PFC Energy 50 the Definitive Annual Ranking of the World's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COSL Annual Report2

ANNUAL REPORT 2002 Business Review development activities offshore China. The number of exploration Drilling wells we drilled surged 137.5% to 57 wells in 2002 compared to COSL is the dominant provider of drilling services offshore China 24 wells in 2001. This significant increase reflected the fact that with a diversified fleet of nine jack-up and three semi-submersible offshore China remains relatively under-explored. rigs. Our rig fleet is capable of drilling in water depths up to 1,500 feet. The number of development wells decreased from 134 in 2001 to 66 in 2002. This is consistent with the development cycle for In 2002, we continued to experience strong demand for our drilling E&P projects. In addition, a few development projects were services, our largest business segment, primarily due to strong deferred. FULL 2002 RIG ASSIGNMENT Drilling Rig Contract Contractor Start Day Wells Location BH IV DRILLING (TURNKEY) SINOPEC GROUP 05/10/2002 4 Bohai Bay BH IV DRILLING CNOOCSES 10/04/2002 3 Indonesia Sea BH IV DRILLING CNOOC 01/01/2002 7 Bohai Bay BH V DRILLING CNOOC 03/30/2002 6 Bohai Bay BH VII DRILLING KERR-McGEE 05/05/2002 5 Bohai Bay BH VIII DRILLING (TURNKEY) AGIP 01/28/2002 1 Bohai Bay BH VIII DRILLING ConocoPhillips 03/29/2002 6 Bohai Bay BH VIII DRILLING CNOOC 08/21/2002 2 Bohai Bay BH IX DRILLING AMNI 02/26/2002 3 Nigeria BH X DRILLING & COMPLETION CNOOC 01/01/2002 12 Bohai Bay BH XII DRILLING & COMPLETION CNOOC 01/01/2002 11 Bohai Bay NH I DRILLING CHEVRON 01/17/2002 5 Bohai Bay NH I DRILLING ConocoPhillips 09/07/2002 11 Bohai -

Polletno Poročilo 2014 Krovni Sklad Triglav Vzajemni Skladi

Polletno poročilo 2014 Krovni sklad Triglav vzajemni skladi Polletno poročilo 2014 avgust 2014 1 Polletno poročilo 2014 Krovni sklad Triglav vzajemni skladi VSEBINA 1 POROČILO KROVNEGA SKLADA ......................................................................................................................... 4 1.1 SPLOŠNI PODATKI O KROVNEM SKLADU ............................................................................................................ 4 1.2 PODATKI O POSLOVANJU KROVNEGA SKLADA IN NJEGOVIH PODSKLADOV ................................................................. 6 1.3 ZBIRNI RAČUNOVODSKI IZKAZI KROVNEGA SKLADA NA DAN 30. 6. 2013 ................................................................. 8 1.4 ZBIRNA BILANCA STANJA KROVNEGA SKLADA (V EUR) ......................................................................................... 9 1.5 ZBIRNI IZKAZ POSLOVNEGA IZIDA KROVNEGA SKLADA (V EUR) ............................................................................ 10 1.6 PRILOGE S POJASNILI K RAČUNOVODSKIM IZKAZOM .......................................................................................... 10 1.7. IZJAVA UPRAVE ........................................................................................................................................ 11 2 POSEBNO POROČILO - DELNIŠKI PODSKLAD TRIGLAV STEBER GLOBAL ............................................................ 12 2.1 SPLOŠNI PODATKI IN POROČILO UPRAVLJAVCA PODSKLADA ................................................................................ -

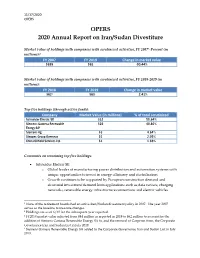

OPERS 2020 Annual Iran/Sudan Divestment Report

11/17/2020 OPERS OPERS 2020 Annual Report on Iran/Sudan Divestiture Market value of holdings with companies with scrutinized activities, FY 20071-Present (in millions):2 FY 2007 FY 2019 Change in market value $659 $63 -90.44% Market value of holdings with companies with scrutinized activities, FY 2018-2019 (in millions): FY 2018 FY 2019 Change in market value $623 $63 2.41% Top five holdings (through active funds): Company Market Value (in millions) % of total scrutinized Schneider Electric SE $32 50.64% Siemens Gamesa Renewable $26 40.80% Energy SA4 Siemens Ag $3 4.64% Sinopec Group Overseas $1 2.05% China Oilfield Services Ltd. $1 1.88% Comments on remaining top five holdings: Schneider Electric SE o Global leader of manufacturing power distribution and automation systems with unique opportunities to invest in energy efficiency and electrification. o Growth continues to be supported by European construction demand and structural investment demand from applications such as data centers, charging networks, renewable energy infrastructure connections and electric vehicles. 1 None of the retirement boards had an active Iran/Sudan divestment policy in 2007. The year 2007 serves as the baseline to measure changes. 2 Holdings are as of 6/30 for the subsequent year reported. 3 FY2018 market value adjusted from $44 million as reported in 2019 to $62 million to account for the addition of Siemens Gamesa Renewable Energy SA to, and the removal of Gazprom from, the Corporate Governance Iran and Sudan List in July 2019. 4 Siemens Gamesa Renewable Energy SA added to the Corporate Governance Iran and Sudan List in July 2019. -

SYMPOSIUM TECHNICAL PROGRAM AGENDA.Pdf

SPWLA 62nd Annual Logging Symposium May 17-20 2021 – 4 day Virtual Event th Monday – May 17 8:00 Opening Remarks - Chairman – Paul Craddock, Schlumberger 8:10 Keynote Speaker – Nial McCollam, Lloyd’s Register 8:40 Panel Discussion – Moderator- Siddarth Misra 10:00 Introduction of Technical Sessions - Vice President of Technology – Tegwyn J. Perkins 10:10 Break (15 mins) 10:25 Session 1A – Production Logging 10:30 SPWLA-2021-0001 PRODUCTION OPTIMIZATION OF SANDING HORIZONTAL WELLS USING A DISTRIBUTED ACOUSTIC SENSING (DAS) SAND MONITORING SYSTEM: A CASE STUDY FROM THE ACG FIELD IN AZERBAIJAN Zahid Hasanov, Parviz Allahverdiyev and Fuad Ibrahimov, BP; Alberto Mendoza, Pradyumna Thiruvenkatanathan, Lilia Noble and Jonathan Stapley, LYTT Limited 10:50 SPWLA-2021-0111 UTILIZING ULTRASONIC AND PULSED-EDDY CURRENT TECHNOLOGIES TO MAP THE LOCATION OF FIBER- OPTIC CABLE AND CLAMPS: A CASE STUDY Roddy Hebert, Rojelio Medina, JC Pinkett and Tyler Costa, Halliburton 11:10 SPWLA-2021-0003 DOPPLER VS. SPINNER PLT SENSING FOR HYDROCARBON VELOCITY ESTIMATE BY DEEP-LEARNING APPROACH Klemens Katterbauer and Alberto Marsala, Saudi Aramco; Virginie Schoepf and Linda Abbassi, Openfield Technology 10:25 Session 1B – Conventional Reservoir Petrophysics- I 10:30 SPWLA-2021-0004 ADDRESSING RESERVOIR HETEROGENEITY BY INTEGRATION OF GEOCHEMISTRY AND PETROPHYSICAL LOGS IN CARBONATE PROSPECTS Kemal C. Hekimoglu, Filippo Casali and Antonio Bonetti, Geolog International 10:50 SPWLA-2021-0005 AN ADVANCED PETROPHYSICAL ORIENTED NUMERICAL METHOD FOR RELIABLE ASSESSMENT -

Iran and China: Dialogue on Energy Abbas Maleki

IranIran andand China:China: DialogueDialogue onon EnergyEnergy Abbas Maleki Research Seminar Repsol YPF-Harvard KSG Fellows Harvard University March 15, 2006 What is the crux of Iran-China relations? the exchange of Chinese capital goods, equipment, industrial technology, and engineering services to Iranian crude, gas and other minerals This exchange has several strategic impacts to International system. 2 Can Growth Continue for another 20 years? Human SOE/Bank Reform Social Social SOE/Bank Reform Unemployment Corruption Environment Unrest Disparity Rights Growth and Reform Effective Expansionary Foreign Social 10th Five leadership Fiscal Direct Safety Net Year Policies Investments Plan 3 China Climbing The Energy Demand Ladder GJ/capita 350 300 US Australia 250 200 EU 150 Korea Japan 100 China Mexico 50 India Brazil Thailand 0 0 5 10 15 20 25 30 35 4 GDP/capita (‘000 $) Energy Intensity in China and Iran 5 6 Basic Energy Statistics of China (Figures in million barrels of oil per day equivalent) 1994 2004 Average annual Growth 1994-2004 OIL 3 6.1 7.5% GAS 0.3 0.7 8.8 Coal 12.1 19.1 4.7 Others 0.8 1.8 8.5 Nuclear, Hydro, etc TOTAL 16.2 27.7 5.5% Source: BP 7 Outlook for Consumption and Import of Oil and Gas in China (Figures in million barrels of oil per day equivalent) Consumption 2015 Potential Import OIL 13 8.5 Gas 2 0.6 Coal 31 - Others 4 - Total 50 9.1 8 China’s Petroleum Strategy Overseas equity investments Supply diversification Reducing demand Substitution Strategic petroleum reserves Maximum domestic production 9 China’s NOCs Reorganization China National China Petrochemical petroleum (CNPC) Corporation Production (Sinopec) Working in North/West Refining PetroChina Working in the South (subsidiary) China National China Oilfield Service, Offshore Oil Ltd. -

Puolivuosi- Kertomus 2015

PUOLIVUOSI- KERTOMUS 2015 Danske Invest Rahastoyhtiö Oy:n hallinnoimat sijoitusrahastot Danske Invest Rahastoyhtiö Oy Rekisteröity kotipaikka ja osoite Helsinki, Hiililaiturinkuja 2, Helsinki PL 1554, 00075 DANSKE BANK Y-tunnus 0671602-6 Sisällysluettelo 2 Tunnuslukujen selitykset 154 Danske Invest Kulta* 3 Arvo Finland Value 158 Danske Invest Kultapossu 7 Danske Invest Arvo Venäjä 162 Danske Invest Latin America 11 Danske Invest Baltic Equity 166 Danske Invest MediLife 15 Danske Invest China 172 Danske Invest Mustameri 20 Danske Invest Emerging Asia 176 Danske Invest Navigaattori 25 Danske Invest Emerging Markets Debt* 181 Danske Invest Neutral 28 Danske Invest Euro Government Bond Index 190 Danske Invest North America Enhanced Index* 34 Danske Invest Euro High Yield 193 Danske Invest Obligaatio 42 Danske Invest Euro Yrityslaina 198 Danske Invest Pohjois-Amerikka Osake 51 Danske Invest Euroopan Pienyhtiöt 204 Danske Invest Pohjoisen Parhaat 55 Danske Invest Eurooppa Osake 209 Danske Invest Pohjoisen Pienyhtiöt 60 Danske Invest Eurooppa Osinko 213 Danske Invest Raaka-aine* 64 Danske Invest Eurooppa Yhdistelmä 217 Danske Invest Rahamarkkina 71 Danske Invest Europe Enhanced Index* 222 Danske Invest Russia 74 Danske Invest Global Tech 226 Danske Invest Russia Small Cap 80 Danske Invest High Yield* 230 Danske Invest Suomen Parhaat* 83 Danske Invest India 234 Danske Invest Suomen Pienyhtiöt 87 Danske Invest Itä-Eurooppa Konvergenssi 238 Danske Invest Suomi Osake 92 Danske Invest Japani Osake 242 Danske Invest Suomi Osinko 98 Danske Invest Kehittyvät -

Hållbara Investeringar

Hållbara investeringar Exkluderingar enligt våra utökade hållbarhetskriterier per Q1 2018 För ett antal fonder har vi, utöver exkluderingar enligt Storebrandstandarden, även utökade hållbarhetskriterier. För mer information om vår policy och vår metod, se www.sppfonder.se. Följande företag är exkluderade: Borr Drilling Limited CONSOLIDATED EDISON INC ENGIE Fossila bränslen BP PLC CONTACT ENERGY LTD ENGIE BRASIL ENERGIA SA A.P. Møller-Mærsk A/S BW LPG LTD CONTINENTAL RESOURCES INC/ Engro Corp Ltd/Pakistan OK Aboitiz Equity Ventures, Inc. BW Offshore Ltd. ENI SPA CORE LABORATORIES N.V. ABOITIZ POWER CORP CABOT OIL & GAS CORP ENN ENERGY HOLDINGS LTD COSAN SA INDUSTRIA CO- ADARO ENERGY TBK PT California Resources Corp. Ensco Plc CALPINE CORP MERCIO ENTERGY CORP AES CORP CPFL ENERGIA SA AES GENER SA CALTEX AUSTRALIA LTD EOC Ltd CAMECO CORP CRESCENT POINT ENERGY CORP EOG RESOURCES INC AF Gruppen ASA Delek Group Ltd. AFRICA OIL CORP CANADIAN NATURAL RESOUR- EQT CORP CES Delta Air Lines, Inc. AGL ENERGY LTD EQUATORIAL ENERGIA SA - ORD Canadian Tire Corp. Ltd. Denbury Resources, Inc. Air Water Inc. EVERSOURCE ENERGY CANADIAN UTILITIES LTD-A DEVON ENERGY CORP Akastor ASA EXELON CORP CENOVUS ENERGY INC Dialog Group Bhd. AKER BP ASA EXXARO RESOURCES LTD CENTERPOINT ENERGY INC Diamond Offshore Drilling, Inc. Aker Solutions ASA EXXON MOBIL CORP Centrais Eletricas Brasilier DIAMONDBACK ENERGY INC Alimentation Couche-Tard, Inc. FIRSTENERGY CORP CENTRICA PLC DMCI Holdings, Inc. ALLIANT ENERGY CORP First Pacific Co. Ltd. CEZ AS DNO ASA ALROSA PJSC FLEX LNG Ltd CHENIERE ENERGY INC DOF ASA ALTAGAS LTD FLSmidth & Co. A/S Chesapeake Energy Corp. -

Investment Management Letterhead

FINAL DIVESTMENT AND DO-NOT-CONTRACT LIST—IRAN Updated as of August 31, 2021 Pursuant to N.C. Gen. Stat. § 147-86.58, the State Treasurer has determined that the following companies appear to be engaged in “investment activities in Iran,” as that term is defined in the amended North Carolina Iran Divestment Act of 2015 (the “Act”), based on other state lists of restricted companies, federal information, and other credible information. This updated List may be found at the State Treasurer’s website: https://www.nctreasurer.com. The State Treasurer and North Carolina Retirement Systems may not invest funds, and must divest any existing investment, with the restricted companies listed below. N.C. Gen. Stat. § 147-86.58. In addition, the restricted companies listed below are generally ineligible to contract with the State of North Carolina or any political subdivision of the State if the contract is valued at more than $1,000.00. N.C. Gen. Stat. §§ 147-86.60 and 147-86.61(a). Any existing contracts with companies listed below shall be allowed to expire in accordance with the terms of the contract. N.C. Gen. Stat. § 147-86.60(c). “Company” is defined by the Act to include not only restricted companies listed as a result of their own apparent investment activities in Iran (see above) but also any “wholly owned subsidiaries, majority-owned subsidiaries, parent companies, or affiliates of those entities.” N.C. Gen. Stat. § 147-86.57(1). The Department of State Treasurer is not responsible for compliance with the Act by other agencies or State political subdivisions. -

World's 10 Largest Oilfield Services Companies

12/14/2016 World's 10 largest oilfield services companies World's 10 largest oilfield services companies Arabian Oil & Gas Staff , June 22nd, 2009 Other stories: Oil industry giants: ADNOC | Oil industry giants: Saudi Aramco | Top 10 MENA Region mega projects | Top 10 billion dollar oil deals of the summer | 2009's winners and losers in the oil industry | 10 events in oil's history that shook the world | Top 10 Gulf mega projects | Top 10 largest publicly traded oil companies | Top 10 National Oil Companies by production | World's 10 largest oilfield services companies | World's 10 largest oil and gas contractors It could be argued that the most difficult job in the oil and gas industry is oilfield services. Most oilfields tend to be located in geographically remote areas, and that's before you even start drilling. The logistics required to extract, process and transfer crude oil or gas would make most companies think twice about even entering the business in the first place. So it was with this in mind that we at ArabianOilandGas.com decided to pay our respects and give you our list of the top 10 world's largest oilfield services companies. The criteria we have used has been based solely on a company's revenues for 2008. However, there are a couple of anomalies that we should point out. First of all we decided that we would exclude all NOCs and IOCs. Second you will notice Fluor finished sixth on the list, but boasts higher revenues than any other company aside from Schlumberger. -

2020 ANNUAL REPORT Company Profile

Endeavour Together to Achieve More 2020 ANNUAL REPORT Company Profile OUR PERFORMANCE In 2020, COSL provided clients with single, bundled, integrated and general contracting business services in each phase of exploration, development and production of oil and gas through business in four main segments (drilling services, well services, marine support services and geophysical acquisition and surveying services). Furthermore, the Company’s performance in some broaden operating aspects such as society and environment has also fulfilled INTRODUCTION its expectation (details please refer to Financial Statements and Sustainability Report). China Oilfield Services Limited (the “Company”, the “Group” or “COSL”), listed on Hong Kong PROSPECT Stock Exchange (HK stock code: The Company has steady market share in the China market and actively 2883) and Shanghai Stock expands the overseas markets in the regions including Asia Pacific, Middle East, America, Europe, Africa and the Far East, which provides a sturdy Exchange (Shanghai stock code: platform for continuous business development. 601808), is one of the leading integrated oilfield services Oilfield service industry has made us facing challenges and risks varies from place to place, including uncertain political and legal environment as providers in the world. Its services well as the risks coming from deepwater and overseas operation. COSL has cover each phase of oil and gas rich experiences in oilfield services. With a better understanding on China exploration, development and market, and strict risk management policy, we believe that we will seize the opportunities and overcome the challenges. production. CORPORATE GOVERNANCE Corporate governance of COSL includes not only those set out in the Corporate Governance Code of Appendix 14 to the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited, the Company Law of PRC and the Articles of Association of the Company, but also stricter and self-established standards. -

Eaton Vance International (Ireland) Funds Plc Annual

EATON VANCE INTERNATIONAL (IRELAND) FUNDS PLC (Public limited liability investment company with variable capital incorporated in Ireland) ANNUAL REPORT AND AUDITED FINANCIAL STATEMENTS For the Financial Year Ended 31 December 2016 Eaton Vance International (Ireland) Funds plc For the Financial Year Ended 31 December 2016 TABLE OF CONTENTS Background Information . .2 Directors’ Report . .3 Depositary’s Report . .6 Independent Auditor’s Report . .7 Management Discussion. .9 Portfolio of Investments . .14 Statement of Financial Position . .84 Statement of Comprehensive Income . .86 Statement of Changes in Net Assets. .88 Notes to the Financial Statements . .90 Total Expense Ratios (Unaudited) . .121 Fund Performance (Unaudited) . .122 Statement of Changes in Composition of Portfolios (Unaudited) . .123 Additional Information (Unaudited) . .131 Directors and Other Information (Unaudited). .13 3 Eaton Vance International (Ireland) Funds plc For the Financial Year Ended 31 December 2016 BACKGROUND INFORMATION Principal activities and review of the operations Eaton Vance International (Ireland) Funds plc (the “Company”) is a public limited liability investment company with variable capital incorporated on 9 August 1999 in Ireland pursuant to the Companies Act 2014 (the “Companies Act”) and authorised by the Central Bank of Ireland (the “Central Bank”) as an investment company pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (as amended) (the “UCITS Regulations”) and the -

OFFSHORE Drill Ships, Semi-Submersibles, Jack-Ups, and Barge Tender Rigs

Hi-Traction® Covers for OFFSHORE Drill Ships, Semi-Submersibles, Jack-ups, and Barge Tender Rigs Walkway Covers Ladder Rung Covers Step Covers SAFEGUARD® Anti-Slip Covers Eliminate Costly Injuries in the Offshore Oil & Gas Exploration Industry. SAFEGUARD Technology Inc. provides Hi-Traction® Anti-Slip Step, Walkway, and Ladder Rung Covers for all types of oil exploration and drilling. www.safeguard-technology.com Step Covers | Walkway Covers | Ladder Rung Covers | Pipe & Cable Covers | Roll-Traction® | Anti-Slip Mats | Anti-Slip Tapes Hi-Traction® Covers for SAFEGUARD® Hi-Traction® Covers OFFSHORE The widest range of Anti-Slip Drill Ships, Semi-Submersibles, Products and Options in the World. Jack-ups, and Barge Tender Rigs The Safeguard Difference situations. Our photoluminescent Installation Safeguard® Hi-Traction® Covers are pigment is non-toxic, non-radioactive Safeguard® Hi-Traction® Covers are manufactured in the widest range of and can be recharged repeatedly during non-load bearing, and are pre-fabricated base material construction including 1.2 the life of the product. for installation over existing surfaces, mm (18ga.) #316 Stainless Steel, G90 Hot including steel and composite grating Dipped Galvanized Steel, and Pultruded as well as metal, wood and concrete. FRP/GRP Composite (Fiberglass). Installation is accomplished using Incorporating Fused Alumina Aggregate Universal Saddle Clip assemblies, makes Safeguard Covers durable enough Screws, Bolts and Adhesive. to provide years of Anti-Slip protection backed by a 5 year warranty. Safeguard Products Used Extensively In These Areas: • Thruster Room • Helideck Stairs • Pipe Deck & Mud Module Stairs • Drill Floor Deck • Crane Area One and Two-Tone Color Configurations “Safety Yellow” is the most popular color Six Sizes of Grit Since 1992, used, but by incorporating a second color, Safeguard offers six sizes SAFEGUARD® Hi-Traction® Covers have a two-tone configuration can be created, of grit.