2018-Q2roundtablerecap81018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Electric Vehicle Demonstration Projects In

ELECTRIC VEHICLE DEMONSTRATION PROJECTS IN THE UNITED STATES Prepared For TEKES The Finnish Funding Agency for Technology and Innovation NWV Market Discovery, Inc. 20781 Evergreen Mills Road · Leesburg, VA 20175, USA Tel 1-703-777-1727 · Cell 1-703-909-0603 · URL: www.nwv.com CONTENTS 1. BACKGROUND & OBJECTIVES ________________________________________ 4 2. INTRODUCTION ____________________________________________________ 6 2.1. POLITICAL CONTEXT _________________________________________________ 6 2.2. ELECTRICAL CAR MANUFACTURERS ___________________________________ 7 2.3. MUNICIPALITIES _____________________________________________________ 7 2.4. INFRASTRUCTURE ___________________________________________________ 7 2.5. TECHNOLOGY & COMPONENT SUPPLIERS______________________________ 9 2.6. RETAIL, SALES & CONSUMER SERVICE _________________________________ 9 2.7. FUNDING ___________________________________________________________ 9 2.8. INTERNATIONAL COLLABORATION ___________________________________ 10 2.9. GLOBAL INITIATIVES ________________________________________________ 10 2.10. SOURCES __________________________________________________________ 12 3. DEMONSTRATION & TEST PROJECTS _________________________________ 13 3.1. THE EV PROJECT ___________________________________________________ 13 3.2. PROJECT PLUG - IN _________________________________________________ 18 3.3. USPS PILOT PROGRAM “CONVERT LLVs TO EVs”_______________________ 23 3.4. PORT OF LOS ANGELES ELECTRIC TRUCK DEMONSTRATION PROJECTS ___ 26 3.5. SDG&E CTP EV DEMONSTRATION -

A Brief History of Grumman Aircraft Engineering Corporation

APOLLO NEWS REFERENCE A BRIEF HISTORY OF GRUMMAN AIRCRAFT ENGINEERING CORPORATION Grumman has come a long way since it opened shop in a rented garage in 1930. Its six founders and fifteen employees, within a year, fulfilled their first government contract: delivery of two amphibious aircraft pontoons. Today with more than 25,000 employees in 35 Long Island plants and 25 field locations, the Corporation is involved in research, development and production programs that encompass aircraft, spacecraft, support equipment, land vehicles, surface vessels, and submersibles. The story of Grumman military aircraft begins in 1933 with the development of the FF-1 (a Navy biplane fighter) and proceeds to the Navy Intruders, the Army Mohawks and the current Navy F-14 Tomcat. The Corporation produced the Denison hydrofoil boat for the U. S. Maritime Administration, the Dolphin hydrofoil for commercial service and the PG(H) Flagstaff, a military hydrofoil. For undersea research, a Grumman research submersible, the Ben Franklin, was designed and built for the historic Gulf Stream Drift Mission. In commercial aviation, Grumman is producing the Ag-Cat for crop dusting and spraying, as well as the fan-jet Gulfstream II corporate transport, the follow-on to the Gulfstream I, of which 200 were produced. With the award of a contract from the Department of Transportation, Grumman moved ahead in a new field of passenger conveyance, the Tracked Air Cushion Vehicle (T ACRV). Wind tunnel testing has been conducted and testing is being scheduled at the Federal High Speed Ground Transportation Test Center in Pueblo, Colorado for the Grumman TACRV. -

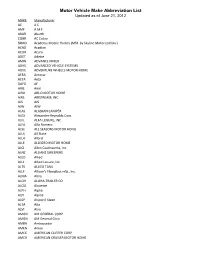

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

Aircraft Collection

A, AIR & SPA ID SE CE MU REP SEU INT M AIRCRAFT COLLECTION From the Avenger torpedo bomber, a stalwart from Intrepid’s World War II service, to the A-12, the spy plane from the Cold War, this collection reflects some of the GREATEST ACHIEVEMENTS IN MILITARY AVIATION. Photo: Liam Marshall TABLE OF CONTENTS Bombers / Attack Fighters Multirole Helicopters Reconnaissance / Surveillance Trainers OV-101 Enterprise Concorde Aircraft Restoration Hangar Photo: Liam Marshall BOMBERS/ATTACK The basic mission of the aircraft carrier is to project the U.S. Navy’s military strength far beyond our shores. These warships are primarily deployed to deter aggression and protect American strategic interests. Should deterrence fail, the carrier’s bombers and attack aircraft engage in vital operations to support other forces. The collection includes the 1940-designed Grumman TBM Avenger of World War II. Also on display is the Douglas A-1 Skyraider, a true workhorse of the 1950s and ‘60s, as well as the Douglas A-4 Skyhawk and Grumman A-6 Intruder, stalwarts of the Vietnam War. Photo: Collection of the Intrepid Sea, Air & Space Museum GRUMMAN / EASTERNGRUMMAN AIRCRAFT AVENGER TBM-3E GRUMMAN/EASTERN AIRCRAFT TBM-3E AVENGER TORPEDO BOMBER First flown in 1941 and introduced operationally in June 1942, the Avenger became the U.S. Navy’s standard torpedo bomber throughout World War II, with more than 9,836 constructed. Originally built as the TBF by Grumman Aircraft Engineering Corporation, they were affectionately nicknamed “Turkeys” for their somewhat ungainly appearance. Bomber Torpedo In 1943 Grumman was tasked to build the F6F Hellcat fighter for the Navy. -

Vehicle Make, Vehicle Model

V8, V9 VEHICLE MAKE, VEHICLE MODEL Format: VEHICLE MAKE – 2 numeric VEHICLE MODEL – 3 numeric Element Values: MAKE: Blanks 01-03, 06-10, 12-14, 18-25, 29-65, 69-77, 80-89, 90-94, 98-99 MODEL: Blanks 001-999 Remarks: SEE REMARKS UNDER VEHICLE IDENTIFICATION NUMBER – V12 2009 181 ALPHABETICAL LISTING OF MAKES FARS MAKE MAKE/ NCIC FARS MAKE MAKE/ NCIC MAKE MODEL CODE* MAKE MODEL CODE* CODE TABLE CODE TABLE PAGE # PAGE # 54 Acura 187 (ACUR) 71 Ducati 253 (DUCA) 31 Alfa Romeo 187 (ALFA) 10 Eagle 205 (EGIL) 03 AM General 188 (AMGN) 91 Eagle Coach 267 01 American Motors 189 (AMER) 29-398 Excaliber 250 (EXCL) 69-031 Aston Martin 250 (ASTO) 69-035 Ferrari 251 (FERR) 32 Audi 190 (AUDI) 36 Fiat 205 (FIAT) 33 Austin/Austin 191 (AUST) 12 Ford 206 (FORD) Healey 82 Freightliner 259 (FRHT) 29-001 Avanti 250 (AVTI) 83 FWD 260 (FWD) 98-802 Auto-Union-DKW 269 (AUTU) 69-398 Gazelle 252 (GZL) 69-042 Bentley 251 (BENT) 92 Gillig 268 69-052 Bertone 251 (BERO) 23 GMC 210 (GMC) 90 Bluebird 267 (BLUI) 25 Grumman 212 (GRUM) 34 BMW 191 (BMW) 72 Harley- 253 (HD) 69-032 Bricklin 250 (BRIC) Davidson 80 Brockway 257 (BROC) 69-036 Hillman 251 (HILL) 70 BSA 253 (BSA) 98-806 Hino 270 (HINO) 18 Buick 193 (BUIC) 37 Honda 213 (HOND) 19 Cadillac 194 (CADI) 29-398 Hudson 250 (HUDS) 98-903 Carpenter 270 55 Hyundai 215 (HYUN) 29-002 Checker 250 (CHEC) 08 Imperial 216 (CHRY) 20 Chevrolet 195 (CHEV) 58 Infiniti 216 (INFI) 06 Chrysler 199 (CHRY) 84 International 261 (INTL) 69-033 Citroen 250 (CITR) Harvester 98-904 Collins Bus 270 38 Isuzu 217 (ISU ) 64 Daewoo 201 (DAEW) 88 Iveco/Magirus -

HD Wiper Motors

HD Wiper Motors Wiper Motor Moteur d’Essuie Glace Wischermotor 雨刮电机Motor Del Limpiaparabrisas Мотор стеклоочистителя Semi Trucks Make OEM No. Details Application WAI Pt No. International Mid 2007-Current 9200/9400/9900/5500/5900, PayStar (3 bolt), 2005-2007 9200/9400/9900/5500/5900, PayStar (4 bolt) Includes Harness WPM8020 International/Peterbuilt/Kenworth E-108-008 Pre-2005 9200/9400/9900/5500/5900, Peterbuilt All 387/587 Kenworth and Bracket 2010-Current C500/T300/T400/T450/T600/T800/W900 (3 bolt) 2594086C91 International 1999-Current 4000/8000/7000 series WPM8021 Freightliner/International 2504129C91 Includes Harness (TerraStar, DuraStar,Work Star), 2007-Current ProStar, LoneStar 2597906C91 TranStar , Freightliner 2001-Current M2 Western Star 2005-Current All models, Kenworth 2006-87 C500/T300 WPM8022 Kenworth/Western Star/Mack E-108-010 Wiper Motor T400/T450/T600/T800/W900 (3 bolt), Mack 1994-Current LE Low entry waste refuse, Mack All RD WPM8023 Peterbuilt E-108-010 Wiper Motor Peterbuilt 1985- Current 379/330/389/337/348/340/335/386 WPM8024 Kenworth 404995, 404.995 Includes Crank Arm Kenworth 2010-06 C500/T300/T400/T450/T600/T800/W900 (4 bolt) WPM8025 Volvo E-108-009 Wiper Motor Volvo All VN series E-007-100, AX9207 WPM8029 Kenworth/Peterbuilt E-005-554 Includes Harness Peterbilt 387 2008-99/587 2008 & up, Kenworth T2000/T700 E-008-222, E-108-010 WPM8032 Mack E-108-011 Wiper Motor Mack 1988-Present C and CH series - Fusion, Vision, Granite, Pinnacle Titan www.waiglobal.com 1027-01-WAI-US-WM-EN Buses WAI Pt No. Make OEM No. -

Lean Aircraft Initiative Plenary Workshop Implementation

Lean Aircraft Initiative Plenary Workshop Implementation IPT October 8 -9, 1997 Presented By: Joel Cutcher-Gershenfeld Sloan School of Management, MIT LEAN AIRCRAFT INITIATIVE Overview l Core themes, design overview and key considerations l IPPD in the Lean Enterprise Model (LEM) l Five dimensions of IPPD l Lessons across three case studies l Recommendations in five topic areas: – Rewards and incentives – Leadership and integration – Performance measurement – Functional roles and career development – Dynamics across product and team lifecycles l Keynote address and industry presentation l Products and next steps IM100997-2 ©1997 Massachusetts Institute of Technology LEAN AIRCRAFT INITIATIVE Core Themes l There is not just one type of IPPD context – No one “cookie cutter” IPT model that applies in all settings – Five elements of the IPPD context to consider: Customers, Products, IPTs, Suppliers, Time l Implementation of IPTs is not a one-time event – The challenge of managing an ongoing process – Key implementation recommendations are deceptively simple l Implementing IPTs in an IPPD context requires fundamental changes in the flow of information, authority, rewards and expertise in organizations IM100997-3 ©1997 Massachusetts Institute of Technology LEAN AIRCRAFT INITIATIVE Design Overview l Teams of 3-5 representatives from 14 organizations l Day One – Morning case study: Rockwell Avionics and Communications – Afternoon case study: Northrop Grumman -- GATS/GAM – Five breakout groups meeting in morning and afternoon – Keynote lunch speaker -

Finding, Opinions, and Orders

1198 FEDERAL TRADE COMMISSION DECISIONS VOLUME 165 Complaint IN THE MATTER OF PAYPAL, INC. CONSENT ORDER, ETC. IN REGARD TO ALLEGED VIOLATIONS OF SECTION 5 OF THE FEDERAL TRADE COMMISSION ACT, THE GRAMM-LEACH-BLILEY ACT, THE PRIVACY RULE, REGULATION P, AND THE SAFEGUARDS RULE Docket No. C-4651; File No. 162 3102 Complaint, May 23, 2018 – Decision, May 23, 2018 This consent order addresses PayPal, Inc.’s peer-to-peer payment service, Venmo, that incorporates a social networking component through a social “news feed” that shares information about a consumer’s Venmo transactions. The complaint alleges that PayPal, through its operation of Venmo, has violated Section 5 of the FTC Act and the Gramm-Leach-Bliley Act’s Privacy and Safeguards Rules. The consent order prohibits PayPal from making misrepresentations regarding material restrictions, limitations, or conditions to use any payment and social networking service. Participants For the Commission: Gregory A. Ashe, Cora Han, Ben Rossen and Lisa Rothfarb. For the Respondent: Eric Mogilnicki, Covington & Burling LLP. COMPLAINT The Federal Trade Commission, having reason to believe that PayPal, Inc., a corporation, (“Respondent”) has violated Section 5(a) of the Federal Trade Commission Act (“FTC Act”), 15 U.S.C. § 45(a); the Privacy of Consumer Financial Information (“Privacy Rule”), 16 C.F.R. Part 313, recodified at 12 C.F.R. Part 1016 (“Reg. P”), and issued pursuant to the Gramm-Leach-Bliley Act (“GLB Act”), 15 U.S.C. §§ 6801-6803; and the Standards for Safeguarding Customer Information Rule (“Safeguards Rule”), 16 C.F.R. Part 314, issued pursuant to Sections 501(b) and 505(b)(2) of the GLB Act, 15 U.S.C. -

HOW to FIND VIN DECODERS Jan. 07, 2009 This Document Contains the File Names Followed by Motor Vehicle Manufacturer's Name Fo

HOW TO FIND VIN DECODERS Jan. 07, 2009 This document contains the file names followed by motor vehicle manufacturer’s name for a great many of the VIN decoders received by NHTSA since the VIN regulations went into effect on October, 1980. It is not intended for amateur use, and as such is not equipped with the graphical user interfaces that main stream “www” consumer Internet sites are designed with. To use it, using your computer keyboard, hold “CONTROL” and tap “F” This action will bring up a query field. Only use one or two words of a manufacturer’s name when performing this search. It is best to use the second name of Chinese manufacturers as their first name may be a Province. Using the “find next” key stroke, go all the way through the document until you find (and record) every file name associated with your manufacturer. Manually type ftp://ftp.nhtsa.dot.gov/mfrmail or just click on this hyperlink. Hold “control” and tap “F” to display the search screen again allowing you to enter the previously discovered “file names.” Double clicking these file names brings up images of the manufacturer’s VIN decoders. NHTSA intends to revise these sites on the 1st and 3rd Wednesdays of each month: (1) ftp://ftp.nhtsa.dot.gov/mfrmail (2) ftp://ftp.nhtsa.dot.gov/manufacture (3) www.nhtsa.dot.gov.cars.rules.manufacture Page : 1 Monday May 22, 2006 Docket: 01-022N11-B Comment Date Date of Number Received Submitter/Firm/Subject Pages Document ======= ======= ================= ===== ======== 00001 04/17/1980 KEITH L. -

2010 Annual Report

60 Years of Inspiring Perspectives 1950 1960 1970 1980 1990 2000 2010 Our Mission The Society of Women Engineers stimulates women to achieve full potential in careers as engineers and leaders, expands the image of the engineering profession as a positive force in improving the quality of life, and demonstrates the value of diversity. Contents Leadership Letter Page 1 Corporate Sponsorships Page 5 Outreach and Scholarships Page 2 Financials Page 6 Awards Page 3 Sponsors Page 7 Corporate Partnership Council Page 4 Donors Page 8–9 To supporters of the Society of Women Engineers: The fiscal year 2010 marked the 60th anniversary of SWE and kick-off of our yearlong SWE60 campaign. Just as we’ve done every year of the six decades preceding this milestone, our partnership led to many exciting accomplishments. Nora Lin, SWE FY10 President Since the first group of 60 pioneering women assembled at days of FY10, SWE took a leading role in public policy action. Cooper Union’s Green Engineering Camp in New Jersey in 1950, SWE participated in numerous STEM-related events over the we’ve all strived to define success on our own terms. Here are course of the year, including two hosted by the White House; just some of the ways we defined success in FY10: at one, President Obama launched the “Educate to Innovate” initiative. SWE also organized, with co-sponsorship from SWE “Recruits” A Major Cultural Icon Into Engineering 17 other engineering societies, a Capitol Hill Day: Diversity 60 years ago, gender roles were strictly defined; from early on and Inclusion Fuels Innovation in STEM. -

Thank You for Being a National Partner Member Organization. We Appreciate Your Support of AUSA

Thank you for being a National Partner Member Organization. We appreciate your support of AUSA. 3M Company ASM Research, An Accenture CACI, Inc. AAR Mobility Systems Federal Services Company CALIBRE Systems, Inc. Abaco Systems, Inc. ASRC Federal Caliburn International Accenture Federal Services Association of the Republic of Camel Expeditionary Accurate Energetic Systems, LLC Korea Army CamelBak Products, LLC Adder Technology Astronics CAMSS Shelters ADL Embedded Solutions AT&T Global Business- Public Carmenta Geospatial Technologies Adobe Sector Solutions AB Advanced Government Logistics, ATI (Allegheny Technologies Carson Industries Inc Incorporated) Caterpillar, Inc. Advanced Technology International Atlantic Signal, LLC CDW Government, Inc. (ATI) Australian Department of Defence CEIA USA, Ltd. Advanced Technology Systems Avon Protection Systems, Inc. Celestica Company Axon CGI Federal Advantech Corp. B.E. Meyers & Co., Inc. Chemring Group Plc AeroGlow LLC BAE Land & Armaments Group Chenega Corporation, MIOS SBU Aerojet Rocketdyne BAE Systems, Inc. CIRCOR Aerospace, Inc. AeroVironment, Inc. Balfour Beatty Communities Citrix Agility Defense & Government Ball Aerospace & Technologies Clark Testing Services Corp. CMI Defence AimLock Inc. Barrett Firearms Manufacturing, Cobham Aimpoint Inc. Inc. Codemettle, LLC Airborne Systems Battelle Memorial Institute COGES AirBoss Defense Group (ADG) BeaverFit North America Collins Aerospace AIRBUS Bell Colt's Manufacturing Company, LLC Alaska Structures Benchmark Electronics Inc. Columbia Southern -

NORTHROP GRUMMAN CORPORATION (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2002 ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from Commission file number to 1-16411 NORTHROP GRUMMAN CORPORATION (Exact name of registrant as specified in its charter) DELAWARE 95-4840775 (State or other jurisdiction of (I.R.S. Employer Identification incorporation or organization) Number) 1840 Century Park East, Los Angeles, California 90067 www.northropgrumman.com (Address of principal executive offices and internet site) (310) 553-6262 (Registrant’s telephone number, including area code) Securities registered pursuant to section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $1 par value New York Stock Exchange Pacific Exchange Series B Convertible Preferred Stock New York Stock Exchange 7.25% Equity Security Units New York Stock Exchange Securities Registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the Registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2).