Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tese Carla Quintas Inclui As Críticas Do Júri Teste1

A redução de custos face à atual conjuntura de crise: Evidência empírica nas empresas do PSI-20 Carla Marlene Silva Quintas Dissertação apresentada ao Instituto Politécnico de Viana do Castelo para obtenção do Grau de Mestre em Gestão das Organizações, Ramo de Gestão de Empresas Orientada por: Professor Doutor Nuno Domingues Viana do Castelo, fevereiro de 2016 A redução de custos face à atual conjuntura de crise: Evidência empírica nas empresas do PSI-20 Carla Marlene Silva Quintas Orientação: Professor Doutor Nuno Domingues Viana do Castelo, fevereiro de 2016 RESUMO A globalização é um fenómeno inevitável e que afeta todas as organizações. Os concorrentes deixaram de ser as empresas da mesma área geográfica e passaram a ser todas as que, a nível mundial, competem no mesmo mercado. Neste sentido, é inevitável por parte das empresas a procura da melhoria da qualidade do seu produto/serviço e a preços cada vez mais competitivos. Esta discussão não é recente mas torna-se proeminente em função da crise económica e social que se atravessa. A redução dos custos e, principalmente, o aumento dos lucros são necessários a qualquer empresa que tem como principal objetivo a sobrevivência neste mercado global. Deste modo, este estudo incide sobre quais as medidas que as maiores empresas portuguesas (PSI-20, cotadas em 2011) tomaram no sentido de reduzir custos face à atual conjuntura de crise. As conclusões apontam no sentido de todas as empresas analisadas demonstrarem preocupação com a temática, sendo que as medidas tomadas nem sempre são possíveis de apurar. As medidas relacionadas com os custos com pessoal são utilizadas por diversas empresas mas possuem várias nuances : redimensionamento do quadro de colaboradores, anulação/corte de remuneração variável, contenção de aumentos salariais, reconversão de quadros, formação, renegociação/reestruturação de seguros de saúde e corte nas horas extraordinárias. -

Banco BPI 1.º Semestre De 2017”

This document is a translation from the Portuguese original “Relatório e Contas Banco BPI 1.º semestre de 2017”. In the event of any inconsistency the Portuguese version shall prevail. BANCO BPI 1st half 2017 Public held company Registered in Oporto C.R.C. and tax identification under the sole number 501 214 534 Headquarters: Rua Tenente Valadim, n.º 284, 4100-476 Porto, PORTUGAL Share Capital: EUR 1 293 063 324.98 Registered in Oporto C.R.C. and tax identification under the sole number 501 214 534 This page was intentionally left blank. 2009 Report and Accounts| Management report 2 Index REPORT Leading business indicators 4 Summary of first half 2017 results 5 Financial structure and business 6 Governing bodies 7 Human resources 8 Distribution channels 9 Background to operations 10 Financial review 13 Rating 36 Banco BPI Shares 37 Annex - Recommendations from Bank of Portugal 38 Annex - Alternative Performance Indicators 40 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES 43 Consolidated financial statements 44 Notes to the consolidated financial statements 49 Statement 236 Audit report prepared by an auditor registered at the Portuguese Securities Market 237 Commission (CMVM) Banco BPI | Report and Accounts 1st half 2017 3 Leading business indicators (Figures in millions of euros, except where indicated otherwise) 1st half 17, excl. 1st half 16 Results and profitability 1st half 17 non-recurring 1 pro forma Net profit 187.8 (101.7) 105.9 Net profit per share (euros) 0,129 (0,070) 0,073 Weighted average number of shares (in millions) 1,455.7 -

Altri SGPS SA

COLEGIO UNIVERSITARIO DE ESTUDIOS FINANCIEROS GRADO EN ADMINISTRACIÓN Y DIRECCIÓN DE EMPRESAS Trabajo Fin de GRADO ANÁLISIS DE DATOS FINANCIEROS ALTRI SGPS S.A. Autor: Hernández López-Sors, Gonzalo Tutor: Queralt Sánchez de las Matas, Ricardo Gracia Díez, Mercedes Madrid, abril de 2019 ÍNDICE 1. Introducción y objetivo del trabajo ………………………………………………………………… 3 2. ALTRI SGPS S.A. 2.1 Descripción de la compañía………………………………………………………………………. 3 2.2 Historia ……………………..………………………………………………………………..……......... 5 2.3 Análisis financiero …………………………………………………………………………..………… 8 2.4 Resumen estados financieros ……………………………………………………………….… 11 2.5 Estructura del accionariado ………………………………………………………….………… 12 3. Análisis descriptivo de los datos …………………………………………………………..………. 12 4. Análisis estadístico de los datos 4.1 Tasas de variación …………………………………………………………………….……………. 15 4.2 Estadística descriptiva ……………………………………………..………………..…………… 17 5. Contrastes de hipótesis 5.1 El efecto de la crisis mundial de 2008 …………..………………………………………… 20 5.2 Inversión en el activo o en el mercado ……………………………………………………. 22 5.3 El efecto de la crisis financiera en Portugal (2010-2014) ..…….………………… 23 5.4 El efecto psicológico del split ……………………………………………………….…………. 24 6. El modelo CAPM 6.1 Estimación por el método MCO ……………………………………………………………… 26 6.2 Estimación por el método NW ………………………………………………………….……. 30 6.3 Hipótesis econométricas ……………………………………………………………..…………. 31 7. Conclusiones ……………………………………………………………………………………….……….. 33 8. Bibliografía ………………………………………………………………………………..…………………. 34 9. Apéndice 9.1 Anexo I: Índice de gráficos y tablas …………………………………………….………..… 36 9.2 Anexo II: Estadística descriptiva ……………………………………………………………... 38 9.3 Anexo III: Contrastes de hipótesis …………………………………………….………….… 39 9.4 Anexo IV: Econometría ………………………………………………………………….…..…… 40 2 1. INTRODUCCIÓN Y OBJETIVO DEL TRABAJO El objetivo principal de este trabajo es la realización de un extenso análisis de la empresa portuguesa Altri; una de las principales compañías cotizadas en el índice más importante de Portugal, el PSI20 (Portuguese Stock Index). -

Efficiency in Stock Markets with DEA: Evidence from PSI20

861 Int. J Latest Trends Fin. Eco. Sc. Vol‐5 No. 1 March, 2015 Efficiency in Stock Markets with DEA: Evidence from PSI20 Nuno Ferreira#1, Adriano Mendonça Souza*2 # Department of Quantitative Methods, IBS-ISCTE Business School, ISCTE Avenida das Forças Armadas, Lisboa, Portugal [email protected] * Department of Statistics, Federal University of Santa Maria Roraima Avenue, 100, Santa Maria, RS state, Brazil [email protected] Abstract - After the US subprime crisis, the first signs of economic efficiency, and technical efficiency. a sovereign debt crisis spread among European Whereas technical efficiency requires only input and financial players. The regulation of the markets by output data, economic efficiency also requires price European Commission and European Central Bank data. The simplest way to differentiate productive and created limitation to obtained great amount of liquidity technical efficiency is to think of productive in commercial banking sector. In this context, the efficiency in terms of cost minimization by adjusting successful survival of some European banks became in a dangerous situation. The present study try to explore the mix of inputs, whereas technical efficiency is the crisis occurred in one of the largest private output maximization from a given mix of inputs. Portuguese banks through the analysis of the efficiency In literature, a large number of papers is based on levels of twenty largest enterprises of the PSI20 since an essentially nonparametric, programming approach 1993. The input variables chosen were market value to analysis of observed outcomes. In fact, the Data and return in a Data Envelopment Analysis model. Envelopment Analysis (DEA) is by far the most used Consistent with earlier studies, the results show methodology to measure efficiency. -

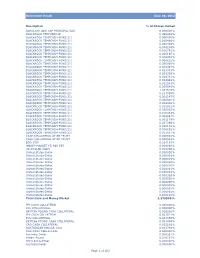

Retirement Funds June 30, 2012 Description % of Shares Owned

Retirement Funds June 30, 2012 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK FEDFUND(30) 0.440244% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000486% BLACKROCK TEMPCASH-FUND(21) 0.000485% BLACKROCK TEMPCASH-FUND(21) 0.008246% BLACKROCK TEMPCASH-FUND(21) 0.006791% BLACKROCK TEMPCASH-FUND(21) 0.005165% BLACKROCK TEMPCASH-FUND(21) 0.006043% BLACKROCK TEMPCASH-FUND(21) 0.004035% BLACKROCK TEMPCASH-FUND(21) 0.035990% BLACKROCK TEMPCASH-FUND(21) 0.020497% BLACKROCK TEMPCASH-FUND(21) 0.023343% BLACKROCK TEMPCASH-FUND(21) 0.008326% BLACKROCK TEMPCASH-FUND(21) 0.000781% BLACKROCK TEMPCASH-FUND(21) 0.004848% BLACKROCK TEMPCASH-FUND(21) 0.022593% BLACKROCK TEMPCASH-FUND(21) 0.000646% BLACKROCK TEMPCASH-FUND(21) 1.307615% BLACKROCK TEMPCASH-FUND(21) 0.214356% BLACKROCK TEMPCASH-FUND(21) 0.001147% BLACKROCK TEMPCASH-FUND(21) 0.024810% BLACKROCK TEMPCASH-FUND(21) 0.009406% BLACKROCK TEMPCASH-FUND(21) 0.018922% BLACKROCK TEMPCASH-FUND(21) 0.030062% BLACKROCK TEMPCASH-FUND(21) 0.010464% BLACKROCK TEMPCASH-FUND(21) 0.004697% BLACKROCK TEMPCASH-FUND(21) 0.001179% BLACKROCK TEMPCASH-FUND(21) 0.007266% BLACKROCK TEMPCASH-FUND(21) 0.000112% BLACKROCK TEMPCASH-FUND(21) 0.008062% BLACKROCK TEMPCASH-FUND(21) 0.011657% CASH COLLATERAL AT BR TRUST 0.000001% CASH COLLATERAL AT BR TRUST 0.000584% EOD STIF 0.024153% MONEY MARKET FD FOR EBT 0.000000% US DOLLAR CASH 0.008786% United States-Dollar 0.000000% United States-Dollar 0.000003% United States-Dollar 0.000019% United States-Dollar 0.000003% United States-Dollar -

30Th September, 2020

MANAGERIAL ACTION AS A RESULT OF THE IMPACT OF COVID - 19 30th September, 2020 I FOREWORD ........................................................................................................................ 9 II IDENTIFIED PATTERNS ......................................................................................................... 9 III COUNTRIES AND EUROPEAN INSTITUTIONS ............................................................................ 13 1. GENERAL .......................................................................................................................... 13 2. BRAZIL ............................................................................................................................ 14 3. CHINA ............................................................................................................................. 14 4. EUROPEAN CENTRAL BANK ..................................................................................................... 14 5. EUROPEAN STABILITY MECHANISM ............................................................................................ 14 6. EUROPEAN UNION ............................................................................................................... 15 7. FRANCE ............................................................................................................................ 15 8. GERMANY ......................................................................................................................... 16 9. ITALY ............................................................................................................................. -

Banco BPI 2008 This Page Was Intentionally Left Blank

Banco BPI 2008 This page was intentionally left blank. Report This page was intentionally left blank. Index REPORT Leading business indicators 4 Introduction 6 Governing Bodies 11 Historical milestones 12 Highlights 14 The identity of BPI 16 Financial structure and business 17 Distribution channels 20 The BPI Brand 24 Social responsibility 27 Human resources 33 Technology 37 Background to operations 41 Domestic Commercial Banking 53 Bancassurance 72 Asset Management 73 Investment Banking 79 Private Equity 84 International Commercial Banking 85 Financial review 90 Risk management 143 Rating 177 Proposed appropriation of net profit 179 Final acknowledgements 180 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES Consolidated financial statements 181 Notes to the consolidated financial statements 191 Statement from the Board of Directors 316 Legal certification of accounts and audit report 317 Report and opinion of the Supervisory Board 319 THE BPI GROUP’S CORPORATE GOVERNANCE REPORT BPI Group’s Corporate Governance report 321 Appendices 422 ANNEXES Definitions, acronyms and abbreviations 444 Glossary 446 Formulary 449 Methodological notes 451 General index 452 Index of figures, tables, charts and “boxes” 456 Thematic index 458 Miscellaneous information 459 Leading business indicators (Consolidated figures in millions of euros, except where indicated otherwise) 2004 2005 2006 2007 2008 07/08 2008 07/08 Δ% adjusted1 Δ% Net total assets 24 010 30 159 35 565 40 546 43 003 6.1% Assets under management 2, F 9 671 14 339 15 184 15 884 12 665 (20.3%) Business -

Circular Synergies, Challenges for Portugal

CIRCULAR SYNERGIES CHALLENGES FOR PORTUGAL TECHNICAL INFORMATION: Authorship and production BCSD Portugal – Business Council for Sustainable Development 3DRIVERS – Engineering, Innovation and Environment Technical consultancy 3DRIVERS – Engineering, Innovation and Environment Coordination Circular Economy and Industrial Symbiosis Work Group of the BCSD Portugal: Altice Portugal, Altri, Amorim, ANA Aeroportos de Portugal, Cimpor, Cortadoria Nacional de Pêlo, Deloitte, EDP, Eurest, EY, Galp, Hovione, Jerónimo Martins, Lipor, Prio Biocombustíveis, PwC, Secil, Sonae, The Navigator Company and Vieira de Almeida & Associados. Contributions The BCSD Portugal wishes to thank the Agência Portuguesa do Ambiente (Portuguese Environmental Agency), the Associação Smart Waste Portugal (Smart Waste Association Portugal), Ambimed Sterycicle PT, Euro Separadora, Ferrovial, Hidurbe and Tratolixo for their contributions. Photographs courtesy of: Altri, Cimpor, EDP, Galp, Jerónimo Martins, Lipor and Secil. Translation of the Circular Synergies report to English sponsored by: ISBN: 978-989-98060-9-2 Design and art Real True Design Illustration Mariana Malhão JUNE 2018 INDEX 04 EDITORIAL 06 PREFACE 07 INTRODUCTION 09 EXECUTIVE SUMMARY 11 THE STUDY 12 Circular Synergies 12 Starting point 13 Waste generation mapping 15 Waste reception mapping 16 Sub-products mapping 17 Industrial symbiosis opportunities 18 Impact of industrial symbiosis 20 ACTIONS TO ACCELERATE THE TRANSITION IN PORTUGAL 21 1. Regulatory changes to facilitate waste trading 22 2. Encouraging environmentally -

WEEKLY Forex Rates Last 1W YTD 2012 Interest Rates Last 1W Chg YE12 EUR/USD 1.31 -0.8% -0.86% 1.97% Euribor 6M 0.34% 0.33% 0Bp 0.32%

IBERIA 28 June 2013 EQUITY RESEARCH TOP STORY Altri went up by 12% in the week, while the PSI 20 rose by 1.9%. There were no major reasons but in the week before Altri underperformed, lost 9.33%, as the PSI20 went down by 5.5%. So we will say that it was mainly a pull back from a strong fall (page 9). OUT THIS WEEK Snapshots / Company Reports - Retail Setor, Semapa Price Target / Recommendation Changes – Semapa, Jerónimo Martins, Altri, Portucel, Mota- Engil News – Banking Sector, Telefónica, Portugal Telecom, EDP Renováveis, Retail Setor, Inditex, Jerónimo Martins, Altri, Galp Energia WEEK AHEAD Monday – New car sales in Portugal and Spain (June) PORTFOLIOS This week, Mib Aggressive Portfolio went up 1.65%, underperforming the PSI20 by 0.27pp. Excluding Portugal Telecom and Novabase, all stocks contributed for this underperformance (page 11). This week, Mib Liquidity Portfolio went up 2.07%, outperforming the PSI20 by 0.14pp. Excluding EDP Renováveis and Portugal Telecom, all stocks contributed for this outperformance (page 12). Stock Market Last 1W YTD 2012 Daily Vol. (€mn) 1W 1M 6M 2012 PSI 20 5,557 1.9% -1.74% 2.93% PSI 20 110 105 111 66 IBEX 35 7,763 0.8% -4.96% -4.66% IBEX 35 3,941 2,830 2,436 2,578 Euro Stoxx 50 2,603 2.1% -1.26% 13.79% Euro Stoxx 50 10,906 8,387 7,753 7,867 WEEKLY Forex Rates Last 1W YTD 2012 Interest Rates Last 1W Chg YE12 EUR/USD 1.31 -0.8% -0.86% 1.97% Euribor 6m 0.34% 0.33% 0bp 0.32% EUR/GBP 0.86 0.5% 5.04% -2.30% 10Y Bond PT 6.45% 6.43% 2bp 7.01% António Seladas, CFA EUR/BRL 2.87 -3.2% 6.32% -10.68% 10Y Bond SP 4.77% 4.91% -14bp 5.26% +351 21 003 7826 [email protected] Best & Worse Performers -1 Week (%) Best & Worse Performers - YTD (%) Impresa 106.5 Altri 11.9 Portucel 8.3 Mota-Engil 48.5 EDP Renováveis 8.0 BCP 28.0 Mota-Engil 6.6 Zon Multimedia 24.9 Av. -

Report and Accounts

REPORT AND ACCOUNTS 2017 WorldReginfo - d81ff46f-9d7a-4f8a-bbf4-6db946f0b0a2 REPORT AND ACCOUNTS 2017 REPORT AND ACCOUNTS 2017 PART 1 MANAGEMENT REPORT……………………………….…..….....3 PART 2 CORPORATE GOVERNANCE REPORT…………………….......48 PART 3 NON‐FINANCIAL STATEMENTS ‐ SUSTAINABILITY INFORMATION...……………………………………..…………115 PART 4 CONSOLIDATED FINANCIAL STATEMENTS………..............143 PART 5 STATUTORY AUDITOR CERTIFICATE AND REPORT OF THE AUDIT BOARD ON THE CONSOLIDATED ACCOUNTS……………............................................................268 PART 6 INDIVIDUAL FINANCIAL STATEMENTS……….....................282 PART 7 STATUTORY AUDITOR CERTIFICATE AND REPORT OF THE AUDIT BOARD ON THE SEPARATE ACCOUNTS……….……344 SEMAPA – SOCIEDADE DE INVESTIMENTO E GESTÃO, SGPS, S.A. SOCIEDADE ABERTA AV. FONTES PEREIRA DE MELO, NO.14, 10TH FLOOR, 1050‐121 LISBON COMPANY’S REGISTRY AND CORPORATE PERSON NO.: 502 593 130 SHARE CAPITAL: € 81,270,000 WorldReginfo - d81ff46f-9d7a-4f8a-bbf4-6db946f0b0a2 REPORT AND ACCOUNTS 2017 PART 1 MANAGEMENT REPORT MANAGEMENT REPORT 3 OF 353 WorldReginfo - d81ff46f-9d7a-4f8a-bbf4-6db946f0b0a2 REPORT AND ACCOUNTS 2017 CONTENTS 1 ECONOMIC BACKGROUND .................................................................................................................................................. 6 2 OVERVIEW OF SEMAPA GROUP OPERATIONS ................................................................................................................... 7 3 PAPER AND PAPER PULP BUSINESS AREA .................................................................................................................... -

The Navigator Company

The Navigator Pulp & Paper / Portugal Reuters/Bloomberg: NVG.LS / NVG PT May 23, 2017 Navigating into new business segments and geographies - Initiating coverage Rating Buy with a Buy rating vs. previous NR We initiate coverage on The Navigator Company (NVG), a leading pulp and paper producer, with Target8.0 Price (€/sh.) 4.75 a Buy rating and a target price of EUR 4.75/share, implying a 23.1% upside form current levels. Current7.0 Share Price* (€/sh) 3.86 Despite the volatility in pulp and paper prices, the company has been able to maintain an average *18 /05/ 2017 EBITDA margin of above 24% over the last 6 years reaching 25.2% in 2016 (+120bps y-o-y) on the 6.0 back of volume sales growth, high capacity utilization (leveraging on a modern and efficient asset base), and good access to raw materials. Stock5.0 Data Market Cap (€m) Pulp and paper prices are expected to remain relatively stable in the short term as (mainly) 2,765.5 4.0 demand from Asia should help counterbalance new capacity coming online. At the same time, the EV (€m) 3,383.2 company has been able to extract additional capacity, increasing volume sales, expanding exports Free 3.0Float 30.6% into higher-growth developing markets, while further efficiency efforts should support the Num. of shares (m) 717.0 profitability of the pulp & paper divisions. 2.0 Still, for the medium-to-longer term the main driver of growth is expected to come from group’s Performance1.0 1m 3m 12m new divisions, namely pellets and primarily tissue paper. -

PSI 20 Factsheet

PSI20 Factsheet 1/3 PSI 20® Objective The PSI 20® is a free float market capitalization weighted index that reflects the performance of the maximal 20 most actively traded shares listed on Euronext Lisbon, and is the most widely used indicator of the Portuguese stock market. The index serves as an underlying for structured products, funds, exchange traded funds and futures. Investability Stocks are screened to ensure liquidity and selected and free float weighted to ensure that the index is investable. Transparency The index rules, that are available on our website, are overseen by the independent PSI committee that acts as Supervisor. All our rulebooks can be found on the following webpage: https://live.euronext.com/en/products-indices/index-rules. Statistics Mar-21 Market Capitalization EUR Bil Performance (%) Fundamentals Full 65,4 Q1 2021 0,64% P/E Incl. Neg LTM 17,89 Free float 30,1 YTD 0,64% P/E Incl. Neg FY1 18,19 % of PSI All-Share Index 98,0% 2020 -6,06% P/E excl. Neg LTM 19,64 2019 10,20% P/E excl. Neg FY1 18,26 Components (full) EUR Bil 2018 -12,19% Price/Book 2,26 Average 3,64 Price/Sales 2,05 Median 1,45 Annualized (%) Price/Cash Flow 6,48 Largest 19,31 2 Year -2,70% Dividend Yield (%) 3,63% Smallest 0,10 3 Years -3,03% 5 Years -0,37% Risk Component Weights (%) Since Base Date 31-Dec-1992 1,77% Sharpe Ratio 1 Year 1,32 Largest 12,7 Volatility 30 Day 19,43 Smallest 0,34 Performance vs.