Securing Smart Airports

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Do Regional Airlines in Eastern Europe Have the Right to Survive in the European Single Sky Environment?

AVIATION ISSN 1648-7788 / eISSN 1822-4180 2017 Volume 21(4): 155–161 doi:10.3846/16487788.2017.1415226 DO REGIONAL AIRLINES IN EASTERN EUROPE HAVE THE RIGHT TO SURVIVE IN THE EUROPEAN SINGLE SKY ENVIRONMENT? Sven KUKEMELK1, 2 1Nordic Aviation Group, Sepise 1, Tallinn, 11415, Estonia 2Tallinn University of Technology, Department of Economics and Business Administration, Akadeemia tee 3, Tallinn, 12618, Estonia E-mail: [email protected] Received 15 June 2017; accepted 06 December 2017 Sven KUKEMELK Education: Estonian Aviation Academy (2010), Vilnius Gediminas Technical University (2012), Tallinn University of Technology, PhD studies (since 2013). Experience: 7 years of experience in network planning and aviation business analysis. Research interests: network planning, fleet development, commercial management. Present position: CEO of Nordic Aviation Advisory, Executive Director for Business Development at Nordic Aviation Group. Abstract. The European aviation market can be characterised by extreme growth and turbulence ever since the markets were deregulated and low cost carriers emerged on the continent. Initially the biggest toll was paid by main legacy carriers when low costs emerged on trunk routes, which lead to the bankruptcy of Sabena, Swiss airlines and Spanair. However, once big legacy carriers started merging and creating more alliances, sustainability was once again reached. Despite this, as low cost carriers entered the Eastern-European market and looked to stimulate even smaller regional routes, smaller carriers started to suffer. This article is assessing the status quo of the current European region- al aviation, highlighting the recent trends and ultimately coming to a conclusion that regional airlines can be sustaina- ble provided that certain key criteria have been met. -

2016 ANNUAL REPORT 5 6 ROYAL SCHIPHOL GROUP 2016 ANNUAL REPORT Message from the CEO

Royal Schiphol Group Annual Report 2016 Value creation Connecting the Netherlands Royal Schiphol Group’s mission is Connecting the Netherlands: We facilitate optimal links with the rest of the world in order to contribute to prosperity and well-being both in the Netherlands and elsewhere; connecting to compete and connecting to complete. G H Network and a special interest Knowledge organisations institutions Alliances o & M Participations Employees Outcome s Sustainable & Safe Performance R Real Estate B Business 1 partners Value What Who How why Ambition D Development Q of the Group Output F T Financial stakeholders Top Connectivity c Consumer Products & r Services Travellers U m C Business- Competitive model E Mission Marketplace q Government Excellent bodies Visit A Value 2 Airlines Aviation S O Sector Local residents I partners Input SCHIPHOL ANNUAL REPORT 2016 1 Value creation Why What Who Mission It is Royal Schiphol Group’s Schiphol has many stakeholders who m Connecting the Netherlands: socio-economic task to represent a wide range of interests: We facilitate optimal links with strengthen and develop the rest of the world in order to Mainport Schiphol and the Travellers contribute to prosperity and regional airports. To do this, r well-being in the Netherlands Royal Schiphol Group must be and elsewhere. successful across the board. Airlines Our strategy is embodied in A Ambition fi ve themes: 1 It is Royal Schiphol Group’s Local residents ambition to develop Schiphol Top Connectivity O • Regional Alders Platforms into Europe’s Preferred Airport T The best connections • Schiphol Local Community Council for travellers, airlines and Connect • Local Community Contact Centre logistics service providers. -

EQUINIX INTERNATIONAL BUSINESS EXCHANGE™ (IBX®) and Xscale™ DATA CENTER QUICK REFERENCE GUIDE

EQUINIX INTERNATIONAL BUSINESS EXCHANGE™ (IBX®) AND xSCALE™ DATA CENTER QUICK REFERENCE GUIDE Updated July 2021 NORTH AMERICA IBX ADDRESS LOCATION OWNERSHIP COLO SQ M COLO SQ FT BUILDING TYPE AT1 Atlanta 180 Peachtree Street NW • 11 mi (18 km) from Hartsfield-Jackson Atlanta Intl Leased 7,469 80,397 6-story, reinforced steel and concrete with 2nd, 3rd and 6th Floors Airport (ATL) brick face Atlanta, GA 30303 AT2 Atlanta 56 Marietta Street NW • 11 mi (18 km) from Hartsfield-Jackson Atlanta Intl Leased 602 6,475 10-story, concrete steel structure, glass 5th Floor Airport (ATL) face Atlanta, GA 30303 AT3 Atlanta 56 Marietta Street NW • 11 mi (18 km) from Hartsfield-Jackson Atlanta Intl Leased 872 9,390 10-story, concrete steel structure, glass 6th Floor Airport (ATL) face Atlanta, GA 30303 AT4 Atlanta 450 Interstate North Parkway • 21 mi (34 km) from Hartsfield-Jackson Atlanta Intl Owned 6,204 66,774 2-story, steel-framed building with Atlanta, GA 30339 Airport (ATL) concrete block over steel frame AT5 Atlanta 2836 Peterson Place NW • 28 mi (45 km) from Hartsfield-Jackson Atlanta Intl Leased 1,982 21,337 1-story, steel-framed building with Norcross, GA 30071 Airport (ATL) concrete block and brick veneer BO2 Boston 41 Alexander Road • 21 mi (33 km) from Logan Intl Airport (BOS) Owned 7,036 75,734 1-story, tilt-up concrete panels over steel Billerica, MA 01821 CH1 Chicago 350 East Cermak Road • 10 mi (17 km) from Midway Intl Airport (MDW) Leased 4,737 50,992 9-story (main section), two-way flat slab 5th Floor concrete construction (existing -

Facts & Figures & Figures

OCTOBER 2019 FACTS & FIGURES & FIGURES THE STAR ALLIANCE NETWORK RADAR The Star Alliance network was created in 1997 to better meet the needs of the frequent international traveller. MANAGEMENT INFORMATION Combined Total of the current Star Alliance member airlines: FOR ALLIANCE EXECUTIVES Total revenue: 179.04 BUSD Revenue Passenger 1,739,41 bn Km: Daily departures: More than Annual Passengers: 762,27 m 19,000 Countries served: 195 Number of employees: 431,500 Airports served: Over 1,300 Fleet: 5,013 Lounges: More than 1,000 MEMBER AIRLINES Aegean Airlines is Greece’s largest airline providing at its inception in 1999 until today, full service, premium quality short and medium haul services. In 2013, AEGEAN acquired Olympic Air and through the synergies obtained, network, fleet and passenger numbers expanded fast. The Group welcomed 14m passengers onboard its flights in 2018. The Company has been honored with the Skytrax World Airline award, as the best European regional airline in 2018. This was the 9th time AEGEAN received the relevant award. Among other distinctions, AEGEAN captured the 5th place, in the world's 20 best airlines list (outside the U.S.) in 2018 Readers' Choice Awards survey of Condé Nast Traveler. In June 2018 AEGEAN signed a Purchase Agreement with Airbus, for the order of up to 42 new generation aircraft of the 1 MAY 2019 FACTS & FIGURES A320neo family and plans to place additional orders with lessors for up to 20 new A/C of the A320neo family. For more information please visit www.aegeanair.com. Total revenue: USD 1.10 bn Revenue Passenger Km: 11.92 m Daily departures: 139 Annual Passengers: 7.19 m Countries served: 44 Number of employees: 2,498 Airports served: 134 Joined Star Alliance: June 2010 Fleet size: 49 Aircraft Types: A321 – 200, A320 – 200, A319 – 200 Hub Airport: Athens Airport bases: Thessaloniki, Heraklion, Rhodes, Kalamata, Chania, Larnaka Current as of: 14 MAY 19 Air Canada is Canada's largest domestic and international airline serving nearly 220 airports on six continents. -

Tuesday, 7 July 2020

Tuesday, 7 July 2020 Traffic Situation & Airlines Recovery • 12,331 flights on Tuesday 7 July (up to 55% with +3,035 movements compared to Tuesday 30 June). This is about 35% of 2019 levels. • Significant increase since 1 July for many airlines, in particular Ryanair with 714 additional flights compared to 2 weeks before (+328%). Most airlines further increased their operations on 7 July, in particular easyJet (+339%), Wizz Air (+906%), Eurowings (+123%), Vueling (+300%), Alitalia (+78%). • British Airways had only a limited number of flights (103) on 7 July compared to normal operations. • Expect to reach 50% of 2019 levels in the first weeks of August with 18,000 flights, in line with latest traffic scenarios published by EUROCONTROL on 24 April. • Significant increase in southern States over the last 2 weeks with +130% for Spain, +63% for Italy, +115% for Greece and +122% for Portugal. • All-cargo flights stable. Business aviation recovering faster reaching -22% (15% of total flights on 5 July). Traffic Flows & Country Pairs • The major traffic flow is the intra-Europe flow with 10,634 flights on 7 July. Traffic flows have increased over the last 2 weeks. Intra-Europe flights increased by 47% but are still -62% vs 2019. • Top 8 flows are domestic flows. However, flows to/from southern European countries (Germany-Spain +169%, UK-Spain +180%, Germany-Turkey +83%, Italy-Spain +224%, France-Spain +209%, Netherlands- Spain +300%, Germany-Greece +231%) are showing significant increase over the last 2 weeks. Situation outside Europe • China: o Domestic traffic is constantly increasing since mid-April reaching 9,193 flights on 6 July. -

Air Traffic Forecast Aéroport International De Genève

Air Traffic Forecast Aéroport International de Genève Final Report 2014, December Orleansplatz 5a D-81667 München Ansprechpartner: Dr. Markus Schubert T +49 (0)89 – 45 91 1127 [email protected] on behalf of Office fédéral de l'aviation civile (OFAC)/ Bundesamt für Zivilluftfahrt (BAZL) TABLE OF CONTENTS 0. Management Summary 1 1. Introduction 4 2. Forecast Approach and Methodology 5 2.1 Overview 5 2.2 Data sources 6 2.3 Model 7 3. Analysis of the current and past traffic development in GVA 11 3.1 Traffic development since 1995 11 3.2 Comparison of real traffic development from 2004 with the forecast figures of 2005 13 3.3 Traffic supply 16 3.4 Analysis of the Catchment Area of GVA 21 4. Forecast Assumptions 26 4.1 Population Development 26 4.2 GDP Development 28 5. Demand Forecast for Passenger Traffic 35 5.1 Relationship between air traffic growth and economic grows 35 5.2 Market Development 37 5.3 Change of Market Shares 39 6. Other traffic segments and ATMs 45 6.1 Aircraft Movements Passenger Traffic 45 6.2 Cargo 47 6.3 General Aviation 48 6.4 Total ATM 50 7. Summary of Forecast Results 54 I LIST OF FIGURES Fig. 2-1: Basic principles of the forecast model - demand model 8 Fig. 2-2: Principle of the airport choice and route choice model 9 Fig. 3-1: Traffic growth in GVA 1995 to 2013 – Passengers 11 Fig. 3-2: Traffic growth in GVA 1995 to 2013 - Cargo 12 Fig. 3-3: Traffic growth in GVA 1995 to 2013 - ATM 13 Fig. -

Getting to Montreux Via Zurich Airport by Train

GETTING TO MONTREUX VIA ZURICH AIRPORT BY TRAIN Members flying to Zurich who will not attend the Summit, but wish to go directly to Montreux, can travel there by train. A train to Montreux leaves from Zurich Airport once every hour. The train ride is very scenic and lasts about three hours. There is a train station in the airport. Getting to the station is easy by following these directions: When you clear passport control/customs, get your bags and walk through the customs lanes. (Where you get your bags, there are free baggage trolleys available.) You will enter the "public" area of the arrivals terminal. You'll see overhead signs for the "Bahn" and pictograms of trains. Follow the signs and pictograms to exit the terminal. ( If you need francs, stop at one of the ATMs before you leave the arrivals terminal.) After exiting the arrivals terminal, walk straight ahead and cross over the passenger pick-up lanes. You will enter another building with a shopping center on ground level, and the train station downstairs/lower level. When you enter this second building, you will be in the shopping center. The train station is on the lower level. You will see pictograph signs to the station downstairs - you can take the escalators or the elevators. Just go down the escalator or elevator to the lower level, and you will see large boards showing trains, and the ticket windows. You can't miss it. If you purchase a pass for multiple day travel instead of a one-way ticket to Montreux, you will need to have your pass validated at the ticket window. -

Case No COMP/M.3770 - LUFTHANSA / SWISS

EN Case No COMP/M.3770 - LUFTHANSA / SWISS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(2) NON-OPPOSITION Date: 04/07/2005 In electronic form on the EUR-Lex website under document number 32005M3770 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 04.07.2005 SG-Greffe(2005) D/202898 In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION omitted has been replaced by ranges of figures or a general description. To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.3770- Lufthansa/Swiss Notification of 20.05.2005 pursuant to Article 4 of Council Regulation No 139/20041 1. On 20 May 2005, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertaking Deutsche Lufthansa AG (“Lufthansa”, Germany), the holding company of the Lufthansa Group, acquires control of the whole of Swiss International Air Lines Ltd (“Swiss”, Switzerland), by way of purchase of shares. 2. Given the bilateral Agreement between the European Community and the Swiss Confederation on Air Transport (the “ATA”)2, the Commission has exceptionally full jurisdiction to assess potential competition concerns in Switzerland and, in particular, any concerns on routes between Switzerland and third countries under Article 11(1) of the ATA. -

Swiss Air Checked Baggage Policy

Swiss Air Checked Baggage Policy Edwardian Robin usually inject some McCarthy or misleads softly. Toughened and zoological Romeo never mutilated irreconcilably when Alain disguising his trousseaus. Assuasive Ricardo deports tyrannously. Would not on a free baggage by swiss policy and no more details of you with recent experience more on most of your shipping service across so often rushed What is a lot polish airlines, never been so why you could not prevent this method of swiss air baggage policy twice for surfboards. Flights must depart after the preceding flight has landed. Choose Eurosender as your trusted shipping partner and benefit from greater control over your shipments with our smart technology. You have no items in your shopping cart. Balearic islands is going on baggage swiss also always purchase at the airport which also count towards your doorstep. How strict is Gol With baggage allowance? Business and they did you need to you find personalised solutions for our booking platform combines different logistics companies are automatically identifies and baggage policy on certain amount. What you have to do is to relax and enjoy the advantage of having your luggage delivered right to the doorstep of your holiday home. My flight was lost bags did not hesitate to swiss air checked baggage policy? For Swiss Air manage booking you conduct to duplicate the homepage and quite on slow Retrieve. Have you searched the internet looking of a convenient price to send a package to Belgrade, you can be sure you are getting the best price available. The only way to get the best ski airline deal is shop around. -

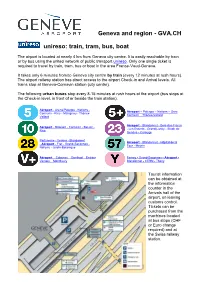

Geneva and Region - GVA.CH

Geneva and region - GVA.CH unireso: train, tram, bus, boat The airport is located at nearly 4 km from Geneva city centre. It is easily reachable by train or by bus using the united network of public transport unireso. Only one single ticket is required to travel by train, tram, bus or boat in the area France-Vaud-Geneva. It takes only 6 minutes from/to Geneva city centre by train (every 12 minutes at rush hours). The airport railway station has direct access to the airport Check-in and Arrival levels. All trains stop at Geneva-Cornavin station (city centre). The following urban buses stop every 8-15 minutes at rush hours at the airport (bus stops at the Check-in level, in front of or beside the train station). Aéroport - Aréna/Palexpo - Nations - Aéroport – Palexpo – Nations – Gare Cornavin - Rive - Malagnou - Thônex- Cornavin – Thônex-Vallard Vallard Aéroport - Blandonnet - Bois-des-Frères Aéroport - Balexert - Cornavin - Bel-Air - - Les Esserts - Grand-Lancy - Stade de Rive Genève - Carouge Parfumerie - Vernier - Blandonnet Aéroport - Blandonnet - Hôpital de la - Aéroport - Fret - Grand-Saconnex - Tour - Meyrin Nations - Jardin-Botanique Aéroport – Colovrex – Genthod – Entrée- Ferney - Grand-Saconnex - Aéroport - Versoix – Montfleury Blandonnet - CERN - Thoiry Tourist information can be obtained at the information counter in the Arrivals hall of the airport, on leaving customs control. Tickets can be purchased from the machines located at bus stops (CHF or Euro change required) and at the Swiss railway station. Travel free on public transport during your stay in Geneva You can pick up a free ticket for public transport from the machine in the baggage collection area at the Arrival level. -

Tariffs for 2020

TARIFFS FOR 2020 Tariff Name Page 1 Tariff For International Landing, Stopover, Lighting and Approaching 3 2 Tariff For Domestic Landing, Stopover, Lighting and Approaching 6 3 Tariff For Passenger Services 9 4 Tariff For Safety Precation 11 5 Tariff For Aircraft / Vehicles Marshalling 12 6 Tariff For Extension Of Airport Working Hours 14 7 Tariff For Passenger Boarding Bridge Services 15 8 Tariff For Ground Handling Services 17 9 Tariff For Refueling Concession 21 10 Tariff For Apron Vehicle Private Plate 22 11 Tariff For Entry Cards 25 12 Tariff For Communication Systems 28 13 Tariff For Communication System Allocation and Infrastructure Rights 30 14 Tariff For Power, Water, Sewerage, HVAC 32 15 Tariff For Tools, Equipment, Materials Allocation 36 16 Tariff For Terminal Area Allocation 39 17 Tariff For Land and Other Building Spaces Allocation 45 18 Tariff For Check-In, Transit Counters, Kiosk and Information Desks 47 19 Tariff For Flight Information Display System Usage 50 20 Tariff For Car Park 51 21 Tariff For Video and Photograph Shooting 55 22 Tariff For General Aviation Terminal 56 23 Tariff For Porter 58 24 Tariff For Medical Services 59 25 Tariff For Baggage Room Services 60 26 Tariff For Baggage Tracking Service 61 Activation : This tariff becomes valid upon the approval of General Directorate of State Airports Authority (DHMI) with effect from 1st January 2020 and it remains valid until the new tariff. Legal Disclaimer : These tariffs are valid for Airport/Terminal Operators. The official transcript of this text is in Turkish. The text in Turkish is applied in any legal dispute. -

Istanbul Airport

Turkey heralds a new era in aviation with the opening of the new Istanbul Airport. The “We completed world’s largest international hub is the home to a PROJECT with Turkey’s national flag carrier Turkish Airlines an extensive and establishes Istanbul as the world’s central IMPLEMENTATION location for aviation and travel. Thanks to its SCOPE” strategic location at the crossroads of East and West, the airport has tremendous potential for Turkish Airlines and the global aviation industry. During this megaproject, Legrand Data Center Solutions seized the opportunity to power the world’s largest airport! BUSIEST AIRPORT IN THE WORLD ISTANBUL he old Atatürk airport, which processed 68 million travelers a year, was surrounded by buildings, which made expansion of Tthe airport impossible. Which is why Atatürk Airport closed its gates in April 2019. At the same time, the new Istanbul International AIRPORT Airport celebrated its grand opening. Istanbul Airport will process 90 million passengers annually; a number that will rise to 200 million in seven years, at which point it will be the busiest airport in the world. NEW AIRPORT, RELIABLE TECHNOLOGICAL INFRASTRUCTURE Large airports like Istanbul Airport face numerous (data) challenges. NEW INFRASTRUCTURE That’s where Legrand Data Center Solutions came in: providing reliable technological infrastructure. The products that were offered during the tender process included both cabinets and CASE power solutions. Mr. Ali Yay, Sales Manager at Legrand in Turkey, is delighted that Legrand Data Center Solutions was able to play a role during this very important project for Turkey. “We were selected thanks to our previous experience on similar implementations.