Optimum Risk Portfolio and Eigen Portfolio: a Comparative Analysis Using Selected Stocks from the Indian Stock Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

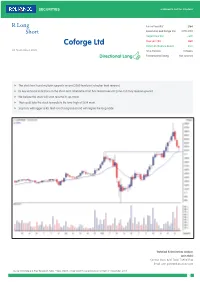

Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not Covered

R Long Future Price (Rs)* 2164 Short Recommended Range (Rs) 2170-2150 Target Price (Rs) 2800 Stop Loss (Rs) 1880 Coforge Ltd Potential Absolute Return 29% 03 November 2020 Time Horizon 9 Weeks Directional Long Fundamental Rating Not covered f The stock has found multiple supports around 2080 level post a higher level reversal. f Its key technical indicators on the short-term timeframe chart has tested oversold zone and may reverse upward. f We believe the stock will soon resume its up-move. f That could take the stock towards its life-time-high of 2814 mark. f Stop loss will trigger at Rs 1880 (on closing basis) and will negate the long trade Technical & Derivatives Analyst: Jatin Gohil Contact: (022) 4215 7024/ 7498411546 Email: [email protected] Source: Bloomberg & RSec Research; Note: * Near Month- Single Stock Future price as on 12:15pm 3rd November, 2020 1 Recommendation Summary R Long Short Sr. Reco. Date Time Call Closure Recommendation Company Name Reco. Target Stop Call Status Current Return No Horizon date Price* Loss Price (%) Open Position 1 09-Sep-20 9 Weeks Short Bajaj Finance 3,413 2,550 3,770 Open 3456 -1.3% 2 20-Oct-20 10 Weeks Long Dabur 528 630 484 Open 516 -2.1% 3 21-Oct-20 6 Weeks Long M&M Financial 129 152 119 Open 126 -2.3% 4 30-Oct-20 6 Weeks Short JSW Steel 311 265 345 Open 314 0.9% 5 02-Nov-20 10 Weeks Long MFSL 615 800 545 Open 614 -0.1% Closed Positions 1 09-Oct-20 6 Weeks 28-Oct-20 Long Larsen & Toubro 900 1,065 842 Profit Booked 978 8.7% 2 15-Oct-20 6 Weeks 27-Oct-20 Long Kotak Bank 1,349 1,550 1,235 -

Opening Bell

Opening Bell October 29, 2020 Market Outlook Today’s Highlights Indian markets are likely to open gap down on the back of Results: TVS Motors, Maruti Suzuki, Zensar, weak global cues amid uncertainty about US stimulus and a BlueDart, Himadri Specialty Chemicals, surge in Coronavirus cases in developed countries. Vodafone Idea, MRPL, SIS India, Havells India, However, global news flows and sector specific Laurus Labs, Bank of Baroda, Mastek, Tata developments will be key monitorables. Chemicals Index Movement Markets Yesterday 12500 41600 . Domestic markets ended lower tracking losses across 12000 39600 sectors, mainly financials amid weak global cues 37600 11500 35600 11000 . US markets ended lower amid concerns regarding 10500 continued rise in Covid-19 infections in the US 33600 31600 10000 Key Developments BSE (LHS) NSE (RHS) C lose Previous C hg (%) MTD(%) YTD(%) P/E (1yrfwd) S ensex 39,922 40,522 -1.5 4.9 -3.2 26.8 . Maruti Suzuki is expected to report a healthy Q2FY21E on Nifty 11,730 11,889 -1.3 4.3 -3.6 27.3 the back of strong volume offtake during the quarter. Total dispatches for the period were at 3.93 lakh units, up 16.2% Institutional Activity YoY (domestic up 18.6%, exports down 13%). ASPs are expected to stay largely unchanged QoQ amid stable C Y18 C Y19 YTD C Y20 Yesterday Last 5 Days product mix (UV at ~16-17% of total volumes), greater F II (| cr) -68,503 40,893 -47,791 -1,131 7,529 D II (| cr) 107,388 44,478 56,711 1 -7,095 absorption of BS-VI pricing in the market. -

An Analysis of Corporate Social Responsibility Initiatives of Selected Manufacturing Companies in Karnataka

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 (April, 2017) PP 23-28 www.iosrjournals.org An Analysis of Corporate Social Responsibility Initiatives of Selected Manufacturing Companies in Karnataka Ramaprakasha. N1 & Dr.Y.Rajaram2 1 Faculty, Maharaja’s College, University of Mysore, Mysuru. 2 Professors, Ramaiah Institute of Management Studies, Bengaluru. Abstract: The enactment of The New Companies Act 2013 is a major milestone in corporate governance, which has resulted in a paradigm shift in business operations across India. Almost all major companies are practicing corporate social responsibility (CSR) and are contributing towards the development of society and environment within which they operate. In the present paper an attempt has been made to throw light on the prominent corporate social responsibility initiatives of the selected manufacturing companies in Karnataka, to determine the trend and orientation of corporate social responsibility and to examine whether there is significant difference in the orientation and implementation of corporate social responsibility initiatives among the selected manufacturing companies in Karnataka. Key words: Corporate social responsibility, Karnataka, Manufacturing companies. I. Introduction Corporate Social Responsibility (CSR) has developed as an important area of management after the enactment of The New Companies Act-2013. CSR is defined as the obligations of a company towards the society and environment within which it operates. CSR was previously a voluntary exercise which were practiced only by a few reputed companies but The New Companies Act which came into force from 01 April, 2014 in India made corporate social responsibility mandatory for companies operating in India having a net profit of Rs 5 crores or above or a net worth of Rs 500 crores or above or a total turnover of Rs 1000 crores or above during any financial year. -

Coforge Ltd (NIITEC)

Coforge Ltd (NIITEC) CMP: | 2456 Target: | 2690 ( 10%) Target Period: 12 months HOLD October 23, 2020 Robust operating performance… Coforge Ltd (Coforge) registered healthy revenue growth, up 8.1% QoQ in constant currency terms, above our estimate of 7.0% QoQ growth. The revenue growth was broad based across verticals mainly led by insurance (up 13.5% QoQ) and BFS (up 10.2% QoQ). Digital revenues (including IP) also increased 18.7% QoQ. Further, Coforge has guided for revenue growth Particulars of 6% YoY organic growth in FY21E and 17.8% EBITDA margin in FY21E Particular Amount before Esop cost. Market Capi (| Crore) 15,116.7 Healthy deal pipeline, digital to drive growth Total Debt (| Crore) 4.8 Update Result Cash & Invests (| Crore) 917.1 Coforge is witnessing healthy traction in cloud, data and artificial intelligence EV (| Crore) 14,204.4 (AI). This has led to healthy growth in digital revenues. The company is driving this growth via partnerships with large players in cloud like Microsoft 52 week H/L 2813 / 739 Azure, Google cloud and AWS and partnering with product start-ups that Equity capital 62.5 can help it to drive new age technology growth. Hence, we expect the Face value 10.0 company to benefit from improved traction in digital technology, going forward. Further, we expect Coforge to witness healthy traction in the BFS Key Highlights and insurance vertical led by large deal wins and wallet share gain in travel segment. In addition, the company expects strong revenue growth in Dollar revenue to improve in coming quarters based on large deal won and healthcare vertical (as seen in this quarter). -

The Australia-India Economic Relationship Mark Thirlwell Chief Economist Australia and India: a Developing Bilateral Relationship Top Ten Trading Partners, 2014-15

Room to grow: The Australia-India economic relationship Mark Thirlwell Chief Economist Australia and India: A developing bilateral relationship Top ten trading partners, 2014-15 Australia's two-way trade with India A$ billions Per cent of all goods and services trade Top ten trading partners goods and services, 2014-15 25 5 A$ bn Share (%) 1 China 149.8 22.7 Value (LHS) 2 Japan 67.7 10.3 20 4 3 United States 64.6 9.8 Share of total (RHS) 4 Korea 34.8 5.3 5 Singapore 28.4 4.3 15 3 6 New Zealand 23.7 3.6 7 United Kingdom 21.1 3.2 8 Thailand 19.9 3.0 10 2 9 Malaysia 19.6 3.0 10 India 18.0 2.7 Subtotal 447.5 67.8 5 1 Total all countries 660.0 100.0 ASEAN 98.6 14.9 0 0 EU 83.1 12.6 Source: DFAT annual direction of trade data Australia Unlimited 3 Balance of trade and exchange rate Australia's trade surplus with India Australia-India bilateral exchange rate A$ billions A$1=INR, end of month* 20 Goods Services 60 55 15 50 10 45 5 40 0 35 Source: DFAT annual direction of trade data Source: RBA. * For February 2016, value is for close on 23 February, not month end Australia Unlimited 4 Top ten export markets 2014-15: Goods vs Services Top ten export markets for goods 2014-15 Top ten export markets for services 2014-15 A$ bn Share (%) A$ bn Share (%) 1 China 81.5 31.8 1 China 8.8 14.1 2 Japan 44.5 17.4 2 United States 7.1 11.3 3 Republic of Korea 18.8 7.4 3 United Kingdom 4.9 7.8 4 United States 13.4 5.2 4 New Zealand 4.0 6.4 5 India 9.8 3.8 5 Singapore 3.8 6.0 6 New Zealand 8.3 3.2 6 India 2.9 4.6 7 Singapore 8.3 3.2 7 Hong Kong SAR 2.1 3.4 8 Taiwan -

India Meets Britain Tracker 2020 17 © 2021 Grant Thornton UK LLP

India meets Britain Tracker The latest trends in Indian investment in the UK 2021 About our research Our Tracker, developed in collaboration with the Confederation of Indian Industry, identifies the top fastest-growing Indian companies in the UK as measured by percentage revenue growth year-on-year. The Tracker includes Indian-owned corporates with operations headquartered or with a significant base in the UK, with turnover of more than £5 million, year-on-year revenue growth of at least 10% and a minimum two-year track record in the UK, based on the latest published accounts filed as at 31 March 2021, where available. Turnover figures have been annualised where periods of less or more than 12 months have been reported1. In the UK, to reflect the pandemic challenges, companies were granted a three-month extension to the usual filing period. Indian companies that took advantage of this option may therefore not appear in this year’s research. Our report also highlights the top Indian employers – those companies that employ more than 1,000 people in the UK2. To compile the India meets Britain Tracker 2021, Grant Thornton analysed data from 850 UK- incorporated limited companies that are owned directly or indirectly, or controlled, by either an Indian-incorporated parent or an Indian citizen resident outside the UK3. 1 As our research relies on published and filed accounts, there is inevitably a time lag between the recording of the performance of the companies and the publication of this report. 2 Employment numbers may include employees -

Loan Against Securities – Approved Single Scrips

Loan against securities – Approved Single Scrips SR no ISIN Scrip Name Margin 1 INE216A01030 BRITANNIA INDUSTRIES LIMITED 50 2 INE854D01024 UNITED SPIRITS LIMITED 50 3 INE437A01024 APOLLO HOSPITALS ENTERPRISE LTD 50 4 INE208A01029 ASHOK LEYLAND LTD 50 5 INE021A01026 ASIAN PAINTS LTD 50 6 INE406A01037 AUROBINDO PHARMA LTD 50 7 INE917I01010 BAJAJ AUTO LTD 50 8 INE028A01039 BANK OF BARODA 50 9 INE084A01016 BANK OF INDIA 50 10 INE463A01038 BERGER PAINTS INDIA LTD 50 11 INE029A01011 BHARAT PETROLEUM CORPORATION LTD 50 12 INE323A01026 BOSCH LTD 50 13 INE010B01027 CADILA HEALTHCARE LTD 50 14 INE059A01026 CIPLA LTD 50 15 INE522F01014 COAL INDIA LTD 50 16 INE259A01022 COLGATE-PALMOLIVE (INDIA) LTD 50 17 INE361B01024 DIVIS LABORATORIES LTD 50 18 INE089A01023 DRREDDYS LABORATORIES LTD 50 19 INE129A01019 GAIL (INDIA) LTD 50 20 INE860A01027 HCL TECHNOLOGIES LTD 50 21 INE158A01026 HERO MOTOCORP LTD 50 22 INE038A01020 HINDALCO INDUSTRIES LTD 50 23 INE094A01015 HINDUSTAN PETROLEUM CORPORATION LTD 50 24 INE030A01027 HINDUSTAN UNILEVER LTD 50 25 INE079A01024 AMBUJA CEMENTS LTD 50 26 INE001A01036 HOUSING DEVELOPMENT FINANCE CORPLTD 50 27 INE090A01021 ICICI BANK LTD 50 28 INE242A01010 INDIAN OIL CORPORATION LTD 50 29 INE009A01021 INFOSYS LTD 50 30 INE154A01025 ITC LTD 50 31 INE237A01028 KOTAK MAHINDRA BANK LTD 50 32 INE498L01015 LT FINANCE HOLDINGS LTD 50 33 INE018A01030 LARSEN TOUBRO LTD 50 34 INE326A01037 LUPIN LTD 50 35 INE101A01026 MAHINDRA MAHINDRA LTD 50 36 INE585B01010 MARUTI SUZUKI INDIA LTD 50 37 INE775A01035 MOTHERSON SUMI SYSTEMS LTD 50 38 INE883A01011 -

Franklin India Fund LU1212701376 31 August 2021

Franklin Templeton Investment Funds India Equity Franklin India Fund LU1212701376 31 August 2021 Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund USD Performance over 5 Years in Share Class Currency (%) Total Net Assets (USD) 1,44 billion Franklin India Fund A (acc) EUR-H1 MSCI India Index-NR in USD Fund Inception Date 25.10.2005 190 Number of Issuers 45 170 Benchmark MSCI India Index-NR 150 Morningstar Category™ Other Equity 130 Summary of Investment Objective The Fund aims to achieve long-term capital appreciation by 110 principally investing in equity securities of companies of any size located or performing business predominately in India. 90 Fund Management 70 Sukumar Rajah: Singapore 50 08/16 02/17 08/17 02/18 08/18 02/19 08/19 02/20 08/20 02/21 08/21 Asset Allocation Discrete Annual Performance in Share Class Currency (%) 08/20 08/19 08/18 08/17 08/16 08/21 08/20 08/19 08/18 08/17 A (acc) EUR-H1 50,51 -1,01 -13,58 -3,55 9,44 Benchmark in USD 53,15 3,00 -7,64 7,12 17,46 % Performance in Share Class Currency (%) Equity 103,05 Cumulative Annualised Cash & Cash Equivalents -3,05 Since Since 1 Mth 3 Mths 6 Mths 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (acc) EUR-H1 7,78 9,87 19,92 50,51 28,75 35,90 46,91 8,79 6,33 6,24 Benchmark in USD 10,94 11,12 22,35 53,15 45,68 83,30 84,41 13,36 12,89 10,11 Calendar Year Performance in Share Class Currency (%) 2020 2019 2018 2017 2016 A (acc) EUR-H1 9,54 4,01 -17,74 34,53 0,74 Benchmark in USD 15,55 7,58 -7,31 38,76 -1,43 Past performance is not an indicator or a guarantee of future performance. -

(15) Sr No Student Name Program Graduated

5.2.2 Average percentage of placement of outgoing students during the last five years (15) Package in Download Sr No Student Name Program graduated from Name of Employer Lac. Proof 1 Yash Kothari B. Tech (Computer Science and Engineering) Media.net 2995000 Click Here 2 Chavda Vijay Ganpatbhai B. Tech (Computer Science and Engineering) eInfochip 450000 Click Here 3 Shah Shikha Snehal B. Tech (Computer Science and Engineering) Endurance International Group 1400000 Click Here 4 Darshan Kanubhai Darji B. Tech (Computer Science and Engineering) Blue Optima Limited 700000 Click Here 5 Jaydutt Nareshbhai Patel B. Tech (Computer Science and Engineering) Samsung R&D Bangalore 1300000 Click Here 6 Kamiyabali Shabbirali Dedhrotia B. Tech (Computer Science and Engineering) Amazon 2875000 Click Here 7 Rutvik Kartik Sutaria B. Tech (Computer Science and Engineering) Amazon 2875000 Click Here 8 Yash Rasikbhai Sinojiya B. Tech (Computer Science and Engineering) Amazon 2875000 Click Here 9 Khushboo Sanjay Shah B. Tech (Computer Science and Engineering) Deutsche Bank 1430000 Click Here 10 Priyanka Deepak Jiandani B. Tech (Computer Science and Engineering) Deutsche Bank 1430000 Click Here 11 Devam Manish Doshi B. Tech (Computer Science and Engineering) Endurance International Group 1400000 Click Here 12 Bhavan Manoj Prajapati B. Tech (Computer Science and Engineering) Samsung R&D Bangalore 1300000 Click Here 13 Het Shaileshbhai Pandya B. Tech (Computer Science and Engineering) Samsung R&D Bangalore 1300000 Click Here 14 Azhar Ali Khaked B. Tech (Computer Science and Engineering) Canary Mail 1220000 Click Here 15 Dhanin Satish Gupta B. Tech (Computer Science and Engineering) Samsung R&D 1200000 Click Here 16 Haridutt Prakashbhai Jani B. -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 5/31/2021 Fund’s investments As of 5-31-21 (unaudited) Shares Value Common stocks 98.2% $200,999,813 (Cost $136,665,998) Australia 0.0% 68,087 MMG, Ltd. (A) 112,000 68,087 Belgium 0.0% 39,744 Titan Cement International SA (A) 1,861 39,744 Brazil 4.2% 8,517,702 AES Brasil Energia SA 14,898 40,592 Aliansce Sonae Shopping Centers SA 3,800 21,896 Alliar Medicos A Frente SA (A) 3,900 8,553 Alupar Investimento SA 7,050 36,713 Ambev SA, ADR 62,009 214,551 Arezzo Industria e Comercio SA 1,094 18,688 Atacadao SA 7,500 31,530 B2W Cia Digital (A) 1,700 19,535 B3 SA - Brasil Bolsa Balcao 90,234 302,644 Banco Bradesco SA 18,310 80,311 Banco BTG Pactual SA 3,588 84,638 Banco do Brasil SA 15,837 101,919 Banco Inter SA 3,300 14,088 Banco Santander Brasil SA 3,800 29,748 BB Seguridade Participacoes SA 8,229 36,932 BR Malls Participacoes SA (A) 28,804 62,453 BR Properties SA 8,524 15,489 BrasilAgro - Company Brasileira de Propriedades Agricolas 2,247 13,581 Braskem SA, ADR (A) 4,563 90,667 BRF SA (A) 18,790 92,838 Camil Alimentos SA 11,340 21,541 CCR SA 34,669 92,199 Centrais Eletricas Brasileiras SA 5,600 46,343 Cia Brasileira de Distribuicao 8,517 63,718 Cia de Locacao das Americas 18,348 93,294 Cia de Saneamento Basico do Estado de Sao Paulo 8,299 63,631 Cia de Saneamento de Minas Gerais-COPASA 4,505 14,816 Cia de Saneamento do Parana 3,000 2,337 Cia de Saneamento do Parana, Unit 8,545 33,283 Cia Energetica de Minas Gerais 8,594 27,209 Cia Hering 4,235 27,141 Cia Paranaense de Energia 3,200 -

Success Through Transformation

Complied by: Dion Global Solutions Limited INNOVATION FINANCIALS OPERATIONS CAPABILITY EMPLOYEES CUSTOMERS Success through 53rd Annual Report Transformation 2013-14 Complied by: Dion Global Solutions Limited 41% Standalone 59% Revenue from Standalone Industrial Sector Revenue from Automotive Sector CONTENTS 300,00 TPA The largest single-location forging facility in the world, situated at Mundhwa in Pune Company Review 02-25 Bharat Forge at a Glance 02 Business Verticals 04 Board of Directors 06 Corporate Information 07 Chairman’s Message 08 Financial Performance 12 Success through Transformation NADCAP Transformation is Innovation… 14 CERTIFICATION Transformation is Excellence… 16 Transformation is the First Step 18 For Aerospace Applications Transformation is Right Relationships… 20 Transformation is People Power… 22 7,000 + Transformation is the Right Numbers… 24 Global workforce Statutory Reports 26-73 Management Discussion & Analysis 26 Report on Corporate Governance 42 Directors’ Report 64 Financials 74-212 Standalone Financials 74 Consolidated Financials 134 EVERY 2ND Heavy truck in the US carries a front axle beam manufactured by Bharat Forge Complied by: Dion Global Solutions Limited “To improve is to change; to be perfect is to change often.” Sir Winston Churchill Transformation, at Bharat Forge, is the drive to remodel our future. It is our effort to forge a new path to growth – to focus on new opportunities and differentiate ourselves as an end-to-end solution provider. We have redefined and reshaped ourselves from just an India-focused auto component supplier to a global engineering company. Today, we cater to varied high-growth sectors in industrial segment like power, oil and gas, construction and mining, locomotive, marine and aerospace while strengthening our presence in the automotive segment. -

R in the High Court of Karnataka at Bangalore

1 R IN THE HIGH COURT OF KARNATAKA AT BANGALORE DATED THIS THE 12 TH DAY OF JUNE, 2013 BEFORE THE HON’BLE MR. JUSTICE H.N. NAGAMOHAN DAS W.P.No. 16896/2012 C/W W.P.Nos. 21939-942/2011 & 21943-946/2011 , W.P.No.23199/2011, W.P.No.39358/2012 (T-IT) W.P.No. 16896/2012 BETWEEN : -------------- M/S MINDTREE LTD GLOBAL VILLAGE, R.V.C.E. POST, MYLASANDRA, MYSORE ROAD, BANGALORE-560059. (REPRESENTED BY ITS CEO & MANAGING DIRECTOR SRI. KRISHNAKUMAR NATARAJAN AGED ABOUT 54 YEARS, S/O SRI.K. NATARAJAN) ... PETITIONER (By Sri. CHYTHANYA K. K., ADV.) AND : -------- 1.UNION OF INDIA REPRESENTED BY THE SECRETARY TO THE MINISTRY OF FINANCE GOVERNMENT OF INDIA NEW DELHI. 2 2.THE COMMISSIONER OF INCOME-TAX-LTU J S S TOWERS, 100 FT RING ROAD, BANASHANKARI III STAGE, BANGALORE-560085. ... RESPONDENTS (By Sri. E. I. SANMATHI, SR.ADV., FOR R1) THIS WRIT PETITION IS FILED UNDER ARTICLES 226 AND 227 OF THE CONSTITUTION OF INDIA WITH A PRAYER TO DECLARE THE NEWLY INSERTED PROVISO TO SECTION 115JB (6) BY FINANCE ACT, 2011 AS ULTRA VIRES SECTION 27 OF THE SEZ ACT READ WITH THE SECOND SCHEDULE THERETO & HENCE,UNENFORCEABLE. W.P.Nos. 21939-942/2011 & 21943-946/2011 BETWEEN : -------------- 1.M/S OPTO INFRASTRUCTURE LIMITED OPTO SEZ, NANJANGUD & HASSAN PLOT NO. 83, 2 ND FLOOR, 1 ST PHASE ELECTRONIC CITY, BANGALORE-560100 (REP BY DR. MANJE GOWDA, DIRECTOR) 2.M/S OPTO CARDIAC CARE LIMITED, VSEZ UNIT, PLOT NO. 83 2ND FLOOR, 1ST PHASE ELECTRONIC CITY, BANGALORE-560100 (REP BY DR MANJE GOWDA, DIRECTOR) 3.M/S OPTO EUROCOR HEALTHCARE LIMITED, VSEZ UNIT, PLOT NO.