Shopperchoice 2021 Variables List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food Delivery Brands Head-To-Head the Ordering Operation

FOOD DELIVERY BRANDS HEAD-TO-HEAD THE ORDERING OPERATION Market context: The UAE has a well-established tradition of getting everything delivered to your doorstep or to your car at the curb. So in some ways, the explosion of food delivery brands seems almost natural. But with Foodora’s recent exit from the UAE, the acquisition of Talabat by Rocket Internet, and the acquisition of Foodonclick and 24h by FoodPanda, it seemed the time was ripe to put the food delivery brands to the test. Our challenge: We compared six food delivery brands in Dubai to find the most rewarding, hassle-free ordering experience. Our approach: To evaluate the complete customer experience, we created a thorough checklist covering every facet of the service – from signing up, creating accounts, and setting up delivery addresses to testing the mobile functionality. As a control sample, we first ordered from the same restaurant (Maple Leaf, an office favorite) using all six services to get a taste for how each brand handled the same order. Then we repeated the exercise, this time ordering from different restaurants to assess the ease of discovering new places and customizing orders. To control for other variables, we placed all our orders on weekdays at 1pm. THE JUDGING PANEL 2 THE COMPETITIVE SET UAE LAUNCH OTHER MARKETS SERVED 2011 Middle East, Europe 2015 12 countries, including Hong Kong, the UK, Germany 2011 UAE only 2010 Turkey, Lebanon, Qatar 2012 GCC, including Bahrain, Kuwait, Qatar, Saudi Arabia 2015 17 countries, including India, the USA, the UK THE REVIEW CRITERIA: • Attraction: Looks at the overall design, tone of voice, community engagement, and branding. -

MUNCHERY, INC., Debtor. Case No

UNITED STATES BANKRUPTCY COURT NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION In re: Case No. 19-30232 (HLB) MUNCHERY, INC., Chapter 11 Debtor. FIRST AMENDED JOINTLY PROPOSED COMBINED CHAPTER 11 PLAN OF LIQUIDATION AND TENTATIVELY APPROVED DISCLOSURE STATEMENT DATED AS OF JUNE 10, 2020 INTRODUCTION This is the First Amended Jointly Proposed Combined Chapter 11 Plan of Liquidation and Disclosure Statement (the “Plan”), which is being proposed by Munchery, Inc. (the “Debtor”) and the Official Committee of Unsecured Creditors of the Debtor (the “Committee”) in the above- captioned chapter 11 case (the “Chapter 11 Case”) pending before the United States Bankruptcy Court for the Northern District of California, San Francisco Division (the “Bankruptcy Court”). The Plan identifies the classes of creditors and describes how each class will be treated if the Plan is confirmed. The treatment of many of the classes of creditors is intended to be consistent with a Restructuring Support Plan and Term Sheet (the “Settlement Term Sheet”), which was previously approved by the Bankruptcy Court. Part 1 contains the treatment of secured claims. Part 2 contains the treatment of general unsecured claims. Part 3 contains the treatment of administrative and priority claims. Part 4 contains the treatment of executory contracts and unexpired leases. Part 5 contains the effect of confirmation of the Plan. Part 6 contains creditor remedies if the Debtor defaults on its obligations under the Plan. Part 7 contains general provisions of the Plan. Creditors in impaired classes are entitled to vote on confirmation of the Plan. Completed ballots must be received by counsel to the Debtor, and objections to confirmation must be filed and served, no later than August 7, 2020 at 5:00 p.m. -

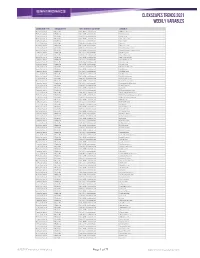

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

The Future of Work

FUTURE OF WORK SIGNED, SEALED, DELIVERED App-based food couriers are turning to collective action to earn worker protections. Is this the end of the gig economy as we know it—or just the beginning? In early April, as the coronavirus made its grim, couriers felt, would guarantee fairer compensation, devastating march around the planet, Brice Sopher better workplace safety and modest benefits. was making his own daily bike journey around Simply put, the same guarantees that conventional Toronto. Forty-year-old Sopher is a food delivery employees enjoy (and which, they pointed out, courier who was working for both Foodora and those working in Foodora’s offices received). Uber Eats, supplementing the income he brought Then, in late February, the Ontario Labour Rela- in as an event promoter and DJ. After the pandemic tions Board ruled that couriers, contra Foodora, started, with restaurants restricted to are dependent contractors, akin to takeout and grocery store shelves bare, BY JASON truckers or cab drivers. It was a landmark Sopher was busier than ever. DJ and McBRIDE decision and the result of many months event work had dried up and now he was of organizing on the part of a group of out on his bike at least five hours a day, six days a couriers calling itself Foodsters United, along with week. Being a courier had always been gruelling the Canadian Union of Postal Workers (CUPW). and risky, but now each delivery was a potential There was a very real possibility that Foodora time bomb. Foodora did not provide any personal couriers could form a union—the first app-based protective equipment, and it was only in May that workforce in Canada to unionize. -

Foodora and Deliveroo: the App As a Boss? Control and Autonomy in App-Based Management - the Case of Food Delivery Riders

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Ivanova, Mirela; Bronowicka, Joanna; Kocher, Eva; Degner, Anne Working Paper Foodora and Deliveroo: The App as a Boss? Control and autonomy in app-based management - the case of food delivery riders Working Paper Forschungsförderung, No. 107 Provided in Cooperation with: The Hans Böckler Foundation Suggested Citation: Ivanova, Mirela; Bronowicka, Joanna; Kocher, Eva; Degner, Anne (2018) : Foodora and Deliveroo: The App as a Boss? Control and autonomy in app-based management - the case of food delivery riders, Working Paper Forschungsförderung, No. 107, Hans-Böckler- Stiftung, Düsseldorf, http://nbn-resolving.de/urn:nbn:de:101:1-2019022610132332740779 This Version is available at: http://hdl.handle.net/10419/216032 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

Reward Points

Double Mental Discounting: Reward Points Tyler Rabey A Thesis from John Molson School of Business Presented in Partial fulfillment of the Requirements For the Degree of Master of Science (Marketing) at Concordia University Montreal, Quebec, Canada June, 2020 © Tyler Rabey, 2020 CONCORDIA UNIVERSITY School of Graduate Studies This is to certify that the thesis prepared By: Tyler Rabey Entitled: Double Mental Discounting: Reward Points and submitted in partial fulfillment of the requirements for the degree of Master of Science in Administration (Marketing) complies with the regulations of the University and meets the accepted standards with respect to originality and quality. Signed by the final examining committee: ___________________________________ Chair, Darlene Walsh ___________________________________ Examiner, Dr. Kemal Buyukkurt ___________________________________ Examiner, Dr. Kamila Sobol ___________________________________ Supervisor, Dr. Mrugank Thakor Approved by ________________________________________________ Dr. Onur Bodur, Graduate Program Director ________________________________________________ Dr. Anne-Marie Croteau, Dean, John Molson School of Business Date ________________________________________________ iii Abstract Double Mental Discounting: Reward Points Tyler Rabey Previous research has shown that when receiving a promotional credit (e.g., a gift card with a primary purchase), consumers mentally deduct the value of the promotion from the cost both when receiving the promotional credit, and when redeeming it, resulting in lower perceived costs than what was truly spent (Cheng & Cryder, 2018). The authors refer to this as “double mental discounting”, which occurred with promotional credit in the form of dollars, but not points. In two between-subjects design experiments, this research broadens our understanding of double mental discounting. Study 1 of this research partially replicates the findings of Cheng & Cryder (2018) and further investigates complexity of the points program as potential moderator to double mental discounting. -

PC Optimum Part 1 PC Optimum Rewards Program

Building a Rewards Program With 5 Million Monthly Visits: PC Optimum Part 1 PC Optimum Rewards Program In February of 2018, Loblaws merged their PC Plus & Shoppers Optimum Loyalty Programs to create a unified loyalty program, PC Optimum. Click to view. Click to view. Part 2 PC Optimum Rewards Program PC Optimum is a standalone loyalty program with its own website (pcoptimum.ca) and app. Part 3 PC Optimum Rewards Program Over the past two years, pcoptimum.ca has seen relatively stable traffic of 4M - 6M monthly visits, but growing only +14% since Nov. ‘18. 8M 6M 4M Monthly Web Traffic 2M 0 Nov. ‘18 Oct. ‘20 Part 4 PC Optimum Rewards Program Compared to competing rewards programs, PC Optimum has roughly 6 times more traffic than getmyoffers.ca (the rewards program for Sobeys, Safeway, IGA, & Foodland) & 42 times more traffic than morerewards.ca (Save-On-Foods’ program). That said, both My Offers & More Rewards have experienced more significant traffic growth during the period (+167% & +70% respectively) than PC Optimum (+14%). 8M 6M 4M Monthly Web Traffic 2M 0 Nov. ‘18 Oct. ‘20 pcoptimum.ca getmyoffers.ca morerewards.ca Part 5 PC Optimum Rewards Program Despite being a standalone program, PC Optimum is deeply integrated into Loblaw’s overall digital ecosystem. 92% of all referrals to PC Optimum are driven by 10+ Loblaws properties. Loblaws Web Property Non-Loblaws Web Property accounts.pcid.ca pcplus.ca shoppersdrugmart.ca secure.pcinsiders.ca secure.pcfinancial.ca realcanadiansuperstore.ca webmail.bell.net nofrills.ca pcfinancial.ca presidentschoice.ca loblaw.force.com play.shoppersdrugmart.ca 0 1M 2M Part 6 PC Optimum Rewards Program Despite being a standalone program, PC Optimum is deeply integrated into Loblaw’s overall digital ecosystem. -

ANNUAL INFORMATION FORM (For the Year Ended December 31, 2020)

ANNUAL INFORMATION FORM (for the year ended December 31, 2020) March 1, 2021 GEORGE WESTON LIMITED ANNUAL INFORMATION FORM TABLE OF CONTENTS I. FORWARD-LOOKING STATEMENTS 1 II. CORPORATE STRUCTURE 2 Incorporation 2 Intercorporate Relationships 2 III. GENERAL DEVELOPMENT OF THE BUSINESS 3 Overview 3 COVID-19 3 Loblaw 3 Retail Segment 3 Financial Services Segment 5 Choice Properties 5 Acquisition of Canadian Real Estate Investment Trust 5 Reorganization of Choice Properties 6 Acquisition, Disposition and Development Activity 6 Weston Foods 10 Acquisitions 10 Dispositions 10 Capital Investment 10 Restructuring Activities 10 Financial Performance 10 IV. DESCRIPTION OF THE BUSINESS 11 Loblaw 11 Retail Segment 11 Financial Services Segment 15 Labour and Employment Matters 15 Intellectual Property 15 Environmental, Social and Governance 15 Choice Properties 16 Retail Portfolio 16 Industrial Portfolio 16 Office Portfolio 16 Residential Portfolio 16 Acquisitions 17 Development 17 Competition 18 Employment 18 Environmental, Social and Governance 18 Weston Foods 18 Principal Products 18 Production Facilities 19 Distribution to Consumers 19 Competitive Conditions 19 Brands 19 Raw Materials 20 Intellectual Property 20 Seasonality 20 Labour and Employment Matters 20 Environmental, Social and Governance 20 Food Safety and Public Health 20 Research and Development and New Products 21 Foreign Operations 21 V. PRIVACY AND ETHICS 21 VI. OPERATING AND FINANCIAL RISKS AND RISK MANAGEMENT 22 Enterprise Risks and Risk Management 22 COVID-19 Risks and Risk Management 22 Operating Risks and Risk Management 23 Financial Risks and Risk Management 33 VII. CAPITAL STRUCTURE AND MARKET FOR SECURITIES 35 Share Capital 35 Trading Price and Volume 36 Medium-Term Notes and Debt Securities 37 Credit Ratings 37 Dominion Bond Rating Service 38 Standard & Poor’s 39 VIII. -

Strategic Marketing Audit Ubereats, Brisbane

AMB359 Strategic Marketing Audit UberEATS, Brisbane Prepared for: Erin Su Prepared by: Juanita Bradford (n9013458) Word Count: 1091 Executive Summary…………………………………………………………3 1.0 Introduction………………………………………………………………4 2.0 Customer Analysis……………………………………………………..4 3.0 Competitor Analysis……………………………………………….....5 4.0 Market/Submarket Analysis………………………………………8 5.0 Environmental Analysis and Strategic Uncertainty...….9 5.1 Technological Trends………………………………………….9 5.2 Consumer Trends.………………………………………………9 5.3 Government/Economic Trends…………………………...9 5.4 Strategic Uncertainty………………………………………..10 6.0 Preliminary Strategic Options…………………………………..10 7.0 References……………………………………………………………….11 2 Executive Summary The Uber Strategic Marketing Audit is a close analysis of the current market environment for intermediate online food delivery services such as UberEATS (UE) in Brisbane. The Strategic Marketing Audit has been prepared ahead of the launch of UE in Brisbane and will present two preliminary strategic objectives in order for the firm to succeed in its entry in this new market. Firstly, the two primary target segments were identified as the most profitable and sustainable in the customer analysis the Young Professionals and the Highend Restaurants. The Young Professionals represent the service receiving segment and the Highend Restaurants represent the service offering end segment. A competitor analysis also revealed two direct competitors, Deliveroo and Foodora and three indirect competitors, Menulog, Eatnow.com and Delivery Hero. Using the Competitor Strength Grid it was revealed that UberEATS was the only direct competitor to utilise drivers and vehicles for distribution. The market and submarket analysis revealed that the overall market is relatively attractive due to promising growth. More specifically the emerging submarkets that were revealed were, vegetarianism, alcohol delivery and utilising the existing app as a search and discovery tool for consumers. -

Sweet on Desserts

DIY DINNERS: HOW TO BUILD A DESIGN STRATEGIES THAT MEAL KIT PROGRAM 10 16 SET THE MOOD JUNE 2016 VOLUME TWO n ISSUE TWO SweetSweet onon DessertsDesserts Gelato bars, retro treats, artisan donuts and more PAGE 4 Bi-Rite Market taps into San Francisco’s culinary talent pool PAGE 26 GRO 0616 01-07 Desserts.indd 1 5/23/16 9:13 PM 570 Lake Cook Rd, Suite 310, Deerfield, IL 60015 • 224 632-8200 http://www.progressivegrocer.com/departments/grocerant Senior Vice President Jeff Friedman 201-855-7621 [email protected] IS FAILURE EDITORIAL Editorial Director Joan Driggs 224-632-8211 [email protected] Managing Editor Elizabeth Brewster Art Director Theodore Hahn [email protected] Contributing Editors THE NEW Kathleen Furore, Kathy Hayden, Amelia Levin, Lynn Petrak, Jill Rivkin, Carolyn Schierhorn, Jody Shee ADVERTISING SALES & BUSINESS Midwest Marketing Manager John Huff NORMAL? 224-632-8174 [email protected] Western Regional Sales Manager Elizabeth Cherry 310-546-3815 [email protected] Eastern Marketing Manager Maggie Kaeppel It doesn’t have to be. 630-364-2150 • Mobile: 708-565-5350 [email protected] Northeast Marketing Manager Mike Shaw 201-855-7631 • Mobile: 201-281-9100 [email protected] Marketing Manager Janet Blaney (AZ, CO, ID, MD, MN, MT, NM, NV, OH, TX, UT, WY) [email protected] 630-364-1601 Account Executive/ Classified Advertising Terry Kanganis 201-855-7615 • Fax: 201-855-7373 [email protected] General Manager, Custom Media Kathy Colwell 224-632-8244 [email protected] -

Online Food and Beverage Sales Are Poised to Accelerate — Is the Packaging Ecosystem Ready?

Executive Insights Volume XXI, Issue 4 Online Food and Beverage Sales Are Poised to Accelerate — Is the Packaging Ecosystem Ready? The future looks bright for all things ecommerce primary and secondary ecommerce food and beverage packaging. in the food and beverage sector, fueled by What do the key players need to consider as they position themselves to win in this brave new world? Amazon’s purchase of Whole Foods, a growing Can the digital shelf compete with the real thing? millennial consumer base and increased Historically, low food and beverage ecommerce penetration consumer adoption rates driven by retailers’ rates have been fueled by both a dearth of affordable, quality push to improve the user experience. But this ecommerce options and consumer inertia. First, brick-and-mortar optimism isn’t confined to grocery retailers, meal grocery retailers typically see low-single-digit profit margins due to the high cost of managing perishable products and cold-chain kit companies and food-delivery outfits. distribution. No exception to that rule, ecommerce retail grocers struggle with the same challenges of balancing overhead with Internet sales are forecast to account for 15%-20% of the food affordable retail prices. and beverage sector’s overall sales by 2025 — a potential tenfold increase over 2016 — which foreshadows big opportunities for Consumers have also driven lagging sales, lacking enthusiasm for food and beverage packaging converters that can anticipate the a model that has seen challenges in providing quick fulfillment evolving needs of brand owners and consumers (see Figure 1). and delivery service — especially for unplanned or impulse And the payoff could be just as lucrative for food and beverage buys. -

Disruption in Fruit and Vegetable Distribution

DISRUPTION IN FRUIT AND VEGETABLE DISTRIBUTION FRUIT LOGISTICA TREND REPORT 2018 IN COOPERATION WITH PRESENTED AT world of fresh ideas IMPRESSUM FRUIT LOGISTICA TREND REPORT 2018 DISRUPTION IN FRUIT AND VEGETABLE DISTRIBUTION A special trend report for the international fresh produce business, commissioned by Fruit Logistica and produced by Oliver Wyman. REPORT AUTHORS @ OLIVER WYMAN Nico Hemker Cornelius Herzog Dr Michael Lierow Rainer Münch Philipp Oest Guillaume Thibault Jens Torchalla Jens von Wedel Dustin Wisotzky EDITORIAL & DESIGN @ FRUITNET MEDIA INTERNATIONAL Mike Knowles Johnny Innes Simon Spreckley PRODUCTION Oliver Wyman www.oliverwyman.com Tel +49 (0)89 939 490 PUBLISHER Messe Berlin GmbH Messedamm 22, 14055 Berlin [email protected] www.fruitlogistica.com Copyright © 2018 Oliver Wyman All rights reserved. Unauthorised publication or reuse in any form whatsoever of all or part of the content of this publication is expressly forbidden without the prior written permission of the publisher. Printed in Germany 2 FRUIT LOGISTICA TREND REPORT 2018 PREFACE Dear members of the fresh produce trade, Here at FRUIT LOGISTICA, we place the greatest importance on providing you, exhibitors and visitors alike, with valuable information that can help you make decisions. New this year is the publication of this Trend Report. Entitled Disruption in Fruit and Vegetable Distribution, it scrutinises developments in the wider business world and how they will affect the fruit and vegetable sector. It focuses on three areas – cold chain logistics and technology, the rise of online retail, and foodservice. Wherever you work in the fresh produce industry, Disruption in Fruit and Vegetable Distribution will enable you to anticipate key issues affecting the trade, and help stakeholders and decision- makers to understand them better.