Governance in Brief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

96 Pagine Interne Layout 1 16/05/11 12:59 Pagina 3 96 Pagine Interne Layout 1 16/05/11 12:59 Pagina 4

96 pagine interne_Layout 1 16/05/11 12:59 Pagina 3 96 pagine interne_Layout 1 16/05/11 12:59 Pagina 4 ASSOCIAZIONE NAZIONALE INDUSTRIE CINEMATOGRAFICHE AUDIOVISIVE E MULTIMEDIALI - LA PRODUZIONE ITALIANA 2010 LA PRODUZIONE ITALIANA 2010 THE ITALIAN PRODUCTION Edito da ANICA I film compresi nel catalogo sono Associazione Nazionale Industrie lungometraggi di produzione italiana forniti Cinematografiche Audiovisive e Multimediali di visto censura nell’anno 2010 In collaborazione con il cast e crediti non contrattuali Ministero per i Beni e le Attività Culturali Direzione Generale per il Cinema ANICA Viale Regina Margherita, 286 A cura dell’Ufficio Stampa ANICA 00198 Roma (Italia) Tel. +39 06 4425961 Coordinatore Editoriale Fax +39 06 4404128 Paolo Di Reda email: [email protected] Elaborazioni Informatiche Elenco Inserzionisti Gennaro Bruni Alberto Grimaldi Productions p. XVII con la collaborazione di Cinetecnica 73 Romina Coppolecchia Eurolab 74 Kodak 75 Redazione e reperimento dati Medusa 76 Claudia Bonomo Panalight XXI Antonio Dell’Erario Sound Art V Technicolor II-III Progetto Grafico e impaginazione Una vita per il cinema 72 Selegrafica‘80 s.r.l. Stampa Selegrafica‘80 s.r.l. - Guidonia (Rm) www.selegrafica.it [email protected] Concessionaria esclusiva della pubblicità Fotolito e impianti Via Tor dè Schiavi, 355 - 00171 Roma Composit s.r.l. - Guidonia (Roma) Tel. 06 89015166 - fax. 06 89015167 [email protected] [email protected] - www.apsadvertising.it Le schede complete della produzione italiana 2010 sono consultabili al sito www.anica.it IV 96 pagine interne_Layout 1 16/05/11 12:59 Pagina 5 ità 7 g.it 96 pagine interne_Layout 1 16/05/11 12:59 Pagina 6 ASSOCIAZIONE NAZIONALE INDUSTRIE CINEMATOGRAFICHE AUDIOVISIVE E MULTIMEDIALI - LA PRODUZIONE ITALIANA 2010 ELENCO REGISTI LIST OF DIRECTORS A D I Adriatico, Andrea pag. -

Copyrighted Material

Part I THE POWER OF A FAMILY COPYRIGHTED MATERIAL cc01.indd01.indd 1111 005/11/115/11/11 22:01:01 PPMM cc01.indd01.indd 1122 005/11/115/11/11 22:01:01 PPMM Chapter 1 The Scattered Pieces short time before he died, Gianni Agnelli had asked his younger brother Umberto, who had come to visit him every A day at Gianni’s mansion on a hill overlooking Turin, to do something very diffi cult. Umberto said he needed to think about it. Now, at the end of January 2003, Umberto had come to give Gianni an answer. Gianni was confi ned to a wheelchair, spending his fi nal days at home. He had once found solace looking out of the window onto his wife Marella’s fl ower gardens below, especially his favorites, the yellow ones. But now it was winter. Gianni looked out at the city of Turin, which was visible across the river through the bare trees. Street after street stretched out toward the horizon in the crisp January air, lined up like an army of troops marching to meet the Alps beyond. It was a clear day, and he could see Fiat’s white Lingotto headquarters, as well as the vast bulk of Fiat’s Mirafi ori car factory on the far side of the city. The factories had been built by their grandfather, Giovanni Agnelli. 13 cc01.indd01.indd 1133 005/11/115/11/11 22:01:01 PPMM 14 the power of a family Gianni wouldn’t admit to his family that he was dying, but they all knew. -

Stellantis N.V. (Name of Issuer)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 13D Under the Securities Exchange Act of 1934 (Amendment No. 1) Stellantis N.V. (Name of Issuer) Common Shares, nominal value of €0.01 each (Title of Class of Securities) N82405106 (CUSIP Number) Thierry Mabille de Poncheville Deputy Chief Executive Officer Établissements Peugeot Frères S.A. 66, avenue Charles de Gaulle 92200 Neuilly-sur-Seine, France +33 6 07 48 38 77 (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) Copy to: Adam O. Emmerich John L. Robinson Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, New York 10019 (212) 403-1000 April 14, 2021 (Date of Event which Requires Filing of this Statement) If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☐ Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are sent. * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). -

The History of Corporate Ownership in Italy

This PDF is a selection from a published volume from the National Bureau of Economic Research Volume Title: A History of Corporate Governance around the World: Family Business Groups to Professional Managers Volume Author/Editor: Randall K. Morck, editor Volume Publisher: University of Chicago Press Volume ISBN: 0-226-53680-7 Volume URL: http://www.nber.org/books/morc05-1 Conference Date: June 21-22, 2003 Publication Date: November 2005 Title: The History of Corporate Ownership in Italy Author: Alexander Aganin, Paolo Volpin URL: http://www.nber.org/chapters/c10273 6 The History of Corporate Ownership in Italy Alexander Aganin and Paolo Volpin 6.1 Introduction Recent contributions show that the Italian corporate governance regime exhibits low legal protection for investors and poor legal enforcement (La Porta et al. 1998), underdeveloped equity markets (La Porta et al. 1997), pyramidal groups, and very high ownership concentration (Barca 1994). Arguably, due to these institutional characteristics, private benefits of con- trol are high (Zingales 1994), and minority shareholders are often expro- priated (Bragantini 1996). How did this corporate governance system emerge over time? In this paper we use a unique data set with information on the control of all companies traded on the Milan Stock Exchange (MSE) in the twentieth century to study the evolution of the stock market, the dynamics of the ownership structure of traded firms, the birth of pyramidal groups, and the growth and decline of ownership by families. We find that all our indicators (stock market development, ownership concentration, separation of ownership and control, and the power of fam- ilies) followed a nonmonotonic pattern. -

Nber Working Paper Series Corporate Control Around

NBER WORKING PAPER SERIES CORPORATE CONTROL AROUND THE WORLD Gur Aminadav Elias Papaioannou Working Paper 23010 http://www.nber.org/papers/w23010 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 December 2016 We thank Julian Franks, Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer for useful suggestions and comments. All errors are our sole responsibility. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2016 by Gur Aminadav and Elias Papaioannou. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Corporate Control around the World Gur Aminadav and Elias Papaioannou NBER Working Paper No. 23010 December 2016 JEL No. F30,G3,G34,G38,K11,K12,K31 ABSTRACT We provide an autopsy of the patterns of corporate control and ownership concentration in a dataset covering more than 40,000 listed firms from 127 countries over 2004 2012. Employing a plethora of original and secondary sources, big data techniques, and applying the Shapley-Shubik algorithm to quantify shareholder’s voting power we trace ultimate controlling shareholders from the complex, pyramidal, and often obscure corporate structures. First, we show that there are large differences in the type of corporate control (widely held firms with and without significant equity blocks, firms controlled by families, governments, and other public-private firms) across and within continents. -

Reviews of Books and Audiobooks in Italian

Reviews of books and audiobooks in Italian Susanna Agnelli (1922-2009), Vestivamo alla marinara, 231pp. (1975). Susanna Agnelli's paternal grandfather founded the Fiat company in 1899. She was thus a member of one of the richest families in Italy. Vestivamo alla marina is an autobiography beginning in childhood and ending with Agnelli's marriage in 1945. The title \We dressed like sailors" refers to the sailor-suits her parents made all the children wear, and gives little hint of what the book is really about. It begins with the sailor-suits and her upbringing under the stern eye of British nanny \Miss Parker", but before long Italy has joined the Axis and the young \Suni", as Susanna was known, is volunteering as a nurse on ships bringing injured soldiers from Africa back to Italy. As a war memoir it is fascinating, including for example an account of the utter confusion and chaos created by the Armistice of September 8, 1943 (Suni was in Rome at the time). Judging by her own account, Suni was a very courageous young woman, but it is only fair to point out that her war experience was highly atypical because of her access to wealth and power. In the middle of the war, she takes a ski vacation in Switzerland. When she and her brother Gianni need a car in Firenze, hoping to get to Perugia where they can hide out in one of their grandfather's numerous houses and await the allied advance, as Agnellis they have only to go to the local Fiat headquarters and they're set. -

Borsa Italiana Welcomes Stellantis

Press Release 18 January 2021 Borsa Italiana welcomes Stellantis Today Borsa Italiana welcomes Stellantis, a new leading group in the automotive sector created from the merger by incorporation of Peugeot (PSA) into Fiat Chrysler Automobiles (FCA). The ordinary shares of Stellantis will begin trading today, 18 January 2021, on the Main Market (MTA) of Borsa Italiana and on Euronext Paris. And from tomorrow, 19 January 2021, also on the New York Stock Exchange (NYSE). The Stellantis stock will be part of the FTSE MIB index from the start of trading. Raffaele Jerusalmi, CEO, Borsa Italiana: “It is with emotion and pride that today we welcome the new group Stellantis to Borsa Italiana. The union between FCA and PSA represents another important step on the centuries-old path traced by the Agnelli family that can respond to the global challenges of the automotive sector. Borsa Italiana has had the privilege to celebrate other significant milestones of FCA, and even before of FIAT: from the spin-off of FIAT Industrial, to the creation of FCA, to the most recent spin-off of Ferrari. We are happy to see the group continue to grow, from an Italian company to an international global player.” John Elkann, Chairman, Stellantis: "This historic first day of trading of Stellantis shares on Borsa Italiana marks the beginning of an era of extraordinary opportunity for our company. These are 1 Press release 18 January 2021 challenging but exciting times in our industry, with change as rapid as at any point since its foundation over a century ago. Stellantis begins life with the leadership, the resources, the diversity and the knowhow with which to build something truly unique and something great, providing our customers with outstanding vehicles and mobility solutions, creating consistent value for all of our stakeholders.” Carlos Tavares, CEO, Stellantis: “Today is the day where Stellantis is born. -

Fiat's Young Boss Steers a Tough Course

FIAT BEHIND THE WHEEL: Fiat Chairman John Elkann drives a Fiat 8V at the start of the “1000 Miglia” International classic car rally in Brescia. REUTERS/PAOLO BONA John Elkann has to decide between Italian passion and corporate pragmatism Fiat’s young boss steers a tough course BY JENNIFER CLARK TURIN, NOVEMBER 9, 2012 SPECIAL REPORT 1 FIAT STEERING A NEW COURSE henever Sergio Marchionne, chief executive of carmakers WFiat and Chrysler, appears in public, television crews jostle to beam his words around the globe. Amid the push and shove it’s easy to miss the tall, curly- headed young man who often looks on from the sidelines. He’s John Elkann. And he’s Mar- chionne’s boss. The 36-year-old scion of Italy’s powerful Agnelli clan became vice chairman of Fiat – founded and still controlled by his fam- ily – just under a decade ago, and chairman in 2010. For years, his was the saga of a shy, awkward young heir thrust prematurely into corporate leadership by family tragedy. No more. Now Elkann is taking the key role in an- swering the question that faces his family’s firm: Is what’s good for Italy really good for Fiat anymore? The question evokes the famous statement - “I thought that what was good for America was good for General Motors and vice versa” – by Charles “Engine Charlie” Wilson, then the president of GM, 60 years ago. Nobody is calling Elkann “Engine John- nie.” But many thought Fiat had outgrown Italy in 2009 when it snapped up a control- ling stake in Chrysler and left Elkann to wrestle with the politically potent question of how closely the family firm, long the sym- bol of corporate Italy, should remain tied to the troubled economy of its home country. -

Exor Invests in Shang Xia Partnering with Hermès to Take the Chinese Luxury Company to the Next Stage of Its Development

EXOR INVESTS IN SHANG XIA PARTNERING WITH HERMÈS TO TAKE THE CHINESE LUXURY COMPANY TO THE NEXT STAGE OF ITS DEVELOPMENT Amsterdam and Paris, 9 December 2020. Exor and Hermès International announce an agreement to take Shang Xia, one of the first Chinese luxury companies, to the next stage of its development. Axel Dumas, Executive Chairman of Hermès said: “We are proud of how far Shang Xia has come in the last 10 years, demonstrating our confidence in the brand’s unique model and original proposal." Exor will invest around €80 million in Shang Xia via a reserved capital increase that will result in it becoming the company’s majority shareholder. Hermès, that has accompanied Shang Xia successfully throughout the initial phase of its development, will remain as an important shareholder alongside Exor and founder Jiang Qiong Er. “With Exor, we share a long family and entrepreneurial culture on which we will be able to build Shang Xia's new successes” added Mr. Dumas. The investment, that is expected to complete by the end of 2020, will result in a non-recurring profit of around €80 million for Hermès. During the decade since its foundation in 2010 Shang Xia has established its reputation both in China and internationally for combining traditional Chinese craftmanship with its distinctive interpretation of luxury. Shang Xia has stores in exclusive locations in Shanghai, where it was founded, and in Beijing, Chengdu, Hangzhou, Shenzhen and Paris. 2021 will see new stores openings in Singapore and Taipei. With this agreement, Shang Xia will benefit from the support of two family-owned companies, one with French roots and one with Italian roots, both with a common culture of excellence and entrepreneurship. -

Family Controlled Businesses

INSIGHTS The diversification benefits of family holding companies Joe Bauernfreund March 2020 For an investor, finding the hidden investment opportunity that the rest of the market has overlooked is the holy grail of stock picking. Inefficiencies within the market can often throw up anomalies such as strong, high quality companies trading at a wide discount to true valuations. Finding these companies, however, requires looking where others don’t - or won’t Uncovering prime investments is a time-consuming task, but worth it to reap the long-term returns. Historically, some of the best of these overlooked companies have been closed- ended funds and family holding companies. "their long-term orientation make family-controlled holding companies well placed to navigate volatile markets" At this late stage of a bull market, discounts in this area of the market remain attractive. The meteoric rise of US technology companies has drawn investor attention elsewhere, with many ignoring the more obscure and less liquid companies. This in turn has led to widespread mispricing of assets, creating strong opportunities for canny investors. Not only are family controlled holding companies a less researched area, they are also predominantly found in Europe or Asia. Given Europe’s slow growth and lukewarm sentiment, firms on the continent have been hit hard by low levels of investor interest. The reality is that many of these companies are in fact global in nature, owning attractive quality assets across the world. Macroeconomic sentiment is, we fear, misguiding investors and impacting the valuations of these companies. This effect is compounded by a lack of both investor interest and, in turn, meaningful sell-side research. -

Fiat, Chrysler, and the Power of a Dynasty

ffirs.indd ii 05/11/11 2:05 PM Mondo Agnelli ffirs.indd i 05/11/11 2:05 PM ffirs.indd ii 05/11/11 2:05 PM Mondo Agnelli Fiat, Chrysler, and the Power of a Dynasty Jennifer Clark John Wiley & Sons, Inc. ffirs.indd iii 05/11/11 2:05 PM Copyright © 2012 by Jennifer Clark. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. Llanto por Ignacio Sánchez Mejías (Lament for Ignacio Sánchez Mejías) by Federico García Lorca copyright © Herederos de Federico García Lorca, from Obras Completas (Galaxia/Gutenberg, 1996 edition). English Translation by Galway Kinnell copyright © Galway Kinnell and Herederos de Federico García Lorca. All rights reserved. For information regarding rights and permissions of all of Lorca’s works in Spanish or in English, please contact [email protected] or William Peter Kosmas, Esq., 8 Franklin Square, London W14 9UU, England. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750 – 8400, fax (978) 646 – 8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748 – 6011, fax (201) 748 – 6008, or online at www.wiley.com/go/permissions. -

FA05 Layout 001-032 V4 Copy.Qxd 7/9/16 4:49 PM Page 2

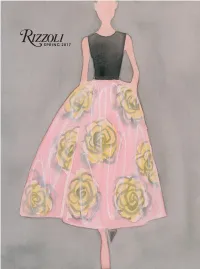

SP17 cover INSIDE LEFT_FULL SIZE V8.qxd:Layout 1 7/9/16 11:24 AM Page 1 TABLE OF CONTENTS RIZZOLI 100 Buildings . .24 Toscanini . .46 The Adirondacks . .44 Watches International XVIII . .102 Adobe Houses . .32 What to Eat for How You Feel: The Appalachian Trail . .44 The New Ayurvedic Kitchen . .11 The Art of Dressing . .39 The Art of Elegance . .13 SKIRA RIZZOLI The Art of Flower Arranging . .28 American Treasures . .51 Ballet for Life . .29 Andrew Wyeth . .50 BEAMS . .36 Carpenters Workshop Gallery . .59 Chocolat . .18 Daniel Lismore . .56 Cinecitta . .46 Enrico Baj . .55 Civil War Battlefields . .21 The Hidden Art . .54 Creating Home . .6 House Style . .48 The Decorated Home . .5 Jim Lambie . .58 Digit@l Girls . .27 Manolo Blahnik: The Art of Shoes . .49 Dior by Mats Gustafson . .47 Mark Tobey . .57 Dora Maar . .14 Painting a Nation . .56 Elizabeth Peyton . .15 Ryan McGinley . .52 Entertaining in the Country . .30 Takashi Murakami . .53 Fashion Forward: 300 Years of Fashion . .3 FuturPiaggio . .42 RIZZOLI/ GAGOSIAN GALLERY The Garden of Peter Marino . .34 Alberto Giacometti, Yves Klein . .81 Gâteaux . .7 Line into Color, Color into Line: Helen Frankenthaler . .80 Giorgio Armani . .76 Painting Paintings (David Reed) 1975 . .80 Grand Complications . .102 Sterling Ruby . .79 Harry Winston . .78 Highland Retreats . .40 UNIVERSE How They Decorated . .38 1000 T-Shirts . .65 I Actually Wore This . .26 Big Shots . .62 In Full Flower . .9 The Bucket List . .60 Jean Dubuffet: Anticultural Positions . .74 Color Your Own Masterpiece . .75 La Colle Noire . .78 Complete Guide to Boating and Seamanship . .71 Les Francaises .