China's Choice and Its Implication: Import Meat Or Soybean

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

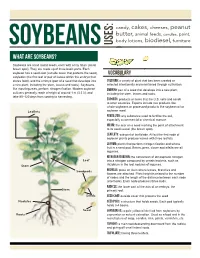

What Are Soybeans?

candy, cakes, cheeses, peanut butter, animal feeds, candles, paint, body lotions, biodiesel, furniture soybeans USES: What are soybeans? Soybeans are small round seeds, each with a tiny hilum (small brown spot). They are made up of three basic parts. Each soybean has a seed coat (outside cover that protects the seed), VOCABULARY cotyledon (the first leaf or pair of leaves within the embryo that stores food), and the embryo (part of a seed that develops into Cultivar: a variety of plant that has been created or a new plant, including the stem, leaves and roots). Soybeans, selected intentionally and maintained through cultivation. like most legumes, perform nitrogen fixation. Modern soybean Embryo: part of a seed that develops into a new plant, cultivars generally reach a height of around 1 m (3.3 ft), and including the stem, leaves and roots. take 80–120 days from sowing to harvesting. Exports: products or items that the U.S. sells and sends to other countries. Exports include raw products like whole soybeans or processed products like soybean oil or Leaflets soybean meal. Fertilizer: any substance used to fertilize the soil, especially a commercial or chemical manure. Hilum: the scar on a seed marking the point of attachment to its seed vessel (the brown spot). Leaflets: sub-part of leaf blade. All but the first node of soybean plants produce leaves with three leaflets. Legume: plants that perform nitrogen fixation and whose fruit is a seed pod. Beans, peas, clover and alfalfa are all legumes. Nitrogen Fixation: the conversion of atmospheric nitrogen Leaf into a nitrogen compound by certain bacteria, such as Stem rhizobium in the root nodules of legumes. -

Soy Products As Healthy and Functional Foods

Middle-East Journal of Scientific Research 7 (1): 71-80, 2011 ISSN 1990-9233 © IDOSI Publications, 2011 Soy Products as Healthy and Functional Foods Hossein Jooyandeh Department of Food Science and Technology, Ramin Agricultural and Natural Resources University, Mollasani, Khuzestan, Iran Abstract: Over the recent decades, researchers have documented the health benefits of soy protein, especially for those who take soy protein daily. Soy products offer a considerable appeal for a growing segment of consumers with certain dietary and health concerns. It is quite evident that soy products do reduce the risks of developing various age-related chronic diseases and epidemiologic data strongly suggest that populations that regularly consume soy products have reduced incidence and prevalence of the aforementioned age-related conditions and diseases than populations that eat very little soy. The subject of what specific components is responsible for the plethora of reported health benefits of soybean remains a strong controversial issue, as the scientific community continues to understand what component(s) in soy is /are responsible for its health benefits. Soy constituents’ benefits mostly relate to the reduction of cholesterol levels and menopause symptoms and the reduction of the risk for several chronic diseases such as cancer, heart disease and osteoporosis. A variety of soy products are available on the market with different flavors and textures and a low-fat, nutritionally balanced diet can be developed from them. This article summarized the beneficial health, nutritional and functional properties of the soy ingredients and intends to illustrate the most current knowledge with a consciousness to motivate further research to optimize their favorable effects. -

Food System and Culture of Eating in India Impact Factor: 5.2 IJAR 2019; 5(3): 87-89 Received: 06-01-2019 Dr

International Journal of Applied Research 2019; 5(3): 87-89 ISSN Print: 2394-7500 ISSN Online: 2394-5869 Food system and culture of eating in India Impact Factor: 5.2 IJAR 2019; 5(3): 87-89 www.allresearchjournal.com Received: 06-01-2019 Dr. Durgesh Kumar Singh Accepted: 10-02-2019 Abstract Dr. Durgesh Kumar Singh India has one of the oldest civilizations in the world with a rich cultural heritage. In the sacred book of Principal, Swatantra Girls the Hindu called ‘Bhagavad Geeta’, foods are classified into three categories based on property, Degree College, Lucknow sanctity and quality – Sattvika, Raajasika and Taamasika. Sattvika food, which denotes food for University Lucknow, Uttar prosperity, longevity, intelligence, strength, health and happiness includes fruits, vegetables, legums, Pradesh, India cereals and sweets. Raajasika food, which signifies activity, passion and restlessness includes hot, sour, spicy and salty foods. Taamasika food is intoxicating and unhealthy. Keywords: health, food, diet, vegetarian, non- vegetarian, regional foods 1. Introduction Hindus are traditionally vegetarian but many non-Brahmins are non- vegetarians. Brahmin Hindu’s do not eat garlic, onion and intoxicants. Ethnic Indian foods have social importance for celebrations particularly during festivals and social occasions. The Indian food is spicy and salt is added directly by cooking seasoning such as soy-sauce and mono sodium glutamate are never used. The Dietary culture of India is a fusion of the Hindu-Aryan culture and the Tibetan–Mangolian culture influence by the ancient Chinese cuisines with modifications based on ethnic preference and sensory likings over a period of time. Use of fingers to grasp food items for feeding remains a traditional features of Hindu, Buddhist, and Muslim dietary cultures in India. -

China's Meat and Egg Production and Soybean Meal Demand for Feed: an Elasticity Analysis and Long-Term Projections

International Food and Agribusiness Management Review Volume 15, Issue 3, 2012 China's Meat and Egg Production and Soybean Meal Demand for Feed: An Elasticity Analysis and Long-Term Projections Tadayoshi Masudaa and Peter D. Goldsmithb aSenior Research Analyst, Research Institute for Humanity and Nature 457-4 Kamigamo Motoyama, Kita-ku, Kyoto 603-8047, Japan bAssociate Professor, Department of Agricultural and Consumer Economics, University of Illinois at Urbana, Champaign 1301 West Gregory Drive, Urbana, Illinois, 61801, USA Abstract China is a large meat and egg producer and correspondingly a large soybean meal consumer. Dual forces affect the derived demand for soybeans; rising livestock production to meet consum- er demand for protein and the shift to commercial feed by the livestock industry. We employ a unique elasticity approach to estimate these dual forces on soybean meal demand over the next 20 years. We then discuss the implications of these forecasts with respect to the modernization of China’s feed industry, land use changes in South America, and the need for yield research to reduce pressure on increasingly scarce land resources. Keywords: meat production; soybean meal; feed demand; elasticity; forecasting; land use Corresponding author: Tel: +217-333-5131 Email: P.D. Goldsmith: [email protected] +The IFAMR is a non-profit publication. The additional support provided from this issue advertisers, Novus International and GlobalGap help keep us open access and dedicated to serving management, scholars, and policy makers worldwide. 35 2012 International Food and Agribusiness Management Association (IFAMA). All rights reserved Madusa and Goldsmith / International Food and Agribusiness Management Review / Volume 15, Issue 3, 2012 Introduction Background The “livestock revolution” (Delgado et al. -

Winter Menu } February Fruit & Veg/ 1/2 Cup Total Milk 6Oz Cup

tm local & organic food for kids december Protein =2oz total january Grain>2oz winter menu } february Fruit & Veg/ 1/2 cup total Milk 6oz cup monday tuesday wednesday thursday friday Dec 31, Jan 28 January 1, 29 January 2, 30 January 3, 31 January 4 Roast Turkey w/ Gravy Three Cheese Baked Chicken Nuggets Beefy Sloppy Joe Three Bean Chili Lasagna Veggie “Chicken” Tenders Veggie Sloppy Joe Tofurkey Fresh Cucumbers Steamed Carrots Mixed Veggies Whipped Potatoes Fresh Broccoli Fruit Salad Fresh Pineapple Fresh Bananas Appleberry Sauce Pear Slices Elbow Pasta Whole Grain Bread Whole Grain Bread Whole Grain Bun January 7 January 8 January 9 January 10 January 11 Orange Chicken Farfalle w/ Tomato Beef Kabab Bites Creamy Three Cheese Orange Vegetarian Chicken Cream Sauce Falafel Mac n’ Cheese Pizza w/ Yogurt Dip Asian Veggies Steamed Carrots Sweet Local Peas Fresh Broccoli Honeydew Melon Fresh Cucumbers Fresh Pineapple Apple Slices Orange Slices Fruit Salad Brown Rice Whole Grain Pita January 14 January 15 January 16 January 17 January 18 Turkey Pot Pie Juicy Beef Burger Cheesy Quesadillas Cheesey Ravioli Sweet Apple Chicken Curry Veggie Pot Pie Veggie Burger w/ Sour Cream w/ Marinara Vegetarian Chicken Local Green Beans Fresh Steamed Broccoli Butternut Squash Sweet Local Peas Cauliflower & Carrots Orange Slices Appleberry Sauce Fresh Pineapple Fresh Melon Fruit Salad Fresh Baked Biscuit Whole Grain Bun Naan Bread January 21 January 22 January 23 January 24 January 25 Pasta w/ Alfredo Chicken w/ Plum Sauce Swedish Meatballs Fish Tenders Adobo -

Soybeans USE

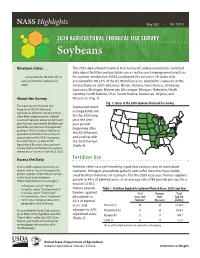

NASS Highlights May 2021 • No. 2021-1 AGRICULTURAL2020 AGRICULTURAL CHEMICAL USE SURVEY CHEMICALSoybeans USE Nineteen states . The 2020 Agricultural Chemical Use Survey of soybean producers collected data about fertilizer and pesticide use as well as pest management practices . accounted for 96.32% of U.S. for soybean production. NASS conducted the survey in 19 states that acres planted to soybeans AGRICULTURAL in accounted for 96.32% of the 83.08 million acres planted to soybeans in the 2020. United States in 2020: Arkansas, Illinois, Indiana, Iowa, Kansas, Kentucky, CHEMICALLouisiana, Michigan, USE Minnesota, Mississippi, Missouri, Nebraska, North Carolina, North Dakota, Ohio, South Dakota, Tennessee, Virginia, and About the Survey Wisconsin. (Fig. 1) Fig. 1. States in the 2020 Soybean Chemical Use Survey The Agricultural Chemical Use Soybean planted Program of USDA’s National Agricultural Statistics Service (NASS) acreage totals are is the federal government’s official for the 2020 crop source of statistics about on-farm and year, the one- post-harvest commercial fertilizer and year period pesticide use and pest management beginning after practices. NASS conducts field crop agricultural chemical use surveys in the 2019 harvest cooperation with USDA’s Economic and ending with Research Service as part of the the 2020 harvest. Agricultural Resource Management (Table 4) Survey. NASS conducted the soybean chemical use survey in the fall of 2020. Access the Data Fertilizer Use Access 2020 soybean chemical use Fertilizer refers to a soil-enriching input that contains one or more plant data as well as results from prior (or nutrients. Nitrogen, phosphate, potash, and sulfur were the most widely earlier) soybean chemical use surveys used fertilizer materials on soybeans. -

The Best Indian Diet Plan for Weight Loss

The Best Indian Diet Plan for Weight Loss Indian cuisine is known for its vibrant spices, fresh herbs and wide variety of rich flavors. Though diets and preferences vary throughout India, most people follow a primarily plant-based diet. Around 80% of the Indian population practices Hinduism, a religion that promotes a vegetarian or lacto-vegetarian diet. The traditional Indian diet emphasizes a high intake of plant foods like vegetables, lentils and fruits, as well as a low consumption of meat. However, obesity is a rising issue in the Indian population. With the growing availability of processed foods, India has seen a surge in obesity and obesity-related chronic diseases like heart disease and diabetes . This document explains how to follow a healthy Indian diet that can promote weight loss. It includes suggestions about which foods to eat and avoid and a sample menu for one week. A Healthy Traditional Indian Diet Traditional plant-based Indian diets focus on fresh, whole ingredients — ideal foods to promote optimal health. Why Eat a Plant-Based Indian Diet? Plant-based diets have been associated with many health benefits, including a lower risk of heart disease, diabetes and certain cancers such as breast and colon cancer. Additionally, the Indian diet, in particular, has been linked to a reduced risk of Alzheimer’s disease. Researchers believe this is due to the low consumption of meat and emphasis on vegetables and fruits. Following a healthy plant-based Indian diet may not only help decrease the risk of chronic disease, but it can also encourage weight loss. -

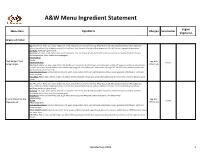

Menu Ingredient Statement

A&W Menu Ingredient Statement Vegan/ Menu Item Ingredients Allergen Sensitivities Vegetarian Burgers and Chicken Bun: Wheat Flour, Water, Corn Syrup, Soybean Oil, Yeast, Contains 2% or less of the following: Wheat Gluten, Salt, Malt, Dough Conditioners (Monoglycerides, Sodium Stearoyl Lactylate, Azodicarbonamide), Artificial Flavor, Yeast Nutrients (Calcium Sulfate, Ammonium Chloride), Calcium Propionate (Preservative). Beef Patty: Hamburger (ground beef). Seasoning: Salt, sugar, spices, paprika, dextrose, onion powder, corn starch, garlic powder, hydrolyzed cornprotein, extractive of paprika, disodium inosinate, disodium guanylate, silicon dioxide (anti-caking agent). Iceberg Lettuce Tomato Papa Burger/ Papa Egg, Milk, Yellow Onion Slices Gluten Burger Single Papa Sauce: Soybean oil, water, sugar, pickle relish (pickles, corn sweeteners, distilled vinegar, salt, xanthan gum, alum 0.10% potassium sorbate as a preservative, Wheat, Soy turmeric, natural spice flavors), tomato paste, distilled vinegar, egg yolk, salt, xanthan gum, artificial color including FD&C Red #40, spices, oleoresin paprika, Beta Apo-8-Carotenal, natural flavorings. Sharp American Cheese: Cultured milk and skim milk, water, cream, sodium citrate, salt, sorbic acid (preservative), sodium phosphate, artificial color, acetic acid, lecithin, enzymes. Pickle Slices: Pickles, water, distilled vinegar, salt, calcium chloride, potassium sorbate (as a preservative), polysorbate 80, natural flavors, turmeric oleoresin, garlic powder. Bun: Wheat Flour, Water, Corn Syrup, Soybean Oil, Yeast, Contains 2% or less of the following: Wheat Gluten, Salt, Malt, Dough Conditioners (Monoglycerides, Sodium Stearoyl Lactylate, Azodicarbonamide), Artificial Flavor, Yeast Nutrients (Calcium Sulfate, Ammonium Chloride), Calcium Propionate (Preservative). Beef Patty: Hamburger (ground beef). Seasoning: Salt, sugar, spices, paprika, dextrose, onion powder, corn starch, garlic powder, hydrolyzed cornprotein, extractive of paprika, disodium inosinate, disodium guanylate, silicon dioxide (anti-caking agent). -

Physicochemical Properties of Soy- and Pea-Based Imitation Sausage Patties ______

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by University of Missouri: MOspace PHYSICOCHEMICAL PROPERTIES OF SOY- AND PEA-BASED IMITATION SAUSAGE PATTIES ______________________________________________________ A Thesis presented to the Faculty of the Graduate School at the University of Missouri _______________________________________________________ In Partial Fulfillment of the Requirements for the Degree Master of Science _____________________________________________________ by CHIH-YING LIN Dr. Fu-hung Hsieh, Thesis Supervisor MAY 2014 The undersigned, appointed by the dean of the Graduate School, have examined the thesis entitled PHYSICOCHEMICAL PROPERTIES OF SOY- AND PEA-BASED IMITATION SAUSAGE PATTIES presented by Chih-ying Lin a candidate for the degree of Master Science, and hereby certify that, in their opinion, it is worthy of acceptance. Dr. Fu-hung Hsieh, Department of Biological Engineering & Food Science Dr. Andrew Clarke, Department of Food Science Dr. Gang Yao, Department of Biological Engineering ACKNOWLEDGEMENTS On the way to acquiring my master degree, many friends, professors, faculty and laboratory specialists gave me a thousand hands toward the completion of my academic research. First of all, I would like to thank Dr. Fu-hung Hsieh and Senior Research Specialist Harold Huff, who supported and offered me the most when conducting the experiment. I would like to thank Dr. Andrew Clarke and Dr. Gang Yao being my committee members and gave suggestion and help during my study. I would like to have a further thank to Dr. Mark Ellersieck for his statistical assistance. I am thankful and appreciate Carla Roberts and Starsha Ferguson help on editing and proofreading my thesis. -

The Gospel According to a Soybean Farmer Matthew 13: 1-9 I've

The Gospel According to a Soybean Farmer Matthew 13: 1-9 I’ve probably preached on the parable of the sower a dozen times over the years. And, no, it’s never the same sermon. Because, even though this is one parable to which Jesus adds an explanation, there is so much meaning to this parable that Jesus offers to us. And so, in this sermon, I’m not going to speak about the seed on the path; or in the thin, rocky soil; or choked among the weeds. I want to focus on the fertile soil, the soil that gave forth thirty, sixty, even a hundredfold. Because, after all, isn’t fertile soil what WE are supposed to be? And this leads to a story from a sermon we heard while we were worshiping on our vacation, a story the pastor very graciously sent me a copy of when I told him how much it spoke to us. And to give further credit to where it is due, it actually comes from a book written by Rev. Robert Schuller, of the Crystal Cathedral in California. You see, one day, Dr. Schuller received in the mail a soybean seed. And a note from Ansley Mueller, a farmer from Pleasant Plains, Ohio. And the note went like this: “It was 1977, Dr. Schuller, and I lost half my crop. It was a bad, bad year. It was so wet I couldn’t get half of it harvested and it didn’t develop. So, at the end of the year, in October, I would walk through the fields and try to pick up a bushel here and a piece there, Then, I saw standing by itself a most extraordinary, unusual looking soybean plant. -

The Relationship of Dietary Pattern and Genetic Risk Score with the Incidence of Dyslipidemia: 14-Year Follow-Up Cohort Study

nutrients Article The Relationship of Dietary Pattern and Genetic Risk Score with the Incidence of Dyslipidemia: 14-Year Follow-Up Cohort Study 1, 2,3, 4, 1, Seon-Joo Park y , Myung-Sunny Kim y , Sang-Woon Choi * and Hae-Jeung Lee * 1 Department of Food and Nutrition, College of BioNano Technoloyg, Gachon University, Gyeonggi 13120, Korea; [email protected] 2 Research Group of Healthcare, Korea Food Research Institute, Wanju 55365, Korea; [email protected] 3 Department of Food Biotechnology, Korea University of Science and Technology, Daejeon 34113, Korea 4 Chaum Life Center, CHA University, Seoul 06062, Korea * Correspondence: [email protected] (S.-W.C.); [email protected] or [email protected] (H.-J.L.); Tel.: +82-31-750-5968 (H.-J.L.); Fax: +82-31-724-4411 (H.-J.L.) These authors contributed equally to this work. y Received: 20 November 2020; Accepted: 13 December 2020; Published: 16 December 2020 Abstract: This study was conducted to investigate the relationship between dietary pattern and genetic risk score (GRS) for dyslipidemia risk among Korean adults. Hypercholesterolemia and hypertriglyceridemia defined as total cholesterol 240 mg/dL and triglyceride 200 mg/dL or use ≥ ≥ dyslipidemia medication. The GRS was calculated by summing the risk alleles of the selected seven single-nucleotide polymorphisms related to dyslipidemia. Dietary patterns were identified by principal component analysis based on the frequency of 36 food groups, “whole grain and soybean products” pattern, “meat, fish and vegetables” pattern, and “bread and noodle” pattern were identified. Hazard ratios (HRs) and 95% confidence intervals (CIs) were estimated using the multivariate Cox proportional hazards regression model. -

Meat & Vegetarian Burger Case Study

Comparison of Water Scarcity Methods: Meat & vegetarian Burger Case Study Urs Schenker*, Pierre-Olivier Roy, Anne-Marie Boulay, Benjamin Gaillard *Nestlé Research, Vers-chez-les-Blanc, 1000 Lausanne 26, Switzerland, [email protected] +41 21 785 9512 Case study description This case study is based on a life cycle assessment (LCA) previously performed with an external consultant (summary published in Nestlé 2015, page 157). It compares the environmental (in particular water) impacts of a beef burger with a vegetarian alternative (based on soy and wheat proteins). All ingredients are sourced, alternatively, from water scarce and water abundant areas. The assessment only takes into account the meat/meat replacement part of the burger, not the bun, tomatoes, lettuce, etc. The initial assessment showed that taking water at inventory level is not helpful to understand water impacts in agriculture: water (most importantly through irrigation) is principally used in areas where there is not enough water available, reinforcing the impact of water consumption. Therefore there was the desire to complement the study with a specific evaluation of water impacts, and compare results obtained using different water scarcity methods. Furthermore, given that some of the ingredients sourced for the assessment originate from very large countries (e.g. soy from US, Brazil), an evaluation at sub-country level has also been performed. This allows identifying whether regional data for water scarcity is preferable to country averages. Methods The exact recipes of the burgers that were used in this case study are confidential. Therefore, simplified recipes are used with ingredient compositions that could be relevant but do not exactly correspond to the products on the market.