100-Baggers Copyright © Agora Financial, LLC, 2015 All Rights Reserved

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital Compounders How to Beat the Market and Make Money Investing in Growth Stocks Revised & Expanded Second Edition

Capital Compounders How to Beat the Market and Make Money Investing in Growth Stocks Revised & Expanded Second Edition Robin R. Speziale National Bestselling Author, Market Masters [email protected] | RobinSpeziale.com Copyright © 2018 Robin R. Speziale All Rights Reserved. ISBN: 978-1-7202-1080-1 DISCLAIMER Robin Speziale is not a register investment advisor, broker, or dealer. Readers are advised that the content herein should only be used solely for informational purposes. The information in “Capital Compounders” is not investment advice or a recommendation or solicitation to buy or sell any securities. Robin Speziale does not propose to tell or suggest which investment securities readers should buy or sell. Readers are solely responsible for their own investment decisions. Investing involves risk, including loss of principal. Consult a registered professional. CONTENTS START HERE vi INTRODUCTION 1 1 How I Built a $300,000+ Stock Portfolio Before 9 30 (And How You Can Too!) My 8-Step Wealth Building Journey 2 Growth Investing vs. Value Investing 21 3 My 72 Rules for Investing in Stocks 28 4 Capital Compounders (Part 1/2) 77 5 Next Capital Compounders (Part 2/2) 88 6 Think Short: Becoming a Smarter Investor 96 7 Small Companies; Big Dreams 106 8 How to Find Tenbaggers 123 9 How I Manage My Stock Portfolio and Generate 131 Outsized Returns – The Three Bucket Model 10 How This Hedge Fund Manager Achieved a 141 24% Compound Annual Return (Since 1998!) 11 100+ Baggers – Top 30 Super Stocks 145 12 Small Cap Ideas – Tech Investor Interview -

Autumn 2K6 Publisher 06G Spare

Total Liberty A journal of Evolutionary Anarchism Volume 5 Number 3 AutuAutumnmn / Winter 2006 £1.00 Radicals held a conference this year in Leeds at- tended by one of Total Liberty’s regular writers. His CONTENTS comments as to the main difference between this and other secular anarchist gatherings were “I was warmly greeted as a stranger, the ratio of women and men was fairly even, the talks and workshops started and Editorial ............................................................. Page 2 finished on time, there was a greater emphasis on The Critics of Clone Towns listening than speaking. It was all very refreshing. I came away quite liking these people. Most choose to By Nigel Meek ................................................... Page 3 live a very simple life; they are as anti-hierarchical Three Examples of Free Association and anti-state as the rest of us. A lot of ideas floating By Steve Cullen ................................................ Page 4 around and a pronounced absence of dogma. It brought home to me the importance of tolerance and A Rebirth of Anarchism? integrity needed in a free community.” by Larry Gambone ............................................ Page 6 “Do the small things” is a saying attributed to Saint The strange case of Kropotkin’s chair, David, a 6th century religious figure from Wales, but it Clement Attlee’s pipe and a Brighton omnibus is as valid today for non-religious individuals, small groups and also for anarchist politics. To welcome by Chris Draper.................................................. Page 8 new comrades, to listen to others, to be open to new Can there be such a thing as a Christian Anarchist? ideas and interpretations, these are vital if anarchists are to keep in touch with being human, and also if the By Keith Hebden .............................................. -

Interfaces of Location and Memory: an Exploration of Place Through Context-Led Arts Practice

Title Interfaces of location and memory: An exploration of place through context-led arts practice. Type Thesis URL http://ualresearchonline.arts.ac.uk/7764/ Date 2011 Citation Lovejoy, Annie (2011) Interfaces of location and memory: An exploration of place through context-led arts practice. PhD thesis, University of the Arts London and Falmouth University. Creators Lovejoy, Annie Usage Guidelines Please refer to usage guidelines at http://ualresearchonline.arts.ac.uk/policies.html or alternatively contact [email protected]. License: Creative Commons Attribution Non-commercial No Derivatives Unless otherwise stated, copyright owned by the author Interfaces of location and memory An exploration of place through context-led arts practice. Annie Lovejoy Falmouth University A thesis submitted in partial fulfillment of the requirements of the University of the Arts London for the degree of Doctor of Philosophy __________ August 2011 Interfaces of location and memory An exploration of place through context-led arts practice TEXT Abstract Interfaces of location and memory is a conceptual framework that invites an understanding of context-led arts practice that is responsive to the particularities of place, rather than a model of practice that is applied to a place.! ‘Socially engaged’ and ‘relational’ practice are examples of contemporary arts field designations that suggest a modus operandi – an operative arts strategy. The presence of such concepts form the necessary conditions for investment in public art sector projects, biennales, community outreach and regeneration programmes. The problem here is that the role of the artist/artwork can be seen as promising to be transformational, but in reality this implied promise can compromise artistic integrity and foreclose a work’s potential. -

Corporate Governance Case Studies Volume Three

CORPORATE GOVERNANCE CASE STUDIES VOLUME THREE Edited by Mak Yuen Teen Corporate Governance Case Studies Volume three Mak Yuen Teen FCPA (Aust.) Editor First published October 2014 Copyright ©2014 Mak Yuen Teen and CPA Australia. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, except for inclusion of brief quotations in a review. The views expressed in this publication are those of the authors and do not necessarily represent the views of, and should not be attributed to, CPA Australia Ltd. Please contact CPA Australia or Professor Mak Yuen Teen for permission of use of any case studies in this publication. Corporate Governance Case Studies Volume Three Editor : Mak Yuen Teen FCPA (Aust.) Editor’s email : [email protected] Published by : CPA Australia Ltd 1 Raffles Place #31-01 One Raffles Place Singapore 048616 Website : cpaaustralia.com.au Email : [email protected] ISBN : 978-981-09-1544-5 II Contents Contents III Foreword V Preface VII Singapore Cases Airocean in Choppy Waters ...............................................................................1 A Brewing Takeover Battle for F&N ..................................................................10 Hong Fok Corporation: The Badger and The Bear............................................20 Olam in Muddy Waters ....................................................................................29 -

Learn the Rules to Making Strong Media Relationships That Improve Your Business by Shawn Duperon Making the Media Work for You

Making the Media Work for You Learn the rules to making strong media relationships that improve your business By Shawn Duperon Making the Media Work for You By Shawne Duperon Copyright © 2013 by Horsesmouth, LLC. All rights reserved. No part of this report may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, faxing, e‐ mailing, posting online or by any information storage and retrieval system without permission by the Publisher. Unauthorized use, reproduction or distribution of the material contained in this report is a violation of federal law and punishable by civil and criminal penalty. Multiple copies of Horsesmouth reports may be purchased for business or promotional use for special sales. For information, contact: Horsesmouth, LLC. 1.888.336.6884 (Outside the U.S: 1‐212‐343‐8760) [email protected] 21 West 38th Street New York, NY 10018 Edition 1.0 Editor’s note: Shawne Duperon is a six-time Emmy Award winning media coach and has been in the TV business for nearly 20 years. She has taught thousands how to communicate as leaders while networking and marketing and social and traditional media. Shawne works with corporations, entrepreneurs, universities, and government agencies across the globe. She’s collaborated with many best-selling authors and replaced Bill Ford of Ford Motor Company when she spoke at the Department of Defense and even lectures on cruise ships. Shawne has interviewed many U.S. presidents and filmed hundreds of celebrities. You may have seen her on national networks such as CNN, CBS’ early show, and seen her featured in USA Today. -

Cornell Alumni News

VOL. XX., No. 11 [PRICE TEN CENTS] DECEMBER 6, 1917 Hundreds of Applicants for the Officers' Training Camps List of Faculty Members in the National Service An Undergraduate Demand for Higher Scholarship Standards Two More Cornell Men Receive the War Cross Pennsylvania 37, Cornell 0 ITHACA, NEW YORK CORNELL ALUMNI NEWS The Farmers' Loan and Herbert G. Ogden Jas. H. Oliphant & Co. E. E., '97 Trust Company ALFRED L. NORRIS, FLOYD W. MUNDY '98 Attorney and Counsellor at Law J. NORRIS OLIPHANT Όl 16, 18, 20, 22 William St., New York Patents and Patent Causes J. J, BRYANT, jr., '98, FRANK L. VAN WIE Branch, 475 Fifth Ave. 120 Broadway New York Members New York Stock Exchange T Λxrτϊr»xr ί 16 Pal1 Mal1 East» S W 1 and Chicago Stock Exchange LONDON \ 26 Old Broad Street, E. C. 2 PARIS 41 Boulevard Haussman Going to Ithaca? New York Office, 61 Broadway Chicago Office,711 The Rookery LETTERS OF CREDIT Use the "Short Line" FOREIGN EXCHANGES between CABLE TRANSFERS Auburn (Monroe St.) and Ithaca Cascadilla School The Leading Better Quicker Cheaper Direct connections at Auburn with Preparatory School for Cornell New York Central Trains for Syra- Located at the edge of the University Do You Use cuse, Albany and Boston. campus. Exceptional advantages for college entrance work. Congenial living. Press Clippings? Athletic training. Certificate privilege. For information and catalogue address: It will more than pay you to secure our extensive service cover- W. D. Funkhouser, Principal ing all subjects, trade and personal Ithaca, N. Y. and get the benefit of the best and Trustees most systematic reading of all papers and periodicals, here and Franklin C. -

How Can Bad News Increase Price? Short Squeezes After Short-Selling Attacks

How Can Bad News Increase Price? Short Squeezes After Short-Selling Attacks Lorien Stice-Lawrence University of Southern California [email protected] Yu Ting Forester Wong University of Southern California [email protected] Wuyang Zhao University of Texas at Austin [email protected] July 2021 Abstract We examine market returns following short-selling attacks, where short sellers publicly disclose the negative information that led them to short their targets. Counterintuitively, we find that for a significant proportion of these attacks (about 30%), the initial market reactions are positive. Consistent with short squeezes being a major driver of these positive returns, we demonstrate that about half of initially positive returns fully reverse over the following quarter, relative to about a third of initially negative returns, and this asymmetric reversal pattern cannot be explained by short sellers profitably covering their positions, by misleading disclosures, or by market attention. Further, short covering levels are high for target firms with initially positive returns that reverse, further suggesting that price pressure from short sellers forced to close their positions explains some of these positive returns. We find that short squeezes are difficult to predict ahead of time but may be triggered by conditions on the day of the attack, including insider purchases, highlighting the difficulty short sellers face in avoiding this risk. Lastly, short squeezes impose substantial costs on short sellers, leading to an average loss of $70 million per suspected squeezed campaign relative to estimated profits of $35 million per successful campaign. Keywords: short squeezes, short attacks, short selling, financial disclosure This paper benefitted from discussions with Soren Aandahl of Blue Orca Capital, Carson Block of Muddy Waters Research, Marc Cohodes, and Ivan Cosovic of Breakout Point about institutional details of activist short selling. -

Albums‐ Chart‐History Regarding Albums Top 50 ‐ Charts the Rolling Stones

Month of 1st Entry Peak+wks # 1: DE GB USAlbums‐ Chart‐History Regarding Albums Top 50 ‐ Charts The Rolling Stones 1 2 3 4 04/1964 3 1 12 11 11/1964 3 12/1964 4 01/1965 1 3101 The Rolling Stones (England's 12 X 5 Around And Around Rolling Stones No. 2 Newest Hit Makers) 5 6 7 8 04/1965 5 08/1965 2 2 1 3 11/1965 1 4 12/1965 4 The Rolling Stones, Now! Out Of Our Heads Bravo Rolling Stones December's Children (And Everybody's) 9 10 11 12 04/1966 1 881 2 04/1966 4 3 01/1967 6 01/1967 2 Aftermath Big Hits (High Tide And Green Got Live If You Want It The Rolling Stones Live Grass) 13 14 15 16 01/1967 2 3 2 08/1967 7 3 12/1967 4 3 2 12/1968 8 3 5 Between The Buttons Flowers Their Satanic Majesties Request Beggars Banquet Month of 1st Entry Peak+wks # 1: DE GB USAlbums‐ Chart‐History Regarding Albums Top 50 ‐ Charts The Rolling Stones 17 18 19 20 09/1969 13 2 2 12/1969 3 1 1 3 09/1970 6 1 2 6 04/1971 30 4 Through The Past Darkly (Big Let It Bleed Get Yer Ya‐Ya's Out! Stone Age Hits Vol. 2) 21 22 23 24 04/1971 1 351 1 409/1971 19 01/1972 3 4 03/1972 14 Sticky Fingers Gimme Shelter Hot Rocks 1964 ‐ 1971 Milestones 25 26 27 28 05/1972 2 1 241 11/1972 41 01/1973 9 09/1973 2 1 241 Exile On Main Street Rock'n'Rolling Stones More Hot Rocks (Big Hits & Goat's Head Soup Fazed Cookies) 29 30 31 32 10/1974 12 2 1 1 06/1975 45 8 06/1975 14 6 12/1975 7 It's Only Rock'n'roll Metamorphosis Made In The Shade Rolled Gold ‐ The Very Best Of The Rolling Stones Month of 1st Entry Peak+wks # 1: DE GB USAlbums‐ Chart‐History Regarding Albums Top 50 ‐ Charts The Rolling -

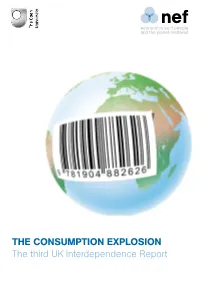

THE CONSUMPTION EXPLOSION the Third UK Interdependence Report the UK’S Global Ecological Footprint

THE CONSUMPTION EXPLOSION The third UK Interdependence Report The UK’s global ecological footprint The United Kingdom consumes products from around the world creating a large ecological footprint. The footprint measures natural resources by the amount of land area required to provide them. This map shows fl ow lines for imported resources that make up our footprint. To attribute impacts properly to the UK consumer, the area required to produce imported goods – a standardised measure of resource use called ‘global hectares’ (gha) – is subtracted from the footprint of the producing countries and is added to the UK’s account. This map is based on data for the total footprint of imports, and summed across product categories. NB: Europe as a source of products is shown disproportionately large because adjustments are not made for re-exports due to the complications of tracing certain goods. This may create a bias suggesting that more raw resources come from European ports when in fact it was merely their most recent port of call on their way from their original source. Our way of life in the UK would be unthinkable without the human, cultural, economic and environmental contributions made by the rest of the world. Our global interdependence is inescapable. But it can also be troubling. The burden in terms of resource consumption that our lifestyles exert on the fields, forests, rivers, seas and mines of the rest of the world is increasing. Months tick by to the point when it becomes much harder to avert runaway climate change. In spite of the global economic downturn, during a typical calendar year, the world as a whole now still goes into ecological debt on 25 September. -

THE IDLER's COMPANION an Anthology of Lazy Literature

THE IDLER'S COMPANION An Anthology of Lazy Literature Edited by Tom Hodgkinson & Matthew De Abaitua FOURTH ESTATE • London CONTENTS Introduction 9 Acknowledgements 11 THE COURTIER The Idler No. 1, Samuel Johnson 12 Oblomov, Ivan Goncharov 14 Cain's Book, Alexander Trocchi 15 On Being Idle, Jerome K. Jerome 17 Enemies of Promise, Cyril Connolly 23 The Idler No. 31, Samuel Johnson 23 Bartleby, Herman Melville 2.6 On Idleness, Michel de Montaigne 33 Phrases and Philosophies for the Use of the Young, Oscar Wilde 35 An Apology for Idlers, Robert Louis Stevenson 35 The Idler No.30, Samuel Johnson 44 Oblomov, Ivan Goncharov 46 On Presumption, Michel de Montaigne 52 On Lying In Bed, G.K. Chesterton 55 THE EPICUREAN Be You Drunken! Charles Baudelaire 60 Miles: The Autobiography Miles Davis 60 Barthes on Barthes, Roland Barthes 64 Against Nature, J.-K. Huysmans 65 Eight Miles High, Will Self 68 A Season in Hell, Rimbaud 73 The Ruba'iyat of Omar Khayyam 75 Labour of Love, Suzanne Moore 80 Don Juan, Lord Byron 83 Dr Faustus, Christopher Marlowe 84 The Critic As Artist, Oscar Wilde 85 THE MONK Lao Tzu 94 Swann's Way, Marcel Proust 94 The Importance of Loafing, Lin Yutang 95 Pensees, Blaise Pascal 109 Ode On Indolence, John Keats 112 Opium, Jean Cocteau 115 Provoked Life, Gottfried Benn 115 The Marriage of Heaven and Hell, William Blake 116 On Experience, Michel de Montaigne 117 Ethics, Aristotle 118 Pensees, Blaise Pascal 122 Walden, Henry David Thoreau 122 Poems, Wang Wei 126 Phrases and Philosophies for the Use of the Young, Oscar Wilde 127 Forest Notes: Idle Hours, Robert Louis Stevenson 127 Damien Hirst Interview, The Idler No. -

THE HARTLAND POST First Published in 2015, in the Footsteps of Th Omas Cory Burrow’S “Hartland Chronicle” (1896-1940) and Tony Manley’S “Hartland Times” (1981-2014)

THE HARTLAND POST First published in 2015, in the footsteps of Th omas Cory Burrow’s “Hartland Chronicle” (1896-1940) and Tony Manley’s “Hartland Times” (1981-2014) Issue No. 20 Autumn 2020 £1 ‘A Prevailing Wind’ by Merlyn Chesterman THE HARTLAND POST A quarterly news magazine for Hartland and surrounding area Issue No. 20 Autumn 2020 Printed by Jamaica Press, Published by Th e Hartland Post Layout: Kris Tooke All communications to: Th e Editor, Sally Crofton, Cover: 'Gathering blackberries near 102 West Street, EX39 6BQ Hartland. Welcombe church' by Peter Stiles Tel. 01237 441617 Email: [email protected] Website: John Zalewski WHERE ARE WE NOW? Another three months have slipped by since the last edition of the seen any signifi cant rise since the lifting of lockdown. Hartland’s Hartland Post, an edition that was dominated by Covid 19. We hospitality trade was able to open in early July and our visitors had all been hoping this life-changing invasion by a virus would have mostly been considerate and thrilled to escape their city now be fading into the past. After all, we have now harvested the prisons to enjoy holidays at the seaside. Our wonderful shops, fruits of our labours in the veggie patch, been duly disappointed restaurants and pubs have maintained an excellent service, both to that the Garden Show 2020 was cancelled, because of the you- locals and visitors, putting in measures to keep us all safe. know-what, and we couldn’t show off our prize-winning fruit and As we move into Autumn, we clearly have to remain vigilant and veg. -

Activist Insight and the Wall Street Journal

2016 ACTIVIST INVESTING An annual review of trends in shareholder activism In association with “Schulte Roth & Zabel … [has] come to dominate the activism market.” — REUTERS “… Schulte Roth & Zabel partners … have UNPARALLELED established themselves as go-to lawyers for activist investors across the United States.” EXPERIENCE — THE AMERICAN LAWYER “SRZ’s clients in the U.S. include several of the highest-profile activist managers …” — FINANCIAL TIMES “Dissident investors are increasingly looking to deploy deep capital reserves outside their bread-and-butter U.S. market, driving Schulte Roth & Zabel LLP to bring its renowned shareholder activism practice to the U.K. – a jurisdiction experts say is on the brink of an activism boom.” — LAW360 Schulte Roth & Zabel is frequently named one of the top law firms for providing legal advice to activist funds. — ACTIVIST INSIGHT AND THE WALL STREET JOURNAL Schulte Roth & Zabel LLP | New York | Washington DC | London | www.srz.com The contents of these materials may constitute attorney advertising under the regulations of various jurisdictions. Editor’s foreword Activist Insight’s Josh Black on a busy year for activism. he end of another year of Microsoft, Darden Restaurants and will be reviewing their options more increased activist activity General Electric added value. frequently in anticipation of activists. T provides a useful opportunity It is not easy to imagine the merger for reflection. What changed in 2015 Moreover, where activists made of DuPont and Dow Chemical in an that wasn’t already in flux and which mistakes, it was far from clear that environment devoid of activists, for trends have been arrested? Is it fair activism was the cause of their trouble.