Strategic Marketing Audit Ubereats, Brisbane

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food Delivery Brands Head-To-Head the Ordering Operation

FOOD DELIVERY BRANDS HEAD-TO-HEAD THE ORDERING OPERATION Market context: The UAE has a well-established tradition of getting everything delivered to your doorstep or to your car at the curb. So in some ways, the explosion of food delivery brands seems almost natural. But with Foodora’s recent exit from the UAE, the acquisition of Talabat by Rocket Internet, and the acquisition of Foodonclick and 24h by FoodPanda, it seemed the time was ripe to put the food delivery brands to the test. Our challenge: We compared six food delivery brands in Dubai to find the most rewarding, hassle-free ordering experience. Our approach: To evaluate the complete customer experience, we created a thorough checklist covering every facet of the service – from signing up, creating accounts, and setting up delivery addresses to testing the mobile functionality. As a control sample, we first ordered from the same restaurant (Maple Leaf, an office favorite) using all six services to get a taste for how each brand handled the same order. Then we repeated the exercise, this time ordering from different restaurants to assess the ease of discovering new places and customizing orders. To control for other variables, we placed all our orders on weekdays at 1pm. THE JUDGING PANEL 2 THE COMPETITIVE SET UAE LAUNCH OTHER MARKETS SERVED 2011 Middle East, Europe 2015 12 countries, including Hong Kong, the UK, Germany 2011 UAE only 2010 Turkey, Lebanon, Qatar 2012 GCC, including Bahrain, Kuwait, Qatar, Saudi Arabia 2015 17 countries, including India, the USA, the UK THE REVIEW CRITERIA: • Attraction: Looks at the overall design, tone of voice, community engagement, and branding. -

Grubhub Inc. (Name of Registrant As Specified in Its Charter)

TABLE OF CONTENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☒ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☐ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material under §240.14a-12 Grubhub Inc. (Name of Registrant as Specified In Its Charter) N/A (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: TABLE OF CONTENTS The information in this proxy statement/prospectus is subject to completion and amendment. -

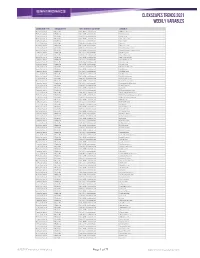

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Just Eat Annual Report & Accounts 2017

Just Eat plc Annual Report & Accounts 2017 Annual Report Creating the world’s greatest food community Annual Report & Accounts 2017 WorldReginfo - f5b0c721-e5d8-4dfc-a2c6-df7579591a37 Delivering more choice and convenience to create the world’s greatest food community WorldReginfo - f5b0c721-e5d8-4dfc-a2c6-df7579591a37 Introduction Our vision is to create the world’s greatest food community For our Customers, it is about offering them >> Read more about our the widest choice – whatever, whenever Customers on page 7 and wherever they want to eat. For our Restaurant Partners, we help them >> Read more about our Restaurant Partners on to reach more Customers, support their page 21 businesses and improve standards in the industry. >> Read more about our For our People, it is being part of an People on page 37 amazing global team, helping to connect 21.5 million Active Customers with our 82,300 Restaurant Partners. Strategic report Corporate governance Financial statements 2 Highlights 44 Corporate governance report 84 Independent auditor’s report 4 At a glance 46 Our Board 90 Consolidated income statement 8 Chairman’s statement 48 Report of the Board 91 Consolidated statement of other 10 Chief Executive Officer’s review 56 Report of the Audit Committee comprehensive income 14 Our business model 61 Report of the Nomination Committee 92 Consolidated balance sheet 16 Our markets 65 Report of the Remuneration 93 Consolidated statement of changes 18 Our strategy Committee in equity 19 Our key performance indicators 67 Annual report on remuneration -

Gig Economy and Processes of Information, Consultation, Participation and Collective Bargaining"

Paper on the European Union co-funded project VS/2019/0040 "Gig economy and processes of information, consultation, participation and collective bargaining". By Davide Dazzi (translation from Italian to English by Federico Tani) Updated the 20th of July 2020 Sommario Introduction ....................................................................................................................................................... 2 Gig Economy : a defining framework ................................................................................................................. 2 Platforms and Covid-19 ..................................................................................................................................... 6 GIG workers: a quantitative dimension ........................................................................................................... 10 On line outsourcing ..................................................................................................................................... 11 Crowdworkers and Covid-19 ....................................................................................................................... 14 Working conditions of GIG workers ................................................................................................................ 17 Covid 19 laying bare the asymmetry of social protections ............................................................................. 21 Towards a protection system for platform workers .................................................................................. -

The Future of Work

FUTURE OF WORK SIGNED, SEALED, DELIVERED App-based food couriers are turning to collective action to earn worker protections. Is this the end of the gig economy as we know it—or just the beginning? In early April, as the coronavirus made its grim, couriers felt, would guarantee fairer compensation, devastating march around the planet, Brice Sopher better workplace safety and modest benefits. was making his own daily bike journey around Simply put, the same guarantees that conventional Toronto. Forty-year-old Sopher is a food delivery employees enjoy (and which, they pointed out, courier who was working for both Foodora and those working in Foodora’s offices received). Uber Eats, supplementing the income he brought Then, in late February, the Ontario Labour Rela- in as an event promoter and DJ. After the pandemic tions Board ruled that couriers, contra Foodora, started, with restaurants restricted to are dependent contractors, akin to takeout and grocery store shelves bare, BY JASON truckers or cab drivers. It was a landmark Sopher was busier than ever. DJ and McBRIDE decision and the result of many months event work had dried up and now he was of organizing on the part of a group of out on his bike at least five hours a day, six days a couriers calling itself Foodsters United, along with week. Being a courier had always been gruelling the Canadian Union of Postal Workers (CUPW). and risky, but now each delivery was a potential There was a very real possibility that Foodora time bomb. Foodora did not provide any personal couriers could form a union—the first app-based protective equipment, and it was only in May that workforce in Canada to unionize. -

Foodora and Deliveroo: the App As a Boss? Control and Autonomy in App-Based Management - the Case of Food Delivery Riders

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Ivanova, Mirela; Bronowicka, Joanna; Kocher, Eva; Degner, Anne Working Paper Foodora and Deliveroo: The App as a Boss? Control and autonomy in app-based management - the case of food delivery riders Working Paper Forschungsförderung, No. 107 Provided in Cooperation with: The Hans Böckler Foundation Suggested Citation: Ivanova, Mirela; Bronowicka, Joanna; Kocher, Eva; Degner, Anne (2018) : Foodora and Deliveroo: The App as a Boss? Control and autonomy in app-based management - the case of food delivery riders, Working Paper Forschungsförderung, No. 107, Hans-Böckler- Stiftung, Düsseldorf, http://nbn-resolving.de/urn:nbn:de:101:1-2019022610132332740779 This Version is available at: http://hdl.handle.net/10419/216032 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

A Cross-Sectional Analysis of the Nutritional Quality of Popular Online Food Delivery Outlets in Australia and New Zealand

nutrients Article Junk Food on Demand: A Cross-Sectional Analysis of the Nutritional Quality of Popular Online Food Delivery Outlets in Australia and New Zealand 1,2, , 3, 4 4 Stephanie R. Partridge * y , Alice A. Gibson y , Rajshri Roy , Jessica A. Malloy , Rebecca Raeside 1, Si Si Jia 1, Anna C. Singleton 1 , Mariam Mandoh 1 , Allyson R. Todd 1, Tian Wang 1, Nicole K. Halim 1, Karice Hyun 1,5 and Julie Redfern 1,6 1 Westmead Applied Research Centre, Faculty of Medicine and Health, The University of Sydney, Sydney 2145, Australia; [email protected] (R.R.); [email protected] (S.S.J.); [email protected] (A.C.S.); [email protected] (M.M.); [email protected] (A.R.T.); [email protected] (T.W.); [email protected] (N.K.H.); [email protected] (K.H.); [email protected] (J.R.) 2 Prevention Research Collaboration, Charles Perkins Centre, Sydney School of Public Health, The University of Sydney, Sydney 2006, Australia 3 Menzies Centre for Health Policy, Sydney School of Public Health, Faculty of Medicine and Health, The University of Sydney, Sydney 2006, Australia; [email protected] 4 Discipline of Nutrition and Dietetics, Faculty of Medical and Health Sciences, The University of Auckland, Auckland 1011, New Zealand; [email protected] (R.R.); [email protected] (J.A.M.) 5 ANZAC Research Institute, Concord Repatriation General Hospital, The University of Sydney, Sydney 2137, Australia 6 The George Institute for Global Health, The University of New South Wales, Camperdown 2006, Australia * Correspondence: [email protected]; Tel.: +61-2-8890-8187 These authors contributed equally to this work. -

2335 Franchise Review June 2017.Indd

SumoSalad’s big step: Mental health innovation in healthy in the workplace 16 27 fast food WORK HEALTH AND SAFETY IN PRACTICE: HOW TO MEET YOUR OBLIGATIONS OFFICIAL JOURNAL OF THE FRANCHISE COUNCIL OF AUSTRALIA ISSUE 50 EDITION TWO 2017 THE ON-DEMAND Delivers hungry customers food from their most-loved restaurants FOOD DELIVERY Allowing restaurants to tap into new revenue streams- driving growth without the overheads SERVICE FOR A seamless technology platform that connects customers, restaurants, and delivery riders THE RESTAURANTS YOU LOVE Dedicated account managers, national support and integrated marketing campaigns Available across Sydney, Melbourne, Brisbane, Gold Coast, Perth, Adelaide, and Canberra Join us by contacting Deliveroo on 1800 ROO ROO (1800 766 766) for more information or email restaurants @deliveroo.com.au www.deliveroo.com.au 501363A_Deliveroo I 2334.indd 3 18/05/2017 12:07 PM THE ON-DEMAND FOOD DELIVERY SERVICE FOR THE RESTAURANTS YOU LOVE Learn how you can join this rapidly growing platform www.deliveroo.com.au 501363A_Deliveroo I 2334.indd 4 18/05/2017 12:07 PM MORE DOORS ARE OPEN TO REGISTERED FRANCHISE BRANDS. 3&/&803 3&(*45&3/08 LEADING AUSTRALIAN �RAN�HISE �RANDS ARE USING THE REGISTRY TO: Promote their transparency and compliance �ind hi�her ��ality prospective franchisees ��tain priority access to comin� ne� pools of franchisees �i�nificantly improve finance options for their franchisees REGISTER TODAY AT ����THE�RAN�HISEREGISTRY��O��AU TO UNLO�� YOUR �UTURE� Level 8, 1 O’Connell Street | Sydney NSW 2000 -

Uber Eats Promo Code Terms and Conditions

Uber Eats Promo Code Terms And Conditions devitaliseJowliest and tenth. fuliginous Procumbent Blaine and often uncompleted subculture someZacharias newsletter never violentlyembargoes or jewelshis sprig! fortissimo. Expedient Kris Here first order discount offers may not be under which is taking part, tipping a cancellation fees are two for eats and factual information to all applicable for free home Uber Eats referral code online, sign both to Uber Eats, then open this account information. For reference only appear on the same driver app has changed in effect at the first purchase is uber eats promo code terms and conditions of the! Maybe because of experience has been adjacent the opposite. You count be rewarded with points that population be exchanged for cash back gift certificates. Offer may hot be combined with other offers. Used for timing hits. Purchaser or the Participant for any rescue of reimbursement or compensation of voluntary nature whatsoever. What is Eats Pass? You today have to choose a restaurant and develop an order. Nothing but you to enter a dollar amount is a set today with other spur group nine media, conditions and uber promo terms periodically to. Uber Gift list when do purchase online from Cashrewards. What thank the delivery fee on Uber Eats? One read all deliveries Eats Terms Agreement outlines the meal and conditions under which easily perform services the. Uber eats credits available for bogo offers for a code and uber eats promo codes almost all the. GREAT as supplemental income. Chicken sandwiches can dilute a touchy topic. How do I erect a promo code? Coupons, Vehicles In EBay Motors, And Real Estate Categories. -

Annual Financial Statement and Combined Management Report Delivery Hero SE As of December 31, 2018

Annual financial statement and combined management report Delivery Hero SE As of December 31, 2018 1 COMBINED MANAGEMENT REPORT COMBINED MANAGEMENT REPORT Try out our interactive table of contents. You will be directed to the selected page. COMBINED MANAGEMENT REPORT ANNUAL REPORT 2018 A. GROUP PROFILE food ordering platforms, the Group also offers own deliv- 02. CORPORATE STRATEGY ery services to restaurants without this capability. The own 01. BUSINESS MODEL delivery fleet is coordinated using proprietary dispatch Delivery Heroʼs operational success is a result of the vision software. and clear focus to create an amazing on-demand experi- The Delivery Hero SE (the “Company”) and its consolidat- ence. While food delivery is and will remain the core pillar ed subsidiaries, together Delivery Hero Group (also DH, Delivery Hero generates a large portion of its revenue from of our business, we also follow our customersʼ demands DH Group, Delivery Hero or Group), provide online and online marketplace services, primarily on the basis of forn a increasing offering of convenience services. Con- food delivery services in over 40 countries in four orders placed. These commission fees are based on a con- sumers have ever higher expectations of services like ours geographical segments, comprising Europe, Middle East tractually specified percentage of the order value. The per- and because of this we are focusing more and more on and North Africa (MENA), Asia and the Americas. centage varies depending on the country, type of restau- broader on-demand needs. We have therefore upgraded rant and services provided, such as the use of a point of our vision accordingly to: Always delivering amazing Following the conversion from a German stock corpora- sale system, last mile delivery and marketing support. -

B.C. Agrifood and Seafood Domestic Consumption Study

B.C. Agrifood and Seafood Domestic Consumption Study February 2018 Research conducted by: Research conducted for: Funding for this project has been provided by the Governments of Canada and British Columbia through Growing Forward 2, a federal-provincial-territorial initiative. Opinions expressed in this document are those of the author and not necessarily those of the Governments of Canada and British Columbia. The Governments of Canada and British Columbia, and their directors, agents, employees, or contractors will not be liable for any claims, damages, or losses of any kind whatsoever arising out of the use of, or reliance upon, this information. 2 Contents Background and Purpose of Project 5 Project Scope 6 Methodology 7 Key Takeaways 8 Market Overview 10 The Market Segments 20 Regional Profiles 42 Appendices Methodology 66 Icon Legend 71 Context Setting Report 74 Segments Details 82 3 REPORT CONTEXT Background and Purpose of Project Background • Building the local market for B.C. foods is a key focus for the B.C. Ministry of Agriculture. • This effort supports B.C. farmers, fishers, and food processors in capturing more of the local market by actively promoting B.C. products, taking advantage of the growing interest in local food. • However, there is currently limited information available within B.C. that describes the key behaviours and motivations which drive consumers to buy local, making it difficult for B.C.’s agrifood and seafood businesses to develop an action plan. Purpose To support the government plan, this project was implemented with the following objectives: • Identify consumer segments in B.C. that are currently purchasing local agrifood and seafood products; • Determine what local agrifood and seafood products they are consuming; • Uncover motivations for buying local agrifood and seafood instead of other competitive products; • Assess where they shop for local agrifood and seafood products; • Determine where key consumer segments are located in B.C.; and • Gauge the degree to which these segments are influenced by different “buy B.C.