Tese Carla Quintas Inclui As Críticas Do Júri Teste1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Navigator Company Reaps the Fruit of Success at Vila Velha De Ródão Mill

THE NAVIGATOR COMPANY REAPS THE FRUIT OF SUCCESS AT VILA VELHA DE RÓDÃO MILL. The Navigator Company is a leading Who is The Navigator Company? producer of forestry, pulp & paper, What are your main products and tissue and energy. In 2015, it how are you positioned in terms of acquired AMS-BR Star Paper, S.A., market share? an established tissue producer that Joaquim Belfo: In 2009, we started owned two Toscotec AHEAD-2.0S up the second paper mill of Setubal tissue machines at its Vila Velha industrial complex - which includes De Ródão mill: PM1, started up in a pulp mill and two paper mills – 2009, 110 t/d capacity, 1,900 m/ and we called it “About the Future”. min operating speed, and PM2, in This undertaking decisively boosted operation since 2015, 115 t/d capacity Portugal’s industrial capacity and it and 2,000 m/min operating speed. positioned the Navigator Company as Europe’s leading manufacturer Joaquim Belfo, Mill Manager BU of uncoated woodfree paper (UWF) Tissue VVR and Pedro Antunes, Tissue and the sixth largest manufacturer Production Manager, shared their worldwide. Secondly, we are one of views on the efficiently integrated industrial unit at Vila Velha De Ródão and the cooperation with Toscotec, the mill’s tissue manufacturing turnkey supplier. the largest producers of bleached 29% of the company’s shares and Zoom eucalyptus kraft pulp (BEKP) in the Investment holds the remaining 2%. world, for which we rank first in Europe. We currently have an installed What can you tell us about your first capacity of 1.6 million tonnes of pulp cooperation with Toscotec in 2009, - of which 1.1 million integrated with PM1 at Vila Velha De Ródão mill? 10 paper production - and 1.6 million years on, how is PM1 performing? tonnes of paper. -

Curricular Information OFFICIAL AUDITOR (Representatives of the Audit Company Pricewaterhousecoopers & Associados, SROC

Curricular Information OFFICIAL AUDITOR (Representatives of the Audit Company PricewaterhouseCoopers & Associados, SROC, L.da and Alternate Member) António Alberto Henriques Assis Nationality Portuguese Position Partner in the Assurance and Business Advisory (Assurance) Line of Service. Currently leader of the Advisory Line of Service For several years he was - Member of the “Territory Leadership Team” Territory Human Resources Partner Responsible for the Cape Verde office Academic and Degree in Business Management, Lisbon School of Economics (ISE) professional Degree in Accounting and Management, Lisbon Accounting and Management qualifications Institute (ISCAL) Registered Statutory Auditor (ROC) Registered Public Accountant Attendance of several internal and external training courses in Portugal and abroad on management, auditing, accounting, information systems, taxation and soft skills Professional Broad auditing experience in local and international commercial, industrial, banking, and business insurance and service companies and non-profit organizations in addition to a relevant tax experience experience Selected major client responsibilities: In Portugal • Industrial, commercial and service companies ° Portucel Group (pulp and paper production) ° Amorim Group ° Sonae Group ° Shell Portuguesa ° Siderurgia Nacional (national steal manufacturer) ° Cap Gemini Ernst & Young ° Portugália ° Euromarché (Portugal) ° Avis (Portugal) ° Brisa ° Cruz Vermelha Portuguesa ° Sapec Group ° Prosegur (Portugal) ° Goodyear ° Hospital da Cruz Vermelha -

Banco BPI 1.º Semestre De 2017”

This document is a translation from the Portuguese original “Relatório e Contas Banco BPI 1.º semestre de 2017”. In the event of any inconsistency the Portuguese version shall prevail. BANCO BPI 1st half 2017 Public held company Registered in Oporto C.R.C. and tax identification under the sole number 501 214 534 Headquarters: Rua Tenente Valadim, n.º 284, 4100-476 Porto, PORTUGAL Share Capital: EUR 1 293 063 324.98 Registered in Oporto C.R.C. and tax identification under the sole number 501 214 534 This page was intentionally left blank. 2009 Report and Accounts| Management report 2 Index REPORT Leading business indicators 4 Summary of first half 2017 results 5 Financial structure and business 6 Governing bodies 7 Human resources 8 Distribution channels 9 Background to operations 10 Financial review 13 Rating 36 Banco BPI Shares 37 Annex - Recommendations from Bank of Portugal 38 Annex - Alternative Performance Indicators 40 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES 43 Consolidated financial statements 44 Notes to the consolidated financial statements 49 Statement 236 Audit report prepared by an auditor registered at the Portuguese Securities Market 237 Commission (CMVM) Banco BPI | Report and Accounts 1st half 2017 3 Leading business indicators (Figures in millions of euros, except where indicated otherwise) 1st half 17, excl. 1st half 16 Results and profitability 1st half 17 non-recurring 1 pro forma Net profit 187.8 (101.7) 105.9 Net profit per share (euros) 0,129 (0,070) 0,073 Weighted average number of shares (in millions) 1,455.7 -

Altri SGPS SA

COLEGIO UNIVERSITARIO DE ESTUDIOS FINANCIEROS GRADO EN ADMINISTRACIÓN Y DIRECCIÓN DE EMPRESAS Trabajo Fin de GRADO ANÁLISIS DE DATOS FINANCIEROS ALTRI SGPS S.A. Autor: Hernández López-Sors, Gonzalo Tutor: Queralt Sánchez de las Matas, Ricardo Gracia Díez, Mercedes Madrid, abril de 2019 ÍNDICE 1. Introducción y objetivo del trabajo ………………………………………………………………… 3 2. ALTRI SGPS S.A. 2.1 Descripción de la compañía………………………………………………………………………. 3 2.2 Historia ……………………..………………………………………………………………..……......... 5 2.3 Análisis financiero …………………………………………………………………………..………… 8 2.4 Resumen estados financieros ……………………………………………………………….… 11 2.5 Estructura del accionariado ………………………………………………………….………… 12 3. Análisis descriptivo de los datos …………………………………………………………..………. 12 4. Análisis estadístico de los datos 4.1 Tasas de variación …………………………………………………………………….……………. 15 4.2 Estadística descriptiva ……………………………………………..………………..…………… 17 5. Contrastes de hipótesis 5.1 El efecto de la crisis mundial de 2008 …………..………………………………………… 20 5.2 Inversión en el activo o en el mercado ……………………………………………………. 22 5.3 El efecto de la crisis financiera en Portugal (2010-2014) ..…….………………… 23 5.4 El efecto psicológico del split ……………………………………………………….…………. 24 6. El modelo CAPM 6.1 Estimación por el método MCO ……………………………………………………………… 26 6.2 Estimación por el método NW ………………………………………………………….……. 30 6.3 Hipótesis econométricas ……………………………………………………………..…………. 31 7. Conclusiones ……………………………………………………………………………………….……….. 33 8. Bibliografía ………………………………………………………………………………..…………………. 34 9. Apéndice 9.1 Anexo I: Índice de gráficos y tablas …………………………………………….………..… 36 9.2 Anexo II: Estadística descriptiva ……………………………………………………………... 38 9.3 Anexo III: Contrastes de hipótesis …………………………………………….………….… 39 9.4 Anexo IV: Econometría ………………………………………………………………….…..…… 40 2 1. INTRODUCCIÓN Y OBJETIVO DEL TRABAJO El objetivo principal de este trabajo es la realización de un extenso análisis de la empresa portuguesa Altri; una de las principales compañías cotizadas en el índice más importante de Portugal, el PSI20 (Portuguese Stock Index). -

Efficiency in Stock Markets with DEA: Evidence from PSI20

861 Int. J Latest Trends Fin. Eco. Sc. Vol‐5 No. 1 March, 2015 Efficiency in Stock Markets with DEA: Evidence from PSI20 Nuno Ferreira#1, Adriano Mendonça Souza*2 # Department of Quantitative Methods, IBS-ISCTE Business School, ISCTE Avenida das Forças Armadas, Lisboa, Portugal [email protected] * Department of Statistics, Federal University of Santa Maria Roraima Avenue, 100, Santa Maria, RS state, Brazil [email protected] Abstract - After the US subprime crisis, the first signs of economic efficiency, and technical efficiency. a sovereign debt crisis spread among European Whereas technical efficiency requires only input and financial players. The regulation of the markets by output data, economic efficiency also requires price European Commission and European Central Bank data. The simplest way to differentiate productive and created limitation to obtained great amount of liquidity technical efficiency is to think of productive in commercial banking sector. In this context, the efficiency in terms of cost minimization by adjusting successful survival of some European banks became in a dangerous situation. The present study try to explore the mix of inputs, whereas technical efficiency is the crisis occurred in one of the largest private output maximization from a given mix of inputs. Portuguese banks through the analysis of the efficiency In literature, a large number of papers is based on levels of twenty largest enterprises of the PSI20 since an essentially nonparametric, programming approach 1993. The input variables chosen were market value to analysis of observed outcomes. In fact, the Data and return in a Data Envelopment Analysis model. Envelopment Analysis (DEA) is by far the most used Consistent with earlier studies, the results show methodology to measure efficiency. -

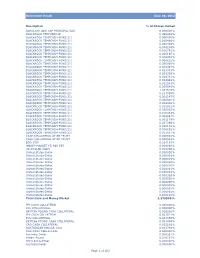

Retirement Funds June 30, 2012 Description % of Shares Owned

Retirement Funds June 30, 2012 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK FEDFUND(30) 0.440244% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000486% BLACKROCK TEMPCASH-FUND(21) 0.000485% BLACKROCK TEMPCASH-FUND(21) 0.008246% BLACKROCK TEMPCASH-FUND(21) 0.006791% BLACKROCK TEMPCASH-FUND(21) 0.005165% BLACKROCK TEMPCASH-FUND(21) 0.006043% BLACKROCK TEMPCASH-FUND(21) 0.004035% BLACKROCK TEMPCASH-FUND(21) 0.035990% BLACKROCK TEMPCASH-FUND(21) 0.020497% BLACKROCK TEMPCASH-FUND(21) 0.023343% BLACKROCK TEMPCASH-FUND(21) 0.008326% BLACKROCK TEMPCASH-FUND(21) 0.000781% BLACKROCK TEMPCASH-FUND(21) 0.004848% BLACKROCK TEMPCASH-FUND(21) 0.022593% BLACKROCK TEMPCASH-FUND(21) 0.000646% BLACKROCK TEMPCASH-FUND(21) 1.307615% BLACKROCK TEMPCASH-FUND(21) 0.214356% BLACKROCK TEMPCASH-FUND(21) 0.001147% BLACKROCK TEMPCASH-FUND(21) 0.024810% BLACKROCK TEMPCASH-FUND(21) 0.009406% BLACKROCK TEMPCASH-FUND(21) 0.018922% BLACKROCK TEMPCASH-FUND(21) 0.030062% BLACKROCK TEMPCASH-FUND(21) 0.010464% BLACKROCK TEMPCASH-FUND(21) 0.004697% BLACKROCK TEMPCASH-FUND(21) 0.001179% BLACKROCK TEMPCASH-FUND(21) 0.007266% BLACKROCK TEMPCASH-FUND(21) 0.000112% BLACKROCK TEMPCASH-FUND(21) 0.008062% BLACKROCK TEMPCASH-FUND(21) 0.011657% CASH COLLATERAL AT BR TRUST 0.000001% CASH COLLATERAL AT BR TRUST 0.000584% EOD STIF 0.024153% MONEY MARKET FD FOR EBT 0.000000% US DOLLAR CASH 0.008786% United States-Dollar 0.000000% United States-Dollar 0.000003% United States-Dollar 0.000019% United States-Dollar 0.000003% United States-Dollar -

Annual Report

Annual Proposal Report 2019 Let’s continue working for a better world #TheRightWay santander.pt SantanderSantander Totta SGPS, Totta, SA SGPS 1 Santander Totta, SGPS, SA Table of Indicators 3 Message from the Chief Executive Officer 4 Customers and Distribution Network 5 Corporate culture, awards, distinctions and other 7 relevant facts in 2019 Sustainability policy 14 Activity and Results Business Framework 18 Major risks and uncertainties for 2020 24 Business Areas 25 Business support areas 30 Economic and financial information 34 Relevant facts after the close of the period and the 41 outlook for 2020 Risk Management 43 Credit, and counterparty risk 44 Balance-sheet risk 46 This report was approved by the Market risk 47 Operational risk 48 Board of Directors on April 21, Compliance and reputation risk 49 2020 Proposal for the Appropriation of Net Income 51 Additional Information 52 Corporate Governance Report 56 Financial statements, notes to the accounts and reports and opinions Consolidated financial statements 61 Notes to the consolidated financial statements 66 Reports and opinions on the consolidated business 227 Santander Totta, SGPS, SA Rua do Ouro, 88 – 1100-063 Lisbon Share Capital: €1,972,962,079.58 Registered at the Lisbon Registry of Companies under number single registration and VAT number 507 096 851 SantanderLEI: 5493005RLLC1P7VSVC58. Totta SGPS, SA 2 TABLE OF INDICATORS BALANCE SHEET AND RESULTS (million euro) 2019 2018 Var. Total Net Assets 56,083 55,028 +1.9% Loans and advances to customers (net) 1 39,349 39,644 -0.7% Customers' Resources 42,420 39,980 +6.1% Total shareholders' equity 4,264 4,172 +2.2% Net Interest Income 855.7 866.3 -1.2% Net Fees and Other Income 381.0 382.9 -0.5% Net Income from Banking Activities 1,344.5 1,259.5 +6.8% Net Operating Income 740.0 633.5 +16.8% Income before taxes and non-controlling interests* 739.8 673.8 +9.8% Consolidated net income attributable to the shareholders of ST, SGPS 527.3 500.0 +5.5% RATIOS 2019 2018 Var. -

30Th September, 2020

MANAGERIAL ACTION AS A RESULT OF THE IMPACT OF COVID - 19 30th September, 2020 I FOREWORD ........................................................................................................................ 9 II IDENTIFIED PATTERNS ......................................................................................................... 9 III COUNTRIES AND EUROPEAN INSTITUTIONS ............................................................................ 13 1. GENERAL .......................................................................................................................... 13 2. BRAZIL ............................................................................................................................ 14 3. CHINA ............................................................................................................................. 14 4. EUROPEAN CENTRAL BANK ..................................................................................................... 14 5. EUROPEAN STABILITY MECHANISM ............................................................................................ 14 6. EUROPEAN UNION ............................................................................................................... 15 7. FRANCE ............................................................................................................................ 15 8. GERMANY ......................................................................................................................... 16 9. ITALY ............................................................................................................................. -

Curriculum Vitae

Curriculum Vitae Jorge Catulo Partner Portugal Education and Participation in Professional Organization: Graduated in Economics by the Universidade Católica Portuguesa (1989). Qualified as Certified Public Accountant (1997). Partner Deloitte & Associados, SROC S.A. Most Relevant Projects: (Portugal) Partner responsible for the audit work of Empresa de Av. Engº Duarte Pacheco, 7 Eletricidade da Madeira, Generg Group, Iberwind, Logoplaste 1070-100 Lisboa Group, Siderurgia Nacional, TrustEnergy, Luis Simões Group, INAPA Group, Lusoponte Group, among others. Tel. +351 210 427 617 [email protected] Partner responsible for the audit work of ENACOL (Cape Verde) and ENAPOR (Cape Verde) in previous years. Review of internal control procedures under the Sarbanes- Oxley Act project for EDP Group, Tejo Energia and International Power. Partner responsible for the audit work of Galp Energia Group (Petrogal, GDP and Galp Power - includes companies from cogeneration, combined cycle and energy including Wind Farms), from 2004 to 2010. Supported the conversion of financial statements to IAS / IFRS in the group Galp Energia, Lusoponte, Metropolitano de Lisboa, among others. Supported Galp Energia Group in its Initial Public Offering (IPO). Supported Galp Energia Group in the development and definition of accounting policies and practices concerning the activity of Petroleum Exploration and Production. Audit of recoverable costs as part of Concession Contracts and Production Sharing Agreements for several oil exploration and production companies in Angola (Total E&P Angola, Chevron and Sonangol Pesquisa & Produção). Between 1996 and 2001 was the Manager responsible for the audit work of Semapa Group and Secil Group. Between 2001 and 2003 was the Partner responsible for the audit work of Secil. -

Banco BPI 2008 This Page Was Intentionally Left Blank

Banco BPI 2008 This page was intentionally left blank. Report This page was intentionally left blank. Index REPORT Leading business indicators 4 Introduction 6 Governing Bodies 11 Historical milestones 12 Highlights 14 The identity of BPI 16 Financial structure and business 17 Distribution channels 20 The BPI Brand 24 Social responsibility 27 Human resources 33 Technology 37 Background to operations 41 Domestic Commercial Banking 53 Bancassurance 72 Asset Management 73 Investment Banking 79 Private Equity 84 International Commercial Banking 85 Financial review 90 Risk management 143 Rating 177 Proposed appropriation of net profit 179 Final acknowledgements 180 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES Consolidated financial statements 181 Notes to the consolidated financial statements 191 Statement from the Board of Directors 316 Legal certification of accounts and audit report 317 Report and opinion of the Supervisory Board 319 THE BPI GROUP’S CORPORATE GOVERNANCE REPORT BPI Group’s Corporate Governance report 321 Appendices 422 ANNEXES Definitions, acronyms and abbreviations 444 Glossary 446 Formulary 449 Methodological notes 451 General index 452 Index of figures, tables, charts and “boxes” 456 Thematic index 458 Miscellaneous information 459 Leading business indicators (Consolidated figures in millions of euros, except where indicated otherwise) 2004 2005 2006 2007 2008 07/08 2008 07/08 Δ% adjusted1 Δ% Net total assets 24 010 30 159 35 565 40 546 43 003 6.1% Assets under management 2, F 9 671 14 339 15 184 15 884 12 665 (20.3%) Business -

Equity Research

EQUITY RESEARCH NOS Telecoms Tailwinds from competition Buy (YE15 Price Target upgraded from €5.30 to €6.30; Buy Medium Risk Recommendation) January 2015 4 Positive signs from competition: All the operators announced price increases in the range of 3-4% for 2015. But given the weight of Portugal customers under promotional prices, the impact is bound to be NOS vs. PSI20 vs. Eurostoxx Telco limited. However, VOD has also increased its 3-Play base price from € 24.90 to € 25.90, which has been the base for the promotional prices in the 3-Play segment for all the operators. Perhaps, more important 120 than the direct impact this will have when renewing the promotions is Eurostoxx the sign VOD is giving the market. We remain conservative in our 110 Telco estimate for sector revenues (CAGR13-18F of -1.2%), but acknowledge upside risks. Apart from this, PT Portugal continues to 100 be strongly conditioned by PT/Oi events which is bound to benefit its competitors and NOS in particular. 90 NOS 4 Still the best positioned player in the sector: NOS continues to have 80 the largest NGN coverage in the country (3.2mn and plans to reach 3.6mn in YE15) and its large 3P customer base is the most powerful 70 argument to surf the wave of convergence. On top of that, NOS is the PSI20 only player that can match PT in network capacity, expertise and 60 reach in the enterprise segment. As pricing pressure fades in the 3- Jan-14 May-14 Sep-14 Jan-15 Play segment, revenue accretion by the strong growth in mobile subs. -

Markowitz Efficient Frontier and Capital Market Line – Evidence from the Portuguese Stock Market

MARKOWITZ EFFICIENT FRONTIER AND CAPITAL MARKET LINE – EVIDENCE FROM THE PORTUGUESE STOCK MARKET 1 2 The European Journal of Management Teresa Garcia and Daniel Borrego Studies is a publication of ISEG, 1 Universidade de Lisboa. The mission of ISEG – Lisbon School of Economics and EJMS is to significantly influence the domain of management studies by Management, Universidade de Lisboa, and UECE, publishing innovative research articles. Portugal; 2ISEG – Lisbon School of Economics and EJMS aspires to provide a platform for Management, Universidade de Lisboa thought leadership and outreach. Editors-in-Chief: Luís M. de Castro, PhD ISEG - Lisbon School of Economics and Management, Universidade de Lisboa, Abstract Portugal Gurpreet Dhillon, PhD This paper estimates the efficient frontier and the capital Virginia Commonwealth University, USA market line using listed stocks of the Portuguese capital Tiago Cardão-Pito, PhD ISEG - Lisbon School of Economics and market that are part of the PSI20 index, considering two Management, Universidade de Lisboa, different periods - before and after the 2008 financial crisis, Portugal known as the Global Financial Crisis. The results show the Managing Editor: impact of the 2008 financial crisis on the global minimum Mark Crathorne, MA ISEG - Lisbon School of Economics and variance portfolio and on the market portfolio. The sensitivity Management, Universidade de Lisboa, analysis of the results to the inclusion or not of the year 2008 Portugal is also considered1. ISSN: 2183-4172 Volume 22, Issue 1 www.european-jms.com Key words: Markowitz portfolio theory. Mean-variance theory. Efficient Frontier. Capital Market Line. PSI20. 1 The authors would like to acknowledge the financial support received from FCT (Fundação para a Ciência e a Tecnologia), Portugal.