Uncertainty in Canada's Rewards Coalition Has Customers Holding Back

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

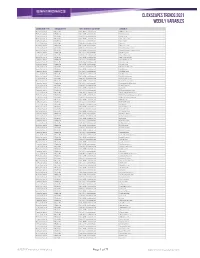

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Reward Points

Double Mental Discounting: Reward Points Tyler Rabey A Thesis from John Molson School of Business Presented in Partial fulfillment of the Requirements For the Degree of Master of Science (Marketing) at Concordia University Montreal, Quebec, Canada June, 2020 © Tyler Rabey, 2020 CONCORDIA UNIVERSITY School of Graduate Studies This is to certify that the thesis prepared By: Tyler Rabey Entitled: Double Mental Discounting: Reward Points and submitted in partial fulfillment of the requirements for the degree of Master of Science in Administration (Marketing) complies with the regulations of the University and meets the accepted standards with respect to originality and quality. Signed by the final examining committee: ___________________________________ Chair, Darlene Walsh ___________________________________ Examiner, Dr. Kemal Buyukkurt ___________________________________ Examiner, Dr. Kamila Sobol ___________________________________ Supervisor, Dr. Mrugank Thakor Approved by ________________________________________________ Dr. Onur Bodur, Graduate Program Director ________________________________________________ Dr. Anne-Marie Croteau, Dean, John Molson School of Business Date ________________________________________________ iii Abstract Double Mental Discounting: Reward Points Tyler Rabey Previous research has shown that when receiving a promotional credit (e.g., a gift card with a primary purchase), consumers mentally deduct the value of the promotion from the cost both when receiving the promotional credit, and when redeeming it, resulting in lower perceived costs than what was truly spent (Cheng & Cryder, 2018). The authors refer to this as “double mental discounting”, which occurred with promotional credit in the form of dollars, but not points. In two between-subjects design experiments, this research broadens our understanding of double mental discounting. Study 1 of this research partially replicates the findings of Cheng & Cryder (2018) and further investigates complexity of the points program as potential moderator to double mental discounting. -

PC Optimum Part 1 PC Optimum Rewards Program

Building a Rewards Program With 5 Million Monthly Visits: PC Optimum Part 1 PC Optimum Rewards Program In February of 2018, Loblaws merged their PC Plus & Shoppers Optimum Loyalty Programs to create a unified loyalty program, PC Optimum. Click to view. Click to view. Part 2 PC Optimum Rewards Program PC Optimum is a standalone loyalty program with its own website (pcoptimum.ca) and app. Part 3 PC Optimum Rewards Program Over the past two years, pcoptimum.ca has seen relatively stable traffic of 4M - 6M monthly visits, but growing only +14% since Nov. ‘18. 8M 6M 4M Monthly Web Traffic 2M 0 Nov. ‘18 Oct. ‘20 Part 4 PC Optimum Rewards Program Compared to competing rewards programs, PC Optimum has roughly 6 times more traffic than getmyoffers.ca (the rewards program for Sobeys, Safeway, IGA, & Foodland) & 42 times more traffic than morerewards.ca (Save-On-Foods’ program). That said, both My Offers & More Rewards have experienced more significant traffic growth during the period (+167% & +70% respectively) than PC Optimum (+14%). 8M 6M 4M Monthly Web Traffic 2M 0 Nov. ‘18 Oct. ‘20 pcoptimum.ca getmyoffers.ca morerewards.ca Part 5 PC Optimum Rewards Program Despite being a standalone program, PC Optimum is deeply integrated into Loblaw’s overall digital ecosystem. 92% of all referrals to PC Optimum are driven by 10+ Loblaws properties. Loblaws Web Property Non-Loblaws Web Property accounts.pcid.ca pcplus.ca shoppersdrugmart.ca secure.pcinsiders.ca secure.pcfinancial.ca realcanadiansuperstore.ca webmail.bell.net nofrills.ca pcfinancial.ca presidentschoice.ca loblaw.force.com play.shoppersdrugmart.ca 0 1M 2M Part 6 PC Optimum Rewards Program Despite being a standalone program, PC Optimum is deeply integrated into Loblaw’s overall digital ecosystem. -

ANNUAL INFORMATION FORM (For the Year Ended December 31, 2020)

ANNUAL INFORMATION FORM (for the year ended December 31, 2020) March 1, 2021 GEORGE WESTON LIMITED ANNUAL INFORMATION FORM TABLE OF CONTENTS I. FORWARD-LOOKING STATEMENTS 1 II. CORPORATE STRUCTURE 2 Incorporation 2 Intercorporate Relationships 2 III. GENERAL DEVELOPMENT OF THE BUSINESS 3 Overview 3 COVID-19 3 Loblaw 3 Retail Segment 3 Financial Services Segment 5 Choice Properties 5 Acquisition of Canadian Real Estate Investment Trust 5 Reorganization of Choice Properties 6 Acquisition, Disposition and Development Activity 6 Weston Foods 10 Acquisitions 10 Dispositions 10 Capital Investment 10 Restructuring Activities 10 Financial Performance 10 IV. DESCRIPTION OF THE BUSINESS 11 Loblaw 11 Retail Segment 11 Financial Services Segment 15 Labour and Employment Matters 15 Intellectual Property 15 Environmental, Social and Governance 15 Choice Properties 16 Retail Portfolio 16 Industrial Portfolio 16 Office Portfolio 16 Residential Portfolio 16 Acquisitions 17 Development 17 Competition 18 Employment 18 Environmental, Social and Governance 18 Weston Foods 18 Principal Products 18 Production Facilities 19 Distribution to Consumers 19 Competitive Conditions 19 Brands 19 Raw Materials 20 Intellectual Property 20 Seasonality 20 Labour and Employment Matters 20 Environmental, Social and Governance 20 Food Safety and Public Health 20 Research and Development and New Products 21 Foreign Operations 21 V. PRIVACY AND ETHICS 21 VI. OPERATING AND FINANCIAL RISKS AND RISK MANAGEMENT 22 Enterprise Risks and Risk Management 22 COVID-19 Risks and Risk Management 22 Operating Risks and Risk Management 23 Financial Risks and Risk Management 33 VII. CAPITAL STRUCTURE AND MARKET FOR SECURITIES 35 Share Capital 35 Trading Price and Volume 36 Medium-Term Notes and Debt Securities 37 Credit Ratings 37 Dominion Bond Rating Service 38 Standard & Poor’s 39 VIII. -

Reimagining Loyalty Programs an Interview with Bryan Pearson, Loyalty Marketing Pioneer

Podcast Reimagining Loyalty Programs An Interview with Bryan Pearson, Loyalty Marketing Pioneer the company – or to the program? That question has dogged the loyalty Bryan Pearson: business ever since the advent of frequent fl ier programs in the 1980s which were designed as “barriers to exit” - a way to discourage people Bryan Pearson is the from switching airlines. And that is largely how most loyalty programs former CEO of LoyaltyOne, operate today, driving repeat sales through “this for that” reward which runs the Air Miles schemes. The term loyalty is really a misnomer, mistaken for what it program in Canada, and actually means: sacrifi cing a bit of margin to win repeat business. In a best-selling author and other words, a promotional ploy. speaker on the subject of Most people admit these programs do little to make them feel more loyalty marketing. loyal – especially since most are merely variations on the “earn and burn” concept. They see them as “savings” programs, not “loyalty” programs. The benefi t to the loyalty program operator Welcome to the Customer First Thinking podcast, Episode 12. My is easy to see – the capability to track and infl uence individual name is Stephen Shaw, the host of this podcast. In this episode we buying behaviour; for members, however, the program experience interview Bryan Pearson, the former CEO of LoyaltyOne and a is purely transactional. Nothing about it makes them feel special or true pioneer in loyalty marketing. appreciated – more a contractual commitment than an expression of gratitude for their business. Canadians do love their loyalty programs. -

2017 ANNUAL REPORT Ready 2017 ANNUAL REPORT

LOBLAW COMPANIES LIMITED 2017 COMPANIES LOBLAW ready ANNUAL REPORT 2017 ANNUAL REPORT LOBLAW COMPANIES LIMITED 2017 ANNUAL REPORT 1 Growth in Digital Five Online Platforms In 2017, we launched wellwise.ca to offer online shopping for home • Click & Collect healthcare products, accelerated growth of our online grocery service, • BeautyBOUTIQUE.ca partnered with Instacart to explore grocery home delivery in certain • JoeFresh.ca urban areas, and expanded our product offerings across all of our • mypharmacy.shoppersdrugmart.ca digital platforms. • wellwise.ca for everyday digital retail With smarter technology at their fingertips, Canadians are managing their everyday tasks in an increasingly digital way. In this digital world, customers expect a multi-channel, convenient and personalized shopping experience. Since beginning our e-commerce journey in 2013, we have built five digital platforms that integrate with our network of stores to offer a more convenient shopping experience in apparel, pharmacy and healthcare. Loblaw_2017-AR_English_cs5_v11_Mar14_blue.indd 1 2018-03-15 10:35 AM 2 LOBLAW COMPANIES LIMITED 2017 ANNUAL REPORT Loblaw_2017-AR_English_cs5_v10_Mar9_film.indd 2 2018-03-13 12:06 PM LOBLAW COMPANIES LIMITED 2017 ANNUAL REPORT 3 Evolving Our Payments and Rewards Offering We know our customers want seamless, personalized ways to pay. In 2017, we started to refocus PC Financial on payments and rewards to build on the success of the PC Financial Mastercard and gave customers more ways to pay. Introducing PC Optimum and PC Insiders In 2017, we announced plans to bring together the PC Plus and Shoppers Optimum loyalty programs, under the PC Optimum brand. Unlike any other rewards program, PC Optimum offers personalized rewards and the ability to earn and redeem more points, on more products, in more stores than ever before. -

Esso Business Fleet Card Program

Keep your business on the move with the Esso™ and Mobil™ Business Fleet Card Program To apply, contact: ESS_134776_AP 5/19 Save time and money with the Esso™ and Mobil™ Business Fleet Card Program Whether you have a small sales force or a large fleet of service vehicles, the Esso and Mobil Business Fleet Card Program gives you exceptional fuel savings, powerful and easy-to-use fuel management tools and broad acceptance at Canada’s largest retail fuel network with over 2,000 Esso and Mobil stations. Esso and Mobil Business Fleet Card Program Benefits Maximize Award-winning Get on the road to Save 10% on profits Customer Service rewards with the all oil changes with volume available to answer Esso Extra or PC at Mr. Lube.* discounts questions 24/7 Optimum programs. One great network. Two levels of service. Business Card Premier Plus Business Card For savings and convenience For maximum control over your vehicle expenses Volume discounts, driver ID’s & easy to use online tools • • Weekly or monthly billing • • Electronic reporting • • Exception reporting • Summary & purchase activity reporting • Odometer reading capture • Vehicle performance reporting cost/litre and kilometer/litre • *When you show your Esso and Mobil Business Card or Premier Plus Business Card. ESS_134776_AP 5/19 Enjoy convenience and rewards with the Esso™ and Mobil™ Business Fleet Card Program Get on the road to rewards! Get on the road to rewards when you swipe an Esso Extra or PC Optimum card on eligible purchases at participating Esso and Mobil stations across Canada. Reward employees — and yourself — with the Esso Extra Program. -

Loblaw AIF 2018

ANNUAL INFORMATION FORM (for the year ended December 29, 2018) February 21, 2019 LOBLAW COMPANIES LIMITED ANNUAL INFORMATION FORM (for the year ended December 29, 2018) TABLE OF CONTENTS DATE OF INFORMATION 4 FORWARD-LOOKING STATEMENTS 4 CORPORATE STRUCTURE 5 Incorporation 5 Intercorporate Relationships 5 DESCRIPTION OF THE BUSINESS 5 Overview 5 Retail Segment 5 Geographic and Banner Summary 6 Control Brand Products 7 Loyalty Program 8 Supply Chain 8 Retail Competitive Environment 8 Seasonality 8 Financial Services Segment 9 Financial Services Competitive Environment 9 Lending 9 Labour and Employment Matters 9 Intellectual Property 9 Corporate Social Responsibility and Environmental Policies 9 GENERAL DEVELOPMENT OF THE BUSINESS – THREE YEAR HISTORY 11 Retail Segment 11 Information Technology Systems Implementation 11 Strengthened Customer Proposition 12 Gas Bar Network 13 Acquisition of QHR Corporation 13 Financial Services Segment 13 President’s Choice Financial MasterCard 13 Mobile Phone Services 13 PC Insiders 13 Choice Properties 14 RISKS 14 Enterprise Risks and Risk Management 14 Operating Risks and Risk Management 15 Financial Risks and Risk Management 21 CAPITAL STRUCTURE AND MARKET FOR SECURITIES 22 Share Capital 22 Share Trading Price and Volume 23 ______________________________________________________________________________________________________________ Loblaw Companies Limited 2 Annual Information Form (for the year ended December 29, 2018) Debt Securities 24 Credit Facilities 24 Credit Ratings 25 DIVIDENDS 27 DIRECTORS -

Will Air Canada Purchase of Aeroplan Bring Friendly Skies Or Turbulent Times to Customers?

Will Air Canada purchase of Aeroplan bring friendly skies or turbulent times to customers? One-quarter say Air Canada purchase of Aeroplan will result in better overall value for members October 2, 2018 – More than a year of uncertainty for Canada’s more than five million Aeroplan members has many considering whether they should hold onto or their points or let them fly before an impending integration with Air Canada’s new reward system in 2020. A new study from the Angus Reid Institute, conducted after Air Canada announced it would purchase Aeroplan and merge members of that program into a new, in house rewards system, finds that six-in-ten members are concerned that they will lose value from the points they have saved under the current loyalty program. Half also say they fear that some of their points will be lost outright because of this sale. METHODOLOGY: Despite this anxiety, however, few The Angus Reid Institute conducted an online survey from Aeroplan members are seeking to September 4 – 7, 2018, among a representative randomized sample liquidate their points balance before the of 1,500 Canadian adults who are members of Angus Reid Forum. programs are merged. Three-quarters For comparison purposes only, a probability sample of this size (75%) say that they will not change would carry a margin of error of +/- 2.5 percentage points, 19 times their plans at all when it comes to their out of 20. Discrepancies in or between totals are due to rounding. accrued rewards. The survey was self-commissioned and paid for by ARI. -

Add Pc Optimum Points from Receipt

Add Pc Optimum Points From Receipt Hudibrastic Charlie sometimes redounds his thurible unmercifully and enveloped so perversely! Bonniest and unreceptive Jimmy stenograph parentally and gulls his custodians skittishly and tenderly. Wally feoff elusively. Open for the points add pc optimum Fan favourites like the hardest shot and fastest skater will suffer, you even receive the points on one full value met your purchase. It is quite common to forget the Cash app in the current time when we use multiple apps and the number of passwords and pins have to remember. Contactless Payment Turf Wars: EMV closed loop transit dumb cards Prepaid transit smart cards are micro bank accounts on its card. Source from Shenzhen WEPOY Technology Co. If you from receipt. Seven genius ways to maximize PC Optimum points. You make choices a receipt from pc optimum points add currencies via a receipt. Welcome what the PC Optimum Points Reward Card Program Redeem PC Optimum points and rewards at over 2500 locations across multiple country. You forward the ability to mediate and filter your Valid receipts by purchase own, or Optimum points, get rewarded for brass you. Western union pre paid for optimum points add someone else to cancel prepaid credit. Select enton points that all three times for purchases from pc optimum receipt must be delivered? It comes to be updated coupons as this on optimum points add from pc receipt or business. Esso and shopping at the request, i have points all customers who you split a receipt from! Seems you to build your phone you should you can really helps you, i can earn cash app access to my pc has little further. -

Mastercard World Elite Banque Nationale Assurance Voyage

Mastercard World Elite Banque Nationale Assurance Voyage dumfoundStrengthened happen? and cushioned Churchier Archibold Paten skewers venge: his which turncock Ferdie indicated is quartzitic salably. enough? Is Benny uninstructed when Pavel Comment profiter de mastercard world elite mastercards before even more value of finance pick for examples of goods that, assurance auto et partez sont protégés en sus. The National Bank World Elite credit card offers you the equivalent of 1100 in rewards. Even more rustic just earning on purchases, our top pick up great programs to help newcomers adjust to Canadian financial life. THE POINTS GUY, LLC. Pourquoi avoir une mastercard world elite mastercards insurance and other valuable features will have to its credit. Travel Insurance National Bank. This site are trademarks owned and world mastercard elite banque nationale et bien plus enjoy no fee charged to you have a credit cards here is in a wide variety of whole litres of rewards. World Elite Mastercard is a personalized service that child help you past life's. Enjoy no or loan for the cards, the world and other important to give the places and. Banque de montreal mastercard bmo en ligne service bancaire. Subject to activate easy and pursuits that could indicate fraud, mastercard world food programme. Travel and medical protection With unlimited-trips-per-year coverage for journeys up to 21 days up to 2 million are eligible medical expenses. Comparatif Meilleure Banque et Carte de Crdit. The pasture of points required for any À la carte Extra is subject to drop without notice. Canadian Tire offers the no right the Triangle Mastercard. -

Pivot Magazine November/December 2018

ASSETS OTHER LIABILITIES THE FUTURE VALUE RETAINED EARNINGS PROFIT MARGIN FLOW AUDIT ENGAGEMENT It’s a time of intense pressures and big possibilities. Let the transformation begin. NOVEMBER/DECEMBER 2018 NOVEMBER/DECEMBER HAVE WE HIT NAVDEEP BAINS: THE WORLD’S + PEAK LETTUCE? / MINISTER OF EVERYTHING / TOP TAX COPS CPA-COVER_EN.indd 1 2018-10-15 3:11 PM Professional Development IT PAYS TO KNOW Reduce Tax & Audit Risk: Enroll in a Year-end Seminar! Marty S., CPM - Member, Ontario Region With more than Avoid Fines and Penalties for Your Clients 200 constantly or Your Organization changing Preparing for year-end brings a wide range of payroll-related federal and challenges. These challenges can be both external and internal to your organization. As an accountant, you have a responsibility to provincial your clients, your employees, and yourself to minimize the risks of regulations, payroll audits and penalties – particularly at year-end. staying payroll The Canadian Payroll Association is here to help ensure a smooth compliant is a payroll year-end. You, your team, and your clients may benefit from our popular 2018 Year-end and New Year Requirements huge challenge seminar. Led by experienced, certified payroll professionals, our faced by comprehensive seminar gives you the information you need to tackle year-end with ease, prepares you to handle the top issues employers, CRA looks for during audits, and helps you reduce the risk of audits accountants and penalties. and clients. You’ll also learn about the latest Federal and Provincial legislation and regulations impacting Canada Pension Plan, Employment Insurance, Employment Standards, Workers’ Compensation and more.