Iran Divestment Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Buy Kunlun Energy

23 August 2017 Utilities Kunlun Energy Deutsche Bank Markets Research Rating Company Date Buy Kunlun Energy 23 August 2017 Results Asia China Reuters Bloomberg Exchange Ticker Price at 21 Aug 2017 (HKD) 7.45 Utilities 0135.HK 135 HK HSI 0135 Price target - 12mth (HKD) 8.50 Utilities 52-week range (HKD) 7.95 - 5.55 HANG SENG INDEX 27,155 Core profit growth in line; robust volume with slightly lower margin Valuation & Risks Kunlun's 1H17 core net profit rose by 14% yoy to Rmb2.7bn, in line with our Hanyu Zhang expectations and accounting for 58/62% of DBe/consensus full year forecast. Research Analyst Volume was as strong as expected with 12-184% yoy growth in four gas related +852-2203 6207 segments. Similar with gas utilities peers, Kunlun recorded a Rmb2cents/cm Michael Tong, CFA yoy (flat hoh) decline in EBITDA margin for gas sales segment due to market competition and failure to pass through PetroChina's winter citygate price hike. Research Analyst Mgmt expect the volume momentum to continue and margins to recover a bit +852-2203 6167 HoH in 2H17. Kunlun is the beneficiary of China's structural growth in both piped gas and the LNG value chain and is trading at an undemanding valuation of 11x Price/price relative 2018E P/E. Maintain Buy. 10 7.5 By segment results review 5 Kunlun's 1H17 reported net profit was flat yoy at Rmb2.4bn. If adding back 2.5 Rmb325mn attributable impairment loss, core net profit rose by 14% yoy to Jan '16 Jul '16 Jan '17 Jul '17 Rmb2.7bn. -

Case M.9837 — BP/Sinopec Fuel Oil Sales/BP Sinopec Marine Fuels) Candidate Case for Simplified Procedure

C 6/16 EN Offi cial Jour nal of the European Union 8.1.2021 Prior notification of a concentration (Case M.9837 — BP/Sinopec Fuel Oil Sales/BP Sinopec Marine Fuels) Candidate case for simplified procedure (Text with EEA relevance) (2021/C 6/13) 1. On 22 December 2020, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1). This notification concerns the following undertakings: — BP Plc. (United Kingdom), — Sinopec Fuel Oil Sales Co. Ltd (People’s Republic of China), controlled by China Petrochemical Corporation (People’s Republic of China), — BP Sinopec Marine Fuels Pte. Ltd. BP Plc. and Sinopec Fuel Oil Sales Co. Ltd acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of BP Sinopec Marine Fuels Pte. Ltd. The concentration is accomplished by way of contract. 2. The business activities of the undertakings concerned are: — for BP Plc.: exploration, production and marketing of crude oil and natural gas; refining, marketing, supply and transportation of petroleum products; production and supply of petrochemicals and related products; and supply of alternative energy, — for Sinopec Fuel Oil Sales Co. Ltd: providing oil products and service to domestic and international trading vessels, — BP Sinopec Marine Fuels Pte. Ltd: wholesale and retail supply of bunker fuels in Europe, Asia and the Middle East. 3. On preliminary examination, the Commission finds that the notified transaction could fall within the scope of the Merger Regulation. However, the final decision on this point is reserved. Pursuant to the Commission Notice on a simplified procedure for treatment of certain concentrations under the Council Regulation (EC) No 139/2004 (2) it should be noted that this case is a candidate for treatment under the procedure set out in the Notice. -

COSL Annual Report2

ANNUAL REPORT 2002 Business Review development activities offshore China. The number of exploration Drilling wells we drilled surged 137.5% to 57 wells in 2002 compared to COSL is the dominant provider of drilling services offshore China 24 wells in 2001. This significant increase reflected the fact that with a diversified fleet of nine jack-up and three semi-submersible offshore China remains relatively under-explored. rigs. Our rig fleet is capable of drilling in water depths up to 1,500 feet. The number of development wells decreased from 134 in 2001 to 66 in 2002. This is consistent with the development cycle for In 2002, we continued to experience strong demand for our drilling E&P projects. In addition, a few development projects were services, our largest business segment, primarily due to strong deferred. FULL 2002 RIG ASSIGNMENT Drilling Rig Contract Contractor Start Day Wells Location BH IV DRILLING (TURNKEY) SINOPEC GROUP 05/10/2002 4 Bohai Bay BH IV DRILLING CNOOCSES 10/04/2002 3 Indonesia Sea BH IV DRILLING CNOOC 01/01/2002 7 Bohai Bay BH V DRILLING CNOOC 03/30/2002 6 Bohai Bay BH VII DRILLING KERR-McGEE 05/05/2002 5 Bohai Bay BH VIII DRILLING (TURNKEY) AGIP 01/28/2002 1 Bohai Bay BH VIII DRILLING ConocoPhillips 03/29/2002 6 Bohai Bay BH VIII DRILLING CNOOC 08/21/2002 2 Bohai Bay BH IX DRILLING AMNI 02/26/2002 3 Nigeria BH X DRILLING & COMPLETION CNOOC 01/01/2002 12 Bohai Bay BH XII DRILLING & COMPLETION CNOOC 01/01/2002 11 Bohai Bay NH I DRILLING CHEVRON 01/17/2002 5 Bohai Bay NH I DRILLING ConocoPhillips 09/07/2002 11 Bohai -

National Oil Companies: Business Models, Challenges, and Emerging Trends

Corporate Ownership & Control / Volume 11, Issue 1, 2013, Continued - 8 NATIONAL OIL COMPANIES: BUSINESS MODELS, CHALLENGES, AND EMERGING TRENDS Saud M. Al-Fattah* Abstract This paper provides an assessment and a review of the national oil companies' (NOCs) business models, challenges and opportunities, their strategies and emerging trends. The role of the national oil company (NOC) continues to evolve as the global energy landscape changes to reflect variations in demand, discovery of new ultra-deep water oil deposits, and national and geopolitical developments. NOCs, traditionally viewed as the custodians of their country's natural resources, have generally owned and managed the complete national oil and gas supply chain from upstream to downstream activities. In recent years, NOCs have emerged not only as joint venture partners globally with the major oil companies, but increasingly as competitors to the International Oil Companies (IOCs). Many NOCs are now more active in mergers and acquisitions (M&A), thereby increasing the number of NOCs seeking international upstream and downstream acquisition and asset targets. Keywords: National Oil Companies, Petroleum, Business and Operating Models * Saudi Aramco, and King Abdullah Petroleum Studies and Research Center (KAPSARC) E-mail: [email protected] Introduction historically have mainly operated in their home countries, although the evolving trend is that they are National oil companies (NOCs) are defined as those going international. Examples of NOCs include Saudi oil companies that have significant shares owned by Aramco (the largest integrated oil and gas company in their parent government, and whose missions are to the world), Kuwait Petroleum Corporation (KPC), work toward the interest of their country. -

Credit Trend Monitor: Earnings Rising with GDP; Leverage Trends Driven by Investment

CORPORATES SECTOR IN-DEPTH Nonfinancial Companies – China 24 June 2021 Credit Trend Monitor: Earnings rising with GDP; leverage trends driven by investment TABLE OF CONTENTS » Economic recovery drives revenue and earnings growth; leverage varies. Rising Summary 1 demand for goods and services in China (A1 stable), driven by the country's GDP growth, Auto and auto services 6 will benefit most rated companies this year and next. Leverage trends will vary by sector. Chemicals 8 Strong demand growth in certain sectors has increased investment requirements, which in Construction and engineering 10 turn could slow some companies’ deleveraging efforts. Food and beverage 12 Internet and technology 14 » EBITDA growth will outpace debt growth for auto and auto services, food and Metals and mining 16 beverages, and technology hardware. As a result, leverage will improve for rated Oil and gas 18 companies in these sectors. A resumption of travel, outdoor activities and business Oilfield services 20 operations, with work-from-home options, as the coronavirus pandemic remains under Property 22 control in China will continue to drive demand. Steel, aluminum and cement 24 Technology hardware 26 » Strong demand and higher pricing will support earnings growth for commodity- Transportation 28 related sectors. These sectors include chemicals, metals and mining, oil and gas, oilfield Utilities 30 services, steel, aluminum and cement. Leverage will improve as earnings increase. Carbon Moody's related publications 32 transition may increase investments for steel, aluminum and cement companies. But List of rated Chinese companies 34 rated companies, which are mostly industry leaders, will benefit in the long term because of market consolidation. -

China and IMO 2020

December 2019 China and IMO 2020 OIES PAPER: CE1 Michal Meidan The contents of this paper are the author’s sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2019 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN : 978-1-78467-154-9 DOI: https://doi.org/10.26889/9781784671549 2 Contents Contents ................................................................................................................................................. 3 Introduction ........................................................................................................................................... 2 I. Background: IMO 2020 .................................................................................................................. 3 II. China: Tough government policies to tackle shipping emissions… ....................................... 5 III. ...but a relatively muted response from refiners ..................................................................... 7 a. A tale of two bunker markets ....................................................................................................... -

Patronage of Vladimir Putin

LLorord of the d of the RiRigsgs RosRosnenefftt a as s a a MMiirrrror oor off Rus Russisia’sa’s Ev Evololututiionon Nina Poussenkova Carnegie Moscow Center PortPortrraiaitt of of RosneRosneft ft E&P Refining Marketing Projects Yuganskneftegas Komsomolsk Purneftegas Altainefteproduct Sakhalin 3, 4, 5 Sakhalinmorneftegas Tuapse Kurgannefteproduct Vankor block of fields Severnaya Neft Yamalnefteproduct West Kamchatka shelf Polar Lights Nakhodkanefteproduct Black and Azov Seas Sakhalin1 Vostoknefteproduct Kazakhstan Vankorneft Arkhangelsknefteproduct Algiers Krasnodarneftegas Murmansknefteproduct CPC Stavropolneftegas Smolensknefteproduct VostochnoSugdinsk block Grozneft Artag Verkhnechonsk KabardinoBalkar Fuel Co Neftegas Karachayevo Udmurtneft Cherkessknefteproduct Kubannefteproduct Tuapsenefteproduct Stavropoliye ExYuganskneftegas: 2004 oil production (21 mt) – 4.7% of Russia’s total CEO – S.Bogdanchikov BoD Chairman – I.Sechin Proved oil reserves – 4.8% of Russia’s total With Yuganskneftegas: > 75% owned by the state Rosneftegas 2006 oil production (75 mt) – 15% of Russia’s total 9.44% YUKOS >14% sold during IPO Proved oil reserves – 20% of Russia’s total RoRosnesneftft’s’s Saga Saga 1985 1990 1992 1995 2000 2005 2015 KomiTEK Sibneft LUKOIL The next ONACO target ??? Surgut TNK Udmurtneft The USSR Slavneft Ministry of Rosneftegas the Oil Rosneft Rosneft Rosneft Rosneft Rosneft Industry 12 mt 240 mt 20 mt 460 mt 75 mt 595 mt VNK 135 mt Milestones: SIDANCO 1992 – start of privatization Severnaya Neft 1998 – appointment of S.Bogdanchikov -

Sinopec Oilfield Service Corporation

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Sinopec Oilfield Service Corporation (a joint stock limited company established in the People’s Republic of China) (Stock code: 1033) Proposed Election of the Directors of the 10th Session of the Board and the Non-employee Representative Supervisors of the 10th Session of the Supervisory Committee The tenure of office of the ninth session of the board of directors and the supervisory committee of Sinopec Oilfield Service Corporation (the “Company”) will soon expire. The board of directors (the “Board”) of the Company announces that: 1. The following candidates are proposed to be elected as the directors (not include independent non-executive directors) of the 10th Session of the Board: Mr. Chen Xikun Mr. Yuan Jianqiang Mr. Lu Baoping Mr. Fan Zhonghai Mr. Wei Ran Mr. Zhou Meiyun 2. The following candidates are proposed to be elected as the independent non-executive directors of the 10th Session of the Board: Mr. Chen Weidong Mr. Dong Xiucheng Mr. Zheng Weijun 1 3. The following candidates are proposed to be elected as the non-employees representative supervisors of the 10th Session of the Supervisory Committee of the Company (the "Supervisory Committee"): Mr. Ma Xiang Mr. Du Jiangbo Ms. Zhang Qin Mr. Zhang Jianbo The information of each of the above proposed candidates for directors of the Company (the "Director") and the non-employee representative supervisors of the Company (the " Non-employee Representative Supervisor") is set out below: Information of the Proposed Directors (1) Mr. -

Process Technologies and Projects for Biolpg

energies Review Process Technologies and Projects for BioLPG Eric Johnson Atlantic Consulting, 8136 Gattikon, Switzerland; [email protected]; Tel.: +41-44-772-1079 Received: 8 December 2018; Accepted: 9 January 2019; Published: 15 January 2019 Abstract: Liquified petroleum gas (LPG)—currently consumed at some 300 million tonnes per year—consists of propane, butane, or a mixture of the two. Most of the world’s LPG is fossil, but recently, BioLPG has been commercialized as well. This paper reviews all possible synthesis routes to BioLPG: conventional chemical processes, biological processes, advanced chemical processes, and other. Processes are described, and projects are documented as of early 2018. The paper was compiled through an extensive literature review and a series of interviews with participants and stakeholders. Only one process is already commercial: hydrotreatment of bio-oils. Another, fermentation of sugars, has reached demonstration scale. The process with the largest potential for volume is gaseous conversion and synthesis of two feedstocks, cellulosics or organic wastes. In most cases, BioLPG is produced as a byproduct, i.e., a minor output of a multi-product process. BioLPG’s proportion of output varies according to detailed process design: for example, the advanced chemical processes can produce BioLPG at anywhere from 0–10% of output. All these processes and projects will be of interest to researchers, developers and LPG producers/marketers. Keywords: Liquified petroleum gas (LPG); BioLPG; biofuels; process technologies; alternative fuels 1. Introduction Liquified petroleum gas (LPG) is a major fuel for heating and transport, with a current global market of around 300 million tonnes per year. -

Polletno Poročilo 2014 Krovni Sklad Triglav Vzajemni Skladi

Polletno poročilo 2014 Krovni sklad Triglav vzajemni skladi Polletno poročilo 2014 avgust 2014 1 Polletno poročilo 2014 Krovni sklad Triglav vzajemni skladi VSEBINA 1 POROČILO KROVNEGA SKLADA ......................................................................................................................... 4 1.1 SPLOŠNI PODATKI O KROVNEM SKLADU ............................................................................................................ 4 1.2 PODATKI O POSLOVANJU KROVNEGA SKLADA IN NJEGOVIH PODSKLADOV ................................................................. 6 1.3 ZBIRNI RAČUNOVODSKI IZKAZI KROVNEGA SKLADA NA DAN 30. 6. 2013 ................................................................. 8 1.4 ZBIRNA BILANCA STANJA KROVNEGA SKLADA (V EUR) ......................................................................................... 9 1.5 ZBIRNI IZKAZ POSLOVNEGA IZIDA KROVNEGA SKLADA (V EUR) ............................................................................ 10 1.6 PRILOGE S POJASNILI K RAČUNOVODSKIM IZKAZOM .......................................................................................... 10 1.7. IZJAVA UPRAVE ........................................................................................................................................ 11 2 POSEBNO POROČILO - DELNIŠKI PODSKLAD TRIGLAV STEBER GLOBAL ............................................................ 12 2.1 SPLOŠNI PODATKI IN POROČILO UPRAVLJAVCA PODSKLADA ................................................................................ -

OPERS 2020 Annual Iran/Sudan Divestment Report

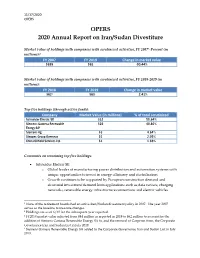

11/17/2020 OPERS OPERS 2020 Annual Report on Iran/Sudan Divestiture Market value of holdings with companies with scrutinized activities, FY 20071-Present (in millions):2 FY 2007 FY 2019 Change in market value $659 $63 -90.44% Market value of holdings with companies with scrutinized activities, FY 2018-2019 (in millions): FY 2018 FY 2019 Change in market value $623 $63 2.41% Top five holdings (through active funds): Company Market Value (in millions) % of total scrutinized Schneider Electric SE $32 50.64% Siemens Gamesa Renewable $26 40.80% Energy SA4 Siemens Ag $3 4.64% Sinopec Group Overseas $1 2.05% China Oilfield Services Ltd. $1 1.88% Comments on remaining top five holdings: Schneider Electric SE o Global leader of manufacturing power distribution and automation systems with unique opportunities to invest in energy efficiency and electrification. o Growth continues to be supported by European construction demand and structural investment demand from applications such as data centers, charging networks, renewable energy infrastructure connections and electric vehicles. 1 None of the retirement boards had an active Iran/Sudan divestment policy in 2007. The year 2007 serves as the baseline to measure changes. 2 Holdings are as of 6/30 for the subsequent year reported. 3 FY2018 market value adjusted from $44 million as reported in 2019 to $62 million to account for the addition of Siemens Gamesa Renewable Energy SA to, and the removal of Gazprom from, the Corporate Governance Iran and Sudan List in July 2019. 4 Siemens Gamesa Renewable Energy SA added to the Corporate Governance Iran and Sudan List in July 2019. -

SYMPOSIUM TECHNICAL PROGRAM AGENDA.Pdf

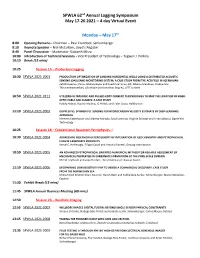

SPWLA 62nd Annual Logging Symposium May 17-20 2021 – 4 day Virtual Event th Monday – May 17 8:00 Opening Remarks - Chairman – Paul Craddock, Schlumberger 8:10 Keynote Speaker – Nial McCollam, Lloyd’s Register 8:40 Panel Discussion – Moderator- Siddarth Misra 10:00 Introduction of Technical Sessions - Vice President of Technology – Tegwyn J. Perkins 10:10 Break (15 mins) 10:25 Session 1A – Production Logging 10:30 SPWLA-2021-0001 PRODUCTION OPTIMIZATION OF SANDING HORIZONTAL WELLS USING A DISTRIBUTED ACOUSTIC SENSING (DAS) SAND MONITORING SYSTEM: A CASE STUDY FROM THE ACG FIELD IN AZERBAIJAN Zahid Hasanov, Parviz Allahverdiyev and Fuad Ibrahimov, BP; Alberto Mendoza, Pradyumna Thiruvenkatanathan, Lilia Noble and Jonathan Stapley, LYTT Limited 10:50 SPWLA-2021-0111 UTILIZING ULTRASONIC AND PULSED-EDDY CURRENT TECHNOLOGIES TO MAP THE LOCATION OF FIBER- OPTIC CABLE AND CLAMPS: A CASE STUDY Roddy Hebert, Rojelio Medina, JC Pinkett and Tyler Costa, Halliburton 11:10 SPWLA-2021-0003 DOPPLER VS. SPINNER PLT SENSING FOR HYDROCARBON VELOCITY ESTIMATE BY DEEP-LEARNING APPROACH Klemens Katterbauer and Alberto Marsala, Saudi Aramco; Virginie Schoepf and Linda Abbassi, Openfield Technology 10:25 Session 1B – Conventional Reservoir Petrophysics- I 10:30 SPWLA-2021-0004 ADDRESSING RESERVOIR HETEROGENEITY BY INTEGRATION OF GEOCHEMISTRY AND PETROPHYSICAL LOGS IN CARBONATE PROSPECTS Kemal C. Hekimoglu, Filippo Casali and Antonio Bonetti, Geolog International 10:50 SPWLA-2021-0005 AN ADVANCED PETROPHYSICAL ORIENTED NUMERICAL METHOD FOR RELIABLE ASSESSMENT