Semiconductors MARKET & OPPORTUNITIES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table No.18 (B) STATEMENT on REMMITTANCE-WISE DETAILS of FDI EQUITY INFLOWS RECEIVED by ACQUISITION of EXISTING SHARES ROUTE DURING JULY, 2013

Table No.18 (b) STATEMENT ON REMMITTANCE-WISE DETAILS OF FDI EQUITY INFLOWS RECEIVED BY ACQUISITION OF EXISTING SHARES ROUTE DURING JULY, 2013 (Amount in million) Sl. Name of Indian Company Country Name of Foreign RBI Regional Item of Manufacture Amount of FDI Inflows No Collaborator Office (In Rs (In US$ million) million) 1 PENNAR ENGINEERED Mauritius ZEPHYR PEACOCK REGION NOT PRE ENGINEERING 42.50 0.71 BUILDING SYSTEMS LTD INDIA FUND III LIMITED INDICATED 2 SENER INDIA Spain SENER INGENIERIA Y REGION NOT TECHNICAL CONSULTANCY, 0.09 0.00 ENGINEERING & SYSTEMS SISTEMAS S.A. INDICATED SOFTWARE DEVELOPMENT PVT LT 3 SIGNATURE Mauritius LEGENDARY REGION NOT MFG BAKERY PRODUCTS 312.73 5.23 INTERNATIONAL FOODS INVESTMENTS LTD INDICATED INDIA PVT 4 TUTOR VISTA GLOBAL PVT Singapore PEARSON REGION NOT EDUCATION & TEACHING OF 1,237.04 20.69 LTD (SINGAPORE) PTE LTD INDICATED MODERN TECHNOLOGY 5 ORBINOX INDIA PRIVATE Spain ORBINOX VALVES REGION NOT MFG OF VALVES 20.41 0.34 LIMITED INTRERNATIONAL SL INDICATED 6 BARBEQUEONATION Mauritius TAMARA PRIVATE REGION NOT CHAIN OF CASUAL DINNING 138.84 2.32 HOSPITALITY LTD INDICATED RESTAURANTS 7 INTERLACE INDIA UAE SOUNDARYAM REGION NOT SOFTWARE 27.98 0.47 GENERAL TRADING INDICATED 8 RAMKRISHNA FORGINGS Mauritius WAYZATA II INDIAN REGION NOT MFG OF CLOSED DIE FORGINGS 265.56 4.44 LTD OCEAN LTD INDICATED 9 IGATE COMPUTER SYSTEM Mauritius PAN ASIA IGATE REGION NOT SOFTWARE DEVELOPMENT 251.32 4.20 LTD SOLUTIONS INDICATED 10 CAMERONTEC INDIA United E INFOTECH REGION NOT CONSULTANCY, PROVIDE 0.36 0.01 PRIVATE LIMITED Kingdom LIMITED2E INDICATED TECHNOLOGICAL SOLUTIONS 11 CALCEUS FASHINS U.S.A CALCEUS REGION NOT TEXTILE, YARN FABRIC 0.05 0.00 PRIVATE LTD ACQUISITION INC INDICATED GARMENTS 12 ORIENT REFRACTORIES Netherlands DUTCH US HOLDING REGION NOT MFG OF REFACTORIES & 1,217.81 20.37 LTD B.V. -

WP-Lem Giarratana Et Al

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Giarratana, Marco; Pagano, Alessandro; Torrisi, Salvatore Working Paper Links between multinational firms and domestic firms: A comparison of the software industry in India, Ireland and Israel LEM Working Paper Series, No. 2003/22 Provided in Cooperation with: Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies Suggested Citation: Giarratana, Marco; Pagano, Alessandro; Torrisi, Salvatore (2003) : Links between multinational firms and domestic firms: A comparison of the software industry in India, Ireland and Israel, LEM Working Paper Series, No. 2003/22, Scuola Superiore Sant'Anna, Laboratory of Economics and Management (LEM), Pisa This Version is available at: http://hdl.handle.net/10419/89372 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

Creating Next Generation Technologies

IT/ITES Creating Next Generation Technologies India’s IT sector is pioneering cutting-edge technology, helping global corporates to launch a fascinating new range of products and services. Shivkamal highlights the achievements of the sector 32 N the 1990s, few countries took notice of India’s potential to emerge as a dominant player in the Informa- Ition Technology (IT) sector. By 2007, the Indian IT industry registered record revenues of $39.6 billion. The key to this success has been innovation. Since the beginning, the Indian IT industry has shown tremendous innova- tion quotient, both in the services space and product domain. This innovative approach has now prompted the National Association of Software & Services Companies (Nasscom), the premier trade body of the Indian IT industry, to forecast $50 billion revenue in a couple of years. A number of Indian IT services and product companies have grown into technology giants such as Tata Consul- tancy Services (TCS) of the Tata Group, India’s largest software exporter, by banking on innovation. It is followed by Bangalore-based Infosys Technologies, which has the highest market capitalisa- tion among Indian IT companies. Third in the list is Wipro Ltd, a traditional product company turned IT behemoth. These three companies are making waves worldwide by acquiring rivals to increase their geographical footprint. Interestingly, their growth has been propelled by innova- tive services and products, which have become popular among its clients. Infosys, which is known for its IT and IT-enabled services, has developed a product called Finacle for the banking DPA sector. It empowers banks to transform MEETING GLOBAL CHALLENGES: The IT/ITES sectors have been catering to the needs of international clients their business leveraging agile and new generation technologies. -

Technology Company Reduces Time to Market, Product Costs by up to 30 Percent

Windows Embedded Customer Solution Case Study Technology Company Reduces Time to Market, Product Costs by Up to 30 percent Overview “With CE 6.0, it is now easy to integrate media related Country or Region: India applications seamlessly into the product; this is highly Industry: Manufacturing – Consumer Electronics advantageous in developing future messaging application support.” Customer Profile Based in Bangalore, India, Ittiam Systems Sheela Prabhakar, Distinguished Member Technical Staff and Technologist, Media Streaming (P) Ltd specializes in digital signal Business, Ittiam Systems (P) Ltd. processing systems. With offices in the U.S., the U.K., and France, the company employs 200 people. Founded in January 2001, Ittiam Systems (P) Ltd is a 200-strong Business Situation technology company that develops digital signal processing (DSP) Ittiam Systems wanted a feature-rich algorithms, applications, and reference designs for multimedia and development environment for its IP Videophone application that would lower wireless devices. Seeking to migrate its IP Videophone application costs and eliminate dependency on third to a feature-rich operating system that would lower costs and party software. eliminate dependency on third party software, the company Solution selected Windows® Embedded CE 6.0 as a platform for its future The company opted to migrate to DSP reference designs. With its embedded multimedia functionality Windows® Embedded CE 6.0 for its embedded media functionality and and applications, CE 6.0 offers Ittiam Systems a stable platform, software interoperability. PC-based application interoperability, standardized interface Benefits development, rapid enabling of features, a production cost Embedded media support Built-In SIP stack reduction of 10 to 25 percent, and a 30 percent cut in development Software interoperability time. -

FIRST BIN (Volume – 9, Issue – 01, Jan – 2021)

Volume – 9 | Issue – 01 Jan 2021 FIRSTFIRST BINBIN A Newsletter for the Semiconductor Engineering Community Contents Dear Customer, I wish all A Very Happy and Healthy New Year! From the CEO’s Desk As you are all aware, it has been a challenging 2020! Tessolve team was able to quickly adapt to the new norm ensured continuity and best of Tessolve Showcase support to you all. 1. Effective Thermal Management Using Heat Pipe I would like to thank you for your support in a challenging year. I would also like to especially thank ADI for awarding us the Best Supplier award in the Ajay Kumar Balakrishna – Design Engineer, Mechanical Design, engineering services category! V J Nitheesh Shenoy – Sr. Design Engineer, Mechanical Design. This is a testament to the commitment and customer focus of Team 2. Low Cost PMIC Testing via conventional Digital cum Tessolve and we will continue to give our best to meet your engineering Mixed Signal ATE needs. Pravenakumara. D – Test Engineer 2, We continue to invest in engineering talent and our team has grown to over Manoj Manimaran Selvaraj – Test Engineer 2 2000 engineers worldwide. We have also invested in acquiring new testers (ETS364B, Advantest T2k Air) and also invested in a full suite of Cadence tools to address our growing project demand. Tessolve Engineering Challenge Contest We also launched the Centre of Excellence initiative to ensure we have dedicated teams working on initiatives to work on the latest technologies 1. DDR IO Calibration Debug Challenges In Multichannel Design and special projects. Some of the projects COE is taking up are 112GBPS PAM4, mmWave, High-Performance Compute qualifications, Analog Suneetha Thentu – Sr. -

AUTOMATIC (RBI) Route (Amount in Milli

STATEMENT ON COMPANY-WISE DETAILS OF FDI INFLOWS DURING 01/12/2004 TO 31/12/2004 ROUTE : AUTOMATIC (RBI) Route (Amount in Million) ---------------------------------------------------------------------------------------------------------------------------------------------------------------- SNo. NAME OF INDIAN COMPANY COUNTRY NAME OF THE FOREIGN COLLABORATOR ITEM OF MANUFACTURE AMOUNT OF FDI RECEIVED (In Rs) (In US$) ---------------------------------------------------------------------------------------------------------------------------------------------------------------- 1 ACE BUSINESS SYSTEMS PVT LTD Australia - DATA PROCESSING,SOFTWARE 1.00 0.02 2 FOCUS ROCK BITS PVT LTD Australia - OF BORING,BROACHIN, DRILL 16.98 0.37 3 KMG INFOTECH (PVT.) LTD., Canada - DATA PROCESSING, SOFTWARE 11.36 0.25 4 AXCEND AUTOMATION & SOFTWARE SOL. P LTD. Canada - DATA PROCESSING SOFTWARE 2.44 0.05 5 PPS INFORMATION SOLUTIONS PVT LTD Canada - SOFTWARE SUPPLY SERVICES 0.15 0.00 6 ARMSTRONG ACMITE INDIA MFG. (P) LTD Canada - CASTING OF NON FERROUS ME 1.68 0.04 7 BIRLA SUN LIFE INSURNACE CO LTD Canada - INSURNACE CARRIERS OTHER 91.00 1.98 8 FACOR ALLOYS LTD Channel Island - OF FERRO ALLOYS 22.77 0.50 9 FRONT AVENUE INFOSOLUTIONS PVT LTD Denmark - DATA PROCESSING,SOFTWARE 2.50 0.05 10 TERXPRO FILMS PVT LTD Finland - MFR. OF PHOTCHEMICAL MATE 5.67 0.12 11 CMA CGM EAST &SOUTH INDIA PVT LTD France - SUPPORTING SERVICES TO WA 2.40 0.05 12 EUROTHERM HEMA REDIATOS INDIA LTD France - ARCHITECUTREAL AND ENGG.C 0.34 0.01 13 W.H WINTECH PVT. LTD France - TIMBER WORK 0.13 0.00 14 CORNAC TRAVEL PVT LTD France - ACTIVITES OF TOURIST AND 1.60 0.03 15 LANXESS INDIA PVT LTD France - MFR. OF ORGANIC CHEMICALS 1440.00 31.30 16 COSMOS CARBON CREDIT PVT LTD France - BUSINESS MANAGEMENT CONSU 0.04 0.00 17 HEXAL PHARMA PVT. -

Industry Associated with Dept Of

PSG COLLEGE OF TECHNOLOGY, COIMBATORE DEPARTMENT OF ELECTRONICS AND COMMUNICATION ENGEINEERING S.No. Name of the Industry with Contact Person and designation Contact No. & email address Nature of address interaction 1 STEPS Knowledge services Pvt. Mr.V.S.Ramesh [email protected] Board of Ltd, Director Studies Ondipudur, Member Coimbatore-16 2 Keysight Technologies India Pvt Mr.V.V.Pathy [email protected] Board of Ltd Business Development Manager Studies Bangalore-560048 Member 3 Qualsys Consultanys(India), Pvt Mr.Tapesh Gautam, [email protected] Board of Ltd, Director Studies Ahmedabad Member 4 Sinetec Technologies, Mr.A.P.Sivaraman [email protected] Board of Coimbatore Managing Director Studies Member 5 Qualcomm Technolgies Inc, Dr.M.Bama [email protected] Board of Senior Engineer, Qualcomm, Studies Chennai Member Mr.Karthi Subbiah [email protected] Senior Engineer, LTE Base Station Qualcomm Technolgies Inc, Colorado, USA 6 CISCO Systems India Pvt., Ltd. Mr.K.Karthikeyan Board of SEZ Unit, Cessna Business Park, Software engineer Studies Bengaluru-560087 Member 7 PriceWaterHouse Coopers Sriram Senthilkumar [email protected] Board of Bangalore Operations Head, Studies IoT & Embedded Systems Member 8 HQ, Southern Naval Command, Commander.M.Ramasubramanian [email protected] One Credit Naval base, Cochin Deputy Head Course Aircraft Repair & Maintenance Yard, Indian Navy, Kochi 9 Bharat Sanchar Nigam Limited, Vikramaditya Penmetsa Summer Velampata Internship Vishakapatnam-530001 10 M/s. Sesana Sorting Machines J.I. -

Country Report on the Indian Electronics Sector Issues And

Country report on the Indian electronics sector Issues and capacity building needs in relation to international and national product-related environmental regulations and other requirements By ELCINA Electronic Industries Association of India Supported by European Commission and coordinated by The Centre for Sustainable Design (UK) Key contributors Somnath Chatterjee, Consultant, India Ritu Kumar, TERI Europe, UK Rajoo Goel, ELCINA, Electronic Industries Association of India, India Martin Charter, The Centre for Sustainable Design, UK May 2007 Asia Eco-Design Electronics (www.cfsd.org.uk/aede) aims to raise awareness of product-related environmental issues and develop eco-design tools for the Chinese, Indian and Thai electronics industries Partners This document has been produced with the financial assistance of European Union. The contents of this document are the sole responsibility of The Centre for Sustainable Design at the University College for the Creative Arts and can under no circumstances be regarded as reflecting the position of the European Union. Contents Foreword 04 1.0 Introduction 05 1.1 Overview of Indian electronics sector 05 1.2 Key industry associations and dissemination 08 routes 2.0 Legislation and industry initiatives 09 2.1 International legislation 09 2.2 Indian legislation 10 2.3 Voluntary initiatives in India 11 3.0 Implications for suppliers 13 3.1 Implications of EU Directives and voluntary 13 initiatives 3.2 Competitiveness of Indian industry versus 15 other Asian countries 4.0 Gaps and future needs 17 4.1 -

ELECTRONICS November 2010 ELECTRONICS November 2010

ELECTRONICS November 2010 ELECTRONICS November 2010 Contents Advantage India Market overview Industry Infrastructure Investments Policy and regulatory framework Opportunities Industry associations 2 ADVANTAGE INDIA Electronics November 2010 Advantage India India has several research-oriented institutes such as the Indian Institute of Science (IISc) and the Indian Institutes of Technology (IITs), which focus on creating innovative products. Strong India has a large pool of technically skilled Out of 579 SEZs in India, more research workforce driven by the presence of 15 than 60 per cent are devoted to support IITs, 20 National Institutes of Technology IT, semiconductors and Robust (NITs), and 2,872 engineering colleges. Large pool of electronic hardware sector. infrastructure skilled development — workforce SEZs Advantage India Growth in per Significant With an annual growth rate of 20 capita income export India exports around 20 per per cent in per capita income, the and corporate potential cent of its total electronics demand for electronics hardware is spending production. projected to increase to US$ 400 Conducive billion in 2020 from the present regulatory demand of US$ 45 billion. environment India has investor-friendly and pro-investment norms for electronics manufacturing such as Export Promotion Capital Goods Scheme (zero duty to exporters of electronic products) and Duty Exemption and Remission Schemes. Source: EY research; Ministry of Human Resource Development, GoI 2009–10 annual report; Indian Electronics industry – -

DSP Selection Guide 2007

TM Technology for Innovators DSP Selection Guide 2007 TI DSP Products: Making Innovation Possible DIGITAL CAMERA SET-TOP BOX FROM SENTIVISION VIDEO PHONE FROM RED EMBEDDED AUTOMOTIVE VISION SET-TOP BOX SECURITY CAMERA MACHINE VISION DIGITAL CAMCORDER PORTABLE MEDIA PLAYER FROM ARCHOS MEDICAL IMAGING VIDEO PHONE FROM SET-TOP BOX AUTOMOTIVE INFOTAINMENT AETHRA FROM AMINO SECURITY CAMERA FROM LUMENERA VIDEO PHONE ii DSP Selection Guide ➔ Table of Contents Introduction to TI DSPs TI Worldwide Technical Support Getting Started with TI DSPs . .1 Internet System Solutions TI Semiconductor Product Information Center Home Page Audio . .2 support.ti.com Biometrics . .5 TI Semiconductor KnowledgeBase Home Page Industrial . .7 support.ti.com/sc/knowledgebase Telecom . .14 Product Information Centers Video and Imaging/Digital Video, Including DaVinci™ Information . .18 Americas TMS320™ DSP Family Phone +1(972) 644-5580 Fax +1(972) 927-6377 Internet/Email support.ti.com/sc/pic/americas.htm Overview . .38 Europe, Middle East, and Africa TMS320C2000™ Controller Platform Phone TMS320C28x™ Controller Generation . .39 Belgium (English) +32 (0) 27 45 54 32 Netherlands (English) +31 (0) 546 87 95 45 Finland (English) +358 (0) 9 25173948 Russia +7 (4) 95 98 10 701 TMS320C24x™ Controller Generation . .41 France +33 (0) 1 30 70 11 64 Spain +34 902 35 40 28 Power Management Products for the C2000™ Controller Platform . .45 Germany +49 (0) 8161 80 33 11 Sweden (English) +46 (0) 8587 555 22 TMS320C5000™ DSP Platform Israel (English) 180 949 0107 United Kingdom +44 (0) 1604 66 33 99 Italy 800 79 11 37 TMS320C55x™ DSP Generation . .46 Fax +(49) (0) 8161 80 2045 TMS320C54x™ DSP Generation . -

How Do New Ventures in MNC Ecosystems Proactively Overcome Interfirm Asymmetries?

IIMB Management Review (2011) 23, 177e188 available at www.sciencedirect.com IIMB INDIAN INSTITUTE OF MANAGEMENT journal homepage: www.elsevier.com/locate/iimb BANGALORE ROUND TABLE How do new ventures in MNC ecosystems proactively overcome interfirm asymmetries? Shameen Prashantham a, K. Kumar b,* a Nottingham University Business School China, PR China b N.S. Raghavan Centre for Entrepreneurial Learning (NSRCEL), Indian Institute of Management Bangalore, India Available online 7 July 2011 Abstract Several contemporary large multinational corporations (MNCs) have developed interfirm ecosystems that are likely to attract a heterogeneous set of actors, including new ventures. New ventures are asymmetric vis-a-vis the focal MNC in terms of organisational size, structure and power which could be an impediment to the development of social capital between these sets of firms. And yet MNCs are potentially a source of novel information, opportunities and ideas. An interesting question to consider therefore is how new ventures overcome interfirm asymmetries to develop and leverage social capital with large MNCs. Our synthesis of the academic literature suggests that some new ventures are more adept than others at partnering with MNCs because they are more proactive in forming and leveraging interfirm ties with large MNCs. Insightful observations of four panellists shed light on how start- ups’ proactive behaviours can be vitally important in forming, consolidating and extending relationships with large MNCs. ª 2011 Indian Institute of Management Bangalore. All rights reserved. Academic perspective (Dhanaraj & Parkhe, 2006; Katila, Rosenberger, & Eisenhardt, 2008). Such networks are likely to attract Several contemporary large multinational corporations a heterogeneous set of actors, several of which are asym- (MNCs) have developed interfirm ecosystems as a basis for metric vis-a-vis the focal MNC in terms of organisational engagement among business units and external firms size, structure and power (Cao, 2006). -

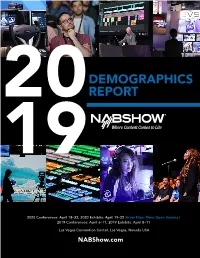

Demographics Report I 2 Geographic Breakdown Overview

DEMOGRAPHICS 20REPORT 19 2020 Conferences: April 18–22, 2020 Exhibits: April 19–22 Show Floor Now Open Sunday! 2019 Conferences: April 6–11, 2019 Exhibits: April 8–11 Las Vegas Convention Center, Las Vegas, Nevada USA NABShow.com ATTENDANCE HIGHLIGHTS OVERVIEW 27% 63,331 Exhibitors BUYERS 4% Other 24,896 91,921 TOTAL EXHIBITORS 69% TOTAL NAB SHOW REGISTRANTS Buyers Includes BEA registrations 24,086 INTERNATIONAL NAB SHOW REGISTRANTS from 160+ COUNTRIES Full demographic information on International Buyer Attendees on pages 7–9. 1,635* 963,411* 1,361 EXHIBITING NET SQ. FT. PRESS COMPANIES 89,503 m2 *Includes unique companies on the Exhibit Floor and those in Attractions, Pavilions, Meeting Rooms and Suites. 2019 NAB SHOW DEMOGRAPHICS REPORT I 2 GEOGRAPHIC BREAKDOWN OVERVIEW ALL 50 STATES REPRESENTED U.S. ATTENDEE BREAKDOWN 160+ COUNTRIES REPRESENTED 44% Pacific Region 19% Mountain Region 16% Central Region 21% New England/Mid and South Atlantic 24% 26% 30% NON-U.S. ATTENDEE BREAKDOWN 26% Europe 30% Asia 3% 24% N. America (excluding U.S.) 14% 3% 14% S. America 3% Australia 3% Africa 55 45 DELEGATIONS ENROLLED COUNTRIES REPRESENTED BY A DELEGATION COUNTRIESCOUNTRIES REPRESENTEDREPRESENTED Afghanistan Colombia Ethiopia Indonesia Pakistan Thailand Argentina Costa Rica France Ivory Coast Panama Tunisia Benin Democratic Republic Germany Japan Peru Turkey Brazil of Congo Ghana Mexico Russia Uruguay Burkina Faso Dominican Republic Greece Myanmar South Africa Venezuela Caribbean Nations Ecuador Guatemala New Zealand South Korea Chile Egypt Honduras