36Th-Annual-Report-2017-2018.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

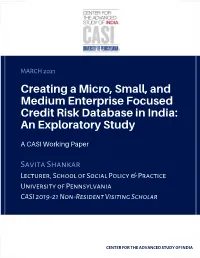

Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: an Exploratory Study

MARCH 2021 Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: An Exploratory Study A CASI Working Paper Savita Shankar Lecturer, School of Social Policy & Practice University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar CENTER FOR THE ADVANCED STUDY OF INDIA CREATING A MICRO, SMALL, AND MEDIUM ENTERPRISE FOCUSED CREDIT RISK DATABASE IN INDIA: AN EXPLORATORY STUDY Savita Shankar Lecturer, School of Social Policy & Practice, University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar A CASI Working Paper March 2021 © Copyright 2021 Savita Shankar & Center for the Advanced Study of India ABOUT THE AUTHOR SAVITA SHANKAR is a CASI 2019-21 Non-Resident Visiting Scholar and a Lecturer at the School of Social Policy & Practice at the University of Pennsylvania. She earned her Ph.D. at the Lee Kuan Yew School of Public Policy, National University of Singapore. She has taught at the Keio Business School, Japan; the Asian Institute of Management, Philippines; and the Institute for Financial Management and Research, Chennai, India. Prior to her academic career, she worked with financial institutions in India for ten years (Export Import Bank of India and ICICI Bank) focusing on project appraisals and stress asset management. Her research interests include issues related to micro, small and medium enterprises, financial inclusion, and social entrepreneurship. She has consulted for the Asian Development Bank as well as for Habitat for Humanity (Cambodia and Philippines). Her ongoing research includes a collaborative project on the potential for setting up a credit risk database for micro, small, and medium enterprises in India. -

Name of the AMC : IIFL ASSET MANAGEMENT LIMITED All Figures

Name of the AMC : IIFL ASSET MANAGEMENT LIMITED All figures - Rs. in Lacs Sr. No. ARN Name of the ARN Holder Total Commission Total Expenses Total Commission + Gross Inflows Net Inflows Whether the Averge Assets under AUM as on Ratio of paid during paid during Expenses paid during distributor is an Management for FY 31-Mar-2019 AUM to FY 2018-19 FY 2018-19 FY 2018-19 associate or group 2018-19 Gross compnay of the Inflows sponsors of the Mutual Fund A B A+B 1 1 BNP Paribas - - - - - - - - 2 2 JM Financial Services Limited 0.01 - 0.01 3.73 3.73 1.52 4.01 1.08 3 5 HDFC Bank Limited - - - - - - - - 4 6 SKP Securities Limited - - - - - - - - 5 7 SPA Capital Services Limited - - - - - - - - 6 9 Way2Wealth Securities Private Limited - - - 2.52 2.52 1.92 2.61 1.04 7 10 Bajaj Capital Ltd. 6.44 - 6.44 540.91 540.29 479.55 564.07 1.04 8 11 SBICAP Securities Limited - - - - - - - - 9 14 Shubhangi Gopal Pai - - - - - - - - 10 16 Bluechip Corporate Investment Centre Ltd - - - - - - - - 11 17 Stock Holding Corporation of India Limited - - - - - - - - 12 18 Karvy Stock Broking Limited 12.23 - 12.23 1,435.72 981.98 915.16 1,022.93 0.71 13 19 Axis Bank Limited 0.08 - 0.08 10.03 10.03 6.43 10.42 1.04 14 20 ICICI Bank Limited 42.05 - 42.05 4,078.27 4,020.20 3,612.52 4,189.04 1.03 15 21 Tata Securities Limited - - - - - - - - 16 22 Hongkong & Shanghai Banking Corporation Ltd. -

Ref. No. SE/ 2020-21/73 June 22, 2020 BSE Limited P. J

HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED www.hdfc.com Ref. No. SE/ 2020-21/73 June 22, 2020 BSE Limited National Stock Exchange of India Limited P. J. Towers, Exchange Plaz.a, Plot No. C/1, Block G, Dalal Street, Bandra-Kurla Complex, Bandra (East) Mumbai 400 001 . Mumbai 400 051. Kind Attn: - Sr. General Manager Kind Attn: Head - Listlng DCS - Listing Department Dear Sirs, Sub: Copy of Notice published in newspapers -Notice of Postal Ballot dated June 19, 2020. Pursuant to provisions of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed herewith copies of newspaper clippings containing the notice published by the Corporation with regard to captioned subject. The said newspaper clippings are also available on website of the Corporation, www.hdfc.com This is for your information and record. Thank you, Yours faith fully, F r Housing Development Finance Corporation Limited Encl: a/a Corporate Office:HDFC House, HT Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai 400 020. Tel.: 66316000, 22820282. Fax: 022-22046834, 22046758. Regd. Office: Ramon House, HT Parekh Marg, 169, Backbay Reclamation, Churchgate, Mumbai 400 020. INDIA. Corporate Identity Number: L70100MH1977PLC019916 THE FREE PRESSJOURNAL 10 MUMBAI | MONDAY | JUNE 22, 2020 www. reepressjournal.in PUBLIC NOTICE SHIVOM INVESTMENT & CONSULTANCY LTD Hilton Metal Forging Limited NOTICE is hereby given to the General Public that We, M/s Accura 8, Shaniya Enclave, 4th Floor, V.P. Road, Vile Parle West, Regd Office: 701, Palm Spring, Link Road, Mumbai-400064 HDFC BANK Pharmaquip Pvt. Ltd., Intending to offer our property described here- Mumbai City, Maharashtra, 400056 http://www.hiltonmetal.com in below as a mortgage to HDFC Bank Ltd., Trade Star Building, We understand your world Email: [email protected], Website: www.shivominvestmentconsultancyltd.in Notice Andheri (E) Branch by way of security to secure the banking facility CIN: L74140MH1990PLC300881 HDFC Bank Limited granted to us by the said Bank. -

Msme Report 2020

OCTOBER 2020 ANALYTICAL CONTACTS TransUnion CIBIL Vipul Mahajan [email protected] Saloni Sinha [email protected] SIDBI Rangadass Prabhavathi [email protected] Table of Contents 02 Executive Summary 04 MSME Lending Portfolio Trends 05 Geography: Credit growth in MSME Lending 06 MSME Lending market share: NBFCs losing market share 07 Impact of Emergency Credit Line Guarantee Scheme (ECLGS) on MSME Lending 10 Behavioral changes in COVID-19 pandemic times to MSME Lending industry 18 NPA Trends in MSME Lending 20 Structurally strong MSMEs continue to be resilient 23 Sectoral Risk Assessment of MSMEs 24 Conclusion 01 Executive Summary ECLGS boosted credit infusion to MSMEs: Credit infusion to MSMEs declined sharply post the lockdowns due to COVID-19 pandemic. The ECLGS scheme implementation brought the much needed boost and significantly helped in reviving credit infusion to MSMEs post its announcement in May 2020. Catalysed by this scheme, Public sector banks disbursed 2.6 times higher loan amount to MSMEs in Jun’20 over Feb’20. Even private sector banks’ credit disbursals in the MSME segment for Jun’20 were back at Feb’20 levels. Geographies which experienced less stringent lockdowns showed relatively better credit infusion and lesser decline in credit outstanding: MSME lending in Metro regions had the sharpest drop during lockdown and relatively lower rate of revival post-ECLGS. While number of MSME loans disbursed in Urban, Semi-urban and Rural regions for Jun’20 is over 3 times that of Feb’20,it was at 1.86 times for Metro regions. Similar trend is observed at state level- i.e. -

Equity Research October 15, 2020 INDIA

` Equity Research October 15, 2020 INDIA BSE Sensex: 40795 BFSI ICICI Securities Limited is the author and MSME credit – few traits of confidence emerging distributor of this report MSME segment was anticipated to bear the biggest brunt of prolonged disruption and be the most vulnerable amidst Covid-19 pandemic – more so vindicated by a sharp decline in credit flow to MSME sector in April-May’20. However, ECLGS scheme (Rs1.88trn sanctioned and Rs1.36trn disbursed till date) revived the credit flow since June’20 and currently credit enquiries on MoM basis have settled at >85% of pre-Covid level, as per latest TransUnion CIBIL data. Further, taking clues from following parameters, pain seems manageable to financiers for now: A) the proportion of credit enquires from new-to-credit and new-to-bank customers reaching pre-Covid level of 31%/23%, respectively, in August’20 (reflecting financiers confidence in few sub-segments); B) ~81% of eligible MSMEs for ECLGS scheme belong to better-rated SMEs ‘up to CMR-6’ (with liquidity support can revive faster). Geographically, states like Bihar, Jharkhand, Punjab and Kerala are leading the bounce back while pace of revival is slow in Maharashtra and Delhi. Few traits of confidence emerging in MSME segment will benefit banks with higher exposure namely SBI, Axis, CUBK, Federal and DCB. Timely implementation of ECLGS schemes kick-started credit flow to MSME - MSME credit enquiries dipped during Covid-19 pandemic to 23% in Apr’20 (of Feb’20 level) and 40% in May’20. Sanctions under ECLGS scheme kick-started the much-needed revival in enquiries – with cumulative Rs1.88trn sanctions enquiries are settling at >85% of pre-Covid level now. -

Capital Market Compendium

January 2012 CRISIL Insights Capital Market Entities Redesigning Strategies: Will They Succeed? CRISIL Insights Analytical Contacts Name Designation Email id Pawan Agrawal Director [email protected] Nagarajan Narasimhan Director [email protected] Rupali Shanker Head [email protected] Suman Chowdhury Head [email protected] Manoj Damle Senior Manager [email protected] Prachi Gupta Senior Manager [email protected] Gourav Gupta Manager [email protected] Subhasri Narayanan Manager [email protected] Abhishek Sonthalia Rating Analyst [email protected] Shailesh Sawant Rating Analyst [email protected] Prashant Mane Executive [email protected] Sahil Utreja Executive [email protected] FOREWORD I am delighted to present this compendium of articles on the India’s capital market entities (CMEs), titled ‘Capital Market Entities Redesigning Strategies: Will They Succeed?’ This compendium is part of our initiatives to share with you, the insights we have gained from our ongoing analysis of key developments and sectors, over the years. Capital market entities are primarily engaged in the business of broking (both retail as well as institutional) and investment banking. They also provide associated services like demat accounts, providing loans against shares, margin funding, etc. to their broking clients. In the financial system, they perform an important intermediary role: n As investment bankers, CMEs facilitate raising of capital (both equity and debt), which is critical raw material for growth. They also play an important role in mergers, acquisitions, and their funding n As brokers, CMEs enable equity investing culture, helping to expand the retail investor base. CRISIL has a strong and diverse rating coverage in this sector – CRISIL rates more than 50 companies engaged in capital market and related businesses, including domestic and foreign, as well as large and small. -

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 1, 2021 Reserve Bank of India sets July 30 deadline for banks to move current accounts: The Reserve Bank of India (RBI) has set a deadline of July 30 for banks to give up current accounts of all companies where their exposure is below a cut-off decided by the regulator. RBI communicated this in a letter to banks a fortnight ago, two senior bankers told ET.The move, initiated more than a year ago, could trigger a migration of many lucrative current accounts - which lower a bank's fund cost and cash management business - from MNC banks to public sector lenders and some of the large private sector Indian banks.According to the new rule, a bank with less than 10% of the total approved facilities - which include loans, non-fund businesses like guarantees, and daylight overdrafts (or intra-day) exposure - to a company is barred from having the client's current account. "RBI is probably upset that banks are taking a long time to shift the accounts. But the delay may also be because several PSU banks may not be ready with the technology. Now, RBI can't direct companies which have been doing business with a bank for years to move to another bank. -

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

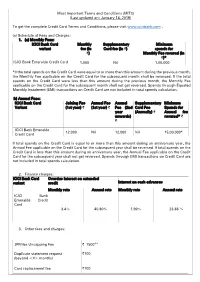

MITC-Emeralde.Pdf

Most Important Terms and Conditions (MITC) (Last updated on: January 14, 2019) To get the complete Credit Card Terms and Conditions, please visit www.icicibank.com . (a) Schedule of Fees and Charges: 1. (a) Monthly Fees: ICICI Bank Card Monthly Supplementary Minimum variant fee (in Card fee (in ₹) spends for ₹) Monthly Fee reversal (in ₹)* ICICI Bank Emeralde Credit Card 1,000 Nil 1,00,000 *If the total spends on the Credit Card were equal to or more than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall be reversed. If the total spends on the Credit Card were less than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall not get reversed. Spends through Equated Monthly Instalment (EMI) transactions on Credit Card are not included in total spends calculation. (b) Annual Fees: ICICI Bank Card Joining Fee Annual Fee Annual Supplementary Minimum Variant (1st year) ₹ (1st year) ₹ Fee (2nd Card Fee Spends for year (Annually) ₹ Annual fee onwards) reversal* ₹ ₹ ICICI Bank Emeralde 12,000 Nil 12,000 Nil 15,00,000* Credit Card If total spends on the Credit Card is equal to or more than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall be reversed. If total spends on the Credit Card is less than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall not get reversed. -

Annual Deal List

Annual Deal List 16th annual edition Contents Section Page Mergers & Acquisitions 04 1. Domestic 05 2. Inbound 15 3. Merger & Internal Restructuring 18 4. Outbound 19 Private Equity 23 QIP 67 IPO 69 Disclaimer This document captures the list of deals announced based on the information available in the public domain. Grant Thornton Bharat LLP does not take any responsibility for the information, any errors or any decision by the reader based on this information. This document should not be relied upon as a substitute for detailed advice and hence, we do not accept responsibility for any loss as a result of relying on the material contained herein. Further, our analysis of the deal values is based on publicly available information and appropriate assumptions (wherever necessary). Hence, if different assumptions were to be applied, the outcomes and results would be different. This document contains the deals announced and/or closed as of 23 December 2020. Please note that the criteria used to define Indian start-ups include a) the company should have been incorporated for five years or less than five years as at the end of that particular year and b) the company is working towards innovation, development, deployment and commercialisation of new products, processes or services driven by technology or intellectual property. Deals have been classified by sectors and by funding stages based on certain assumptions, wherever necessary. Dealtracker editorial team Pankaj Chopda and Monica Kothari Our methodology for the classification of deal type is as follows: Minority stake - 1%-25% | Strategic stake - 26%-50% | Controlling stake - 51%-75% | Majority stake - 76%-99% Maps are for graphical purposes only. -

Knowledge Page

Knowledge Page Regulation of Credit Rating Agencies (CRAs) in India rising debt levels of IL&FS, and continued maintaining the rating assigned to IL&FS as AAA, indicating the highest level of creditworthiness. Introduction and Governance Following the default of IL&FS and its subsidiaries, contagion effect was witnessed in the entire NBFC space that led to an impairment in the Credit Rating Agencies (CRAs) assess creditworthiness of organizations demand for such issuers. This led to a sharp plunge in their share prices and rate their credit risk by analyzing their financial performance, level and discounted trade levels of their issuances, calling for heightened and type of debt, lending and borrowing history, ability to repay the debt, stringency in the norms followed by credit rating agencies to assess and the past debts of the entity into consideration. In India, CRAs are creditworthiness of the issuers. regulated as per the SEBI (Credit Rating Agencies) Regulations, 1999 which provide for eligibility criteria for registration of credit rating SEBI regulations on CRA’s | Proposed Changes agencies, monitoring and review of ratings, requirements for a proper rating process, avoidance of conflict of interest and inspection of rating In order to strengthen the regulatory practices governing CRA’s, SEBI has agencies by SEBI, amongst other matters. However, certain other issued the following detailed guidelines: regulatory agencies, such as the Reserve Bank of India (RBI), Insurance Regulatory and Development Authority (IRDA), and Pension Fund • Hike in the minimum net worth threshold for the rating agencies to INR Regulatory and Development Authority (PFRDA) also regulate certain 25 crore from the current level of INR 5 crore. -

INDIAN FINANCIAL SYSTEM M.COM Semester II CREDIT RATING

INDIAN FINANCIAL SYSTEM M.COM Semester II CREDIT RATING AGENCIES Dr. Geetika T. Kapoor Department Of Commerce CREDIT RATING AGENCIES MEANING • Credit rating agency(CRA) means a body corporate which is engaged in the business of rating of securities offered by companies. • The debt instruments rated by CRAs include government bonds, corporate bonds, certificate of deposits, municipal bonds, stock and collateralized securities, such as mortgage- backed securities and collateralized debt obligations. DEFINITION OF CREDIT RATING • According to CRISIL, credit rating is “an unbiased and independent opinion as to issuer’s capacity to meet its financial obligations. It does not constitute a recommendation to buy , sell or hold a particular security” • According to Moodys , “ratings are designed exclusively for the purpose of grading bonds according to their investment qualities” INTERNATIONAL AGENCIES • MOODY’S INVESTORS SERVICES • STANDARD AND POOR’S CORPORATION(S &P) MOODY’S INVESTORS SERVICES • John Moody founded the Moody’s agency at the beginning of the 20th century. • It undertakes the rating of wide range of debt related securities , international issues , commercial papers , etc. Both in USA and international markets. • Other services include- assessing financial strength of insurance companies , mutual funds, banks , public utilities. STANDARD AND POOR’S FINANCIAL SEVICES LLC(S &P) • One of the first credit rating institutions which has a history of 160 years, founded in the year 1860. • Offers rating on wide range of debt securities , both in the US and overseas markets. OTHER INTERNATIONAL AGENCIES • Duff and Phelps Credit Rating Company • Japan Credit Rating Agency • Fitch Investors Service • Thomason Bank Watch • IBCA Ltd CRISIL • CRISIL formerly Credit Rating Information Services of India Ltd is a global analytical company.