Analysis of Fish Feed Market in Delta State

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nigeria's Constitution of 1999

PDF generated: 26 Aug 2021, 16:42 constituteproject.org Nigeria's Constitution of 1999 This complete constitution has been generated from excerpts of texts from the repository of the Comparative Constitutions Project, and distributed on constituteproject.org. constituteproject.org PDF generated: 26 Aug 2021, 16:42 Table of contents Preamble . 5 Chapter I: General Provisions . 5 Part I: Federal Republic of Nigeria . 5 Part II: Powers of the Federal Republic of Nigeria . 6 Chapter II: Fundamental Objectives and Directive Principles of State Policy . 13 Chapter III: Citizenship . 17 Chapter IV: Fundamental Rights . 20 Chapter V: The Legislature . 28 Part I: National Assembly . 28 A. Composition and Staff of National Assembly . 28 B. Procedure for Summoning and Dissolution of National Assembly . 29 C. Qualifications for Membership of National Assembly and Right of Attendance . 32 D. Elections to National Assembly . 35 E. Powers and Control over Public Funds . 36 Part II: House of Assembly of a State . 40 A. Composition and Staff of House of Assembly . 40 B. Procedure for Summoning and Dissolution of House of Assembly . 41 C. Qualification for Membership of House of Assembly and Right of Attendance . 43 D. Elections to a House of Assembly . 45 E. Powers and Control over Public Funds . 47 Chapter VI: The Executive . 50 Part I: Federal Executive . 50 A. The President of the Federation . 50 B. Establishment of Certain Federal Executive Bodies . 58 C. Public Revenue . 61 D. The Public Service of the Federation . 63 Part II: State Executive . 65 A. Governor of a State . 65 B. Establishment of Certain State Executive Bodies . -

Niger Delta Quarterly Conflict Trends

Niger Delta Quarterly Conflict Trends July to September 2016 Sustainable peace and security remains a Heatmap of Conflict Incidents in the Niger Delta key challenge in the Niger Delta region. Data shows a significantly higher number of conflict incidents and fatalities in 2016 than in 2015. However, shorter term trends do show a slight improvement from Q2 2016 to Q3 (see page 2). This quarterly tracker looks at the trends and patterns of conflict risk factors and incidents of violence, and their pressures on peace and stability in the Niger Delta. It is not designed as a conflict analysis, but rather it is intended to update stakeholders on patterns and trends in violence. Understanding the deeper conflict drivers, implications, and mitigating options requires a robust participatory, qualitative analysis of these trends by local stakeholders in affected communities, Heatmap shows concentration of incidents reported from July-September 2016 in the Niger Delta. Source: All data sources formatted for including women, traditional authorities, the P4P Peace Map www.p4p-nigerdelta.org political leaders, youths, private sector actors, and others. Conflict issues in the Niger Delta include The Niger Delta comprises 185 out of the Fishing and farming are historically the communal tensions, political competition, 774 local government areas and covers 9 main occupations in the region. The region organized criminality, and resource-based out of the 36 states of Nigeria: Abia, Akwa contains vast reserves of oil and gas, which conflicts. Incidents include militancy, piracy, Ibom, Bayelsa, Cross River, Delta, Edo, Imo, play an important role in the Nigerian cultism, election violence, communal Ondo and Rivers. -

Financial Statement Year 2017

Report of the Auditor- General (Local Government) on the December 31 Consolidated Accounts of the twenty-five (25) Local Governments of Delta State for the year 2017 ended Office of the Auditor- General (Local Government), Asaba Delta State STATEMENT OF FINANCIAL RESPONSIBILITY It is the responsibility of the Chairmen, Heads of Personnel Management and Treasurers to the Local Government to prepare and transmit the General Purpose Financial Statements of the Local Government to the Auditor-General within three months after 31st December in each year in accordance with section 91 (4) of Delta State Local Government Law of 2013(as amended). They are equally responsible for establishing and maintaining a system of Internal Control designed to provide reasonable assurance that the transactions consolidated give a fair representation of the financial operations of the Local Governments. Report of the Auditor-General on the GPFS of 25 Local Governments of Delta State Page 2 AUDIT CERTIFICATION I have examined the Accounts and General Purpose Financial Statements (GPFS) of the 25 Local Governments of Delta State of Nigeria for the year ended 31st December, 2017 in accordance with section 125 of the constitution of the Federal Republic of Nigeria 1999, section 5(1)of the Audit Law No. 10 of 1982, Laws of Bendel State of Nigeria applicable to Delta state of Nigeria; Section 90(2) of Delta State Local Government Law of 2013(as amended) and all relevant Accounting Standards. In addition, Projects and Programmes were verified in line with the concept of performance Audit. I have obtained the information and explanations required in the discharge of my responsibility. -

Needs Assesment Report Patani Idp Camp

© GRID Photo /Isi Elebhose NEEDS ASSESMENT REPORT PATANI IDP CAMP OCTOBER, 2018 1 | P a g e Acknowledgment We would like to thank the women and girls in Patani IDP camp, and Chairman of the camp, Laiden Omiebi Promise. We also appreciate the members of the GRID women’s group and the camp volunteers for their support and participation throughout this assessment 2 | P a g e Table of Contents 1. Executive Summary............................................................................ 4 2. Methodology ..................................................................................... 5 3. Key Findings ..................................................................................... 5 4. Recommendation .............................................................................. 6 3 | P a g e Make shift Shelter at the Camp. © GRID Photo /Isi Elebhose 1. Executive Summary Delta state, encompassed by rain forest in the southern part of Nigeria has been lately besieged by torrential rainfall and some communities in the state have never fared well at such times. In 2012, the great Nigeria flood as it was called killed 363 people and rendered over 2 million homeless, according to the National Emergency Management Agency (NEMA). In Delta state, 11 communities were submerged, leaving 53,000 people homeless, most of whom were women and children. Again in 2018, there has been another flood situation which affected no fewer than sixteen(16) Local Government Areas in Delta State; Aniocha South, Burutu, Bomadi, Patani, Isoko south, Warri south, Warri south west, Warri north, Ndokwa west, Ndokwa east, Oshimilli south, Okpe, Ndokwa West, Isoko North. Udu, Ughelli South. NEMA on 18 September declared a state of Emergency in Delta State and other affected by the flood disaster. On 27 September, reported the nationwide flood impact to be 106 submerged communities, 176,299 displaced persons (including 10 pregnant women), 1,036 injured, 17,816 houses, 150,285 hectares of farmlands, 321 road and bridges destroyed. -

39. Variability of Voting Pattern Among

Variability of Voting Pattern among Ethnic Nationality in the 2015 Gubernatorial Elections of Delta State IKENGA, F. A. Department of Political Science Faculty of the Social Sciences Delta State University, Abraka, Delta State. E-mail: [email protected] pp 352 - 360 Abstract he study assessed the variability of voting pattern among the different ethnic groups in the 2015 governorship election in Delta State. Data was Tcollected in respect of the votes from the 8 major ethnic groups in the state, and was analyzed accordingly. The hypothesis formulated was tested at 5% level of significance with the aid of the Kruskal- Wallis test. Findings indicate that there was no significant variation in the voting pattern of Deltans across the different ethnic groups. This simply indicates that ethnicity did not influence the results of the 2015 governorship election in Delta State. Given this result, the study recommended that the winner of the 2015 governorship election should form an all-inclusive government and ensure that no ethnic group experience any form of marginalization. Government should also strive to sustain unity among the various ethnic groups in the State by ensuring good governance at all facets and levels. Key words: Voting Pattern, Ethnicity, Election, Delta State, Governance Nigerian Journal of Management Sciences Vol. 6 No.1, 2017 353 Introduction the total votes casted in their ethnic localities. Several The problem of ethnicity/ culture is a global issue and analysts have argued that the political behaviour of not a Nigerian phenomenon. It has been and is still some Nigeria is influenced heavily by the hyperbolic been experienced in both developing and developed assumption that one's destiny is intrinsically and nations. -

Niger Delta Quarterly Conflict Trends

Niger Delta Quarterly Conflict Trends April to June 2016 Sustainable peace and security remains a state and Local Government Area (LGA) Contents key challenge in the Niger Delta region. levels. Data sources include ACLED Recent trends in violence have shown (www.acleddata.com), Nigeria Watch Context and Risk Profile 1 significant rise in conflict incidents and (www.nigeriawatch.org), NSRP Sources (focused on Regional Patterns and Trends 2 violent fatalities since February 2015. violence against women and girls), as well as According to data formatted from the Peace the IPDU SMS early warning system, and State-level Patterns and Trends Map, in April-June 2016 (Q2), the number of others. Abia 3 fatalities is at the highest point since the Akwa Ibom 4 end of the 2009 militancy. To ensure that these trackers are Bayelsa 5 comprehensive, please contribute your Cross River 6 The conflict landscape in the Niger Delta is knowledge by reporting any verified Delta 7 layered and complex, involving communal incident of conflict to the IPDU Early Edo 8 tensions, political competition, organized Warning System by texting a message to Imo 9 criminality, and resource-based conflicts; 080 9936 2222. Kindly include the relevant Ondo 10 exemplified by militancy, piracy, cultism, state, LGA, town, date, and brief description Rivers 11 election violence, armed robbery, of the incident. To read the latest monthly About Us and Contact Us 12 kidnapping, and land disputes varying at tracker, please visit: www.p4p-nigerdelta.org Context and Risk Profile This quarterly tracker looks at the trends information to inform that process of and dialects (Source: www.wilsoncenter.org/sites/default/ and patterns of conflict risk factors and analysis and joint planning to promote files/AFR_110929_Niger%20Delta_0113.pdf). -

Conflict Incident Monthly Tracker

Conflict Incident Monthly Tracker Delta State: May -J un e 201 8 B a ck gro und Cult Violence: In April, a 26-year old man in Ofagbe, Isoko South LGA. was reportedly killed by cultists in Ndokwa This monthly tracker is designed to update Other: In May, an oil spill from a pipeline West LGA. The victim was a nephew to the Peace Agents on patterns and trends in belonging to an international oil company chairman of the community's vigilante reportedly polluted several communities in conflict risk and violence, as identified by the group. In May, a young man was reportedly Burutu LGA. Integrated Peace and Development Unit shot dead by cultists at a drinking spot in (IPDU) early warning system, and to seek Ughelli North LGA. The deceased was feedback and input for response to mitigate drinking with friends when he was shot by Recent Incidents or areas of conflict. his assailants. Issues, June 2018 Patterns and Trends Political Violence: In May, a male aspirant Reported incidents during the month related M arch -M ay 2 018 for the All Progressives Congress (APC) ward mainly to communal conflict, criminality, cult chairmanship position was reportedly killed violence, sexual violence and child abuse. According to Peace Map data (see Figure 1), during the party’s ward congress in Ughelli Communal Conflict: There was heightened there was a spike in lethal violence in Delta South LGA. tension over a leadership tussle in Abala- state in May 2018. Reported incidents during Unor clan, Ndokwa East LGA. Tussle for the the period included communal tensions, cult Violence Affecting Women and Girls traditional leadership of the clan has violence, political tensions, and criminality (VAWG): In addition to the impact of resulted in the destruction of property. -

Ecological Risk Zone Mapping for Flood and Oil Spill in Delta State, Nigeria Ojiako J.C, Igbokwe, E.C

International journal of Rural Development, Environment and Health Research(IJREH) [Vol-1, Issue-3, Sep-Oct, 2017] https://dx.doi.org/10.22161/ijreh.1.3.12 ISSN: 2456-8678 Ecological Risk Zone Mapping for Flood and Oil Spill in Delta State, Nigeria Ojiako J.C, Igbokwe, E.C Department of Surveying & Geoinformatics, Nnamdi Azikiwe University Awka, Nigeria Abstract — The development of risk assessments inherently public health considerations. This papers looks into areas requires a significant amount of spatial data concerning the that will be affected by flooding and oil spill in the study status, extent, and distribution of natural and manmade area. Flooding and oil spillage has had a serious features. GIS systems provide the tools for storage, devastating effect on the environment in Delta State retrieval, and analysis of geographic information, and are Nigeria. This phenomenon has had profound impact on the uniquely suited to integrate multiple layers of information natural environment by affecting the climate, soil, in the complex process of ecological risk assessment. This hydrological and topographic system, meanwhile, lead to research paper attempted to map and characterizes the the change of ecosystem structure and function, such as ecological risk zones for flood and oil spill in Delta State decrease of biodiversity and dramatic change in landscape Nigeria, using Landsat 8 OLI and Shuttle radar structure, with no precise data that will aid in management topographic mission. Results show that the flood risk zones of the damages cause by these events. Several techniques in the study area had 30.42% high risk area, 44.79% have been used to map flood hazard and risks. -

Economic Development of Nigeria – a Case Study of Delta State of Nigeria (Pp

An International Multi-Disciplinary Journal, Ethiopia Vol. 4 (4), Serial No. 17, October, 2010 ISSN 1994-9057 (Print) ISSN 2070-0083 (Online) Preliminary Multivariate Analysis of the Factors of Socio- Economic Development of Nigeria – A Case Study of Delta State of Nigeria (Pp. 187-204) Ugbomeh, B. A. - Department of Geography and Regional Planning, Delta State University, Abraka, Delta State, Nigeria E-mail : [email protected] Atubi, A.O. - Department of Geography and Regional Planning, Delta State University, Abraka, Delta State, Nigeria E-mail: [email protected] Abstract The paper examined the socio-economic factors of development in the Delta state of Nigeria. The major source of data is secondary and the statistical technique is the step-wise multiple regression. The household income was used as an index of development while the socio-economic variables included population, education, and employment, capital water projects, housing unit, health centres, industries and police station. Four key socio-economic variables of population, health centres, employment and capital water projects were identified as being responsible for 80% of the variation in the development of Delta state of Nigeria among other variables. Solutions to identified problems were proffered. Keywords: Socio Economic, Development Delta, Introduction There is no single agreed definition of economic development. Economic development refers to the structural transformation of human society from subsistence economy to urban – industrialization, to the sustained raise in Copyright © IAARR, 2010: www.afrrevjo.com 187 Indexed African Journals Online: www.ajol.info Vol. 4 (4), Serial No. 17, October, 2010. Pp 187-204 productivity and income that result. The transformation is seen in the structure of production, consumption, investment and trade, in occupation, rural-urban residence. -

States and Lcdas Codes.Cdr

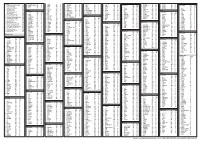

PFA CODES 28 UKANEFUN KPK AK 6 CHIBOK CBK BO 8 ETSAKO-EAST AGD ED 20 ONUIMO KWE IM 32 RIMIN-GADO RMG KN KWARA 9 IJEBU-NORTH JGB OG 30 OYO-EAST YYY OY YOBE 1 Stanbic IBTC Pension Managers Limited 0021 29 URU OFFONG ORUKO UFG AK 7 DAMBOA DAM BO 9 ETSAKO-WEST AUC ED 21 ORLU RLU IM 33 ROGO RGG KN S/N LGA NAME LGA STATE 10 IJEBU-NORTH-EAST JNE OG 31 SAKI-EAST GMD OY S/N LGA NAME LGA STATE 2 Premium Pension Limited 0022 30 URUAN DUU AK 8 DIKWA DKW BO 10 IGUEBEN GUE ED 22 ORSU AWT IM 34 SHANONO SNN KN CODE CODE 11 IJEBU-ODE JBD OG 32 SAKI-WEST SHK OY CODE CODE 3 Leadway Pensure PFA Limited 0023 31 UYO UYY AK 9 GUBIO GUB BO 11 IKPOBA-OKHA DGE ED 23 ORU-EAST MMA IM 35 SUMAILA SML KN 1 ASA AFN KW 12 IKENNE KNN OG 33 SURULERE RSD OY 1 BADE GSH YB 4 Sigma Pensions Limited 0024 10 GUZAMALA GZM BO 12 OREDO BEN ED 24 ORU-WEST NGB IM 36 TAKAI TAK KN 2 BARUTEN KSB KW 13 IMEKO-AFON MEK OG 2 BOSARI DPH YB 5 Pensions Alliance Limited 0025 ANAMBRA 11 GWOZA GZA BO 13 ORHIONMWON ABD ED 25 OWERRI-MUNICIPAL WER IM 37 TARAUNI TRN KN 3 EDU LAF KW 14 IPOKIA PKA OG PLATEAU 3 DAMATURU DTR YB 6 ARM Pension Managers Limited 0026 S/N LGA NAME LGA STATE 12 HAWUL HWL BO 14 OVIA-NORTH-EAST AKA ED 26 26 OWERRI-NORTH RRT IM 38 TOFA TEA KN 4 EKITI ARP KW 15 OBAFEMI OWODE WDE OG S/N LGA NAME LGA STATE 4 FIKA FKA YB 7 Trustfund Pensions Plc 0028 CODE CODE 13 JERE JRE BO 15 OVIA-SOUTH-WEST GBZ ED 27 27 OWERRI-WEST UMG IM 39 TSANYAWA TYW KN 5 IFELODUN SHA KW 16 ODEDAH DED OG CODE CODE 5 FUNE FUN YB 8 First Guarantee Pension Limited 0029 1 AGUATA AGU AN 14 KAGA KGG BO 16 OWAN-EAST -

Conflict Incident Monthly Tracker

Conflict Incident Monthly Tracker Delta State: April - M ay 201 8 B a ck gro und herdsmen reportedly blocked an expressway period. In February, a female student of a and inflicted bullet wounds on five travelers polytechnic in Delta state was reportedly This monthly tracker is designed to update in Ndokwa East LGA. In another incident, the killed for ritualistic purposes in Ozoro, Isoko Peace Agents on patterns and trends in severed head of a man was found on the North LGA. In a separate incident, a middle- conflict risk and violence, as identified by the street of Uzere community, Isoko South LGA. aged man attacked and cut his wife with a Integrated Peace and Development Unit cutlass, and later committed suicide in (IPDU) early warning system, and to seek Cult Violence: In April, a 26-year old man Oshimili South LGA. feedback and input for response to mitigate was reportedly killed by cultists in Ndokwa areas of conflict. West LGA. The victim is a nephew to the Recent Incidents or chairman of the community's vigilante Issues, May 2018 group. Patterns and Trends Reported incidents during the month related Febr u ar y - Apr il 2 0 1 8 Criminality and communal conflict were key mainly to communal conflict, criminality, According to Peace Map data (see Figure 1), drivers of Violence Affecting Women and political and cult violence. Girls (VAWG) in the state during this period. conflict issues during the period included Communal Conflict: Two men were For instance, in March, an 18-year old boy communal tensions, cult violence, and reportedly killed during a leadership tussle in was arrested by the police for defiling his six- criminality including kidnapping for ransom. -

Access to Agricultural Information by Fish Farmers in Niger Delta Region of Nigeria

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Library Philosophy and Practice (e-journal) Libraries at University of Nebraska-Lincoln October 2010 Access to Agricultural Information by Fish Farmers in Niger Delta Region of Nigeria Margaret U. Ogboma Delta State Polytechnic, Ozoro, Nigeria, [email protected] Follow this and additional works at: https://digitalcommons.unl.edu/libphilprac Part of the Library and Information Science Commons Ogboma, Margaret U., "Access to Agricultural Information by Fish Farmers in Niger Delta Region of Nigeria" (2010). Library Philosophy and Practice (e-journal). 424. https://digitalcommons.unl.edu/libphilprac/424 Library Philosophy and Practice 2010 ISSN 1522-0222 Access to Agricultural Information by Fish Farmers in Niger Delta Region of Nigeria Margaret U. Ugboma PhD Delta State Polytechnic, Library, Ozoro Introduction Among the varieties of agricultural practices is fish farming which is predominant in the coastal states of Nigeria. Currently, there is observed increase in the population of fish farms and farmers. Fishing is no longer restricted to the wild alone; fish farms can be found around towns and villages even behind peoples homes. To sustain this development, it becomes imperative that information on and for them be provided. This is because information is the driving and sustaining force behind any development strategy. In agriculture, the role of information in enhancing agricultural development cannot be over emphasized. Information is vital for increasing production and improving marketing and distribution strategies (Oladele, 2006). Information also opens windows of sharing experiences, best practices, sources of financial aids and new markets. As posited by Aina et al (1995) information has a vital role to play in improving and sustaining agricultural production of any nation.