Week 14 SUNDAY, 07 APRIL 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of World's Tallest Buildings in the World

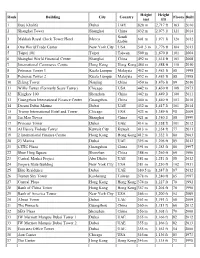

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Well Maintained Vacant Spacious Multiple Cheques

RENTING @ AED42K PER ANNUM well Maintained Vacant Spacious Multiple cheques *This property is subject to availability and the price is subject to change. Size may be approximate and images may be genereic. RESIDENTIAL FOR RENT Type Apartment Built-up Area 801 sqft Location Dubai Marina Bedrooms 1 Bed Property Marina Pinnacle Bathrooms 1 Bath RERA Permit - Parking 1 Car Park Agency Fee AED3K Security Deposit AED2.1K Entered Date Jan 21, 2021 05:55 am Updated Date Feb 28, 2021 08:37 am Ref#:GMR-11231 AZZA NAIMI [email protected] Client Manager +971 50 473 7763 BRN 0 Detroit House, Motor City, Office 205, PO Box 644919, Dubai, United Arab Emirates ORN 16805 | DED License 745304 | www.goldmark.ae [email protected] | Tel: +971 4 451 1886 | Fax: +971 4 451 1581 (AZ) Marina Pinnacle is a great located Tower, which offers great size apartments in a growing community, Gold Mark presents you this spacious exclusive 1 bedroom apartment furnished in Marina Pinnacle Tower PROPERTY FEATURES: 1 bedrooms ● 1 bathrooms full ● Property size: 801 sqft ● furnished ● Kitchen appliances ● Washing machine ● Balcony ● Wooden floor ● BUILDING AMENITIES: ● AC Fre ● Gas ● Security access ● GYM ● Outside swimming pool ● Kids area ● Dinning in building ● Near Tram station ● Close to Beach ● Great size floor plan ● The Marina Pinnacle is a 77-floor tower in the Dubai Marina in Dubai, United Arab Emirates. The tower has a total structural height of 280 m and 764 residential and commercial units. Construction of the Marina Pinnacle has been completed in 2011 . ● Building located just 1 min walk to tram station, close to the beach and Marina walk. -

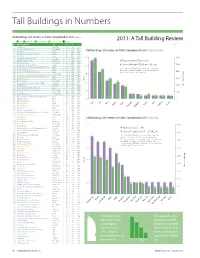

Tall Buildings in Numbers

Tall Buildings in Numbers All Buildings 200 meters or Taller Completed in 2011 (88 no.) 2011: A Tall Building Review Asia Middle East North America Central America Europe Note: For a detailed “Tallest Twenty in 2011” analysis, see page 38–42 No Building Name City Stories m ft 1 Kingkey 100 Shenzhen 100 442 1449 2 Al Hamra Firdous Tower Kuwait City 77 413 1354 3 23 Marina Dubai 90 393 1289 Tall Buildings 200 meters or Taller Completed in 2011: by Country 4 Tianjin Global Financial Center Tianjin 74 337 1105 5 The Torch Dubai 79 337 1105 25 6000 6 Longxi International Hotel Jiangyin 74 328 1076 5790 23 7 Wenzhou Trade Center Wenzhou 68 322 1056 Total Number (Total = 88) 8 Etihad Towers 2 Abu Dhabi 80 305 1002 5000 9 Northeast Asia Trade Tower Incheon 68 305 1001 20 Sum of Heights (Total = 21,642 m) 10 Doosan Haeundae We've the Zenith Tower A Busan 80 301 988 4243 Note: One tall building 200 m+ in height also completed 11 Khalid Al Attar Tower 2 Dubai 66 294 965 during 2011 in these countries: France, Germany, Mexico, 16 4000 12 Haeundae I Park Marina Tower 2 Busan 72 292 958 Russia, Saudi Arabia, United Kingdom 13 Trump Ocean Club International Hotel & Tower Panama City 68 284 932 15 14 Doosan Haeundae We've the Zenith Tower B Busan 75 282 924 15 Marina Pinnacle Dubai 73 280 919 2875 3000 11 16 Etihad Towers 1 Abu Dhabi 69 278 911 Number 2407 10 17 Nantong Zhongnan International Plaza Nantong 53 273 897 10 8 2000 (m) Heights of Sum 18 Lvjing Tower Shenzhen 56 273 896 1726 19 Haeundae I Park Marina Tower 1 Busan 66 273 895 20 Nation Towers -

Tall Buildings

02/12 апрель/май Рациональный консеРватизм Дубая Rational Conservatism of Dubai ПеРсПективный комПозит Prospective Composite аРхитектуРная мистеРия ngs i ld i Architectural Mysterium я» Tall bu я» Tall и Tall Buildings журнал высотных технологий 2/12 «Высотные здан международный Журнал обзор INTERNATIONAL«Высотные здания» OVERVIEW Tall buildings На обложке: проект Urban Forest, MAD Architects On the cover: Urban Forest, project by MAD Architects Учредитель ООО «Скайлайн медиа» при участии ЗАО «Горпроект» Редакционная коллегия: Сергей Лахман Надежда Буркова Юрий Софронов Петр Крюков Татьяна Печеная Святослав Доценко Елена Зайцева Александр Борисов Генеральный директор Сергей Лахман Главный редактор Содержание Татьяна Никулина Редактор Фотофакт/ Photo Session 74 Дубай Елена Домненко contents Dubai Исполнительный директор Сергей Шелешнев Среда обитания/Habitat 82 Ванкуверский «Утюг» Редактор-переводчик The «Flatiron» of Vancouver Ирина Амирэджиби Коротко/In brief 6 События и факты Редактор-корректор Город/City 90 Полицентричная модель развития городов Алла Шугайкина Events and Facts Иллюстрации Polycentric Model of Cities Development Алексей Любимкин Выставки/Exhibitions 20 Light & Building 2012. Новые рубежи Объект/Site 96 Окутанная плащом Над номером работали: Light & Building 2012. New Frontiers Марианна Маевская Enshrouded международный обзор Отдел рекламы строительство Тел./факс: (495) 545-2497 INTERNATIONAL OVERVIEW CONSTRUCTION Отдел распространения Светлана Богомолова Владимир Никонов История/History 22 Рациональный консерватизм Дубая -

Rank Building City Country Height (M) Height (Ft) Floors Built 1 Burj

Rank Building City Country Height (m) Height (ft) Floors Built 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 Makkah Royal Clock 2 Mecca Saudi Arabia 601 m 1,971 ft 120 2012 Tower Hotel 3 Taipei 101 Taipei Taiwan 509 m[5] 1,670 ft 101 2004 Shanghai World 4 Shanghai China 492 m 1,614 ft 101 2008 Financial Center International 5 Hong Kong Hong Kong 484 m 1,588 ft 118 2010 Commerce Centre Petronas Towers 1 6 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 and 2 Nanjing Greenland 8 Nanjing China 450 m 1,476 ft 89 2010 Financial Center 9 Willis Tower Chicago USA 442 m 1,450 ft 108 1973 10 Kingkey 100 Shenzhen China 442 m 1,449 ft 98 2011 Guangzhou West 11 Guangzhou China 440 m 1,440 ft 103 2010 Tower Trump International 12 Chicago USA 423 m 1,389 ft 98 2009 Hotel and Tower 13 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 14 Al Hamra Tower Kuwait City Kuwait 413 m 1,352 ft 77 2011 Two International 15 Hong Kong Hong Kong 416 m 1,364 ft 88 2003 Finance Centre 16 23 Marina Dubai UAE 395 m 1,296 ft 89 2012[F] 17 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 18 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 19 Empire State Building New York City USA 381 m 1,250 ft 102 1931 19 Elite Residence Dubai UAE 381 m 1,250 ft 91 2012[F] 21 Tuntex Sky Tower Kaohsiung Taiwan 378 m 1,240 ft 85 1994 Emirates Park Tower 22 Dubai UAE 376 m 1,234 ft 77 2010 1 Emirates Park Tower 22 Dubai UAE 376 m 1,234 ft 77 2010 2 24 Central Plaza Hong Kong Hong Kong 374 m 1,227 ft 78 1992[C] 25 Bank of China Tower Hong Kong Hong Kong 367 m 1,205 ft 70 1990 Bank -

UAE Pricing Study January 2019

UAE Pricing Study January 2019 UAE Residential & Commercial Pricing Study January 2019 PO Box 474103 Dubai United Arab Emirates t +971 44205316 [email protected] www.britisharabian.com UAE RESIDENTIAL & COMMERCIAL PRICING STUDY The purpose of the study is to give the reader an indication of the typical values of property in various established residential and commercial areas of Dubai and Abu Dhabi. We would stress that the study is not a formal valuation and under no circumstance should it be used as the basis for lending, buying or selling property, it serves only to indicate the prices and values achieved by a sample of properties in the areas listed. The data used as the basis for this study is obtained through a variety of sources. The sources include actual mortgage transaction data provided by some of our bank clients, and other transactional data provided by both clients and trusted and reliable third parties. Valuation is not an exact science, and this is particularly true in the residential sector, where buyer sentiment is all-important. Many factors demand consideration, such as view, aspect, proximity to local amenities, orientation, decoration and condition. Moreover, there is currently no standard method of reporting measurement, and different developers may include common area or balconies, and some may not. For these reasons, a "price per square foot”, applied in isolation and without regard to other material factors is not a reliable way of assessing values, and a professionally qualified and experience valuer should be engaged to give an opinion of value when assessing the true Market Value. -

Letter of Confirmation

CCOOMMPPAANNYY PPRROOFFIILLEE SINCE 1976 QQuuaalliittyy AAssssuurraannccee Musaffah Industrial Area Abu Dhabi: Tel: +971 (2) 5508042 Fax: +971 (2) 5508046 P.O. Box # 132634 Dubai Investment Park, Beside (MB Mix) Off. Tel: +971 (4) 8854854 Off. Fax: +971 (4) 8854853 Dubai: P.O. Box # 60462 Lab Tel: +971 (4) 8854771 Lab Fax: +971 (4) 8854772 Sharjah Ind. Area – 17 Sharjah: Tel: +971 (6) 5350357 Fax: +971 (6) 5350358 P. O. Box # 5116 Industrial Area 38, Gate 54, Doha Qatar: Tel: +974 44715063 Fax: +974 44515387 P. O. Box # 491 Website: www.ahamgeo.com Email: [email protected] CP/UAE/2013 TABLE OF CONTENTS INTRODUCTION ..................................................................................................................................... 3 KEY PERSONNEL QUALIFICATIONS .................................................................................................. 5 MOHAMMAD MUKADDAM ............................................................................................................................... 6 ADEEB ELIAS SAWAYA .................................................................................................................................. 8 BASSEL MUKADDAM .................................................................................................................................... 12 ALI ABDEL AZIZ ALI ...................................................................................................................................... 14 SAJID JALIL ................................................................................................................................................... -

UAE Pricing Study Q2 2018

UAE Pricing Study Q2 2018 UAE Residential & Commercial Pricing Study Q2 2018 PO Box 474103 Dubai United Arab Emirates t +971 44205316 [email protected] www.britisharabian.com UAE RESIDENTIAL & COMMERCIAL PRICING STUDY The purpose of the study is to give the reader an indication of the typical values of property in various established residential and commercial areas of Dubai and Abu Dhabi. We would stress that the study is not a formal valuation and under no circumstance should it be used as the basis for lending, buying or selling property, it serves only to indicate the prices and values achieved by a sample of properties in the areas listed. The data used as the basis for this study is obtained through a variety of sources. The sources include actual mortgage transaction data provided by some of our bank clients, and other transactional data provided by both clients and trusted and reliable third parties. Valuation is not an exact science, and this is particularly true in the residential sector, where buyer sentiment is all-important. Many factors demand consideration, such as view, aspect, proximity to local amenities, orientation, decoration and condition. Moreover, there is currently no standard method of reporting measurement, and different developers may include common area or balconies, and some may not. For these reasons, a "price per square foot”, applied in isolation and without regard to other material factors is not a reliable way of assessing values, and a professionally qualified and experience valuer should be engaged to give an opinion of value when assessing the true Market Value. -

Ghubaiba Bus Station - Al Maktoum International Airport, Arrivals

Route N55: Ghubaiba Bus Station - Al Maktoum International Airport, Arrivals N55 Ghubaiba Bus Station Department of Ports & Customs Capital Hotel Power Gas Station World Hudheiba Islands JumeiraDhiyafa, Rotana Road Hotel Satwa, Square Satwa,Satwa,Satwa, Clinic Masjid Post Office E Satwa, Masjid 2 11 Bilal Bin Ribah School Jumeira Bay Island Khadri Masjid Rehabilitation Center Satwa, Road Rashid Al Hadees Masjid Wasl, Emirates Bank Jumeira, Post Office Rashid PoliceBin Bakhait Training Masjid School Hilton Beach Club E Majlis Al Ghoreifa 79 Jumeira 3, Masjid E Saeed Majid Bil Yoha Masjid 44 Manara, Enoc Dubai Offshore Sailing Club Abdallah Mleih Masjid UmmAbu ManaraSuqeim Masjid 1 Umm Suqeim, Library Saeed Bin Huzeim Masjid Umm Suqeim, Dubai Municipality Center Wild Wadi Umm Suqeim, Park King Salman Bin Abdulaziz Maharba Masjid Palm Al Saud Street 1 Palm Burj Al Arab Hotel Island Jumeirah King Salman Bin Abdulaziz Madinat Jumeira Al Saud Street 3 King Salman Bin Abdulaziz E Knowledge Village Al Saud Street 2 44 Dubai College Villas Complex, Tecom Royal Mirage Hotel 2 Royal Mirage Hotel 1 Jumeira, Royal Meridian Mina Al Siyahi, E Dubai Jumeirah Beach Le Meridien Hotel 61 Residence Station 2 Jumeirah Beach Residence Station 1 E 311 Ibn Battuta Metro Bus Station E Ibn Battuta, Food Court 3 44 Jebel Ali Jebel Ali Gardens, Turnoff Container Terminal E E 611 311 E 57 United Arab Emirates E E 77 11 E 77 E E 77 311 E 11 E 611 E Al Maktoum International Al Maktoum International 311 Airport, Arrivals Airport, Departure N55 Abu Dhabi 5 km 10 km 15 -

Marina Pinnacle the Height of Luxury!

Marina Pinnacle The height of luxury! The Marina Pinnacle is a 73-floor tower in the Dubai Marina in Dubai, United Arab Emirates. The tower has a total structural height of 280 m (853 ft). Construction of the Marina Pinnacle is expected to be completed handover in June 2011. When finished, it will be one of the tallest residential buildings around the World. Available Apartment - 2 flats (Read Position) 1) 3 bedrooms 62nd Floor Total Area: 1887sq.ft Sea View 2) 3 bedrooms 62nd Floor Total Area: 1873 sq.ft Partial Sea View Projects Details: The tower topped out in December, 2010 with 99 % completion and became 19th tallest building in Dubai. Handover process will start in JUNE 2011. Stunning views, fresh sea air and glamorous living are key elements of the marina pinnacle lifestyle, where one can enjoy the dazzling surroundings from high above this soaring tower that overlooks Dubai marina. Iconic in style, Marina Pinnacle rises from the surrounding green landscape to grace Dubai skyline with its stylish architectural features. The 73-storey tower is divided into residential floors, retail component, recreational facilities and dedicated parking sections. The ground-floor lobby is reflective of the elegance of the building with its high quality granite and marble flooring, stylish water feature, and hardwood and stone walls. Marina pinnacle features stylish one, two and three bedroom apartments, furnished with premier European amenities. The residents can also benefit from professional housekeeping services as well as nursery and day care facilities. The property also has 24 hour security and maintenance, CCTV, high speed internet and 10 high speed elevators. -

UAE Pricing Study October 2017

UAE Pricing Study October 2017 UAE Residential & Commercial Pricing Study October 2017 PO Box 474103 Dubai United Arab Emirates t +971 44205316 [email protected] www.britisharabian.com UAE RESIDENTIAL & COMMERCIAL PRICING STUDY The purpose of the study is to give the reader an indication of the typical values of property in various established residential and commercial areas of Dubai and Abu Dhabi. We would stress that the study is not a formal valuation and under no circumstance should it be used as the basis for lending, buying or selling property, it serves only to indicate the prices and values achieved by a sample of properties in the areas listed. The data used as the basis for this study is obtained through a variety of sources. The sources include actual mortgage transaction data provided by some of our bank clients, and other transactional data provided by both clients and trusted and reliable third parties. Valuation is not an exact science, and this is particularly true in the residential sector, where buyer sentiment is all-important. Many factors demand consideration, such as view, aspect, proximity to local amenities, orientation, decoration and condition. Moreover, there is currently no standard method of reporting measurement, and different developers may include common area or balconies, and some may not. For these reasons, a "price per square foot”, applied in isolation and without regard to other material factors is not a reliable way of assessing values, and a professionally qualified and experience valuer should be engaged to give an opinion of value when assessing the true Market Value. -

A Year in Review: Trends of 2011 Skyscraper Completion Reaches New High for Fifth Year Running

Council on Tall Buildings and Urban Habitat CTBUH Contact: S.R. Crown Hall, Illinois Institute of Technology Nathaniel Hollister 3360 South State Street [email protected] Chicago, IL 60616, USA P: 1 (312) 567-3429 A Year in Review: Trends of 2011 Skyscraper Completion Reaches New High for Fifth Year Running Chicago January 18, 2012 In January of each year, CTBUH publishes a review of tall building construction and statistics from the previous year. The annual story is becoming a familiar one: 2007, 2008, 2009, 2010, and now 2011 have each sequentially broke the record for the most 200 meter or higher buildings completed in a given year. Once again, more 200 m+ buildings were completed in 2011 than in any year previous, with a total of 88 projects opening their doors. Shenzhen’s Kingkey 100, at 442 meters, tops the 2011 list. Looking to the future, it is now foreseeable – even through the end of the decade. This hold. Now however, due in large part to the indeed likely – that the recent trend of an represents a change in recent predictions. It continuing high activity of skyscraper design annual increase in building completions will had been expected that skyscraper and construction in China, as well as the continue for the next several years, perhaps completions would drop off very sharply after development of several relatively new 2011, as a result of the 2008 global financial markets, this global dip is no longer expected. crisis and the large number of projects put on The effect this will have on the skylines of the 03.