Iifl Home Finance Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: an Exploratory Study

MARCH 2021 Creating a Micro, Small, and Medium Enterprise Focused Credit Risk Database in India: An Exploratory Study A CASI Working Paper Savita Shankar Lecturer, School of Social Policy & Practice University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar CENTER FOR THE ADVANCED STUDY OF INDIA CREATING A MICRO, SMALL, AND MEDIUM ENTERPRISE FOCUSED CREDIT RISK DATABASE IN INDIA: AN EXPLORATORY STUDY Savita Shankar Lecturer, School of Social Policy & Practice, University of Pennsylvania CASI 2019-21 Non-Resident Visiting Scholar A CASI Working Paper March 2021 © Copyright 2021 Savita Shankar & Center for the Advanced Study of India ABOUT THE AUTHOR SAVITA SHANKAR is a CASI 2019-21 Non-Resident Visiting Scholar and a Lecturer at the School of Social Policy & Practice at the University of Pennsylvania. She earned her Ph.D. at the Lee Kuan Yew School of Public Policy, National University of Singapore. She has taught at the Keio Business School, Japan; the Asian Institute of Management, Philippines; and the Institute for Financial Management and Research, Chennai, India. Prior to her academic career, she worked with financial institutions in India for ten years (Export Import Bank of India and ICICI Bank) focusing on project appraisals and stress asset management. Her research interests include issues related to micro, small and medium enterprises, financial inclusion, and social entrepreneurship. She has consulted for the Asian Development Bank as well as for Habitat for Humanity (Cambodia and Philippines). Her ongoing research includes a collaborative project on the potential for setting up a credit risk database for micro, small, and medium enterprises in India. -

Msme Report 2020

OCTOBER 2020 ANALYTICAL CONTACTS TransUnion CIBIL Vipul Mahajan [email protected] Saloni Sinha [email protected] SIDBI Rangadass Prabhavathi [email protected] Table of Contents 02 Executive Summary 04 MSME Lending Portfolio Trends 05 Geography: Credit growth in MSME Lending 06 MSME Lending market share: NBFCs losing market share 07 Impact of Emergency Credit Line Guarantee Scheme (ECLGS) on MSME Lending 10 Behavioral changes in COVID-19 pandemic times to MSME Lending industry 18 NPA Trends in MSME Lending 20 Structurally strong MSMEs continue to be resilient 23 Sectoral Risk Assessment of MSMEs 24 Conclusion 01 Executive Summary ECLGS boosted credit infusion to MSMEs: Credit infusion to MSMEs declined sharply post the lockdowns due to COVID-19 pandemic. The ECLGS scheme implementation brought the much needed boost and significantly helped in reviving credit infusion to MSMEs post its announcement in May 2020. Catalysed by this scheme, Public sector banks disbursed 2.6 times higher loan amount to MSMEs in Jun’20 over Feb’20. Even private sector banks’ credit disbursals in the MSME segment for Jun’20 were back at Feb’20 levels. Geographies which experienced less stringent lockdowns showed relatively better credit infusion and lesser decline in credit outstanding: MSME lending in Metro regions had the sharpest drop during lockdown and relatively lower rate of revival post-ECLGS. While number of MSME loans disbursed in Urban, Semi-urban and Rural regions for Jun’20 is over 3 times that of Feb’20,it was at 1.86 times for Metro regions. Similar trend is observed at state level- i.e. -

India Infoline Limited (Incorporated on October 18, 1995 As Probity Research & Services Private Limited at Mumbai Under the Companies Act, 1956 with Registration No

C M K PROSPECTUS Please read Section 60B of the Companies Act, 1956 Dated May 3, 2005 100% Book Building Issue India Infoline Limited (Incorporated on October 18, 1995 as Probity Research & Services Private Limited at Mumbai under the Companies Act, 1956 with Registration No. 11 – 93797. It was converted into a Public Limited Company on April 28, 2000 and the name of the Company was changed to Probity Research & Services Limited. The name of the company was changed to India Infoline.com Limited on May 23, 2000. The name of the company was further changed to India Infoline Limited on March 23, 2001.) Registered office: 24, Nirlon Complex, Off Western Express Highway, Goregaon (East), Mumbai - 400 063. Tel: +91-22-5677 5900; Fax: +91-22-2685 0451; E-mail: [email protected]; Website: www.indiainfoline.com PUBLIC ISSUE OF EQUITY SHARES COMPRISING 11,878,138 EQUITY SHARES OF FACE VALUE RS. 10/- EACH AT A PRICE OF RS. 76 FOR CASH AT A PREMIUM AGGREGATING RS. 902.74 MILLION (HEREINAFTER REFERRED TO AS THE “ISSUE”), INCLUDING EMPLOYEE RESERVATION OF 878,138 EQUITY SHARES OF FACE VALUE OF RS. 10/- EACH AT A PRICE OF RS. 76 FOR CASH AGGREGATING RS. 66.74 MILLION AND NET ISSUE TO THE PUBLIC OF 11,000,000 EQUITY SHARES OF FACE VALUE OF RS. 10/- EACH AT A PRICE OF RS. 76 FOR CASH AGGREGATING RS. 836.00 MILLION (HEREINAFTER REFERRED TO AS THE “NET ISSUE”) AND THE ISSUE WOULD CONSTITUTE 27.31% OF THE POST ISSUE PAID-UP CAPITAL OF INDIA INFOLINE LIMITED PRICE BAND: Rs. -

Equity Research October 15, 2020 INDIA

` Equity Research October 15, 2020 INDIA BSE Sensex: 40795 BFSI ICICI Securities Limited is the author and MSME credit – few traits of confidence emerging distributor of this report MSME segment was anticipated to bear the biggest brunt of prolonged disruption and be the most vulnerable amidst Covid-19 pandemic – more so vindicated by a sharp decline in credit flow to MSME sector in April-May’20. However, ECLGS scheme (Rs1.88trn sanctioned and Rs1.36trn disbursed till date) revived the credit flow since June’20 and currently credit enquiries on MoM basis have settled at >85% of pre-Covid level, as per latest TransUnion CIBIL data. Further, taking clues from following parameters, pain seems manageable to financiers for now: A) the proportion of credit enquires from new-to-credit and new-to-bank customers reaching pre-Covid level of 31%/23%, respectively, in August’20 (reflecting financiers confidence in few sub-segments); B) ~81% of eligible MSMEs for ECLGS scheme belong to better-rated SMEs ‘up to CMR-6’ (with liquidity support can revive faster). Geographically, states like Bihar, Jharkhand, Punjab and Kerala are leading the bounce back while pace of revival is slow in Maharashtra and Delhi. Few traits of confidence emerging in MSME segment will benefit banks with higher exposure namely SBI, Axis, CUBK, Federal and DCB. Timely implementation of ECLGS schemes kick-started credit flow to MSME - MSME credit enquiries dipped during Covid-19 pandemic to 23% in Apr’20 (of Feb’20 level) and 40% in May’20. Sanctions under ECLGS scheme kick-started the much-needed revival in enquiries – with cumulative Rs1.88trn sanctions enquiries are settling at >85% of pre-Covid level now. -

BSE LTD IIFL Investment Ideas

IPO Note BSE LTD IIFL Investment Ideas Issue Opens: 23rd Jan 2017 Issue Closes: 25th Jan 2017 Price Band: Rs.805-806 Subscribe Company Overview BSE Ltd is India’s largest and world’s 10th largest exchange in terms of market capitalization (~US$1.7 tn) of the companies listed on its platform. It also has the maximum number of listed companies on its platform. Its income comes Issue Details from four streams i.e. securities services (~37%), services to corporate Face Value: Rs. 2 (~24%), data dissemination fees (~3%) and income from investment & Public Issue 1.54 cr Shares deposits and other income (~35%). Its consolidated revenues grew ~11% Price Band : Rs.805-806 CAGR over FY14-FY16. In FY16, BSE had an average of ~28.5 cr orders and Issue Size ~Rs 1241 cr ~0.155 cr trades in equity shares per day, making it as the 12th most active 100% Book Issue Type: building exchange in the world. Post Issue Market Cap: ~Rs 4,400Cr Objective of the offer % Pre IPO Public 55% It is an offer for sale (OFS) by existing share holders and the offer would act Trading Members & as a route to monetize assets for some of existing investors. As per regulatory 45% Associates requirement BSE Ltd will only be listed on National Stock Exchange (NSE). Source: www.bseindia.com,RHP Share Reservation % of Issue Our view BSE Ltd has an integrated business model and has presence across segments QIB 50 NII 15 from trading and listing of securities to clearing and settlement. Its BSE StAR Retail 35 MF and BSE SME products are market leaders. -

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 1, 2021 Reserve Bank of India sets July 30 deadline for banks to move current accounts: The Reserve Bank of India (RBI) has set a deadline of July 30 for banks to give up current accounts of all companies where their exposure is below a cut-off decided by the regulator. RBI communicated this in a letter to banks a fortnight ago, two senior bankers told ET.The move, initiated more than a year ago, could trigger a migration of many lucrative current accounts - which lower a bank's fund cost and cash management business - from MNC banks to public sector lenders and some of the large private sector Indian banks.According to the new rule, a bank with less than 10% of the total approved facilities - which include loans, non-fund businesses like guarantees, and daylight overdrafts (or intra-day) exposure - to a company is barred from having the client's current account. "RBI is probably upset that banks are taking a long time to shift the accounts. But the delay may also be because several PSU banks may not be ready with the technology. Now, RBI can't direct companies which have been doing business with a bank for years to move to another bank. -

India Infoline Finance Limited

COMMON APPLICATION FORM INDIA INFOLINE FINANCE LIMITED APPLICATION FORM ISSUE OPENS ON : SEPTEMBER 5, 2012 FOR ASBA / NON ASBA “ ‘[ICRA]AA- (STABLE)’ BY ICRA AND ‘CRISIL AA-/STABLE’ BY CRISIL” (FOR RESIDENT APPLICANTS) ISSUE CLOSES ON* : SEPTEMBER 18, 2012 *‘For Early Closure / Extension of the Issue refer to page 3 of Abridged Prospectus To, The Board of Directors Application INDIA INFOLINE FINANCE LIMITED Form No. PUBLIC ISSUE OF UN-SECURED REDEEMABLE NON CONVERTIBLE DEBENTURES (SUB-ORDINATED DEBT) (“NCD”) VIDE PROSPECTUS DATED 27 / 08 / 2012 I/We hereby confirm that I/We have read and understood the terms and conditions of this application form and the attached Abridged Prospectus and agree to the ‘applicant’s undertaking’ as given overleaf. I/We hereby confirm that I/We have read the instructions for filling up the application form given overleaf. #MEMBER OF SYNDICATE / TRADING SUB-BROKER’S/AGENT’S CODE SCSB BRANCH STAMP & CODE BANK BRANCH REGISTRAR’S / SCSB DATE OF TEAR HERE MEMBER STAMP & CODE SERIAL NO. SERIAL NO. RECEIPT 1. APPLICANT’S DETAILS - PLEASE FILL IN BLOCK LETTERS (Please refer to page no. 11 of the Abridged Prospectus) First Applicant (Mr./ Ms./M/s.) Date of Birth* D D M M Y Y Y Y Name of Guardian (if applicant is minor$) (* Compulsory in case of application to hold the NCDs in physical form) ($Please refer to instruction (d) overleaf) Address __________________________________________________________________________________________________________________________ PIN (compulsory)__________________ Tel. No. (with STD Code) / Mobile _________________________ Email _______________________________________ Second Applicant (Mr./ Ms./M/s.) Third Applicant (Mr./ Ms./M/s.) 2. Investor Category (Please refer overleaf) Category I Category II Category III Sub Category Code (Please refer overleaf) 3. -

MITC-Emeralde.Pdf

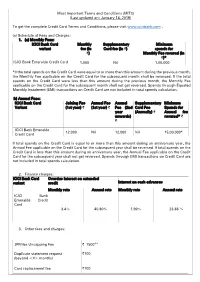

Most Important Terms and Conditions (MITC) (Last updated on: January 14, 2019) To get the complete Credit Card Terms and Conditions, please visit www.icicibank.com . (a) Schedule of Fees and Charges: 1. (a) Monthly Fees: ICICI Bank Card Monthly Supplementary Minimum variant fee (in Card fee (in ₹) spends for ₹) Monthly Fee reversal (in ₹)* ICICI Bank Emeralde Credit Card 1,000 Nil 1,00,000 *If the total spends on the Credit Card were equal to or more than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall be reversed. If the total spends on the Credit Card were less than this amount during the previous month, the Monthly Fee applicable on the Credit Card for the subsequent month shall not get reversed. Spends through Equated Monthly Instalment (EMI) transactions on Credit Card are not included in total spends calculation. (b) Annual Fees: ICICI Bank Card Joining Fee Annual Fee Annual Supplementary Minimum Variant (1st year) ₹ (1st year) ₹ Fee (2nd Card Fee Spends for year (Annually) ₹ Annual fee onwards) reversal* ₹ ₹ ICICI Bank Emeralde 12,000 Nil 12,000 Nil 15,00,000* Credit Card If total spends on the Credit Card is equal to or more than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall be reversed. If total spends on the Credit Card is less than this amount during an anniversary year, the Annual Fee applicable on the Credit Card for the subsequent year shall not get reversed. -

Annual Deal List

Annual Deal List 16th annual edition Contents Section Page Mergers & Acquisitions 04 1. Domestic 05 2. Inbound 15 3. Merger & Internal Restructuring 18 4. Outbound 19 Private Equity 23 QIP 67 IPO 69 Disclaimer This document captures the list of deals announced based on the information available in the public domain. Grant Thornton Bharat LLP does not take any responsibility for the information, any errors or any decision by the reader based on this information. This document should not be relied upon as a substitute for detailed advice and hence, we do not accept responsibility for any loss as a result of relying on the material contained herein. Further, our analysis of the deal values is based on publicly available information and appropriate assumptions (wherever necessary). Hence, if different assumptions were to be applied, the outcomes and results would be different. This document contains the deals announced and/or closed as of 23 December 2020. Please note that the criteria used to define Indian start-ups include a) the company should have been incorporated for five years or less than five years as at the end of that particular year and b) the company is working towards innovation, development, deployment and commercialisation of new products, processes or services driven by technology or intellectual property. Deals have been classified by sectors and by funding stages based on certain assumptions, wherever necessary. Dealtracker editorial team Pankaj Chopda and Monica Kothari Our methodology for the classification of deal type is as follows: Minority stake - 1%-25% | Strategic stake - 26%-50% | Controlling stake - 51%-75% | Majority stake - 76%-99% Maps are for graphical purposes only. -

Mutual Fund Distributors' Income Jumps 33% in FY17 Mutual Funds Paid a Whopping Rs 4986.67 Crore As Gross Commissions and Expenses to 687 Top Distributors

#SimpleHai Mutual fund distributors' income jumps 33% in FY17 Mutual funds paid a whopping Rs 4986.67 crore as gross commissions and expenses to 687 top distributors. Read the full report Jul 6, 2017 The good times for the mutual fund industry are reflecting in higher incomes for MF distributors. After a 23% drop in FY16, mutual funds paid a whopping Rs 4986.67 crore as gross commissions and expenses to 687 top distributors in FY17 for bringing in gross inflows of Rs 101,832.22 crore and net inflows to the tune of Rs 29,957.13 crore, according to AMFI data. In FY16, AMFI data shows that mutual fund companies paid Rs 3657.71 crore as gross commissions and expenses to 540 top distributors for gross inflows of Rs 76,228.98 crore and net inflows of Rs 20,270.03 crore. SEBI had, in 2011 directed individual asset management companies (AMCs) to disclose the total commission and expenses paid each year to their large distributors. In 2012, the market regulator had also asked fund houses to make additional disclosures regarding distributor-wise gross inflows, net inflows, average AUMs and the ratio of AUM to gross inflows on their website along with commission disclosures. MF industry body AMFI has been asked to disclose the consolidated information on its website. Top guns In FY17, the top 20 MF distributors collected Rs 3031.38 crore as gross commissions & expenses, 34% higher than Rs 2253.57 crore in FY16. Similar to recent years, NJ IndiaInvest Pvt. Ltd. has managed to hold on to its number 1 position in FY17 too. -

(•IIFL Inside 1-35.Qxd:India Info Inside Pg

“IF MONEY IS YOUR“ HOPE FOR INDEPENDENCE YOU WILL NEVER HAVE IT. THE ONLY REAL SECURITY THAT A MAN WILL HAVE IN THIS WORLD IS A RESERVE OF KNOWLEDGE, EXPERIENCE AND ABILITY.” –” Henry Ford 2 India Infoline Limited KNOWLEDGE @ IIFL. Catalyst. Enricher. Hedge. For the benefit of more than one million IIFL customers. Annual Report 2009-10 3 Snapshot IIFL – THE ONE-STOP FINANCIAL SERVICES SHOP. The IIFL Group is a leading player in MCX/SX and NSE for currency operations and final approval from SGX the Indian financial services space. derivatives segment, with MCX, are under progress. IIFL Capital Pte IIFL offers advice and execution NCDEX and DGCX for commodities Ltd. is notified with MAS for business platforms across the entire range of trading and with CDSL and NSDL as of fund management and as financial financial services – equities, depository participants. It is also adviser. derivatives, currencies, commodities, registered as a Category I merchant IIFL’s subsidiary in Sri Lanka, IIFL wealth and asset management, life banker and as a portfolio manager Securities Ceylon (Pvt) Ltd., has insurance mobilisation, investment with SEBI. Its equity shares are listed received an in-principle membership of banking and credit. Founded in 1995 on the Bombay Stock Exchange (BSE) the Colombo Stock Exchange. and the National Stock Exchange as an independent business research India Infoline Commodities DMCC (NSE). and knowledge provider, IIFL has regulated by DGCX and DMCC and is evolved into a one-stop financial IIFL Securities Pte Ltd is registered engaged in Commodity broking services solutions provider. with the Monetary Authority of business in Dubai. -

Office of the Chief Commissioner of CGST& Central Excise (Chandigarh Zone), Central Revenue Building, Sector 17-C Chandigarh

/ Office of the Chief Commissioner of Department of Excise and Taxation CGST& Central Excise Additional Town hall Building (Chandigarh Zone), Sector-17-C, UT Chandigarh Central Revenue Building, Sector 17-C Chandigarh-160017 Order 03/2017 Dated 20.12.2017 Subject: Division of Taxpayers base between the Central Government and Union Territory of Chandigarh In accordance with the guidelines issued by the GST Council Secretariat vide Circular No. 01/2017, issued vide F. No. 166/Cross Empowerment/GSTC/2017 dated 20.09.2017, with respect to the division of taxpayer base between the Central Government and Union Territory of Chandigarh to ensure single interface under GST, the State Level Committee comprising Ms. Manoranjan Kaur Virk, Chief Commissioner, Central Tax and Central Excise, Chandigarh Zone and Shri Ajit Balaji Joshi, Commissioner, Excise and Taxation Department, UT Chandigarh has hereby decided to assign the taxpayers registered in Union Territory of Chandigarh in the following manner: 1. Taxpayers with turnover above Rs l.S Crores. a) Taxpayers falling under the jurisdiction of the Centre (List of 2166 Taxpayers enclosed as Annexure- 'lA') SI. NO. Trade Name GSTIN 1 BANK OF BARODA 04AAACB1534F1ZE 2 INDIAN OVERSEAS BANK 04AAACI1223J2Z3 ---------- 2166 DASHMESH TRADING COMPANY 04AAAFD7732Q1Z7 b) Taxpayers falling under the jurisdiction of Union Territory of Chandigarh (List of 2162 Taxpayers enclosed as Annexure- 'lB') SI. NO. Trade Name GSTIN 1 IBM INDIA PRIVATE LIMITED 04AAACI4403L1ZW 2 INTERGLOBE AVIATION LIMITED 04AABCI2726B1ZA ---------- 2162 HARJINDER SINGH 04ABXPS8524P1ZK Taxpayers with Turnover less than Rs. 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre (List of 1629 Taxpayers enclosed as Annexure- '2A') 51.