Quantifying the Information Flow Between Ghana Stock Market Index and Its Constituents Using Transfer Entropy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017 Annual Report and Financial Statements

2017 ANNUAL REPORT AND FINANCIAL STATEMENTS 2017 ANNUAL REPORT AND FINANCIAL STATEMENTS SAS FORTUNE FUND LIMITED 3 SAS FORTUNE FUND LIMITED CORPORATE INFORMATION The Manager: SAS Investment Management Ltd. (SAS-IM) 14th Floor WTCA Building, Indep. Avenue, Accra Tel: +233-302-661770/2/008/880 +233-302-661900 Fax: +233-302-663999 E-mail: [email protected] Website: www.sasghana.com Directors of the Fund: Maxwell Logan (Chairman) Togbe Afede XIV Apiigy Afenu (Removed on 6th July 2017) Nana Soglo Alloh (Removed on 6th July 2017) Paul Hammond The Custodian: Standard Chartered Securities Services Head Office P. O. Box 768 Accra Independent Auditors: Nexia Debrah & Co. (Chartered Accountants) BCB Legacy House # 1 Nii Amugi Avenue East Adabraka, Accra P. O. Box CT 1552 Cantonments, Accra Solicitors: R. S. Agbenoto and Associates 4th Floor Total House 25 Liberia Road Secretary: Accra Nominees Cedar House No. 13 Samora Machel Road Asylum Down, Accra 4 CONTENTS Corporate Information 4 Chairman’s Report 8-9 Fund Manager’s Report 10-15 Report of the Directors 16-17 Report of the Auditors 18-21 Statement of Investment Assets 22-23 Statement of Comprehensive Income 24 Statement of Financial Position 25 Statement of Cash Flows 26 Portfolio Summary 28 SAS Notes to the Financial Statements 29-37 FORTUNE FUND REPORT Report of the Custodian 38-40 Information on Directors 41 AND FINANCIAL STATEMENTS 5 SAS FORTUNE FUND LIMITED NOTICE OF MEETING NOTICE is hereby given that the 13th Annual General Meeting of the Members of the SAS Fortune Fund will be held on Thursday July 26, 2018 at the British Council Hall, Liberia Road, Accra at 12.30 p.m. -

![Market Review [H1-2017]](https://docslib.b-cdn.net/cover/8810/market-review-h1-2017-138810.webp)

Market Review [H1-2017]

Half-Year Market Review [H1-2017] July 2017 Economic Overview GDP Growth: Aided by increased crude oil production, the economy expanded by 6.6 percent on year-on-year basis in the first quarter of 2017 compared to 4.4 percent in the same period in 2016. The non-oil sector GDP growth stood at 3.9 percent relative to 6.3 percent recorded for the same period in 2016. Economic growth has been weak since 2014, with GDP staying around 4 percent, due to lower prices for Monetary Policy Easing: The Bank of Ghana reduced commodity exports and a fiscal crisis. The government its policy rate by 300 basis points during the first half has projected a GDP growth of 6.3 percent in 2017. of the year citing positive inflation outlook and a Fiscal Deficit: Central government operations for the relatively stable Ghana cedi. The benchmark interest first half of the year was largely in line with targets in rate was lowered 200 basis points in March to 23.50 the 2017 budget. Fiscal operations for the first half percent and further lowered by 100 basis points in May resulted in a cash deficit of 2.7 percent of GDP, against to 22.50 percent. a set target of 3.5 percent, mainly due to expenditure controls even as revenue fell below target. Total Fixed Income Market expenditure stood at 23.0 billion cedis against a target of 27.6 billion cedis whereas total revenue and grants Yields on GoG domestic securities trended downwards stood at 17.5 billion cedis against a target of 20.5 during the first half of the year, signaling a drive billion cedis. -

THE DATABANK BALANCED FUND LIMITED 2010 Annual Report

AUDITED FULL YEAR REPORT 2010 THE DATABANK BALANCED FUND LIMITED 2010 Annual Report 1 THE DATABANK BALANCED FUND LIMITED 2ii AUDITED FULL YEAR REPORT 2010 THE DATABANK BALANCED FUND LIMITED Audited Full Year Report For The Period Ended December 31, 2010 1 THE DATABANK BALANCED FUND LIMITED 2 AUDITED FULL YEAR REPORT 2010 CONTENTS Notice of Annual General Meeting 04 Chairman’s Statement to Shareholders 05 Performance Summary 09 Portfolio at a Glance 10 Interview with your Fund Manager 11 Report of Directors 14 Report of the Auditors 15 Statement Of Net Assets 16 Statement of Assets and Liabilities 17 Income and Distribution Accounts 18 Statement of Movement In Net Assets and Issued Shares 19 Notes to Financial Statements 21 Custodian’s Report 26 Corporate Information 29 Directors and Officers Information 30 Proxy Form 34 This report shall not constitute an invitation to buy shares of the Fund. Subscriptions are to be made only on the basis of the current scheme particulars, accompanied by a copy of the latest available annual report, and if published thereafter, the most recent half year report. 3 THE DATABANK BALANCED FUND LIMITED NOTICE OF ANNUAL GENERAL MEETING Notice is hereby given that the 3rd Annual General Meeting of the shareholders of Databank Balanced Fund Limited will be held at the National Theatre, Accra, Ghana on Friday the 29th of July 2011 at 11:00a.m for the following purposes: 1. To consider the Directors’ Report and the Report of the Auditors for the year ended December 31, 2010. 2. To receive and adopt the Statement of Assets and Liabilities and Statement of Operations for the year ended December 31, 2010 3. -

Ssnit Investments Series

SSNIT INVESTMENTS SERIES SECOND EDITION INTRODUCTION This edition of the SSNIT Investments Series focuses on the Listed Equities Portfolio, one of the three sub-asset classes of the Equities Portfolio. Listed equity refers to ownership interests in companies whose shares are traded publicly on a Stock Market. The Trust currently has share interests in 23 out of the 37 companies listed on the Ghana Stock Exchange (GSE), with a total value of GH¢1.8 billion as at June 2017. A portion of the Trust’s shares in Tullow Oil Plc is also listed on the London Stock Exchange (LSE). The composition of the Trust’s Listed Equities Portfolio, also referred to as the SSNIT Stock Market Portfolio (SSMP), is shown in Table 1. Table 1: SSNIT Listed Equity Holdings # Company Ticker Shareholding (%) 1 Anglogold Ashanti Ltd. AGA 0.02% 2 Aluworks Limited ALW 62.62% 3 Ayrton Drug Man. Ltd. AYRTN 18.00% 4 Benso Oil Palm Plantation BOPP 4.31% 5 CAL Bank Limited CAL 33.18% 6 Cocoa Processing Co. Ltd. CPC 10.14% 7 Ecobank Ghana Ltd. EGH 16.21% 8 Enterprise Group Ltd EGL 6.22% 9 Ecobank Transnational Inc. ETI 3.86% 10 Fan Milk Limited FML 1.59% 11 GCB Bank GCB 29.89% 12 Guinness Gh. Breweries Ltd. GGBL 7.57% 13 Ghana Oil Co. Ltd. GOIL 25.00% 14 Golden Web Ltd. GWEB 20.78% 15 HFC Bank Ltd. HFC 26.09% 16 Produce Buying Co. Ltd. PBC 38.10% 17 Standard Chartered Bank SCB 14.55% 18 SIC Insurance Ltd. -

Has Gse Played Its Role in the Economic Development of Ghana?

CAPITAL MARKET 23 YEARS AND COUNTING: HAS GSE PLAYED ITS ROLE IN THE ECONOMIC DEVELOPMENT OF GHANA? 1st CAPITAL MARKET CONFERENCE BY EKOW AFEDZIE, DEPUTY MANAGING DIRECTOR MAY 10, 2013 INTRODUCTION Ghana Stock Exchange (GSE) was established with a Vision: -To be a relevant, significant, effective and efficient instrument in mobilizing and allocating long-term capital for Ghana’s economic development and growth. INTRODUCTION OBJECTIVES - To facilitate the Mobilization of long term capital by Corporate Bodies/Business and Government through the issuance of securities (shares, bonds, etc). - To provide a Platform for the trading of issued securities. MEMBERSHIP OF GHANA STOCK EXCHANGE GSE as a public company limited by Guarantee has No OWNERS OR SHAREHOLDERS. GSE has Members who are either corporate or individuals. There are two categories of members:- - Licensed Dealing Members - 20 - Associate Members - 34 HISTORICAL BACKGROUND 1968 - Pearl report by Commonwealth Development Finance Co. Ltd. recommended the establishment of a Stock Exchange in Ghana within two years and suggested ways of achieving it. 1970 – 1989 - Various committees established by different governments to explore ways of bringing into being a Stock Exchange in the country. HISTORICAL BACKGROUND 1971 - The Stock Exchange Act was enacted. - The Accra Stock Exchange Company incorporated but never operated. Feb, 1989 - PNDC government set up a 10-member National Committee on the establishment of Stock Exchange under the chairmanship of Dr. G.K. Agama, the then Governor of the Bank of Ghana. HISTORICAL BACKGROUND July, 1989 - Ghana Stock Exchange was incorporated as a private company limited by guarantee under the Companies Code, 1963. HISTORICAL BACKGROUND Nov. -

Annual Report 2016 Annual Report National Insurance Commission National Insurance Commission

ANNUAL REPORT 16 & FINANCIAL STATEMENTS National Insurance Commission 2016 | Annual Report NNATIONALational Insu INSURANrance CECommission COMMISSION Appiah-Ampofo House Standard Conference Package Hall Rental (Seating Capacity 200) Power Point Projector P.A System One Coee Break Buet Lunch Mineral Water Note Pad, Folder And Pen Internet Connectivity Ultra Modern Hall | Modern and State of the Art Facilities | Secured and Large Car Park | Central Location | Competitive Price | Spacious Lawns For More Information And Reservation, Please Call The Following Numbers 0302 238300 | 0302 238301 Location: Appiah-Ampofo House, Independence Ave, National Insurance Commission Tel: 233 302 238 300/1 | Fax: 233 302 237 248 | Email: [email protected] | Website: www.nicgh.Org Contents Foreword 7 Chairman’s Report 8 The National Insurance Commission Corporate Information 11 NIC’s Operations 12 Ghana Insurance Market Report 2016 Economic Review 21 Ghana Insurance Market Report (2012 – 2016) 22 Financial & Ratio Analysis 36 Appendices 2016 NIC Financial Reports 72 2016 Fire Maintenance Fund Financial Reports 86 List of Registered Insurance Companies 96 List of Registered Reinsurance Companies 103 List of Registered Broking Companies 104 2016 Annual Report National Insurance Commission 6 2016 Annual Report 2016 Annual Report National Insurance Commission National Insurance Commission FOREWORD Introduction The National Insurance Commission (NIC) issued the Governance and Risk Management framework in 2015. The activities of NIC in 2016 was geared at ensuring that the principles and values set out in the Governance and Risk Management framework are embedded in the regulated entities operations. To this end, the NIC organised a number of workshops for key stakeholders in the insurance industry to educate them on what is expected of them in relation to the Governance and Risk Management framework. -

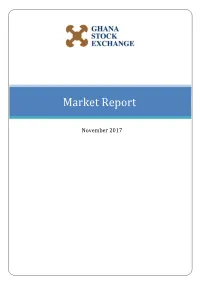

Market Report

Market Report November 2017 MARKET HIGHLIGHTS GSE STOCK INDICES/CAPITALIZATION NOV 2017 YTD CHANGE NOV 2016 YTD CHANGE GSE COMPOSITE INDEX (GSE-CI) 2,521.67 49.29% 1,575.71 -21.01% GSE FINANCIAL STOCK INDEX (GSE-FSI) 2,228.29 44.19% 1,397.86 -27.57% MARKET CAPITALIZATION (GH¢ M) 58,503.37 10.91% 50,917.09 10.85% DOMESTIC CAPITALIZATION (GH¢ M) 15,875.06 41.93% 9,084.99 -18.78% MARKET TURNOVER - EQUITIES NOV 2017 NOV 2016 VOLUME TRADED 17,841,085 8,530,830 VALUE TRADED (GH¢) 40,884,976.08 13,779,065.36 NUMBER OF TRANSACTIONS 1,432 1,784 TRADING DAYS 22 22 NUMBER OF TRADED SYMBOLS 28 33 MARKET DAILY AVERAGES - EQUITIES NOV 2017 NOV 2016 AVERAGE VOLUME TRADED 810,958 387,765 AVERAGE VALUE TRADED (GH¢) 1,858,408.00 626,321.15 AVERAGE NUMBER OF TRANSACTIONS 65 81 MARKET TURNOVER - EQUITIES JAN TO NOV 2017 JAN TO NOV 2016 VOLUME TRADED 315,712,633 123,776,938 VALUE TRADED (GH¢) 503,131,084.08 233,285,598.39 NUMBER OF TRANSACTIONS 19,753 19,385 TRADING DAYS 229 230 NUMBER OF TRADED SYMBOLS 39 43 MARKET TURNOVER - FIXED INCOME (DEBT) SECURITIES IN GH¢ MILLIONS NOV 2017 NOV 2016 CORPORATE - - GOG NOTES AND BONDS (GH¢ M) *** 1,045.19 789.79 MARKET TURNOVER - FIXED INCOME (DEBT) SECURITIES IN GH¢ MILLIONS JAN-NOV 2017 JAN-NOV 2016 CORPORATE - - GOG NOTES AND BONDS (GH¢ M) *** 12,237.91 - LISTINGS NOV 2017 NOV 2016 LISTED COMPANIES 40 39 LISTED EQUITIES ORDINARY SHARES 36 35 DEPOSITORY SHARES 1 1 PREFERENCE SHARES 1 1 EXCHANGE TRADED FUNDS 1 1 FOUR (4) EQUITIES ON GHANA ALTERNATIVE MARKET (GAX) 4 4 DELISTINGS-EQUITIES NOV 2017,NOV 2016) 0 0 NUMBER -

Quarterly Financial Markets Report

Quarterly Financial Markets Report Second Quarter 2016 Global Economic Highlights Highlighted by UK’s vote to leave the EU, weak demand, high unemployment levels, financial frailties and geopolitical risks, the global economic environment continued to be plagued by weakened growth prospects in the last three months. The late June U.K. referendum to leave the European Union sent shock waves across the globe, leaving global financial markets in turmoil. The equity markets fell sharply and the British Pound plunged 8.4% and 12.5% against the U.S. Dollar and Japanese Yen, respectively. The value of the British Pound against the US Dollar was at its lowest in the past 31 years. Reassurance on support from the central bank saw the economy enjoying some reprieve as the financial markets rebounded partially in fragments. With manufacturing growth stalling over the past year and construction figures weakening markedly in June, U.K. growth continued to be driven primarily by the services sector. The rate of Consumer Price Inflation (CPI) remained low at around 0.3% partly due to relatively subdued global demand growth. Both Standard & Poor’s, and Fitch on the back of the foregoing downgraded U.K’s credit ratings. With a lift from the European Central Bank’s stimulus cut, low energy prices and a rebound in consumer spending, figures from the 19-nation bloc were impressive before the Brexit, with GDP rising by 0.6% in Q1 2016 despite a backdrop of the global market turmoil at the start of the year. However, questions about the EU’s stability and the potential for an economic downturn after Britain’s surprise exit from the EU dominated the centre stage in the Eurozone at the end of the second quarter. -

SIC Insurance Company Limited PROSPECTUS

SIC Insurance Company Limited PROSPECTUS Initial Public Offer 97,822,500 ordinary shares of no par value at 30Gp (¢3,000) per share (Regarding the Divestiture of SIC General Business) Lead Broker/Manager MERBAN STOCKBROKERS LIMITED Co-Sponsoring Broker SIC FINANCIAL SERVICES LIMITED December 3, 2007 1 SIC Insurance Company Ltd. Initial Public Offer DISCLAIMER The Directors of SIC Insurance Company Limited (SIC) collectively and individually accept full responsibility for the accuracy of the information given in this prospectus. After making all reasonable inquiries and to the best of their knowledge and belief there are no facts the omission of which would make any statement in this document misleading. No director has an interest in the Company. There is however no restriction on any director who wants to acquire some of the shares during the offer period. To the best of the knowledge and belief of the Sponsoring Brokers this prospectus constitutes full and true disclosure of all material facts about the Issue and the Issuer and where appropriate the profit forecast has been stated by the directors after due and careful inquiry. A copy of this document has been delivered to the Registrar of Companies for registration. The Registrar has not checked and will not check the accuracy of any statement made and accepts no responsibility thereof or for the financial soundness of the Company or the value of securities concerned. This prospectus has been reviewed and approved by the Securities and Exchange Commission (SEC) in accordance with Section 9 of the Securities Industry Law, 1993 (PNDCL 333) as amended. -

Aluworks Annual Report

ALUWORKS LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS 31ST DECEMBER 2018 ALUWORKS LIMITED CONTENTS. Notice of Annual General Meeting 3 Corporate Information 4 Directors Gallery and Profiles 5 Corporate Governance 8 Chairman’s Statement 9 Quality Assurance Policy 13 Management Gallery 14 Financial Highlights 15 Report of the Directors 16 Independent Auditor’s Report 23 Statement of Financial Position 27 Statement of Comprehensive Income 28 Statement of Changes in Equity 29 Statement of Cash Flows 30 Notes to the Financial Statements 31 Shareholders Information Appendix 72 Corporate Social Responsibility Appendix 73 Proxy Form 79 Page 2 2018 Aluworks Limited Annual Report ALUWORKSALUWORKS LIMITEDLIMITED CONTENTS. Notice of Annual General Meeting 3 Corporate Information 4 Directors Gallery and Profiles 5 Corporate Governance 8 Chairman‟s Statement 9 Quality Assurance Policy 12 Management Gallery 13 Financial Highlights 14 Report of the Directors 15 Independent Auditor‟s Report 20 By Order Of the Board Statement of Financial Position 24 Statement of Comprehensive Income 25 Statement of Changes in Equity 26 Statement of Cash Flows 27 Notes to the Financial Statements ACCRA28 NOMINEES LIMITED COMPANY SECRETARIES Note:Shareholders Information Appendix 58 A member of the company entitled to attend and vote may appoint a proxy to attend and vote in his/her stead. A proxy need not be a member of the company. Completed proxy forms should beCorporate deposited atSocial the offices Responsibility of the Registrars Appendix Universal Merchant Bank 59Limited, 123 Kwame Nkrumah Avenue, Sethi Plaza, Adabraka, Accra, P. O. Box GP401, Accra not less than 48 hours beforeProxy the Form appointed time of the meeting. -

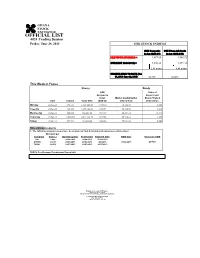

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES GSE Composite GSE Financial Stocks Index (GSE-CI) Index (GSE-FSI) PREVIOUS 27/06/2013) = 1,877.65 1,585.72 CURRENT 28/06/2013) = 1,880.26 1,591.18 2.61 points 5.46 points CHANGE-YEAR TO DATE (Jan 01, 2013- June 28, 2013) 56.72% 53.02% This Week in Focus Shares Bonds GSE Value of Composite Government Index Market Capitalization Bonds Traded Date Volume Value GH¢ (GSE-CI) GH¢ million GH¢ million Monday 24-Jun-13 493,511 1,581,041.68 1,900.10 56,154.80 0.000 Tuesday 25-Jun-13 426,550 1,196,438.69 1,891.94 56,110.32 1.240 Wednesday 26-Jun-13 880,088 966,256.30 1,874.67 55,894.32 15.743 Thursday 27-Jun-13 1,553,869 2,844,118.70 1,877.65 55,910.61 4.295 Friday 28-Jun-13 251,546 482,820.80 1,880.26 55,924.82 0.000 Notes/Announcements 1. The following announcements have been made on final dividends and annual general meetings: Dividend per Company Share ¢ Qualifying Date Ex-Div Date Payment Date AGM Date Venue for AGM CAL 0.006 26/06/2013 24/06/2013 30/08/2013 AYRTN 0.0013 25/06/2013 21/06/2013 8/8/2013 27/06/2013 OEPCH TOTAL 0.6900 18/07/2013 16/07/2013 26/07/2013 GCPS:GhanaAICC: Accra International College of Physicians Conference and Centre Surgeons OEPCH:Osu Ebenezer Presbyterian Church HalL Enquiries to: General Manager Ghana Stock Exchange 5th & 6th Floors Cedi House, Liberia Road, Accra Tel: 021 669908, 669914, 669935 Fax: 021 669913 e-mail: [email protected] OFFICIAL LIST 4024 Trading Session ODD LOT Friday, June 28, 2013 ISIN Share Code Total Shares No. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 8th January, 2015 STOCK MARKET ACCRA BOURSE MAKES PROMISING START INDICATORS WEEK OPEN WEEK END CHANGE The year 2014 has begun living up to expectations as bullish runs in equities from the petroleum, finance and consumer Market Capitalization (GH¢ goods sectors saw the annual returns of the broader market 'million) 64,352.42 64,229.12 -0.19% Market Capitalization (US$' inch up to 0.42% last Thursday. Though, most equities gave million) 20,109.50 20,014.06 -0.47% up their opening prices, rise in the market value of Ghana Oil Petroleum Company Limited (GOIL), Societe Generale Ghana Volume traded (shares) 783,118.00 573,274.00 -26.80% Table 1: Market Summary Limited (GOIL) and Fan Milk Limited (FML) were enough to close the week’s activities on a positive note. Key benchmark indices closed the week better despite slight volatilities during inter-day trading. The GSE Composite INDEX ANALYSIS index closed at a year-to-date return of 0.42% whiles the GSE Financial Stocks Index settled at 0.67% returns. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization of the Ghana Stock Exchange was GH¢64.23 billion, an equivalent to USD20.00 billion. GSE Composite Index 2,270.57 0.42% 0.42% GSE Financial Stocks Index 2,258.77 0.67% 0.67% Table 2: Key Stock Market Indices LIQUIDITY The absence of block trades over the period saw liquidity comparatively down last week. All in all, an approximate figure of 573,274 shares exchanged hands within the first trading week of the year, and was also valued about GH¢2.48 million.