Gaylen D. Rust and Rust Rare Coin, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seniority Rank with Extimated Times.Xlsx

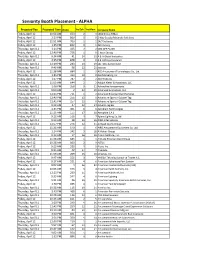

Seniority Booth Placement ‐ ALPHA Projected Day Projected Time Order Yrs Exh Yrs Mem Company Name Friday, April 12 10:54 AM 633 2 3 1602 Group TiMax Friday, April 12 2:10 PM 860 002 Way Supply/Motorola Solutions Friday, April 12 11:51 AM 700 1 2 24/7 Software Friday, April 12 1:45 PM 832 0 1 360 Karting Thursday, April 11 3:14 PM 435 7 2 50% OFF PLUSH Friday, April 12 12:40 PM 756 105‐hour Energy Thursday, April 11 9:34 AM 41 24 10 A & A Global Industries Friday, April 12 2:25 PM 878 0 0 A.E. Jeffreys Insurance Thursday, April 11 12:29 PM 243 13 19 abc rides Switzerland Thursday, April 11 9:49 AM 58 22 25 accesso Friday, April 12 11:38 AM 684 1 3 ACE Amusement Technologies Co., Ltd. Thursday, April 11 1:46 PM 333 10 8 Ace Marketing Inc. Friday, April 12 1:07 PM 787 0 2 ADJ Products Friday, April 12 11:03 AM 644 2 2 Adolph Kiefer & Associates, LLC Thursday, April 11 2:08 PM 358 9 11 Adrenaline Amusements Thursday, April 11 9:00 AM 2 33 29 Advanced Animations, LLC Friday, April 12 12:01 PM 711 1 2 Advanced Entertainment Services Thursday, April 11 12:40 PM 256 13 0 Adventure Sports HQ Laser Tag Thursday, April 11 12:41 PM 257 13 0 Adventure Sports HQ Laser Tag Thursday, April 11 9:39 AM 47 23 24 Adventureglass Thursday, April 11 2:45 PM 401 8 8 Aerodium Technologies Thursday, April 11 11:13 AM 155 17 18 Aerophile S.A.S Friday, April 12 9:12 AM 516 4 7 Aglare Lighting Co.,ltd Thursday, April 11 9:23 AM 28 25 26 AIMS International Thursday, April 11 12:57 PM 276 12 11 Airhead Sports Group Friday, April 12 11:26 AM 670 1 6 AIRO Amusement Equipment Co. -

Attractions Management News 7Th August 2019 Issue

Find great staff™ Jobs start on page 27 MANAGEMENT NEWS 7 AUGUST 2019 ISSUE 136 www.attractionsmanagement.com Universal unveils Epic Universe plans Universal has finally confirmed plans for its fourth gate in Orlando, officially announcing its Epic Universe theme park. Announced at an event held at the Orange County Convention Center in Orlando, Epic Universe will be the latest addition to Florida's lucrative theme park sector and has been touted as "an entirely new level of experience that forever changes theme park entertainment". "Our new park represents the single- largest investment Comcast has made ■■The development almost doubles in its theme park business and in Florida Universal's theme park presence in Orlando overall,” said Brian Roberts, Comcast chair and CEO. "It reflects the tremendous restaurants and more. The development excitement we have for the future of will nearly double Universal’s total our theme park business and for our available space in central Florida. entire company’s future in Florida." "Our vision for Epic Universe is While no specific details have been historic," said Tom Williams, chair and revealed about what IPs will feature in CEO for Universal Parks and Resorts. This is the single largest the park, Universal did confirm that the "It will become the most immersive and investment Comcast has made 3sq km (1.2sq m) site would feature innovative theme park we've ever created." in its theme park business an entertainment centre, hotels, shops, MORE: http://lei.sr/J5J7j_T Brian Roberts FINANCIALS NEW AUDIENCES -

GLBT, Vatican Child Molester Protection --- Newsfollowup.Com

GLBT, Vatican child molester protection --- NewsFollowUp.com NewsFollowUp.com search Obama pictorial index sitemap home Gay / Lesbian News for the 99% ...................................Refresh F5...archive home 50th Anniversary of JFK assassination "Event of a Lifetime" at the Fess Parker Double Tree Inn. JFKSantaBarbara. below Homosexuality is natural, Livescience There's no link between homosexuality and pedophilia ... The Catholic Church would have you believe otherwise. more = go to NFU pages Gay Bashing. Legislation Gay marriage Media Gays in the Military Troy King, Alabama Attorney General, homophobe. related topics: AIDS Health Social Umbrella PROGRESSIVE REFERENCE CONSERVATIVE* Advocate.com stop the slaughter of LGBT's in Iraq GOP hypocrisy? CAW gay and lesbian rights wins, pension info Egale, Canada, to advance equality for Canadian LGBT Gay Blog news Gaydata Gay media database, info Answers Jeff "Gannon, Gaysource Lesbian, gay, Bisexual, Transgender Crist, Foley, Haggard... who knew the GOP was below Community having a coming out party? We could have been DOMA, Defense of Marriage Act Gay World travel, media, news, health, shopping supportive of their decisions to give oral sex to male American Family Association preservation of traditional GLAD Gay Lesbian Advocates and Defenders prostitutes but they went and outlawed it.... family. Boycott Ford for contributing to gay issues. GLAAD Media coverage of openly gay, lesbian, Canada, Netherlands, Belgium and Spain have all bisexual, and transgender candidates and elected legalized gay marriage as of July, 2005 officials in the West does not seem to be focusing on Daily Comet the sexual orientation of those candidates. DayLife "U.S. Republican presidential candidate John Human Rights Campaign lgbt equal rights. -

Attractions Management News 4Th September 2019 Issue

Find great staff ™ IAAPA EXPO EUROPE ISSUE MANAGEMENT NEWS 4 SEPTEMBER 2019 ISSUE 138 www.attractionsmanagement.com World's tallest coaster for Six Flags Qiddiya Six Flags has announced new details for its long-awaited venture in Saudi Arabia, revealing among its planned attractions the longest, tallest and fastest rollercoaster in the world and the world's tallest drop-tower ride. When it opens in 2023, Six Flags Qiddiya will be a key entertainment facility in the new city of Qiddiya, which is being built 40km (25m) from the Saudi capital of Riyadh. The park will cover 320,000sq m (3.4 million sq ft) and will feature 28 rides and attractions, with QThe record-breaking Falcon's Flight will six distinct lands around The Citadel open as part of the Qiddiya park in 2023 – a central hub covered by a billowing canopy inspired by Bedouin tents, where from all over the world have come to visitors will fi nd shops and cafés. expect from the Six Flags brand and The record-breaking Falcon's Flight to elevate those experiences with coaster and Sirocco Tower drop-tower will authentic themes connected to the be situated in The City of Thrills area. location," said Michael Reininger, CEO Our vision is to make "Our vision is to make Six Flags of Qiddiya Investment Company, which Six Flags Qiddiya a park Qiddiya a theme park that delivers all is driving the development of Qiddiya. that delivers thrills the thrills and excitement that audiences MORE: http://lei.sr/w5R9z_A Michael Reininger THEME PARKS AQUARIUMS MUSEUMS Disney to open Avengers World's 'highest -

Art Direction Interior Design Digital Modeling Concept Development

ART DIRECTION INTERIOR DESIGN DIGITAL MODELING CONCEPT DEVELOPMENT An enthusiastic visual storyteller and a bold environmental designer. I delight in world building, collaborating on inspiring and creative solutions, and breaking down the biggest conceptual ideas into the smallest design details. Space planning to material selection, distilling broad concepts into presentation mood boards to building comprehensive 3D models, I’ve enjoyed working for clients such as Warner Bros., NBC Universal, Lionsgate, Cirque du Soleil, NFL, Nickelodeon, & Google. SketchUp Lumion Adobe Creative Suite Revit V-ray AutoCAD 3ds Max G-Suite Interior Design Scenic Painting Material & Texture Reference Packages Historical Research PROFESSIONAL EXPERIENCE SHIRAZ CREATIVE, Los Angeles, CA 2019 EXPERIENTIAL EVENT DESIGNER - CONTRACT [DEC 2019] Conceived and developed design proposals for multiple immersive pop-up exhibition events. SCOUT EXPEDITION CO, Los Angeles, CA 2019 LEAD SCENIC ARTIST [AUG - SEPT 2019] Designed & installed large scenic elements for The Nest, a THEA Award winning immersive experience. THE HETTEMA GROUP, Pasadena, CA 2019 DESIGNER [APRIL - JULY 2019] Built and managed project Master Model, refining area development and maintaining design integrity of an E-Ticket attraction from SD into DD, which served as the base for all illustration and show set design efforts. THINKWELL GROUP, Los Angeles, CA 2015 – 2019 ASSOC. ART DIRECTOR [SEPT 2018 - FEB 2019] Directed the design deliverable efforts on 5 domestic and international projects (including the THEA Award winning projects Lionsgate Entertainment World & WB World, Abu Dhabi) ranging in scope from shoestring budget museum overlays to multi-million dollar entertainment complexes and attractions. Conceptualized and communicated the visual aesthetic of projects with clients, working closely with the project management teams and Creative Director to develop the overall narrative and maintain consistency. -

Art Direction Experience Design

ART DIRECTION EXPERIENCE DESIGN DIGITAL MODELING CONCEPT DEVELOPMENT An enthusiastic visual storyteller and a bold experience designer. My aim is to craft innovative and impactful experiences starting with the unexpected and layering in thought-provoking design. I delight in world building, collaborating on inspiring and creative solutions, and breaking down the biggest conceptual ideas into the smallest design details. From space planning to material selection, storyboarding broad concepts to building comprehensive 3D models, I’ve enjoyed working for clients such as Warner Bros., NBC Universal, Lionsgate, Cirque du Soleil, NFL, Nickelodeon, & Google. SketchUp Lumion Adobe Creative Suite V-ray Podium AutoCAD G-Suite Storyboarding Scenic Painting Material & Texture Reference Packages Historical Research PROFESSIONAL EXPERIENCE SHIRAZ CREATIVE, Los Angeles, CA 2019 EXPERIENTIAL EVENT DESIGNER - CONTRACT [DEC 2019] Conceived and developed design proposals for multiple immersive pop-up product launch events. SCOUT EXPEDITION CO, Los Angeles, CA 2019 LEAD SCENIC ARTIST [AUG - SEPT 2019] Designed and installed large scenic elements on a micro-budget for "The Nest" immersive experience. THE HETTEMA GROUP, Pasadena, CA 2019 DESIGNER [APRIL - JULY 2019] Built and managed project Master Model, refining area development and maintaining design integrity of an E-Ticket attraction from SD into DD, which served as the base for all illustration and show set design efforts. THINKWELL GROUP, Los Angeles, CA 2015 – 2019 ASSOC. ART DIRECTOR [SEPT 2018 - FEB 2019] Directed the design deliverable efforts on 5 domestic and international projects ranging in scope from shoestring budget museum overlays to multi-million dollar entertainment complexes and attractions. Conceptualized and communicated the visual aesthetic of projects with clients, working closely with the project management teams and Creative Director to develop the overall narrative and maintain consistency. -

Applying Immersive Theater Trends to Theme Parks and Attractions 14 November 2018

Applying Immersive Theater Trends to Theme Parks and Attractions 14 November 2018 Taylor Jeffs, Legacy Entertainment Today’s Agenda -Introduction -What is Immersive Theater? -A History of Extreme Immersion in Theme Parks & Attractions -What’s Happening Now? And What’s Next? -Why is This Trend Important? -Discussion Discussion Preview -Which of these experiences is most interesting to you, and why? -Why do you think guests connect with Immersive Experiences? -How important are Brands / IP’s to the success of these projects? -Is there relevance for these trends beyond Theme Parks? -Is high-immersion a fad, or a permanent part of our industry? Introduction Taylor Jeffs Legacy Entertainment President & Chief Creative Officer Legacy Entertainment What is Immersive Theater? What is Immersive Theater? -A theatrical work that takes place in a non-traditional setting. -Spectator may be an active participant in the proceedings. -All five senses may be engaged. -Often skews young / popular with Millennial Audiences. -Dynamic format to remove barriers between guests and performers. Benchmark: Sleep no More Benchmark: Sleep no More Producer: Punchdrunk International Location: New York & Shanghai Premiered: March 2011 in New York, December 2016 in Shanghai Special Characteristic: High Capacity “Choose your Own Adventure” Benchmark: Sleep no More Benchmark: Delusion Benchmark: Delusion Producer: Jon Braver / Delusion Location: Los Angeles Premiered: October 2011 (Seasonal Productions) Special Characteristics: Highly-Active First-Person Experience, and -

Attractions Management 1 2021

www.attractionsmanagement.com @attractionsmag VOL26 1 2021 MARINE WHITE LIGHT SPECIAL Adventures Merlin's new in extended whale sanctuary in reality p66 Iceland, plus robot dolphins p46 BLACK LIVES MATTER BOB Debating ROGERS the role of museums Celebrating the p34 40th anniversary of BRC p58 ALONE WITH VERMEER A personal audience with a masterpiece p44 SARAH ROOTS Applying lessons learned in London to the Harry Potter Studio Tour Tokyo OF TRANSFORMATIVE, HUMAN EXPERIENCES. 14 attractionsmanagement.com 1 2021 BRC Imagination Arts is a full-service, strategic design and production company that translates brand and cultural stories into transformative, human experiences. For 40 years, we’ve stood on the front lines, helping our clients build more meaningful, enduring relationships with audiences around the globe. Our unique body of work has earned us over 400 awards for some of the most respected and acclaimed brand and cultural destinations in the world. Learn more: www.brcweb.com Rock and Roll Hall of Fame | Cleveland, Ohio attractionsmanagement.com 1 2021 15 www.forrec.com EDITOR’S LETTER Doing better The Black Lives Matter movement has challenged museums professionals to ask testing questions about their role in reparative history and the way we display and interpret racist and colonial collections ine months have passed since the murder of George Floyd ignited the Black Lives Matter movement, N causing many to pause, reflect and commit to change. BLM didn’t make demands – protesters were simply saying, this is a catastrophic problem but not of our making, we’ve done nothing wrong. What are YOU going to do about it? The global response was immediate and unprecedented, with organisations, private individuals and corporations promising change. -

The Legend of Camel Bells

#76 • volume 14, issue 6 • 2018 www.inparkmagazine.com The Legend of Camel Bells ACE technology and a Thea Award 骆驼传奇; ACE技术与Thea IAAPA 2018 Cartoon Network The Zoovolution A look at the highlights, news and New IP for the Zoos and aquariums trends from the 2018 IAAPA Expo LBE marketplace rely on public support inparkmagazine.com Niche is nice, but When VR really works broader is better Judith Rubin, Martin Palicki, IPM editor IPM publisher ompared to the film and TV industry that predates re we missing the point about VR? It’s easy to get Cit, themed entertainment has traditionally been small, Acaught up in the noise around this presentation compact and laser-focused on a few big theme park clients. technology. Virtual Reality carries a lot of baggage between the jaded skeptics (including yours truly) who saw it come But visiting Orlando’s IAAPA Expo last month made it and go in the 1990s, the hype, and the headset wars. But at clear that the industry is growing – evidenced not only by the 2018 IAAPA Expo in Orlando, there were some truly the expanded and still sold out exhibit floor but also by the effective presentations, even transcendent. reach of the market. Large theme parks are not the only customers seeking themed entertainment’s expertise. As a media delivery tool, the VR headset needs to be so good that it makes the headset go away, freeing the end user It’s a story we at InPark have been telling for some to dive into the experience. At IAAPA Orlando, we saw this time now. -

Complaint: Rust Rare Coin Inc., Et Al

Case 2:18-cv-00892-TC Document 56 Filed 12/06/18 Page 1 of 45 Thomas L. Simek, [email protected] Jennifer J. Chapin, [email protected] Attorneys for Plaintiff COMMODITY FUTURES TRADING COMMISSION 4900 Main Street, Suite 500 Kansas City, MO 64112 (816) 960-7700 SEAN D. REYES (7969) Utah Attorney General Thomas M. Melton (4999), [email protected] Robert Wing (4445), [email protected] Jennifer Korb (9147), [email protected] Paula Faerber (8518), [email protected] Assistant Attorneys General Attorneys for Plaintiff STATE OF UTAH DIVISION OF SECURITIES 160 East 300 South, Fifth Floor Salt Lake City, Utah 84114 (801) 366-0310 IN THE UNITED STATES DISTRICT COURT DISTRICT OF UTAH, CENTRAL DIVISION COMMODITY FUTURES TRADING FIRST AMENDED COMPLAINT FOR COMMISSION, and INJUNCTIVE RELIEF, CIVIL MONETARY PENALTIES, AND OTHER EQUITABLE STATE OF UTAH DIVISION OF RELIEF SECURITIES, through Attorney General, Sean D. Reyes, Plaintiffs, Case No. 2:18-CV-00892-TC v. Judge: Tena Campbell RUST RARE COIN INC., a Utah corporation, GAYLEN DEAN RUST, an individual, DENISE GUNDERSON RUST, an individual, and JOSHUA DANIEL RUST, an individual Defendants; 1 Case 2:18-cv-00892-TC Document 56 Filed 12/06/18 Page 2 of 45 and ALEESHA RUST FRANKLIN, an individual, R LEGACY RACING INC, a Utah corporation, R LEGACY ENTERTAINMENT LLC, a Utah limited liability company, and R LEGACY INVESTMENTS LLC, a Utah limited liability company. Relief Defendants. Plaintiffs Commodity Futures Trading Commission (“CFTC”) and the State of Utah Division of Securities (“State of Utah”), by and through their undersigned attorneys, hereby allege as follows: I. -

Attractions Management News 30Th October 2019 Issue

Find great staff™ Jobs start on page 25 MANAGEMENT NEWS 30 OCTOBER 2019 ISSUE 142 www.attractionsmanagement.com Cannes to become 'audiovisual Silicon Valley' The Palais des Festivals in Cannes – venue for the iconic film festival and a host of other events – is to be enlarged as part of a multifaceted project that aims to turn the French city into an "audiovisual Silicon Valley". The €500m (US$556m, £432m) project will add another storey to the Palais building to house a 500-seat theatre, as well as renovating the Salon des Ambassadeurs, which is used for hosting receptions and exhibitions. /FRANTOGIAN © WIKIPEDIA.COM Also included in the project is the ■■The annual Cannes Film Festival takes creation of a technology park that will place at the Palais des Festivals feature a 1,200-student university campus dedicated to film, television, Cannes festival and special effects, is set video games and web creation, a to be ready for its first visitors by 2025. 12-screen multiplex cinema that would Cannes mayor David Lisnard house the biggest screen in southwestern announced the project at an event France and an international film museum. in Paris and revealed that €175m €175m of the project The cinema is due to open in June (US$195m, £151m) of the project budget budget has so far been 2020, while the film museum, which will has so far been raised or committed. raised or committed focus on the history of moviemaking, the MORE:READ http: MO//lei.sr/r6RE ONLINES5S_A David Lisnard LATEST JOBS RESULTS MAJOR PROJECT Universal theme parks Waterpark -

Following the Leaders Following the Leaders

Following the leaders #78 • volume 15, issue 2 • 2019 www.inparkmagazine.com 如下是领导者 Also in this issue • Ten AV technologies transforming the attractions industry • Reports from DEAL, ISE and the TEA Summit/Theas • IAAPA Expo Asia brings together professionals in Shanghai •题娱乐产业技术前瞻 •Thea Awards相关报道 • IAAPA亚洲博览会预览 We’ve just one-upped ourselves. Again. Cabinet-free. Ultra-lightweight. Any shape you want. © 2019 Christie Digital Systems USA, Inc. All rights reserved. Inc. USA, © 2019 Christie Digital Systems microtiles.com CHRI4739_InPark_May_19_Final.indd 1 25/04/2019 11:34 审视自我,迈向世界 Think locally, act globally Martin Palicki, 作者:Martin Palicki IPM publisher 本期内容关注故事方面,很容易得出几个结 ooking at stories in this issue, it’s easy to draw a couple of 论。首先,行业正处于良性发展并持续增长状 Lconclusions. First, the industry is in a good spot. Growth continues to be positive, but perhaps more importantly, 态。但可能更重要的是,感觉有点摇摆的市场 markets that perhaps felt a bit questionable appear more 似乎更加稳定。世界一直变化多端,但是和我 stable. There will always be volatility in the world, but the 们行业息息相关的特定区域,地继续推动着休 particular regions most relevant to our industry seem reliably 闲和娱乐花费。此外,还有其他经济体(特别 poised to continue driving leisure and entertainment spending. 是俄罗斯,印度和中东地区)正在为新的机遇 Further, there are additional economies (especially in Russia, India and the Middle East) that are gearing up for new waves 潮做好准备。 of opportunity. 其次,很显然北美和欧洲在这个行业处于领导 Second, it’s also clear that the era of North American and 地位的时代正在发生变化。DEAL会议和2019 European leadership in this industry is changing. As evidenced TEA Thea颁奖名单都证明了,亚洲的供应商和 at both the DEAL conference and in the slate of 2019 TEA 领导者正在改变这种范式,并且他们的能力似 Thea Awards, suppliers and leaders in Asia are changing the 乎在不断提升。 paradigm, and their capabilities appear to be ever-expanding.