GF Restaurant Take out & Delivery March 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Store Directory

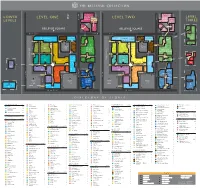

Hyatt Regency Bellevue Hyatt Regency 0 Bellevue 52 BELLEVUE - LOWER LEVEL ONE LEVEL TWO BELLEVUE LEVEL PLACE Wintergarden Wintergarden TO SR-520 13 Coins SR TO Nova Restaurant 24/7 PLACE Eye Care Eques Fonté THREE LEVELS Suite Coffee Needs Fresh Roaster Restaurant Deli N More Elevators Papillon to Daniel’s Hall | Spassov /Prime 21 Gallery K City Lounge JOEY Flowers (21st Bellevue Floor) Parlor Gunnar Trillium Custom Billiards & Nordstrom Tailoring & Design Ultralounge BELLEVUE SQUARE Gallery O2 Blow Dry Bar BELLEVUE SQUARE Fidelity K BoConcept Obadiah Salon Investments Lincoln Square EL Cinemark NN TO I-405 TO I-405 NE 8th Street NE 8th Street Cinemark TU TUNNEL Box Office Crate and Barrel Paddy Nordstrom Grill Pagliacci Coyne’s Zoom Pizza Din Nordstrom Kemper Irish Pub Urgent Care Nordstrom Ruth’s Chris Crate and Barrel AT&T Nordstrom Tai Fung Development Co. A Marketplace Café Steak House J A (5th Floor) Nordstrom ebar (3rd Floor) Thomasville McCormick Habitant @ Nordstrom Home Nordstrom ebar & Schmick’s I The Maggiano’s I Furnishings Lodge Little Italy inSpa The & Urban T-Mobile Lodge The Westin True Religion Pressed Tommy Interiors Bahama Everything Bellevue SEVEN the salon Starbucks Juicery Cactus Lucky Strike Taco Del Mar FROST Chico’s But Water Power Play Sleep Number P.F. Chang’s J SkinSpirit Papyrus White House | Vans Bose Tiffany & Co. Peloton NE Parking China Bistro Black Market NE Parking Tavern Hall Lucky The Soma Henredon Strike Moksha Soft B Urbanity Garage Container Garage & Schoener J Lanes Burberry Indian Cuisine Store -

Courtyard Lobby Renovation Press Release Template

CONTACT: Nick Graham 425-454-5888 [email protected] DOWNTOWN BELLEVUE HOTEL ENCOURAGES GUESTS TO HIT THE MALLS WITH SPECIAL DEAL $50 Visa gift card, complimentary high-speed Internet among perks included in holiday package from Courtyard Seattle Bellevue/Downtown Hotel Bellevue, WA – Let them shop. Let them save. Let them snore. The weather at home may be frightful, but this hotel deal in the Pacific Northwest is delightful! A new holiday shopping package from the Courtyard Seattle Bellevue/Downtown Hotel will surely provide delight for travelers making their way to grandma’s house – or any other special destination – this season. The Bellevue Washington hotel’s Deck the Malls Package offers deluxe accommodations from $139 to 189 per night along with free high-speed Internet and a $50 Visa gift card for each night booked. That means vacationers who book two nights at the downtown Bellevue hotel can earn $100, while three-day weekends can garner a cool $150. Visitors can spend that extra green in the Evergreen State at Bellevue Square or The Shops at The Bravern and experience nearly 200 stores and restaurants while taking in the holiday sights and sounds. Bellevue Square, just minutes from the downtown hotel in Bellevue, WA, features such stores as Coach, BCBGMAXAZRIA, The Disney Store, 7 For All Mankind, Tiffany & Co., Michael Kors, Abercrombie & Fitch and Bath and Body Works surrounded by anchors Macy’s, JCPenney and Nordstrom. Shoppers will be able to spend hours looking for Christmas or Hanukkah gifts for themselves or others after they refuel at one of 23 sit- down restaurants including P.F. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Restaurant Quarterly Update

Restaurant Quarterly Update F a l l 2 0 1 8 1 Restaurant MonthlyQuarterly Update Update | January| Fall 2018 2018 KEY Market Update INFORMATION ( 1 ) September restaurant survey data indicated a 1.2% improvement in same-store sales (SSS), while the third quarter had an overall increase in SSS of 1.2%. This quarterly result represents the strongest sales growth rates for restaurants in the past three years and is the first quarter since the fourth quarter of 2015 in which all three consecutive months were positive. September SSS grew by 1.2%, while comparable traffic fell by Even though the industry appeared stronger due to hurricanes in Texas 1.4% and Florida in the previous year, sales growth was impressive across the entire country. All geographic regions reported positive sales growth throughout both September and the third quarter as a whole, with 76% of all designated market areas (“DMAs”) posting positive growth. Average guest checks are up 2.9% in 2018 vs. 2.2% for the same Although the industry generated positive sales growth, restaurants period last year, helping to mitigate experienced a 1.4% decline in same-store traffic in September. While the drop in traffic this is an improvement from earlier in the year, it still indicates that restaurants are likely far from a true long-term recovery. Even though the third quarter experienced a 1.3% decline in same-store traffic, this represented the best quarterly result in the past three years. Job growth among chain restaurants has accelerated in Even as sales hint at a recovery, the reality is that restaurants opened recent months, with the number of for more than one year continue to lose guests. -

Merchant Wishlist REP#______

Merchant Wishlist REP#_____________ Organization: ____________________ Contact name: _________________ Email: __________________________ Phone: _______________________ Fax to 1-888-870-9040 or email Address: ________________________ City: _________________________ [email protected] State: ____________ Zip: __________ Number of cards: _______________ We use the central address you provide like a pin point in a map, then create a list of the closest 100-200 merchants by distance and move your wishlist merchants to the top of the list. We do NOT call only the wishlist merchants and then wait until they get back with us (your card would never get finished if we did). 15 to 20% of merchants will provide an offer. We cannot guarantee the participation of any merchant. We reserve the right to determine final merchants and card design. List your local wishlist merchants (excluding Fast Food national merchants). This is a great place to include A&W Chipotle Jack’s PDQ Taco Bell your favorite eateries, hair care, hardware, Auto Arby's Church's KFC Pollo Tropical Taco John's Baja Fresh Culver's Krystal Popeyes Tijuana Flats Care, and others. Include known owner’s names Bojangles' Del Taco Long John Silver's Qdoba Wendy's 1. Burger King El Pollo Loco McDonald's Rally's Whataburger Captain D's Farmer Boys Moe's Red Robin White Castle 2. Carl's Jr. Five Guys Noodles & Co Rubio's Wienerschnitzel Checkers In-N-Out Burger Panda Express Sonic Drive-In Wingstop 3. Chick-fil-A Jack in the Box Panera Bread Steak 'n Shake Zaxby's 4. Subs/Sandwiches Boston Market Firehouse Subs Jimmy John's Portillo’s Schlotzsky's 5. -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken -

View/Download the Media

MEDIA [email protected] @PizzaMarktplace www.pizzamarketplace.comKIT2021 our mission // Be the premier online destination for C-level pizza executives seeking cutting-edge intelligence for their multiunit restaurant concepts. PizzaMarketplace.com’s coverage unearths trends before they manifest and keeps pizza executives informed about all the latest innovations in: • Food & beverage • Digital signage • Equipment & supplies • Franchising & growth • Health & nutrition • Risk management • Marketing • Branding & promotion • Operations management • Ingredients • Supply market dynamics • Staffing & training • Sustainability • Food safety • And much more [email protected] @PizzaMarktplace www.pizzamarketplace.com about the editor // SHELLY WHITEHEAD // editor [email protected] Award-winning veteran print and broadcast journalist, Shelly Whitehead, has spent most of the last 31 years reporting for TV and newspapers, including the former Kentucky and Cincinnati Post and a number of network news affiliates nationally. She brings her cumulative experience as a multimedia storyteller and video producer to the web-based pages of PizzaMarketplace.com and QSRweb.com, after a lifelong “love affair” with reporting the stories behind the businesses that make our world go ‘round. Ms. Whitehead is driven to find and share news of the many professional passions people take to work with them every day in the pizza and quick-service restaurant industry. She is particularly interested in the growing role of sustainable agriculture and nutrition in food service worldwide and is always ready to move on great story ideas and news tips. KATHY DOYLE // publisher [email protected] As the former group publisher of Purchasing, Semiconductor International, and Industrial Distribution magazines and websites at Reed Business Information, Kathy Doyle brings 20-plus years of print and online media experience to this position. -

Retail Investment Group Taco Bell & 2 Tenant Building

w Click For Drone Footage Two Free Standing Buildings 7058 & 7150 WA-303 | BREMERTON, WA PRICE: $3,350,000 | CAP: 5.37% INVESTMENT OFFERING EXECUTIVE SUMMARY PRICE: CAP: NOI: $3,350,000 5.37% $179,548 7058 & 7150 WA-303 LOCATION: Bremerton, Washington Taco Bell: ±2,085 SF BUILDING SIZE: Taco Del Mar/Quiznos: ±2,872 SF LAND SIZE: ±1.07 Acres GUARANTOR: * LEASE TYPE: Absolute NNN LEASE EXPIRATION: * Taco Bell: 2018 YEAR BUILT: Taco Del Mar/Quiznos: 2003 LESSEE: * OPTIONS: * INCREASES: * ROFR: None *See Page 3 ALL PHOTOS TAKEN SEPT. 24TH 2019 TACO BELL & 2 TENANT BUILDING | BREMERTON, WA RETAIL INVESTMENT GROUP PROPERTY OVERVIEW Retail Investment Group is pleased to be the exclusive listing agent for the Taco Bell and Taco Del Mar/Quiznos property in Bremerton, Washington. The property is surrounded by single-family homes, Olympic Village Apartments and numerous retailers and churches. Some of those retailers include: Starbucks, McDonald’s, Walmart, Safeway, Walgreens, Burger King, Les Schwab Tire Center, Central Valley Garden Supply and Subject Properties Chevron. This Taco Bell is ±0.5 miles from the Kitsap Tennis and Athletic Center and ±1 mile from Esquire Hills Elementary School and Bremerton Skateland. The Taco Bell offers an Absolute NNN Lease, while the Quizno’s/ Taco Del Mar offers an NNN lease.T aco Bell offers 4 (5)Y ear Options and Quizno’s/Taco Del Mar offers 1 (5) Year Option. Both are located on the WA- 303 HWY seeing more than ±33,000 vehicles per day. These properties are located ±15 miles from Seattle WA, the 18th most populous city in the US with more than ±724,700 people. -

Agenda Item 7

Item Number: AGENDA ITEM 7 TO: CITY COUNCIL Submitted By: Douglas D. Dumhart FROM: CITY MANAGER Community Development Director Meeting Date: Subject: Conceptual Review of a Proposal for the July 19, 2011 Development of a Chase Bank at 5962 La Palma Avenue RECOMMENDATION: It is recommended that the City Council conceptually approve a proposal for the development of a Chase Bank at 5962 La Palma Avenue and direct staff to draft a Zoning Code Text Amendment and Development Agreement for further consideration. SUMMARY: The City has received a letter from Studley, the real estate brokerage firm representing the property owner at 5962 La Palma Avenue, requesting that the City consider the development of a JP Morgan Chase Bank on their property. The letter is provided as Attachment 1 to this report. The site is located at the southwest corner of Valley View Street and La Palma Avenue and has been vacant for over 10 years. Late last year, the subject parcel was rezoned from Neighborhood Commercial (NC) to Planned Neighborhood Development (PND) land use designation, which prohibits financial institutions and banks. The Broker has stated that they have exhausted attempts to find end users for his client’s property that are consistent with the goals of the new PND Zone and that meet the needs of his client. They have a ground lease offer from Chase to develop a free-standing bank. The financial institution use alone does not meet the requirements in the PND Zoning District to develop the commercial corner with retail uses that are lacking in the community. -

Online, Mobile, and Text Food Ordering in the U.S. Restaurant Industry

Online, Mobile, and Text Food Ordering in the U.S. Restaurant Industry Cornell Hospitality Report Vol. 11, No. 7, March 2011 by Sheryl E. Kimes, Ph.D., and Philipp F. Laqué www.chr.cornell.edu Advisory Board Niklas Andréen, Group Vice President Global Hospitality & Partner Marketing, Travelport GDS Ra’anan Ben-Zur, Chief Executive Officer, French Quarter Holdings, Inc. Scott Berman, Principal, Industry Leader, Hospitality & Leisure Practice, PricewaterhouseCoopers Raymond Bickson, Managing Director and Chief Executive Officer, Taj Group of Hotels, Resorts, and Palaces Stephen C. Brandman, Co-Owner, Thompson Hotels, Inc. Raj Chandnani, Vice President, Director of Strategy, WATG Benjamin J. “Patrick” Denihan, Chief Executive Officer, Denihan Hospitality Group Brian Ferguson, Vice President, Supply Strategy and Analysis, Expedia North America Chuck Floyd, Chief Operating Officer–North America, Hyatt The Robert A. and Jan M. Beck Center at Cornell University Gregg Gilman, Partner, Co-Chair, Employment Practices, Back cover photo by permission of The Cornellian and Jeff Wang. Davis & Gilbert LLP Susan Helstab, EVP Corporate Marketing, Four Seasons Hotels and Resorts Jeffrey A. Horwitz, Chair, Lodging + Gaming, and Co-Head, Mergers + Acquisitions, Proskauer Kevin J. Jacobs, Senior Vice President, Corporate Strategy & Treasurer, Hilton Worldwide Kenneth Kahn, President/Owner, LRP Publications Cornell Hospitality Reports, Kirk Kinsell, President of Europe, Middle East, and Africa, InterContinental Hotels Group Vol. 11, No. 7 (March 2011) Radhika Kulkarni, Ph.D., VP of Advanced Analytics R&D, SAS Institute © 2011 Cornell University Gerald Lawless, Executive Chairman, Jumeirah Group Mark V. Lomanno, President, Smith Travel Research Cornell Hospitality Report is produced for Betsy MacDonald, Managing Director, HVS Global Hospitality the benefit of the hospitality industry by Services The Center for Hospitality Research at David Meltzer, Vice President of Global Business Development, Cornell University Sabre Hospitality Solutions William F. -

High Bluff Takes on the Turnaround of Quiznos, Taco Del Mar

Send to printer Close window High Bluff Takes on the Turnaround of Quiznos, Taco Del Mar N I C H O L A S U P T O N TACO DEL MAR There are a handful of new multi-brand operators out there, pooling resources to take on the big challenges in the restaurant space, including turning around tired brands. The private equity firm High Bluff Capital Partners is doubling down on the model and seeks to return both Quiznos and Taco Del Mar to growth. Quiznos needs little introduction as the brand that soared to 5,000 locations in a short period and famously imploded when bad real estate decisions, unqualified operators and bad unit volumes caught up with it. It sunk to about 750 locations when High Bluff acquired the brand. Taco Del Mar had a similar trajectory. The Seattle-founded taco brand known for Baja-inspired Mexican food surged to 270 locations in 2008, just ahead of the Great Recession. Similar brand issues and ownership missteps led to the brand filing for bankruptcy protection in 2010. The brand also lost a lot of locations, slimming to about 100 units in the U.S. and Canada today. High Bluff, based in San Diego, announced the acquisition of both brands in the past 30 days at what seems to be the bottom. “In these two particular situations, the store count is now reaching a level of stability where the precipitous decline is largely behind us and we’re at bottom or near bottom of the store count journey. Now it becomes a question for new prototypes and new opportunities for growth,” said Gerry Lopez. -

SBA Franchise Directory Effective March 31, 2020

SBA Franchise Directory Effective March 31, 2020 SBA SBA FRANCHISE FRANCHISE IS AN SBA IDENTIFIER IDENTIFIER MEETS FTC ADDENDUM SBA ADDENDUM ‐ NEGOTIATED CODE Start CODE BRAND DEFINITION? NEEDED? Form 2462 ADDENDUM Date NOTES When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Collateral Assignment of Lease and Lease S3606 #The Cheat Meal Headquarters by Brothers Bruno Pizza Y Y Y N 10/23/2018 Addendum may not be executed. S2860 (ART) Art Recovery Technologies Y Y Y N 04/04/2018 S0001 1‐800 Dryclean Y Y Y N 10/01/2017 S2022 1‐800 Packouts Y Y Y N 10/01/2017 S0002 1‐800 Water Damage Y Y Y N 10/01/2017 S0003 1‐800‐DRYCARPET Y Y Y N 10/01/2017 S0004 1‐800‐Flowers.com Y Y Y 10/01/2017 S0005 1‐800‐GOT‐JUNK? Y Y Y 10/01/2017 Lender/CDC must ensure they secure the appropriate lien position on all S3493 1‐800‐JUNKPRO Y Y Y N 09/10/2018 collateral in accordance with SOP 50 10. S0006 1‐800‐PACK‐RAT Y Y Y N 10/01/2017 S3651 1‐800‐PLUMBER Y Y Y N 11/06/2018 S0007 1‐800‐Radiator & A/C Y Y Y 10/01/2017 1.800.Vending Purchase Agreement N N 06/11/2019 S0008 10/MINUTE MANICURE/10 MINUTE MANICURE Y Y Y N 10/01/2017 1. When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Addendum to Lease may not be executed.