Pennsylvania Real Estate Investment Trust ®

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

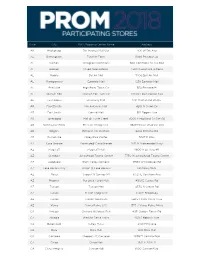

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Q413 Supplemental 021814.Xlsx

Pennsylvania Real Estate Investment Trust ® Supplemental Financial and Operating Information Quarter Ended December 31, 2013 www.preit.com NYSE: PEI NYSE: PEIPRA, PEIPRB Pennsylvania Real Estate Investment Trust Supplemental Financial and Operating Information December 31, 2013 Table of Contents Introduction Company Information 1 Market Capitalization and Capital Resources 2 Operating Results Statement of Operations - Proportionate Consolidation Method - Quarters Ended December 31, 2013 and December 31, 2012 3 Statement of Operations - Proportionate Consolidation Method - Years Ended December 31, 2013 and December 31, 2012 4 Statement of Net Operating Income - Quarters and Years Ended December 31, 2013 and December 31, 2012 5 Computation of Earnings Per Share 6 Funds From Operations and Funds Available for Distribution - Quarters Ended December 31, 2013 and December 31, 2012 7 Funds From Operations and Funds Available for Distribution - Years Ended December 31, 2013 and December 31, 2012 8 Operating Statistics Leasing Activity Summary 9 Summarized Sales and Rent Per Square Foot and Occupancy Percentages 10 Mall Occupancy Percentage and Sales Per Square Foot 11 Strip and Power Center Occupancy Percentages 12 Top Twenty Tenants 13 Lease Expirations 14 Property Information 15 Department Store Lease Expirations 17 Balance Sheet Condensed Balance Sheet - Proportionate Consolidation Method 19 Investment in Real Estate 20 Capital Expenditures 22 Debt Analysis 23 Debt Schedule 24 Selected Debt Ratios 25 Definitions 26 Forward Looking Statements 27 Pennsylvania Real Estate Investment Trust Company Information Background Pennsylvania Real Estate Investment Trust, founded in 1960 and one of the first equity REITs in the U.S., has a primary investment focus on retail shopping malls. As of December 31, 2013, the Company owned interests in 43 retail properties, 40 of which are operating retail properties and three are development properties. -

Pennsylvania Real Estate Investment Trust

Pennsylvania Real Estate Investment Trust QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005) www.preit.com Pennsylvania REIT QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005) Table of Contents Company Information 1 Property Development/Redevelopment Summary 19 Timeline/Recent Developments 2 Top Twenty Tenants Schedule 20 Stock Information 3 Lease Expiration Schedule - Anchor Tenants 21 Market Capitalization and Capital Resources 4 Lease Expiration Schedule - Non-Anchor Tenants 22 Balance Sheet--Wholly Owned and Partnerships Detail 5 New Lease/Renewal Summary and Analysis 23 Balance Sheet--Property Type 6 Capital Expenditures-Quarterly 24 Income Statement--Wholly Owned and Partnerships Detail -Quarterly Comparison 7 Enclosed Mall-Summary and Occupancy 25 Income Statement--Property Type- Quarterly Comparison 8 Enclosed Mall-Rent Summary 26 Income Statement--Retail (Property Status) -Quarterly Comparison 9 Power Center- Summary and Occupancy 27 Income Statement--Retail (Property Subtype) -Quarterly Comparison 10 Strip Center- Summary and Occupancy 28 FFO and FAD 11 Retail Overall- Summary and Occupancy 29 Key Ratios 12 Summary of Portfolio Services 30 Property Debt Schedule--Wholly Owned 13 Flash Report-Quarterly 31 Property Debt Schedule--Partnerships 14 Debt Analysis 15 RECONCILIATION TO GAAP: Debt Ratios 16 Balance Sheet-Reconciliation to GAAP 32 Portfolio Summary--Retail 17 Income Statement-Reconciliation to GAAP -Quarterly 33 Property Acquisitions/Dispositions- Quarterly Summary 18 Flash Report-Reconciliation to GAAP- Quarterly 34 Definitions page 35 THIS QUARTERLY SUPPLEMENTAL DISCLOSURE CONTAINS CERTAIN “FORWARD-LOOKING STATEMENTS” THAT RELATE TO EXPECTATIONS, PROJECTIONS, ANTICIPATED EVENTS, TRENDS AND OTHER MATTERS THAT ARE NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS REFLECT PREIT’S CURRENT VIEWS ABOUT FUTURE EVENTS AND ARE SUBJECT TO RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT MAY CAUSE FUTURE EVENTS, ACHIEVEMENTS OR RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED BY THE FORWARD-LOOKING STATEMENTS. -

Q2 Investor Update

Q2 INVESTOR UPDATE PREIT Malls ABOUT PREIT Our community-centric retail and leisure real estate solutions maximize opportunities for the communities we serve, connecting people to jobs and businesses to customers. Our portfolio is located primarily in densely-populated, high businesses barrier-to-entry markets attractive to a wide array of uses. Recognizing the role we play, we optimize our real estate to create the most sustainable business model for each community, in turn MAXIMIZING THE VALUE OF OUR customers jobs PORTFOLIO FOR STAKEHOLDERS. PREIT has spent the last decade creating a stronger portfolio that meets the needs of the modern consumer through thriving disposition of 19 lower-productivity properties, repositioning communities 19 anchor boxes with over 3 dozen new tenants and securing a differentiated tenant base that is comprised of 30% “open air” tenancy. 2 Q2 FINANCIAL HIGHLIGHTS Same store NOI is up 62% Total liquidity of $104.9 million at end of Q2 FFO per share exceeding plan at $0.10, up 267% over the 2020 quarter Core Mall June sales +16% over June 3 Q2 OPERATING HIGHLIGHTS Core Mall Rolling 12 sales are est. to have reached a new high at $549 per sq Total Core Mall leased ft, an increase of space at 92.6% 1.3% over last reported comp sales in Feb. 2020 Construction is underway 500,000 sq ft of leases for Aldi to open its first signed for future openings, store in our portfolio at expected to contribute Dartmouth Mall in annual gross rent of $10.8 Dartmouth, MA in Q3 million 2021 4 RECENT ACTIVITY Phoenix Theatres signed a lease to replace former theater at Woodland Mall in Grand Rapids HomeGoods will replace the former Bed Bath & Beyond space at Cumberland Mall New retailer, Turn 7 signed to replace the former Lord & Taylor at Moorestown Mall Our properties welcomed 15 new tenants across the portfolio in Q2, accounting for over 120,000 square feet of leased space Retailers expanding in portfolio: Aerie/Offline, Rose & Remington, Windsor, Purple and more. -

Arkansas Colorado Florida Georgia Illinois Indiana

THE FOLLOWING STORES ARE CLOSED THANKSGIVING - RE-OPEN AT 5AM FRIDAY SHOP BLACK FRIDAY DOORBUSTERS ALL DAY THANKSGIVING AT SEARS.COM ALL OTHER SEARS STORES OPEN 6PM THANKSGIVING DAY ARKANSAS ILLINOIS NEW MEXICO HOT SPRINGS SEARS PERU SEARS BROADMOOR CENTER 4501 CENTRAL AVE STE 101 1607 36TH ST 1000 S MAIN ST HOT SPRINGS, AR PERU, IL, 61354-1232 ROSWELL, NM (501) 525-5197 M(815) 220-4700 (575) 622-1310 6P NORTH PLAINS MALL THANKSGIVINGCOLORADO INDIANA 2811 N PRINCE ST CLOVIS, NM FORT COLLINS SEARS MARQUETTE S/C (575) 769-4700 3400 S COLLEGE AVENUE 3901 FRANKLIN ST FT COLLINS, CO MICHIGAN CITY , IN 46360-7314 970-297-2770 (219) 878-6600 NEW YORK TOWN SQUARE SHOPPING CTR WILTON MALL FLORIDA 120 US HIGHWAY 41 3065 ROUTE 50 SCHERERVILLE, IN SARATOGA SPGS, NY GULF VIEW SQ (219) 864-8987 (518) 583-8500 9409 US HIGHWAY 19 N STE 101 PORT RICHEY, FL (727) 846-6255 MARYLAND NORTH CAROLINA OVIEDO MARKETPLACE EAST POINT MALL MONROE MALL 1360 OVIEDO MARKETPLACE BLVD 7885 EASTERN BLVD 2115 E ROOSEVELT BLVD STE 200 OVIEDO, FL BALTIMORE, MD MONROE, NC (407) 971-2600 (410) 288-7700 (704) 225-2100 SEMINOLE TOWNE CTR TOWNMALL OF WESTMINSTER RANDOLPH MALL 320 TOWNE CENTER CIR 400 N CENTER ST 200 RANDOLPH MALL SANFORD, FL WESTMINSTER, MD ASHEBORO, NC (407) 328-2600 (410) 386-6500 (336) 633-3200 SEARSTOWN MALL 3550 S WASHINGTON AVE MISSOURI NORTH DAKOTA TITUSVILLE, FL (321) 268-9255 EAST HILLS MALL COLUMBIA MALL 3702 FREDERICK AVE 2800 S COLUMBIA RD SAINT JOSEPH, MO GRAND FORKS, ND GEORGIA (816) 364-7000 (701) 787-9300 ALBANY MALL 2601 DAWSON RD BLDG G NEW -

Promenade at Granite Run

Promenade at Granite Run Owned & Developed by: get in touch. ROB COOPER DAN BRICKNER DAVID JUDD office 856.866.1900 office 856.866.1900 office 856.866.1900 direct 856.222.3054 direct 856.222.3031 direct 856.222.3037 MetroCommercial.com | PLYMOUTH MEETING, PA | MOUNT LAUREL, NJ [email protected] [email protected] [email protected] 329,836 DAYTIME POPULATION WITHIN 7 MILES Mixed Use Retail Center integrated with Luxury Living Now Open! 830,000 SQUARE FEET OF RETAIL, RESTAURANTS & ENTERTAINMENT 400 LUXURY APARTMENTS IMMEDIATE TRADE AREA DRAW OF MORE THAN 345,020 PEOPLE WITHIN 7 MILES The Shoppes at The Shoppes at PROMENADE AT Exton Square Mall Valley Square King of Prussia Mall English Village Plymouth Meeting Mall Ellis Preserve GRANITE RUN Exton, PA North Wales, PA King of Prussia, PA North Wales, PA Plymouth Meeting, PA Newtown Square, PA 10 Mile 767,281 322,216 557,218 599,959 645,729 1,004,808 912,680 7 Mile 345,020 190,397 288,970 302,302 311,341 394,324 318,473 Population 5 Mile 136,917 102,265 153,511 180,690 156,332 185,354 126,448 10 Mile $114,171 $145,791 $130,670 $144,998 $122,150 $113,359 $115,280 7 Mile $115,788 $139,208 $130,902 $143,262 $131,109 $127,167 $153,491 Avg HH Income Avg 5 Mile $132,615 $141,885 $127,103 $129,741 $140,985 $122,124 $170,740 10 Mile 115,425 65,783 103,251 119,018 112,388 154,287 136,667 7 Mile 53,905 37,609 53,756 57,730 57,296 69,880 65,479 5 Mile 24,681 21,285 27,409 31,129 30,318 32,074 26,915 HH’s over $100K HH’s 10 Mile 737,355 339,023 567,455 655,139 666,300 1,040,096 -

Investor Update May 2017

INVESTOR UPDATE M AY 2 0 1 7 1 PREIT: Company Overview Strong market position with quality properties concentrated in mid-Atlantic’s top MSAs 23 million square feet dedicated to retail, dining and entertainment with an increasingly strong and diversified anchor mix Early-mover advantage in rapidly-changing retail environment has created differentiated platform Small scale creates outsized growth opportunities through: • Redevelopment and remerchandising • Anchor transformation • Densification 2 Geography PHILADELPHIA WASHINGTON DC Valley Mall Francis Scott Key Mall Willow Grove Park Plymouth Meeting Mall Exton Square Mall Fashion Outlets Moorestown Mall Springfield Mall Cherry Hill Mall Mall at Prince Georges Gloucester Premium Outlets Cumberland Mall Springfield Town Center PREIT’s portfolio is primarily located along the east coast with a concentration in the mid-Atlantic’s top MSA’s - Philadelphia and Washington DC. 3 Successful Transformation • Concentrated portfolio in densely populated, high barrier-to-entry markets CREATED A FOCUSED MARKET • Focused on high-quality, well-located assets in Top MSAs STRATEGY • 40% of NOI generated from Top 5 assets with sales PSF of $588 • Significantly reduced risk profile through strategic disposition program • $720 million raised OPTIMIZED PORTFOLIO • Sold 16 low-productivity malls with 2 more coming to market • Capitalizing on opportunities to improve quality through remerchandising and redevelopment • Lifestyle Experience: ~20% of space committed to dining & entertainment REVITALIZING CORE ASSETS -

Personal Rapid Transit (PRT) New Jersey

Personal Rapid Transit (PRT) for New Jersey By ORF 467 Transportation Systems Analysis, Fall 2004/05 Princeton University Prof. Alain L. Kornhauser Nkonye Okoh Mathe Y. Mosny Shawn Woodruff Rachel M. Blair Jeffery R Jones James H. Cong Jessica Blankshain Mike Daylamani Diana M. Zakem Darius A Craton Michael R Eber Matthew M Lauria Bradford Lyman M Martin-Easton Robert M Bauer Neset I Pirkul Megan L. Bernard Eugene Gokhvat Nike Lawrence Charles Wiggins Table of Contents: Executive Summary ....................................................................................................................... 2 Introduction to Personal Rapid Transit .......................................................................................... 3 New Jersey Coastline Summary .................................................................................................... 5 Burlington County (M. Mosney '06) ..............................................................................................6 Monmouth County (M. Bernard '06 & N. Pirkul '05) .....................................................................9 Hunterdon County (S. Woodruff GS .......................................................................................... 24 Mercer County (M. Martin-Easton '05) ........................................................................................31 Union County (B. Chu '05) ...........................................................................................................37 Cape May County (M. Eber '06) …...............................................................................................42 -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Multifamily Rental Market Assessment

RealPropertyResearchGroup Multifamily Rental Market Assessment Frederick County, Maryland Date: April 2010 Prepared for: Maryland Department of Housing and Community Development Community Development Administration BRAC Market Study Services Contract 10400 LITTLE PATUXENT PARKWAY SUITE 450 VOICE 410.772.1004 COLUMBIA, MARYLAND 21044 FAX 410.772.1110 RealPropertyResearchGroup April 16, 2010 Ms. Patricia Rynn Sylvester Director, Multifamily Housing Maryland Department of Housing and Community Development 100 Community Place Crownsville, Maryland 21032-2023 and Ms. Jenny Short Director Frederick County Department of Housing and Community Development 520 North Market Street Frederick, Maryland 21701 RE: Frederick County Multifamily Rental Market Assessment Dear Ms. Sylvester and Ms. Short: We are pleased to present our comprehensive assessment of the Multifamily Rental Market in Frederick County, Maryland. This is the first of two deliverables under our contract with the Maryland Department of Housing and Community Development (the “Department”). The second deliverable will be an electronic database of the inventory of multifamily rental properties in Frederick County with a ranking of the properties in order of feasibility for preservation as affordable housing. This assignment is part of the Maryland Preservation Compact, a partnership between the John D. and Catherine T. MacArthur Foundation, MD-DHCD and the eight subject Maryland counties: Anne Arundel, Baltimore, Cecil, Frederick, Harford, Howard, Prince George’s and St. Mary’s Counties. The Compact seeks to preserve the existing stock of affordable rental housing in Maryland in areas anticipated to be impacted by growth stemming from the US Department of Defense’s ongoing efforts to expand military installations throughout the state. Maryland stands to gain more military, civilian and mission contractor personnel than any other state under the Base Realignment and Closure (BRAC) recommendations approved by the President and Congress in 2005. -

271 Filed 01/06/21 Page 1 of 5

Case 20-13076-BLS Doc 271 Filed 01/06/21 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, Case No. 20-13076 (BLS) 1 : et al., : : Debtors. Jointly Administered : : Re: D.I. 45, 266 ------------------------------------------------------------ x NOTICE OF POTENTIAL ASSUMPTION AND ASSIGNMENT OF EXECUTORY CONTRACTS OR UNEXPIRED LEASES AND CURE AMOUNTS PLEASE TAKE NOTICE THAT: 1. The above-captioned debtors (collectively, the “Debtors”) each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Court”) on December 3, 2020. 2. On December 4, 2020, the Debtors filed the Motion of Debtors for Entry of Orders (I)(A) Approving Bidding Procedures for Sale of Substantially All of the Debtors’ Assets, (B) Approving Process for Designation of Stalking Horse Bidder and Provision of Bid Protections, (C) Scheduling Auction for, and Hearing to Approve, Sale of Substantially All of the Debtors’ Assets, (D) Approving Form and Manner of Notices of Sale, Auction and Sale Hearing, (E) Approving Assumption and Assignment Procedures and (F) Granting Related Relief and (II)(A) Approving Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Interests and Encumbrances, (B) Approving Assumption and Assignment of Executory Contracts and Unexpired Leases