Airports Economic Regulatory Authority of India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chaipoint Outlets

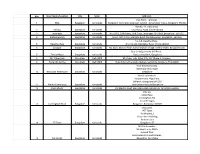

Sno Store Name/Location City State Address1 Chai Point , Terminal, 1 BIAL Bangalore Karnataka Bangalore International Airport Limited , Devanahali Taluka, Bangalore-560300 Plot No. 44, Electronics 2 Infosys Bangalore Karnataka City, Hosur Road, B'lore-560100 3 Jayanagar Bangalore Karnataka No.524/2, 10th Main, 33rd Cross, Jayanagar 4th Block, Bangalore - 560 011 4 Malleshwaram Bangalore Karnataka No.64, 18th Cross, Margosa Road, Malleshwaram, Bangalore - 560 055 No.A-8, Devatha Plaza, 5 Devatha Plaza Bangalore Karnataka No.131-132, Residency Road, B'lore-560025 6 Sarjapur Bangalore Karnataka No. 38/2, Ground Floor, Kaikondrahalli village, Varthur Hobli, Bangalore East Opp to Adigas hotel, MG Road , 7 Trinity Metro Bangalore Karnataka Next to Axis Bank, Bangalore 8 DLF Cyber Hub Gurugram Delhi NCR K5, Cyber hub, Cyber City, DLF Phase 3, Gurgaon 9 Huda City Centre Gurugram Delhi NCR Huda City Centre Metro Station, Sector 29, Gurgaon, HR 122009 Near Electronics City Bommasandra village 10 Narayana Healthcare Bangalore Karnataka Bangalore Mantri commercio Kariyammana Ahgrahara , Bellendur,Bangalore-560103 11 Mantri Commercio Bangalore Karnataka Near Sakara Hospital Bangalore 12 RMZ Infinity Bangalore Karnataka Old Madras Road, Bennigana Halli, Bangalore, Karnataka 560016 S No 50, Little Plaza, Cunningham Rd, Vasanth Nagar, 13 Cunningham Road Bangalore Karnataka Bangalore, Karnataka 560002 Chai point #77 Town Building No,3 Divya shree building Yamalur post 14 77 Town Bangalore Karnataka Bangalore -37 NH Cardio center NH Health city -258/a Ground floor, Bommasandra Industrial area, 15 NH Cardio Bangalore Karnataka Bangalore, Karnataka 16 Unitech Infospace Gurugram Delhi NCR Store No 6, Unitech Infospace SEZ Sector-21, Gurgaon 17 Salarpuria Softzone Bangalore Karnataka Salarpuria Softzone ,Outer ring road ,Near sarjapur junction ,Bangalore -43 John F. -

Bengaluru International Airport Is a 4,050 Acre International Airport That Is Being Built to Serve the City of Bangalore, Karnataka, India

Bengaluru International Airport is a 4,050 acre international airport that is being built to serve the city of Bangalore, Karnataka, India. The airport is located in Devanahalli, which is 30 km from the city The new Bengaluru International Airport at Devanahalli will put Bangalore city on the global destination and offer travelers facilities comparable with the best international airports. The airport will offer quality services and facilities, which will ensure the comfort and ease of travel for all concerned. Construction of the airport began in July 2005, after a decade long postponement Explore this presentation for more information and find out how BIAL is working to make Bengaluru touch the skies and raise the bar for future airports in India. A plan is also being processed for a direct Rail service from Bangalore Cantonment Railway Station to the Basement Rail terminal at the new International Airport. Access on the National Highway is being widened to a six lane expressway, with a 3 feet boundary wall, construction is moving ahead. As of June 2007, a brand new expressway is expected to connect the International Airport to the City's Ring Road. The Expressway will begin at Hennur on the Outer Ring Road. This is expected to be a tolled road. Land Acquisition for the road is expected to be complete by December 2007 and the road would be readied in 18 months since then. Departure – All flights schedule to depart after 00:01 on 30th March 2008 will operate from the new Bangaluru International Airport Arrival – All flights on 29th March 2008 after (20:00) hours may land at the new Bangaluru International Airport or at HAL. -

0News Analysis of BIAL

NEWS ANALYSIS FLAWED BY DESIGN? THE BANGALORE INTERNATIONAL AIRPORT WAS RECENTLY PULLED UP FOR ‘FAULTY’ DESIGN AND CONSTRUCTION. AR APURVA BOSE DUTTA SPEAKS TO EXPERTS TO GET A PERSPECTIVE ON THE BURNING ISSUE The Bangalore International Airport Limited (BIAL) was recently in the news TD L for all the wrong reasons. A joint legislative committee (JLC) enquiring into the airport’s RPORT ‘faulty’ design and construction termed AI the BIA below global standards. The ONAL I report titled ‘Examination of construction of the Bangalore International Airport’ recommended that the private partners in the consortium for the construction of the airport should be blacklisted and not considered for any work by the government for a minimum of five years owing to the ‘poor quality of workmanship’ that has been shown in the project. : COURTESY BANGALORE INTERNAT It also said that ‘appropriate action’ HS P should be taken against the officers involved in important decisions regarding the project. 1 BIA Ltd is a consortium of Unique Zurich PHOTOGRA Airport, Siemens Project Ventures and Larsen & Toubro (L&T), with the Airports Authority of India (AAI) and the Karnataka government as stakeholders. said that they will review the report and architectural detailing needs much more implement its recommendations. attention, most glass roofs are dirty with NOT BY DESIGN water marks visible in many areas, and the The committee listed many flaws starting FUNCTIONAL, BUT... external pedestrian pathways require wider from the design approval stage of the project. Quiz architects on the BIA design and they space and shelter.” Concerns were expressed over the design of agree with the JLC on the design part. -

Plan Bengaluru 2020

www.•bldebe!IPIUN.In PI an Vffit,})fn\ BENGALURu_i(lj8 {lj Bringing back a Bengaluru of Kempe Gowda's dreams JANUARY 2010 Agenda for Bengaturu With hlnding & support of Infrastructure and Namma Benpluru Foundation Devetopement Task force -.Mmi'I'IIH!enJIIIIUru.ln BENGA~~0 1010 Bringing ba1k a Bengaluru of Kempe Gowda's dreams BE ASTAKEHOLDER OF PLANBENGALURU20201 1. PlanBengaluru2020 marks a significant deliverable for the Abide Task force - following the various reports and recommendations already made. 2. For the first time, there is a comprehensive blueprint and reforms to solve the city's problems and residents' various difficulties. This is a dynamic document that will continuously evolve, since there will be tremendous scope for expansion and improvement, as people read it and contribute to it 3. PlanBengaluru2020 is a powerful enabler for RWAs 1 residents and citizens. It will enable RWAs 1 residents to engage with their elected representatives and administrators on specific solutions and is a real vision for the challenges of the city. 4. The PlanBengaluru2020 suggests governance reforms that will legally ensure involvement of citizens 1 RWAs through Neighbourhood Area Committee and Ward Committee to decide and influence the future/ development of the Neighbourhoods, Wards and City 5. This plan is the basis on which administrators and elected representatives must debate growth, overall and inclusive development and future of Bangalore. 6. The report will be reviewed by an Annual City Report-Card and an Annual State of City Debate/conference where the Plan, its implementation and any new challenges are discussed and reviewed. 7. PlanBengaluru2020 represents the hard work, commitment and suggestions from many volunteers and citizens. -

Colour Coded Zoning Map of Bangalore

WGS-1984 DATUM N (TR U E ) BANGALORE (HAL) AIRPORT BANGALORE (DEVANHALLI) AIRPOT LIST OF NAV AIDS (HAL) LIST OF NAV AIDS (DEVANHALLI) S CAL E 1:50,000 S .No. NAV AID S CO-OR D INATE S TOP E L E V. M E TE R S (M AG .) S .NO. NAV AID S CO-OR D INATE S TOP E L E V. N 1. D VOR /D M E 13°12' 24.6" N 77°43' 55.9" E 881M 0 1000 2000 3000 4000 5000 6000 12°56' 59.1" N 77°40' 51.6" E 895.5M 1. D VOR V A R AS R /M S S R 13°12' 36.6" N 77°42' 17.2" E 915M 2. 2 2. AR S R 12°56' 49.1" N 77°40' 08.7" E ------ - L ATITU D E 12°57' 07.86"N 0 2500 5000 7500 10000 12500 15000 17500 20000 0 L ATITU D E 13°11' 55.92" N 0 ' 898M 3. G P (27) 13°12' 28.0" N 77°43' 14.3" E 901M W 3. G P 12°57' 02.1" N 77°40' 55.6" E - 2 L ONG ITU D E 77°39' 52.59"E F E E T 0 1 COLOUR CODED ZONING L ONG ITU D E 77°42' 19.70" E 4. L L Z 12°56' 55.0" N 77°39' 04.7" E 877.2M 4. L L Z (27) 13°12' 26.1" N 77°40' 55.7" E 916M 0 2914F T (888.3M ) AR P E L E VATION AR P E L E VATION 2954F T (900.0M ) 5. -

Aro Details.Xlsx

Bommanahalli Zone Office Ph.No Zonal Officers Name of the Officer Mobile No. Email Id Office Address (Prefix -080) 25732447, Joint Commissioner Rama Krishna 9480683433 [email protected] 25735642 Begur Road, Bommanahalli, Banglaore – 560068 Deputy Commissioner N.Shashikala 9480684171 25735608 [email protected] Name of the RO Revenue R.O’s Mobile No. Office Ph.No ARO Sub-division Ward No. & Name Assistant Revenue Mobile No. Email Id Office Address Division Officer & Office Ph.No (Prefix -080) Officer 175 - Bommanahalli Bommanahalli 188 - Bilekahalli Nataraj 9480685528 25735000, [email protected] Begur Road, Bommanahalli, Bengaluru 189 - Hongasandra 186 - Jaraganahalli 9480683167 Bannerghatta Road, MICO Layout, Balachandra Arakere 187 - Puttenahalli S V Manjunath 9731103437 26467619 [email protected] 25735390 Bengaluru. 193 - Arakere Bommanhalli 174 - HSR Layout 7892757079 Behind BDA Complex HSR 6TH Sector, HSR Layout Lakshmi 25725964 [email protected] 190 - Mangammanapalya 9th Main, 14TH A Cross, HSR Layout 191 – Singasandra 9480683006 Old Gram Panchayath Office, Begur, Begur Ananthramaiah 25745300 [email protected] 192 - Begur Banglore. Y. Muniyappa 9480684143 Anjanapura 194 - Gottigere Old Gram Panchayath Office, Begur, Anjanapura Ramesh 9731383407 22453000 [email protected] 196 - Anjanapura Banglore. 195 - Konanakunte Konanakunte Cross, Kanakapura Road, Yelachenahalli Rangaswamy 9480684564 26321177 [email protected] 185 - Yelachenahalli Bengaluru, 9480684034 Venkatesh 25735394 Uttarahalli 184 - Uttarahalli Near Subramanyapura Police Station, Uttarahalli Devaraj 9448905713 [email protected] 197 -Vasanthapura Bengaluru Dasarahalli Zone Office Ph.No Zonal Officers Name of the Officer Mobile No. Email Id Office Address (Prefix -080) BBMP Dasarahalli Joint Joint Commissioner Sri. Narashimamurthy [email protected] 9036828015 22975901 Commissioner MEI layout, Hesargatta Main road, Deputy Commissioner Sri. -

MG Road, Bangalore. Bhadra Legacy, an Epitome of Luxury by Bhadra Landmarks Is a Comfort for Selected Few in the Heart of the City

TREASURE OF LUXURY MG Road, Bangalore. Bhadra Legacy, an epitome of luxury by Bhadra Landmarks is a comfort for selected few in the heart of the city. Embodying the splendors of modern day luxury these 19 apartments offer a distinctively modern and contemporary architectural design. A Redefined luxury space in Bangalore, it is a rare blend of smart technology in ultimate luxurious living. Inspired from the tech-savvy Bangalore, these apartments offer a unique lifestyle choice with smart homes features and optimally designed wide-open spaces providing efficient natural light. The elegance of this futuristic design built on the multitude of smart features is bringing of future to present, ideal for connoisseurs of modern living. Each apartment exudes elegant style, a sense of fulfillment and boasts of plush rooftop clubhouse with a wonderful view of the surrounding Central Business District. A treasure of luxury, Bhadra Legacy is an address of Legacy in Making. Location / BHADRA LEGACY Platinum League of Location Experience the vibrant city life as you step out to the platinum area of the city. These apartments of new age at MG Road offer a lifestyle like no other. Live in the platinum league of Bangalore. Lifestyle / BHADRA LEGACY Live among the elite Amenities / BHADRA LEGACY Joy of Play • Outdoor Kids Play Area • Rappelling Wall Amenities / BHADRA LEGACY Sense of Fullfillment • Yoga and Meditation Room • Gymnasium • Library and Reading Room • Cards & Carrom Room • Multi- Purpose Hall • Foosball • Table Tennis • Pool-Table • Karaoke • -

Srmod Ilgj O-Ordai, Nenaso$Elo:D Drn-Oor-O

doort"ld eOod dOd$. z$Ed rbcb8d dd+ no{ 1280 (1s4) +,<-t,< l"J .V-L/ CIJ=?-',t. ..J L J ge ^J z) d.b.sdeea) ( uod:Ddred J d"ooOdddJ) .^.-?q*- ++l\ \J U(,U^l'ir:,^)(-)'.) : z"-lrd$ d:eJ drnoOd o-or1-o J "$AddJ xnCre;Od elDq$dsi nddd) e,rdoi)d Oanod J 11.03.2020. 9ro. erDdd ,..\)::!. w;rJ\ cJJUgl \VJ d;dilU- ducr-ud oc Edd* u oddosddr* udarie Er d do 20 Z\d g +i- - 2020uC, cJ;oe:f no cJ(,gC) da eoscfdooo dedd "o'o{pe:f"dQ dddodd e* ererd e:Qrd ryin de '€J Jd deOd lWorld Od (World Economic Forum) nCode5dQ Economics Forum) de2 drCod:opl9 dedrd.CQ eoloerld zporldtc,td:. r^ I ql-q* +r^.-!-?, I \ .JCrJn lir'J!?L\Jl'lQ^ dU\9Q-^)J d"on drnooro Deg 2otg-24d dddi tuqCB,tcno, d.lon ddriD06-o ia-ordC dD 5e e-:doJ:Qd. "cb &(ifiva' *-oe&&ogdo3:e: dJaf drnaoro &e3oJ:e zJooilEsj o,tfld ud&r-Xe-rr 6:n5.J- 1,. ic;s::rer dJe 6,3 pzJri,z-r. oor.d i"$d drn-ooro uedoe cJ:io. eJo.&o$e2o:) liv\ t,dti\*! &dedacA bod:9d 6iCe5fr9: ei.-t Lic,J:d-2 6oi1Ja ulo$oo-3 drldrlgri z,Jodarog.J&\ sd&rie;-. "d.ogt drnoor-o OeS"oJrd:* Eoodragre gd, ddd"q,oori:$d. ds ee3o$Q ad"odd do$xgJd9: oo;'Lo def-cl en:dn.cd n {d sdacdad:d de;oJ:rlvri udod ledeDrbddr m-crlo AAd dgrqd dJA Oo$oc:g Oeder edaod deierorbBd. -

Upload to Web Updated List of Faas, Cpios Etc As on 05.03.18.X

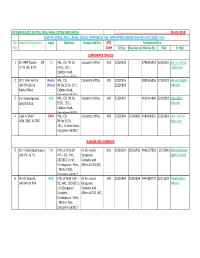

UP DATED LIST OF TOs, NOs, FAAs, CPIOs AND APIOs 05-03-2018 LIST OF APIOs, PIOs , FAAs, NODAL OFFICER & TOs APPOINTED UNDER THE RTI ACT-2005, HAL Ser Name & Designation Appt Address Responsibility STD Telephone Nos No Code Office Residence Mobile No FAX E-Mail CORPORATE OFFICE 1 Shri MM Tapase GM TO HAL, CO, PB No Corporate Office 080 22320930 8756996582 22320361 gm-jv-os@hal (JV & OS) & TO 5150, 15/1, -india.com Cubbon Road, Bangalore-560001 2 Shri, Alok Verma Nodal HAL, CO, Corporate Office 080 22320046 8985266806 22320432 alok.verma@hal- GM (HR-ER) & Officer PB No 5150, 15/1, 22320858 india.com Nodal Officer Cubbon Road, Bangalore-560001 3 Shri Rajeev Agarwal, FAA HAL, CO, PB No Corporate Office 080 22320924 9611044084 22320892 rajeev@hal- GM (IT) & FAA 5150, 15/1, india.com Cubbon Road, Bangalore-560001 4 Capt A Ghani CPIO HAL, CO, Corporate Office 080 22320004 25248685 9480809001 22320004 cpio_co@hal- AGM (S&F) & CPIO PB No 5150, india.com 15/1, Cubbon Road, Bangalore-560001 BANGALORE COMPLEX 5 Smt Vidya Upadhyaya, TO Offic of Offg GM All Div under 080 22318324 25236782 9900137520 22315041 vidya.upadhyaya GM (Fin) & TO (Fin) -BC, HAL, Bangalore @hal-india.com CEO(BC)'s Unit, Complex and Vimanapura - Post, Office of CEO(BC) , PB No 1785, Bangalore-560017 6 Shri D Deepak, FAA Offic of AGM (HR) - All Div under 080 22316488 23650654 9449288775 22312629 d.deepak@hal- GM (HR) & FAA BC, HAL, CEO(BC)'s Bangalore india.cim Unit,Bangalore Complex and Complex, Office of CEO (BC) Vimanapura - Post, , PB No 1785, Bangalore-560017 7 Shri M.M. -

Annual Report 2019-20

Hindustan Aeronautics Limited th 57 Annual Report 2019-20 To view or download, Annual - Report 2019-20, please log on to Contents www.hal-india.co.in/Investors CORPORATE OVERVIEW FINANCIAL STATEMENTS 03 Chairman’s Statement Standalone 06 Major Achievements, Events & Awards 116 Independent Auditors’ Report 12 Board of Directors & Chief Executive Officers 130 Comments of the C & A G 18 Financial Highlights 132 Balance Sheet 22 Corporate Information 134 Statement of Profit and Loss 24 Notice of 57th Annual General Meeting 136 Statement of Changes in Equity 138 Statement of Cash Flow STATUTORY REPORTS 140 Significant Accounting Policies 31 Board’s Report 147 Notes to Financial Statements 44 Annexures to Board’s Report Consolidated 82 Management Discussion & Analysis Report 230 Independent Auditors’ Report 89 Corporate Governance Report 241 Comments of the C & A G 106 Business Responsibility Report 248 Balance Sheet 250 Statement of Profit and Loss 252 Statement of Changes in Equity 254 Statement of Cash Flow 256 Significant Accounting Policies 263 Notes to Financial Statements Vision To become a significant global player in the aerospace industry. To achieve self reliance in design, development, manufacture, upgrade and Mission maintenance of aerospace equipment, diversifying into related areas and managing the business in a climate of growing professional competence to achieve world- class performance standards for global competitiveness and growth in exports. 2 Hindustan Aeronautics Limited Annual Report 2019-20 Chairman’s Statement Dear Shareholders, It is my privilege to extend a very warm welcome to you all for Your Company overhauled 201 platforms including both the 57th Annual General Meeting of your Company. -

The Indian Experience with the Bangalore International Airport

A JOURNAL OF M P BIRLA INSTITUTE OF MANAGEMENT, ASSOCIATE BHARATIYA VIDYA BHAVAN, BANGALORE Vol:6, 2 (2012) 3-45 ISSN 0974-0082 Pain without Gain? : Land Assembly and Acquisition for Infrastructure Mega Projects : The Indian experience with the Bangalore International Airport Kalpana Gopalan Doctoral Candidate, Centre for Public Policy, Indian Institute of Management, Bannerghatta Road, Bangalore 560 076 Abstract This comprehensive case study on Bangalore International Airport enumerates in a sequence, in stages and phases the role of people involved who finally make up a mega project. Episodes of people, evaluation of process, procedures and systems and the final call of polity are dilated with precision. The complexities of a mega project make impact on future generation. A recount of these will be utility oriented experience and learning. Key Words & Phrases: Context, Brand, Bangalore, Evaluation, Corporates, Civil Society & Political Voices. 1. Introduction public policy option throughout the world. They may even symbolize the new relationship between the 1.1 Public Private Partnerships as a Policy Option citizen and the state” (Greve & Hodge, 2005). Public Private Partnerships (ppps) are attracting In spite of ppps attracting widespread media attention, considerable attention in both scholarly and policy there is very little clarity in the public mind about discourses. Politicians, policy makers, bankers, what is a Public Private Partnership. There is certainly scholars, researchers the world over are talking about no consensus about what outcomes we can expect them. Industrial countries such as the United Kingdom, from a successful ppp, or how we can execute them Australia, Canada and the Netherlands, have adopted successfully, not just in the popular or policy discourse ppp arrangements to provide infrastructure, education, but even in scholarly debates about the subject. -

Vision Mission

VISION To become a significant global player in the aerospace industry MISSION To achieve self reliance in design, development, manufacture, upgrade and maintenance of aerospace equipment, diversifying into related areas and managing the business in a climate of growing professional competence to achieve world-class performance standards for global competitiveness and growth in exports 1 BOARD OF DIRECTORS Shri T. Suvarna Raju is an alumnus of India’s prestigious National Defence College with an M.Phil in Defence Strategic studies. A Mechanical Engineer by graduation and an MBA (Marketing). Shri Raju also holds a PG Diploma in Intellectual Property Rights (IPR) from National Law School of India University. Shri Raju joined HAL as a Management Trainee in July 1980 and grew up the ladder with varied experiences of manufacturing, overhaul and upgrade of several fleets including Jaguar and Mirage. He saw through the production of Hawk Mk-132 for the Indian Air Force and Indian Navy well ahead of schedule, right from establishing its manufacturing facilities. Shri T. Suvarna Raju Having worked through Aircraft and Overhaul Divisions in various capacities, he rose on Chairman and Managing the portals of HAL as GM, Aircraft Division and then to the post of Director (Design & Director (CMD) Development). Shri Raju was assigned the additional charge of Chairman w.e.f 1st February, 2015, and appointed as Chairman from 5th March, 2015. The post was re-designated as Chairman & Managing Director w.e.f. 1st April, 2015. Shri Raju is a firm believer that best of technology can never be bought, it can only be developed.