Msme Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: an Exploratory Study

MARCH 2021 Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: An Exploratory Study A CASI Working Paper Savita Shankar Lecturer, School of Social Policy & Practice University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar CENTER FOR THE ADVANCED STUDY OF INDIA CREATING A MICRO, SMALL, AND MEDIUM ENTERPRISE FOCUSED CREDIT RISK DATABASE IN INDIA: AN EXPLORATORY STUDY Savita Shankar Lecturer, School of Social Policy & Practice, University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar A CASI Working Paper March 2021 © Copyright 2021 Savita Shankar & Center for the Advanced Study of India ABOUT THE AUTHOR SAVITA SHANKAR is a CASI 2019-21 Non-Resident Visiting Scholar and a Lecturer at the School of Social Policy & Practice at the University of Pennsylvania. She earned her Ph.D. at the Lee Kuan Yew School of Public Policy, National University of Singapore. She has taught at the Keio Business School, Japan; the Asian Institute of Management, Philippines; and the Institute for Financial Management and Research, Chennai, India. Prior to her academic career, she worked with financial institutions in India for ten years (Export Import Bank of India and ICICI Bank) focusing on project appraisals and stress asset management. Her research interests include issues related to micro, small and medium enterprises, financial inclusion, and social entrepreneurship. She has consulted for the Asian Development Bank as well as for Habitat for Humanity (Cambodia and Philippines). Her ongoing research includes a collaborative project on the potential for setting up a credit risk database for micro, small, and medium enterprises in India. -

Equity Research October 15, 2020 INDIA

` Equity Research October 15, 2020 INDIA BSE Sensex: 40795 BFSI ICICI Securities Limited is the author and MSME credit – few traits of confidence emerging distributor of this report MSME segment was anticipated to bear the biggest brunt of prolonged disruption and be the most vulnerable amidst Covid-19 pandemic – more so vindicated by a sharp decline in credit flow to MSME sector in April-May’20. However, ECLGS scheme (Rs1.88trn sanctioned and Rs1.36trn disbursed till date) revived the credit flow since June’20 and currently credit enquiries on MoM basis have settled at >85% of pre-Covid level, as per latest TransUnion CIBIL data. Further, taking clues from following parameters, pain seems manageable to financiers for now: A) the proportion of credit enquires from new-to-credit and new-to-bank customers reaching pre-Covid level of 31%/23%, respectively, in August’20 (reflecting financiers confidence in few sub-segments); B) ~81% of eligible MSMEs for ECLGS scheme belong to better-rated SMEs ‘up to CMR-6’ (with liquidity support can revive faster). Geographically, states like Bihar, Jharkhand, Punjab and Kerala are leading the bounce back while pace of revival is slow in Maharashtra and Delhi. Few traits of confidence emerging in MSME segment will benefit banks with higher exposure namely SBI, Axis, CUBK, Federal and DCB. Timely implementation of ECLGS schemes kick-started credit flow to MSME - MSME credit enquiries dipped during Covid-19 pandemic to 23% in Apr’20 (of Feb’20 level) and 40% in May’20. Sanctions under ECLGS scheme kick-started the much-needed revival in enquiries – with cumulative Rs1.88trn sanctions enquiries are settling at >85% of pre-Covid level now. -

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 1, 2021 Reserve Bank of India sets July 30 deadline for banks to move current accounts: The Reserve Bank of India (RBI) has set a deadline of July 30 for banks to give up current accounts of all companies where their exposure is below a cut-off decided by the regulator. RBI communicated this in a letter to banks a fortnight ago, two senior bankers told ET.The move, initiated more than a year ago, could trigger a migration of many lucrative current accounts - which lower a bank's fund cost and cash management business - from MNC banks to public sector lenders and some of the large private sector Indian banks.According to the new rule, a bank with less than 10% of the total approved facilities - which include loans, non-fund businesses like guarantees, and daylight overdrafts (or intra-day) exposure - to a company is barred from having the client's current account. "RBI is probably upset that banks are taking a long time to shift the accounts. But the delay may also be because several PSU banks may not be ready with the technology. Now, RBI can't direct companies which have been doing business with a bank for years to move to another bank. -

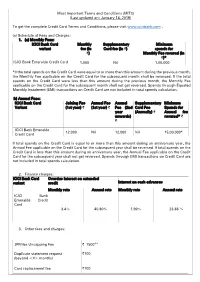

MITC-Emeralde.Pdf

Most Important Terms and Conditions (MITC) (Last updated on: January 14, 2019) To get the complete Credit Card Terms and Conditions, please visit www.icicibank.com . (a) Schedule of Fees and Charges: 1. (a) Monthly Fees: ICICI Bank Card Monthly Supplementary Minimum variant fee (in Card fee (in ₹) spends for ₹) Monthly Fee reversal (in ₹)* ICICI Bank Emeralde Credit Card 1,000 Nil 1,00,000 *If the total spends on the Credit Card were equal to or more than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall be reversed. If the total spends on the Credit Card were less than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall not get reversed. Spends through Equated Monthly Instalment (EMI) transactions on Credit Card are not included in total spends calculation. (b) Annual Fees: ICICI Bank Card Joining Fee Annual Fee Annual Supplementary Minimum Variant (1st year) ₹ (1st year) ₹ Fee (2nd Card Fee Spends for year (Annually) ₹ Annual fee onwards) reversal* ₹ ₹ ICICI Bank Emeralde 12,000 Nil 12,000 Nil 15,00,000* Credit Card If total spends on the Credit Card is equal to or more than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall be reversed. If total spends on the Credit Card is less than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall not get reversed. -

Annual Deal List

Annual Deal List 16th annual edition Contents Section Page Mergers & Acquisitions 04 1. Domestic 05 2. Inbound 15 3. Merger & Internal Restructuring 18 4. Outbound 19 Private Equity 23 QIP 67 IPO 69 Disclaimer This document captures the list of deals announced based on the information available in the public domain. Grant Thornton Bharat LLP does not take any responsibility for the information, any errors or any decision by the reader based on this information. This document should not be relied upon as a substitute for detailed advice and hence, we do not accept responsibility for any loss as a result of relying on the material contained herein. Further, our analysis of the deal values is based on publicly available information and appropriate assumptions (wherever necessary). Hence, if different assumptions were to be applied, the outcomes and results would be different. This document contains the deals announced and/or closed as of 23 December 2020. Please note that the criteria used to define Indian start-ups include a) the company should have been incorporated for five years or less than five years as at the end of that particular year and b) the company is working towards innovation, development, deployment and commercialisation of new products, processes or services driven by technology or intellectual property. Deals have been classified by sectors and by funding stages based on certain assumptions, wherever necessary. Dealtracker editorial team Pankaj Chopda and Monica Kothari Our methodology for the classification of deal type is as follows: Minority stake - 1%-25% | Strategic stake - 26%-50% | Controlling stake - 51%-75% | Majority stake - 76%-99% Maps are for graphical purposes only. -

INDIAN FINANCIAL SYSTEM M.COM Semester II CREDIT RATING

INDIAN FINANCIAL SYSTEM M.COM Semester II CREDIT RATING AGENCIES Dr. Geetika T. Kapoor Department Of Commerce CREDIT RATING AGENCIES MEANING • Credit rating agency(CRA) means a body corporate which is engaged in the business of rating of securities offered by companies. • The debt instruments rated by CRAs include government bonds, corporate bonds, certificate of deposits, municipal bonds, stock and collateralized securities, such as mortgage- backed securities and collateralized debt obligations. DEFINITION OF CREDIT RATING • According to CRISIL, credit rating is “an unbiased and independent opinion as to issuer’s capacity to meet its financial obligations. It does not constitute a recommendation to buy , sell or hold a particular security” • According to Moodys , “ratings are designed exclusively for the purpose of grading bonds according to their investment qualities” INTERNATIONAL AGENCIES • MOODY’S INVESTORS SERVICES • STANDARD AND POOR’S CORPORATION(S &P) MOODY’S INVESTORS SERVICES • John Moody founded the Moody’s agency at the beginning of the 20th century. • It undertakes the rating of wide range of debt related securities , international issues , commercial papers , etc. Both in USA and international markets. • Other services include- assessing financial strength of insurance companies , mutual funds, banks , public utilities. STANDARD AND POOR’S FINANCIAL SEVICES LLC(S &P) • One of the first credit rating institutions which has a history of 160 years, founded in the year 1860. • Offers rating on wide range of debt securities , both in the US and overseas markets. OTHER INTERNATIONAL AGENCIES • Duff and Phelps Credit Rating Company • Japan Credit Rating Agency • Fitch Investors Service • Thomason Bank Watch • IBCA Ltd CRISIL • CRISIL formerly Credit Rating Information Services of India Ltd is a global analytical company. -

36Th-Annual-Report-2017-2018.Pdf

contents Corporate Chairman’s Operational 02 snapshot 06 overview 08 review Five years Business Industry financial model numbers 10 highlights 12 14 Management Risk man- Project discussion agement details 16 and analysis 22 23 Directors’ Corporate Financial report Governance statement 42 61 report 73 Forward looking statement This document contains statements about expected future events and fi- nancial and operating results of Poddar Housing and Development Limited, which are forward-looking. By their nature, forward-looking statements re- quire the Company to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that the assumptions, predictions and other forward-looking statements will not prove to be accurate. Read- ers are cautioned not to place undue reliance on forward-looking state- ments as a number of factors could cause assumptions, actual future results and events to differ materially from those expressed in the forward-looking statements. Accordingly, this document is subject to the disclaimer and qualified in its entirety by the assumptions, qualifications and risk factors re- ferred to in the management’s discussion and analysis of the Poddar Hous- ing and Development Limited Annual Report 2017-18. Poddar Housing and Development Limited’s growth was muted across the last couple of years. This slowdown was the result of a sluggishness in the country’s real estate sector, delay in getting approvals for new project launches and the Company’s conscious decision to delay launches and let the GST and RERA-induced uncertainty to pass. The wait is over. The Company launched two projects in 2017-18 and expects to launch a handful of projects in FY2018-19. -

List of Live Authentication User Agencies (Auas)

Unique Identification Authority Of India Government of India List of Live Authentication User Agencies (AUAs) st 31 August, 2018 Unique Identification Authority of India Government of India List of Live Authentication User Agencies (AUAs) as on 31.08.2018 Sl. No. Organization Name Management point of contact Technical point of contact Address "Mr. G M. Varliani Head-Operations +91-93270-56796 "14th Floor, Tower One, [email protected]" Road 5C, Zone 5, Mr. P B Kansara Gujarat International (n) Code Solutions -A Y B Gandhi -Executive Director , Head-ERP and Applications 1 Finance Tech City (GIFT City) division of GNFC Ltd. [email protected] , 9898997939 +91-93761-80850 Gandhinagar - 382355, [email protected] Gujarat, India Mr. Vimal P Purohit " Head-Audit and Quality +91-98242-11439 [email protected] "Navaneetha Krishnan 3rd floor, Hameedia Center, "Piyush Gada A and A Dukaan Financial navaneetha.krishnan@bankbazaar 14/43 Haddows Road, 2 [email protected] Services Private Limited .com Nugambakkam, Chennai, +91 7358308282" +91 93 22 851614 " Pin : 600006 Mr. Sunil S. Shetty;Asst. Shri. Premnath S. Salian, Managing General Manager K.K. Tower, Abhyudaya Director 9820590685 (Mobile) Abhyudaya Co-operative Bank Lane, Off. G.D. 3 Tel. No. : 2418 0961 – 64 022-25246445 (Office) Bank Ltd Ambekar Marg, Parel [email protected] [email protected] Village Mumbai - 400012 [email protected] t [email protected] David Alappat Designation :Deputy Vice Builing No. 3, 3rd Floor, Mr. Jitin Parekh, Head -Legal & President (IT Applications) Aegon Religare life Unit No.1 NESCO IT Park, 4 Company Secretary; 9967023139; E-mail ID Insurance Company Limited Goregaon (E), Mumbai- [email protected] :[email protected] 400063 m Mobile no. -

Customer Matters”

October-December 2017│Vol. 8 | Issue: 4 RNI No. MAHENG/2009/34379 Banking Codes and Standards Board of India Customer भारतीय बℂकिंग िोड एवं मानि बोड㔡 www.bcsbi.org.in Matters Chairman's Message Dear Readers, The new Code has a number of safeguards for protecting the interest of the consumers It has been a great pleasure and honour for viz limited liability on account of unauthorized me over the years to stay connected with you electronic and internet transactions. Besides an all through our quarterly in-house newsletter exclusive chapter on Internet and Digital Banking “Customer Matters”. Let me begin by wishing all in view of the increasing thrust on digitization, new our readers a Happy and Prosperous New Year. payment settlement systems and the move to a near cashless economy has been added. The year 2017 has been eventful. In the first quarter, we released BCSBI’s Code Compliance We do note that the number of complaints Survey Rating of 51 select Banks. The availability pertaining to non adherence to the Code regarding of ratings in public domain has created more delayed resolution or non resolution of cases awareness and a sense of competition amongst related to unauthorized electronic transactions, bankers to excel in customer service and improve particularly ATM withdrawals is on the increase. on grievance redressal which will in turn assist We may infer that this may be due to the increased overall compliance ratings. awareness amongst the customers about their rights which results in increase in the number of In the second quarter of 2017, we started the grievances. -

Serial Number: 1 the TATA POWER COMPANY LIMITED

Private & Confidential – For Private Circulation Only (This Information Memorandum is neither a Prospectus nor a statement in Lieu of Prospectus) Dated: November 24, 2020 Serial Number: 1 THE TATA POWER COMPANY LIMITED (The Tata Power Company Limited, incorporated in India with limited liability on September 18, 1919 under the Companies Act, 1913) Registered Office: Bombay House, 24 Homi Mody Street, Mumbai 400 001, India Compliance Person: Mr. H.M. Mistry, Company Secretary | Email of Compliance Person: [email protected] | Telephone: +91 22 6665 8282 | Fax: +91 22 6665 8885 | Website: www.tatapower.com | CIN: L28920MH1919PLC000567 INFORMATION MEMORANDUM AND PRIVATE PLACEMENT OFFER LETTER BY WAY OF PRIVATE PLACEMENT BY THE ISSUER (THE “ISSUE”) BY THE TATA POWER COMPANY LIMITED (THE “ISSUER”) FOR ISSUE OF UNSECURED, REDEEMABLE, TAXABLE, LISTED, RATED, NON-CONVERTIBLE DEBENTURES OF A FACE VALUE OF RS. 10,00,000 EACH AGGREGATING TO RS. 10,00,00,00,000 (“DEBENTURES”). THIS ISSUANCE WOULD BE UNDER THE ELECTRONIC BOOK MECHANISM FOR ISSUANCE OF DEBT SECURITIES ON PRIVATE PLACEMENT BASIS AS PER SEBI CIRCULAR SEBI/HO/DDHS/CIR/P/2018/05 DATED JANUARY 5, 2018 ISSUED BY SEBI UNDER SEBI (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS, 2008. THE COMPANY INTENDS TO USE BSE’S ELECTRONIC BIDDING PLATFORM (“BSE-BOND EBP”) FOR THIS ISSUE. This Information Memorandum contains relevant information and disclosures required for issue of the Debentures. The issue of the Debentures comprised in the Issue and described under this Information Memorandum has been authorised by the Issuer through resolutions passed by the shareholders of the Issuer on 13 August 2014, the Board of Directors of the Issuer on 29 October 2018, the Committee of Directors of the Issuer on May 31, 2020 and the Memorandum and Articles of Association of the Issuer. -

IBTEX No.150

IBTEX No. 150 of 2021 July 29, 2021 US 74.32| EUR 88.09| GBP 103.50| JPY 0.68 NEWS CLIPPINGS INTERNATIONAL NEWS No Topics 1 Global economy projected to grow at 6% in 2021, 4.9% in 2022: IMF 2 Textile Industry Lauds White House Buy America Rule Change Why Sourcing from China? A Case Study on VF Corporation’s Textile 3 and Apparel Sourcing and Supply Chain Strategy 4 China cotton lint imports up 146 per cent 5 Delay expected as deadline looms for AfCFTA rules of origin talks 6 Chittagong Port Authority urged to allow BGMEA help desk at port Vietnam garment units under severe stress due to pandemic 7 lockdowns Bangladesh, Vietnam benefit most from RMG, footwear shift from 8 China 9 Bangladesh: Govt forms working committee on int’l trade disputes DISCLAIMER: The information in this message be privileged. If you have received it by mistake please notify "the sender" by return e-mail and delete the message from "your system". Any unauthorized use or dissemination of this message in whole or in part is strictly prohibited. Any "information" in this message that does not relate to "official business" shall be understood to be neither given nor endorsed by TEXPROCIL - The Cotton Textiles Export Promotion Council. Page 1 News Clippings NATIONAL NEWS 1 Renegotiating FTAs: India and the European Union India logs 85.88 % growth in merchandise exports in April-June 2 2021, as compared to same period last year 3 Pre-packs for MSMEs: Lok Sabha passes insolvency bill Covid 2.0 relaxations lead to sharp bounce back in credit demand 4 by MSMEs, says report -

Table No.19 (B)

Table No.19 (b) STATEMENT ON REMMITTANCE-WISE DETAILS OF FDI EQUITY INFLOWS RECEIVED BY ACQUISITION OF SHARES ROUTE DURING JANUARY 2018 TO MARCH, 2018 Sl. Name of Indian Country Name of Foreign RBI Item of Manufacture Amount of FDI No Company Collaborator Regional Inflows Office (In Rs (In US$ million) million) 1 ARTEFACTS SYSTEMS U.S.A ARTEFACTS REGION Writing , modifying, testing of computer 0.34 0.01 (INDIA) PVT LTD SOLUTIONS INC NOT program to meet the needs of a particular INDICATED client excluding web-page designing 2 Melody Technologies U.S.A FPK Services LLC USA REGION Other information technology and computer 0.23 0.00 Private Limited NOT service activities n.e.c. INDICATED 3 Esteem Industries U.S.A Harcros India Llc, Usa REGION Manufacture of organic and inorganic 60.61 0.93 Private Limited NOT chemical compounds n.e.c. INDICATED 4 Exeter Premedia Services United Cumeragh Ltd, Uk REGION Other publishing activities (including on-line) 9.53 0.15 Pvt Ltd Kingdom NOT n.e.c. INDICATED 5 SCHUTZ INDIA PVT LTD Germany SCHUETZ GMBH AND REGION Other non-specialised wholesale trade n.e.c. 0.00 0.00 CO KGAA - GERMANY NOT INDICATED 6 Hnv Castings Private Japan Hitachi Metals REGION Manufacture of other iron and steel casting 31.31 0.48 Limited Limited, Japan NOT and products thereof INDICATED 7 Neev Knowledge Netherlands Global Education REGION Other educational services n.e.c. 46.86 0.72 Managment Pvt Ltd International B.V. NOT Neth INDICATED 8 Amelio Early Education France Babilou SAS (FRANCE) REGION Other social work activities without 8.99 0.14 Private Limited NOT accommodation n.e.c.