Dynamically Hedging Oil and Currency Futures Using Receding Horizontal Control and Stochastic Programming Paul Edward Cottrell Walden University

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

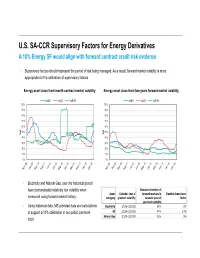

U.S. SA-CCR Supervisory Factors for Energy Derivatives a 10% Energy SF Would Align with Forward Contract Credit Risk Evidence

U.S. SA-CCR Supervisory Factors for Energy Derivatives A 10% Energy SF would align with forward contract credit risk evidence • Supervisory factors should represent the period of risk being managed. As a result, forward market volatility is more appropriate for the calibration of supervisory factors Energy asset class front month contract market volatility Energy asset class front two years forward market volatility VolNG VolOil VolPJM VolNG VolOil VolPJM 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% 50% Vol Vol 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% • Electricity and Natural Gas, over the historical period have demonstrated relatively low volatility when Standard deviation of Asset Calendar year of forward markets in Implied Supervisory measured using forward market history. category greatest volatility calendar year of Factor greatest volatility • Using historical data, MS provided data and calculations Electricity 1/1/08-12/31/08 24% 6% to support a 10% calibration in our public comment Oil 1/1/08-12/31/08 47% 13% Natural Gas 1/1/09-12/31/09 32% 9% letter 1 U.S. SA-CCR Supervisory Factors for Energy Derivatives A 10% Energy SF would align with credit risk in energy derivative transactions 1. Cal18 WTI Swap Pricing: Notional BBLs x Cal18 Prices 2. Cal18 WTI MTM vs SA-CCR vs Mean Positive Exposure 150 90 Oil 1 0 /12 450 1 /10 80 1 1 100 /11 /8 1 1 350 /9 /6 70 1 1 /7 /4 1 1 50 /5 /2 60 250 1 1 /3 50 - $MM 150 $MM 40 $/BBL 50 (50) 30 20 -50 (100) 10 -150 (150) 0 Cal18 MTM SA-CCR RWA Exposure at 40% SF Cal18 MTM ($MM) Notional Quantity (BBLs) * SA-CCR RWA Exposure at 10% SF Max Mean Positive Exposure Cal18 Price ($/BBL) 1/# Spot Contribution to MTM • Energy derivative counterparty credit risk exposures decline, • A 10% Supervisory Factor correctly aligns SA-CCR month by month, as the transaction nears maturity since the credit risk measurements with other reliable counterparty remaining total notional quantity declines credit risk measures (i.e. -

Derivatives and Risk Management in the Petroleum, Natural Gas, and Electricity Industries

SR/SMG/2002-01 Derivatives and Risk Management in the Petroleum, Natural Gas, and Electricity Industries October 2002 Energy Information Administration U.S. Department of Energy Washington, DC 20585 This report was prepared by the Energy Information Administration, the independent statistical and analytical agency within the U.S. Department of Energy. The information contained herein should be attributed to the Energy Information Administration and should not be construed as advocating or reflecting any policy position of the Department of Energy or any other organization. Service Reports are prepared by the Energy Information Administration upon special request and are based on assumptions specified by the requester. Contacts This report was prepared by the staff of the Energy The Energy Information Administration would like to Information Administration and Gregory Kuserk of the acknowledge the indispensible help of the Commodity Commodity Futures Trading Commission. General Futures Trading Commission in the research and writ- questions regarding the report may be directed to the ing of this report. EIA’s special expertise is in energy, not project leader, Douglas R. Hale. Specific questions financial markets. The Commission assigned one of its should be directed to the following analysts: senior economists, Gregory Kuserk, to this project. He Summary, Chapters 1, 3, not only wrote sections of the report and provided data, and 5 (Prices and Electricity) he also provided the invaluable professional judgment Douglas R. Hale and perspective that can only be gained from long expe- (202/287-1723, [email protected]). rience. The EIA staff appreciated his exceptional pro- ductivity, flexibility, and good humor. -

Long-Term Swings and Seasonality in Energy Markets Working Paper Nº 1929

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by EPrints Complutense Long-term swings and seasonality in energy markets Instituto Manuel Moreno Complutense Department of Economic Analysis and Finance, University of Castilla-La Mancha, Toledo, Spain de Análisis Económico Alfonso Novales Instituto Complutense de Análisis Económico (ICAE), and Department of Economic Analysis, Facultad de Ciencias Económicas y Empresariales, Universidad Complutense, Madrid, Spain Federico Platania Léonard de Vinci Pôle Universitaire, Paris La Défense, France Abstract This paper introduces a two-factor continuous-time model for commodity pricing under the assumption that prices revert to a stochastic mean level, which shows smooth, periodic fluctuations over long periods of time. We represent the mean reversion price by a Fourier series with a stochastic component. We also consider a seasonal component in the price level, an essential characteristic of many commodity prices, which we represent again by a Fourier series. We obtain analytical pricing expressions for futures contracts. Using futures price data on Natural Gas, we provide evidence on the presence of long-term fluctuations and show how to estimate the long-term component simultaneously with a seasonal component using the Kalman filter. We analyse the in-sample and out-of-sample empirical performance of our pricing model with and without a seasonal component and compare it with the Schwartz and Smith (2000) model. Our findings show the in-sample and out-of-sample superiority of our model with seasonal fluctuations, thereby providing a simple and powerful tool for portfolio management, risk management, and derivative pricing. -

Schedule Rc-L – Derivatives and Off-Balance Sheet Items

FFIEC 031 and 041 RC-L – DERIVATIVES AND OFF-BALANCE SHEET SCHEDULE RC-L – DERIVATIVES AND OFF-BALANCE SHEET ITEMS General Instructions Schedule RC-L should be completed on a fully consolidated basis. In addition to information about derivatives, Schedule RC-L includes the following selected commitments, contingencies, and other off-balance sheet items that are not reportable as part of the balance sheet of the Report of Condition (Schedule RC). Among the items not to be reported in Schedule RC-L are contingencies arising in connection with litigation. For those asset-backed commercial paper program conduits that the reporting bank consolidates onto its balance sheet (Schedule RC) in accordance with FASB Interpretation No. 46 (Revised), any credit enhancements and liquidity facilities the bank provides to the programs should not be reported in Schedule RC-L. In contrast, for conduits that the reporting bank does not consolidate, the bank should report the credit enhancements and liquidity facilities it provides to the programs in the appropriate items of Schedule RC-L. Item Instructions Item No. Caption and Instructions 1 Unused commitments. Report in the appropriate subitem the unused portions of commitments to make or purchase extensions of credit in the form of loans or participations in loans, lease financing receivables, or similar transactions. Exclude commitments that meet the definition of a derivative and must be accounted for in accordance with FASB Statement No. 133, which should be reported in Schedule RC-L, item 12. Report the unused portions of all credit card lines in item 1.b. Report in items 1.a and 1.c through 1.e the unused portions of commitments for which the bank has charged a commitment fee or other consideration, or otherwise has a legally binding commitment. -

Chapter 19 Futures and Options

M19_MCNA8932_01_SE_C19.indd Page 1 07/02/14 9:15 PM f-w-155-user ~/Desktop/7:2:2014/Mcnally Chapter 19 Futures and Options LEARNING OBJECTIVES | LO1 | LO2 | LO3 | LO4 | LO5 | LO6 Understand the Understand futures Describe how Understand Understand the Understand basics of forward contracts, how futures are used option contracts payoffs to options intrinsic value contracts. futures are traded, to hedge price and how options contracts. and time value. and the payoffs to risk. are traded. futures contracts. M19_MCNA8932_01_SE_C19.indd Page 2 07/02/14 9:15 PM f-w-155-user ~/Desktop/7:2:2014/Mcnally Futures and Options History of Futures and Options Introduction Futures and options are derivative contracts . The term “derivative” is used because the price of a future or option is derived from the price (level) of an underlying asset (variable). The Explain It video presents an overview of the derivatives, markets, and some of the assets (variables) underlying Chicago Mercantile Exchange futures and options contracts. In this chapter, we introduce derivatives as tools that companies use to reduce price risk . An action that reduces price risk is called a hedge. We will focus on hedging with derivatives. An action that increases price risk is called speculating. Speculators accept price risk in the hope of making a profi t. The derivatives markets are a place where hedgers pass their price risk off to speculators. The Explain It video provides a simple example of a business using a derivative (a futures contract) to hedge a price risk. Also in this chapter, we will provide the detail that you need to fully understand the profi ts of a futures transaction. -

Product Specific Contract Terms and Eligibility Criteria Manual

PRODUCT SPECIFIC CONTRACT TERMS AND ELIGIBILITY CRITERIA MANUAL CONTENTS Page SCHEDULE 1 REPOCLEAR ................................................................................................... 3 Part A Repoclear Contract Terms: Repoclear Contracts arising from Repoclear Transactions, Repo Trades or Bond Trades .......................................................... 3 Part B Product Eligibility Criteria for Registration of a RepoClear Contract ................... 9 Part C Repoclear Term £GC Contract Terms: Repoclear term £GC Contracts Arising From Repoclear Term £GC Transactions Or Term £GC Trades ........................ 12 Part D Product Eligibility Criteria for Registration of a RepoClear Term £GC Contract ............................................................................................................................. 19 SCHEDULE 2 SWAPCLEAR ................................................................................................ 21 Part A Swapclear Contract Terms ................................................................................... 21 Part B Product Eligibility Criteria for Registration of a SwapClear Contract ................ 36 SCHEDULE 3 EQUITYCLEAR ............................................................................................. 46 Part A EquityClear (Equities) Contract Terms ................................................................ 46 Part B EquityClear Eligible (Equities) ............................................................................ 48 Part C EquityClear -

The Dynamics of Commodity Spot and Future Markets

The Dynamics of Commodity Spot and Futures Markets: A Primer Robert S. pindyck* I discuss the short-run dynamics of commodity prices, production, and inventories, as well as the sources and effects of market volatility. I explain how prices, rates of production, ana’ inventory levels are interrelated, and are determined via equilibrium in two interconnected markets: a cash market for spot purchases and sales of the commodity, and a market for storage. I show how equilibrium in these markets affects and is affected by changes in the level qf price volatility. I also explain the role and behavior of commodity futures markets, and the relationship between spot prices, futures prices, and inventoql behavior. I illustrate these ideas with data for the petroleum complex - crude oil, heating oil, and gasoline - over the past two decades. INTRODUCTION The markets for oil products, natural gas, and many other commodities are characterized by high levels of volatility. Prices and inventory levels fluctuate considerably from week to week, in part predictably (e.g., due to seasonal shifts in demand) and in part unpredictably. Furthermore, levels of volatility themselves vary over time. This paper discusses the short-run dynamics of commodity prices, production, and inventories, as well as the sources and effects of market volatility. I explain how prices, rates of production, and inventory levels are interrelated, and are determined via equilibrium in two interconnected markets: a cash market for spot purchases and sales of the commodity, and a market for storage. I also explain how equilibrium in these markets affects and is affected by changes in the level of price volatility. -

Financial Services Guide As Amended, Supplemented Or Updated from Time to Time

Ingenuity that bridges you with the global marketplace Product Disclosure Statement November 24, 2016 | Version 1.3 Issuer: Cambridge Mercantile (Australia) Pty. Ltd. (ACN 126642448) Address: Suite 13.02, Level 13, 35 Clarence Street Sydney, NSW, Australia Web: www.cambridgefx.com.au Phone: 1300 553 140 Fax: (02) 9262 1522 Email: [email protected] Australian Financial Services Licence Number: 351278 Table of Contents 1. Key Information – pg. 3 2. Spot Contracts – pg. 4 3. Forward Contracts – pg. 5 4. Non-Deliverable Forwards – pg. 8 5. Bids (or Market Orders) –pg. 11 6. Options –pg. 13 7. Significant benefits common to all our products –pg.20 8. Significant risks common to all our products –pg. 20 9. Are there any credit requirements prior transacting? –pg. 21 10.How we are paid, and what are the product costs? –pg. 22 11.Terms and Conditions –pg. 22 12.Providing instructions by telephone –pg. 23 13.How we handle your money –pg. 23 14.Client Monies –pg. 23 15.Stopping or cancelling a payment –pg. 23 16.Tax implications –pg. 24 17.What are our different roles? –pg. 24 18.How do we handle your personal information? –pg. 24 19.Would you like more information? –pg. 24 20.What should you do if you have a complaint? –pg. 24 21.Glossary –pg. 25 2 Cambridge | Product Disclosure Statement | 24 - 11 - 2016 1. Key Information Cambridge Mercantile (Australia) Pty. Ltd. [ACN 126642448 and Australian Financial Services License 351278] (Cambridge, us, we, our) is the issuer of the products described in this Product Disclosure Statement (PDS). -

The Impact of Energy Derivatives on the Crude Oil Market

THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY OF RICE UNIVERSITY THE IMPACT OF ENERGY DERIVATIVES ON THE CRUDE OIL MARKET JEFF FLEMING ASSISTANT PROFESSOR OF FINANCE JONES SCHOOL OF MANAGEMENT, RICE UNIVERSITY BARBARA OSTDIEK ASSISTANT PROFESSOR OF FINANCE JONES SCHOOL OF MANAGEMENT, RICE UNIVERSITY THE IMPACT OF ENERGY DERIVATIVES ON THE CRUDE OIL MARKET Introduction Beginning in the 1970s, deregulation dramatically increased the degree of price uncertainty in the energy markets, prompting the development of the first exchange- traded energy derivative securities. The success and growth of these contracts attracted a broader range of participants to the energy markets and stimulated trading in an even wider variety of energy derivatives. Today, many exchanges and over-the-counter markets worldwide offer futures, futures options, swap contracts, and exotic options on a broad range of energy products, including crude oil, fuel oil, gasoil, heating oil, unleaded gasoline, and natural gas. It is well known that derivative securities provide economic benefits. The key attribute of these securities is their leverage (i.e., for a fraction of the cost of buying the underlying asset, they create a price exposure similar to that of physical ownership). As a result, they provide an efficient means of offsetting exposures among hedgers or transferring risk from hedgers to speculators. In addition, derivatives promote information dissemination and price discovery. The leverage and low trading costs in these markets attract speculators, and as their presence increases, so does the amount of information impounded into the market price. These effects ultimately influence the underlying commodity price through arbitrage activity, leading to a more broadly based market in which the current price corresponds more closely to its true value. -

Energy Derivatives and Risk Management

Department of Business and Management Master thesis in Advanced Corporate Finance ENERGY DERIVATIVES AND RISK MANAGEMENT SUPERVISOR: CANDIDATE: Prof. Raffaele Oriani Alessia Gidari 643081 CO-SUPERVISOR: Prof. Simone Mori ACADEMIC YEAR 2012-2013 1 Table of contents Abstract ...........................................................................................................................4 Introduction......................................................................................................................5 1. Risk management 1.1. A brief historical background……………………………………………………………….9 1.2. Risk definition and measurement……………………………………………………….10 1.3. The risk in corporate finance……………………………………………………………….12 1.4. The reasons for hedging……………………………………………………………………..13 1.5. The risk in capital investment……………………………………………………………..15 1.6. From hedging to risk management……………………………………………………..17 2. Enterprise risk management 2.1. Definition……………………………………………………………………………………………19 2.2. Implementation………………………………………………………………………………….20 2.3. Case studies in literature…………………………………………………………………….23 2.4. Empirical observations………………………………………………………………………..26 2.5. Evolution of risk management…………………………………………………………….32 3. The quantitative tools of risk management 3.1. The Black-Scholes model…………………………………………………………………….35 3.2. The main VaR methodologies……………………………………………………………..37 3.2.1. The historical simulation…………………………………………………………38 3.2.2. The Variance-covariance or analytical method……………………….39 3.2.3. The Monte Carlo method………………………………………………………..41 -

A Market Consistent Gas Storage Modelling Framework: Valuation, Calibration, & Model Risk

A Market Consistent Gas Storage Modelling Framework: Valuation, Calibration, & Model Risk by Greg Kiely B.Sc, National University of Ireland, Galway, (1st Hons.) M.Sc University of Limerick, (1st Hons.) Submitted to the Department of Accounting and Finance, Kemmy Business School, University of Limerick in December 2015, in partial fulfillment of the requirements for the degree of Doctor of Philosophy Abstract A typical natural gas derivatives book within an energy trading business, bank, or even large utility will generally be exposed to two broad categories of market risk. The first being outright price volatility, where contracts such as caps/floors, options and swing, will have a non-linear exposure to the variability of the gas price level. The second, although equally as prominent, is time-spread volatility where gas storage, take-or-pay contracts, and calendar spread options will be exposed to the realized variability of different time-spreads. Developing a market consistent valuation framework capable of capturing both risk exposures, and thus allowing for risk diversification within a natural gas trading book, is the primary goal of this thesis. To accomplish this, we present a valuation methodology which is capable of pricing the two most actively traded natural gas derivative contracts, namely monthly options and storage, in a consistent manner. The valuation of the former is of course trivial as the prices are set by the market, therefore the primary focus of this thesis is in obtaining market-based pricing measures for the purpose of storage valuation. A consistent pricing and risk management framework will, by definition, accurately reflect the cost of hedging both outright and spread volatility and thus our work can be viewed as a ba- sis capable of incorporating the other less actively traded contracts listed above. -

Currency Option Pricing Ii

Jones Graduate School Masa Watanabe Rice University INTERNATIONAL FINANCE MGMT 657 CURRENCY OPTION PRICING II ¾ Calibrating the Binomial Tree to Volatility ¾ Black-Scholes Model for Currency Options Properties of the BS Model ¾ Option Sensitivity Analysis Delta Gamma Vega Theta Rho International Finance Fall 2003 CURRENCY OPTION PRICING II Calibrating the Binomial Tree Instead of u and d, you will usually obtain the volatility, σ , either as Historical volatility à Compute the standard deviation of daily log return (ln(St/ St-1)) à Multiply the daily volatility by √252 to get annual volatility Implied volatility ¾ In reality, both types of volatility are available from, e.g., Reuters. ¾ In fact, OTC options are quoted by implied volatility. Euro options quotes, Reuters, 11/27/2003 ¾ To construct a binomial tree that is consistent with a given volatility, set u = eσ dt , d = e−σ dt , where dt = τ/n is the length of a time step (a subtree) and n is the number of time steps (subtrees) until maturity. 2 International Finance Fall 2003 CURRENCY OPTION PRICING II Example. Let us construct a one-period tree that is consistent with a 10% volatility. Using this tree, we will price call and put options. Spot S = 1.15$/€ Strike K = 1.15$/€ Domestic interest rate i$ = 1.2% (continuously compounded) Foreign interest rate i€ = 2.2% (continuously compounded) Volatility σ = 10% (annualized) Time to maturity = 6 months (τ = 0.5) u = exp(.1×√.5) = 1.0773 d = exp(-.1×√.5) = 0.93173 q = [exp((.012 – .022)×.5) – d]/(u – d) = 0.44709 Risk neutral pricing gives C = [.08426×q + 0×(1 – q)]×exp(-.012×.5) = .03745 P = [0×q + .07851×(1 – q)]×exp(-.012×.5) = .04315 Spot rate ($/€) q=.44709 1.2343 1.15 1-q=.55291 1.0715 Call Put .08426 0 .03745 .04315 0 .07851 3 International Finance Fall 2003 CURRENCY OPTION PRICING II ¾ As the number of time steps increases (n → ∞ and dt → 0), the binomial model price converges to the Black-Scholes price.