Millennium Investment Banking Weekly 11 May 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sonae 1St Quarter Results 2018

SONAESONAE 1Q18 RESULTS 1ST QUARTER RESULTS 2018 1 WorldReginfo - fecbe82b-35d6-44a4-a830-8f6b4c5da279 SONAE 1Q18 RESULTS 1 HIGHLIGHTS AND CEO’S MESSAGE • Sonae turnover posted a solid evolution, increasing 8.7% y.o.y., to €1,342 M in 1Q18 (+6.7% in aggregated terms) • Sonae underlying EBITDA totalled €57 M, improving 11.0% versus 1Q17 • Sonae EBITDA reached €70 M, growing 9.5% versus 1Q17 (+6.0% in aggregated terms) • Sonae net debt decreased by 8.2% y.o.y., to €1,266 M in the first quarter of 2018 “Sonae recorded a good start to the year of 2018, with Q1 consolidated turnover growing by 8.7% and profitability (EBITDA) by 9.5%. The performance of our food retail business and of Worten were particularly strong, both in terms of absolute growth but also in terms of LFL sales, (recording LFL growth of 5.3% and 8.8% respectively), well above what the calendar effect can explain. Including the remaining co-controlled companies, which performance also showed a favorable trend, turnover and EBITDA in aggregated terms reached 1.8 billion euros (+6.7%) and 230 million euros (+6.0%), respectively. In addition to these encouraging results, we continued the execution of our different businesses’ strategies and management of our portfolio, namely through the creation of the Iberian Sports Retail Group, materialised in the beginning of February, which is a result of the combination of Sport Zone with Sprinter and JD’s Iberian operations and whose impact will start to be seen in our accounts from the next quarter onwards. -

Gazzetta Ufficiale C 333, 28/11/2001, Pag. 10

C 333/10IT Gazzetta ufficiale delle Comunità europee 28.11.2001 Notifica preventiva di una concentrazione (Caso COMP/M.2678 Sonae/CNP Assurances/Inparsa JV) Caso ammissibile alla procedura semplificata (2001/C 333/05) (Testo rilevante ai fini del SEE) 1. In data 20 novembre 2001 Ł pervenuta alla Commissione la notifica di un progetto di concentra- zione in conformità all’articolo 4 del regolamento (CEE) n. 4064/89 del Consiglio (1), modificato da ultimo dal regolamento (CE) n. 1310/97 (2). Con tale operazione l’impresa portoghese Sonae ImobiliÆria SGPS Sa («Sonae»), appartenente al gruppo Sonae, e l’impresa francese CNP Assurances («CNP»), acquisiscono me- diante acquisto di azioni ai sensi dell’articolo 3, paragrafo 1, lettera b), del suddetto regolamento, il controllo in comune dell’impresa portoghese Inparsa-Investimentos e Participaçıes SGPS, SA («Inparsa»), attualmente esclusivamente controllata da Sonae. 2. Le attività svolte dalle imprese interessate sono le seguenti: Sonae: affitto di immobili per uso commerciale, prodotti derivati dal legno, rivendita al dettaglio di prodotti alimentari e altri prodotti, telecomunicazioni, media, turismo, trasporto, CNP: assicurazioni sulla vita, Inparsa: affitto di immobili per uso commerciale. 3. A seguito di un esame preliminare, la Commissione ritiene che la concentrazione notificata possa rientrare nel campo d’applicazione del regolamento (CEE) n. 4064/89. Tuttavia si riserva la decisione finale al riguardo. Si rileva che, ai sensi della comunicazione della Commissione concernente una procedura semplificata per l’esame di determinate concentrazioni a norma del regolamento (CEE) n. 4064/89 (3), il presente caso potrebbe soddisfare le condizioni per l’applicazione della procedura di cui alla comunica- zione stessa. -

Tese Carla Quintas Inclui As Críticas Do Júri Teste1

A redução de custos face à atual conjuntura de crise: Evidência empírica nas empresas do PSI-20 Carla Marlene Silva Quintas Dissertação apresentada ao Instituto Politécnico de Viana do Castelo para obtenção do Grau de Mestre em Gestão das Organizações, Ramo de Gestão de Empresas Orientada por: Professor Doutor Nuno Domingues Viana do Castelo, fevereiro de 2016 A redução de custos face à atual conjuntura de crise: Evidência empírica nas empresas do PSI-20 Carla Marlene Silva Quintas Orientação: Professor Doutor Nuno Domingues Viana do Castelo, fevereiro de 2016 RESUMO A globalização é um fenómeno inevitável e que afeta todas as organizações. Os concorrentes deixaram de ser as empresas da mesma área geográfica e passaram a ser todas as que, a nível mundial, competem no mesmo mercado. Neste sentido, é inevitável por parte das empresas a procura da melhoria da qualidade do seu produto/serviço e a preços cada vez mais competitivos. Esta discussão não é recente mas torna-se proeminente em função da crise económica e social que se atravessa. A redução dos custos e, principalmente, o aumento dos lucros são necessários a qualquer empresa que tem como principal objetivo a sobrevivência neste mercado global. Deste modo, este estudo incide sobre quais as medidas que as maiores empresas portuguesas (PSI-20, cotadas em 2011) tomaram no sentido de reduzir custos face à atual conjuntura de crise. As conclusões apontam no sentido de todas as empresas analisadas demonstrarem preocupação com a temática, sendo que as medidas tomadas nem sempre são possíveis de apurar. As medidas relacionadas com os custos com pessoal são utilizadas por diversas empresas mas possuem várias nuances : redimensionamento do quadro de colaboradores, anulação/corte de remuneração variável, contenção de aumentos salariais, reconversão de quadros, formação, renegociação/reestruturação de seguros de saúde e corte nas horas extraordinárias. -

Banco BPI 1.º Semestre De 2017”

This document is a translation from the Portuguese original “Relatório e Contas Banco BPI 1.º semestre de 2017”. In the event of any inconsistency the Portuguese version shall prevail. BANCO BPI 1st half 2017 Public held company Registered in Oporto C.R.C. and tax identification under the sole number 501 214 534 Headquarters: Rua Tenente Valadim, n.º 284, 4100-476 Porto, PORTUGAL Share Capital: EUR 1 293 063 324.98 Registered in Oporto C.R.C. and tax identification under the sole number 501 214 534 This page was intentionally left blank. 2009 Report and Accounts| Management report 2 Index REPORT Leading business indicators 4 Summary of first half 2017 results 5 Financial structure and business 6 Governing bodies 7 Human resources 8 Distribution channels 9 Background to operations 10 Financial review 13 Rating 36 Banco BPI Shares 37 Annex - Recommendations from Bank of Portugal 38 Annex - Alternative Performance Indicators 40 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES 43 Consolidated financial statements 44 Notes to the consolidated financial statements 49 Statement 236 Audit report prepared by an auditor registered at the Portuguese Securities Market 237 Commission (CMVM) Banco BPI | Report and Accounts 1st half 2017 3 Leading business indicators (Figures in millions of euros, except where indicated otherwise) 1st half 17, excl. 1st half 16 Results and profitability 1st half 17 non-recurring 1 pro forma Net profit 187.8 (101.7) 105.9 Net profit per share (euros) 0,129 (0,070) 0,073 Weighted average number of shares (in millions) 1,455.7 -

Altri SGPS SA

COLEGIO UNIVERSITARIO DE ESTUDIOS FINANCIEROS GRADO EN ADMINISTRACIÓN Y DIRECCIÓN DE EMPRESAS Trabajo Fin de GRADO ANÁLISIS DE DATOS FINANCIEROS ALTRI SGPS S.A. Autor: Hernández López-Sors, Gonzalo Tutor: Queralt Sánchez de las Matas, Ricardo Gracia Díez, Mercedes Madrid, abril de 2019 ÍNDICE 1. Introducción y objetivo del trabajo ………………………………………………………………… 3 2. ALTRI SGPS S.A. 2.1 Descripción de la compañía………………………………………………………………………. 3 2.2 Historia ……………………..………………………………………………………………..……......... 5 2.3 Análisis financiero …………………………………………………………………………..………… 8 2.4 Resumen estados financieros ……………………………………………………………….… 11 2.5 Estructura del accionariado ………………………………………………………….………… 12 3. Análisis descriptivo de los datos …………………………………………………………..………. 12 4. Análisis estadístico de los datos 4.1 Tasas de variación …………………………………………………………………….……………. 15 4.2 Estadística descriptiva ……………………………………………..………………..…………… 17 5. Contrastes de hipótesis 5.1 El efecto de la crisis mundial de 2008 …………..………………………………………… 20 5.2 Inversión en el activo o en el mercado ……………………………………………………. 22 5.3 El efecto de la crisis financiera en Portugal (2010-2014) ..…….………………… 23 5.4 El efecto psicológico del split ……………………………………………………….…………. 24 6. El modelo CAPM 6.1 Estimación por el método MCO ……………………………………………………………… 26 6.2 Estimación por el método NW ………………………………………………………….……. 30 6.3 Hipótesis econométricas ……………………………………………………………..…………. 31 7. Conclusiones ……………………………………………………………………………………….……….. 33 8. Bibliografía ………………………………………………………………………………..…………………. 34 9. Apéndice 9.1 Anexo I: Índice de gráficos y tablas …………………………………………….………..… 36 9.2 Anexo II: Estadística descriptiva ……………………………………………………………... 38 9.3 Anexo III: Contrastes de hipótesis …………………………………………….………….… 39 9.4 Anexo IV: Econometría ………………………………………………………………….…..…… 40 2 1. INTRODUCCIÓN Y OBJETIVO DEL TRABAJO El objetivo principal de este trabajo es la realización de un extenso análisis de la empresa portuguesa Altri; una de las principales compañías cotizadas en el índice más importante de Portugal, el PSI20 (Portuguese Stock Index). -

Efficiency in Stock Markets with DEA: Evidence from PSI20

861 Int. J Latest Trends Fin. Eco. Sc. Vol‐5 No. 1 March, 2015 Efficiency in Stock Markets with DEA: Evidence from PSI20 Nuno Ferreira#1, Adriano Mendonça Souza*2 # Department of Quantitative Methods, IBS-ISCTE Business School, ISCTE Avenida das Forças Armadas, Lisboa, Portugal [email protected] * Department of Statistics, Federal University of Santa Maria Roraima Avenue, 100, Santa Maria, RS state, Brazil [email protected] Abstract - After the US subprime crisis, the first signs of economic efficiency, and technical efficiency. a sovereign debt crisis spread among European Whereas technical efficiency requires only input and financial players. The regulation of the markets by output data, economic efficiency also requires price European Commission and European Central Bank data. The simplest way to differentiate productive and created limitation to obtained great amount of liquidity technical efficiency is to think of productive in commercial banking sector. In this context, the efficiency in terms of cost minimization by adjusting successful survival of some European banks became in a dangerous situation. The present study try to explore the mix of inputs, whereas technical efficiency is the crisis occurred in one of the largest private output maximization from a given mix of inputs. Portuguese banks through the analysis of the efficiency In literature, a large number of papers is based on levels of twenty largest enterprises of the PSI20 since an essentially nonparametric, programming approach 1993. The input variables chosen were market value to analysis of observed outcomes. In fact, the Data and return in a Data Envelopment Analysis model. Envelopment Analysis (DEA) is by far the most used Consistent with earlier studies, the results show methodology to measure efficiency. -

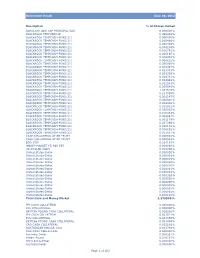

Retirement Funds June 30, 2012 Description % of Shares Owned

Retirement Funds June 30, 2012 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK FEDFUND(30) 0.440244% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000486% BLACKROCK TEMPCASH-FUND(21) 0.000485% BLACKROCK TEMPCASH-FUND(21) 0.008246% BLACKROCK TEMPCASH-FUND(21) 0.006791% BLACKROCK TEMPCASH-FUND(21) 0.005165% BLACKROCK TEMPCASH-FUND(21) 0.006043% BLACKROCK TEMPCASH-FUND(21) 0.004035% BLACKROCK TEMPCASH-FUND(21) 0.035990% BLACKROCK TEMPCASH-FUND(21) 0.020497% BLACKROCK TEMPCASH-FUND(21) 0.023343% BLACKROCK TEMPCASH-FUND(21) 0.008326% BLACKROCK TEMPCASH-FUND(21) 0.000781% BLACKROCK TEMPCASH-FUND(21) 0.004848% BLACKROCK TEMPCASH-FUND(21) 0.022593% BLACKROCK TEMPCASH-FUND(21) 0.000646% BLACKROCK TEMPCASH-FUND(21) 1.307615% BLACKROCK TEMPCASH-FUND(21) 0.214356% BLACKROCK TEMPCASH-FUND(21) 0.001147% BLACKROCK TEMPCASH-FUND(21) 0.024810% BLACKROCK TEMPCASH-FUND(21) 0.009406% BLACKROCK TEMPCASH-FUND(21) 0.018922% BLACKROCK TEMPCASH-FUND(21) 0.030062% BLACKROCK TEMPCASH-FUND(21) 0.010464% BLACKROCK TEMPCASH-FUND(21) 0.004697% BLACKROCK TEMPCASH-FUND(21) 0.001179% BLACKROCK TEMPCASH-FUND(21) 0.007266% BLACKROCK TEMPCASH-FUND(21) 0.000112% BLACKROCK TEMPCASH-FUND(21) 0.008062% BLACKROCK TEMPCASH-FUND(21) 0.011657% CASH COLLATERAL AT BR TRUST 0.000001% CASH COLLATERAL AT BR TRUST 0.000584% EOD STIF 0.024153% MONEY MARKET FD FOR EBT 0.000000% US DOLLAR CASH 0.008786% United States-Dollar 0.000000% United States-Dollar 0.000003% United States-Dollar 0.000019% United States-Dollar 0.000003% United States-Dollar -

Sustainability Report

SUSTAINABILITY REPORT 2016 2184-0725 ISSN: MOTA-ENGIL GROUP 1 Designação comercial: Escritórios Porto Mota-Engil, S.G.P.S., S.A. Rua do Rego Lameiro, n.º 38 Sociedade Aberta 4300-454 Porto Capital Social: 237 505 141 euros Tel.: +351 225 190 300 Mat. na C.R.C do Porto com o n.º 502 399 694 Fax: +351 225 191 261 NIF: 502 399 694 www.mota-engil.com Message from the Chairman of the Board of Directors Africans in Africa, Ibero-Americans in Latin America, Europeans in Europe, Mota-Engil across the world. Mota-Engil celebration in the issue of this Report 70 years of an history that is the result of the vision, founding values and our journey towards Sustainability. For Mota-Engil Group sustainability means the commitment to local communities and their development, the commitment to our Collaborators who represent our main source competitive edge, commitment to our Costumers and Partners who are the focus of our action and overall commitment to our stakholders and shareholders who grant the stability and trust that now makes us a benchmark player worldwide. Operating in over 20 countries and with a network of collaborators exceeding 25.000 people across the world, Mota- Engil currently stands out for being a multinational group, established across multiple geographies and with a varied portfolio based on added-value solutions of engineering and infrastructure management. The issue of this report on Sustainability is the perfect example of this huge cultural, human, social and environmental richness that is reflected on a daily basis on the multiple projects which involve, galvanize and drive the ambassadors of Sustainability at Mota-Engil Group – to integrate, appreciate and develop the communities with which we work and the Customers whom we serve, by renewing daily our commitment to the sustainable future of Mota-Engil. -

Annual Report

Annual Proposal Report 2019 Let’s continue working for a better world #TheRightWay santander.pt SantanderSantander Totta SGPS, Totta, SA SGPS 1 Santander Totta, SGPS, SA Table of Indicators 3 Message from the Chief Executive Officer 4 Customers and Distribution Network 5 Corporate culture, awards, distinctions and other 7 relevant facts in 2019 Sustainability policy 14 Activity and Results Business Framework 18 Major risks and uncertainties for 2020 24 Business Areas 25 Business support areas 30 Economic and financial information 34 Relevant facts after the close of the period and the 41 outlook for 2020 Risk Management 43 Credit, and counterparty risk 44 Balance-sheet risk 46 This report was approved by the Market risk 47 Operational risk 48 Board of Directors on April 21, Compliance and reputation risk 49 2020 Proposal for the Appropriation of Net Income 51 Additional Information 52 Corporate Governance Report 56 Financial statements, notes to the accounts and reports and opinions Consolidated financial statements 61 Notes to the consolidated financial statements 66 Reports and opinions on the consolidated business 227 Santander Totta, SGPS, SA Rua do Ouro, 88 – 1100-063 Lisbon Share Capital: €1,972,962,079.58 Registered at the Lisbon Registry of Companies under number single registration and VAT number 507 096 851 SantanderLEI: 5493005RLLC1P7VSVC58. Totta SGPS, SA 2 TABLE OF INDICATORS BALANCE SHEET AND RESULTS (million euro) 2019 2018 Var. Total Net Assets 56,083 55,028 +1.9% Loans and advances to customers (net) 1 39,349 39,644 -0.7% Customers' Resources 42,420 39,980 +6.1% Total shareholders' equity 4,264 4,172 +2.2% Net Interest Income 855.7 866.3 -1.2% Net Fees and Other Income 381.0 382.9 -0.5% Net Income from Banking Activities 1,344.5 1,259.5 +6.8% Net Operating Income 740.0 633.5 +16.8% Income before taxes and non-controlling interests* 739.8 673.8 +9.8% Consolidated net income attributable to the shareholders of ST, SGPS 527.3 500.0 +5.5% RATIOS 2019 2018 Var. -

Continente Online: Building a Success Story in the Food Retail Business

Continente Online: Building a Success Story in the Food Retail Business Case Author: Winnie Ng Picoto & Rita Fuentes Henriques Online Pub Date: January 02, 2018 | Original Pub. Date: 2018 Subject: Competitive Strategy, E-Commerce Level: Intermediate | Type: Direct case | Length: 6619 words Copyright: © Winnie Ng Picoto and Rita Fuentes Henriques 2018 Organization: Continente Online | Organization size: Large Region: Western Europe | State: Industry: Retail trade, except of motor vehicles and motorcycles Originally Published in: Publisher: SAGE Publications: SAGE Business Cases Originals DOI: http://dx.doi.org/10.4135/9781526440570 | Online ISBN: 9781526440570 SAGE SAGE Business Cases © Winnie Ng Picoto and Rita Fuentes Henriques 2018 © Winnie Ng Picoto and Rita Fuentes Henriques 2018 This case was prepared for inclusion in SAGE Business Cases primarily as a basis for classroom discussion or self-study, and is not meant to illustrate either effective or ineffective management styles. Nothing herein shall be deemed to be an endorsement of any kind. This case is for scholarly, educational, or personal use only within your university, and cannot be forwarded outside the university or used for other commercial purposes. 2020 SAGE Publications Ltd. All Rights Reserved. This content may only be distributed for use within CQ PRESS. http://dx.doi.org/10.4135/9781526440570 Continente Online: Building a Success Story in the Food Retail Business Page 2 of 18 SAGE SAGE Business Cases © Winnie Ng Picoto and Rita Fuentes Henriques 2018 Abstract The online marketplace has grown exponentially during the last decade and today most click- and-mortar businesses have developed Internet sales channels. The online food industry, and more specifically groceries, presents a huge challenge for managing operations online. -

Sonae Sgps Report and Accounts 2007

FULL YEAR RESULTS 2007/YEAR ENDED 31 DECEMBER SONAE SGPS REPORT AND ACCOUNTS 2007 3 Table of contents MANAGEMENT REPORT..........................................................................................................5 At a glance..................................................................................................................................6 Key Figures ................................................................................................................................8 Message from the Chairman ......................................................................................................9 Message from the CEO............................................................................................................11 1. The Sonae Group ..............................................................................................................13 1.1. Corporate profile..........................................................................................................13 1.2. Governing Bodies........................................................................................................15 1.3. Success factors ...........................................................................................................15 1.4. Human resources ........................................................................................................17 1.5. Main corporate events during 2007.............................................................................19 1.6. Relevant facts -

30Th September, 2020

MANAGERIAL ACTION AS A RESULT OF THE IMPACT OF COVID - 19 30th September, 2020 I FOREWORD ........................................................................................................................ 9 II IDENTIFIED PATTERNS ......................................................................................................... 9 III COUNTRIES AND EUROPEAN INSTITUTIONS ............................................................................ 13 1. GENERAL .......................................................................................................................... 13 2. BRAZIL ............................................................................................................................ 14 3. CHINA ............................................................................................................................. 14 4. EUROPEAN CENTRAL BANK ..................................................................................................... 14 5. EUROPEAN STABILITY MECHANISM ............................................................................................ 14 6. EUROPEAN UNION ............................................................................................................... 15 7. FRANCE ............................................................................................................................ 15 8. GERMANY ......................................................................................................................... 16 9. ITALY .............................................................................................................................