The Consumer Classification Consumer Classification Just Got Smarter User Guide the Consumer Classification

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

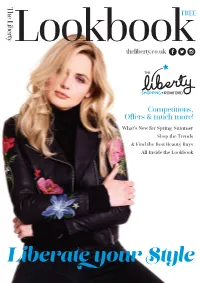

Iberate Our Style

The Liberty The FREE the theliberty.co.uk Competitions, Offers & much more! What's New for Spring/Summer Shop the Trends & Find the Best Beauty Buys All Inside the Lookbook iberate our Style The Liberty Lookbook | Spring/Summer 2017 The Liberty Store List the Accessories River Island Holland & Barrett Music Liberty The Liberty Claire’s Select Hot Shots Barbers HMV the Children Super 25 & Hairdressers Services theliberty.co.uk Abacus Superdry Kiko Milano Boots Opticians Topman Lush Euro Change Competitions, BASE Offers & much more! Topshop MET – Rx Liberty Flowers What's New for Spring/Summer Department Stores Shop the Trends & Find the Best Beauty Buys Debenhams Food & Drink Naturally Unique Post Oce (in WHSmith) All Inside the Lookbook WELCOME to The Liberty Lookbook 2017, your one-stop Marks & Spencer Beleaf Paul Falltrick Hair & Beauty Shopmobility Primark Café Liberty The Perfume Shop Sky guide to what to wear and where to shop. In the following Electrical & Phones Cake Box Purple Valentine Timpson Shoe Repair TSB BASEO Costa Coee Supercuts iberate our Style Carphone Warehouse (in Debenhams & Waterstones) Jewellery Shoes pages, you’ll find the latest looks from The Liberty stores, Clarks Chitter Chatter Debenhams Beaverbrooks Foot Locker EE El Mexicana The Diamond Shop COVER: style and beauty advice, news, exclusive offers and much more. Gingham Kitchen Ernest Jones Hotter Embroidered Jacket, New Look Fone Fusion Linzi Liberty Mobile Greggs H. Samuel Italianissimo Pandora Oce Mobile Bitz Schuh Liberty Wok Swarovski O2 Shoe Zone Stormfront -

A Leading Multi-Channel, International Retailer 2011 Highlights

Debenhams Annual Report and Accounts 2011 A leading multi-channel, international retailer 2011 highlights Financial highlights* Gross transaction value £2.7bn +4.5% Revenue £2.2bn +4.2% Headline profit before tax £166.1m +10.0% Basic earnings per share 9.1p +21 . 3% Dividend per share 3.0p *All numbers calculated on 53 week basis Operational highlights • Market share growth in most key categories: women’s casualwear, menswear, childrenswear and premium health & beauty • Strong multi-channel growth; online GTV up 73.8% to £180.4 million1 • Excellent performance from Magasin du Nord: EBITDA up 141.1% to £13.5m2 • Sales in international franchise stores up 16.5% to £77.0m1 • Three new UK stores opened, creating 350 new jobs • Eleven store modernisations undertaken • New ranges including Edition, Diamond by Julien Macdonald and J Jeans for Men by Jasper Conran • “Life Made Fabulous” marketing campaign introduced 1 53 weeks to 3 September 2011 2 53 weeks to 3 September 2011 vs 42 weeks to 28 August 2010 Welcome Overview Overview p2 2 Chairman’s statement 4 Market overview 6 2011 performance Chief Executive’s review New Chief Executive p8 Michael Sharp reviews the past year and sets the Strategic review strategy going forward Strategic review p8 8 Chief Executive’s review 11 Setting a clear strategy for growth 12 Focusing on UK retail 16 Delivering a compelling customer proposition 20 Multi-channel Focusing on UK retail 24 International Improving and widening Finance review p12 the brand in the UK Finance review p28 28 Finance Director’s review -

Silver Belle NEW YORK — Hollywood Glamour Is Always in Style

THE NEW NORTHPARK/9 FASHION’S STARRING ROLE/13 WWDWomen’s Wear DailyWEDNESDAY • The Retailers’ Daily Newspaper • May 3, 2006 • $2.00 Sportswear Silver Belle NEW YORK — Hollywood glamour is always in style. Simple, sassy and elegant party frocks are sure to liven up the coming holiday season. Here, Nanette Lepore’s silk and metallic halter dress, a Head Dress headband and Stuart Weitzman shoes. The British Invasion: Topshop Aims to Open Flagship in New York By David Moin M FRIDAY M FRIDAY NEW YORK — Get ready America: Topshop is on its way. British retail tycoon Philip Green wants to make his mark in the U.S. and SON MAKEUP; STYLED BY KI SON MAKEUP; STYLED BY a Topshop flagship could open in New York as soon as next spring. He already has his eyes on a site, but declined to reveal details beyond saying it is 60,000 to 90,000 square feet in size. “If we enter here, we’re not going to be TZ/KRAMER + KRAMER/HAKANS TZ/KRAMER low-key,” assured Green, the flamboyant billionaire owner of Arcadia, parent of Topshop, Dorothy Perkins, Burton, Miss Selfridge and department store British Home Stores. Topshop 12 E; HAIR AND MAKEUP BY SUZANNE KA E; HAIR AND MAKEUP BY See , Page PHOTO BY TALAYA CENTENO; MODEL: CECILIA/SUPREM TALAYA PHOTO BY 2 WWD, WEDNESDAY, MAY 3, 2006 WWD.COM Maria D. Lopez Resigns at St. John WWDWEDNESDAY Sportswear NEW YORK — Maria D. Lopez, who was second on a mission the past 18 months to reach a young- in command to Tim Gardner, head designer at er clientele and started experimenting with new St. -

10 Industry Developments That Shaped the Decade

10 industry developments that shaped the decade 23 December 2009 | Source: Joe Ayling Having delivered apparel and footwear industry news for the past decade, just-style takes a reflective look through its archives to highlight ten key themes that have helped shape the apparel industry over the last 10 years. view image 1. China quotas The defining moment for apparel sourcing came on 31 December 2004, when quotas between member countries of the World Trade Organization ( WTO ) were lifted. The measure was aimed at levelling the playing field for supplier countries, but a rapid drop in prices meant the EU and US dramatically increased their clothing imports from China. Faced with a surge in shipments from China, both the US and EU lost no time in making significant use of the textile special safeguard provision built into China's WTO accession agreement. While the US restrictions went without a hitch , a delay in application of the EU's plan to introduce a phased quota system limiting annual growth in Chinese textile and apparel imports resulted in 87m garments getting stuck in customs posts around the world - the so-called Bra Wars shambles . This was only resolved after new regulations were introduced to release the blocked products. 2. Sportswear battle The past decade has seen much consolidation in the sporting goods marketplace. The spending started in 2003, when Nike snapped up trendy pump producer Converse for US$305m. The footwear brand signalled a migration towards fashion for Nike. Two years later German firm Adidas Group snapped up Reebok for EUR3.1bn. -

Clean Clothes Campaign Living Wage Survey Responses 2019 Including UK Brands

Clean Clothes Campaign Living Wage survey responses 2019 including UK brands Please note, this PDF is ordered alphabetically in two sections, with 12 UK brands listed in the UK report first, followed by 20 brands listed in the international report. This was for ease of data handling. It is advisable to use the search function to find the brand you are looking for. Arcadia Clean Clothes Campaign Living Wage Survey This survey is being carried out on behalf of the Clean Clothes Campaign and will be used to update our study into brand progress towards payment of a living wage (last published as Tailored Wages - www.cleanclothes.org/livingwage/tailoredwages - in 2014). The outcomes of the study will be promoted to consumers across Europe and the US. We firmly believe that there should be more evidence-backed information available for consumers and the wider public about garment supply chains, and wages in particular. As such, links and upload options are given for providing evidence to back up your answers throughout this survey. Please note that documents uploaded or links provided may be checked for verification reasons, but will not be used as part of the assessment. Please make sure to include any data you want to be read in the main body of your answers. All the information that you provide to us may become publicly available. If however, in exceptional circumstances, there are sensitive pieces of information that you would like to provide to the assessment process but that can't be made public, please indicate these clearly. Defining terms For the purposes of this study, a living wage is defined by the following statement: Wages and benefits paid for a standard working week shall meet at least legal or industry minimum standards and always be sufficient to meet basic needs of workers and their families and to provide some discretionary income. -

Topshop Topman Dorothy Perkins Miss Selfridge

TOPSHOP TOPMAN DOROTHY PERKINS MISS SELFRIDGE Robinsons Galleria Robinsons Galleria Robinsons Galleria Shangri-La Plaza East Wing Robinsons Magnolia Robinsons Magnolia Robinsons Magnolia Greenbelt 5 Robinsons Place Manila Robinsons Place Manila Robinsons Place Manila SM Aura Premier Shangri-La Plaza Shangri-La Plaza East Wing Power Plant Mall Mega Fashion Hall Power Plant Mall Power Plant Mall Glorietta 2 Greenbelt 3 Greenbelt 3 TriNoma Bonifacio High Street Alabang Town Center Eastwood Mall Alabang Town Center TriNoma The Podium* TriNoma The Podium* SM Aura Premier The Podium* SM Aura Premier SM Mall of Asia SM Aura Premier SM Mall of Asia Abreeza Mall, Davao SM Mall of Asia Ayala Center Cebu Mega Fashion Hall Ayala Center Cebu Mega Fashion Hall Mega Fashion Hall WAREHOUSE BEN SHERMAN BASIC HOUSE G2000 Robinsons Galleria Robinsons Magnolia Robinsons Galleria Robinsons Galleria Robinsons Magnolia Shangri-La Plaza* The Shops, Greenhills Shopping CenterRobinsons Magnolia Shangri-La Plaza Glorietta 5 Shangri-La Plaza East Wing Power Plant Mall SM Megamall Mega Fashion Hall Greenbelt 5 SM North Edsa SM Aura Premier Centrio Mall, CDO SM Mall of Asia Ayala Center Cebu Mega Fashion Hall RIVER ISLAND SHANA BURTON BENEFIT Glorietta 5 Robinons Magnolia Mega Fashion Hall Greenbelt 5 SM Aura Premier Shangri-La Plaza East Wing TriNoma SM Mega Fashion Hall Glorietta 5 Alabang Town Center SHISEIDO Shangri-La Plaza The Shops, Greenhills Greenbelt 5 Alabang Town Center TriNoma Century Mall Lucky Chinatown Mall Abreeza Mall, Davao Ayala Center Cebu Centrio Mall, CDO *October 31, 2014 will be the last day of operations and collection of entries for safekeeping under the custody of Teresa David-Lo, Marketing Services Manager. -

The Fight Continues

LS2 interviews Jimmy Eat World and Uffie plus stocking filler ideas CIJ IJ) :::, (/) !!1 ::;: IJ) E :::, ~ www.leegsstudent.org The fight continues Thousands take to streets in protest, P7 02 Frida y , Novembe r 26, 20 I 0 rw le ~c:!.,~ 1dent.m Leeds Student Boy T0omany hours in the library about hasmeanta diminsbed Boy Leaders campus// about Campus Walking around campus, as Boy about ~particular protester think twice about Campus does, this sentence has been staying at the rally iostead of heading Leeds Student's views on this week's hot topics heard a lot: 'Wow it's so early but so to the warm confines of a reasonably dark J;lOw! And it's so.cold!' priced pasty shop. Unless you come from abroad, you The chants and placards were good will have seen a few British winters in though, the J:Iogwarts ones never get -Sit-in comfortably?- your life. fn those winters it's Probably old. Boy abo1.,1.ttilmpus could not hear guidance of the university protesters got colder and darker earlier than in any of the speeches, so just cheered Leeds University's role in the become violent in the first place and occupiers who helped the the summer. So why the fuck does when everyone else did. And booed national 'Day of Action' began as a shifts the focus onto the few who younger students to harness their everyone keep talking about how dark whenever Nick Clegg was mentioned. luke-warm affair with many students tum to force for effect, rather than political motivation rather than and cold it is?You know why it's dark Boy about Campus once had dreams opting out of the proposed walk-out those who peacefully protest for real allowing it to spiral into vandalism and cold? It's fucking winter. -

Clearpay Introduces a Diverse Set of New Brands for Christmas Peak

Clearpay Introduces a Diverse Set of New Brands for Christmas Peak Shopping Arcadia Group Brands including Topshop, Topman, Miss Selfridge, Dorothy Perkins, Wallis partner with Clearpay, amongst others LONDON, 18 November 2020 – Clearpay, a leader in “Buy Now, Pay Later” payments known as Afterpay (ASX:APT) in the US, Canada, Australia and New Zealand, announced today that it has partnered with top fashion and jewellery retailers including Arcadia Group Brands (Topshop, Topman, Miss Selfridge, Dorothy Perkins, Wallis), Signet Brands (Ernest Jones and H Samuel), and Pandora - offering shoppers a more flexible way to pay for all of their Christmas shopping needs while continuing to support businesses during lockdown. These new brands represent Clearpay’s diverse set of retail partners which give consumers more places to shop for the latest fashion and beauty trends. Other new merchants include Jo Malone, Clinique, Clarins, La Mer, Hunter Boots, Karen Millen, Savage x Fenty, Smashbox and Coast. Shoppers can rely on Clearpay for more freedom and flexibility as they shop for all of their Christmas gifts - from festive outfits to extra-special stocking fillers. According to recent Clearpay data from its Bi-Annual Fashion and Beauty Trend Report, consumers are continuing to take a turn towards comfort - embracing casual-fashion staples while at home during lockdown. Clearpay is seeing a spike in items such as rings, belts, and fashion cardigans. By adding these brands to the Clearpay Shop Directory, customers will have access to even more shopping options as they re-enter lockdown and prepare for the upcoming Christmas season. Carl Scheible, U.K. -

Business-Afm-Challenge.Pdf

Accounting, Financial Management and Economics Department Summer Challenge The Collapse of the Arcadia group has had a large impact on the UK High Street. Using the information provided and your own research you are required to prepare a report which covers the following four areas. You should present the report in a professional manner and each section should be limited to no more than 500 words (ie 2,000 words maximum). Credit will be given for your own research. 1) It has been argued that the strategy adopted by the Arcadia group was the single biggest factor in relation to its collapse into administration. Based on the information provided, and your own research, identify any evidence of poor decision making. 2) Arcadia has identified its five key values in its strategic report. Discuss to what extent the company lived up to these values and how its behaviour in relation to these values may have impacted on the business. 3) Philip Green was the face of the Arcadia Group. Consider the extent that he personally contributed to the demise of Arcadia group. 4) The failure of a high profile retailer such as Arcadia is likely to have a major impact on all of its stakeholders. Discuss the positive and negative impacts on the following stakeholders: a) Customers b) Local communities c) Competitors d) The audit profession e) Government Arcadia Group: Page 1 of 15 The Arcadia Group (Arcadia), is a subsidiary of Taveta Investments Ltd. Its principal activities are the retailing, wholesaling and franchising of clothing and accessories under various brand names including Topshop, Topman, Dorothy Perkins, Burton, Wallis, Evans, Miss Selfridge and Outfit. -

“Topshop and Topman Enter the Japanese Market in Earnest”

October 15, 2008 Press release T’s Co., Ltd. Mori Building Ryutsu System Co., Ltd. JBF Partners Co., Ltd. “Topshop and Topman Enter the Japanese Market In Earnest” Topshop and Topman start a full-scale roll out on the 16th with the reopening of the expanded and refurbished Laforet Harajuku store A new company called T’s, jointly financed by Mori Building Ryutsu System and JBF Partners, has acquired the exclusive marketing rights in Japan for the British high street fashion brands Topshop and Topman from their owner, Arcadia Group Limited (a UK group hereafter referred to as Arcadia). Under a wholesale contract with Arcadia, a concept store was launched in August 2006 in Laforet Harajuku, a shopping center run by Mori Ryutsu System. Arcadia had been considering a full-scale expansion into the Japanese market for several years, however the track record of the Laforet Harajuku store, combined with Arcadia’s high evaluation of the business scheme involving support from Mori Building in rolling out new stores and financial and administrative support from JBF Partners led to T’s recent successful acquisition of the exclusive marketing rights. A full-scale roll out of Topshop and Topman stores in Japan started with the reopening of the expanded and refurbished store in Laforet Harajuku on Thursday, October 16. The objective is to establish ten or more outlets in Tokyo and major Japanese cities within the next two or three years. The Laforet Harajuku store will continue to act as a concept store and will collaborate with the flagship store in London’s Oxford Street. -

The Real Powers in the Land from Morning Coffee to Evening Viewing, Political Leanings to Personal Finances, These People Have Shaped Our Lives and Our Ambitions

Section: News Review Edition: 01 Circulation: 812262 Date: 25 January 2015 Source: ABC Sep 2014 Page: 5,6,7,8 The real powers in the land From morning coffee to evening viewing, political leanings to personal finances, these people have shaped our lives and our ambitions he Debrett’s 500, published in associ- ation with The Sunday Times, recognises the obvious, more thought-provoking choices. And T you don’t get on to this list because you’re one of most influential and inspiring people living and workinginBritaintoday.Itacknowledgespower, the richest people in the land:it’s not about how talent, hard work, brilliance, originality, persist- much money you’ve made, it’s about how you ence, courage and, occasionally, luck: in short, shape the national life and the key national achievement. debates. The list has been compiled by Debrett’s in con- “In years gone by, Debrett’s has always been sultation with expert practitioners and commen- seenassynonymouswithpeerageandprivilege,” tators in each of the categories, including Sunday says Joanne Milner, its chief executive. “This per- Timesjournalists(seepage2fordetails).Debrett’s ception belongs in the past. The future of this certainly has the authority to identify and cele- country lies in social mobility and diversity. brate the most influential people in British society “TheDebrett’s500includespeoplefromawide — it’s been doing so for the best part of 250 years. range of ethnic and socio-economic back- It started with an annual register, The Peerage, grounds. But there’s work to be done if future lists back in 1769, and has followed this since the early are to be increasingly diverse. -

Rent: £80,000 PA Area 2,484 Sq Ft / 231 Sq M

Leeds Office: 0113 388 4848 Manchester Office: 0161 631 2852 SHOPPING CENTRE PROPERTY / CLASS A1 Unit 5 Four Seasons Shopping Centre, Mansfield Rent: £80,000 PA Area 2,484 Sq ft / 231 Sq M Viewing Strictly through the sole letting agent. Barker Proudlove James Lamming Mob: 07715 678630 Email: [email protected] www.barkerproudlove.co.uk Page: 1 Leeds Office: 0113 388 4848 Manchester Office: 0161 631 2852 Location: The Chancellor has announced that from 1st April Mansfield is the second largest urban centre in to 30th June 2021, eligible businesses will Nottinghamshire, with a population of approximately continue to receive 100% rates relief. From 1st 100,000 and a catchment of approximately 470,000 July 2021 to 31st March 2022, eligible businesses within a 10 mile radius. Accessed via junction 27, 28 will receive 66% rates relief. The business rates and 29 of the M1 and is now home to a number of multiplier for 2021/22 is 49.9p for small large manufacturers and distribution companies. businesses, and 51.2p for all other businesses. Service Charge: Four Seasons shopping centre is located in the heart The on-account service charge for the current year of Mansfield town centre and comprises 285,000 ft2 stands at approximately £26,230 of retail space across 58 retail units. As the prime retail pitch in the town, the scheme is anchored by EPC: Debenhams, Primark and Boots and has a strong Energy Performance Asset Rating - TBC fashion line up, which includes River Island, Arcadia Legal Costs: (Topshop/Topman/Burton), Quiz and Select.