Taubman Declares Common and Preferred Dividends 9-3-15

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

STATE of MICHIGAN CIRCUIT COURT for the 6TH JUDICIAL CIRCUIT OAKLAND COUNTY SIMON PROPERTY GROUP, INC. and SIMON PROPERTY GROUP

STATE OF MICHIGAN CIRCUIT COURT FOR THE 6TH JUDICIAL CIRCUIT OAKLAND COUNTY SIMON PROPERTY GROUP, INC. and SIMON PROPERTY GROUP, L.P., Plaintiffs, Case No. v. TAUBMAN CENTERS, INC. and TAUBMAN REALTY GROUP, L.P., Honorable Defendants. There is no other pending or resolved civil action arising out of the transaction or occurrence alleged in this complaint. This case involves a business or commercial dispute as defined in MCL 600.8031 and meets the statutory requirements to be assigned to the business court. COMPLAINT Plaintiffs Simon Property Group, Inc. (“SPG”) and Simon Property Group L.P. (“SPG Operating Partnership”) (collectively “Simon”), by and through their undersigned counsel, file this Complaint against Defendants Taubman Centers, Inc. (“TCO”) and Taubman Realty Group, L.P. (“TRG”) (collectively, “Taubman” or “Defendants”), upon knowledge as to matters relating to themselves and upon information and belief as to all other matters, and allege as follows: NATURE OF THE CLAIMS 1. On February 9, 2020, after extensive negotiations, Simon agreed to acquire most of Taubman—a retail real estate company that promotes itself as having the “most productive” shopping centers in the United States—for approximately $3.6 billion. Taubman agreed that Simon could terminate the deal if Taubman suffered a Material Adverse Effect Document Submitted for Filing to MI Oakland County 6th Circuit Court. (“MAE”) or if Taubman breached its covenant to operate its business in the ordinary course until closing. The parties explicitly agreed that a “pandemic” would be an MAE, if it disproportionately affected Taubman “as compared to other participants in the industries in which [it] operate[s].” On June 10, 2020, Simon properly exercised its right to terminate the acquisition agreement (the “Agreement”; Ex. -

Country Club Plaza

KANSAS CITY — MISSOURI COUNTRY CLUB PLAZA 4750 BROADWAY, KANSAS CITY, MISSOURI 64112 CULTURAL EPICENTER SELECT TENANTS — — Country Club Plaza is the dominant upscale shopping and dining destination in Kansas City. This one-of-a- kind, 15-block open air destination also serves as an urban cultural district offering long-standing yearly events and traditions. UNIQUE-TO-MARKET — Including Eileen Fisher, Free People, Kate Spade New York, Moosejaw, Sur La Table, Tiffany & Co., Vineyard Vines, Warby Parker and West Elm. DINING — Brio Tuscan Grille, Buca Di Beppo, Chuy’s Mexican Food, Classic Cup Cafe, Cooper’s Hawk Winery, Fogo de Chao, Gram & Dun, Granfalloon Restaurant & Bar, Hogshead Kansas City, Jack Stack Barbecue, McCormick & Schmick’s, O’Dowd’s Gastrobar, P.F. Chang’s, Parkway Social, Rye, Seasons 52, Shake Shack, The Capital Grille, The Cheesecake Factory, The Melting Pot, True Food Kitchen, Zocalo Mexican Cuisine and Tequileria and more. LOCATION — The Plaza is at the heart of where people live and work, with over 20 condominium communities within walking distance and many multi-million dollar homes within five miles of the Plaza. 2019 TRADE AREA DEMOGRAPHICs – 15-MILE RADIUS (SOURCES: CLARITAS, TETRAD, ENVIRONICS, ESRI) TOURISM ll rights reserved. A — Population ______________________ 1,337,953 Households ______________________ 551,630 Kansas City welcomed a record 25.2 million visitors in and its licensors are $75K+ Households _______________ 223,970 RI 2016 who spent $3.4 billion. S $100K+ Households ______________ 155,045 E and its licensors. Daytime Population ______________ 1,522,073 RI S In its 88th year, the Plaza Art Fair, recognized as one of —— E the top five art fairs in the U.S., is held during the third MALL TENANT SPACE week of September. -

Country Club Plaza Walking Guide

7 WAYS OF LOOKING AT THE PLAZA 50 NOTABLE THINGS TO SEE BY HISTORIC KANSAS CITY COUNTRY CLUB PLAZA WALKING GUIDE PUBLISHED WITH THE SUPPORT OF THE WILLIAM T. KEMPER FOUNDATION COUNTRY CLUB PLAZA WALKING GUIDE Introduction .................................................................... 3 7 Ways of Looking at the Plaza: A few words about the history and lasting value of Kansas City’s prized shopping district. Planning ........................................................................... 4 Architecture ..................................................................... 6 Business ............................................................................ 8 Placemaking .................................................................. 10 Neighborhood .............................................................. 12 Community ................................................................... 14 Legacy ............................................................................. 16 50 Notable Things to See: A Plaza Walking Guide: Towers, tiles and tucked-away details that make up the essence of the Country Club Plaza. Maps and details .....................................................18-33 A Plaza Timeline ..........................................................34 Acknowledgments ......................................................34 Picture credits ...............................................................34 About Historic Kansas City Foundation ...............35 2 INTRODUCTION TAKE A WALK By Jonathan Kemper n addition -

Two-Year Appraisal Services Contracts to Terzo Bologna, Integra Realty

CITY of NOVI CITY COUNCIL Agenda Item 8 May 20,2013 cityofnovi.org SUBJECT: Approval to award two (2) year appraisal services contracts to Terzo Bologna Inc., Integra Realty Resources, and fuller Appraisal Services to provide Property Appraisal and Related Services, for an estimated annual amount of $135,000. • I SUBMITTING DEPARTMENT: A,,es~mg ,~/'/ CITY MANAGER APPRO¢: I EXPENDITURE REQUIRED $135,000 Estimated AMOUNT BUDGETED $135,000 2013-2014 and $135,000 2104-2015 APPROPRIATION REQUIRED $0 LINE ITEM NUMBER 101-209.00-816.900 BACKGROUND INFORMATION: The City periodically requires professional property appraisals and expert testimony on commercial, industrial and residential properties that are being appealed to the Michigan Tax Tribunal. A Request for Qualifications (RFQ) was posted in March 2013 on the MITN/Bidnet website and three (3) responses were received. All three responders are currently providing appraisal services to the City of Novi. The most recent RFQs were evaluated for their personnel qualifications and their expertise in the areas of commercial, industrial, residential, and personal property appraisals. The three firms listed above are in good standing and have assisted the Assessing Department in the resolution of many cases. Two one (1) year options will be available to the city at the end of two (2) year contract. For each Michigan Tax Tribunal case requiring an appraisal, the firms will be reviewed for subject expertise and contacted for competitive quotes when appropriate. All quotes provided for appraisals will be lump sum for the complete appraisal. Typically, an appraisal will cost between $5,000 and $15,000 depending on property type and complexity. -

1625 Watt Avenue WATT AVENUE & ARDEN WAY, SACRAMENTO, CALIFORNIA

FOR SALE OR LEASE> ±9,584 SF FREESTANDING RESTAURANT BUILDING 1625 Watt Avenue WATT AVENUE & ARDEN WAY, SACRAMENTO, CALIFORNIA Highlights > ±9,584 square foot freestanding building > ±1.21 acre site with 71 parking spaces > Recently-renovated, fully improved restaurant building > High identity location in a prime retail trade area > Heavily-trafficked intersection, over 50,000 cars per day > Highly-visible monument and building signage > Strong residential and daytime population Traffic Count > Watt Avenue @ Arden Way: 50,084 ADT > Arden Way @ Watt Avenue: 22,124 ADT Demographic Snapshot 1 Mile 3 Miles 5 Miles Population 16,610 144,257 332,104 Daytime Population 18,687 166,145 383,255 Households 6,808 60,490 130,824 Average Income $80,656 $70,554 $66,946 Pricing > Sale Price: $2,200,000 > Lease Rate: $1.50/SF NNN (Estimated Operating Expenses: ±$0.50/SF) COLLIERS INTERNATIONAL MARK ENGEMANN MICHAEL DRAEGER San Francisco Peninsula [email protected] [email protected] 203 Redwood Shores Pkwy, Ste 125 +1 916 563 3007 +1 650 486 2221 Redwood City, CA 94065 CA License No. 00865424 CA License No. 01766822 colliers.com/redwoodcity FOR SALE OR LEASE> ±9,584 SF FREESTANDING RESTAURANT BUILDING 1625 Watt Avenue WATT AVENUE & ARDEN WAY, SACRAMENTO, CALIFORNIA Market Square Country Club Centre Country Club Plaza Arden & Watt Point West Plaza Arden Plaza Arden Square 1625 WATT AVENUE Arden Watt Marketplace MARK ENGEMANN MICHAEL DRAEGER [email protected] [email protected] +1 916 563 3007 +1 650 486 2221 CA License No. 00865424 CA License No. 01766822 FOR SALE OR LEASE> ±9,584 SF FREESTANDING RESTAURANT BUILDING 1625 Watt Avenue WATT AVENUE & ARDEN WAY, SACRAMENTO, CALIFORNIA EXISTING ADJACENT SINGLE STORY OFFICE BUILDING Site Plan PROJECT SUMMARY THIS PROJECT IS A PROPOSED RENOVATION OF AN EXISTING RESTAURANT BUILDING. -

Taubman Centers, Inc. Annual Meeting Investor Presentation

Taubman Centers, Inc. Annual Meeting Investor Presentation Spring 2018 0 We are Taubman We own, manage and develop retail properties that deliver superior financial performance to our shareholders 23 Owned Centers¹ We distinguish ourselves by creating extraordinary retail properties where customers choose to shop, dine and be entertained; where retailers can thrive $10.7bn Total Market Cap² As we benefit from the markets in which we operate, we endeavor to give back and ensure our presence adds value to our employees, our tenants and communities $12.5bn Est. Gross Asset Value³ We foster a rewarding and empowering work environment, where we strive for excellence, encourage innovation and demonstrate teamwork 68 We recognize that strong governance improves corporate decision-making and Years in strengthens our company, and we have taken steps to significantly enhance Operation our governance We have been the best performing U.S. public mall REIT over the last 20 years 468 with a 14% total shareholder return CAGR and have grown our sales per square Employees4 foot by ~18% over the past five years5 Source: Company filings as of 31-Dec-2017 (1) Includes centers from unconsolidated JVs, as of 1-May-2018. (2) As of 31-Dec-2017. (3) Per Green Street Advisors. (4) Full-time employees as of 31-Dec-2017, including Taubman Asia and certain other affiliates. (5) TSR per KeyBanc Capital Markets: The Leaderboard; sales per square foot growth reflects the increase from 2012 ($688) to 2017 ($810). 1 Key Accomplishments Through 2017 Both our recent and historical performance reflect our ability to create long-term sustainable value 14.0% 4.5 % $810 20-Year Total Shareholder Dividend CAGR Highest Sales Per Square 1 2 Return CAGR Since IPO Foot in the U.S. -

Issue: Shopping Malls Shopping Malls

Issue: Shopping Malls Shopping Malls By: Sharon O’Malley Pub. Date: August 29, 2016 Access Date: October 1, 2021 DOI: 10.1177/237455680217.n1 Source URL: http://businessresearcher.sagepub.com/sbr-1775-100682-2747282/20160829/shopping-malls ©2021 SAGE Publishing, Inc. All Rights Reserved. ©2021 SAGE Publishing, Inc. All Rights Reserved. Can they survive in the 21st century? Executive Summary For one analyst, the opening of a new enclosed mall is akin to watching a dinosaur traversing the landscape: It’s something not seen anymore. Dozens of malls have closed since 2011, and one study predicts at least 15 percent of the country’s largest 1,052 malls could cease operations over the next decade. Retail analysts say threats to the mall range from the rise of e-commerce to the demise of the “anchor” department store. What’s more, traditional malls do not hold the same allure for today’s teens as they did for Baby Boomers in the 1960s and ’70s. For malls to remain relevant, developers are repositioning them into must-visit destinations that feature not only shopping but also attractions such as amusement parks or trendy restaurants. Many are experimenting with open-air town centers that create the feel of an urban experience by positioning upscale retailers alongside apartments, offices, parks and restaurants. Among the questions under debate: Can the traditional shopping mall survive? Is e-commerce killing the shopping mall? Do mall closures hurt the economy? Overview Minnesota’s Mall of America, largest in the U.S., includes a theme park, wedding chapel and other nonretail attractions in an attempt to draw patrons. -

Taubman Centers Lifts up Reits

November/December 2011 PIONEER MILTON COOPER LED THE WAY. THE MODERN REIT AT Robert Taubman Chairman, President & CEO 20TAUBMAN CENTers’ IPO INTRODUCED THE UPREIT AND HELPED CHANGE THE INDUSTRY. www.REIT.com T aubman’s IPO brought the UPREIT into practice and more real estate players into the public market. Robert S. Taubman Chairman, President & CEO REIT.com • 2 Lifts UP REITs By: Anna Robaton y the early 1990s, Taubman Centers Inc. (NYSE: company access to a more permanent source of capital at a time TCO) had amassed one of the best-performing port- when financing was scarce and the scope of its projects was growing. folios in its sector and established itself as a pioneer of “The UPREIT really unlocked the public capital markets to pri- the American mall business. vate ownership of real estate,” says Robert Taubman, the company’s B Yet, in November 1992, the company, which had chairman, president and CEO. He estimates that more than 90 been the managing partner of a limited partnership, became a percent of the equity capital that has been raised by listed REITs pioneer of a different sort when it went public in the form of since his company’s IPO has been raised through the UPREIT the first-ever umbrella partnership real estate investment trust structure and the total REIT float has increased from about $10 (UPREIT)—an approach that allowed Taubman and eventu- billion in 1992 to nearly $400 billion today. ally many other privately held real estate companies to go public “All of these (private) companies rolled up their assets and created without exposing existing partners to large capital gains tax bills, a consolidated entity in the UPREIT structure because it solved the explains REIT historian Ralph L. -

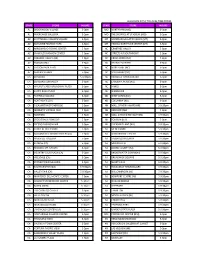

Store # Address 1 Address 2 City State 1 2837 WINCHESTER PIKE

Store # Address_1 Address_2 City State 1 2837 WINCHESTER PIKE BERWICK PLAZA COLUMBUS OH 3 PEACH ORCHARD PLAZA 2708 PEACH ORCHARD RD AUGUSTA GA 5 GREAT SOUTHERN S/C 3755 S HIGH STREET COLUMBUS OH 7 68 N WILSON ROAD GREAT WESTERN SC COLUMBUS OH 21 606 TAYWOOD ROAD NORTHMONT PLAZA ENGLEWOOD OH 29 918 EAST STATE STREET ATHENS SHOPPING CENTER ATHENS OH 30 818 S. MAIN STREET BOWLING GREEN OH 32 2800 WILMINGTON PIKE DAYTON OH 37 13 ACME STREET MARIETTA OH 39 2250 DIXIE HIGHWAY HAMILTON PLAZA HAMILTON OH 42 2523 GALLIA STREET PORTSMOUTH OH 43 3410 GLENDALE AVE. SOUTHLAND SHOPPING CENTER TOLEDO OH 45 3365 NAVARRE AVENUE OREGON OH 49 825 MAIN STREET MILFORD OH 51 1090 MILLWOOD PIKE WINCHESTER VA 57 OAKHILL PLAZA S/C 3041 MECHANICSVILLE TURNPIKE RICHMOND VA 58 370 KROGER CENTER MOREHEAD KY 61 800 14TH STREET W. HUNTINGTON WV 62 1228 COUNTRY CLUB ROAD COUNTRY CLUB PLAZA FAIRMONT WV 64 127 COMMERCE AVE COMMERCE VILLAGE S/C LAGRANGE GA 71 1400 S. ARLINGTON STREET ARLINGTON PLAZA AKRON OH 72 3013 NORTH STERLING AVE WARDCLIFFE S/C PEORIA IL 77 1615 MARION-MT. GILEAD ROAD FORUM SHOPPING CENTER MARION OH 78 3600 S DORT HIGHWAY #58 MID-AMERICA PLAZA FLINT MI 79 1140 PARK AVENUE WEST MANSFIELD OH 82 1350 STAFFORD DRIVE PRINCETON WV 83 1211 TOWER BLVD. LORAIN OH 86 ALTON SQUARE SHOPPING CTR 1751 HOMER ADAMS PARKWAY ALTON IL 91 5520 MADISON AVE INDIANAPOLIS IN 97 1900 BRICE RD BRICE POINT REYNOLDSBURG OH 98 498 CADIZ RD STEUBENVILLE OH 102 27290 EUREKA ROAD CAMBRIDGE SQUARE TAYLOR MI 109 15 E 6TH STREET BELLEVUE PLAZA BELLEVUE KY 111 5640 N. -

Store Number

Store Number STORE NAME State 0788 ANCHORAGE AK 0124 BIRMINGHAM AL 0140 RIVERCHASE GALLERIA AL 0724 HUNTSVILLE AL 0132 PINNACLE HILLS AR 0488 LITTLE ROCK AR 0016 BILTMORE AZ 0094 ARROWHEAD AZ 0168 SAN TAN VILLAGE AZ 0288 CHANDLER AZ 0364 SCOTTSDALE AZ 0480 TUCSON AZ 0736 THE QUARTER AZ 0926 PARK PLACE AZ 1258 DANA PARK AZ 1308 NORTERRA AZ 0026 SANTA MONICA CA 0028 HILLSDALE CA 0030 ANAHEIM CA 0032 HOLLYWOOD & HIGHLAND CA 0034 PASADENA CA 0036 FASHION VALLEY CA 0038 UNIVERSITY TOWNE CENTER CA 0048 STANFORD CA 0052 BURLINGAME CA 0058 POWELL STREET CA 0078 CENTURY CITY CA 0082 RANCHO CUCAMONGA CA 0088 FRESNO FASHION FAIR CA 0090 SANTA BARBARA CA 0104 BAKERSFIELD CA 0116 EMERYVILLE CA 0196 UNION STREET CA 0202 WALNUT CREEK CA 0206 NOVATO CA 0232 OTAY RANCH CA 0382 EMBARCADERO CA 0438 SAN LUIS OBISPO CA 0462 PACIFIC COMMONS CA 0484 MODESTO CA 0494 TEMECULA CA 0614 CALABASAS CA 0646 VALENCIA CA 0672 AMERICANA CA 0674 PALM DESERT CA 0740 MALIBU CA 0914 HUNTINGTON BEACH CA 0922 MARINA DEL REY CA 0928 BEVERLY DRIVE CA 0934 MONTEREY CA 0938 WESTLAKE CA 0946 THE GROVE CA 0958 SANTANA ROW CA 1118 RIVER PARK CA 1128 CORTE MADERA TOWN CENTER CA 1134 CONCORD CA 1138 UNIVERSAL CITY WALK CA 1144 STUDIO CITY CA 1150 CHINO HILLS CA 1158 TUSTIN MARKET PLACE CA 1166 PACIFIC PALISADES CA 1168 LAUREL VILLAGE CA 1172 DALY CITY CA 1176 ALISO VILLAGE CA 1190 FOLSOM CA 1192 SANTEE CA 1200 BERKELEY CA 1202 SAN FRANCISCO CENTRE CA 1218 PALM SPRINGS CA 1222 ONE PASEO CA 1230 IRVINE SPECTRUM CA 1236 REDLANDS CA 1240 BISHOP RANCH CA 1250 LONG BEACH CA 1268 SHOPPES AT -

State Store Hours State Store Hours Al Brookwood

ALL HOURS APPLY TO LOCAL TIME ZONES STATE STORE HOURS STATE STORE HOURS AL BROOKWOOD VILLAGE 5-9pm MO NORTHPARK (MO) 5-9pm AL RIVERCHASE GALLERIA 5-9pm MO THE SHOPPES AT STADIUM (MO) 5-9pm AZ SCOTTSDALE FASHION SQUARE 5-9pm MT BOZEMAN GALLATIN VALLEY (MT) 5-9pm AZ BILTMORE FASHION PARK 5-9pm MT HELENA NORTHSIDE CENTER (MT) 5-9pm AZ ARROWHEAD TOWNE CENTER 5-9pm NC CRABTREE VALLEY 5-9pm AZ CHANDLER FASHION CENTER 5-9pm NC STREETS AT SOUTHPOINT 5-9pm AZ PARADISE VALLEY (AZ) 5-9pm NC CROSS CREEK (NC) 5-9pm AZ TUCSON MALL 5-9pm NC FRIENDLY CENTER 5-9pm AZ TUCSON PARK PLACE 5-9pm NC NORTHLAKE (NC) 5-9pm AZ SANTAN VILLAGE 5-9pm NC SOUTHPARK (NC) 5-9pm CA CONCORD 5-9:30pm NC TRIANGLE TOWN CENTER 5-9pm CA CONCORD SUNVALLEY 5-9pm NC CAROLINA PLACE (NC) 5-9pm CA WALNUT CREEK BROADWAY PLAZA 5-9pm NC HANES 5-9pm CA SANTA ROSA PLAZA 5-9pm NC WENDOVER 5-9pm CA FAIRFIELD SOLANO 5-9pm ND WEST ACRES (ND) 5-9pm CA NORTHGATE (CA) 5-9pm ND COLUMBIA (ND) 5-9pm CA PLEASANTON STONERIDGE 5-9pm NH MALL OF NEW HAMPSHIRE 5-9:30pm CA MODESTO VINTAGE FAIR 5-9pm NH BEDFORD (NH) 5-9pm CA NEWPARK 5-9pm NH MALL AT ROCKINGHAM PARK 5-9:30pm CA STOCKTON SHERWOOD 5-9pm NH FOX RUN (NH) 5-9pm CA FRESNO FASHION FAIR 5-9pm NH PHEASANT LANE (NH) 5-9:30pm CA SHOPS AT RIVER PARK 5-9pm NJ MENLO PARK 5-9:30pm CA SACRAMENTO DOWNTOWN PLAZA 5-9pm NJ WOODBRIDGE CENTER 5-9:30pm CA ROSEVILLE GALLERIA 5-9pm NJ FREEHOLD RACEWAY 5-9:30pm CA SUNRISE (CA) 5-9pm NJ MONMOUTH 5-9:30pm CA REDDING MT. -

Taubman Centers Inc

TAUBMAN CENTERS INC FORM 10-Q (Quarterly Report) Filed 11/16/98 for the Period Ending 09/30/98 Address 200 E LONG LAKE RD SUITE 300 P O BOX 200 BLOOMFIELD HILLS, MI 48303-0200 Telephone 2482586800 CIK 0000890319 Symbol TCO SIC Code 6798 - Real Estate Investment Trusts Industry Real Estate Operations Sector Services Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2013, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-Q QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarter Ended: June 30, 1998 Commission File No. 1-11530 Taubman Centers, Inc. (Exact name of registrant as specified in its charter) Michigan 38-2033632 ---------------------------------- --------------------------- (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 200 East Long Lake Road, Suite 300, P.O. Box 200, Bloomfield Hills, Michigan (Address of principal executive offices) 48303-0200 ------------ (Zip Code) (248) 258-6800 --------------------------------------------------------------------------- (Registrant's telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X . No . As of November 12, 1998, there were outstanding 52,922,823 shares of the Company's common stock, par value $0.01 per share.