A Market Consistent Gas Storage Modelling Framework: Valuation, Calibration, & Model Risk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

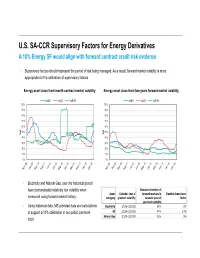

U.S. SA-CCR Supervisory Factors for Energy Derivatives a 10% Energy SF Would Align with Forward Contract Credit Risk Evidence

U.S. SA-CCR Supervisory Factors for Energy Derivatives A 10% Energy SF would align with forward contract credit risk evidence • Supervisory factors should represent the period of risk being managed. As a result, forward market volatility is more appropriate for the calibration of supervisory factors Energy asset class front month contract market volatility Energy asset class front two years forward market volatility VolNG VolOil VolPJM VolNG VolOil VolPJM 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% 50% Vol Vol 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% • Electricity and Natural Gas, over the historical period have demonstrated relatively low volatility when Standard deviation of Asset Calendar year of forward markets in Implied Supervisory measured using forward market history. category greatest volatility calendar year of Factor greatest volatility • Using historical data, MS provided data and calculations Electricity 1/1/08-12/31/08 24% 6% to support a 10% calibration in our public comment Oil 1/1/08-12/31/08 47% 13% Natural Gas 1/1/09-12/31/09 32% 9% letter 1 U.S. SA-CCR Supervisory Factors for Energy Derivatives A 10% Energy SF would align with credit risk in energy derivative transactions 1. Cal18 WTI Swap Pricing: Notional BBLs x Cal18 Prices 2. Cal18 WTI MTM vs SA-CCR vs Mean Positive Exposure 150 90 Oil 1 0 /12 450 1 /10 80 1 1 100 /11 /8 1 1 350 /9 /6 70 1 1 /7 /4 1 1 50 /5 /2 60 250 1 1 /3 50 - $MM 150 $MM 40 $/BBL 50 (50) 30 20 -50 (100) 10 -150 (150) 0 Cal18 MTM SA-CCR RWA Exposure at 40% SF Cal18 MTM ($MM) Notional Quantity (BBLs) * SA-CCR RWA Exposure at 10% SF Max Mean Positive Exposure Cal18 Price ($/BBL) 1/# Spot Contribution to MTM • Energy derivative counterparty credit risk exposures decline, • A 10% Supervisory Factor correctly aligns SA-CCR month by month, as the transaction nears maturity since the credit risk measurements with other reliable counterparty remaining total notional quantity declines credit risk measures (i.e. -

Derivatives and Risk Management in the Petroleum, Natural Gas, and Electricity Industries

SR/SMG/2002-01 Derivatives and Risk Management in the Petroleum, Natural Gas, and Electricity Industries October 2002 Energy Information Administration U.S. Department of Energy Washington, DC 20585 This report was prepared by the Energy Information Administration, the independent statistical and analytical agency within the U.S. Department of Energy. The information contained herein should be attributed to the Energy Information Administration and should not be construed as advocating or reflecting any policy position of the Department of Energy or any other organization. Service Reports are prepared by the Energy Information Administration upon special request and are based on assumptions specified by the requester. Contacts This report was prepared by the staff of the Energy The Energy Information Administration would like to Information Administration and Gregory Kuserk of the acknowledge the indispensible help of the Commodity Commodity Futures Trading Commission. General Futures Trading Commission in the research and writ- questions regarding the report may be directed to the ing of this report. EIA’s special expertise is in energy, not project leader, Douglas R. Hale. Specific questions financial markets. The Commission assigned one of its should be directed to the following analysts: senior economists, Gregory Kuserk, to this project. He Summary, Chapters 1, 3, not only wrote sections of the report and provided data, and 5 (Prices and Electricity) he also provided the invaluable professional judgment Douglas R. Hale and perspective that can only be gained from long expe- (202/287-1723, [email protected]). rience. The EIA staff appreciated his exceptional pro- ductivity, flexibility, and good humor. -

Long-Term Swings and Seasonality in Energy Markets Working Paper Nº 1929

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by EPrints Complutense Long-term swings and seasonality in energy markets Instituto Manuel Moreno Complutense Department of Economic Analysis and Finance, University of Castilla-La Mancha, Toledo, Spain de Análisis Económico Alfonso Novales Instituto Complutense de Análisis Económico (ICAE), and Department of Economic Analysis, Facultad de Ciencias Económicas y Empresariales, Universidad Complutense, Madrid, Spain Federico Platania Léonard de Vinci Pôle Universitaire, Paris La Défense, France Abstract This paper introduces a two-factor continuous-time model for commodity pricing under the assumption that prices revert to a stochastic mean level, which shows smooth, periodic fluctuations over long periods of time. We represent the mean reversion price by a Fourier series with a stochastic component. We also consider a seasonal component in the price level, an essential characteristic of many commodity prices, which we represent again by a Fourier series. We obtain analytical pricing expressions for futures contracts. Using futures price data on Natural Gas, we provide evidence on the presence of long-term fluctuations and show how to estimate the long-term component simultaneously with a seasonal component using the Kalman filter. We analyse the in-sample and out-of-sample empirical performance of our pricing model with and without a seasonal component and compare it with the Schwartz and Smith (2000) model. Our findings show the in-sample and out-of-sample superiority of our model with seasonal fluctuations, thereby providing a simple and powerful tool for portfolio management, risk management, and derivative pricing. -

The Impact of Energy Derivatives on the Crude Oil Market

THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY OF RICE UNIVERSITY THE IMPACT OF ENERGY DERIVATIVES ON THE CRUDE OIL MARKET JEFF FLEMING ASSISTANT PROFESSOR OF FINANCE JONES SCHOOL OF MANAGEMENT, RICE UNIVERSITY BARBARA OSTDIEK ASSISTANT PROFESSOR OF FINANCE JONES SCHOOL OF MANAGEMENT, RICE UNIVERSITY THE IMPACT OF ENERGY DERIVATIVES ON THE CRUDE OIL MARKET Introduction Beginning in the 1970s, deregulation dramatically increased the degree of price uncertainty in the energy markets, prompting the development of the first exchange- traded energy derivative securities. The success and growth of these contracts attracted a broader range of participants to the energy markets and stimulated trading in an even wider variety of energy derivatives. Today, many exchanges and over-the-counter markets worldwide offer futures, futures options, swap contracts, and exotic options on a broad range of energy products, including crude oil, fuel oil, gasoil, heating oil, unleaded gasoline, and natural gas. It is well known that derivative securities provide economic benefits. The key attribute of these securities is their leverage (i.e., for a fraction of the cost of buying the underlying asset, they create a price exposure similar to that of physical ownership). As a result, they provide an efficient means of offsetting exposures among hedgers or transferring risk from hedgers to speculators. In addition, derivatives promote information dissemination and price discovery. The leverage and low trading costs in these markets attract speculators, and as their presence increases, so does the amount of information impounded into the market price. These effects ultimately influence the underlying commodity price through arbitrage activity, leading to a more broadly based market in which the current price corresponds more closely to its true value. -

Energy Derivatives and Risk Management

Department of Business and Management Master thesis in Advanced Corporate Finance ENERGY DERIVATIVES AND RISK MANAGEMENT SUPERVISOR: CANDIDATE: Prof. Raffaele Oriani Alessia Gidari 643081 CO-SUPERVISOR: Prof. Simone Mori ACADEMIC YEAR 2012-2013 1 Table of contents Abstract ...........................................................................................................................4 Introduction......................................................................................................................5 1. Risk management 1.1. A brief historical background……………………………………………………………….9 1.2. Risk definition and measurement……………………………………………………….10 1.3. The risk in corporate finance……………………………………………………………….12 1.4. The reasons for hedging……………………………………………………………………..13 1.5. The risk in capital investment……………………………………………………………..15 1.6. From hedging to risk management……………………………………………………..17 2. Enterprise risk management 2.1. Definition……………………………………………………………………………………………19 2.2. Implementation………………………………………………………………………………….20 2.3. Case studies in literature…………………………………………………………………….23 2.4. Empirical observations………………………………………………………………………..26 2.5. Evolution of risk management…………………………………………………………….32 3. The quantitative tools of risk management 3.1. The Black-Scholes model…………………………………………………………………….35 3.2. The main VaR methodologies……………………………………………………………..37 3.2.1. The historical simulation…………………………………………………………38 3.2.2. The Variance-covariance or analytical method……………………….39 3.2.3. The Monte Carlo method………………………………………………………..41 -

18. Energy Futures Markets for Managing Risk

Self Test Energy Futures Markets for Managing Risk Click on True or False to test your knowledge of the chapter. 1. True False Riskiness of the energy industry is perceived as a "chance of loss" in the popular sense. 2. True False Financial risk includes the possibility of accidents that have health and safety implications, examples such as power plant melt down, oil spill, an LNG explosion, smog etc. 3. True False There are six types of financial risk including market, credit, premium, liquidity, operational, and legal. 4. True False A risk neutral individual would be indifferent between $200 and an asset that has 20% chance of paying $1000 and 80% chance of paying nothing. 5. True False To find the optimal hedge ratio (the ratio which minimizes risk or variance), we T use the following formula: δ = ρ + μ+ (lnSt - lnFt )/T. 6. True False The efficient market hypothesis suggests that the spot price plus any necessary risk premium (RP) is a good predictor of future energy prices. 7. True False A derivative is a financial instrument whose value depends on the value of an underlying asset. 8. True False Suppose you have purchased a futures contract of 1,000 barrels for $35/bbl for June delivery and you have posted a margin of $3400, and the price of crude for June delivery increases to $35.50 tomorrow, and you decide to cash out tomorrow. Your margin will increase to $3900, and if you decide to cash out, you will have $500 less a transaction fee. 9. True False High volatility of energy prices since 1973 is one of the reasons that drove the development of financial derivative markets. -

Energy and Power Risk Management

Additional Praise for Energy and Power Risk Management “Eydeland and Wolyniec give a very detailed, yet quite readable, presenta- tion of the risk management tools in energy markets. The book will be a valuable resource for anyone studying or participating in energy markets.” —Severin Borenstein E.T. Grether Professor of Business Administration and Public Policy, Haas School of Business, University of California, Berkeley Director, University of California Energy Institute “Activity in the power sector exposes all participants to complex and unique risk. Deregulation and the collapse of Enron have only increased the need to understand and control these risks. Covering the spectrum of risk and valu- ation, from the fundamentals of price movement and modeling with poor data, to physical asset valuation and the complex energy derivatives, this book offers a firm foundation from which to solve real world problems.” —Dr. Chris Harris General Manager, Commercial Operations, InnogyOne Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Aus- tralia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers’ professional and personal knowledge and understanding. The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to e- commerce, risk management, financial engineering, valuation and financial instrument analysis, as well as much more. For a list of available titles, please visit our web site at www.WileyFinance.com. Energy and Power Risk Management New Developments in Modeling, Pricing, and Hedging ALEXANDER EYDELAND KRZYSZTOF WOLYNIEC John Wiley & Sons, Inc. -

Course Objectives 1. to Have a Clear Understanding of the Economic Rationale for Risk Management in Energy Sector

OGET 8006 Energy Trading Markets and Risk L T P C Management Version 1.0 4 0 0 4 Pre-requisites/Exposure Econometrics Modeling, Econometrics Lab Co-requisites Energy Pricing, Oil & Gas Economics Course Objectives 1. To have a clear understanding of the economic rationale for risk management in energy sector. 2. To know the basic techniques for the valuation of forwards, futures, and vanilla options (call and puts); 3. To master the various techniques of hedging practices in terms of energy risk. Course Outcomes On completion of this course, the students will be able to CO1. Understand the concept of various derivative products such as futures, options, and swaps; CO2. To apply hedging models in assessing price risk of various energy derivatives; CO3. To analyse and estimate value at risk for various energy derivatives; CO4. To comprehend various energy derivative products and their performance in Indian and Global Markets; CO5. To integrate the understanding on various energy derivative products and their performance in Indian and Global Markets. Catalog Description Risk is inherent in modern enterprise risk management. Learning different risk management tools such as forwards, futures, options and swaps is necessary. In this course, the focus will be on to learn these tools and the application in Energy price risk management. Students will be applying their econometric skills in learning various risk management models for hedging. Practical application of business data analysis will be done in the class for integrating theories and real business data. Class participation is a fundamental aspect of this course. Students will be encouraged to actively take part in lab activities and to give an oral group presentation. -

Regulation in Energy Derivatives Trading

University of Colorado Law School Colorado Law Scholarly Commons Articles Colorado Law Faculty Scholarship 2007 Beyond Enron: Regulation in Energy Derivatives Trading Alexia Brunet University of Colorado Law School Meredith Shafe Chapman and Cutler LLP Follow this and additional works at: https://scholar.law.colorado.edu/articles Part of the Energy and Utilities Law Commons, and the Securities Law Commons Citation Information Alexia Brunet and Meredith Shafe, Beyond Enron: Regulation in Energy Derivatives Trading, 27 NW. J. INT'L. L. & BUS. 665 (2007), available at https://scholar.law.colorado.edu/articles/319. Copyright Statement Copyright protected. Use of materials from this collection beyond the exceptions provided for in the Fair Use and Educational Use clauses of the U.S. Copyright Law may violate federal law. Permission to publish or reproduce is required. This Article is brought to you for free and open access by the Colorado Law Faculty Scholarship at Colorado Law Scholarly Commons. It has been accepted for inclusion in Articles by an authorized administrator of Colorado Law Scholarly Commons. For more information, please contact [email protected]. +(,121/,1( Citation: 27 Nw. J. Int'l L. & Bus. 665 2006-2007 Provided by: William A. Wise Law Library Content downloaded/printed from HeinOnline Mon Mar 27 18:34:26 2017 -- Your use of this HeinOnline PDF indicates your acceptance of HeinOnline's Terms and Conditions of the license agreement available at http://heinonline.org/HOL/License -- The search text of this PDF is generated from uncorrected OCR text. -- To obtain permission to use this article beyond the scope of your HeinOnline license, please use: Copyright Information Beyond Enron: Regulation in Energy Derivatives Trading Alexia Brunet* & Meredith Shafe** I. -

Dynamically Hedging Oil and Currency Futures Using Receding Horizontal Control and Stochastic Programming Paul Edward Cottrell Walden University

Walden University ScholarWorks Walden Dissertations and Doctoral Studies Walden Dissertations and Doctoral Studies Collection 2015 Dynamically Hedging Oil and Currency Futures Using Receding Horizontal Control and Stochastic Programming Paul Edward Cottrell Walden University Follow this and additional works at: https://scholarworks.waldenu.edu/dissertations Part of the Economics Commons, Finance and Financial Management Commons, and the Oil, Gas, and Energy Commons This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contact [email protected]. Walden University College of Management and Technology This is to certify that the doctoral dissertation by Paul Cottrell has been found to be complete and satisfactory in all respects, and that any and all revisions required by the review committee have been made. Review Committee Dr. David Bouvin, Committee Chairperson, Management Faculty Dr. Branford McAllister, Committee Member, Management Faculty Dr. Jeffrey Prinster, University Reviewer, Management Faculty Chief Academic Officer Eric Riedel, Ph.D. Walden University 2015 Abstract Dynamically Hedging Oil and Currency Futures Using Receding Horizontal Control and Stochastic Programming by Paul Edward Cottrell MBA, Wayne State University, 2008 BS, Wayne State University, 2007 Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy Finance Walden University February 2015 Abstract There is a lack of research in the area of hedging future contracts, especially in illiquid or very volatile market conditions. It is important to understand the volatility of the oil and currency markets because reduced fluctuations in these markets could lead to better hedging performance. -

PRICING of SWING OPTIONS: a MONTE CARLO SIMULATION APPROACH a Dissertation Submitted to Kent State University in Partial Fulfill

PRICING OF SWING OPTIONS: A MONTE CARLO SIMULATION APPROACH A dissertation submitted to Kent State University in partial fulfillment of the requirements for the degree of Doctor of Philosophy by Kai-Siong Leow May, 2013 Dissertation written by Kai-Siong Leow B.S., Iowa State University, 1998 M.S., Oklahoma State University, 2003 Ph.D., Kent State University, 2013 Approved by , Chair, Doctoral Dissertation Committee Dr. Oana Mocioalca , Member, Doctoral Dissertation Committee Dr. Mohammad Kazim Khan , Member, Doctoral Dissertation Committee Dr. Lothar Reichel , Member, Outside Discipline Dr. Maxim Dzero , Member, Graduate Faculty Representative Dr. Eric Johnson Accepted by , Chair, Department of Mathematical Sciences Dr. Andrew Tonge , Associate Dean, College of Arts and Sciences Dr. Raymond A. Craig ii TABLE OF CONTENTS LIST OF FIGURES ......................................... v ACKNOWLEDGEMENTS ..................................... vi 1 Introduction ............................................ 1 1.1 Literature Review ..................................... 1 1.2 Derivative Pricing in Incomplete Market ......................... 3 1.3 Calibration of Energy Spot Price Process ........................ 8 1.4 Organization of the Dissertation ............................. 12 2 Model Description and Formulation ............................... 14 2.1 Swing Optionality ..................................... 14 2.2 Definition of Swing Options ................................ 17 2.3 Stochastic Optimal Control Model ............................ 18 2.4 -

©Copyright 2016 Thomas Fillebeen How Do Small Players Deduce Beliefs About Uncertainty? a Look at Texas Shale Oil Investments

©Copyright 2016 Thomas Fillebeen How Do Small Players Deduce Beliefs about Uncertainty? A Look at Texas Shale Oil Investments Thomas Fillebeen A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Washington 2016 Reading Committee: Chris Anderson, Chair Robert Halvorsen, Chair Eric Zivot Program Authorized to Offer Degree: Economics University of Washington Abstract How Do Small Players Deduce Beliefs about Uncertainty? A Look at Texas Shale Oil Investments Thomas Fillebeen Co-Chairs of the Supervisory Committee: Associate Professor Chris Anderson School of Aquatic and Fishery Sciences Professor Robert Halvorsen Department of Economics Derivative markets enable firms to eliminate unwanted risk and, thereby, focus on their core competence. We ask whether small firms respond to changes in complex risk struc- tures, using the emerging Texas shale oil industry. Unlike their conventional drilling coun- terparts, shale oil producers are small, with short production lead times and most revenue earned in two to three years. This exposes them to recent unprecedented volatility in product prices, production costs, and-in the Permian, pipeline transportation basis risk. We develop a real option model of their decision process, within which we measure firm responsiveness to volatility. To estimate revenue expectations, we use forward-looking time-varying beliefs deduced from futures and futures option prices. For costs, we use expectations about the evolution of production technology and forward-contracted trans- port capacity. Our results show that investment in new wells responds optimally not only to time-varying market price, but also to a second source of uncertainty: transportation basis.