Propindex Pune OND2019.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHAPTER II RESEARCH METHODOLOGY C Hapter 2 RESEARCH METHODOLOGY

CHAPTER II RESEARCH METHODOLOGY C hapter 2 RESEARCH METHODOLOGY In this section, the description of the study site will be discussed. Further it will also elaborates upon the sample, sampling procedure, methods of data collection, ethical procedures adopted, framework of analysis and interpretation. 2.1 Study Setting The study was conducted in Pune, which is one of the important cities in the western State of Maharashtra in India (Figure 2,1). Pune, known as the cultural capital of Maharashtra, exemplifies indigenous Marathi culture and ethos, which give due prominence to education, arts and crafts, and theatre. Pune has been an example of the blending of culture and heritage with modernization. Pune is known by various names such as Pensioner's Paradise, the Oxford of East, cultural capital of Maharashtra, Deccan Queen, etc. It is also the upcoming Information Technology (IT) capital of India. (Wikipedia, 2011) 2.2 Locale and Characteristics Pune district is located between 17 degrees 54’ and 10 degrees 24' North latitude and 73 degrees 19' and 75 degrees 10' East longitude. Pune is located 560 m (1,840 ft) above sea level on the western margin of the Deccan plateau. It is situated on the leeward side of the Sahyadri mountain range, which form a barrier from the Arabian Sea (Wikipedia, 2011). The total geographical area of Pune district is 15642 sq. kms. Pune district is bound by Ahmadnagar district on North-East, Solapur district on the South-East, Satara district on South, Raigad district on the West and Thane district on the North-West. It is the second largest district in the state and covers 5.10% of the total geographical area of the state. -

1 Education Landscape of Pune

An report on Education Landscape of Pune For Teach For India in association with Symbiosis School of Economics 1 Key Contributions: Teach For India: Madhukar Banuri, Manager – Operations & Government Relations Paulami Sen, Fellowship Recruitment Associate Symbiosis School of Economics: Mr. Deepanshu Mohan (SSE Faculty) 2051 – Abhay Krishnan 2005 – Abhijit A. Patil 2001 – Agneesh Bhaduri 2092 – Ajinkya Upasani 2063 – Mehak Malhotra 2015 – Niyati Malhotra 2047 – Persis Bharucha 2050 – R. Roshini Shantanu Gangakhedkar (Student, SCAC) Vasundhara Pande (Student, SCAC) Shwetank Rastogi (Intern) Government Officials: Mrs. Shubhangi Chavan, Deputy Education Officer, PMC School Board Mr. Dhananjay Pardeshi, Deputy Education Officer, PMC School Board Mr. Subhash Swamy, Project Officer, SSA Pune Mrs. Dhonde, Officer, Zilla Parishad Education Department Mr. Sable, Officer, Zilla Parishad Education Department 2 Table of Contents EXECUTIVE SUMMARY 4 1. GEOGRAPHIC AND GENERAL CITY LANDSCAPE OF PUNE 8 a. Map of Pune ................................................................................................................................................................... 8 b. Key Communities & Sectors in Pune ............................................................................................................................. 8 c. Background & History of Pune ...................................................................................................................................... 9 Present Day Pune .................................................................................................................................................................. -

Environmental Clearance Yes Has Been Obtained for Existing Project 8.Location of the Project Gat No

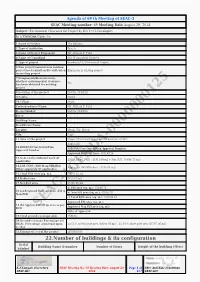

Agenda of 69 th Meeting of SEAC-3 SEAC Meeting number: 69 Meeting Date August 29, 2018 Subject: Environment Clearance for Project by M/s S.O.L Developers Is a Violation Case: No 1.Name of Project The Address 2.Type of institution Private 3.Name of Project Proponent Mr. Mukesh P. Patel 4.Name of Consultant M/s JV Analytical Services 5.Type of project Residential & Commercial Project 6.New project/expansion in existing project/modernization/diversification Expansion in existing project in existing project 7.If expansion/diversification, whether environmental clearance Yes has been obtained for existing project 8.Location of the project Gat No. 519/520, 9.Taluka Haveli 10.Village Moshi Correspondence Name: Mr. Mukesh P. Patel Room Number: Gat No. 519/520, Floor: - Building Name: - Road/Street Name: - Locality: Moshi, Tal. Haveli City: Pune 11.Area of the project Pimpri Chinchwad Municipal Corporation (PCMC) Applicable 12.IOD/IOA/Concession/Plan IOD/IOA/Concession/Plan Approval Number: - Approval Number Approved Built-up Area: 100199.24 13.Note on the initiated work (If 22608.19 m2 ( FSI : 11911.44 m2 + Non-FSI : 10696.75 m2) applicable) 14.LOI / NOC / IOD from MHADA/ Applicable (MHADA Area : 5495.85 m2) Other approvals (If applicable) 15.Total Plot Area (sq. m.) 39381.05 m2 16.Deductions 3615.09 m2 17.Net Plot area 35765.96 m2 a) FSI area (sq. m.): 53190.74 18 (a).Proposed Built-up Area (FSI & b) Non FSI area (sq. m.): 47008.50 Non-FSI) c) Total BUA area (sq. m.): 100199.24 Approved FSI area (sq. -

Ffiq'rqttrq,Got Ffiqre{Qro} Srcrq{S'ent Qrqqo* Iqkrqqr Ss=T

m.fe.qr.fit qr./t6tks- q qnfi"rfu/E q/ ? o ? q ffiq'rqttrq,got f{iiq,^ tgix/qoqq qfttrrq. fuqq ;- ffiq gqEYFrqT qrzqrqrq-a. 1ffi : - l) qr. snTfi , sr=r q s+qq Hqn-s{ qii q+rtr qr.m.*lt+g1-/HFr+t tr/x/R o $*vrqlt. ! - R 1, tfli-f, R 1. R) qr qtffif, qr qrqffio eiltn m. tq.sl. /en.q /qlfu /qrgq /1o11.fqiq. lq/x/Roit. qr qr q;rqffio m. fq.sT. /en.q /q.rfu /q\et ?) ) +lffin @r r* /1o1q.fuf+. tq/x/?oit ene tqqis qs/x/tott nqt 5") i,ffi qrq Hder Hfrff{ iffi s,runf,q flTdq qra Et{dqr qffi H-{rirrfl eTrffi sTrt *1 qdRm qlks wuneqi+ iqi+ qlqrsqt{ qelfruqrir 3Tr+€r {ffi q eTtwl T.ddKR TqR iqi++-qq atrrra tqffi{ tiE{q ynsfli Fflqtd afur q{-i el'il sFT qaf, . qqcff, ffil srcr q?rurrc m-fr.q1"6 r*.rrfi ffi , zldlera', q,qr Elqrr ql€i qrql eror s.ruil-f,q qflRlr e qrss'm qi+ n H srt {cift{-f, st-trs s.'q-roqitr sflqT st}E?T *[ar qrq ssq nn)qtfr Frune,rqrql +gr ts qr vot ffii yrftr+nqn e v'rfrrflf, qffit+ sH Brtdry qr$F ffiqrE{qro} srcrq{s'ent qrqqo* Iqkrqqr ss=T qrffF ffir1 silqqr+ E+,q fl{f,{ur v<t entnri Rriflu' Eft q fls+tq / qqq} <rm s{uli qTt yu) qorqrRqrfusr, fim FflTr{qrfur,g"} uwft qfiN-(,gfr ,rr+ot, q'i{qrflf,fir qflRm q qrrc riqqf,sd ,v6t.sTrgffi si*I q silqq qflr-s{ , go} qi-+ qrc{rGr-f, q riciRrf, ertltq trri v'rers.fl qltrq erfrr+.rfr qiql vs{ fufl{rr iffirTsR eRH 6td ers&q} q {T({ ffifr stqt{i-dr srdd Hftqt'r uta ersrarrfr Mffi EkRq-qr qF;T qtrirffif,r silaats {aiProiqr sR-qTt q-rrq1. -

Pride World City – Brooklyn and Long Island Rating Assigned: ‘Pune 6 Star’

Pride World City – Brooklyn and Long Island Rating assigned: ‘Pune 6 Star’ February 2016 Project Profile Type of project Residential Location of project Dhanori-Lohgaon Road, Charholi, Pune Type of development Bought Out Land Area 15.11 acres 1.25 million square feet (sq ft) Total saleable area Brooklyn – 0.66 million sq ft Long Island – 0.59 million sq ft No. of blocks 18 – Brooklyn – 8 blocks and Long Island – 10 blocks No. of units 1260 – Brooklyn – 560 units and Long Island – 700 units Brooklyn – 2 and 3 BHK (1030 to 1425 sq ft) Unit configuration Long Island – 1, 2 and 3 BHK (690 to 1600 sq ft) No. of floors Stilt + 12 floors Location: The project is located near Dhanori at Charholi Budruk in Pune. The location has good connectivity with other parts of the city such as the airport which is located 6 kilometres (km) from the site, the city railway station at 12 km, and the information technology (IT) hub of Kalyani Nagar at about 9 km. Additionally, the project lies along the proposed 170- km ring road around Pune and Pimpri-Chinchwad which will provide good connectivity between Pune and Pimpri- Chinchwad. For the location map, please refer to http://www.prideworldcity.com/location.html CREST Rating Report 2016 Pricing Table Loading on carpet area 35 percent Loading on built up area 28 percent Base price Rs.2.6 million – Rs.5.9 million (March 2014)* Rs.3.5 million – Rs.8.1 million (March 2016)* Stamp Duty 6 percent of the agreement value Registration Charges 1 percent of the agreement value or maximum Rs.30,000 Service Tax 3.50 percent of the agreement value Corpus fund Rs.135 per sq ft on carpet area Maintenance charge Rs.5.4 per sq ft per month on carpet area * The ticket range is calculated on all inclusive prices except statutory taxes and optional parking. -

State Expert Appraisal Committee (SEAC-3)

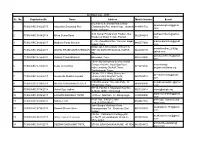

69th Meeting of State Expert Appraisal Committee (SEAC-3) Date: 29th & 30th August,2018 Time: 09:30 AM Onwards. Venue:- Conference Hall, 1st Floor, MIG Cricket Club,MIG Colony, Bandra (East),Mumbai-51. Agenda of 69th Meeting of State Expert Appraisal Committee (SEAC-III) Sr. Name of Project Online Unique no. No. Date -29-08-2018 Time-9.30 am 1. Environment Clearance for Project at Gat No. 519/520 by M/s S.O.L 000000999 Developers. 2. Environment Clearance for Proposed Development project 'PMRDA Corporate office'At S.No. 191A/1A/A/1,C.S.No.2176, Yerawada, Haveli 000001054 Taluka, Pune By Pune Metropolitan Regional Development Authority. 3. Environment Clearance for proposed construction project at S. No. 63/2 by 000000905 M/s G.K. Associates 4. Environment Clearance for Application for Environmental Clearance for proposed Residential & Commercial project at Charholi Budruk, Pune at S. 000000838 No. 309/1 & 309/2 by M/s.Xrbia Mirth Properties LLP. 5. Environment Clearance for Proposed Group Housing project at S.No.98/1(P),98/2,99/1,99/2(P),99/3(P),99/4(P),101/2(P) & 101/3 at Village 000000913 Ñame - Mann, Tal. Mulshi, Dist. Pune, Maharashtra by Mr. Rajendra Gadekar. 6. Environment Clearance for Environment Clearance for Proposed Residential Construction at Tathawade, Pune at S. No. 125/1/B/1, 000001034 125/1/B/2, 125/2/1 &125/2/2 by Mr. Milind Lunkad/ Mr. Ashwin Lunkad 7. Environment Clearance for Proposed Residential Construction at Tathawade, Pune at S. No. 125/1/B/1, 125/1/B/2, 125/2/1 &125/2/2 by 000000891 Mr. -

Student Allotment As Per Police Station for the Bandobast of Ganesh Festival-2012 (Training Not Attended) FEMALE VOLUNTEERS FARASKHANA POLICE STATION Sr.No

Student Allotment As per Police Station for the Bandobast of Ganesh Festival-2012 (Training Not Attended) FEMALE VOLUNTEERS FARASKHANA POLICE STATION Sr.No. Name of Student \ College \ Mobile No Address Work Place / Police Station 1 DHANASHREE RAJENDRA BADAMBE 2, SHIVRATNA SOCIETY, BIBVEWADI, BIBAWEWADI ROAD, PUNE CITY H. M. V. M 8237774874 HAVELI, PUNE, MAHARASHTRA, PIN- 411037 FARASKHANA 2 SOALI DNYANESHVAR SHELAR 970, VIGNAHAR APP, SADASHIV PETH, , HAVELI, PUNE, MANDAI HUZURPAGA MAHAVIDYALA (HMVM) 9960471330 MAHARASHTRA, PIN- 411003 FARASKHANA 3 VAISHALI SHANKAR SHAJWAL , NANDED PHATA, , SINHGAD ROAD, HAVELI, PUNE, FARASKHANA SIDDHIVINAYAK COLLEGE 9850987981 MAHARASHTRA, PIN- 411023 FARASKHANA 4 MADHURI BABURAO BHOSLE , SONAI BUNGLOW, SUKHSAGAR NAGAR, IN FRONT OF LAXMI ROAD VIT COLLEGE 7385499337 BSNL OFFICE, , PUNE, MAHARASHTRA, PIN- 411046 FARASKHANA TOTAL FEMALE VOLUNTEERS = (4 Volunteers) Tuesday, September 18, 2012 Developed by HC/WO Ingavale R N Page 1 of 28 Student Allotment As per Police Station for the Bandobast of Ganesh Festival-2012 (Training Not Attended) FEMALE VOLUNTEERS KHADAK POLICE STATION Sr.No. Name of Student \ College \ Mobile No Address Work Place / Police Station 1 AKSHTA JITENDRA BHOSALE 929, KIRAD HOSPITAL, NANA PETH, , HAVELI, PUNE, PUNE CITY APPASAHEB JEDHE ART. COM. SCI. COLLEGE MAHARASHTRA, PIN- 411002 KHADAK 2 ASHWINI ARJUN GOTE 739, A D CAMP CHOWK, NANA PETH, NANA PETH, HAVELI, PUNE CITY APPASAHEB JEDHE ART. COM. SCI. COLLEGE 8805523445 PUNE, MAHARASHTRA, PIN- 411002 KHADAK TOTAL FEMALE VOLUNTEERS = (2 Volunteers) Tuesday, September 18, 2012 Developed by HC/WO Ingavale R N Page 2 of 28 Student Allotment As per Police Station for the Bandobast of Ganesh Festival-2012 (Training Not Attended) FEMALE VOLUNTEERS DECCAN POLICE STATION Sr.No. -

Architect List - 2019 Sr

Architect List - 2019 Sr. No. RegistrationNo Name Address Mobile Number E-mail 642,Flat no 9, Snehal Park,Behind splusadesigners@gmail. 1 PCMC/ARC/0652/2017 Adityasinh Dayanand Patil Chandrakant Patil Heart Hosp. Jawahar 8149991732 com Nagar, Kolhapur. A/16 Kumar Priydarshan Pashan, Sus subhaarchitects@yahoo. 2 PCMC/ARC/0438/2018 Milind Subha Saraf 9822554283 Road,near Balaji Temple Pashan com C - 16, Jivandhara Soc. Yamuna nagar, madhuraarchitect@gmail. 3 PCMC/ARC/0692/2017 Madhura Parag Merukar 9860577999 Nigadi- Pune com SHOP NO 1,SHIVANJALI HEIGHTS anandkhedkar_2000@ 4 PCMC/ARC/0562/2017 ANAND PRABHAKAR KHEDKAR BEHIND BORATE SANKUL KARVE 9822400439 yahoo.com RD. sucratuarchitects@gmail. 5 PCMC/ARC/0725/2018 Siddesh Pravin Bhansali Bibvewadi, Pune. 9028783400 com 1901/1902 Drewberry Everest World Complex Kolshet Road,Opp Bayer kedar.bhat@ 6 PCMC/ARC/0768/2018 Kedar Arvind Bhat 9819519195 India Company Dhokali,Thane, srujanconsultants.org Sandozbaugh Thane. Flat no. 102 J- Wing, Survey no directionnextds@gmail. 7 PCMC/ARC/0682/2017 Amannulla Shabbir Inamdar 5A/2A,212B/2, Mayfair Pacific, 9657009789 com Kondhawa Khurd Pune,NIBM C/O-AR.Laxman Thite Sita Park, 18, milind.laxmanthite@gmail 8 PCMC/ARC/0399/2018 MILIND RAMCHANDRA PATIL 8408880898 Shivajinagar, Pune .com RH 55, Flat No 8, Nityanand Hsg Soc, 9 PCMC/ARC/0718/2018 Vishal Vijay Jadhav 9923128414 [email protected] G-Block, MIDC, Chinchwad datta.laxmanthite@gmail. 10 PCMC/ARC/0532/2017 LAXMAN SADASHIV THITE 1st Floor, Sita Park, 18, Shivajinagar, 8408880890 com PLOT NO - 390,SECTOR archetype_associates@ 11 PCMC/ARC/0074/2017 Nafisa A Kazi 9922007885 27/A,PCNTDA,NIGDI gmail.com Janiv Bangla Malshiras Road swapnilgirme173@gmail. -

Local Biodiversity Strategies and Action Plan

Draft Report Pimpri Chinchwad Municipal Corporation Prepared by: Terracon Ecotech Private Limited, Mumbai 2019 Acknowledgement We are thankful to Mr. Shravan Hardikar (I.A.S), Municipal Commissioner, Pimpri Chinchwad Municipal Corporation (PCMC) for assigning us this unique opportunity to formulate Local Biodiversity Strategy and Action Plan for Pimpri Chinchwad city. We express our gratitude to Dr. Vilas Bardekar (I.F.S), Chairman, Maharashtra State Biodiversity Board, Mr. A. Ashraf (I.F.S), Member Secretary and Mr. Vivek Daware, Technical Officer, Maharashtra State Biodiversity Board for their precious inputs. We would especially like to thank Mrs. Usha Mundhe, Chairperson (Biodiversity Management Committee), Mr. Sanjay Kulkarni, Executive Engineer (Environment) and Mr. Suresh Salunkhe, Garden Superintendent, PCMC and Member of BMC for their unrelenting support, coordination, invaluable inputs and active involvement in the Project. This project involved interactions and detailed discussions with a large number of people working in Pimpri Chinchwad Municipal Corporation (PCMC), Local NGO’s, Organization and Subject Experts. We would like to extend our sincere thanks to each and every one of them. We also thank our Dr. Ramesh Madav, Chairman, Dr. C.S.Latoo, Advisor of Terracon Ecotech Private Limited and Dr. Pravin Cholke, Assistant Professor, Anantrao Pawar College for their guidance, support and assistance in directing us to the appropriate resources for information. Ashok Jain Managing Director Terracon Ecotech Private Limited Page | i Local Biodiversity Strategy and Action Plan - PCMC Executive Summary The phrase “local actions have global effects” is one of the most heard in recent times and very aptly fits conservation science. Pimpri-Chinchwad Municipal Corporation has acted upon this by one of its latest green initiatives of developing ‘local biodiversity strategy and action plan’ (LBSAP) in conformity with the guidelines of National Biodiversity Strategy and Action Plan (NBSAP) and Aichi targets 2020. -

Download Pune Report

PropIndex | Magicbricks Pune Jan-Mar 2021 Residential Market Insights Market Dynamics Parameters India Pune Under-construction segment leading recovery in Pune Demand+ -14.0% -16.4% With the economy gradually entering into a revival mode post the COVID-led downturn, construction activities are Supply++ 7.7% 14.1% back on track in the city, helping the supply of homes in Pune grow 14% QoQ in Q1 2021, as compared to the national Price Index+++ 1.2% 1.1% supply growing at ~8% in the same period. Notes: Further, as the government and the industry stepped in to help the ailing real estate sector, various sops including Above parameters represent QoQ change in Q1 2021 at India and city level 50% reduction in construction premiums payable by developers, low home loan rates, discounted pricing and flexible + change in volume of property searches payment plans offered by developers, and absorption of 1% stamp duty (payable by buyers) by the developer ++ change in volume of active listings +++ change in the average price of UC and RM properties members of CREDAI helped in boosting the supply-side as well as the demand-side dynamics. Source: Magicbricks Research Ready-to-move Price Index Key Developers based on active listings 8,000 "Ready-to-move (RM) Kolte Patil Developers 7,500 t Marvel Realtors f segment grew by q s r Godrej Properties e 7,000 ~1% QoQ, which p R Kumar Properties N I remained flat in Q4 e VTP Realty c 6,500 i r 2020" P Goyal Ganga Group e g a 6,000 r Pride Purple Properties e v A 5,500 Goel Ganga Developments 5 Years YoY QoQ Majestique Landmarks 5,000 Rohan Builders & Developers 7 8 9 0 1 2 1 1 1 2 2 2 3.1% -0.9% 0.9% 0 0 0 0 0 0 2 2 2 2 2 2 Notes: Note: The above table represents the top developers by 1. -

Pimpri Chinchwad Municipal Corporation Pimpri - 411 018 Maharashtra

S ystem of A ssisting R esidents A nd T ourists through H elpline I nformation 1 System of Assisting Residents And Tourists through Helpline Information SARATHI (English) Pimpri Chinchwad Municipal Corporation Pimpri - 411 018 Maharashtra SARATHI Pimpri Chinchwad Municipal Corporation, Pimpri - 411 018 2 S ystem of A ssisting R esidents A nd T ourists through H elpline I nformation Pimpri Chinchwad Municipal Corporation - Ward wise Map - Ward Municipal Corporation Pimpri Chinchwad SARATHI Pimpri Chinchwad Municipal Corporation, Pimpri - 411 018 S ystem of A ssisting R esidents A nd T ourists through H elpline I nformation 3 New Ways... Pimpri Chinchwad Municipal Corporation is committed to provide basic amenities and ensure the welfare of its citizens. The rapid growth of the city is a big challenge to meet this objective. Many people are usually not aware of the functioning and activities of various departments of the corporation as well as the procedures for submitting applications. The administration also has to spend a lot of time in answering queries and providing information. SARATHI is an initiative which provides this information in the form of Frequently Asked Questions (FAQs) through multiple channels i.e. book, PROLOGUE website, mobile app, e-book & pdf book. In addition an interactive platform in the form of a helpline has been started to answer the queries, aid grievance redressal and guide the citizens when needed. SARATHI will enable the citizens of Pimpri Chinchwad to seek information easily which will save their precious time. I am sure SARATHI will play a key role in empowering the citizens for taking decisions and actions for their own welfare. -

Inoperative Account 19 June-2020

UNCLAIMED DEPOSITS AS ON 19 JUNE 2020 Longname Account Holders Address KAPSE ATUL NARHARI BHIKU KAPSE MENTION MUMBAI PUNE-ROAD NEAR GANESH MANDIR MORWADIPIMPRI PUNE SHREE TAPASAWI & D ENTERPRISES GAWADE VIJAY PANDURANG ,KENDRAI KRUPA OPP.RAILWAY STATIONCHINCHWAD PUNE TILLU PLASTICS DALVI,AGARCHINCHWAD ROSE TAILOR GANDHI PETHCHINCHWADGAON SHRIKANT ENT. R.R.ENTERPRISES MULTITECH SERVICES MODERN AUTOMOBILES LAXMAN NAGAR THERGAONCHINCHWAD S.J.BHOIR PROMOTORS & ,SR.NO.164 BHOIR NAGARCHINCHWADPUNE KARMARKAR INDUSTRIES SHASH, TOWER D.II 29/4 M.I.D.C.CHINCHWAD PARDESHI TRANSPORT RAKESH ENTERPRISES APA CONSTRUCTION PVT LTD SHIVSMRUTI 510 SHANIWAR PETH PUNE30 SHREE AUTOMOBILIES RAM NAGARCHINCHWAD MADAN VISHANATH BHOIR JITENDRA SEETARAM RAHATE ATLAS INDIA SYSTEM DESAI TRANSPORT SERVICE J-279 MIDCBHOSARI R.S.SCARP CENTER SNO ,170 DNYANESHWAR COLONY AKURDIPUNE SHANKAR ENTERPRISES INDRAYANI NAGAR NEAR PRIYADARSHNISCHOOL BHOSARI SATISH ENG. & FAB.WORKS NEAR FORMICAAKURDI SHREEYASH CONSTRUCTION MEMANE VILAS SOPANRAO SHIV CHATRAPATI HOUSING SOCIETYNEAR GANESH MANDIR TAMHANE WASTICHIKHALI KANIHIALAL MOTILAL TALERA 14 JAYAPRAKASH NARAYAN GARDENPUNE MULY PANDHRINATH P JADHAV CHALBHOSARI SHRIRAMCHANDRA TRANSPORT 1375 RAMCHANDRA NIVAS SHIVSHAMBHOHSG SOCY RUPEENAGAR TALWADE J.B.INDUSTRIES SADGU,UNAGARBHOSARI SAGAR ARTS DATTAWADIAKURDI ABHYANKAR ENGRAVERS SHREE SAMARTH INDUSTRIES 380 SECT 2 INDRAYANI NAGARBHOSARI SHREE GANESH PROVISION STORES SUBHASH SUPPLIERS TRIVENAGARTALWADE RAJDEEP TEMPO SERVICE VIDYANAGARCHINCHWAD PREMCHAND R JAVERI MUTHA BROTHERS SHREE