 12 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 14.6 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 13.9 14 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.1 15 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 11.7 16 HK0011000095 6408374 0011.HK 640837 Hang Seng Bank Ltd. -

聯想控股股份有限公司 Legend Holdings Corporation

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 聯想控股股份有限公司 Legend Holdings Corporation (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 03396) Connected Transaction Investment in a Private Equity Fund On December 24, 2019, Dongfangqihui (a subsidiary of the Company, and as one of the limited partners) and other limited partners jointly entered into the Partnership Agreement with Hony Capital Management (as the general partner and manager) to set up a fund, pursuant to which, the total amount of the final capital commitment of Dongfangqihui shall not exceed RMB800 million, and the proportion of its commitment shall not exceed 20% of the total size of the Fund. Mr. ZHAO is a connected person of the Company under Chapter 14A of the Listing Rules, and he also indirectly controls over 30% of interests in Hony Capital Management. Therefore, Hony Capital Management is deemed to be an associate of Mr. ZHAO. Under Chapter 14A of the Listing Rules, the transaction contemplated under the Partnership Agreement constitutes a connected transaction of the Company. As the applicable percentage ratio exceeds 0.1% but is less than 5%, it is subject to the reporting and announcement requirements but exempt from the independent shareholders’ approval requirements under Chapter 14A of the Listing Rules. -

Alternative Investments 2020: the Future of Capital for Entrepreneurs and Smes Contents Executive Summary

Alternative Investments 2020 The Future of Capital for Entrepreneurs and SMEs February 2016 World Economic Forum 2015 – All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, or by any information storage and retrieval system. B Alternative Investments 2020: The Future of Capital for Entrepreneurs and SMEs Contents Executive summary 1 Executive summary Over the past decade, the external environment for alternative investments has seen 2 1. Introduction enormous changes. The areas affected the most are start-up capital and venture 3 1.1. Background funding for entrepreneurs, crowdfunding and marketplace lending for small businesses, 3 1.2. Scope and private debt for mid-market enterprises. 6 2. The shake-up of traditional start-up capital 6 2.1. Overview In all three cases, a set of interlocking factors is driving the emergence of new 8 2.2. What you need to know capital sources: 11 2.3. What to look out for 11 2.4. Take-away Regulation: where regulation constrains a capital flow for which there 1. is demand, a new source of capital will emerge to fulfil that demand; 12 3. The rise of crowdfunding 12 3.1. Overview 14 3.2. What you need to know Changes in demand for capital: where capital destinations develop 16 3.3. What to look out for 2. demand for new forms of funding, investors will innovate to meet it; 17 3.4. Take-away Technology: where technology enables new types of origination, 18 4. Mid-market capital 18 4.1. -

PE & QSR: Ambition on a Bun Asian Venture Capital Journal | 06

PE & QSR: Ambition on a bun Asian Venture Capital Journal | 06 November 2019 Many private equity investors think they can make a fast buck from fast dining, but rolling out a Western-style brand in Asia requires discipline on valuation and competence in execution Gondola Group was among the last remaining assets in Cinven’s fourth fund, and as one LP tells it, exit prospects were uncertain. The portfolio company’s primary business was PizzaExpress, which had 437 outlets in the UK and a further 68 internationally as of June 2014. Expansion in China by the brand’s Hong Kong-based franchise partner had been measured, with about a dozen restaurants apiece in Hong Kong and the mainland. Cinven wasn’t willing to be so patient. In May 2014, Gondola opened a directly owned outlet in Beijing – as a showcase of what the brand might achieve in China when backed by enough capital and ambition. Two months after that, PizzaExpress was sold to China’s Hony Capital for around $1.5 billion. By the start of the following year, Cinven had offloaded the remaining Gondola assets and generated a 2.4x return for its investors. The LP was “pleasantly surprised” by the outcome. Hony’s experience with the restaurant chain hasn’t be as fulfilling. Adverse commercial conditions in the UK – still home to 480 of its approximately 620 outlets – has eaten into margins and left PizzaExpress potentially unable to sustain an already highly leveraged capital structure. Hony is considering restructuring options for a GBP1.1 billion ($1.4 billion) debt pile. -

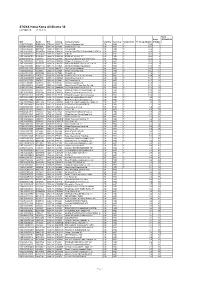

2019Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2019 REPORT For the six months ended 30 June 2019 Value Partners Limited 43rd Floor, The Center 99 Queen’s Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartner-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-8 Statement of fnancial position (unaudited) 9 Investment portfolio (unaudited) 10-13 Statement of movements in portfolio holdings (unaudited) 14-15 SEMI-ANNUAL REPORT 2019 For the six months ended 30 June 2019 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law: 43rd Floor, The Center Maples and Calder 99 Queen’s Road Central P.O. Box 309, Ugland House Hong Kong Grand Cayman, KY1-1104 Cayman Islands Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law: Mr. So Chun Ki Louis Deacons Mr. -

Xiaomi Soars on Dualclass Shares Deal

16 BUSINESS Thursday, July 19, 2018 CHINA DAILY HONG KONG EDITION BGI officials hike equity stakes as prices fall Xiaomi soars By CHAI HUA range of its gene testing in Shenzhen, Guangdong methods. [email protected] The company said it had performed DNA-based non- on dual-class Chinese genomics giant invasive prenatal testing on BGI, known as the Beijing 3.1 million pregnant women Genomics Institute previous- globally by the end of May, ly, announced on Tuesday that and 2.48 million of their seven of its executives have babies were born. It also shares deal decided to increase their equi- admitted 70 infants with ty holdings in the company, abnormal chromosome con- after a two-day stock slump ditions were born due for Mainland, HK bourses’ agreement on triggered by a series of reports different reasons and insur- attacking its credibility. ance was provided for these Stock Connect inclusion lifts sentiment A report from tech news families. site huxiu revealed some new- DNA-based non-invasive By SUN FEIER in Hong Kong structure, Xiaomi, which borns with defects were previ- prenatal testing is generally [email protected] opened at HK$21.40 ($2.73) ously assessed as low risk by used to test for Down syn- on Wednesday, surged more BGI’s DNA-based non-inva- drome, and 98 percent of Mainland stock exchanges than six percent in the morn- sive prenatal testing. It took fetuses with the condition can and the Hong Kong stock ing trading session. It hit an the case of a boy with mental be tested, according to a study exchange have reached an intraday high of HK$22.20, disabilities and physical in the United Kingdom, said agreement on adjusting Stock before closing at HK$21.55 in deformities in Hunan prov- Cheung Ching-lung, assistant A visitor walks past a board showing big data for genomics in a BGI R&D facility in Qingdao, Connect inclusion arrange- the afternoon, up 3.11 percent ince as an example. -

SME Financial Services in China: Institutional Framework And

SME Financial Services in China: Institutional Framework and Emerging Opportunities SMEs are the backbone of China’s economy but are under-served In China, SMEs accounted for 60% of GDP and 80% of employment but they accounted for less than 40% of total bank loans. Aside from banks, SMEs have few other sources of finance. Risk management is commercial banks’ primary concern, such that loan approval usually takes at least 1 month which certainly cannot fulfill the timely funding requirement of SMEs. Further, most types of loan products such as cashflow lending and unsecured lending are still in premature stage. SME’s difficulties are especially great during periods of liquidity tightening when bank head offices allocate lending quotas to the politically powerful state-owned enterprise sector in preference to SMEs. Rapid growth in the non-bank financing sector creates opportunities We estimated that the CAGR for new loan from non-bank channels grew at 32.8% during 2008-2012, far exceeding new RMB bank loan growth of 13.7%. This is due to the government’s promuglation of new regulations on non-bank financing institutions. As a result, the sector grew rapidly, for example, small loan companies experienced 98% and 51% growth in loan during 2011 and 2012, and finance leasing companies recorded 40% growth in receivabes during 2011. We believe that the industry is in its infancy and will grow substantially, but the industry is still quite fragmented with yet non-existence of national players. The SME financing sector has begun to receive policy support Over the past 10 years, the central government has rolled out numerous policy document encouraging SME lending and clarifying the legal status of non-bank financing institutions. -

GESCHÄFTSBERICHT 2007 ANNUAL REPORT 2007 GB P3 07.Qxp:GB P3 18.3.2008 16:15 Uhr Seite 2

GB_P3_07.qxp:GB_P3 18.3.2008 16:15 Uhr Seite 1 GESCHÄFTSBERICHT 2007 ANNUAL REPORT 2007 GB_P3_07.qxp:GB_P3 18.3.2008 16:15 Uhr Seite 2 GESCHÄFTSBERICHT 2007 ÜBERBLICK 2007 OVERVIEW 2007 ENTWICKLUNG DES BÖRSENKURSES UND DES INNEREN WERTES 01.01.2007 BIS 31.12.2007 PRICE AND NAV DEVELOPMENT 01.01.2007 UNTIL 31.12.2007 1’600 1’500 1’400 1’300 EUR in 1’200 1’100 1’000 900 12.06 01.07 02.07 03.07 04.07 05.07 06.07 07.07 08.07 09.07 10.07 11.07 12.07 Innerer Wert pro Zertifikat / Net Asset Value (NAV) per certificate Preis / Price 2 GB_P3_07.qxp:GB_P3 18.3.2008 16:15 Uhr Seite 3 ANNUAL REPORT 2007 Firmenprofil Company Profile Die Partners Group Private Equity Performance Holding Partners Group Private Equity Performance Holding Limited Limited («P3 Holding», «P3») ist eine nach dem Recht von (“P3 Holding”, “P3”) is a limited liability company, which was Guernsey gegründete Gesellschaft mit beschränkter Haftung incorporated under the laws of Guernsey and is domiciled in mit Sitz in St. Peter Port, Guernsey. Der Zweck der Gesell- St. Peter Port, Guernsey. The objective of the company is to schaft ist die Verwaltung und Betreuung eines Portfolios aus professionally manage a portfolio of investments in private Beteiligungen an Private Equity-Zielfonds, börsennotierten equity partnerships, listed private equity vehicles and direct Private Equity-Gesellschaften und Direktinvestitionen. P3 investments. P3 is supported in its activities by the Invest- wird in dieser Tätigkeit durch ihren Anlageberater Partners ment Advisor, Partners Group, which is a global alternative Group beraten.