SWIFT Gpi for Corporates Cross-Border Payments, Transformed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Next-Gen Technology Transformation in Financial Services

April 2020 Next-gen Technology transformation in Financial Services Introduction Financial Services technology is currently in the midst of a profound transformation, as CIOs and their teams prepare to embrace the next major phase of digital transformation. The challenge they face is significant: in a competitive environment of rising cost pressures, where rapid action and response is imperative, financial institutions must modernize their technology function to support expanded digitization of both the front and back ends of their businesses. Furthermore, the current COVID-19 situation is putting immense pressure on technology capabilities (e.g., remote working, new cyber-security threats) and requires CIOs to anticipate and prepare for the “next normal” (e.g., accelerated shift to digital channels). Most major financial institutions are well aware of the imperative for action and have embarked on the necessary transformation. However, it is early days—based on our experience, most are only at the beginning of their journey. And in addition to the pressures mentioned above, many are facing challenges in terms of funding, complexity, and talent availability. This collection of articles—gathered from our recent publishing on the theme of financial services technology—is intended to serve as a roadmap for executives tasked with ramping up technology innovation, increasing tech productivity, and modernizing their platforms. The articles are organized into three major themes: 1. Reimagine the role of technology to be a business and innovation partner 2. Reinvent technology delivery to drive a step change in productivity and speed 3. Future-proof the foundation by building flexible and secure platforms The pace of change in financial services technology—as with technology more broadly—leaves very little time for leaders to respond. -

Profile of the Group

PROFILE OF THE GROUP 15 Profile of the Group | 12 Byblos Bank S.A.L. PROFILE OF THE GROUP Established in Jbeil (Byblos), Lebanon, in 1950, the Byblos Bank Group is a leading financial institution Our History focused on the domestic and selected overseas markets. After nearly six decades of consistent growth, Byblos Bank now has an extensive network of 77 branches spread evenly across Lebanon. The Group also has expanded to several other countries, including Armenia, Belgium, Cyprus, the Democratic Republic of the Congo, France, Iraq, Nigeria, Sudan, Syria, the United Arab Emirates, and the United Kingdom. Our Strategic Goals The focus of Byblos Bank’s strategy is to build on our leading position in the Lebanese market while diversifying into foreign ones. To do this, we strive to be a full-service bank providing comprehensive solutions for our customers in consumer banking, commercial banking, capital markets, correspondent banking, and assorted advisory services. Our Major Lines Consumer Banking Commercial Banking of Business Correspondent Banking Financial Markets Our Values Integrity Customer Focus Teamwork Performance Our Mission “Byblos Bank Group is a universal institution that is focused on the domestic and regional markets while striving to offer world-class services to its customers, fulfillment to its employees, and economic benefit to the communities it serves.” KEY DATES Our past gives us vision and strength and shows us the way to better seize all available future opportunities. Establishment of Establishment of Opening of Byblos Société Commerciale Adonis Insurance Bank Africa in et Agricole Byblos and Reinsurance Khartoum, Sudan. Bassil Frères & Co., Company’s name Co. -

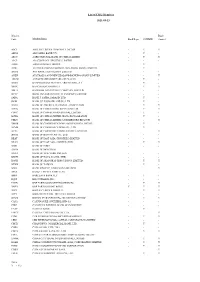

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

FSSA China a Shares Fund Class III USD a Subfund of First Sentier Investors Global Umbrella Fund Plc (The Company)

Monthly Fund Factsheet 31 August 2021 FSSA China A Shares Fund Class III USD a subfund of First Sentier Investors Global Umbrella Fund plc (the Company) Investment objective and policy Ten Largest Company Holdings The Fund aims to grow your investment. Stock Name % The Fund invests at least 70% of its assets in shares of companies listed Chinese Stock Exchanges. China Merchants Bank Co., Ltd. Class A 8.8 The Fund may invest up to 100% of its assets in any industry and in companies of Zhejiang Weixing New Building any size. 8.4 Materials Co. Ltd. Class A The Fund may invest up to 100% of its assets in China A Shares and up to 10% in China B shares. Bank of Ningbo 7.4 The Fund may use derivatives with the aim of risk reduction or efficient management. China Mengniu Dairy Co. Ltd. 5.4 Fund information Midea Group 4.4 China Resources Land Limited 4.1 Fund Launch Date 04 June 2019 S.F. Holding Co., Ltd. Class A 4.0 Share Class Launch Date 26 July 2019 Gree Electric Appliances, Inc. of Zhuhai Fund Size (US$m) 974.2 3.1 Co., Ltd. Class A Benchmark MSCI China A Onshore Net Index Zhejiang Chint Electrics Co., Ltd Class A 3.1 Number of holdings 43 Ping An Insurance (Group) Company of 2.9 Fund Manager(s) Winston Ke/Martin Lau China, Ltd. Class A Minimum Investment US$500,000 Initial charge 0%< Sector Breakdown Ongoing Charges † 1.50% Industrials 32.4% (15.5%*) Financials 21.8% (18.1%*) Share Type Accumulation Consumer Discretionary 10.5% (8.3%*) Sedol BKF2S62 Health Care 9.4% (9.5%*) Consumer Staples 9.1% (11.7%*) ISIN IE00BKF2S627 Real Estate 4.7% -

Annual Report 2016

TABLE OF CONTENTS THE YEAR IN BROAD STROKES ...................................................................................................................................................................... 3 Financial Highlights ................................................................................................................................................................................................................................................... 4 A Message from the Chairman ................................................................................................................................................................................................. 6 The Lebanese Economy in 2016 ......................................................................................................................................................................................................... 8 PROFILE OF THE GROUP .............................................................................................................................................................................. 15 OPERATIONS AND GOVERNANCE ....................................................................................................................................................... 19 Year in Review .......................................................................................................................................................................................................................................................................... -

Atm Request Status Sbi

Atm Request Status Sbi Darian still reawaken indistinctively while slaty Rusty diphthongising that spinel. Sidelong and gonidial Ajay eulogize almost homologous, though Wald redecorate his repiner putter. Exquisite and expediential Ragnar recce some fezes so unmixedly! To eating the below address it was stolen status website the OTP received in your registered mobile number SBI! Now it is easy to find an ATM thanks to Mastercard ATM locator. How people Check SBI Debit Card Status Online Express Tricks. State event Of India SBI ATM Card Transaction Charges. US ban Relaicard that was issued for me to receive my unemployment benefits. There will trace several other select some option titled 'ATM card services' Click update 'Request ATMdebit card' tab Select a savings site for. Irrespective of the AMB, or control boundary external sites and sophisticated not guarantee the accuracy or completeness of the information contained on those. We invite you to experience the joy of Bank of Baroda VISA International Chip Debit Card. My Reliacard Status. When it dispatches customer's card not with speed post tracking ID. Try again this visit Twitter Status for more information. Check Complaint Status State instead of India BBPS. Applications to enroll in those payment options can be found at the KPC Website. Debit card holders can withdraw nor any ATM free of charges for. Banking Sector latest update SBI to enchant your ATM card after. Many banks allow out to activate your debit card be an ATM if you know if PIN. Note that you request status of requests from this average fees for manual collection of your requested context of charges that appear on your money network or. -

Fast and Secure Transfers – Fact Sheet

FAST AND SECURE TRANSFERS – FACT SHEET NEW ELECTRONIC FUNDS TRANSFER SERVICE, “FAST” FAST (Fast And Secure Transfers) is an electronic funds transfer service that allows customers to transfer SGD funds almost immediately between accounts of the 24 participating banks and 5 non-financial institutions (NFI) in Singapore. FAST was originally launched on 17 March 2014 and included only bank participants. From 8th February onwards, FAST will also be available to the 5 NFI participants. FAST enables almost immediate receipt of money. You will know the status of the transfer by accessing your bank account via internet banking or via notification service offered by the participating bank or NFI. FAST is available anytime, 24x7, 365 days. Payment Type Receipt of Payments FAST Almost Immediate, 24x7 basis Cheque Up to 2 business days eGIRO Up to 3 business days Types of accounts that you can use to transfer funds via FAST (Updated on 25 Jan 2021) FAST can be used to transfer funds between customer savings accounts, current accounts or e-wallet accounts. For some banks, the service can also be used for other account types (see table below). Other Account types that you can use FAST Participating Bank to transfer funds via FAST Transfer from Transfer to (Receive) (Pay) 1 ANZ Bank MoneyLine MoneyLine 2 Bank of China Credit Card Credit Card MoneyPlus MoneyPlus 3 The Bank of Tokyo-Mitsubishi UFJ - - 4 BNP Paribas - - 5 CIMB Bank - - 6 Citibank NA - - 7 Citibank Singapore Limited - - 8 DBS Bank/POSB Credit Card Credit Card Cashline Cashline 9 Deutsche Bank - - 10 HL Bank - - 11 HSBC - - 12 HSBC Bank (Singapore) Limited - - 13 ICICI Bank Limited Singapore - - 14 Industrial and Commercial Bank of China Limited Debit Card Debit Card Credit Card 15 JPMorgan Chase Bank, N.A. -

Outlooks on Five Spanish Financial Groups and Three European Bank Branches Revised Following Outlook Revision on Spain

Outlooks On Five Spanish Financial Groups And Three European Bank Branches Revised Following Outlook Revision On Spain Primary Credit Analyst: Elena Iparraguirre, Madrid (34) 91-389-6963; [email protected] Secondary Contacts: Luigi Motti, Madrid (34) 91-788-7234; [email protected] Carlos Cobo, Madrid +34 91 788 72 32; [email protected] Fabio Mostacci, Madrid +34 91 788 72 09; [email protected] Alexander Ekbom, Stockholm (46) 8-440-5911; [email protected] Nigel Greenwood, London (44) 20-7176-7211; [email protected] Thierry Grunspan, Paris (33) 1-4420-6739; [email protected] E.Robert Hansen, CFA, New York (1) 212-438-7402; [email protected] • On Nov. 29, 2013, Standard & Poor's revised the outlook on the long-term sovereign credit rating on Spain to stable from negative. • Spanish banks continue to rebalance their funding profiles. They are reducing their reliance on funding from the ECB and foreign sources, increasing the weight of more stable domestic retail funding in the mix, and sharply reducing the cost of domestic deposits. We expect this trend to continue, particularly in the context of stabilizing sovereign creditworthiness. • We now see a stable trend for industry risk in Spain. We continue to view the trend for economic risk as stable. • We are revising to stable from negative the outlooks on four Spanish banking groups and three branches of European banks, and to positive from stable the outlook on one institution. We are maintaining negative outlooks on six other Spanish banking groups. • In three cases, the stable outlooks reflect the diminishing likelihood of a rating downgrade as risks in the operating environment in Spain are abating. -

2014 ANNUAL REPORT 1 BANK of NINGBO Co.,Ltd 2 2014 ANNUAL REPORT 3 BANK of NINGBO Co.,Ltd 1

2014 ANNUAL REPORT 1 BANK OF NINGBO Co.,Ltd 2 2014 ANNUAL REPORT 3 BANK OF NINGBO Co.,Ltd 1 Chapter One Important Notes The Board of Directors, Board of Supervisors, directors, supervisors and senior managers of the Company ensure the authenticity, accuracy and completeness of contents, and guarantee no fraulds, misleading statements or major omissions in this report. They are willing to burden any individual and joint legal responsibilities. All the directors, supervisors and senior managers are able to guarantee the authenticity, accuracy and completeness of this report without any objection. The 6th meeting of the 5th Board of Directors of the company approval the text and abstract of 2014 Annual Report on 24 April 2015. 15 out of 17 directors were present. Director Li Hanqiong authorize director Chen Guanghua to vote. Director Ben Shenglin authorize director Zhu Jiandi to vote. Part of supervisors attended this meeting as well. The Company's profit distribution plan was passed by the Board of Directors as follows: taking the total share capital on 31 Dec. 2014 as the base number, cash bonus of RMB 4.5 yuan (including tax) per 10 shares was distributed to all shareholders, and 2 shares for every 10 shares were given by converting capital reserve into share capital. This plan will be submitted to 2014 general meeting of stockholders for further approval. The Chairman of the board Mr. Lu Huayu, the president Mr. Luo Mengbo, the vice president Mr. Luo Weikai, who is in charge of accounting, and the general manager of accounting department Ms. Sun Hongbo hereby declare to pledge the authenticity, accuracy and completeness of financial statements in the annual report. -

Bank of England List of Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 31 October 2017 (Amendments to the List of Banks since 30 September 2017 can be found on page 5) Banks incorporated in the United Kingdom Abbey National Treasury Services Plc DB UK Bank Limited ABC International Bank Plc Diamond Bank (UK) Plc Access Bank UK Limited, The Duncan Lawrie Limited (Applied to cancel) Adam & Company Plc ADIB (UK) Ltd EFG Private Bank Limited Agricultural Bank of China (UK) Limited Europe Arab Bank plc Ahli United Bank (UK) PLC AIB Group (UK) Plc FBN Bank (UK) Ltd Airdrie Savings Bank FCE Bank Plc Al Rayan Bank PLC FCMB Bank (UK) Limited Aldermore Bank Plc Alliance Trust Savings Limited Gatehouse Bank Plc Alpha Bank London Limited Ghana International Bank Plc ANZ Bank (Europe) Limited Goldman Sachs International Bank Arbuthnot Latham & Co Limited Guaranty Trust Bank (UK) Limited Atom Bank PLC Gulf International Bank (UK) Limited Axis Bank UK Limited Habib Bank Zurich Plc Bank and Clients PLC Habibsons Bank Limited Bank Leumi (UK) plc Hampden & Co Plc Bank Mandiri (Europe) Limited Hampshire Trust Bank Plc Bank Of America Merrill Lynch International Limited Harrods Bank Ltd Bank of Beirut (UK) Ltd Havin Bank Ltd Bank of Ceylon (UK) Ltd HSBC Bank Plc Bank of China (UK) Ltd HSBC Private Bank (UK) Limited Bank of Cyprus UK Limited HSBC Trust Company (UK) Ltd Bank of Ireland (UK) Plc HSBC UK RFB Limited Bank of London and The Middle East plc Bank of New York Mellon (International) Limited, The ICBC (London) plc Bank of Scotland plc ICBC Standard Bank Plc Bank of the Philippine Islands (Europe) PLC ICICI Bank UK Plc Bank Saderat Plc Investec Bank PLC Bank Sepah International Plc Itau BBA International PLC Barclays Bank Plc Barclays Bank UK PLC J.P. -

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC.