Investor Update May 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2012 FINALISTS ICSC Is Proud to Announce the Finalists of the 2012 U.S

2012 FINALISTS ICSC is proud to announce the finalists of the 2012 U.S. MAXI Awards. The U.S. MAXI Awards honor outstanding marketing campaigns from all over the United States. Chosen by a panel of industry professionals, these finalists represent excellence throughout the industry. The 2012 U.S. Maxi Awards will be presented at ICSC’s first-ever NOI + Conference in Orlando, Florida, September 5, 2012. TRADITIONAL MARKETING - ADVERTISING Single Center Pooches Pose at The Brickyard’s PUParazzi! The Brickyard Shopping Center Chicago, Illinois Owner: Retail Properties of America, Inc. Management Company: RPAI US Management, LLC The Gateway provides Daily Dish The Gateway Salt Lake City, Utah Owner: Retail Properties of America, Inc. Management Company: RPAI, Southwest Management Favorite Label Consumer Campaign Natick Mall Natick, Massachusetts Owner/Management Company: General Growth Properties Home for the Holidays Promotional Campaign Southlake Town Square Southlake, Texas Owner: Retail Properties of America Inc Management Company: RPAI Southwest Management LLC Company 2011 Hillsdale’s South End Renovation Bohannon Development Company San Mateo, California MORE Holiday Advertising CBL & Associates Properties, Inc. Chattanooga, Tennessee Joint Center Club Estrellas E-Magazine The Shops at La Cantera and North Star Mall San Antonio, Texas Management Company: General Growth Properties TRADITIONAL MARKETING - BUSINESS-TO-BUSINESS (B2B) Single Center The Writing’s on the Wall West Acres Shopping Center Fargo, North Dakota Owner/Management Company: West Acres Development, LLP Company Think Retail. Create Value. DDR Corp. Beachwood, Ohio Keep The Dollars In Dallas United Commercial Realty Dallas, Texas TRADITIONAL MARKETING - CAUSE RELATED MARKETING Single Center Queen for a Day Aspen Grove Littleton, Colorado Owner/Management Company: DDR Corp. -

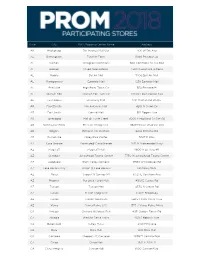

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Plymouth Road Pad BROCHURE

Specialist in Commercial & Industrial Real Estate AVAILABLE: GROUND LEASE | BUILD TO SUIT & LEASE 440 Plymouth Rd | Plymouth Meeting | Montgomery County, PA PAD SITE: RETAIL, OFFICE, RESTAURANT 60,000 + Traffic at Intersection 48,552 AADT WEST GERMANTOWN PIKE 179 Rms MID-COUNTY PLYMOUTH MEETING MALL INTERCHANGE EXIT 333 276 149 Rms 276 121,694 D A O R AAD OUTH M T Y PAD SITE L GROUND LEASE P P BUILD TO SUIT ENN 90,000 SF Class A S Oce Space Y L V ANIA TURN T AAD P IK ,691 9 E “R” 200,000 SF Class A Oce Space PARKING: 128 LIQUOR LICENSE 549’ of Frontage AVAILABLE H 202 H SITE Minutes to 276 76 476 76 Freestanding Pad Site Opportunity on +_ 1.4 Acres 202 76 Build to suit | multi-story option| 64’ x 100’ footprint Located just off of the Mid-County Interchange, the highest volume interchange of the PA Turnpike 476 128 Lined Parking Spaces | Zoned: Interchange Dev. Contact: Demographics 1 mile 3 miles 5 miles Charles Tornetta, SIOR® [email protected] Population 6,438 81,983 383,833 Daytime Population 15,569 107,555 217,426 610-279-4000 www.TORNETTA.com Median Income $89,873 $112,818 $121,118 The foregoing information has been obtained from sources deemed to be reliable; however, no warranty or representation is made as to accuracy. This information is subject to errors, omissions, prior sale or lease, or withdrawal without notice. 910 Germantown Pike, Plymouth Meeting, PA 19462 610-279-4000 FAX: 610-275-6787/ Specialist in Commercial & Industrial Real Estate Contact: AVAILABLE: GROUND LEASE | BUILD TO SUIT & LEASE Charles Tornetta, SIOR 440 Plymouth Rd | Plymouth Meeting | Montgomery County, PA [email protected] 610-279-4000 PAD SITE: RETAIL, OFFICE, RESTAURANT www.TORNETTA.com SITE PLAN EXISTING OFFICE BUILDING AVAILABLE 64’ x 100’ PAD SITE 128 LINED SPACES PLYMOUTH ROAD 9.691 ADT The foregoing information has been obtained from sources deemed to be reliable; however, no warranty or representation is made as to accuracy. -

Pennsylvania Real Estate Investment Trust

Pennsylvania Real Estate Investment Trust QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005) www.preit.com Pennsylvania REIT QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005) Table of Contents Company Information 1 Property Development/Redevelopment Summary 19 Timeline/Recent Developments 2 Top Twenty Tenants Schedule 20 Stock Information 3 Lease Expiration Schedule - Anchor Tenants 21 Market Capitalization and Capital Resources 4 Lease Expiration Schedule - Non-Anchor Tenants 22 Balance Sheet--Wholly Owned and Partnerships Detail 5 New Lease/Renewal Summary and Analysis 23 Balance Sheet--Property Type 6 Capital Expenditures-Quarterly 24 Income Statement--Wholly Owned and Partnerships Detail -Quarterly Comparison 7 Enclosed Mall-Summary and Occupancy 25 Income Statement--Property Type- Quarterly Comparison 8 Enclosed Mall-Rent Summary 26 Income Statement--Retail (Property Status) -Quarterly Comparison 9 Power Center- Summary and Occupancy 27 Income Statement--Retail (Property Subtype) -Quarterly Comparison 10 Strip Center- Summary and Occupancy 28 FFO and FAD 11 Retail Overall- Summary and Occupancy 29 Key Ratios 12 Summary of Portfolio Services 30 Property Debt Schedule--Wholly Owned 13 Flash Report-Quarterly 31 Property Debt Schedule--Partnerships 14 Debt Analysis 15 RECONCILIATION TO GAAP: Debt Ratios 16 Balance Sheet-Reconciliation to GAAP 32 Portfolio Summary--Retail 17 Income Statement-Reconciliation to GAAP -Quarterly 33 Property Acquisitions/Dispositions- Quarterly Summary 18 Flash Report-Reconciliation to GAAP- Quarterly 34 Definitions page 35 THIS QUARTERLY SUPPLEMENTAL DISCLOSURE CONTAINS CERTAIN “FORWARD-LOOKING STATEMENTS” THAT RELATE TO EXPECTATIONS, PROJECTIONS, ANTICIPATED EVENTS, TRENDS AND OTHER MATTERS THAT ARE NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS REFLECT PREIT’S CURRENT VIEWS ABOUT FUTURE EVENTS AND ARE SUBJECT TO RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT MAY CAUSE FUTURE EVENTS, ACHIEVEMENTS OR RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED BY THE FORWARD-LOOKING STATEMENTS. -

Q2 Investor Update

Q2 INVESTOR UPDATE PREIT Malls ABOUT PREIT Our community-centric retail and leisure real estate solutions maximize opportunities for the communities we serve, connecting people to jobs and businesses to customers. Our portfolio is located primarily in densely-populated, high businesses barrier-to-entry markets attractive to a wide array of uses. Recognizing the role we play, we optimize our real estate to create the most sustainable business model for each community, in turn MAXIMIZING THE VALUE OF OUR customers jobs PORTFOLIO FOR STAKEHOLDERS. PREIT has spent the last decade creating a stronger portfolio that meets the needs of the modern consumer through thriving disposition of 19 lower-productivity properties, repositioning communities 19 anchor boxes with over 3 dozen new tenants and securing a differentiated tenant base that is comprised of 30% “open air” tenancy. 2 Q2 FINANCIAL HIGHLIGHTS Same store NOI is up 62% Total liquidity of $104.9 million at end of Q2 FFO per share exceeding plan at $0.10, up 267% over the 2020 quarter Core Mall June sales +16% over June 3 Q2 OPERATING HIGHLIGHTS Core Mall Rolling 12 sales are est. to have reached a new high at $549 per sq Total Core Mall leased ft, an increase of space at 92.6% 1.3% over last reported comp sales in Feb. 2020 Construction is underway 500,000 sq ft of leases for Aldi to open its first signed for future openings, store in our portfolio at expected to contribute Dartmouth Mall in annual gross rent of $10.8 Dartmouth, MA in Q3 million 2021 4 RECENT ACTIVITY Phoenix Theatres signed a lease to replace former theater at Woodland Mall in Grand Rapids HomeGoods will replace the former Bed Bath & Beyond space at Cumberland Mall New retailer, Turn 7 signed to replace the former Lord & Taylor at Moorestown Mall Our properties welcomed 15 new tenants across the portfolio in Q2, accounting for over 120,000 square feet of leased space Retailers expanding in portfolio: Aerie/Offline, Rose & Remington, Windsor, Purple and more. -

PREIT Highlights New Portfolio Following Opening of Three

CONTACT: Heather Crowell EVP, Strategy & Communications (215) 454-1241 [email protected] PREIT Highlights New Portfolio Following Opening of Three Catalyst Projects within the Past 60 Days The opening of Fashion District Philadelphia, alongside the completed redevelopments at Woodland and Plymouth Meeting Malls, represent the culmination of PREIT’s visionary strategy Philadelphia, PA, November 12, 2019 – PREIT (NYSE: PEI) celebrated a milestone fall with the successful opening of its newest property, Fashion District Philadelphia; a new phase of tenant openings at Plymouth Meeting Mall; and the redevelopment and expansion of Woodland Mall. These three projects are the latest in PREIT’s long-term transformation plan that encompassed low-productivity asset dispositions, anchor repositioning and high-impact redevelopment and remerchandising initiatives, laying the groundwork for earnings growth and portfolio strength in the new paradigm for retail. PREIT’s investment of over $360 million and years of strategic planning at these properties has already proven successful, with sales and traffic exceeding expectations across all three opening weekends, setting the stage for the future of each property. “This was a monumental two months for PREIT as three very distinct and exciting projects came to fruition,” said Joseph F. Coradino, CEO of PREIT. “Our series of openings at Fashion District Philadelphia, Plymouth Meeting Mall and Woodland Mall exemplify our strategic vision and tactical expertise in creating environments that offer a -

Promenade at Granite Run

Promenade at Granite Run Owned & Developed by: get in touch. ROB COOPER DAN BRICKNER DAVID JUDD office 856.866.1900 office 856.866.1900 office 856.866.1900 direct 856.222.3054 direct 856.222.3031 direct 856.222.3037 MetroCommercial.com | PLYMOUTH MEETING, PA | MOUNT LAUREL, NJ [email protected] [email protected] [email protected] 329,836 DAYTIME POPULATION WITHIN 7 MILES Mixed Use Retail Center integrated with Luxury Living Now Open! 830,000 SQUARE FEET OF RETAIL, RESTAURANTS & ENTERTAINMENT 400 LUXURY APARTMENTS IMMEDIATE TRADE AREA DRAW OF MORE THAN 345,020 PEOPLE WITHIN 7 MILES The Shoppes at The Shoppes at PROMENADE AT Exton Square Mall Valley Square King of Prussia Mall English Village Plymouth Meeting Mall Ellis Preserve GRANITE RUN Exton, PA North Wales, PA King of Prussia, PA North Wales, PA Plymouth Meeting, PA Newtown Square, PA 10 Mile 767,281 322,216 557,218 599,959 645,729 1,004,808 912,680 7 Mile 345,020 190,397 288,970 302,302 311,341 394,324 318,473 Population 5 Mile 136,917 102,265 153,511 180,690 156,332 185,354 126,448 10 Mile $114,171 $145,791 $130,670 $144,998 $122,150 $113,359 $115,280 7 Mile $115,788 $139,208 $130,902 $143,262 $131,109 $127,167 $153,491 Avg HH Income Avg 5 Mile $132,615 $141,885 $127,103 $129,741 $140,985 $122,124 $170,740 10 Mile 115,425 65,783 103,251 119,018 112,388 154,287 136,667 7 Mile 53,905 37,609 53,756 57,730 57,296 69,880 65,479 5 Mile 24,681 21,285 27,409 31,129 30,318 32,074 26,915 HH’s over $100K HH’s 10 Mile 737,355 339,023 567,455 655,139 666,300 1,040,096 -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Public Transportation Services Available in Bucks County

PUBLIC TRANSPORTATION SERVICES AVAILABLE IN BUCKS COUNTY This is an interactive map that allows the user to click on public transit routes to view the schedules for each route. • Click on the area of interest within the red inset boxes. A detailed map will open in a separate window. • Use the Magnifying Glass to zoom in and out of areas you would like to view. • Use the mouse to hover over one of the route identifying symbols. • Once the Hyperlink Tool appears, click on the identifier and the appropriate bus or train schedule will appear in a separate window. • For any questions or to report problems with this map, please email Richard Brahler at [email protected] 99" Springfield 99" 99" 99" Richland 9 9" 99" Richlandtown 99" 9 9" 9 Qua kertown9 Bor ough 9" Trumbauer sville Borough 9 Nockamixon Haycock 99" 99" Richland Township 99" 9 99" 9" 9 East Rockhill Township9" West Rockhill Township 9 9" 9 9" 9 " 9 Public9 Transportation9 Services 9" 9 East West Rockhill Rockhill Township Township 9 Tinicum 9Available in" Bucks CouTownshipnty " 9 9 Bedminster Township 9" 9152 Telford Borough 9 "309 Silverdale 9 Borough 9 9" Dublin 9113 BUCKS COUNTY COMMISSIONERS Borough 9 Robert G. Loughery, Chairman 9 9" Charles H. Martin, Vice-Chairman 9 413 Diane M. Ellis-Marseglia, LCSW 9 9 "611 9 "152 9 9 9 "313 9 9 9" 932 Hilltown Township 9 9" Plumstead Township 9309 New Britain Township 9" Chalfont9 9313 Borough" 9 New Britain Borough 9" 9611 ¤£202 9" 9152 ¤£202 Doylestown 9 9 "413 " Borough 9 9263 9 9 202 "32 "152 ¤£ Solebury Township 9 9 202 9 -

Plymouth Township News

Fall 2018 MONTGOMERY COUNTY, TidingsTidingsPA Plymouth2040 Comprehensive Plan Open House You’re invited! Please join us this fall for an open house to learn about the vision, goals, and recommendations of the draft Plymouth2040 Comprehensive Plan. You will be able to provide feedback on the draft plan and vote on your priorities for recommended improvements. Your opinion is important in understanding what you want to see happen in your community! Greater Plymouth Community Center Tuesday, December 11th | 5:00 – 8:00 pm 2910 Jolly Road, Plymouth Meeting, PA 19462 Stop by whenever you’re available and stay as long as you’d like! Light refreshments will be provided. Questions or comments about Plymouth2040? Contact Marley Bice, AICP at [email protected] or 610-278-3740 Find us on Facebook! Search for Plymouth2040 and tag us #Plymouth2040 Save the Date Holiday Tree Lighting Veterans’ Ceremony Ceremony Wednesday, November 14 Wednesday, November 28 2:00 pm 6:00 pm Service and Devotion Service and Devotion Monument Monument See Page 4 for details INSIDE THIS ISSUE: Plymouth Township News ..........................................................2-3 Finance & Administration ..............................................................7 Fire Marshall’s Office ....................................................................4 Police News ..................................................................................8 Harmonville Fire Company ...........................................................5 Public Works ............................................................................9-16 -

Penn Township Chester County, Pennsylvania “A Great Place to Live

Information Packet for New Residents Welcome to Penn Township Chester County, Pennsylvania “A great place to live, work and retire.” Mission Statement “To facilitate the health, safety and well-being of the Penn Township community by providing residents, visitors and the business community with the highest quality of municipal leadership, municipal service and strategic, sustainable, effective and visionary planning in order to enhance the quality of life for all.” Vision Statement "To provide a healthy, vibrant, affordable, economically successful, progressive community where citizens feel safe, enjoy their neighborhoods and access to1 their local government and have a great place to live, work and raise their families or retire." Contents Office Information The Penn Township office building is located at 260 Lewis Road West Grove, PA 19390. Across from the Jennersville YMCA and next to Jennersville Regional Hospital. Office hours are Monday through Thursday 8:30 a.m. to 4:00 p.m. If you have any questions, don’t hesitate to call (610) 869-9620 or fax (610) 869-9194. You can also email the office at [email protected] or visit our website at www.penntownship.us. Directory …………………………………………………………………………………………….. 3 Welcome ……………………………………………………………………………………. 4 History ……………………………………………………………………………………… 5 Water & Sewer …………………………………………………………………………….. 9 Trash & Recycling …………………………………………………………………………10 Roads & Snow Removal ………………………………………………………………….11 Stormwater Management ………………………………………………………………...12 Pets & Animals …………………………………………………………………………….13 -

Norristown Transportation Center to Graterford

SOUTHEASTERN PENNSYLVANIA TRANSPORTATION AUTHORITY SUBURBAN TRANSIT AND CONTRACT OPERATIONS ______________________________________ TARIFF NO. 155 SUPPLEMENT NO. 26 ______________________________________ LOCAL RATES OF FARE AND REGULATIONS GOVERNING THE FURNISHING OF PASSENGER TRANSPORTATION ON REGULAR SCHEDULED SERVICE ______________________________________ ISSUED: March 17, 2010 APPROVED: AMENDED: EFFECTIVE: ISSUED BY: Joseph M. Casey General Manager 1234 Market Street Philadelphia, PA 19107-3780 CHANGES MADE BY THIS TARIFF 1. The title cover and related text in sections 3, 4, 10 and 20 has been changed from Suburban Transit Division to Suburban Transit and Contract Operations to reflect the nature of Suburban Transit routes operated by Victory and Frontier Districts, as well as transit services contracted to a private carrier. 2. Fare Zones are revised on the following routes as part of the FY 2012 Annual Service Plan: 92, 95, 98, 115, 119, 127, 130 and 139. New Routes 126 and 133 are included. Routes 304 and 314 would be discontinued. These fare zone changes would take effect upon SEPTA Board approval of the FY 2012 Annual Service Plan and funding availability. 3. Fare Zones are revised on the following routes as part of the FY 2011 Annual Service Plan: 97, 105 and 106. 4. Route 100 is now known as Norristown High Speed Line. 5. All references to 69th Street Terminal are changed to read 69th Street Transportation Center (69th Street TC). 6. Route 129 references to Torresdale have been updated to reflect what is printed on the public timetable and destination signs. 7. Fare zone information is revised for Routes 204, 205 and 306. 8. Information regarding Route 305 has been removed 9.