Restaurant Quarterly Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Store Directory

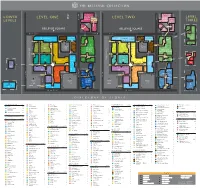

Hyatt Regency Bellevue Hyatt Regency 0 Bellevue 52 BELLEVUE - LOWER LEVEL ONE LEVEL TWO BELLEVUE LEVEL PLACE Wintergarden Wintergarden TO SR-520 13 Coins SR TO Nova Restaurant 24/7 PLACE Eye Care Eques Fonté THREE LEVELS Suite Coffee Needs Fresh Roaster Restaurant Deli N More Elevators Papillon to Daniel’s Hall | Spassov /Prime 21 Gallery K City Lounge JOEY Flowers (21st Bellevue Floor) Parlor Gunnar Trillium Custom Billiards & Nordstrom Tailoring & Design Ultralounge BELLEVUE SQUARE Gallery O2 Blow Dry Bar BELLEVUE SQUARE Fidelity K BoConcept Obadiah Salon Investments Lincoln Square EL Cinemark NN TO I-405 TO I-405 NE 8th Street NE 8th Street Cinemark TU TUNNEL Box Office Crate and Barrel Paddy Nordstrom Grill Pagliacci Coyne’s Zoom Pizza Din Nordstrom Kemper Irish Pub Urgent Care Nordstrom Ruth’s Chris Crate and Barrel AT&T Nordstrom Tai Fung Development Co. A Marketplace Café Steak House J A (5th Floor) Nordstrom ebar (3rd Floor) Thomasville McCormick Habitant @ Nordstrom Home Nordstrom ebar & Schmick’s I The Maggiano’s I Furnishings Lodge Little Italy inSpa The & Urban T-Mobile Lodge The Westin True Religion Pressed Tommy Interiors Bahama Everything Bellevue SEVEN the salon Starbucks Juicery Cactus Lucky Strike Taco Del Mar FROST Chico’s But Water Power Play Sleep Number P.F. Chang’s J SkinSpirit Papyrus White House | Vans Bose Tiffany & Co. Peloton NE Parking China Bistro Black Market NE Parking Tavern Hall Lucky The Soma Henredon Strike Moksha Soft B Urbanity Garage Container Garage & Schoener J Lanes Burberry Indian Cuisine Store -

Courtyard Lobby Renovation Press Release Template

CONTACT: Nick Graham 425-454-5888 [email protected] DOWNTOWN BELLEVUE HOTEL ENCOURAGES GUESTS TO HIT THE MALLS WITH SPECIAL DEAL $50 Visa gift card, complimentary high-speed Internet among perks included in holiday package from Courtyard Seattle Bellevue/Downtown Hotel Bellevue, WA – Let them shop. Let them save. Let them snore. The weather at home may be frightful, but this hotel deal in the Pacific Northwest is delightful! A new holiday shopping package from the Courtyard Seattle Bellevue/Downtown Hotel will surely provide delight for travelers making their way to grandma’s house – or any other special destination – this season. The Bellevue Washington hotel’s Deck the Malls Package offers deluxe accommodations from $139 to 189 per night along with free high-speed Internet and a $50 Visa gift card for each night booked. That means vacationers who book two nights at the downtown Bellevue hotel can earn $100, while three-day weekends can garner a cool $150. Visitors can spend that extra green in the Evergreen State at Bellevue Square or The Shops at The Bravern and experience nearly 200 stores and restaurants while taking in the holiday sights and sounds. Bellevue Square, just minutes from the downtown hotel in Bellevue, WA, features such stores as Coach, BCBGMAXAZRIA, The Disney Store, 7 For All Mankind, Tiffany & Co., Michael Kors, Abercrombie & Fitch and Bath and Body Works surrounded by anchors Macy’s, JCPenney and Nordstrom. Shoppers will be able to spend hours looking for Christmas or Hanukkah gifts for themselves or others after they refuel at one of 23 sit- down restaurants including P.F. -

GF Restaurant Take out & Delivery March 2020

Name of Business Phone Number Take Out? Delivery? Delivery Options? Family Meal Option? 2k's Cafe (406) 727-2053 Yes Yes Grubhub No 3D International (406) 453-6561 Yes Yes Uber Eats Yes 5th and Wine (406) 761-9463 Yes (online or over phone) No No 909 Cafe at the B.E.C.C (406) 761-8435 Yes & Curbside No No Al Banco (406) 952-0624 Yes No No American Bar (406) 736-5601 Yes No No Amigo Lounge (406) 761-1195 Yes No No Amy's Morning Perk (406) 727-1162 Yes Yes Store Delivery No Applebee's (406) 452-5051 Yes & Curbside Yes DoorDash, Grubhub Yes Arby's (406) 268-8297 Yes & Drive Thru No 10th Ave Delivers Bar S Lounge (406) 761-9550 Yes No No Beef N Bone (406) 866-2333 Curbside Pick-up No Best Wok (406) 761-2727 Yes & Drive thru Yes DoorDash, Grubhub Bighorn Bar & Grill (406) 454-1004 Yes No No Black Bear Diner (406) 204-1390 Yes Yes DoorDash Yes Black Eagle Community Center (406) 453-4736 Yes & Curbside pickup No The Block Bar & Grill (406) 315-1783 Yes No Yes Borrie's Supper Club (406) 761-0300 Yes No Yes Boston's (406) 761-2788 Yes Yes DoorDash, Grubhub Brian's Top Notch Cafe (406) 727-4255 Yes No No Bright Eyes Cafe (406) 453-5763 Yes Yes No Broadwater Coffee (406) 315-2490 Yes & Drive thru No Buffalo Wild Wings (406) 551-9464 Yes Yes Uber Eats, DoorDash Yes Burger Bunker (406) 952-0130 Yes Yes Cafe Courior, DoorDash, Grubhub, Uber Eats No Burger King (406) 771-1329 Yes No Burger King - 10th Ave S (406) 452-1666 Yes Yes Grubhub, DoorDash, Uber Eats Cafe Rio Mexican Grill (406) 791-5000 Yes Yes Grubhub Cattleman's Cut (406) 452-0702 Yes No -

Restaurant Portfolio Investment Opportunity

RESTAURANT PORTFOLIO INVESTMENT OPPORTUNITY Burger King | Pontiac, MI Hardees | Columbia, SC Long John Silver’s | Cincinnati, OH Raising Cane’s | Blue Springs, MO Net Lease Restaurant Portfolio – Four Triple Net Lease Properties Available on an Individual or Portfolio Basis DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING PORTFOLIO OVERVIEW -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Restaurants: Updating Our Thoughts on M&A

RBC Capital Markets, LLC Christopher Carril (Analyst) (617) 725-2109 [email protected] November 10, 2020 Restaurants: Updating Our Thoughts on M&A In light of the recently announced deal for DNKN to be acquired by Inspire Brands, in this note we take a look at recent trends in restaurant M&A, and what it means for the companies in our coverage. Is the DNKN deal a sign of things to come? Restaurants have been an active space for M&A—we EQUITY RESEARCH estimate that approximately 40% of the top 100 largest brands in the US have changed ownership over the last ten years—and we expect this trend to continue. Restaurants make attractive acquisition targets, particularly single brand, asset-light "all-franchised" companies able to generate significant free cash flow (e.g. DNKN w/near-100% FCF conversion). Additionally, this year's pandemic has also highlighted the resilience of fast food models, and especially those featuring significant drive-thru or delivery/carryout mix (conversely, over 80% of recent large chain bankruptcies are in the full service segment). However, the bargain hunting window has largely closed, with average valuations of single brand companies back to (or above) pre-COVID levels. But holding this aside, we expect the attractive qualities of restaurants to continue to draw the interest of potential acquirers, setting the stage for continued M&A activity. Thinking through the universe of potential acquirers: We expect private equity to remain active participants in restaurant M&A given the reasons cited above, and driven by substantial available dry powder. -

2) Buffalo Wild Wings' Success Is Ti

Buffalo Wild Wings (nickname B-Dubs) is a fast-casual sports restaurant chain that specializes in Buffalo-style chicken wings. A popular chain for football fans, Buffalo Wild Wings was revamped in 2016 to provide customers with a stadium arena sports experience [1]. However, B-Dubs has struggled to remain relevant among an American audience that is less interested in eating at sit-down restaurants. In Nov 2017, B-Dubs was bought by Arby’s. Basic History Basic Information Primary Audience: Young men (18-34) living fast- Founded: 1982 (renamed in 1998) Website: https://www.buffalowildwings.com/en/ paced lives in the Midwest, who like sports Home State: Ohio Revenue: $1.81 billion, as of 2015 Secondary Audience: Women and families for Founder: Jim Disbrow and friends Slogan: Wings. Beer. Sports. whom sports is a part of their bonding Going with Friends # of Locations: 1237 (as of 3/2017) Goal: Same store sales growth of 2% every year [2] Applebee’s USP: Large variety of wing flavors, unique sports atmosphere Red Robin Brand: Cool sports bar to chill with friends and watch the game Broad Dave and Busters Specialty Personality: Masculine (bromance/brofriend), upbeat, energetic Food Wingstop Brand Guide: https://www.buffalowildwings.com/globalassets/pdfs/press- TGI Friday kit/2014-1994_bww_style-guide.pdf Chipotle Going with family Product: Buffalo wings, Price: $12-20 (food only), Place: Buffalo Wild Wing Restaurants; Promotion: sport events & digital media 1) The cost of chicken wings is on the rise, resulting in more expensive boned wings [3]. 2) Buffalo Wild Wings’ success is tied to how exciting sports games are. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ____________________________ FORM 8-K ____________________________ CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported) July 13, 2021 ____________________________ Carrols Restaurant Group, Inc. (Exact name of registrant as specified in its charter) ____________________________ Delaware 001-33174 83-3804854 (State or other jurisdiction of (Commission (I.R.S. Employer incorporation or organization) File Number) Identification No.) 968 James Street Syracuse, New York 13203 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code: (315) 424-0513 N/A (Former name or former address, if changed since last report.) ____________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $.01 per share TAST The NASDAQ Global Market Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

Carrols Restaurant Group, Inc. 2017 Annual Report

Carrols Restaurant Group, Inc. 2017 Annual Report April 27, 2018 Dear Fellow Stockholders: 2017 was a year of continued progress at Carrols Restaurant Group, Inc. and we were pleased with our accomplishments, which included crossing the $1 billion mark in restaurant sales and increasing our unit count to more than 800 restaurants. We are proud to reach these milestones and intend to build upon them as we further position the Company for continued groowth. Total revenues in 2017 were $1.09 billion, an increase of 15.4% over the prior year, including $210.3 million in restaurant sales from the 175 restaurants acquired from 2015 to 2017. Comparable restaurant sales growth in 2017 of 5.2% yielded a strong 7.5% two-yyear trend, which outpaced most of our quick- service restaurant peers. Despite higher beef costs and wwage inflation, we also increased Adjusted EBITDA in 2017 to $91.4 million from $89.5 million in the prior year. BURGER KING®’s marketing strategy continues to effectively balance premium, value, and limited time product offerings to drive sales, average check, and customer traffic in a highly competitive environment. Premium offerings during the year included a number of products built around our new King™ sandwich platform and our new Crispy Chicken Sandwich. Notable value oofferings included the 2 for $6 WHOPPER® promotion, 2 cheeseburgers with small fries and a drink for $3.49, and 2 for $4 Mix and Match breakfast sandwiches, among others. In 2017, we acquired 64 BURGER KING restaurants in three separate transactions, consisting of 43 in Ohio (Cincinnati market), 17 in Maryland (Baltimore - Washington, DC market), and four in Maine. -

Carrols Restaurant Group, Inc. Carrols Corporation

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended July 3, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number: 001-33174 CARROLS RESTAURANT GROUP, INC. (Exact name of Registrant as specified in its charter) Delaware 16-1287774 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 968 James Street Syracuse, New York 13203 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code: (315) 424-0513 Commission File Number: 001-06553 CARROLS CORPORATION (Exact name of registrant as specified in its charter) Delaware 16-0958146 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 968 James Street Syracuse, New York 13203 (Address of principal executive offices) (Zip Code) Registrant’s telephone number including area code: (315) 424-0513 Carrols Corporation meets the conditions set forth in General Instruction H(1) and is therefore filing this form with reduced disclosure format pursuant to General Instruction H(2). Indicate by check mark whether either of the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. -

2016 •Fi a YEAR in REVIEW for RESTAURANT FIRMS

Journal of Hospitality Financial Management The Professional Refereed Journal of the Association of Hospitality Financial Management Educators Volume 24 | Issue 1 Article 1 5-23-2016 2016 – A YEAR IN REVIEW FOR RESTAURANT FIRMS Atul Sheel Isenberg School of Management, University of Massachusetts, Amherst, MA Follow this and additional works at: https://scholarworks.umass.edu/jhfm Recommended Citation Sheel, Atul (2016) "2016 – A YEAR IN REVIEW FOR RESTAURANT FIRMS," Journal of Hospitality Financial Management: Vol. 24 : Iss. 1 , Article 1. DOI: https://doi.org/10.1080/10913211.2016.1174034 Available at: https://scholarworks.umass.edu/jhfm/vol24/iss1/1 This Editor's Note is brought to you for free and open access by ScholarWorks@UMass Amherst. It has been accepted for inclusion in Journal of Hospitality Financial Management by an authorized editor of ScholarWorks@UMass Amherst. For more information, please contact [email protected]. The Journal of Hospitality Financial Management ISSN: 1091-3211 (Print) 2152-2790 (Online) Journal homepage: http://www.tandfonline.com/loi/uhfm20 2016 - A Year in Review for Restaurant Firms Atul Sheel To cite this article: Atul Sheel (2016) 2016 - A Year in Review for Restaurant Firms, The Journal of Hospitality Financial Management, 24:1, 1-4, DOI: 10.1080/10913211.2016.1174034 To link to this article: https://doi.org/10.1080/10913211.2016.1174034 Published online: 23 May 2016. Submit your article to this journal Article views: 674 View related articles View Crossmark data Full Terms & Conditions -

Food and Beverage Industry Update │ December 2017

FOOD AND BEVERAGE INDUSTRY UPDATE │ DECEMBER 2017 www.harriswilliams.com Investment banking services are provided by Harris Williams LLC, a registered broker-dealer and member of FINRA and SIPC, and Harris Williams & Co. Ltd, which is a private limited company incorporated under English law with its registered office at 5th Floor, 6 St. Andrew Street, London EC4A 3AE, UK, registered with the Registrar of Companies for England and Wales (registration number 07078852). Harris Williams & Co. Ltd is authorized and regulated by the Financial Conduct Authority. Harris Williams & Co. is a trade name under which Harris Williams LLC and Harris Williams & Co. Ltd conduct business. FOOD AND BEVERAGE INDUSTRY UPDATE │ DECEMBER 2017 WHAT WE’RE SEEING CONTENTS MARKET UPDATE . INDUSTRY VITAL SIGNS . EQUITY MARKET OVERVIEW The food & beverage M&A market remains active through December, with several . M&A MARKET OVERVIEW . DEBT MARKET OVERVIEW notable transactions. Arby’s, a portfolio company of Roark Capital Group, . RECENT M&A ACTIVITY announced its acquisition of Buffalo Wild Wings, demonstrating the continued . EARNINGS CALENDAR appetite of private equity groups to enter or continue to expand their holdings in GROUP OVERVIEW the restaurant space. Also notable is Nestle’s announced acquisition of Atrium Harris Williams & Co. is a leading advisor to the food and Innovations. Nestle is actively looking for growth avenues in consumer healthcare beverage market. Our significant to complement its focus on high-growth food and beverage categories. Mars’ experience covers a broad range of end markets, industries, and minority investment in KIND further illustrates the desire of large CPGs to capture business models.