United States Securities and Exchange Commission Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Télécharger La Synthèse De L'enquête Nationale Sur L'autopartage 2019

Enquête nationale sur l’autopartage - Edition 2019 Actualisation et étude de l’impact des services d’autopartage sur l’équipement des ménages et sur les kilomètres parcourus en voiture UNE ÉTUDE RÉALISÉE PAR 6T-BUREAU DE RECHERCHE SUR UN COFINANCEMENT 6T ET ADEME Contexte Enjeux Publiées en 2012 et 2016, les deux premières Tout comme en 2012 et 2016, l’édition 2019 porte éditions de l’Enquête Nationale sur l’Autopartage1 principalement sur l’autopartage en boucle. Elle vise constituaient les premières études d’envergure sur deux objectifs : les usagers, usages et impacts de l’autopartage en France. mettre à jour les résultats de la précédente édition : les usagers, usages et impacts de l’autopartage ont- Menées auprès d’au moins 2 000 usagers abonnés ils évolué entre 2016 et 2019 ? d’une vingtaine de services d’autopartage différents, ces enquêtes ont mis en évidence l’effet « déclencheur affiner la compréhension des usagers, usages et de multimodalité » de l’autopartage en boucle : impacts de l’autopartage : notamment, qui sont les l’autopartage permet aux habitants des villes de usagers de l’autopartage ? Une fois abonnés à s’affranchir de la voiture individuelle, de découvrir l’autopartage, leurs pratiques de déplacements et de s’approprier d’autres modes de déplacement. évoluent-elles de la même manière ? Quels sont les usages et les impacts de l’autopartage entre Trois ans après la dernière enquête, l’autopartage particuliers et de l’autopartage en contexte joue-t-il encore le même rôle dans la mobilité professionnel ? urbaine ? Ses usagers sont-ils restés les mêmes ? Ses usages, ses impacts ont-ils évolué ? Le rapport d’étude complet est disponible sur notre blog : Lien Autopartage B2C en boucle : (fr Autopartage B2C en trace Autopartage entre l’objet principal de l’étude directe particuliers ou P2P Le véhicule est rendu dans la Avec stations : le véhicule peut Réalisée entre particuliers station de départ. -

2018 Annual Report

2018 ANNUAL REPORT The New NY Bridge Project serve customers in a growth environment. We Letter to our increased rental revenue across all our regions and verticals, and we continued to foster organic growth through cross-selling. This was aided by Stockholders the expansion of our specialty segment to 323 Our record performance in 2018 underscored locations. our ability to capitalize on demand through a combination of scale, technology and other Furthermore, while the U.S. equipment rental sustainable competitive advantages. This is industry grew by a solid 8% in 2018, we grew how we best serve our customers and create faster. Our rental revenue, pro-forma for 2017 value for our investors. acquisitions, increased 10.5% year-over-year. Growth is synergistic for us: it creates the We entered 2018 from a position of strength, with potential for greater efficiency and generates a large and diversified presence in North America. cash that we use to advance our strategy. During the year, we acquired BakerCorp, a fluid solutions specialist business, and BlueLine, a In 2018, in addition to allocating capital for national construction equipment rental company, M&A, rental fleet, technology and productivity as well as several smaller operations. These initiatives, we embarked on a $1.25 billion share transactions helped us reach a new milestone of repurchase program to provide further value for over $8 billion in annual revenue. our stockholders. We intend to complete the program in 2019. For the full year 2018, United Rentals delivered GAAP earnings per diluted share of $13.12, Value through Productivity compared with $15.73 for the full year 2017. -

A Collaborative Design Process to Support Sustainable

SCENARIODEVELOPMENTINPRODUCTSERVICESYSTEMS: ACOLLABORATIVEDESIGNPROCESSTOSUPPORT SUSTAINABLECONSUMPTION CatharinaB.Nawangpalupi Athesissubmittedforthedegreeof DoctorofPhilosophy FACULTYOFTHEBUILTENVIRONMENT THEUNIVERSITYOFNEWSOUTHWALES COPYRIGHT STATEMENT ‘I hereby grant the University of New South Wales or its agents the right to archive and to make available my thesis or dissertation in whole or part in the University libraries in all forms of media, now or here after known, subject to the provisions of the Copyright Act 1968. I retain all proprietary rights, such as patent rights. I also retain the right to use in future works (such as articles or books) all or part of this thesis or dissertation. I also authorise University Microfilms to use the 350 word abstract of my thesis in Dissertation Abstract International (this is applicable to doctoral theses only). I have either used no substantial portions of copyright material in my thesis or I have obtained permission to use copyright material; where permission has not been granted I have applied/will apply for a partial restriction of the digital copy of my thesis or dissertation.' Signed Date 2 August 2010 AUTHENTICITY STATEMENT ‘I certify that the Library deposit digital copy is a direct equivalent of the final officially approved version of my thesis. No emendation of content has occurred and if there are any minor variations in formatting, they are the result of the conversion to digital format.’ Signed Date 2 August 2010 i ORIGINALITY STATEMENT ‘I hereby declare that this submission is my own work and to the best of my knowledge it contains no materials previously published or written by another person, or substantial proportions of material which have been accepted for the award of any other degree or diploma at UNSW or any other educational institution, except where due acknowledgement is made in the thesis. -

Letter to Our Stockholders

In 2020, we achieved a net income margin Letter to our of 10.4% and an adjusted EBITDA margin1 of 46.1% — within 220 and 50 basis points Stockholders of 2019, respectively, despite significantly lower demand. We also generated net cash provided by operating activities of We executed well in a difficult year, drawing $2.7 billion and record free cash flow1 of on the disciplines we’ve engineered into $2.4 billion, contributing to the $3.1 billion of our business for more than a decade. Most total liquidity we had at year-end. importantly, we delivered on our promises. These results reflect the considerable economic Nothing about 2020 was business as usual. The constraints of the pandemic, mitigated by the year began on a positive note that dissipated resilience of our business model. Beyond that, as the pandemic took root. We moved quickly our performance reflects the fierce determination to establish the priorities that would guide us of our team, strong capital management and in the coming months: protect our employees, rigorous cost discipline. provide continuity of service for our customers, maintain our service capacity and safeguard the A purposeful response interests of our investors. We’re proud that United To manage effectively through the pandemic, we Rentals met all of these objectives, while providing took a balanced short-term and long-term view. essential services to our communities. Each time we committed to a course of action, we considered all of the implications of that The trough for equipment rental came in April, decision. For instance, with capital expenditures, and demand stayed at low ebb for several weeks we aggressively curtailed fleet purchases in 2020 before starting to improve. -

Semi-Annual-Report-Lmf-Icvc.Pdf

Interim Report and Unaudited Financial Statements Legg Mason Funds ICVC 31 August 2020 – (Long Form Version) Legg Mason Funds ICVC 0820 Interim Report and Financial Statements (unaudited) – (long form version) Table of Contents Report of the Authorised Corporate Director* 3 Economic and Market Overview 5 Statement of Authorised Corporate Director’s Responsibilities 6 12 Month Performance 7 Legg Mason Funds ICVC’s Fund Range 10 Accounting Policies 11 Legg Mason IF Brandywine Global Income Optimiser Fund 12 Legg Mason IF ClearBridge Global Equity Income Fund 23 Legg Mason IF ClearBridge Global Infrastructure Income Fund 32 Legg Mason IF ClearBridge US Equity Fund 47 Legg Mason IF ClearBridge US Equity Income Fund 53 Legg Mason IF Japan Equity Fund 62 Legg Mason IF Martin Currie Asia Pacific Fund 69 Legg Mason IF Martin Currie Asia Unconstrained Fund 75 Legg Mason IF Martin Currie Emerging Markets Fund 84 Legg Mason IF Martin Currie European Unconstrained Fund 91 Legg Mason IF Martin Currie Global Equity Income Fund 101 Legg Mason IF Martin Currie US Unconstrained Fund 111 Legg Mason IF QS Emerging Markets Equity Fund 118 Legg Mason IF QS UK Equity Fund 122 Legg Mason IF Royce US Smaller Companies Fund 128 Legg Mason IF Western Asset Global Multi Strategy Bond Fund 135 Legg Mason IF Western Asset Retirement Income Bond Fund 149 Portfolio Statements* 162 Investment Funds Information* 214 Investment Managers* 214 Glossary 215 * These reports with the addition of the fund review section of each sub-fund comprise the Authorised Corporate Director’s Report. 2 Legg Mason Funds ICVC 0820 Interim Report and Financial Statements (unaudited) – (long form version) Report of the Authorised Corporate Director Legg Mason Investment Funds Limited, the authorised corporate director (the “ACD”) of Legg Mason Funds ICVC (the “Company”) is pleased to present the Interim Report & Financial Statements for the Company for the half year ended 31 August 2020. -

A City-Level Analysis of B2C Carsharing in Europe

A city-level analysis of B2C carsharing in Europe Master’s thesis Jan Lodewijk Blomme Master’s program: Innovation Sciences Student number: 3642658 Email: [email protected] Telephone: +316 4419 6103 Supervisor: Prof. Dr. Koen Frenken Second reader: Dr. Wouter Boon Date: May 13, 2016 A city-level analysis of B2C carsharing in Europe – Master’s thesis J. L. Blomme Summary Business to consumer (B2C) carsharing is a phenomenon that started in Europe in the 1940s but has gained in popularity quickly since the 1990s. This development is a welcome addition to the means that can be supported by local governments in order to mitigate greenhouse gas emissions and curb congestion in cities. Cities have however experienced differences in the extent to which carsharing has been adopted in their area. This research uncovers several important city features that explain this differential adoption of carsharing in a city. This study uses the multi-level perspective (MLP) to distinguish between the contemporary car regime and the carsharing niche. Several indicators are identified that theoretically would weaken the regime and/or strengthen the niche in a city. These indicators are therefore expected to have a noticeable effect on the amount of shared B2C vehicles in cities, as the local car regime would be weaker. The research develops a unique database by collecting the amount of shared B2C cars online through carsharing operator (CSO) websites. Independent variables are in turn collected through various sources both on- and offline, including national statistics databases and Eurostat. Results are initially analyzed through bivariate correlations. -

Car Sharing in the Byron Shire

Car Sharing in the Byron Shire Purpose: • To investigate the different types of car sharing models available in Australia and how they work. • To explore the potential for car sharing to alleviate car parking and traffic issues, reduce emissions and provide a more affordable transport option for the Byron Shire community. • Ascertain whether Council can participate in car sharing as an alternative to traditional fleet leasing arrangements, or in conjunction with these. Objectives: 1. Demonstrate leadership – contribute to Council and community behaviour changes about sustainable transport. 2. Introduce an alternative option to developers for site development including an option for no parking to deliver better design outcomes for sustainability. 3. Reduce on-street parking demand in the Shire. 4. Reduce traffic (even minimally) – relieve congestion and improve air quality, and the pedestrian environment. 5. Explore the use of car sharing for Council and whether it could compliment the traditional fleet leasing model (delivering on emissions reductions and cost efficiencies). 6. Encouragement of more sustainable models of transport for both locals and visitors in line with emissions reduction objectives. 7. Another transport option for locals that may deliver greater affordability, flexibility and environmental value for residents. Strategic links: Community Strategic Plan 2022 Council Resolution 17-005 Resolved that Council note the report Byron Bay Town Centre Local Environmental Plan and Development Control Plan controls review (Richardson/Hunter). -

We're Hertz. They're Not

We’re Hertz. They’re Not. 2006 Annual Report Broad, Balanced Business with Consistent Growth Dear Hertz Stockholders 2006 was a historic year of change for Hertz. 2006 was also a year of continuity – meaning At the end of 2005, Ford Motor Company sold Hertz another year of successful innovation for one of the to a consortium of leading private equity investors world’s iconic brands. Financial performance was — Clayton, Dubilier & Rice, The Carlyle Group, and significantly improved and better than that of our Merrill Lynch Global Private Equity – and, on peer group. Our global platform and complemen- November 16, the Company launched a successful tary businesses continued to set us apart from the initial public offering of common stock traded on competition, with both car and equipment rental the New York Stock Exchange. The Company also making significant contributions to Hertz’s financial welcomed me as its new CEO in July, and I sincerely results. We built on a reputation for leading-edge appreciate our employees’ openness toward me innovation by introducing two new car rental brand and enthusiasm for the exciting initiatives we are segments – The Fun and Green Collections – and implementing together, which should make Hertz further diversified our product offerings and geo- the global industry leader for many years to come. graphical reach in equipment rental. Our customer 2006: A Historic Year Of Change service superiority was widely recognized by cus- The strong operating results reflect revenue tomers. And, perhaps most importantly, our peo- growth from both car and, especially, equipment ple remain unquestionably the best in the business rental, the latter of which grew by 18.2% for the – the most experienced leadership team in car and full year with strong profits in every quarter and equipment rental is supported by the most commit- meaningful contributions coming from operations ted, talented employees. -

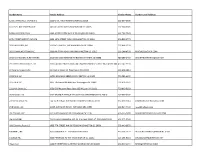

Report of Contracting Activity

Vendor Name Vendor Address Vendor Phone Vendor Email Address 1213 U STREET LLC /T/A BEN'S 1213 U ST., NW 0 WASHINGTON DC 20009 202-667-0909 1417 N ST NW COOPERATIVE 1417 N STREET NW 0 WASHINGTON DC 20005 202-588-0026 1919 Calvert Street LLC 6230 3rd Street NW Suite 2 Washington DC 20011 202-722-7423 19TH STREET BAPTIST CHRUCH 4606 16TH STREET, NW 0 WASHINGTON DC 20011 202-829-2773 2013 HOLDINGS, INC 2013 H ST NW STE 300 WASHINGTON DC 20006 202-454-1220 202 COMMUNICATIONS INC. 3900 MILITARY ROAD NW 0 WASHINGTON DC 20015 202-244-8700 [email protected] 20-20 CAPTIONING & REPORTING 1010 NW 52ND TERRACE PO BOX 8593 TOPEAK KS 66608 785-286-2730 [email protected] 21ST CENTURY SECURITY, LLC 1550 CATON CENTER DRIVE, #A DBA/PROSHRED SECURITY BALTIMORE MD 21227410-242-9224 22 Atlantic Street CoOp 22 Atlantic Street SE Washington DC 20032 202-409-1813 2228 MLK LLC 11701 BOWMAN GREEN DRIVE RESTON VA 20190 703-581-6109 2255 MLK LLC 1805 7th Street NW 8th Floor Washington DC 20001 703-606-2971 2321 4th Street LLC 1651 Old Meadow Road Suite 305 McLean VA 22102 703-893-0303 2620 Bowen LLC 3232 GEORGIA AVENUE NW SUITE 100 WASHINGTON DC 20010 202-567-3202 270 STRATEGIES INC 722 12TH STREET NW FLOOR 3 WASHINGTON DC 20005 312-618-1614 [email protected] 2ND LOGIC, LLC 10405 OVERGATE PLACE POTOMAC MD 20854 202-827-7420 [email protected] 3M COGENT, INC. 639 N ROSEMEAD BLVD 0 PASADENA CA 91107 626-325-9600 [email protected] 3M COMPANY TSS DIVISION, BUILDING 225-5S- P.O. -

The Sharing Economy

vol 9 issue 4 transport matters the sharing economy Will the sharing economy spell the end of car ownership? And what will it mean for transport planning? transport matters vol 9 issue 4 sharing economy Originally, the term ‘sharing economy’ described digital exchange models, or on-line platforms, where the supply of underutilised assets, or time, can be efficiently matched to demand for those assets. At its simplest – “I have a power-drill I’m not using; - If you would like to use it, click here”. Over time, the use of these Peer-to-Peer (P2P) platforms has proliferated, and because the technology involved is common, many disparate behaviours and transactions are seen as belonging to a new class of economy – i.e. the sharing economy. Providers Platform Owners (App) Customers Service, Money, Matches request to offer Service, Money, Goods, Asssets Manages the transaction Goods, Asssets Provides the technology Handles Risk and regulation Provides ratings service All done for a fee There are some key elements we can use to help Ratings are used as a way of identifying good value/ define the sharing economy; service and act as a proxy for quality and regulation It’s peer to peer - customers deal directly with As the amount of goods and services being providers across a platform exchanged across these platforms has increased other terms have begun appearing – the collaborative The platform ‘matches’ customers to providers and economy, peer economy, the on-demand economy facilitates the exchange and so on. While definitions can be problematic, what The platform owner may take a fee or provide the is clear is that the nature of the transaction, the use of service for free a P2P platform is common. -

United Rentals Annual Report 2021

United Rentals Annual Report 2021 Form 10-K (NYSE:URI) Published: January 27th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 __________________________________________________________________________________________ FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 1-14387 United Rentals, Inc. Commission File Number 1-13663 United Rentals (North America), Inc. (Exact Names of Registrants as Specified in Their Charters) __________________________________________________________________________________________ Delaware 06-1522496 Delaware 86-0933835 (States of Incorporation) (I.R.S. Employer Identification Nos.) 100 First Stamford Place, Suite 700 Stamford Connecticut 06902 (Address of Principal Executive Offices) (Zip Code) Registrants’ Telephone Number, Including Area Code: (203) 622-3131 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange on Title of Each Class Trading Symbol(s) Which Registered Common Stock, $.01 par value, of United Rentals, Inc. URI New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Y es ☑ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Sharing Is Contagious 1960-2010

SHARING IS CONTAGIOUS THIS INFOGRAPHIC CHARTS THE RISE OF COLLABORATIVE CONSUMPTION: THE RAPID EXPLOSION IN TRADITIONAL SHARING, BARTERING, LENDING, TRADING, RENTING, GIFTING, AND SWAPPING REDEFINED THROUGH TECHNOLOGY AND PEER COMMUNITIES. WWW.COLLABORATIVECONSUMPTION.COM 1960-2010 PEER-TO-PEER PRODUCT SHARING STARTS TO RELAYRIDES / WHIPCAR / MU DRIVE MY CAR RENTALS / WHEELS B-CYCLE / MELBOURNE BIKE SHARE THREDUP/ 99 DRESSES / OPENSPOT / PRIMOSPOT THING LOOP / SNAPGOODS YES-SECURE / IGRIN BECOME MAINSTREAM AND HYPER-LOCAL 2010 STICKY BITS / ITIZEN BLOCKCHALK ZIBIGO / RIDEPENGUIN / CAB CORNER NICE RIDE / BIXI (LONDON) / ECOBICI SHARE ZEN / CROWDRENT COZYBUG SWAPBOOKS SHARED EARTH / URBAN GARDEN SHARE NEIGHBORGOODS / TRADESCHOOL PAYPAL 2.0 / PEEPEX/ OURGOODS 1.96 BN ELINOR OSTROM WINS NOBEL PRIZE FOR ECONOMICS HOURCAR / WHIZZ CAR CARSHARE HFX / CONNECT HIRE THINGS / SMARTYRENTS / SWAPITBABY / SWAPSTER / SWAPCOVE / FIRST TO WIN WITH A THEORY IN THE EFFICIENCY OF COMMONS-BASED SOCIETIES 2009 FOURSQUARE U-CARSHARE / WECAR / CAR2GO BIXI / DUBLIN BIKES / VILLO WEAR TODAY, GONE TOMORROW REUSEITNETWORK TOYSWAP / THREDSWAP CRASHPADDER / ISTOPOVEROFFICE SHARE SOME SUGAR VENMO / TINY / QUIDS / KROONOS 1.8 BN ACCESS IS THE NEW OWNERSHIP GREAT FINANCIAL CRASH SHOCKS CONSUMER BEHAVIORS RENTALIC / BABYPLAYS / AIRBNB / LAUNCHPAD / SPAREGROUND / PRESIDENT OBAMA (MYBO.COM) PROVES THE POWER OF MASS COLLABORATION 2008 CONNECT / CITYWHEELS / MINT HZ BIKE / VEL'OH / BIKE ONE LUCKYDUCK / DRESSEDUP KASHLESS DIGNSWAP / SWAPACE LANDSHARE / ROOMORAMA WECOMMUNE /