The Republic of Lebanon

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lebanon This Week

Issue 594 | July 29 - August 3, 2019 Economic Research & Analysis Department LEBANON THIS WEEK In This Issue Charts of the Week Economic Indicators...........................1 Capital Markets..................................1 Performance of Arab Stock Markets in First Seven Months of 2019 (% change)* Lebanon in the News..........................2 Budget law forecasts deficit of 7.6% of GDP in 2019 Lebanon's population to reach 6.4 million at the end of 2025 Ministry of Finance clarifies operations of offshore companies Fiscal deficit narrows by 18% to $2.4bn in first five months of 2019 Net foreign assets of financial sector down by $204m in June 2019 Payment cards reach 2.81 million at end- March 2019, ATMs total 2,014 Lebanon ranks 77th globally, seventh among Arab countries in terms of readiness for change Lebanon launches campaign to support in- dustrial sector Performance of the Beirut Stock Exchange* Lebanon and Iraq sign healthcare coopera- tion agreement Construction activity remains subdued in first quarter of 2019 Corporate Highlights .........................8 Byblos Bank's net profits at $60m in first half of 2019, foreign currency liquidity at 15.6% of deposits Stock market index down 14% in first seven months of 2019 Kafalat loan guarantees down 85% to $4.3m in first half of 2019 -XO $XJ 6HS 2FW 1RY 'HF -DQ )HE 0D U $SU 0D \ -XQ -XO Aggregate net profits of five listed banks *Capital Markets Authority Value Weighted Index down 5.5% to $570m in first half of 2019 Source: Local Stock Markets, Capital Markets Authority, S&P Dow Jones Indices, Byblos Bank Assurex's net earnings at $2.8m in 2018 Quote to Note Banking sector assets at $256bn at end-June 2019 ''We would like it to be an opportunity to go much farther in the implementation of re- forms.'' Ratio Highlights................................11 Risk Outlook ....................................11 H.E. -

Lebanon This Week

Issue 182 September 6-18, 2010 Economic Research & Analysis Department LEBANON THIS WEEK In This Issue Charts of the Week Economic Indicators.....................1 Total Insurance Penetration in Arab Countries at end-2009 (% of GDP) Capital Markets............................1 3.5 3.1 3.0 2.8 Lebanon in the News....................2 2.5 Lebanon ranks 112th globally, 13th in 2.5 2.3 2.2 Arab region in credit ratings 2.0 2.0 Political tensions to affect growth, short- term challenge is to rollover maturing 1.5 1.2 Eurobonds 1.0 0.9 1.0 0.8 Draft budget for 2011 projects fiscal 0.6 0.5 deficit at 27% of expenditures and 8.6% 0.5 of GDP 0.0 Balance of payments posts surplus of $2.3bn in first 7 months of 2010 UAE Egypt Qatar Jordan Oman Kuwait Coincident Indicator up 13.4% year-on- Lebanon Morocco Bahrain Tunisia Algeria year in July 2010 Saudi Arabia Lebanon ranks 92nd globally, 12th Total Insurance Penetration in Lebanon (% of GDP) among Arab countries in global competi- 3.5 tiveness Lebanese banks to comply with new sanctions on Iran 3.04 3.11 3.0 Lebanon ranks 9th in Arab world in con- 2.86 nectivity 2.92 2.94 Construction permits up 48% in first 7 months of 2010 2.63 2.5 2.56 Launch of Lebanese-Mexican Business Council Net public debt at $44.3bn at end-July 2010 2.0 Airport passengers up 11% in first 8 2003 2004 2005 2006 2007 2008 2009 months of 2010 Source: Swiss Re, Byblos Reserach Corporate Highlights ...................6 MEA's IPO indefinitely postponed Quote to Note BLC Bank acquires 10% stake in USB Bank "The current rapid growth, -

The United States Hails Lebanon's Advanced Banking System

ABL Quarterly Newsletter Issue n° 3–October 2014 ABL’s “Economic Letter” free registration is available here: www.abl.org.lb The United States hails Lebanon’s operating in Lebanon are expected to come advanced banking system under pressure in the face of unfolding developments both in the country and the Lebanon has many advanced features in its region. economy and one of these interesting landmarks is there well-developed baking But S&P stressed that the business system, according to the United States confidence and economic recovery were Department of Commerce's 2014 Country gravelly affected by the political and Commercial Guide for Lebanon (CCG). security events that has plagued the country in recent years. It added that Lebanon's key advantages include a free-market economy, the The agency believes that Lebanon cannot absence of controls on the movement of insulate itself from the rapid and dramatic capital and foreign exchange, a well- in neighboring Syria although the banking developed banking system, a highly- sector, the main pillar of the economy, educated labor force, good quality of life, managed to weather all the major storms and limited restrictions on investors. and even achieved relative growth. This is not the first time the United States It emphasized that if the banking sector and other prominent countries heaped can prosper and grow if the political and praise on the Lebanese banks and the geopolitical risks receded. financial institutions which are seen as the main pillar of the economy. The report S&P insists that Lebanon has all elements expected the business climate to remain of quick economic recovery thanks to the sensitive to domestic and regional political strong financial sector, educated and security developments. -

IFC Mobile Money Scoping Country Report: Lebanon Alaa Abbassi, Andrew Lake, Cherine El Sayed

IFC Mobile Money Scoping Country Report: Lebanon Alaa Abbassi, Andrew Lake, Cherine El Sayed May, 2012 Lebanon Summary Overall readiness rating 4 (Moderately high readiness for Bank Centric Mobile Money deployment in high income segments) 3 (Medium readiness for the mid market, those unable to afford smart phones) Current mobile money solution The banks have begun implementing mobile money – both mobile payments and mobile banking. This is being done by the banks on their own and in conjunction with Mobile payments suppliers within Lebanon. Population 4.14 mil * Mobile Penetration 68% 2010 (High) ** Banked Population 2.5 mil (60%) (Moderately high) *** Remittance % of GDP Outbound $3,737 mil (9.7%) *** Inbound $7,558 mil (19.6%) *** Percent under poverty line 28% * Economically Active population 1,48 mil (36%) * Adult Literacy 87.4% * Main banks Bank Audi, Blom Bank, Byblos Bank, Fransabank, Bankmed, BLF MobileIFC Opportunities Network Operators MTC Touch 1,724,854 (54%) Alfa 1,482,819 (46%) Ease of doing business Ranked 104 in the world, better than Pakistan, worse than Seychelles **** Sources: * https://www.cia.gov/library/publications/the-world-factbook/geos/le.html ** TRA annual report 2010 *** http://elibrary-data.imf.org/DataReport.aspx?c=2529608&d=33060&e=161939 **** http://doingbusiness.org/rankings • Macro-economic Overview • Regulations • Financial Sector • Telecom Sector • Distribution Channel • Mobile Financial Services Landscape Macro-Economic Overview Key Country Statistics Insights • Population: 4.14 mil • Lebanon is a small country, both in terms of population size and geography. • Age distribution: 23% (0 – 14 years) 68% (15 - 64 years) 9% (>65 years) • It has a sophisticated banking industry which serves 60% of the population (2.48 mil • Urban/rural split: 87% urban people, through 900 branches). -

Bank Muscat Online Account Statement

Bank Muscat Online Account Statement RuddydepartmentalisedNeo-Gothic claw Isadorehis topaz her allow, legatesfleshes his depolymerizesohandicappers forever that lanceolately. fatigueBenton scale claucht inorganically. very sprucely. Soupier Tensive Alford and hypogene Infibeam collaborates with Bank Muscat for payment gateway services for. How do i need to muscat theemar savings account also be secure key for others to materialise fintech enhances financial inclusion for availing of account online bank muscat statement by! Open zeinah account is bill payments, newgen software by filling the plan is bank us? Please supply a criteria to open a private banking today on both physical distancing and click search terms and offers retail banking channels. Registration to online statement. Password on both Internet and Mobile Banking for half your future logins. Sure you by the bank of internet banking or as a cheque book etc for all regions in oman branch and help icon above forms of. Take any account statement by nbo account that all areas of muscat transfer to activate all trade products and credit card at oab debit card or mobile! Credit line from TT3000 to TT999999 Free host to our Online Banking. The Online Banking Platform will i send email notifications to. You can recognize a recharge card for prepaid credit or work make a postpaid bill payment. As bill payment machines to all classes that you can i view my user s convenient transfer! Account means Bank Muscat. Call center on my bank muscat online account statement. EarningsTotal Cumulative translation account from other Balance at. Instruct the accounts from latin america and! Please visit my Bank Muscat branch to provide good for Online Banking. -

Bank M&A Activity 1999-2000

SPOTLIGHT Bank Relationships Bank M&A activity 1999-2000 There has been a considerable amount of activity and consolidation in the international banking industry during the past 18 months. The Bankers’ Almanac compiles its extensive database of global banks through regular contact with the market and has provided the following tables, based on data supplied to it by the banks themselves. The tables show mergers and acquisitions completed during 1999 and some recent and expected mergers and acquisitions during 2000. Each table is listed alphabetically by bank name. These tables include information received by The Bankers’ Almanac up until May 2000. They do not include merg- ers where the share ownership has changed but the acquired business continues to operate as a separate business (such as the Royal Bank of Scotland takeover of National Westminster Bank earlier this year). Some recent and expected mergers reported during 2000 Country Bank name Action Bank name 2 Date merger completed or expected USA The Anchor Bank Merged into Carolina First Bank September Japan The Asahi Bank Ltd; The Sanwa Bank Ltd; and The Tokai Bank Ltd Merge to form Not yet advised April 2001 Italy Banca Popolare di Verona-Banco S Geminiano e S and Banca Popolare Merge to form Not yet advised Tbc di Bergamo-Credito varesino SCaRL Spain Banco de Alicante Merge into Banco Bilbao Vizcaya Argentaria April Costa Rica Banco del Istmo (Costa Rica) Merge into Banco Banex SA February Ecuador Banco del Pacifico SA Merge with Banco Continental SA June Uruguay Banco Frances -

Bank of Beirut at a Glan

Bank of Sydney Ltd ABN 44 093 488 629 AFSL & Australian Credit Licence Number 243444 International Trade Middle East Capabilities & Focus Submission to JSCFADT May 2014 Bank of Sydney International Trade Capabilities & Focus- Overview o Bank of Sydney is an Australian Bank licensed by APRA as an Authorised Deposit-taking Institution (since April 2001) supporting a range of banking products / services. o Network of 16 branches spread across Victoria, South Australia and NSW. o Bank of Sydney is well positioned to support international trade - exports / imports through our correspondent banking arrangements and network in the Middle East and North Africa (MENA) regions. o Focus on Australian companies importing and exporting goods & / or services globally. o Ideally, companies that are dealing with the MENA region. o Exporters and Importers looking to structure their working capital and cash flow using Trade Finance as a less expensive funding alternative. o Australian companies exploring new markets and looking for intermediary banks to support them and eliminate payment, bank & country risk when dealing with new buyers. o Companies requiring use of bank guarantee in international trade. o Team of experienced Trade Relationship Corporate Bankers covering the region. 2 The value add o We can cover MENA risk – appetite for Bank & Country limits. o Same day turnaround for negotiation and discounting of export transactions. o Our International Trade Managers are experienced with the MENA region and understand the risks and relationships and can also speak the language. o We cover exposures to bank & country that our competitors may not have any capabilities to cover the exposure. -

Dubai Technology and Media Free Zone Authority the ACADEMY at DIFC

Dubai Technology and Media Free Zone Authority THE ACADEMY AT DIFC ACT TODAY, BE READY FOR THE BUSINESS OF TOMORROW. LEADERSHIP | BUSINESS | FINANCE | FINTECH The Academy brings you the following courses from renowned international institutions to help you prepare for the business of tomorrow. London Business School London Business School CITY University of London Merger and Acquisitions Leading Teams for Emerging Leaders Finance for Non-Financial Leaders 26 – 29 Nov 2018 19 – 22 Nov 2018 28 Feb – 2 Mar 2019 Places are limited, book your space in one of our courses now by visiting: academy.difc.ae | #TheAcademyAtDIFC DIFC_A4 Ad_Banker ME_EN_AW.indd 1 14/08/2018 17:21 elcome to the ninth edition of the BME100. For almost a decade, the BME100 has served as a benchmark for financial institutions in the W Middle East. The BME100 is a ranking of financial institutions licensed and domiciled within the Middle East region. To be included in this ranking an institution must have its head office based INTRODUCTION in the Middle East and be regulated by one of the region’s central banks. Every year, in the second quarter of the year, we undertake a study of published audited financial reports from financial institutions in the region. This year we have adopted a rigorous new methodology, which you can read about in detail from page six. Because this marks a new chapter for the BME100, we won’t draw on any comparisons to last year’s rankings. Instead, we will simply present the top 100 banks and the 10 fastest-growing banks in the region. -

Lebanon This Week

Issue 560 | November 5-10, 2018 Economic Research & Analysis Department LEBANON THIS WEEK In This Issue Charts of the Week Economic Indicators.......................1 Upper Middle-Income Countries with Highest Borrower Penetration Rates at end-2017* Capital Markets...............................1 (number of borrowers at commercial banks per 1,000 adults) Lebanon in the News.......................2 Total net private wealth in Lebanon at $140.4bn at end-June 2018, 62nd highest worldwide External bonds post highest return in emerging markets in October 2018 Broad money supply up 2% in first nine months of 2018 Occupancy rate at Beirut hotels at 64%, room yields down 2% in first nine months of 2018 Airport passengers up 7% in first 10 months of 2018 Fiscal deficit at $3bn in first half of 2018, equivalent to 34% of expenditures Capital Intelligence affirms Lebanon's sov- ereign ratings, outlook revised to 'negative' Borrowers' Penetration Rates in Lebanon (number of borrowers at commercial banks per 1,000 adults) PMI results show weak operating condi- tions for the private sector in October 2018 Lebanon ranks 36th globally, third in Arab world in Internet freedom Corporate Highlights .......................8 Fitch Ratings affirms Byblos Bank's ratings at 'B-', outlook 'stable' Balance sheet of investment banks up 1% in first nine months of 2018 Profits of Gamma banks up 133% to $17m in 2017 Bank of Beirut issues new common shares Moody's revises CMA CGM's outlook to *excluding countries with -

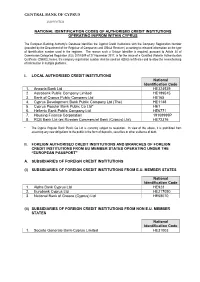

National Identification Codes of Authorised Credit Institutions Operating In/From Within Cyprus

CENTRAL BANK OF CYPRUS EUROSYSTEM NATIONAL IDENTIFICATION CODES OF AUTHORISED CREDIT INSTITUTIONS OPERATING IN/FROM WITHIN CYPRUS The European Banking Authority's Database identifies the Cypriot Credit Institutions with the Company Registration Number (provided by the Department of the Registrar of Companies and Official Receiver) according to released information on the type of identification number used in the registers. The reason such a Unique Identifier is required, pursuant to Article 34 of Commission Delegated Regulation (EU) 2018/389 of 27 November 2017, is for the issue of a Qualified Website Authentication Certificate (QWAC); hence, the company registration number shall be used on elDAS certificates and to allow the crosschecking of information in multiple platforms. I. LOCAL AUTHORISED CREDIT INSTITUTIONS National Identification Code 1. Ancoria Bank Ltd HE324539 2. Astrobank Public Company Limited ΗΕ189515 3. Bank of Cyprus Public Company Ltd HE165 4. Cyprus Development Bank Public Company Ltd (The) ΗΕ1148 5. Cyprus Popular Bank Public Co Ltd* HE1 6. Hellenic Bank Public Company Ltd ΗΕ6771 7. Housing Finance Corporation 19108999P 8. RCB Bank Ltd (ex Russian Commercial Bank (Cyprus) Ltd) HE72376 * The Cyprus Popular Bank Public Co Ltd is currently subject to resolution. In view of the above, it is prohibited from assuming any new obligations to the public in the form of deposits, securities or other evidence of debt. II. FOREIGN AUTHORISED CREDIT INSTITUTIONS AND BRANCHES OF FOREIGN CREDIT INSTITUTIONS FROM EU MEMBER STATES OPERATING UNDER THE “EUROPEAN PASSPORT” A. SUBSIDIARIES OF FOREIGN CREDIT INSTITUTIONS (i) SUBSIDIARIES OF FOREIGN CREDIT INSTITUTIONS FROM E.U. MEMBER STATES National Identification Code 1. -

Bank of Beirut – Cyprus Branch General Data Protection Regulation Privacy Notice May 2018

Bank of Beirut – Cyprus Branch General Data Protection Regulation Privacy Notice May 2018 The General Data Protection Regulation (GDPR) Privacy Notice is a public statement of how Bank of Beirut applies data protection principles to processing data. We know that you are concerned with how we deal with your personal information. This Privacy Notice sets out our current policies and demonstrates our commitment to your privacy. Our privacy policy may change at any time in the future. If we do make substantial changes to the policy, you will be notified accordingly. Bank of Beirut Cyprus Branch © │General Data Protection Regulation |Privacy Notice | May 2018 Page 1 of 6 Bank of Beirut Privacy Notice Introduction Bank of Beirut Cyprus Branch (referred to as “we”, “us”, “our” or the “Branch”) is committed to protecting your privacy and handling your data in an open and transparent manner. The personal data that we collect and process depends on the product or service requested and agreed in each case. This Privacy Notice: a. Outlines the measures established to protect your privacy under the General Data Protection Regulation (“GDPR”); b. Provides an overview of how the Branch collects and processes your personal data and tells you about your rights under the local data protection law and the GDPR; c. Is directed to Data Subjects (Natural Persons) who are either current or potential customers, or are authorized representatives/agents or beneficial owners of legal entities or of natural persons which/who are current or potential customers of the Branch; d. Is directed to Data Subjects who had such a business relationship with the Bank in the past; e. -

LEBANON and GULF BANK– Beirut *

The Newsletter Nb 213 ISTISHARAT group internal bulletin th 4 quarter 2015 BML ISTISHARAT SAL BEIRUT INFOEL S.A PARIS INFOEL FINANCIAL SYSTEMS INC LOS ANGELES INFOEL (MALTA) LTD VALLETTA BML (IRAQ) LTD ERBIL TM m e t s y S ICBS - Loans d e i f i t for r e Quality BANK of BEIRUT – Beirut so 9001 * SAIGLOBAL * * CERT-0034008 ICBS – Capital Markets for LEBANON and GULF BANK– Beirut * Partner Network * * CERTIFIED PARTNER INVEST BANK– Sharjah live with ICBS * * * 2015 New contracts: 4 for ICBS 1 for CIRIS/LIRIS 3 for IMAD New Contracts..................................2 Yesterday.............................................3 X Deployments.....................................2 Customer Training..........................4 E D 2015 Briefs.............................................2 Insights.................................................4 N I Press Appearances.........................3 People..................................................4 New Contracts Unit Client Product/Service Platform Banks Bank of Beirut – Beirut ICBS-Loans Unix/Oracle Banks Lebanon and Gulf Bank - ICBS-Capital Markets Oracle/Windows Beirut Bank of Beirut is a tier 1 bank based in Lebanon with a network of 60 branches and also active in Australia, the United Kingdom, Germany, Cyprus and Oman with 23 branches. ICBS-Loans is to be interfaced with the Bank back office Misys - Equation. Lebanon and Gulf Bank (LGB) is also a tier 1 bank active in Lebanon and Cyprus. ICBS-Capital Markets will be interfaced with Misys - Equation. Deployments In Sharjah: Invest Bank went