List of Live Authentication User Agencies (Auas)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banking Annual DATABASE

bank-datatable-2021-revised.qxd 29/01/2021 07:01 PM Page 8 Banking Annual DATABASE (In %) FY 2018 FY 2019 FY 2020 (In %) FY 2018 FY 2019 FY 2020 FOREIGN BANKS PRIVATE BANKS Standard Chartered Bank 15.8 15.5 14.9 Yes Bank 1.3 3.2 16.8 Sumitomo Mitsui 37.6 30.3 40.9 SMALL FINANCE BANKS SOUNDNESS: GROSS NPA (%) AU Small Finance Bank 2.0 2.0 1.7 Equitas Small Finance Bank 2.7 2.5 2.7 PUBLIC SECTOR BANKS ESAF Small Finance Bank 3.8 1.6 1.5 Bank of Baroda - 10.0 9.4 Fincare Small Finance Bank 0.9 1.3 0.9 Bank of India 16.6 15.8 15.8 Jana Small Finance Bank 42.2 8.1 2.8 Bank of Maharashtra 19.5 16.4 12.8 Suryoday Small Finance Bank 3.5 1.8 2.8 Canara Bank 11.8 8.8 8.2 Ujjivan Small Finance Bank 3.7 0.9 1.0 Central Bank of India 21.5 19.3 18.9 Utkarsh Small Finance Bank 1.9 1.4 0.7 Indian Bank 7.4 7.1 6.9 Indian Overseas Bank 25.3 22.0 14.8 SOUNDNESS: NET NPA (%) Punjab & Sind Bank 11.2 11.8 14.2 PUBLIC SECTOR BANKS Punjab National Bank 18.4 15.5 14.2 Bank of Baroda - 3.7 3.1 State Bank of India 10.9 7.5 6.2 Bank of India 8.3 5.6 3.9 UCO Bank 24.6 25.0 16.8 Bank of Maharashtra 11.2 5.5 4.8 Union Bank of India 15.7 15.0 14.2 Canara Bank 7.5 5.4 4.2 Central Bank of India 11.1 7.7 7.6 PRIVATE BANKS Indian Bank 3.8 3.8 3.1 Axis Bank 6.8 5.3 4.9 Indian Overseas Bank 15.3 10.8 5.4 Punjab & Sind Bank 6.9 7.2 8.0 Bandhan Bank 1.3 2.0 1.5 Punjab National Bank 11.2 6.6 5.8 City Union Bank 3.0 3.0 4.1 State Bank of India 5.7 3.0 2.2 CSB Bank 7.9 4.9 3.5 UCO Bank 13.1 9.7 5.5 DCB Bank 1.8 1.8 2.5 Union Bank of India 8.4 6.9 5.5 Dhanlaxmi Bank 7.4 7.5 5.9 -

Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: an Exploratory Study

MARCH 2021 Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: An Exploratory Study A CASI Working Paper Savita Shankar Lecturer, School of Social Policy & Practice University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar CENTER FOR THE ADVANCED STUDY OF INDIA CREATING A MICRO, SMALL, AND MEDIUM ENTERPRISE FOCUSED CREDIT RISK DATABASE IN INDIA: AN EXPLORATORY STUDY Savita Shankar Lecturer, School of Social Policy & Practice, University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar A CASI Working Paper March 2021 © Copyright 2021 Savita Shankar & Center for the Advanced Study of India ABOUT THE AUTHOR SAVITA SHANKAR is a CASI 2019-21 Non-Resident Visiting Scholar and a Lecturer at the School of Social Policy & Practice at the University of Pennsylvania. She earned her Ph.D. at the Lee Kuan Yew School of Public Policy, National University of Singapore. She has taught at the Keio Business School, Japan; the Asian Institute of Management, Philippines; and the Institute for Financial Management and Research, Chennai, India. Prior to her academic career, she worked with financial institutions in India for ten years (Export Import Bank of India and ICICI Bank) focusing on project appraisals and stress asset management. Her research interests include issues related to micro, small and medium enterprises, financial inclusion, and social entrepreneurship. She has consulted for the Asian Development Bank as well as for Habitat for Humanity (Cambodia and Philippines). Her ongoing research includes a collaborative project on the potential for setting up a credit risk database for micro, small, and medium enterprises in India. -

S No Housing Finance Companies Website PLI Code

List of Primary Lending Institutions that have signed MoU with NHB (National Housing Bank) under Rural Housing Interest Subsidy Scheme (RHISS) status as on 31/12/2018. S No Housing Finance Companies Website PLI Code 1 Aadhar housing Finance Ltd www.aadharhousing.com RAADR1101 2 Aavas Financiers LTD www.auhfin.in/index RAUHF1101 3 Aditya Birla Housing Finance LTD adityabirlahomeloans.com RBRLA1101 4 Altum Credo Home Finance Private LTD www.altumcredo.com RALTM1101 5 Anand Housing Finance Ltd RANAD1101 6 Aptus Value Housing Finance India LTD www.aptusindia.com RAPTS1101 7 ART Affordable Housing Finance India LTD arthfc.com RRAAS1101 8 Aspire Home Finance LTD www.ahfcl.com RASPR1101 9 Bee Secure Home Finance PVT LTD www.incred.com RBSEC1101 10 Can Fin Home Finance LTD www.canfinhomes.com RCANF1101 11 Capri Global Housing Finance LTD cgclhomeloans.com RCPRI1101 12 Cent Bank Home Finance LTD www.cbhfl.com RCENT1101 13 DMI Housing Finance Pvt Ltd www.dmihousingfinance.in RDMIH1101 14 Edelweiss Housing Finance LTD www.edelweissfin.com REDEL1101 15 Fasttrack Housing Finance Ltd www.fasttrackhfc.com RFAST1101 16 Fullerton India Home Finance LTD www.fullertonindia.com RFULL1101 17 Gruh Finance Ltd www.gruh.com RGRUH1101 18 Hinduja Housing Finance Ltd http://www.hindujahousingfinance.com/ RHIND1101 19 Homeshree Housing Finance LTD homeshree.com RHOME1101 20 IKF Housing Finance Pvt LTD www.ikffinance.com RIKFL1101 21 India Bulls Housing Finance LTD www.indiabullshomeloans.com RINDB1101 22 India Home Loan LTD www.indiahomeloan.co.in RINDH1101 23 India Infoline Housing Finance LTD www.iifl.com/home-loans RIIHF1101 24 India Shelter Finance Corporation LTD www.indiashelter.in RISFC1101 25 IndoStar Home Finance Private LTD www.indostarcapital.com RINDO1101 26 LIC Housing Finance Ltd. -

Msme Report 2020

OCTOBER 2020 ANALYTICAL CONTACTS TransUnion CIBIL Vipul Mahajan [email protected] Saloni Sinha [email protected] SIDBI Rangadass Prabhavathi [email protected] Table of Contents 02 Executive Summary 04 MSME Lending Portfolio Trends 05 Geography: Credit growth in MSME Lending 06 MSME Lending market share: NBFCs losing market share 07 Impact of Emergency Credit Line Guarantee Scheme (ECLGS) on MSME Lending 10 Behavioral changes in COVID-19 pandemic times to MSME Lending industry 18 NPA Trends in MSME Lending 20 Structurally strong MSMEs continue to be resilient 23 Sectoral Risk Assessment of MSMEs 24 Conclusion 01 Executive Summary ECLGS boosted credit infusion to MSMEs: Credit infusion to MSMEs declined sharply post the lockdowns due to COVID-19 pandemic. The ECLGS scheme implementation brought the much needed boost and significantly helped in reviving credit infusion to MSMEs post its announcement in May 2020. Catalysed by this scheme, Public sector banks disbursed 2.6 times higher loan amount to MSMEs in Jun’20 over Feb’20. Even private sector banks’ credit disbursals in the MSME segment for Jun’20 were back at Feb’20 levels. Geographies which experienced less stringent lockdowns showed relatively better credit infusion and lesser decline in credit outstanding: MSME lending in Metro regions had the sharpest drop during lockdown and relatively lower rate of revival post-ECLGS. While number of MSME loans disbursed in Urban, Semi-urban and Rural regions for Jun’20 is over 3 times that of Feb’20,it was at 1.86 times for Metro regions. Similar trend is observed at state level- i.e. -

An Empirical Study on Selected Small Finance Bank in Mysuru with Reference to Micro, Small and Medium Enterprises

International Journal of Mechanical Engineering and Technology (IJMET) Volume 9, Issue 11, November 2018, pp. 723–731, Article ID: IJMET_09_11_073 Available online at http://www.iaeme.com/ijmet/issues.asp?JType=IJMET&VType=9&IType=11 ISSN Print: 0976-6340 and ISSN Online: 0976-6359 © IAEME Publication Scopus Indexed AN EMPIRICAL STUDY ON SELECTED SMALL FINANCE BANK IN MYSURU WITH REFERENCE TO MICRO, SMALL AND MEDIUM ENTERPRISES Abijith S and Raghavendra N Department of management and commerce, Amrita School of Arts and Sciences, Mysuru Amrita Vishwa Vidyapeetham, India ABSTRACT Bank is type of financial institution which provide services such as accepting deposit and providing credit facilities to their customers. Reserve Bank of India (RBI) is the governing body that has been taking care of the banking industry in our country. Over the past few years our banking industry has gone through numerous changes on such change has been in initiation Small Finance Banks. Small Finance Bank are those banks which perform basic services such as accepting deposit and lending loans to its customers. The main objective of Small Finance bank is to provide financial inclusion to disadvantaged section who are not served by other banks. This study tries to measure the challenges faced Small Finance Bank and to analyse the awareness among the Micro, Small and Medium enterprises about Small Finance Banks. KEYWORDS : Financial Inclusion, Small Financial Banks and Micro Small and Medium Enterprises Cite this Article Abijith S and Raghavendra N, an Empirical Study on Selected Small Finance Bank in Mysuru with Reference to Micro, Small and Medium Enterprises, International Journal of Mechanical Engineering and Technology, 9(11), 2018, pp. -

Equity Research October 15, 2020 INDIA

` Equity Research October 15, 2020 INDIA BSE Sensex: 40795 BFSI ICICI Securities Limited is the author and MSME credit – few traits of confidence emerging distributor of this report MSME segment was anticipated to bear the biggest brunt of prolonged disruption and be the most vulnerable amidst Covid-19 pandemic – more so vindicated by a sharp decline in credit flow to MSME sector in April-May’20. However, ECLGS scheme (Rs1.88trn sanctioned and Rs1.36trn disbursed till date) revived the credit flow since June’20 and currently credit enquiries on MoM basis have settled at >85% of pre-Covid level, as per latest TransUnion CIBIL data. Further, taking clues from following parameters, pain seems manageable to financiers for now: A) the proportion of credit enquires from new-to-credit and new-to-bank customers reaching pre-Covid level of 31%/23%, respectively, in August’20 (reflecting financiers confidence in few sub-segments); B) ~81% of eligible MSMEs for ECLGS scheme belong to better-rated SMEs ‘up to CMR-6’ (with liquidity support can revive faster). Geographically, states like Bihar, Jharkhand, Punjab and Kerala are leading the bounce back while pace of revival is slow in Maharashtra and Delhi. Few traits of confidence emerging in MSME segment will benefit banks with higher exposure namely SBI, Axis, CUBK, Federal and DCB. Timely implementation of ECLGS schemes kick-started credit flow to MSME - MSME credit enquiries dipped during Covid-19 pandemic to 23% in Apr’20 (of Feb’20 level) and 40% in May’20. Sanctions under ECLGS scheme kick-started the much-needed revival in enquiries – with cumulative Rs1.88trn sanctions enquiries are settling at >85% of pre-Covid level now. -

310-324 Research Article Digital Transformation in Indian Insurance Industry

Turkish Journal of Computer and Mathematics Education Vol.12 No.4 (2021), 310-324 Research Article Digital Transformation In Indian Insurance Industry 1Ramesh Kumar Satuluri, 2Raavi Radhika 1Research Scholar, Department of Management, GITAM University, Hyderabad 2Associate Professor, Department of Management, GITAM University, Hyderabad Article History: Received:11 January 2021; Accepted: 27 February 2021; Published online: 5 April 2021 ABSTRACT : This paper titled “Digital Transformation in Indian Insurance Industry” is an attempt to give deep insights to all the readers on digital transformation in insurance space. Technological innovations are extensive and all encompassing. Disruptions are not industry specific and insurance industry is no exception to this. Recently regulator published a draft regulation on sandbox concept, which permits carriers to innovate their offering to end user. This is led by fintech and insure tech companies and carriers have structured digital boards to take this revolution forward.Major findings of this paper are usage of block chain technology and data security in insurance industry. With companies constituting digital boards, pandemic has only acted like a tailwind for the digital push wherein entire sales process is migrated to digital way of selling. This move has a multiplier effect on customer reach, cost efficiency and service precision. Customers who are keen to have the best in terms of technological innovation will be delighted with the advancement in digital transformation.Also with big data and analytics, we are coming back to risk based pricing, which is proportionate to the risk borne by the customer. This is still evolving in life insurance as the deployment of wearables is at a nascent stage.Newer technologies like AI and machine learning are facilitating companies register higher growth both on cross and upsell opportunities. -

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 1, 2021 Reserve Bank of India sets July 30 deadline for banks to move current accounts: The Reserve Bank of India (RBI) has set a deadline of July 30 for banks to give up current accounts of all companies where their exposure is below a cut-off decided by the regulator. RBI communicated this in a letter to banks a fortnight ago, two senior bankers told ET.The move, initiated more than a year ago, could trigger a migration of many lucrative current accounts - which lower a bank's fund cost and cash management business - from MNC banks to public sector lenders and some of the large private sector Indian banks.According to the new rule, a bank with less than 10% of the total approved facilities - which include loans, non-fund businesses like guarantees, and daylight overdrafts (or intra-day) exposure - to a company is barred from having the client's current account. "RBI is probably upset that banks are taking a long time to shift the accounts. But the delay may also be because several PSU banks may not be ready with the technology. Now, RBI can't direct companies which have been doing business with a bank for years to move to another bank. -

Press Release ESAF Small Finance Bank Limited

Press Release ESAF Small Finance Bank Limited March 05, 2021 Ratings Amount Rating Facilities Rating1 (Rs. crore) Action 125 CARE A; Stable Tier II Bonds (Basel III) # Reaffirmed (Rs. One hundred twenty five crore only) (Single A; Outlook: Stable) Certificate of Deposits 500 CARE A1+ Reaffirmed (Proposed) (Rs. Five hundred crore only) (A One Plus) Details of instruments/facilities in Annexure-1 #Tier II Bonds under Basel III are characterised by a ‘Point of Non-Viability’ (PONV) trigger due to which the investor may suffer a loss of principal. PONV will be determined by the Reserve Bank of India (RBI) and is a point at which the bank may no longer remain a going concern on its own unless appropriate measures are taken to revive its operations and thus, enable it to continue as a going concern. In addition, the difficulties faced by a bank should be such that these are likely to result in financial losses and raising the Common Equity Tier I capital of the bank should be considered as the most appropriate way to prevent the bank from turning non-viable. In CARE’s opinion, the parameters considered to assess whether a bank will reach the PONV are similar to the parameters considered to assess rating of Tier II instruments even under Basel II. CARE has rated the Tier II bonds under Basel III after factoring in the additional feature of PONV. Detailed Rationale & Key Rating Drivers The ratings assigned to the debt instruments of ESAF Small Finance Bank (ESAF SFB) continue to factor in experience of the promoter & management team in the lending business, the group’s significant experience in microfinance loans, comfortable capitalization levels and adequate liquidity position. -

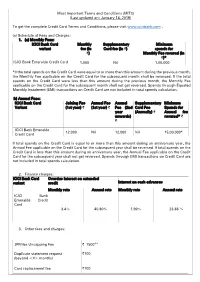

MITC-Emeralde.Pdf

Most Important Terms and Conditions (MITC) (Last updated on: January 14, 2019) To get the complete Credit Card Terms and Conditions, please visit www.icicibank.com . (a) Schedule of Fees and Charges: 1. (a) Monthly Fees: ICICI Bank Card Monthly Supplementary Minimum variant fee (in Card fee (in ₹) spends for ₹) Monthly Fee reversal (in ₹)* ICICI Bank Emeralde Credit Card 1,000 Nil 1,00,000 *If the total spends on the Credit Card were equal to or more than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall be reversed. If the total spends on the Credit Card were less than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall not get reversed. Spends through Equated Monthly Instalment (EMI) transactions on Credit Card are not included in total spends calculation. (b) Annual Fees: ICICI Bank Card Joining Fee Annual Fee Annual Supplementary Minimum Variant (1st year) ₹ (1st year) ₹ Fee (2nd Card Fee Spends for year (Annually) ₹ Annual fee onwards) reversal* ₹ ₹ ICICI Bank Emeralde 12,000 Nil 12,000 Nil 15,00,000* Credit Card If total spends on the Credit Card is equal to or more than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall be reversed. If total spends on the Credit Card is less than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall not get reversed. -

Tracking Performance of Small Finance Banks Against Financial Inclusion Goals

Tracking Performance of Small Finance Banks against Financial Inclusion Goals Amulya Neelam 1 November 2019 1 The author works as a Research Associate with Dvara Research. The author acknowledges the contribution of Deepti George, Dwijaraj B, Madhu Srinivas, Sowmini G Prasad for their valuable inputs on the draft. Tracking Performance of Small Finance Banks against Financial Inclusion Goals 1. Introduction In this report, we review a new type of bank, a variation of the universal bank, called the Small Finance Bank (SFB which was introduced in 2015 with the Reserve Bank of India (RBI issuing in-principle approvals to ten financial services providers. SFBs are authorised to perform all the banking functions – payments, accepting deposits and lending. This makes them functionally identical to universal banks. However, given the SFBs' financial inclusion focus, there are essential differences brought about by the business-model-level regulatory prescriptions of the RBI. The requirement for fulfilling priority sector lending is higher for SFBs – at 75% of its Adjusted Net Bank Credit (ANBC) compared to the 40% for the universal banks. Also, to benefit small borrowers, SFBs have a restriction on their loan portfolio that requires 50% of the portfolio to be comprised of loans and advances of up to Rs. 25 lakhs. Additionally, there are some differences in prudential requirements as well for SFBs. The minimum paid-up equity capital for SFBs is Rs. 100 Cr, one-fifth of the requirement for universal banks. The minimum capital requirement for SFBs -

MUTHOOT FINANCE LIMITED’S Shelf Prospectus Dated February 05, 2019 and Tranche II Prospectus Dated May 03, 2019 ( “Prospectus” )

APPLICANT’S UNDERTAKING ,:HKHUHE\DJUHHDQGFRQ¿UPWKDW 1. I/We have read, understood and agreed to the contents and terms and conditions of MUTHOOT FINANCE LIMITED’s Shelf Prospectus dated February 05, 2019 and Tranche II Prospectus dated May 03, 2019 ( “Prospectus” ). 2 I/We hereby apply for allotment of the NCDs to me/us and the amount payable on application is remitted herewith. 3. I/We hereby agree to accept the NCDs applied for or such lesser number as may be allotted to me/us in accordance with the contents of the Prospectus subject to applicable statutory and/or regulatory requirements. 4. I/We irrevocably give my/our authority and consent to IDBI TRUSTEESHIP SERVICES LIMITED, (the “Debenture Trustee” ) to act as my/our trustees and for doing such acts as are necessary to carry out their duties in such capacity. 5. I am/We are Indian National(s) resident in India and I am/ we are not applying for the said NCDs as nominee(s) of any person resident outside India and/or Foreign National(s). 6. The application made by me/us do not exceed the investment limit on the maximum number of NCDs which may be held by me/us under applicable statutory and/or regulatory requirements. 7. In making my/our investment decision I/We have relied on my/our own examination of Muthoot Finance Limited the Issuer and the terms of the Issue, including the merits and risks involved and my/our decision to make this application is solely based on disclosures contained in the Prospectus.