David-Siddons-Luxury-Report-2018.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

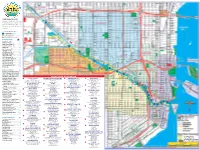

Locator Keys Identify Sites on This Map, 23 Heading NW from the Confluence of the P Miami River and Biscayne Bay

A NOTE USING THIS GUIDE… Locator keys identify sites on this map, 23 heading NW from the confluence of the P Miami River and Biscayne Bay. Locator keys are in one of the following four 21 categories: HISTORIC SITES: Blue numbers 22 RIVER BRIDGES: Blue letters POINTS OF INTEREST: Green numbers AREA BUSINESSES: Red numbers MIAMI RIVER BRIDGE Bascule (B); Fixed (F) 3 Brickell Bridge (B) . A 19 27 Metro Mover Bridge (F) . B South Miami Avenue (B) . C 2021 O Metrorail (F) . .D S .W . 2nd Avenue (B) . E Interstate I-95 (3F) . F 14 N S .W . First Street (B) . G West Flagler Street (B) . .H 15 N .W . 5th Street (B) . I 24 N .W . 12th Avenue (B) . J 18 19 S .R . 836/Dolphin Expwy . (F) . K 16 14 N .W . 17th Avenue (B) . L M 12 N .W . 22nd Avenue (B) . M 13 N .W . 27th Avenue (B) . N 16 N .W . South River Dr . (B) . O Railroad (B) . P 12 13 L 32 30 POINTS OF INTEREST 4 Beginning of Miami River Greenway . 1 K 10 34 27 James L . Knight Convention Center . 2 J Metro-Mover “Fifth Street” Station .3 26 34 11 Metro-Mover “Riverwalk” Station . 4 MIAMI RIVER BUSINESSES 22 12 Metro-Rail “Brickell” Station . 5 1 5TH STREET MARINA 11 DOWNTOWN DEVELOPMENT AUTHORITY 21 MARITIME AGENCY INC 32 RIVER LANDING Miami-Dade Cultural Center . 6 Marina To grow, strengthen & promote Downtown Miami International Shipping Terminal Retail, Restaurants, Residential 341 NW South River Dr. Miami 33128 (305) 579-6675 3630 NW North River Dr. -

Developed by G&G Business Developments

Developed by G&G Business Developments LLC [email protected] +1.305.573.7333 Developed by G&G Business Developments LLC KITCHEN APPLIANCES [email protected] +1.305.573.7333 Developed by G&G Business Developments LLC - GAGGENAU - GAGGENAU 30” Single Oven S400 The professional kitchen principle is their foundation. Professional equipment, much like ingredients, must be of the highest quality and - GAGGENAU 400 Series speed microwave oven add something to the final dish. We use the same 30”wide. approach for the private kitchen, but with the The handle-free doors proudly protrude from the added aesthetic consideration. Given these means Wall and are opened by a simple touch of the and the passion, the private chef can produce intuituve TFT touch display. professional results, time and again. - GAGGENAU Dishwasher U200 - GAGGENAU 400 Series refrigerator column with fresh cooling. Niche width 30”. - BOSCH 24” Compact Washer. The 800 Series Washer are one of few Energy - GAGGENAU 400 Series freezer column. Star qualified 24” pairs offering quality, wáter Niche width 30” protection and design. - GAGGENAU 400 Series wine climate cabinet. - BOSCH 24” w 800 series Condenser Dryer Niche width 24. Fully integrated. Push the (or latest model). The 800 Series washer and enormous door and it opens to a profesional dryer with Home Connect can be operated fron – grade stainless Steel interior with anthracite anywhere remotely via a Smart device. anodised aluminium elementos, housing clear glass shelving. The minimalist internal aesthetic is accentuated by warn White, glare-free LED lights - Faber Stratus Isola, ceiling mounted range Hood that discreetly and gently illuminate. -

All Right Reserved 2018 © David Siddons Group | [email protected] | +1.305.508.0899 PG

All Right Reserved 2018 © David Siddons Group | [email protected] | +1.305.508.0899 PG. 1 Welcome to our David Siddons David Siddons is a top producing Miami 2018 Luxury Report real estate agent who has helped dozens of families relocate. David is known as a market This year we have revamped the report in more ways than ever before. analyst and the publisher of Miami’s most We have made it extremely easy to navigate your way through every anticipated real estate investment guides. neighborhood and for those who don’t have time to read, I have even made short, 5 minutes videos explaining the luxury movements within +1.305.508.0899 each neighborhood! So lets dive in… [email protected] What I have always found it is important to recognize these. interesting with the luxury What we classify as luxury within ABOUT THE DAVID SIDDONS GROUP residential market is that it truly this report are properties over operates in a completely different $3M (Apart from Brickell where capacity to normal ‘standard’ real the threshold is $2M). This really estate market conditions. This, I though is the tip of the iceberg, always feel, is largely due to the and many will consider real The Miami Luxury Real Estate Guide 2018 fact that the same rules that apply luxury to kick in at $5m upwards. Are you short in time and want to know the highlights of this report? to normal buyers (constraints, Because the number and velocity Watch these short videos. motivations and market forces) of luxury sales is so much less than do not apply to luxury buyers. -

SB 4 2019 PDF Download

global spa and wellness www.spabusiness.com 2019 4 Award-winning spa&wellness software CELEBRATING YEARS 2004 - 2019 LEARN MORE AT BOOK4TIME.COM http://www.spabusiness.com World-renowned cloud-based spa & wellness software 12 99.99% 24/7 LANGUAGES UPTIME SUPPORT 70+ 50+ 97% COUNTRIES INTEGRATIONS SATISFACTION RATE LEARN MORE AT BOOK4TIME.COM http://www.spabusiness.com global spa and wellness www.spabusiness.com 2019 4 Spa in the sky LARRY Verena Lasvigne-Fox on ELLISON the sparkling new gem spa at launches Sensei Four Seasons Philadelphia wellness retreat POLAR in Hawaii Global TOURISM Wellness Exploring spa potential Summit in the Arctic and Antarctic review Our highlights from Singapore ALEXANDRE CANTIN on Groupe Nordik’s plans to have 10 nature spas by 2027 http://www.spabusiness.com FROM THE SEA TO THE SKIN (re)connect WITH A FRENCH BEAUTY HOUSE PHYTOMER is the story of 3 generations born in the Brittany region of France and driven by a dream: to transform the sea into skin care. Our family-run company remains profoundly attached to its region and its incredible marine biodiversity, using natural, organic, wild and sustainably-grown marine ingredients. In its own laboratory, PHYTOMER discovers and cultivates the purest and most powerful natural ingredients turning them into safe and high- performing products, that revitalize the skin and deliver natural beauty. (re)breathe (re)join THE BEST PROFESSIONALS At PHYTOMER, we build and strengthen a one-on-one relationship based on trust, and understanding to help you grow your business, train your staff, develop and enhance your space and make the most of our longstanding brand reputation. -

Miamireport-16-ISG-Watermarked

FALL 2016 TM AN IN-DEPTH ANALYSIS OF SOUTH FLORIDA’S NEW CONDOMINIUM MARKET CELEBRATING 120 YEARS OF MIAMI’S 1896 - 2016 New Condo Construction Resale Condo Inventory Condo Rental Trends International Market Cultural & Economic Growth ISG City Watch South Florida 2020 On the Ground WELCOME TO THE FALL 2016 EDITION OF THE MIAMI REPORT For over seven years, the ISG World Miami ReportTM has served as the go-to “But if sheer size source on the state of the Miami market, and in that time, it has expanded. Once solely a statistical analysis of the current market conditions, today’s report is your yardstick, examines so much more: what’s drawing so many people to Miami’s shores, the factors that have made Miami a global city, news on the current and future hap- penings in South Florida, comprehensive market data and trends, of course, and nothing beats information to guide you in understanding where the market is headed. America’s housing The last seven years have also seen a major evolution of Miami itself. A myriad of trendy neighborhoods have blossomed. The arts and entertainment landscape market. has exploded. The skylines of Brickell, downtown Miami and the Biscayne Corridor have filled in with some of the most luxurious and architecturally impressive condominium towers the world has ever seen. It is the world’s In this edition of the Miami Report, we take a look back through the 120-year history of this inspiring city, and how the various elements that make it up have largest asset class, developed. -

2019 Greater Downtown Miami Annual Residential Market Study

Greater Downtown Miami Mid-YearAnnual ResidentialResidential Market Market Study Study Update AprilAugust 2019 2018 Prepared for the Miami Downtown Development Authority (DDA) By Integra Realty Resources (IRR) Greater Downtown Miami Annual Residential Market Study Prepared for the Miami Downtown Development Authority (DDA) by Integra Realty Resources (IRR) April 2019 For more information, please contact IRR-Miami/Palm Beach The Dadeland Centre 9155 S Dadeland Blvd, Suite 1208 Miami, FL 33156 305-670-0001 [email protected] Contents 2 Introduction 4 Greater Downtown Miami Condo Pipeline 6 Greater Downtown Miami Market Sizing 7 Greater Downtown Miami Market Condo Delivery and Absorption of Units 12 Analysis of Resale 13 2013-2018 Resale Inventory Retrospective 16 Currency Exchange and Purchasing Patterns 17 Current Cycle Completions 18 Major Market Comparison 19 Condominium Rental Activity 23 Conventional Rental Market Supply 27 Land Prices Trends 29 Opportunity Zone Analysis 30 Greater Downtown Miami Market Submarket Map 31 Conclusions 32 Condo Development Process Appendix Introduction Integra Realty Resources – Miami|Palm Beach (IRR-Miami) is pleased to present the following Residential Real Estate Market Study within the Miami Downtown Development Authority’s (Miami DDA) market area, defined as the Greater Downtown Miami market. This report updates IRR-Miami’s findings on the local residential real estate market through January 2019. Key findings are as follows: • The under construction pipeline delivered between Q2-Q4 2018 reduced the number of units under construction by 43% with a total of 1,649 units delivered, 1,020 of which were located in the Edgewater submarket, and 513 units representing the Canvas project in A&E. -

F I R S T T H O U G H

0123456789 FIRST THOUGHTS 0123456789 FIRST RETURNS I s Miami Ten years after the financial crisis, Florida’s largest city is enjoying a positive frenzy of high-end, high- rise condominium development, with asking prices soaring accordingly and global brands such as Porsche, Aston Martin, Armani, having Fendi and Missoni attaching themselves to a new generation of luxury properties. Renzo Piano, Zaha Hadid, Rem Koolhaas, César Pelli and Jean Nouvel are just some of the starchitects who a have planted their names on the city’s rapidly evolving skyline. THE ‘MAGIC CITY’ Some of the ideas are, frankly, IS SEEING AN outrageous. At the Porsche Design UNPRECEDENTED Center on Sunny Isles Beach, finished in LUXURY BUILDING 2018, the developers installed a car elevator that enables owners to park BOOM. SO IS IT A outside their apartment, right up to the BUBBLE OR AN 57th floor. The $32m penthouse, as yet INVESTMENT unsold, takes up four storeys, with OPPORTUNITY? swimming pools, giant terraces and barbecues to party away far above the ALEXANDER beach – and a garage for 11 cars. GARRETT REPORTS Aston Martin, meanwhile, has already sold the first of seven penthouses at its Aston Martin Residences in Downtown Miami, with a limited edition DB11 sportscar included in the $4.7m price tag. The sail-shaped building won’t complete until 2021. And close by, One Thousand Museum moment? is taking shape as the parting shot of Iraqi-British architect Zaha Hadid, who died in 2016. It’s set to be the city’s fourth tallest tower with 83 uber-luxury apartments in a building crowned with a double height indoor aquatic centre, a Arte – “ultra-luxury sky lounge and a private helipad. -

Webside Score Exploremiamirealestate.Com

Webside score exploremiamirealestate.com Genereret Oktober 15 2020 06:16 AM Scoren er 56/100 SEO Indhold Titel Explore Miami Real Estate - Condos and Homes for Sale and Rent Længde : 62 Perfekt, din titel indeholder mellem 10 og 70 bogstaver. Beskrivelse Miami Beach condos for sale and rent - view listings, prices, floor plans. Længde : 74 Perfekt, din meta beskrivelse indeholder mellem 70 og 160 karakterer. Nøgleord miami real estate,sunny isles,aventura,hallandale,hollywood beach, fort lauderdale real estate, bal harbour, brickell, miami beach, south beach, florida real estate, condo for sale, oceanfront condos, single family homes, miami condo, miami condo for sell, florida homes, miami realtor, miami residence, buy home in florida, sell condo, sunny isles beach Godt, din side indeholder meta nøgleord. Og Meta Egenskaber Godt, din side benytter Og egenskaberne Egenskab Indhold title Explore Miami Real Estate - Condos and Homes for Sale and Rent type article url https://exploremiamirealestate.com/ site_name Explore Miami Real Estate description Miami Beach condos for sale and rent - view listings, prices, floor plans. image https://exploremiamirealestate.com/wp-content /themes/real-estate- miami/img/logo_with_bg.png SEO Indhold Overskrifter H1 H2 H3 H4 H5 H6 1 10 0 1 0 0 [H1] Miami Real Estatefor Professionals and Investors [H2] Explore the Neighborhoods [H2] Featured Homes [H2] Featured Condos [H2] Featured Penthouses [H2] Houses with Pools [H2] Just Listed [H2] Just Sold [H2] Estimated monthly cost [H2] $ [H2] Top real estate company in Miami [H4] Register to access all homes Billeder Vi fandt 257 billeder på denne side. Godt, de fleste eller alle af dine billeder har ALT tags. -

Transit Leap Webinar | July 10, 2019

Transit Leap Webinar | July 10, 2019 SDForward.com Today’s Presenters Coleen Clementson Brian Lane Katie Chalmers Ben Porritt Special Projects Director Senior Transit Planner Service Planning Senior Vice President of SANDAG SANDAG Supervisor Corporate Affairs King County Metro Virgin Trains 3 5 Big Moves NEXT OS COMPLETE Enabling technology CORRIDORS Backbone of the system FLEXIBLE FLEETS Last mile options TRANSIT LEAP Alternatives to automobiles MOBILITY HUBS Transfer points 4 A Bold New Vision 5 Brian Lane SANDAG Senior Transit Planner Transit Leap high frequency | high capacity | high speed | fixed guideway | convenient 7 Improvements Underway 8 Travel Times 9 High Speed Transit 10 Faster Transit Service 11 Better Integration 12 Transition to Electric or Alternative Fuels Source: https://www.newflyer.com 13 Transit Leap Benefits 14 Transit Leap 15 Katie Chalmers Service Planning Supervisor King County Metro 16 Growing the Transit System – System changes, expansion, and ridership growth in Seattle and King County Katie Chalmers, Service Planning Supervisor [email protected] What’s Happening in Seattle Expansion of transit funding Supportive policy environment -- external and internal History and success with network redesigns Growing appetite for change & innovation 18 King County Metro Overview Regional & Local Funding Successful transit ballot measures Sound Transit (1996, 2008, 2016) King County (2007) Seattle (2006, 2014, 2015) Unsuccessful ballot measures King County (2014) – “roads and transit” 20 Results of Investment -

Website Beoordeling Exploremiamirealestate.Com

Website beoordeling exploremiamirealestate.com Gegenereerd op Oktober 15 2020 06:16 AM De score is 56/100 SEO Content Title Explore Miami Real Estate - Condos and Homes for Sale and Rent Lengte : 62 Perfect, uw title tag bevat tussen de 10 en 70 karakters. Description Miami Beach condos for sale and rent - view listings, prices, floor plans. Lengte : 74 Perfect, uw meta description bevat tussen de 70 en 160 karakters. Keywords miami real estate,sunny isles,aventura,hallandale,hollywood beach, fort lauderdale real estate, bal harbour, brickell, miami beach, south beach, florida real estate, condo for sale, oceanfront condos, single family homes, miami condo, miami condo for sell, florida homes, miami realtor, miami residence, buy home in florida, sell condo, sunny isles beach Goed, uw bevat meta keywords. Og Meta Properties Goed, uw page maakt gebruik van Og Properties. Property Content title Explore Miami Real Estate - Condos and Homes for Sale and Rent type article url https://exploremiamirealestate.com/ site_name Explore Miami Real Estate description Miami Beach condos for sale and rent - view listings, prices, floor plans. image https://exploremiamirealestate.com/wp-content /themes/real-estate- miami/img/logo_with_bg.png SEO Content Headings H1 H2 H3 H4 H5 H6 1 10 0 1 0 0 [H1] Miami Real Estatefor Professionals and Investors [H2] Explore the Neighborhoods [H2] Featured Homes [H2] Featured Condos [H2] Featured Penthouses [H2] Houses with Pools [H2] Just Listed [H2] Just Sold [H2] Estimated monthly cost [H2] $ [H2] Top real estate company in Miami [H4] Register to access all homes Afbeeldingen We vonden 257 afbeeldingen in de pagina. -

Greater Downtown Miami Mid-Yearannual Residentialresidential Market Market Study Study Update

Greater Downtown Miami Mid-YearAnnual ResidentialResidential Market Market Study Study Update AprilAugust 2019 2018 Prepared for the Miami Downtown Development Authority (DDA) By Integra Realty Resources (IRR) Greater Downtown Miami Annual Residential Market Study Prepared for the Miami Downtown Development Authority (DDA) by Integra Realty Resources (IRR) April 2019 For more information, please contact IRR-Miami/Palm Beach The Dadeland Centre 9155 S Dadeland Blvd, Suite 1208 Miami, FL 33156 305-670-0001 [email protected] Contents 2 Introduction 4 Greater Downtown Miami Condo Pipeline 6 Greater Downtown Miami Market Sizing 7 Greater Downtown Miami Market Condo Delivery and Absorption of Units 12 Analysis of Resale 13 2013-2018 Resale Inventory Retrospective 16 Currency Exchange and Purchasing Patterns 17 Current Cycle Completions 18 Major Market Comparison 19 Condominium Rental Activity 23 Conventional Rental Market Supply 27 Land Prices Trends 29 Opportunity Zone Analysis 30 Greater Downtown Miami Market Submarket Map 31 Conclusions 32 Condo Development Process Appendix Introduction Integra Realty Resources – Miami|Palm Beach (IRR-Miami) is pleased to present the following Residential Real Estate Market Study within the Miami Downtown Development Authority’s (Miami DDA) market area, defined as the Greater Downtown Miami market. This report updates IRR-Miami’s findings on the local residential real estate market through January 2019. Key findings are as follows: • The under construction pipeline delivered between Q2-Q4 2018 reduced the number of units under construction by 43% with a total of 1,649 units delivered, 1,020 of which were located in the Edgewater submarket, and 513 units representing the Canvas project in A&E. -

Sivuston Tiedotexploremiamirealestate.Com

Sivuston tiedotexploremiamireal estate.com Luotu Lokakuu 15 2020 09:22 AM Pisteet56/100 SEO Sisältö Otsikko Explore Miami Real Estate - Condos and Homes for Sale and Rent Pituus : 62 Täydellistä, otsikkosi sisältää väliltä 10 ja 70 kirjainta. Kuvaus Miami Beach condos for sale and rent - view listings, prices, floor plans. Pituus : 74 Hienoa, sinun meta-kuvauksesi sisältää väliltä70 ja 160 kirjainta. Avainsanat miami real estate,sunny isles,aventura,hallandale,hollywood beach, fort lauderdale real estate, bal harbour, brickell, miami beach, south beach, florida real estate, condo for sale, oceanfront condos, single family homes, miami condo, miami condo for sell, florida homes, miami realtor, miami residence, buy home in florida, sell condo, sunny isles beach Hyvä, sinun sivullasi on meta -avainsanoja. Open Graph (OG- Hienoa, sinun sivu käyttää hyödyksi Open Graph protokollaa (OG meta tägit) tarjoavat prop). mahdollisuuden merkitä Omaisuus Sisältö verkkosivustojen sisältöä meta- tiedoilla. title Explore Miami Real Estate - Condos and Homes for Sale and Rent type article url https://exploremiamirealestate.com/ site_name Explore Miami Real Estate description Miami Beach condos for sale and rent - view listings, prices, floor plans. image https://exploremiamirealestate.com/wp-content /themes/real-estate- miami/img/logo_with_bg.png SEO Sisältö Otsikot H1 H2 H3 H4 H5 H6 1 10 0 1 0 0 [H1] Miami Real Estatefor Professionals and Investors [H2] Explore the Neighborhoods [H2] Featured Homes [H2] Featured Condos [H2] Featured Penthouses [H2] Houses with Pools [H2] Just Listed [H2] Just Sold [H2] Estimated monthly cost [H2] $ [H2] Top real estate company in Miami [H4] Register to access all homes Kuvat Emme löytäneet 257 yhtään kuvia tältä sivustolta.