As Banks Initiative for Sustainable Development

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OTICON' 2017 BOOK.Cdr

OTICON' 2017 THE 54th ANNUAL NATIONAL CONFERENCE OF ALL INDIA OCCUPATIONAL THERAPISTS' ASSOCIATION (Founder Council Member: “World Occupational Therapists”) 17th -19th February' 2017 Organized By Mahatma Gandhi Occupational Therapy College In collaboration with Rajasthan Branch of AIOTA Theme: Occupational Therapy: Glories of Past and Challenges for the Future Venue: R. L. Swarankar Auditorium Mahatma Gandhi University of Medical Sciences & Technology RIICO Institutional Area, Sitapura, Tonk Road, Jaipur-302022 OTICON' 2017 Principal Advisor Patron in Chief Organizing Secretary Conference Secretariat : Dr. Anil K. Srivastava Dr. M. L. Swarankar Dr. S. K. Meena President-AIOTA, Chairperson/Chancellor Principal WFOT Delegate & Mahatma Gandhi University of Medical Mahatma Gandhi Occupational Dr. S. K. Meena Executive Chairman-Academic Sciences & Technology, Jaipur Therapy College, Jaipur Organizing Secretary Council of OT, Lucknow 9/199, Malviya Nagar, Jaipur-302017 (Rajasthan) 09414058796, 08502005480 Email: [email protected], [email protected], www.oticon2017.com Come ... Celebrate... Remember... OTICON' 2017 INVITE FROM PRESIDENT AIOTA OTICON'2017, JAIPUR, RAJASTHAN Dr. Anil K. Srivastava President- AIOTA & WFOT Delegate Executive Chairman, Academic Council of OT Editor-in-Chief, - Indian Journal of OT 93, Laxmanpuri, Faizabad Road, Lucknow-226016 Tel: +91 522 2350582, 3258974, +919415405095, +919415415095 E-mail:[email protected] Website:www.aiota.org The Members of Executive Committee of AIOTA join me, in graciously inviting you all, on the great occasion of OTICON'2017: The 54th Annual National Conference of AIOTA at Jaipur, Rajasthan from Feb.17-19, 2017. The conference is being organized by Mahatma Gandhi Occupational Therapy College in collaboration with Rajasthan Branch of AIOTA at Mahatma Gandhi University of Medical Sciences & Technology, Jaipur. -

Curriculum Vitae

Curriculum Vitae Meena Jaggi, Ph. D Professor (Tenured) Department of Immunology and Microbiology School of Medicine University of Texas Rio Grande Valley McAllen, TX 78503, USA E-mail: [email protected] Ph: 901-216-3416 EDUCATION: Ph.D. (December 1998) Cell Biology/Reproductive Endocrinology “In-vitro Studies on First Trimester Human Trophoblasts” Central Drug Research Institute (CDRI), Lucknow, India M.Sc. (July 1990) Zoology (With specialization in cytogenetics) University of Allahabad, India B.Sc. (July 1988) Botany, Chemistry, Zoology University of Allahabad, India HONORS/AWARDS: 1. Qualified GATE Examination 1993 (Discipline-General Sciences) Conducted by Ministry of Human Resource Development, India. 2. Junior Research Fellowship (1993) awarded by Ministry of Health and family welfare, G.O.I. at C.D.R.I. Lucknow, India. 3.Senior Research Fellowship (1995) awarded by Ministry of Health and family welfare, G.O.I. at C.D.R.I. Lucknow, India. 4. Received an Internal Research Award (4/18/2006) from Sanford School of Medicine of The University of South Dakota for $5,000. 5. Argus Leader, Sioux Falls Nov 3, 2008 “Researcher spending time in rehab”. 6. Sanford Health, Sioux Falls, Mach, 17, 2009, “Sanford Researcher Published in Top Cancer Research Journal” 7. YWCA, Sioux Falls, April 2, 2009, Tribute to women “Science and Technology 8. Argus Leader, Friday, April 3, 2009, “Tribute to Women” 9. Interviewed in the, May 20, 2009, Q&A of the Sioux Falls Business Journal, “Jaggi’s cancer research help put pieces together to save lives” 10. Sioux Falls Woman, June/July 2009, Vol 7, Issue 4, A tribute to Women YWCA, of Sioux Falls Honors 10 Inspirational Women 11. -

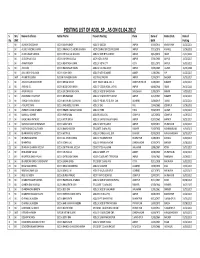

Posting List of Addl.Sp., As on 01.04.2017 S

POSTING LIST OF ADDL.SP., AS ON 01.04.2017 S. SH./ Name of officers Father Name Present Posting Place Date of Home Distt. Date of No. SMT. Birth Posting 1. SH. ADARSH CHOUDHARY S/O SH.AMAR SINGH ADDL.SP.DISCOM JAIPUR 09/09/1975 BHARATPUR 10/02/2017 2. SH. ALOK CHANDRA SHARMA S/O SH.PRAKASH CHANDRA SHARMA ADCP COMMI. OFFICE JPR COMM. JAIPUR 27/10/1976 KARAULI 19/06/2016 3. SH. ALOK KUMAR SINGHAL S/O SH.CHHAJU LAL SINGHAL ADDL.SP.ACB INTELLIGENCE JAIPUR 22/12/1976 SIKAR 21/11/2016 4. SH. ALOK SRIVASTAVA S/O SH.J.M.SRIVASTAVA ADCP HQRs. JAIPUR JAIPUR 07/01/1966 JAIPUR 10/02/2017 5. SH. ANANT KUMAR S/O SH.ROHITASH KUMAR ADDL.SP.KOTA CITY KOTA 08/11/1975 JAIPUR 16/11/2015 6. SH. ANIL RAO S/O SH.RAM SINGH YADAV ADDL.SP.CID VIGILANCE JAIPUR 15/05/1965 ALWAR 19/06/2016 7. SH. ANIL SINGH CHAUHAN S/O SH.VIJAY SINGH ADDL.SP.ATS HQ AJMER AJMER 11/06/1961 U.P. 10/02/2017 8. SMT. ANUKRITI UJJAINIA W/O SH.PRAVEEN KUMAR VICE PRINCIPAL RPA JAIPUR 01/04/1974 NAGAUR 26/02/2014 9. SH. ARJUN SINGH RAJPUROHIT S/O SH.KHINW SINGH ADCP POLICE AID & ADV. C. JODHPUR POLICE 01/08/1957 BIKANER 10/02/2017 10. SH. ARSHAD ALI S/O SH.NOOR DEEN KHAN ADDL.SP.CID(SB) HQRs. JAIPUR JAIPUR 08/08/1968 SIKAR 26/02/2014 11 . SH. ARUN MACHYA S/O SH.LAL CHAND MACHYA ADDL.SP.ACB OP BANSWARA BANSWARA 21/05/1974 BARAN 14/10/2015 12 . -

List of Officers Who Attended Courses at NCRB

List of officers who attened courses at NCRB Sr.No State/Organisation Name Rank YEAR 2000 SQL & RDBMS (INGRES) From 03/04/2000 to 20/04/2000 1 Andhra Pradesh Shri P. GOPALAKRISHNAMURTHY SI 2 Andhra Pradesh Shri P. MURALI KRISHNA INSPECTOR 3 Assam Shri AMULYA KUMAR DEKA SI 4 Delhi Shri SANDEEP KUMAR ASI 5 Gujarat Shri KALPESH DHIRAJLAL BHATT PWSI 6 Gujarat Shri SHRIDHAR NATVARRAO THAKARE PWSI 7 Jammu & Kashmir Shri TAHIR AHMED SI 8 Jammu & Kashmir Shri VIJAY KUMAR SI 9 Maharashtra Shri ABHIMAN SARKAR HEAD CONSTABLE 10 Maharashtra Shri MODAK YASHWANT MOHANIRAJ INSPECTOR 11 Mizoram Shri C. LALCHHUANKIMA ASI 12 Mizoram Shri F. RAMNGHAKLIANA ASI 13 Mizoram Shri MS. LALNUNTHARI HMAR ASI 14 Mizoram Shri R. ROTLUANGA ASI 15 Punjab Shri GURDEV SINGH INSPECTOR 16 Punjab Shri SUKHCHAIN SINGH SI 17 Tamil Nadu Shri JERALD ALEXANDER SI 18 Tamil Nadu Shri S. CHARLES SI 19 Tamil Nadu Shri SMT. C. KALAVATHEY INSPECTOR 20 Uttar Pradesh Shri INDU BHUSHAN NAUTIYAL SI 21 Uttar Pradesh Shri OM PRAKASH ARYA INSPECTOR 22 West Bengal Shri PARTHA PRATIM GUHA ASI 23 West Bengal Shri PURNA CHANDRA DUTTA ASI PC OPERATION & OFFICE AUTOMATION From 01/05/2000 to 12/05/2000 1 Andhra Pradesh Shri LALSAHEB BANDANAPUDI DY.SP 2 Andhra Pradesh Shri V. RUDRA KUMAR DY.SP 3 Border Security Force Shri ASHOK ARJUN PATIL DY.COMDT. 4 Border Security Force Shri DANIEL ADHIKARI DY.COMDT. 5 Border Security Force Shri DR. VINAYA BHARATI CMO 6 CISF Shri JISHNU PRASANNA MUKHERJEE ASST.COMDT. 7 CISF Shri K.K. SHARMA ASST.COMDT. -

G. SRIDEVI Assistant Professor

G. SRIDEVI Assistant Professor Department of Plant Biotechnology Mobile No: 9688222156 School of Biotechnology Email:[email protected] Educational Qualifications : M.Sc., Ph.D. Professional Experience : 2010-Present: Assistant Professor, Department of Plant Biotechnology, School of Biotechnology, Madurai Kamaraj University, Madurai, India. 2009-2010:Postdoctoral Research Associate, South China Agricultural University, Guangzhou, PR China. 2005-2007: Postdoctoral position, University of New Hampshire, NH, USA. 2002-2004: Senior Research Fellowship (CSIR), Madurai Kamaraj University, Madurai, India. FIELD OF SPECIALIZATION Plant Molecular Biology Plant Functional Genomics RNA silencing Plant Genetic Engineering RESEARCH SPECIALIZATION Genetic engineering of crop plants for biotic/abiotic stresses Biofortification Metagenomics Gene silencing Research Supervision: Program Completed Ongoing Ph.D 1 4 M.Phil 3 1 PROFESSIONAL EXPERIENCE No Institution Position From To Duration (date) (date) 1. University of New Hampshire, Postdoctoral Nov 01, Oct 05, 1 y 11 m NH, USA fellow 2005 2007 2. University of New Hampshire, Assistant Mar 25, Oct 15, 2 y 6 m NH, USA Affiliate 2005 2007 Professor 3. South China Agricultural Postdoctoral Nov 09, Jun 23, 7 m University, Guangzhou, PR Research 2009 2010 China Associate 4. Madurai Kamaraj University, Assistant Jun 30, Till - Madurai, India Professor 2010 date RESEARCH COLLABORATION (BOTH NATIONAL & INTERNATIONAL) Name of the Institute Collaboration Collaboration Output Collaborator Details ( Papers/Patents/Research/Online) Dr. S.M. DRR, DBT Support Research project Balachandran Hyderabad Project Dr. S.K. Mangrauthia COMPLETED RESEARCH PROJECT No Title of the Project Funding Agency Total Grant Year 1. Strategies to improve UGC Rs. 10.34 lakhs 2011-2014 transformation and regeneration efficiency in indica rice varieties ON‐GOING RESEARCH PROJECT No Title of the Project Funding Total Grant Year Agency 1. -

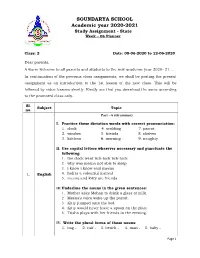

SOUNDARYA SCHOOL Academic Year 2020-2021 Study Assignment - State Week – 06 Planner

SOUNDARYA SCHOOL Academic year 2020-2021 Study Assignment - State Week – 06 Planner Class: 2 Date: 08-06-2020 to 12-06-2020 Dear parents, A warm welcome to all parents and students to the new academic year 2020- 21... In continuation of the previous class assignments, we shall be posting the present assignment as an introduction to the 1st lesson of the new class. This will be followed by video lessons shortly. Kindly see that you download the same according to the promoted class only. Sl. Subject Topic no. Part –A (Grammar) I. Practice these dictation words with correct pronunciation: 1. clock 4. scolding 7. parrot 2. window 5. friends 8. shelves 3. kitchen 6. morning 9. naughty II. Use capital letters wherever necessary and punctuate the following: 1. the clock went tick-tock tick-tock 2. why was meena not able to sleep 3. i know i know said meena 1. English 4. holi is a colourful festival 5. meena and kitty are friends III. Underline the nouns in the given sentences: 1. Mother asks Mohan to drink a glass of milk. 2. Meena’s voice woke up the parrot. 3. Kitty jumped onto the bed. 4. Kitty would never leave a spoon on the plate. 5. Trisha plays with her friends in the evening. IV. Write the plural forms of these nouns: 1. bag - 2. calf - 3. bench - 4. man - 5. baby - Page 1 V. Write the other gender for: 1. grandfather - 2. sister - 3. peacock - 4. ox - 5. lion - VI. Make your own sentence using the given words: 1. -

AND IT's CONTACT NUMBER Tirunelveli 0462

IMPORTANT PHONE NUMBERS AND EMERGENCY OPERATION CENTRE (EOC) AND IT’S CONTACT NUMBER Name of the Office Office No. Collector’s Office Control Room 0462-2501032-35 Collector’s Office Toll Free No. 1077 Revenue Divisional Officer, Tirunelveli 0462-2501333 Revenue Divisional Officer, Cheranmahadevi 04634-260124 Tirunelveli 0462 – 2333169 Manur 0462 - 2485100 Palayamkottai 0462 - 2500086 Cheranmahadevi 04634 - 260007 Ambasamudram 04634- 250348 Nanguneri 04635 - 250123 Radhapuram 04637 – 254122 Tisaiyanvilai 04637 – 271001 1 TALUK TAHSILDAR Taluk Tahsildars Office No. Residence No. Mobile No. Tirunelveli 0462-2333169 9047623095 9445000671 Manoor 0462-2485100 - 9865667952 Palayamkottai 0462-2500086 - 9445000669 Ambasamudram 04634-250348 04634-250313 9445000672 Cheranmahadevi 04634-260007 - 9486428089 Nanguneri 04635-250123 04635-250132 9445000673 Radhapuram 04637-254122 04637-254140 9445000674 Tisaiyanvilai 04637-271001 - 9442949407 2 jpUney;Ntyp khtl;lj;jpy; cs;s midj;J tl;lhl;rpah; mYtyfq;fspd; rpwg;G nray;ghl;L ikaq;fspd; njhiyNgrp vz;fs; kw;Wk; ,izatop njhiyNgrp vz;fs; tpguk; fPo;f;fz;lthW ngwg;gl;Ls;sJ. Sl. Mobile No. with Details Land Line No No. Whatsapp facility 0462 - 2501070 6374001902 District EOC 0462 – 2501012 6374013254 Toll Free No 1077 1 Tirunelveli 0462 – 2333169 9944871001 2 Manur 0462 - 2485100 9442329061 3 Palayamkottai 0462 - 2501469 6381527044 4 Cheranmahadevi 04634 - 260007 9597840056 5 Ambasamudram 04634- 250348 9442907935 6 Nanguneri 04635 - 250123 8248774300 7 Radhapuram 04637 – 254122 9444042534 8 Tisaiyanvilai 04637 – 271001 9940226725 3 K¡»a Jiw¤ jiyt®fë‹ bršngh‹ v§fŸ mYtyf vz; 1. kht£l M£Á¤ jiyt®, ÂUbešntè 9444185000 2. kht£l tUthŒ mYty®, ÂUbešntè 9445000928 3. khefu fhtš Miza®, ÂUbešntè 9498199499 0462-2970160 4. kht£l fhtš f§fhâ¥ghs®, ÂUbešntè 9445914411 0462-2568025 5. -

1. Andaman and Nicobar Island Shri K.R. Meena Principal Secretary (UD

S.N State Principal Secretary/ Secretary (PMAY-U) SLNA o. 1. Andaman Shri K.R. Meena and Nicobar Principal Secretary (UD) Island UT of Andaman & Nicobar Islands, Secretariat, Port Blair Andaman-744101 Tel: 03192-233205 [email protected] 2. Andhra Shri R. Karikal Valaven Mohd. B.M. Diwan Mydeen Pradesh Principal Secretary, Managing Director, Municipal Administration & UD. Andhra Pradesh Township Infrastructure Government of Andhra Pradesh, Development Corporation Limited. AP Secretariat, Amravati, Building No. 2 Flat No.101, Vijaya Lakshmi Residency, ESI Andhra Pradesh 522503 Hospital Road, Gunadala, Vijayawada- 520004, Krishna District, A.P Phone: 0863-2442313 0866-2577300 [email protected] [email protected] [email protected] 3. Arunachal Shri S.K. Jain Er. Taba Tedir Pradesh Secretary (UD) Chief Engineer cum Director, Government of Arunachal Pradesh, Urban Development & Housing Civil Secretariat, Department Itanagar-791111 Government of Arunachal Pradesh, Itanagar-791111 0360-2213114 [email protected] [email protected] [email protected] 4. Assam Shri Ajay Tewari Dr. Sadnek Singh Principal Secretary Mission Director Urban Development Department Government of Assam Government of Assam Dispur, Guwahati Janata Bhavan, 1st Floor, C-Block Dispur, Guwahati-06, Assam [email protected] 0361-2237234 [email protected] 5. Bihar Shri Chaitanya Prasad Shri B.N. Jha Principal Secretary Deputy Director Government of Bihar, Urban Development & Housing Urban Development & Housing Department, Department, Government of Bihar Vikash Bhavan, Bailey Road, Urban Development & Housing New Sectt. Patna-15, Bihar Department, Vikash Bhavan, Bailey Road, [email protected] New Sectt. Patna-15, Bihar Tel: 0612-2215580. Tel: 0612-2205520 [email protected] 6. -

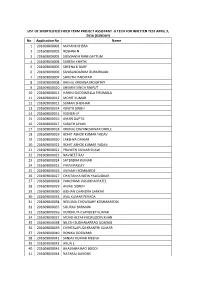

LIST of SHORTLISTED FIXED TERM PROJECT ASSISTANT -B TECH for WRITTEN TEST APRIL 3, 2016 (SUNDAY) No

LIST OF SHORTLISTED FIXED TERM PROJECT ASSISTANT -B TECH FOR WRITTEN TEST APRIL 3, 2016 (SUNDAY) No. Application No Name 1 201609000001 MAYANK KHERA 2 201609000002 ROSHNA N 3 201609000003 SOWJANYA RANI GATTUM 4 201609000004 SURESH KHATIK 5 201609000005 SHEENA K BABY 6 201609000006 SIVASUNDARAM DURAIRAJAN 7 201609000007 SHRUTHI PAIDIPATI 8 201609000008 RAGHU KRISHNA MOORTHY 9 201609000010 SHIVANI SINGH RAJPUT 10 201609000011 HARINI GUDDIMELLA TIRUMALA 11 201609000012 MOHIT KUMAR 12 201609000013 SUMAN SHEKHAR 13 201609000014 KAVITA SINGH 14 201609000015 VIGNESH P 15 201609000016 AMAN GUPTA 16 201609000017 SARATH JAYAN 17 201609000018 KRUNAL DNYANESHWAR DHOLE 18 201609000019 ROHIT ASHOK KUMAR YADAV 19 201609000020 LAKSHYA DAWAR 20 201609000021 ROHIT ASHOK KUMAR YADAV 21 201609000022 PRAVEEN KUMAR SHAW 22 201609000023 NAVNEET RAJ 23 201609000024 SATENDRA KUMAR 24 201609000025 PAVNI PASSEY 25 201609000026 AVINASH BOMBARDE 26 201609000027 CHAITANYA NITIN YALGUDKAR 27 201609000028 PANCHAMI VASUBHAI PATEL 28 201609000029 ANJALI SOREN 29 201609000030 BIDHAN CHANDRA SARKAR 30 201609000033 ANIL KUMAR PERADA 31 201609000034 NEELIMA CHOWDARY KOMMAREDDI 32 201609000035 SOURAV BARMAN 33 201609000036 VUNDRUTHI SANDEEP KUMAR 34 201609000037 MOHD ALTAF FAQRUDDIN KHAN 35 201609000038 NILESH SUDHAKARRAO GOMASE 36 201609000039 CHINTALAPUDI KRANTHI KUMAR 37 201609000040 RONIKA GOSWAMI 38 201609000041 SANJAY KUMAR MEENA 39 201609000042 ARUN E 40 201609000043 BHASKARA RAO BODDI 41 201609000044 NATARAJ GANDGE 42 201609000045 VINOD KUMAR SINGH 43 201609000046 -

Mohanlal Filmography

Mohanlal filmography Mohanlal Viswanathan Nair (born May 21, 1960) is a four-time National Award-winning Indian actor, producer, singer and story writer who mainly works in Malayalam films, a part of Indian cinema. The following is a list of films in which he has played a role. 1970s [edit]1978 No Film Co-stars Director Role Other notes [1] 1 Thiranottam Sasi Kumar Ashok Kumar Kuttappan Released in one center. 2 Rantu Janmam Nagavally R. S. Kurup [edit]1980s [edit]1980 No Film Co-stars Director Role Other notes 1 Manjil Virinja Pookkal Poornima Jayaram Fazil Narendran Mohanlal portrays the antagonist [edit]1981 No Film Co-stars Director Role Other notes 1 Sanchari Prem Nazir, Jayan Boban Kunchacko Dr. Sekhar Antagonist 2 Thakilu Kottampuram Prem Nazir, Sukumaran Balu Kiriyath (Mohanlal) 3 Dhanya Jayan, Kunchacko Boban Fazil Mohanlal 4 Attimari Sukumaran Sasi Kumar Shan 5 Thenum Vayambum Prem Nazir Ashok Kumar Varma 6 Ahimsa Ratheesh, Mammootty I V Sasi Mohan [edit]1982 No Film Co-stars Director Role Other notes 1 Madrasile Mon Ravikumar Radhakrishnan Mohan Lal 2 Football Radhakrishnan (Guest Role) 3 Jambulingam Prem Nazir Sasikumar (as Mohanlal) 4 Kelkkatha Shabdam Balachandra Menon Balachandra Menon Babu 5 Padayottam Mammootty, Prem Nazir Jijo Kannan 6 Enikkum Oru Divasam Adoor Bhasi Sreekumaran Thambi (as Mohanlal) 7 Pooviriyum Pulari Mammootty, Shankar G.Premkumar (as Mohanlal) 8 Aakrosham Prem Nazir A. B. Raj Mohanachandran 9 Sree Ayyappanum Vavarum Prem Nazir Suresh Mohanlal 10 Enthino Pookkunna Pookkal Mammootty, Ratheesh Gopinath Babu Surendran 11 Sindoora Sandhyakku Mounam Ratheesh, Laxmi I V Sasi Kishor 12 Ente Mohangal Poovaninju Shankar, Menaka Bhadran Vinu 13 Njanonnu Parayatte K. -

ANNOUNCEMENT Recruitment of Probationary Officers: IBPS CRP

ANNOUNCEMENT Recruitment of Probationary Officers: IBPS CRP PO/MT IX 2020-21 List of Candidates was allotted through IBPS under CRP PO/MT IX 2020-21 based on the option exercised by the candidate at the time of application for recruitment in the post of Probationary Officer in JMG Scale I in Indian Bank and Erstwhile Allahabad Bank. Post amalgamation of Erstwhile Allahabad Bank with Indian Bank, provisional offer of appointment has been issued by Indian Bank to the candidates. The offer of appointment letter containing the detailed terms and conditions is sent to registered email. Please note that the offer of appointment is purely provisional, subject to submission of the required documents by the candidate and verification of all the details furnished by the candidate while submitting online application. Name of candidates and venue of reporting and is enclosed as annexure. Candidates are advised to report at the venue indicated against their name in the annexure on 05.10.2020 at 09.00 a.m. for document verification and completion of joining formalities for joining in the Bank’s services. Disclaimer: Though utmost care has been taken while issuance of the provisional offer of appointment, the Bank reserves the right to rectify inadvertent errors, if any, found subsequently. Decision of the Bank in all matters pertaining to the selection process shall be final and binding. Deputy General Manager (HRM) 21.09. -

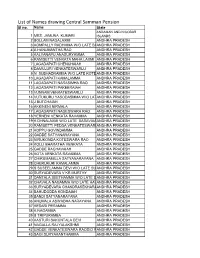

List of Names Drawing Central Samman Pension Sl No

List of Names drawing Central Samman Pension Sl no. Name State ANDAMAN AND NICOBAR 1 MRS. JAMUNA KUMARI ISLANDS 2 BOLLAM NAGALAXMI ANDHRA PRADESH 3 KOMPALLY RADHMMA W/O LATE BAANDHRA PRADESH 4 A HANUMANTHA RAO ANDHRA PRADESH 5 KALYANAPU ANASURYAMMA ANDHRA PRADESH 6 RAMISETTI VENKATA MAHA LAXMI ANDHRA PRADESH 7 LAGADAPATI CHENCHAIAH ANDHRA PRADESH 8 DAMULURI VENKATESWARLU ANDHRA PRADESH 9 N SUBHADRAMMA W/O LATE KOTEANDHRA PRADESH 10 LAGADAPATI KAMALAMMA ANDHRA PRADESH 11 LAGADAPATI NARASIMHA RAO ANDHRA PRADESH 12 LAGADAPATI PAKEERAIAH ANDHRA PRADESH 13 VUNNAM VENKATESWARLU ANDHRA PRADESH 14 VUTUKURU YASODASMMA W/O LATANDHRA PRADESH 15 J BUTCHAIAH ANDHRA PRADESH 16 AKKINENI NIRMALA ANDHRA PRADESH 17 LAGADAPATI NAGESWARA RAO ANDHRA PRADESH 18 YERNENI VENKATA RAVAMMA ANDHRA PRADESH 19 K DHNALAXMI W/O LATE BASAVAIAANDHRA PRADESH 20 RAMISETTI PEDDA VENKATESWARLANDHRA PRADESH 21 KOPPU GOVINDAMMA ANDHRA PRADESH 22 GADDE SATYANARAYANA ANDHRA PRADESH 23 NIRUKONDA KOTESWARA RAO ANDHRA PRADESH 24 KOLLI BHARATHA VENKATA ANDHRA PRADESH 25 GADDE RAGHAVAIAH ANDHRA PRADESH 26 KOTA VENKATA RAVAMMA ANDHRA PRADESH 27 CHIRUMAMILLA SATYANARAYANA ANDHRA PRADESH 28 CHERUKURI KAMALAMMA ANDHRA PRADESH 29 S SUSEELAMMA DEVI W/O LATE SU ANDHRA PRADESH 30 SURYADEVARA V KR MURTHY ANDHRA PRADESH 31 DANTALA SEETHAMMA W/O LATE DANDHRA PRADESH 32 CHAVALA NAGAMMA W/O LATE HAVANDHRA PRADESH 33 SURYADEVARA CHANDRASEKHARAANDHRA PRADESH 34 BAHUDODDA KONDAIAH ANDHRA PRADESH 35 BANDI SATYANARAYANA ANDHRA PRADESH 36 ANUMALA ASWADHA NARAYANA ANDHRA PRADESH 37 KESARI PERAMMA ANDHRA