R in the High Court of Karnataka at Bangalore

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Analysis of Corporate Social Responsibility Initiatives of Selected Manufacturing Companies in Karnataka

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 (April, 2017) PP 23-28 www.iosrjournals.org An Analysis of Corporate Social Responsibility Initiatives of Selected Manufacturing Companies in Karnataka Ramaprakasha. N1 & Dr.Y.Rajaram2 1 Faculty, Maharaja’s College, University of Mysore, Mysuru. 2 Professors, Ramaiah Institute of Management Studies, Bengaluru. Abstract: The enactment of The New Companies Act 2013 is a major milestone in corporate governance, which has resulted in a paradigm shift in business operations across India. Almost all major companies are practicing corporate social responsibility (CSR) and are contributing towards the development of society and environment within which they operate. In the present paper an attempt has been made to throw light on the prominent corporate social responsibility initiatives of the selected manufacturing companies in Karnataka, to determine the trend and orientation of corporate social responsibility and to examine whether there is significant difference in the orientation and implementation of corporate social responsibility initiatives among the selected manufacturing companies in Karnataka. Key words: Corporate social responsibility, Karnataka, Manufacturing companies. I. Introduction Corporate Social Responsibility (CSR) has developed as an important area of management after the enactment of The New Companies Act-2013. CSR is defined as the obligations of a company towards the society and environment within which it operates. CSR was previously a voluntary exercise which were practiced only by a few reputed companies but The New Companies Act which came into force from 01 April, 2014 in India made corporate social responsibility mandatory for companies operating in India having a net profit of Rs 5 crores or above or a net worth of Rs 500 crores or above or a total turnover of Rs 1000 crores or above during any financial year. -

The Australia-India Economic Relationship Mark Thirlwell Chief Economist Australia and India: a Developing Bilateral Relationship Top Ten Trading Partners, 2014-15

Room to grow: The Australia-India economic relationship Mark Thirlwell Chief Economist Australia and India: A developing bilateral relationship Top ten trading partners, 2014-15 Australia's two-way trade with India A$ billions Per cent of all goods and services trade Top ten trading partners goods and services, 2014-15 25 5 A$ bn Share (%) 1 China 149.8 22.7 Value (LHS) 2 Japan 67.7 10.3 20 4 3 United States 64.6 9.8 Share of total (RHS) 4 Korea 34.8 5.3 5 Singapore 28.4 4.3 15 3 6 New Zealand 23.7 3.6 7 United Kingdom 21.1 3.2 8 Thailand 19.9 3.0 10 2 9 Malaysia 19.6 3.0 10 India 18.0 2.7 Subtotal 447.5 67.8 5 1 Total all countries 660.0 100.0 ASEAN 98.6 14.9 0 0 EU 83.1 12.6 Source: DFAT annual direction of trade data Australia Unlimited 3 Balance of trade and exchange rate Australia's trade surplus with India Australia-India bilateral exchange rate A$ billions A$1=INR, end of month* 20 Goods Services 60 55 15 50 10 45 5 40 0 35 Source: DFAT annual direction of trade data Source: RBA. * For February 2016, value is for close on 23 February, not month end Australia Unlimited 4 Top ten export markets 2014-15: Goods vs Services Top ten export markets for goods 2014-15 Top ten export markets for services 2014-15 A$ bn Share (%) A$ bn Share (%) 1 China 81.5 31.8 1 China 8.8 14.1 2 Japan 44.5 17.4 2 United States 7.1 11.3 3 Republic of Korea 18.8 7.4 3 United Kingdom 4.9 7.8 4 United States 13.4 5.2 4 New Zealand 4.0 6.4 5 India 9.8 3.8 5 Singapore 3.8 6.0 6 New Zealand 8.3 3.2 6 India 2.9 4.6 7 Singapore 8.3 3.2 7 Hong Kong SAR 2.1 3.4 8 Taiwan -

Answered On:22.12.2000 Compulsory Rolling Formula for Shares Sudha Yadav

GOVERNMENT OF INDIA FINANCE LOK SABHA UNSTARRED QUESTION NO:5277 ANSWERED ON:22.12.2000 COMPULSORY ROLLING FORMULA FOR SHARES SUDHA YADAV Will the Minister of FINANCE be pleased to state: (a) the name of Public Limited Companies whose shares have been brought under daily compulsory rolling stock; (b) the justification for this discriminatory treatment; (c) whether the share value of these Companies have been slashed by 90 percent as a result of this compulsory rolling formula; (d) if so, the details thereof; (e) the steps proposed to be taken to bring the shares of these companies under weekly settlement like others; and (f) if not, the reasons therefor? Answer MINISTER OF STATE IN THE MINISTRY OF FINANCE (BALASAHEB VIKHE PATIL) (a) The Securities and Exchange Board of India (SEBI) has intimated that as on date,t here are 163 scrips of public limited companies mandated for compulsory rolling settlement. Names of these companies are provided in the Annexure. (b) SEBI has also intimated that the scrips included under rolling settlement have been identified by a Committee comprising the stock exchanges and market participants on the basis of parameters such as a reasonable degree of liquidity with a daily turnover of about Rs. 1 crore, compulsory dematerialised trading, connectivity with both depositories etc. According to SEBI, the coverage of scrips under rolling settlement will be increased in phases. (c) & (d)There has been a fall in the market price of the scrips of these companies. However, the pricing of shares is market determined which is a function of the fundamentals of the company, and prevailing economic conditions. -

Media Release

Media Release Review of S&P BSE indices Index Committee of S&P BSE Indices has decided to revise the composition of S&P BSE indices as detailed below, w. e. f. June 24, 2013: 1. S&P BSE 200 Index: Exclusions: Inclusions: Code Name Code Name FFF NEYVELI LIGNITE 513683 534816 BHARTI INFRATEL LIMITED CORPORATION LTD. 0.15 531500 RAJESH EXPORTS LTD. 531162 EMAMI LTD 0.30 500840 EIH LTD 533398 MUTHOOT FINANCE LIMITED 0.20 GUJARAT FLUOROCHEMICALS 500173 505200 EICHER MOTORS LTD. LTD. 0.45 532778 LANCO INFRATECH LTD. 532209 JAMMU AND KASHMIR BANK LTD. 0.50 CHAMBAL FERTILISERS & 500085 509480 BERGER PAINTS INDIA LTD CHEMICALS LTD 0.25 532524 PTC INDIA LTD 500034 BAJAJ FINANCE LIMITED 0.35 532670 SHREE RENUKA SUGARS LTD. 500260 MADRAS CEMENTS LTD., 0.55 502742 SINTEX INDUSTRIES LTD 532800 TV18 BROADCAST LTD. 0.45 532391 OPTO CIRCUITS (INDIA) LTD. 500008 AMARA RAJA BATTERIES LTD 0.50 532693 PUNJ LLOYD LTD 532218 SOUTH INDIAN BANK LTD. 1.00 530773 IVRCL LTD 532652 KARNATAKA BANK LTD. 1.00 2. S&P BSE 500 Index: Exclusions: Inclusions: Code Name Code Name FFF 531900 CCL INTERNATIONAL LTD 531465 NOUVEAU GLOBAL VENTURES 0.65 LIMITED 531426 TAMILNADU NEWSPRINT & 526045 LUMINAIRE TECHNOLOGIES LTD 0.75 PAPERS 523838 SIMPLEX INFRASTRUCTURES LTD 534690 LAKSHMI VILAS BANK LTD. 0.95 509631 HEG LTD 531522 RASOYA PROTEIBO LTD 0.70 524051 POLYPLEX CORP. LTD. 502420 ORIENT PAPER & INDUSTRIES LTD. 0.55 532481 NOIDA TOLL BRIDGE CO. LTD. 512105 SHREE NATH COMMERCIAL & 0.85 FINANCE LTD 509550 GAMMON INDIA LTD 512355 ANUKARAN COMMERCIAL 0.90 ENTERPRISES LT 512463 SHREE GLOBAL TRADEFIN LTD 530557 NCL RESEARCH & FINANCIAL 0.80 SERVICES LTD 513250 JYOTI STRUCTURES LTD 500027 ATUL LTD. -

Shifting Global Value Chains: the India Opportunity

In collaboration with Kearney Shifting Global Value Chains: The India Opportunity WHITE PAPER JUNE 2021 Cover: Tony Sebastian, Unsplash – Inside: Unsplash Contents 3 Executive summary 4 1 Study methodology 5 2 Shifting global value chains 5 2.1 Shifting global value chains: A new opportunity for emerging economies 7 3 India in the spotlight: The opportunity and the need 7 3.1 The opportunity for India 10 3.2 India’s pressing need for manufacturing investment 12 4 India’s five transformation pathways 13 4.1 Transformation pathway 1: From the national scale to the global scale 15 4.2 Transformation pathway 2: From cost arbitrage to capability advantage 17 4.3 Transformation pathway 3: From measured to accelerated integration in global value chains 18 4.4 Transformation pathway 4: From financial incentives to agile execution on the ground 20 4.5 Transformation pathway 5: From infrastructure inputs to infrastructure outcomes 22 Conclusion 23 Contributors 24 Endnotes © 2021 World Economic Forum. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, or by any information storage and retrieval system. Shifting Global Value Chains: The India Opportunity 2 Executive summary A window of opportunity has opened for India to emerge as a manufacturing location of choice. Global value chains (GVCs) are under transition. 4. From financial incentives to agile execution on Three pre-pandemic megatrends were already the ground: Building on the emerging success driving this shift: emerging technologies; climate of the Production Linked Incentive scheme to change and the imperative of environmental focus on reducing the cost of compliance and sustainability; and the reconfiguration of establishing manufacturing capacities faster globalization, with COVID-19 acting as a major accelerator. -

FTSE India 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE India 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3M India 0.1 INDIA Glenmark Pharmaceuticals 0.14 INDIA Oil India Ltd 0.07 INDIA ABB India 0.13 INDIA GMR Infrastructure 0.1 INDIA Oracle Financial Services Software 0.12 INDIA ACC 0.24 INDIA Godrej Consumer Products 0.45 INDIA Page Industries 0.24 INDIA Adani Enterprises 0.57 INDIA Godrej Industries 0.07 INDIA Petronet LNG 0.24 INDIA Adani Gas 0.4 INDIA Godrej Properties 0.18 INDIA PI Industries 0.3 INDIA Adani Green Energy 0.63 INDIA Grasim Industries 0.82 INDIA Pidilite Industries 0.47 INDIA Adani Ports and Special Economic Zone 0.77 INDIA Gujarat Gas 0.19 INDIA Piramal Enterprises 0.41 INDIA Adani Power 0.15 INDIA Havells India 0.34 INDIA Power Finance 0.21 INDIA Aditya Birla Capital 0.08 INDIA HCL Technologies 1.52 INDIA Power Grid Corp of India 0.78 INDIA Alkem Laboratories 0.11 INDIA HDFC Asset Management 0.27 INDIA Punjab National Bank 0.06 INDIA Ambuja Cements 0.33 INDIA HDFC Life Insurance Company 0.63 INDIA Rajesh Exports 0.11 INDIA Apollo Hospitals Enterprise 0.51 INDIA Hero MotoCorp 0.54 INDIA RBL Bank 0.13 INDIA Ashok Leyland 0.25 INDIA Hindalco 0.75 INDIA REC 0.2 INDIA Asian Paints 1.92 INDIA Hindustan Aeronautics 0.05 INDIA Reliance Industries 9.35 INDIA Astral 0.25 INDIA Hindustan Petroleum 0.3 INDIA Reliance Industries - Partly Paid 0.36 INDIA AU Small Finance Bank 0.23 INDIA Hindustan -

1 Reliance Industries Limited 2 Tata Consultancy Services (TCS)

1 Reliance Industries Limited 2 Tata Consultancy Services (TCS) 3 Infosys Technologies Ltd 4 Wipro Limited 5 Bharti Tele-Ventures Limited 6 ITC Limited 7 Hindustan Lever Limited 8 ICICI Bank Limited 9 Housing Development Finance Corp. Ltd. 10 TATA Steel Limited 11 Ranbaxy Laboratories Limited 12 HDFC Bank Ltd 13 Tata Motors Limited 14 Larsen & Toubro Limited (L&T) 15 Satyam Computer Services Ltd. 16 Maruti Udyog Limited 17 Bajaj Auto Ltd. 18 HCL Technologies Ltd. 19 Hero Honda Motors Limited 20 Hindalco Industries Ltd 21 Reliance Energy Limited 22 Grasim Industries Limited 23 Jet Airways (India) Ltd. 24 Sun Pharmaceuticals Industries Ltd 25 Cipla Ltd. 26 Gujarat Ambuja Cements Ltd. 27 Videsh Sanchar Nigam Limited 28 The Tata Power Company Limited 29 Sterlite Industries (India) Ltd. 30 Associated Cement Companies Ltd. 31 Nestlé India Ltd. 32 Hindustan Zinc Limited 33 GlaxoSmithKline Pharmaceuticals Limited 34 Siemens India Ltd. 35 Motor Industries Company Limited 36 Mahindra & Mahindra Limited 37 UTI Bank Ltd. 38 Zee Telefilms Limited 39 Bharat Forge Limited 40 ABB Limited 41 i-Flex Solutions Ltd. 42 Dr. Reddy's Laboratories Ltd. 43 Nicholas Piramal India Limited 44 Kotak Mahindra Bank Limited 45 Reliance Capital Ltd. 46 Ultra Tech Cement Ltd. 47 Patni Computer Systems Ltd. 48 Wockhardt Limited 49 Indian Petrochemicals Corporation Limited 50 Biocon India Limited 51 Essar Oil Limited. 52 Asian Paints Ltd. 53 Dabur India Limited 54 Jaiprakash Associates Limited 55 JSW Steel Limited 56 Tata Chemicals Limited 57 Tata Tea Limited 58 Tata Teleservices (Maharashtra) Limited 59 The Indian Hotels Co. Ltd. 60 Glenmark Pharmaceuticals Limited 61 NIRMA Limited 62 Jindal Steel & Power Ltd 63 HCL Infosystems Ltd. -

Press Release February 23, 2021

Press Release February 23, 2021 Replacements in Indices The Index Maintenance Sub-Committee (Equity) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from March 31, 2021 (close of March 30, 2021). 1) NIFTY 50 The following company is being excluded: Sr. No. Company Name Symbol 1 GAIL (India) Ltd. GAIL The following company is being included: Sr. No. Company Name Symbol 1 Tata Consumer Products Ltd. TATACONSUM The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bank of Baroda BANKBARODA 2 Container Corporation of India Ltd. CONCOR 3 General Insurance Corporation of India GICRE 4 Hindustan Zinc Ltd. HINDZINC 5 Oracle Financial Services Software Ltd. OFSS 6 Power Finance Corporation Ltd. PFC 7 Tata Consumer Products Ltd. TATACONSUM The following companies are being included: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Apollo Hospitals Enterprise Ltd. APOLLOHOSP 3 GAIL (India) Ltd. GAIL 4 Jubilant Foodworks Ltd. JUBLFOOD 5 MRF Ltd. MRF Sr. No. Company Name Symbol 6 Vedanta Ltd. VEDL 7 Yes Bank Ltd. YESBANK 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bombay Dyeing & Manufacturing Co. Ltd. BOMDYEING 2 CARE Ratings Ltd. CARERATING 3 Chennai Petroleum Corporation Ltd. CHENNPETRO 4 D.B.Corp Ltd. DBCORP 5 ESAB India Ltd. ESABINDIA 6 Gujarat Mineral Development Corporation Ltd. GMDCLTD 7 Hathway Cable & Datacom Ltd. HATHWAY 8 Heritage Foods Ltd. -

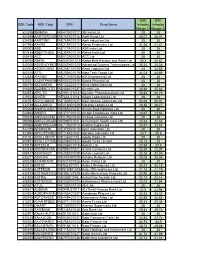

BSE Code NSE Code ISIN Scrip Name NSE Intraday Margin % BSE

NSE BSE BSE Code NSE Code ISIN Scrip Name Intraday Intraday Margin % Margin % 523395 3MINDIA INE470A01017 3M India Ltd 20 20 524348 AARTIDRUGS INE767A01016 Aarti Drugs Ltd 26.01 26.01 524208 AARTIIND INE769A01020 Aarti Industries Ltd 20 20 541988 AAVAS INE216P01012 Aavas Financiers Ltd 21.46 21.41 500002 ABB INE117A01022 ABB India Ltd 20 20 500488 ABBOTINDIA INE358A01014 Abbott India Ltd 20 20 500410 ACC INE012A01025 ACC Ltd 20 20 535755 ABFRL INE647O01011 Aditya Birla Fashion and Retail Ltd 20.4 20.62 540025 ADVENZYMES INE837H01020 Advanced Enzyme Technologies Ltd 25.33 25.28 500003 AEGISCHEM INE208C01025 Aegis Logistics Ltd 23 22.95 500215 ATFL INE209A01019 Agro Tech Foods Ltd 21.02 20.99 532683 AIAENG INE212H01026 AIA Engineering Ltd 20 20 532331 AJANTPHARM INE031B01049 Ajanta Pharma Ltd 20 20 500710 AKZOINDIA INE133A01011 Akzo Nobel India Ltd 20 20 506235 ALEMBICLTD INE426A01027 Alembic Ltd 25.66 25.62 533573 APLLTD INE901L01018 Alembic Pharmaceuticals Ltd 20.82 20.79 539523 ALKEM INE540L01014 Alkem Laboratories Ltd 20 20 506767 ALKYLAMINE INE150B01021 Alkyl Amines Chemicals Ltd 26.94 26.91 532749 ALLCARGO INE418H01029 Allcargo Logistics Ltd 20.35 20.27 500008 AMARAJABAT INE885A01032 Amara Raja Batteries Ltd 20 20 540902 AMBER INE371P01015 Amber Enterprises India Ltd 23.67 23.64 500425 AMBUJACEM INE079A01024 Ambuja Cements Ltd 20 20 590006 AMRUTANJAN INE098F01031 Amrutanjan Health Care Ltd 22.63 22.63 590062 ANDHRSUGARINE715B01013 Andhra Sugars Ltd 23.47 23.47 532259 APARINDS INE372A01015 Apar Industries Ltd 20 20 523694 APCOTEXIND -

India Disclosure Index 2016

23 JUNE 2016 INDIA DISCLOSURE INDEX HOW INDIA’S LEADING LISTED COMPANIES FARE ON MANDATORY & VOLUNTARY DISCLOSURE CRITICAL THINKING AT THE CRITICAL TIME™ INDIA DISCLOSURE INDEX HOW INDIA’S LEADING LISTED COMPANIES FARE ON MANDATORY & VOLUNTARY DISCLOSURE 23 JUNE 2016 Table of Contents Executive Summary ..................................................................................................................................................................................... 3 Introduction .......................................................................................................................................................................................... 3 Report Findings .................................................................................................................................................................................... 3 Composite Disclosure Scores...................................................................................................................................................... 3 Mandatory Disclosure Scores ..................................................................................................................................................... 3 Voluntary Disclosure Scores ........................................................................................................................................................ 4 Conclusion ........................................................................................................................................................................................... -

Csr Analysis of Bse Big 370 Companies (Fy 2016-17)

CSR ANALYSIS OF BSE BIG 370 COMPANIES (FY 2016-17) September 2016 Abridged Version www.ngobox.org Abridged version September 2017 www.ngobox.org. #IndiaCSRsummit @ngobox About the Report The ‘India CSR Outlook Report (ICOR), an annual research publication of NGOBOX, presenting in-depth analysis of CSR spend of big companies in previous financial year. The 2017 report is third such annual publication after 2015 and 2016. The report provides an in-depth analysis of CSR spend of big 370 companies in FY 2016-17. The report visualizes a few important curves of CSR landscapes in India, entirely based on the actual CSR spending data of these companies. While at the time of its release on 18th Sept. 2017, this is the first such analysis of CSR spend of this large number of companies in FY 2016-17.. These 370 companies account for more than 2/3rd of total CSR spend in India, making it a big sample size for any such study and analysis The 370 Companies selected in this report were selected on the basis of the following criteria: I. INR Cr or above prescribed CSR in FY 2016-17 II. Listed on BSE or subsidiary of a BSE-listed company III. Availability of data by 10thSept. 2017 Key Highlights No. of companies 370 Total no. of projects implemented 4176 No. of public sector companies 28 Interesting Insights • 1/3rd of the companies spent more than the prescribed CSR budget • Almost 1/4th of the companies fail to meet the prescribed CSR budget • 18% increase in the prescribed CSR budget from FY 2014-15 (beginning of CSR compliance) • Public sector companies spent more than the prescribed CSR (as a sector altogether) • 41% increase in actual CSR spent since FY 2014-15 and 8% since last financial year • Almost 20% of India’s actual CSR spent is in Maharashtra and Gujarat states only • Education projects received almost one-third of total CSR spent • Almost 1/3rd of companies go beyond compliance and spend more than the prescribed CSR © 2017 ngobox.org 1 Prescribed and Actual CSR Spent (All numbers are in INR Cr. -

Press Release June 15, 2021

Press Release June 15, 2021 Replacements in Indices The Index Maintenance Sub-Committee (Equity) of NSE Indices Limited has decided to make the following replacement of stocks in various indices as given hereunder. These changes shall become effective from June 30, 2021 (close of June 29, 2021). A. Replacement on account of scheme of arrangement Replacement of Motherson Sumi Systems Ltd. on account of proposed scheme of arrangement of demerger of domestic wiring harness undertaking as approved by equity shareholders’ as listed hereunder: 1) NIFTY 500 The following company is being excluded: Sr. No. Company Name Symbol 1 Motherson Sumi Systems Ltd. MOTHERSUMI The following company is being included: Sr. No. Company Name Symbol 1 Gland Pharma Ltd. GLAND The above replacements will also be applicable to NIFTY500 Multicap 50:25:25 Index. 2) NIFTY 100 The following company is being excluded: Sr. No. Company Name Symbol 1 Motherson Sumi Systems Ltd. MOTHERSUMI The following company is being included: Sr. No. Company Name Symbol 1 Gland Pharma Ltd. GLAND The above replacements will also be applicable to NIFTY100 Equal Weight Index. 3) NIFTY Next 50 The following company is being excluded: Sr. No. Company Name Symbol 1 Motherson Sumi Systems Ltd. MOTHERSUMI The following company is being included: Sr. No. Company Name Symbol 1 Gland Pharma Ltd. GLAND 4) NIFTY 200 The following company is being excluded: Sr. No. Company Name Symbol 1 Motherson Sumi Systems Ltd. MOTHERSUMI The following company is being included: Sr. No. Company Name Symbol 1 Gland Pharma Ltd. GLAND 5) NIFTY LargeMidcap 250 The following company is being excluded: Sr.