Aluworks Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017 Annual Report and Financial Statements

2017 ANNUAL REPORT AND FINANCIAL STATEMENTS 2017 ANNUAL REPORT AND FINANCIAL STATEMENTS SAS FORTUNE FUND LIMITED 3 SAS FORTUNE FUND LIMITED CORPORATE INFORMATION The Manager: SAS Investment Management Ltd. (SAS-IM) 14th Floor WTCA Building, Indep. Avenue, Accra Tel: +233-302-661770/2/008/880 +233-302-661900 Fax: +233-302-663999 E-mail: [email protected] Website: www.sasghana.com Directors of the Fund: Maxwell Logan (Chairman) Togbe Afede XIV Apiigy Afenu (Removed on 6th July 2017) Nana Soglo Alloh (Removed on 6th July 2017) Paul Hammond The Custodian: Standard Chartered Securities Services Head Office P. O. Box 768 Accra Independent Auditors: Nexia Debrah & Co. (Chartered Accountants) BCB Legacy House # 1 Nii Amugi Avenue East Adabraka, Accra P. O. Box CT 1552 Cantonments, Accra Solicitors: R. S. Agbenoto and Associates 4th Floor Total House 25 Liberia Road Secretary: Accra Nominees Cedar House No. 13 Samora Machel Road Asylum Down, Accra 4 CONTENTS Corporate Information 4 Chairman’s Report 8-9 Fund Manager’s Report 10-15 Report of the Directors 16-17 Report of the Auditors 18-21 Statement of Investment Assets 22-23 Statement of Comprehensive Income 24 Statement of Financial Position 25 Statement of Cash Flows 26 Portfolio Summary 28 SAS Notes to the Financial Statements 29-37 FORTUNE FUND REPORT Report of the Custodian 38-40 Information on Directors 41 AND FINANCIAL STATEMENTS 5 SAS FORTUNE FUND LIMITED NOTICE OF MEETING NOTICE is hereby given that the 13th Annual General Meeting of the Members of the SAS Fortune Fund will be held on Thursday July 26, 2018 at the British Council Hall, Liberia Road, Accra at 12.30 p.m. -

Has Gse Played Its Role in the Economic Development of Ghana?

CAPITAL MARKET 23 YEARS AND COUNTING: HAS GSE PLAYED ITS ROLE IN THE ECONOMIC DEVELOPMENT OF GHANA? 1st CAPITAL MARKET CONFERENCE BY EKOW AFEDZIE, DEPUTY MANAGING DIRECTOR MAY 10, 2013 INTRODUCTION Ghana Stock Exchange (GSE) was established with a Vision: -To be a relevant, significant, effective and efficient instrument in mobilizing and allocating long-term capital for Ghana’s economic development and growth. INTRODUCTION OBJECTIVES - To facilitate the Mobilization of long term capital by Corporate Bodies/Business and Government through the issuance of securities (shares, bonds, etc). - To provide a Platform for the trading of issued securities. MEMBERSHIP OF GHANA STOCK EXCHANGE GSE as a public company limited by Guarantee has No OWNERS OR SHAREHOLDERS. GSE has Members who are either corporate or individuals. There are two categories of members:- - Licensed Dealing Members - 20 - Associate Members - 34 HISTORICAL BACKGROUND 1968 - Pearl report by Commonwealth Development Finance Co. Ltd. recommended the establishment of a Stock Exchange in Ghana within two years and suggested ways of achieving it. 1970 – 1989 - Various committees established by different governments to explore ways of bringing into being a Stock Exchange in the country. HISTORICAL BACKGROUND 1971 - The Stock Exchange Act was enacted. - The Accra Stock Exchange Company incorporated but never operated. Feb, 1989 - PNDC government set up a 10-member National Committee on the establishment of Stock Exchange under the chairmanship of Dr. G.K. Agama, the then Governor of the Bank of Ghana. HISTORICAL BACKGROUND July, 1989 - Ghana Stock Exchange was incorporated as a private company limited by guarantee under the Companies Code, 1963. HISTORICAL BACKGROUND Nov. -

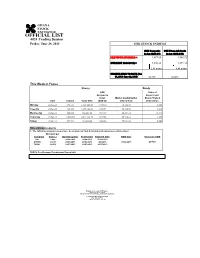

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES GSE Composite GSE Financial Stocks Index (GSE-CI) Index (GSE-FSI) PREVIOUS 27/06/2013) = 1,877.65 1,585.72 CURRENT 28/06/2013) = 1,880.26 1,591.18 2.61 points 5.46 points CHANGE-YEAR TO DATE (Jan 01, 2013- June 28, 2013) 56.72% 53.02% This Week in Focus Shares Bonds GSE Value of Composite Government Index Market Capitalization Bonds Traded Date Volume Value GH¢ (GSE-CI) GH¢ million GH¢ million Monday 24-Jun-13 493,511 1,581,041.68 1,900.10 56,154.80 0.000 Tuesday 25-Jun-13 426,550 1,196,438.69 1,891.94 56,110.32 1.240 Wednesday 26-Jun-13 880,088 966,256.30 1,874.67 55,894.32 15.743 Thursday 27-Jun-13 1,553,869 2,844,118.70 1,877.65 55,910.61 4.295 Friday 28-Jun-13 251,546 482,820.80 1,880.26 55,924.82 0.000 Notes/Announcements 1. The following announcements have been made on final dividends and annual general meetings: Dividend per Company Share ¢ Qualifying Date Ex-Div Date Payment Date AGM Date Venue for AGM CAL 0.006 26/06/2013 24/06/2013 30/08/2013 AYRTN 0.0013 25/06/2013 21/06/2013 8/8/2013 27/06/2013 OEPCH TOTAL 0.6900 18/07/2013 16/07/2013 26/07/2013 GCPS:GhanaAICC: Accra International College of Physicians Conference and Centre Surgeons OEPCH:Osu Ebenezer Presbyterian Church HalL Enquiries to: General Manager Ghana Stock Exchange 5th & 6th Floors Cedi House, Liberia Road, Accra Tel: 021 669908, 669914, 669935 Fax: 021 669913 e-mail: [email protected] OFFICIAL LIST 4024 Trading Session ODD LOT Friday, June 28, 2013 ISIN Share Code Total Shares No. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 8th January, 2015 STOCK MARKET ACCRA BOURSE MAKES PROMISING START INDICATORS WEEK OPEN WEEK END CHANGE The year 2014 has begun living up to expectations as bullish runs in equities from the petroleum, finance and consumer Market Capitalization (GH¢ goods sectors saw the annual returns of the broader market 'million) 64,352.42 64,229.12 -0.19% Market Capitalization (US$' inch up to 0.42% last Thursday. Though, most equities gave million) 20,109.50 20,014.06 -0.47% up their opening prices, rise in the market value of Ghana Oil Petroleum Company Limited (GOIL), Societe Generale Ghana Volume traded (shares) 783,118.00 573,274.00 -26.80% Table 1: Market Summary Limited (GOIL) and Fan Milk Limited (FML) were enough to close the week’s activities on a positive note. Key benchmark indices closed the week better despite slight volatilities during inter-day trading. The GSE Composite INDEX ANALYSIS index closed at a year-to-date return of 0.42% whiles the GSE Financial Stocks Index settled at 0.67% returns. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization of the Ghana Stock Exchange was GH¢64.23 billion, an equivalent to USD20.00 billion. GSE Composite Index 2,270.57 0.42% 0.42% GSE Financial Stocks Index 2,258.77 0.67% 0.67% Table 2: Key Stock Market Indices LIQUIDITY The absence of block trades over the period saw liquidity comparatively down last week. All in all, an approximate figure of 573,274 shares exchanged hands within the first trading week of the year, and was also valued about GH¢2.48 million. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 14th September, 2017 Address: No. 67A & B Switchback Road, Email: [email protected] Website: www.sic-fsl.com Phone: +233-302-767-051 +233-302-767-123 STOCK MARKET PROFIT-TAKING SLOWS MARKET PERFORMANCE Intense profit-taking on the Ghana Stock Exchange (GSE) INDICATORS WEEK OPEN WEEK END CHANGE saw key performance indicators dip for the first time in Market Capitalization several weeks. Among the nine (9) price movers, five (5) (GH¢'million) 58,810.32 58,022.89 -1.34% equities were ticked-down while the rest gained. Among the Market Capitalization (US$'million) 13,359.91 13,171.45 -1.41% laggards, shares of Standard Chartered Bank Limited (SCB), GCB Bank Limited (GCB), Enterprise Group Limited (EGL) Volume traded (shares) 1,090,896.00 3,860,498.00 253.88% and Trust Bank Gambia Limited (TBL) were the hardest hit on Value Traded (GH¢) 7,134,447.86 9,038,209.20 26.68% the bourse last week. Value Traded (US$) 1,620,728.73 2,051,713.70 26.59% At the close of activities last Thursday yields on the GSE- Table 1: Market Summary Composite Index (GSE-CI), the GSE Financial Stocks Index (GSE-FSI) and the SIC-FSL Top 15 liquid Index (T-15 Index) declined from their previous week year-to-date gains of INDEX ANALYSIS 44.73%, 42.91% and 52.92% to settle at annual returns of 37.08%, 31.38% and 45.33% respectively. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization dipped from the previous week’s GSE Composite Index 2,315.48 -5.28% 37.08% figure of GH¢58.81 billion to GH¢58.02 billion. -

CONFERENCE PROCEEDINGS Editors: Dr

UNIVERSITY OF GHANA BUSINESS SCHOOL CONFERENCE PROCEEDINGS editors: Dr. Richard Boateng, Dr. Mohammed A. Sanda, Dr. Godfred A. Bokpin, Dr. Adelaide Kastner and Mr. Francis Adzei UNIVERSITY OF GHANA BUSINESS SCHOOL UGBS CONFERENCE ON BUSINESS AND DEVELOPMENT 2013 This book of proceedings features a mix of conceptual and empirical research papers which set the agenda for discussion on key themes in accounting; finance, banking & insurance; marketing and customer management; operations and management information systems; organisation and human resource management; and public administration and health services management. Published 2013 in Ghana by University of Ghana Business School (UGBS) Copyright © 2013 UGBS. All Rights Reserved. ISBN: xxx-xxxx-x-xxxx-x All rights reserved. Published by University of Ghana Business School (UGBS) P. O. Box LG 78 Legon, Accra, Ghana Tel: +233 302 501008 Email: [email protected] Printed in Ghana by UGBS in collaboration with Craft Concepts Limited P. O. Box NB 649, Nii Boiman, Accra, Ghana Tel: +233-302-925-762 Email: [email protected] Copyright©2013 Internet Version (30 April 2013) The Internet version of this document can be accessed at: http://ugbs.ug.edu.gh/ UGBS Conference on Business and Development – Conference Proceedings Contents Contents ................................................................................................................................................................. 1 Conference Welcome ............................................................................................................................................ -

WEEKLY MARKET REVIEW 25 June 2018

DATABANK RESEARCH WEEKLY MARKET REVIEW 25 June 2018 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Weekly Market Update Databank Stock Index 36,989.82 37,829.75 -2.22% The equities market ended the week with reducing year to date GSE-CI Level 2,918.27 2,989.68 -2.39% returns of 13.12% for the GSE’s Composite Index and 12.49% for Market Cap (GH¢ m) 58,718.96 62,501.44 -6.05% the Databank Stock Index. YTD Return DSI 12.49% 15.04% YTD Return GSE-CI 13.12% 15.89% The gainers this week were ACCESS (+17.65% GH¢4.00), ETI Weekly Volume Traded (Shares) 7,111,051 3,728,037 90.75% (+5.00%, 21Gp) and GOIL (+1.27% GH¢4.00). Weekly Turnover (GH¢) 10,906,829 1,946,907 460.21% The laggards were CAL (-2.40% GH¢1.22), EGH (-11.76% Avg. Daily Volume Traded 878,468 854,409 2.82% (Shares) GH¢9.00), GCB (-0.39% GH¢5.15), SCB (-0.66% GH¢27.15), TLW Avg. Daily Value Traded (GH¢) 3,788,144 3,859,240 -1.84% (-15.00% GH¢14.56), SOGEGH (-17.58%, GH¢1.36) and Total (- No. of Counters Traded 20 20 1.23%, GH¢4.00). No. of Gainers 3 5 A total of ~7.11 million shares valued at ~GH¢10.9 million were No. of Laggards 7 11 traded on the Ghana Stock Exchange this week. Outlook KEY ECONOMIC INDICATORS Fixed Income Market Current Previous Change We anticipate lackluster activity on the Ghana Stock Exchange 91-Day Treasury Bill 13.34% 13.30% +4bps next week with a price gain in Unilever Ghana. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 30th March, 2017 Address: No. 67A & B Switchback Road, Email: [email protected] Website: www.sic-fsl.com Phone: +233-302-767-051 +233-302-767-123 STOCK MARKET ACCRA BOURSE HALTS UPWARD TRAJECTORY The excitement on the Ghana Stock Exchange (GSE) slowed INDICATORS WEEK OPEN WEEK END CHANGE down as a consequence of increased bearish sentiment in last week’s market activites. At the close of the week’s trading Market Capitalization (GH¢'million) 49,247.38 49,138.04 -0.22% laggards emergered stronger Shares of Cal Bank Limited Market Capitalization (CAL), SIC Insurance Company Limited (SIC), Societe (US$'million) 11,137.91 11,326.30 1.69% Generale Ghana LImited (SOGEGH) and Tullow Oil Plc (Plc) pause the market’s upward course. Volume traded (shares) 2,204,711.00 3,581,141.00 62.43% Value Traded (GH¢) 3,838,627.48 4,012,333.06 4.53% In effect, the yields on the GSE-Composite Index, the GSE Financial Stocks Index (GSE-FSI) and the SIC-FSL Top 15 Value Traded (US$) 868,153.49 924,841.66 6.53% liquid Index (T-15 Index) dropped from their previous week Table 1: Market Summary year-to-date returns of 11.77%, 16.32% and 16.27% each INDEX ANALYSIS to close at 11.26%, 15.54% and 15.73% respectively last Thursday. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization dropped from the previous week’s figure of GH¢49.25 billion to GH¢49.14 billion last GSE Composite Index 1,879.25 -0.46% 11.26% Thursday due to depreciations in CAL, SIC, SOGEGH and SIC-FSL Top 15 Index 3,018.11 -0.69% 15.73% TLW. -

WEEKLY MARKET REVIEW 19 October 2018

DATABANK RESEARCH WEEKLY MARKET REVIEW 19 October 2018 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Weekly Market Update Databank Stock Index 37,664.26 38,062.17 -1.05% Price declines in 8 counters weighed down stock market indices, GSE-CI Level 2,974.02 3,006.86 -1.09% eroding the year-to-date returns of the Ghana Stock Exchange’s Market Cap (GH¢ m) 65,801.69 66,123.80 -0.49% Composite Index and the Databank Stock Index to 15.28% (-1.28%) and YTD Return DSI 14.54% 15.75% YTD Return GSE-CI 15.28% 16.56% 14.54% (-1.21%) respectively by the end of this week. Weekly Volume Traded (Shares) 840,145 1,425,750 -41.07% GOIL (+8.47%, GH¢3.20) was the only advancer on the bourse this week. Weekly Turnover (GH¢) 2,882,639 4,584,200 -37.12% Avg. Daily Volume Traded (Shares) 874,823 892,945 -2.03% The laggards were: ACCESS (-0.96%, GH¢3.10), CAL (-4.31%, GH¢1.11), Avg. Daily Value Traded (GH¢) 2,988,422 3,050,265 -2.03% EGH (-0.62%, GH¢7.95), EGL (-0.66%, GH¢3.02), RBGH (-12.41%, No. of Counters Traded 19 22 GH¢1.27), MTNGH (-1.10%, 90Gp), SCB (-0.38%, GH¢26.00) and TOTAL No. of Gainers 1 2 (-14.76%, GH¢4.10). No. of Laggards 8 10 Market activity remained subdued for a second consecutive week. A total of ~840,145 shares valued at ~GH¢2.88 million were exchanged KEY ECONOMIC INDICATORS across 19 counters. -

& Financial Statements for the Financial Year 2019

ALUWORKS LIMITED ANNUAL REPORT & FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR 2019 31 DECEMBER 2019 Contents Notice of Annual General Meeting 3 Corporate Information 4 Directors Gallery and Profiles 5 Corporate Governance 8 Chairman’s Statement 9 Quality Assurance Policy 14 Management Gallery 15 Financial Highlights 16 Report of the Directors 17 Independent Auditor’s Report 23 Statement of Financial Position 27 Statement of Comprehensive Income 28 Statement of Changes in Equity 29 Statement of Cash Flows 30 Notes to the Financial Statements 31 Proxy Form 71 2019 Aluworks Limited Annual Report Page 2 ALUWORKS LIMITED NOTICE OF VIRTUAL ANNUAL GENERAL MEETING NOTICE is hereby given that the 33rd Annual General Meeting of the Shareholders of Aluworks Limited will be held online i.e. virtually via ZOOM on Thursday November 26, 2020 at 10 O’clock in the forenoon to transact the following ordinary business: AGENDA Ordinary Business 1. To receive and consider the Reports of the Directors, Auditors and the Audited Financial Statements for the year ended December 31, 2019. 2. To ratify the appointment of Directors. 3. To re-elect Directors. 4. To fix the remuneration of the Directors. 5. To confirm the Auditors remuneration for the year ended December 31, 2019 and to authorise the Directors to fix the remuneration of the Auditors for the year ending December, 31 2020. Special Business 1. To change the name of the company from Aluworks Limited to Aluworks PLC in compliance with the provisions of the Companies Act 2019, Act 992. 2. To amend the Company’s Regulations/Constitution to accommodate the holding of Annual General Meetings by electronic or virtual means where the Directors deem it necessary to do so. -

Market Review August 2017 Pent Assets

Market Review August 2017 Pent Assets cedis during the month compared to a scheduled Month’s Highlights: target of 5.73 billion cedis. The 91-day bill constituted ▪ IMF Approves One-Year Extension to Ghana’s the highest share of issued securities [with 54 percent] Credit Program. followed by the 5-year bond [with 29 percent] and 10- ▪ Bank of Ghana shuts two banks to protect year bond [with 10 percent]. financial stability. ▪ Ghana Stock Exchange suspends listing status of UT Bank Ltd indefinitely. ▪ Foreign Exchange Market The Ghana cedi remained largely stable in August. The currency weakened 0.6 percent month-on-month to 4.3994 per US dollar, yielding a year-to-date depreciation of 4.5 percent. The currency also lost 1.2 percent against the Euro but however gained 1.8 percent against the British Pound. Interbank Foreign Exchange August 2017 Month Chg. (%) YTD Chg. (%) USD/GHS 4.3994 -0.57% -4.53% GBP/GHS 5.6629 1.76% -8.24% EUR/GHS 5.2215 -1.23% -15.03% Equity Market Government Securities Market Ghana’s stock market remained optimistic in August. The benchmark GSE Composite Index gained 132.23 Yields on government of Ghana short-term treasury points [5.9 percent] to close the month at 2,389.01 securities generally made gains during August. The 91- points, extending year-to-date return to 41.4 percent. day bill gained 65 basis points (bps) to close the month at 13.19 percent, yielding a year-to-date decline of 324 bps whereas the 182-day bill gained 95 basis points to 13.93 percent. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 29th June, 2017 Address: No. 67A & B Switchback Road, Email: [email protected] Website: www.sic-fsl.com Phone: +233-302-767-051 +233-302-767-123 STOCK MARKET GSE REMAINS ON COURSE The excitement on Ghana Stock Exchange (GSE) remained INDICATORS WEEK OPEN WEEK END CHANGE on course last week as gainers surged in strength and numbers over laggards. Out of the ten (10) price movers, Market Capitalization (GH¢'million) 58,908.79 59,176.21 0.45% only two equities were losers, this pushed to push key Market Capitalization performance indicators further. Shares of Standard (US$'million) 13,532.30 13,566.92 0.26% Chartered Bank (SCB), HFC Bank (Ghana) Limited (HFC), Fan Milk Limited (FML) and Ecobank Transnational Incorporated Volume traded (shares) 2,499,559.00 1,796,032.00 -28.15% (ETI) were behind the market’s upside performance. Value Traded (GH¢) 4,576,227.19 6,527,887.96 42.65% The yield on the GSE Composite Index (GSE CI) improved Value Traded (US$) 1,051,232.93 1,496,604.15 42.37% from 1,941.43 points to 1,951.77 points, resulting in an Table 1: Market Summary improved year-to-date gain of 15.55%. Similarly, the GSE INDEX ANALYSIS Financial Stocks Index (GSE-CI) and the SIC-FSL Top 15 Index (SIC-FSL T-15) closed at year-to-date returns of INDICATORS Closing Week YTD 17.34% and 18.72% respectively better than the 16.60% Level Change CHANGE and 15.75% recorded in the previous week.