THE MILLS CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

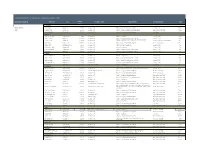

Track Record of Prior Experience of the Senior Cobalt Team

Track Record of Prior Experience of the Senior Cobalt Team Dedicated Executives PROPERTY City Square Property Type Responsibility Company/Client Term Feet COLORADO Richard Taylor Aurora Mall Aurora, CO 1,250,000 Suburban Mall Property Management - New Development DeBartolo Corp 7 Years CEO Westland Center Denver, CO 850,000 Suburban Mall Property Management and $30 million Disposition May Centers/ Centermark 9 Years North Valley Mall Denver, CO 700,000 Suburban Mall Property Management and Redevelopment First Union 3 Years FLORIDA Tyrone Square Mall St Petersburg, FL 1,180,000 Suburban Mall Property Management DeBartolo Corp 3 Years University Mall Tampa, FL 1,300,000 Suburban Mall Property Management and New Development DeBartolo Corp 2 Years Property Management, Asset Management, New Development Altamonte Mall Orlando, FL 1,200,000 Suburban Mall DeBartolo Corp and O'Connor Group 1 Year and $125 million Disposition Edison Mall Ft Meyers, FL 1,000,000 Suburban Mall Property Management and Redevelopment The O'Connor Group 9 Years Volusia Mall Daytona Beach ,FL 950,000 Suburban Mall Property and Asset Management DeBartolo Corp 1 Year DeSoto Square Mall Bradenton, FL 850,000 Suburban Mall Property Management DeBartolo Corp 1 Year Pinellas Square Mall St Petersburg, FL 800,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year EastLake Mall Tampa, FL 850,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year INDIANA Lafayette Square Mall Indianapolis, IN 1,100,000 Suburban Mall Property Management -

3Q08 SUPP V2

Third Quarter 2008 Supplemental Information TAUBMAN CENTERS, INC. Table of Contents Third Quarter 2008 Introduction 1 Summary Financial Information 2 Income Statement- Quarter 3 Income Statement- Year to Date 4 Earnings Reconciliations: Net Income Allocable to Common Shareowners to Funds from Operations 5 Net Income to Beneficial Interest in EBITDA 6 Net Income to Net Operating Income 7 Changes in Funds from Operations and Earnings Per Share 8 Components of Other Income, Other Operating Expense, and Gains on Land Sales and Other Nonoperating Income - Quarter 9 Components of Other Income, Other Operating Expense, and Gains on Land Sales and Other Nonoperating Income - Year to Date 10 Recoveries Ratio Analysis 11 Balance Sheets (Updated as of 11/03/08) 12 Debt Summary (Updated as of 11/03/08) 13 Other Debt, Equity, and Certain Balance Sheet Information 14 Construction 15 Capital Spending 16 Operational Statistics 17 Owned Centers 18 Major Tenants in Owned Portfolio 19 Anchors in Owned Portfolio 20 TAUBMAN CENTERS, INC. Introduction Third Quarter 2008 Taubman Centers, Inc. (the Company or TCO) is a Michigan corporation that operates as a self-administered and self-managed real estate investment trust (REIT). The Taubman Realty Group Limited Partnership (Operating Partnership or TRG) is a majority-owned partnership subsidiary of TCO that owns direct or indirect interests in all of its real estate properties. In this report, the term “Company" refers to TCO, the Operating Partnership, and/or the Operating Partnership's subsidiaries as the context may require. The Company engages in the ownership, management, leasing, acquisition, disposition, development, and expansion of regional and super-regional retail shopping centers and interests therein. -

Simon Property Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Digital Media and Learning Competition, Now in Its Second Year

Supported by Administered by The Digital Media and Learning Competition, now in its second year, is an annual effort designed to find — and to inspire — the most novel uses of new media in support of learning. In April 2009, the Competition awarded $2 million to individuals, for-profit companies, universities, and community organizations for projects that employ games, mobile phone applications, virtual worlds, social networks, wikis, and video blogs to explore how digital technologies are changing the way that people learn and participate in daily life. To broaden the search for innovative ideas, this year’s Competition was expanded to include international submissions and proposals from young people aged 18-25. The 19 winning projects are those that best engaged the theme of “participatory learning,” or the ways in which new technologies enable learners to contribute in diverse ways to individual and shared learning experiences. The Competition is supported by the John D. and Catherine T. MacArthur Foundation and administered by the Humanities, Arts, Science, and Technology Advanced Collaboratory (HASTAC). Winners of the Competition were drawn from two categories: Playpower is helping people create educational 8-bit games. Innovation in Participatory Learning ($30,000 to $250,000) Photo credit: Derek Lomas. Artist: Daniel Rehn and Young Innovators ($5,000 to $30,000). Innovation awards support projects that demonstrate new modes of participatory young people aged 18-25 to think boldly about “what comes learning, in which people take part in virtual communities, next” in participatory learning and to contribute to making it share ideas, comment on one another’s projects, and advance happen — will aid recipients in bringing their most visionary goals together. -

The Block at Orange Orange, California

The Block at Orange Orange, California Project Type: Commercial/Industrial Case No: C030008 Year: 2000 SUMMARY An 812,000-square-foot retail/entertainment center located about 2.5 miles from Disneyland in Orange, California. Although the center, which has drawn more than 12 million visitors in its first year of operation, has a racetrack-shaped circulation pattern, its design is meant to resemble a city grid featuring two principal parallel "streets" connected by smaller streets. The project is anchored by a 30-theater AMC Cineplex at the center of the site. An ever-changing choreography of signs, lighting, and special effects helps to keep the project fresh and exciting. FEATURES Urban entertainment center Innovative signage Tourist attraction Urban design The Block at Orange Orange, California Project Type: Retail/Entertainment Volume 30 Number 08 April-June 2000 Case Number: C030008 PROJECT TYPE An 812,000-square-foot retail/entertainment center located about 2.5 miles from Disneyland in Orange, California. Although the center, which has drawn more than 12 million visitors in its first year of operation, has a racetrack-shaped circulation pattern, its design is meant to resemble a city grid featuring two principal parallel "streets" connected by smaller streets. The project is anchored by a 30-theater AMC Cineplex at the center of the site. An ever-changing choreography of signs, lighting, and special effects helps to keep the project fresh and exciting. SPECIAL FEATURES Urban entertainment center Innovative signage Tourist attraction Urban design DEVELOPMENT TEAM DEVELOPER The Mills Corporation 1300 Wilson Boulevard Suite 400 Arlington, Virginia 22309 703-526-5000 ARCHITECT D'AIQ 1310 Broadway Somerville, Massachusetts 02144 617-623-3000 DESIGN CONSULTANT Communication Arts 1112 Pearl Street Boulder, Colorado 80302 303-447-8202 SITE PLANNER Site Signatures 2120 Freeport Road New Kensington, Pennsylvania 15068 724-339-1899 LIGHTING CONSULTANT Frances Krahe & Associates Inc. -

Store Locator - ALDO Kids Collection

Store locator - ALDO Kids collection 46 23 31 2932 25 19 2630 6 21 20 2728 7 12 5 22 8 45 24 1 33 3 36 9 34 10 4 2 41 44 Hawaii 37 11 40 42 38 16 15 18 43 14 17 13 39 35 Puerto Rico 1 Glendale Galleria 2 Las Americas Premium Outlets 3 Ontario Mills 2154 Glendale Galleria 4155 Camino De La Plaza 1 Mills Cir Glendale, California, 91210 San Diego, California, 92173 Ontario, CA, 91764 Contact: (818) 548-2540 Contact: (619) 428-4817 Contact: (909) 476-5916 4 Desert Hills Premium Outlets 5 Vacaville Premium Outlets 6 Camarillo Premium Outlets 48400 Seminole Dr 131 Nut Tree Rd 740 E Ventura Blvd Cabazon, CA, 92230 Vacaville, CA, 95687 Camarillo, CA, 93010 Contact: (951) 922-4981 Contact: (707) 447-7831 Contact: (805) 388-2157 7 Great Mall 8 San Francisco Premium Outlets 9 Citadel Outlets 447 Great Mall Dr 2780 Livermore Outlets Dr 100 Citadel Dr Milpitas, CA, 95035 Livermore, CA, 94551 Commerce, CA, 90040 Contact: (408) 719-8607 Contact: (925) 447-0519 Contact: (323) 887-4850 10 The Outlets At Orange 11 The Florida Mall 12 Vacaville Premium Outlets 20 City Blvd W 8001 S Orange Blossom Tr 131 Nut Tree Rd Orange, CA, 92868 Orlando, FL, 32809 Vacaville, CA, 95687 Contact: (714) 634-3982 Contact: (407) 240-1008 Contact: (707) 447-7831 13 Dolphin Mall 14 Sawgrass Mills 15 Orlando Vineland Premium Outlets 11401 NW 12th St 12801 W Sunrise Blvd 8174 Vineland Ave Miami, FL, 33172 Sunrise, FL, 33323 Orlando, FL, 32821 Contact: (305) 594-6604 Contact: (954) 845-1194 Contact: (407) 238-5392 16 Orlando International Premium Outlets 17 Palm Beach Outlets 18 -

Fort Worth Arlington

RealReal EstateEstate MarketMarket OverviewOverview FortFort Worth-ArlingtonWorth-Arlington Jennifer S. Cowley Assistant Research Scientist Texas A&M University July 2001 © 2001, Real Estate Center. All rights reserved. RealReal EstateEstate MarketMarket OverviewOverview FortFort Worth-ArlingtonWorth-Arlington Contents 2 Population 6 Employment 9 Job Market 10 Major Industries 11 Business Climate 13 Education 14 Transportation and Infrastructure Issues 15 Public Facilities 16 Urban Growth Patterns Map 1. Growth Areas 17 Housing 20 Multifamily 22 Manufactured Housing Seniors Housing 23 Retail Market 24 Map 2. Retail Building Permits 26 Office Market 28 Map 3. Office and Industrial Building Permits 29 Industrial Market 31 Conclusion RealReal EstateEstate MarketMarket OverviewOverview FortFort Worth-ArlingtonWorth-Arlington Jennifer S. Cowley Assistant Research Scientist Haslet Southlake Keller Grapevine Interstate 35W Azle Colleyville N Richland Hills Loop 820 Hurst-Euless-Bedford Lake Worth Interstate 30 White Settlement Fort Worth Arlington Interstate 20 Benbrook Area Cities Counties Arlington Haltom City Hood Bedford Hurst Johnson Benbrook Keller Parker Burleson Mansfield Tarrant Cleburne North Richland Hills Land Area of Fort Worth- Colleyville Saginaw Euless Southlake Arlington MSA Forest Hill Watauga 2,945 square miles Fort Worth Weatherford Grapevine White Settlement Population Density (2000) 578 people per square mile he Fort Worth-Arlington Metro- cane Harbor and The Ballpark at square-foot rodeo arena, and to the politan Statistical -

Lone Star Pavilion 3100-3300 Grapevine Mills Parkway, Grapevine, TX 76051

PHILIP LEVY 972.755.5225 SENIOR MANAGING DIRECTOR [email protected] OFFERING MEMORANDUM TABLE OF CONTENTS Lone Star Pavilion 3100-3300 Grapevine Mills Parkway, Grapevine, TX 76051 Confidenality & Disclaimer Contents The informaon contained in the following Markeng Brochure is proprietary and strictly PROPERTY INFORMATION 3 confidenal. It is intended to be reviewed only by the party receiving it from Marcus & Millichap and should not be made available to any other person or enty without the wrien consent of LOCATION INFORMATION 7 Marcus & Millichap. This Markeng Brochure has been prepared to provide summary, unverified informaon to prospecve purchasers, and to establish only a preliminary level of interest in the FINANCIAL ANALYSIS 13 subject property. The informaon contained herein is not a substute for a thorough due diligence invesgaon. Marcus & Millichap has not made any invesgaon, and makes no SALE COMPARABLES 20 warranty or representaon, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the DEMOGRAPHICS 25 property and improvements, the presence or absence of contaminang substances, PCB's or asbestos, the compliance with State and Federal regulaons, the physical condion of the improvements thereon, or the financial condion or business prospects of any tenant, or any tenant’s plans or intenons to connue its occupancy of the subject property. The informaon contained in this Markeng Brochure has been obtained from sources we believe to be reliable; however, Marcus & Millichap has not verified, and will not verify, any of the informaon contained herein, nor has Marcus & Millichap conducted any invesgaon regarding these maers and makes no warranty or representaon whatsoever regarding the accuracy or completeness of the informaon provided. -

® Sp E C I a L Fx® Li G H T I N G Wo R L Dw I D E Pro J E C T Li

S P E C I A L F X ® L I G H T I N G W O R L D W I D E P R O J E C T L I S T DICHRO•X AND EZ GLASS LENSES, FADE•NOT® POLY TUBES, FADENOT® GEL, LIGHTBULBS, AND CUSTOM COATED PRODUCTS WERE SPECIFIED IN THE FOLLOWING SELECTED PROJECTS H i s t o r i c a l S i t e s a n d H o t e l s a n d C a s i n o s M u s e u m s Mohegan Sun/Wombi Planetarium - Uncaseville Jefferson Memorial - Washington DC The Clift Hotel - San Francisco, CA Lincoln Memorial - Washington DC Motor City Casino - Detroit, MI Bridge of the Americas - Panama Canal Bellagio - Las Vegas, NV McArthur Causeway - Miami, FL Caesar’s Palace - Las Vegas, NV Space Needle - Seattle, WA Grand TriBeCa Hotel - New York, NY Henry Ford Museum - Detroit, MI Hard Rock Cafe & Casino - Tampa, FL Puerto Rico Convention Center - Puerto Rico America West Arena - Phoenix, AZ B u s i n e s s e s , S t o r e s , a n d Fourth Street Live - Lexington, KY R e s t a u r a n t s Guggenheim Museum - Las Vegas, NV Bank of Quebec - Quebec, Canada US Holocaust Museum - Washington DC Victoria’s Secret Stores - Nationwide Pennsylvania State Museum - Harrisburg, PA Equinox Health Club - Nationwide Museum of Tolerance - New York, NY Macy’s Las Vegas - Las Vegas, NV Harvard Depository - Southboro, MA Vanderbuilt Children’s Hospital - Nashville,TN St. -

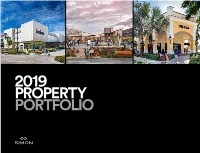

2019 Property Portfolio Simon Malls®

The Shops at Clearfork Denver Premium Outlets® The Colonnade Outlets at Sawgrass Mills® 2019 PROPERTY PORTFOLIO SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 THE SIMON EXPERIENCE WHERE BRANDS & COMMUNITIES COME TOGETHER SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 ABOUT SIMON Simon® is a global leader in retail real estate ownership, management, and development and an S&P 100 company (Simon Property Group, NYSE:SPG). Our industry-leading retail properties and investments across North America, Europe, and Asia provide shopping experiences for millions of consumers every day and generate billions in annual sales. For more information, visit simon.com. · Information as of 12/16/2019 3 SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining, and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience—places where people choose to shop and retailers want to be. 4 LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME WE DELIVER: SCALE A global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations, including Simon Malls®, Simon Premium Outlets®, and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon. -

Tempe (Phoenix), Arizona Phoenix a City on the Rise

BUSINESS CARD DIE AREA 5425 Wisconsin Avenue, Suite 300 Chevy Chase, MD 20815 (301) 968-6000 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). TEMPE (PHOENIX), ARIZONA PHOENIX A CITY ON THE RISE Arizona Mills® is located in Tempe, Arizona in the Phoenix market. Phoenix is the sixth largest city in the U.S. with a population of over 1.6 million. — The center serves the greater Phoenix area which includes the cities of Chandler, Glendale, Scottsdale, and Tempe among others and spans over 2,000 square miles. — The City of Tempe continues to grow bringing in company headquarters such as State Farm. Greater Phoenix is the corporate headquarters of five Fortune 500 companies: Freeport-McMoRan, PetSmart, Avnet, Republic Services, and Insight Enterprises. — The property is only two miles from Tempe Diablo Stadium, one of 11 Spring Training stadiums in the Phoenix metro area. Each year, thousands of baseball fans visit the city to support their favorite teams during Spring Training. — Phoenix is one of the few U.S. cities with franchises in all four major professional sports leagues: Phoenix Suns (NBA), Arizona Diamondbacks (MLB), Arizona Cardinals (NFL), and Arizona Coyotes (NHL). HOT VALUES COOL SELECTION Arizona Mills is the state’s largest, indoor outlet, value-retail, and entertainment destination providing the ultimate shopping experience with more than 185 outlet and value-retail stores and high quality entertainment venues. — Arizona Mills is an unbeatable family-friendly destination for shopping, dining, and entertainment. -

Ontario (Riverside), California a High-Profile Opportunity

BUSINESS CARD DIE AREA 5425 Wisconsin Avenue, Suite 300 Chevy Chase, MD 20815 (301) 968-6000 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). ONTARIO (RIVERSIDE), CALIFORNIA A HIGH-PROFILE OPPORTUNITY Ontario Mills® is located in San Bernardino County, the fifth largest county in California with over 2.1 million residents. — Ontario Mills is well positioned at the intersection of I-10 and I-15, two of the most heavily trafficked interstates in southern California. — Many day trippers and tourist shoppers visit Ontario Mills from Los Angeles and Orange County, which are approximately 35 miles away. — The busy LA/Ontario International Airport is only five minutes away. — Multiple single-family home developments are under construction and scheduled to open over the next several years. — Ontario, California, is home to the Citizens Business Bank Arena, hosting local sporting events and concerts. AN ATTRACTIVE DESTINATION Ontario Mills is California’s largest outlet and value shopping destination. — 100,000-square-foot development now open with new small shops and restaurants, including The North Face, Original Penguin, Samsonite, and Blaze Pizza. Coach, Tommy Hilfiger, and Nautica will be relocating to this new area. — UNIQLO will join the lineup in August 2016 with ULTA Beauty following this Fall. — More than 200 retailers offer a diverse selection of women’s and children’s apparel, sportswear, dining, entertainment, and more. — Ample open-air parking is available. — Millions of area residents and tourists shop at Ontario Mills every year.