Pobeda Airline: Group’S Low Cost Carrier

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Air Transport in Russia and Its Impact on the Economy

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Tomsk State University Repository Вестник Томского государственного университета. Экономика. 2019. № 48 МИРОВАЯ ЭКОНОМИКА UDC 330.5, 338.4 DOI: 10.17223/19988648/48/20 V.S. Chsherbakov, O.A. Gerasimov AIR TRANSPORT IN RUSSIA AND ITS IMPACT ON THE ECONOMY The study aims to collect and analyse statistics of Russian air transport, show the in- fluence of air transport on the national economy over the period from 2007 to 2016, compare the sector’s role in Russia with the one in other countries. The study reveals the significance of air transport for Russian economy by comparing airlines’ and air- ports’ monetary output to the gross domestic product. On the basis of the research, the policies in the aviation sector can be adjusted by government authorities. Ключевые слова: Russia, aviation, GDP, economic impact, air transport, statistics. Introduction According to Air Transport Action Group, the air transport industry supports 62.7 million jobs globally and aviation’s total global economic impact is $2.7 trillion (approximately 3.5% of the Gross World Product) [1]. Aviation transported 4 billion passengers in 2017, which is more than a half of world population, according to the International Civil Aviation Organization [2]. It makes the industry one of the most important ones in the world. It has a consid- erable effect on national economies by providing a huge number of employment opportunities both directly and indirectly in such spheres as tourism, retail, manufacturing, agriculture, and so on. Air transport is a driving force behind economic connection between different regions because it may entail economic, political, and social effects. -

Aeroflot Group East Capital Investor Trip

AEROFLOT GROUP EAST CAPITAL INVESTOR TRIP May 31, 2017 Disclaimer This document has been prepared by PJSC “Aeroflot” (the “Company”). By attending the meeting where the presentation is made, or by reading the presentation slides, you agree to the following. This document does not constitute or form part of any advertisement of securities, any offer or invitation to sell or issue or any solicitation of any offer to purchase or subscribe for, any securities of the Company in any jurisdiction, nor shall it or any part of it nor the fact of its presentation or distribution form the basis of, or be relied on in connection with, any contract or investment decision. No reliance may be placed for any purpose whatsoever on the information contained in this document or on assumptions made as to its completeness. No representation or warranty, express or implied, is given by the Company, its subsidiaries or any of their respective advisers, officers, employees or agents, as to the accuracy of the information or opinions or for any loss howsoever arising, directly or indirectly, from any use of this presentation or its contents. This document may include forward-looking statements. These forward-looking statements include matters that are not historical facts or statements regarding the Company’s intentions, beliefs or current expectations concerning, among other things, the Company’s results of operations, financial condition, liquidity, prospects, growth, strategies, and the market in which the Company operates. By their nature, forwarding-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. -

(VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers February 1, 2020 In order to facilitate the arrival of Visa Waiver Program (VWP) passengers, carriers need to be signatory to a current agreement with U.S. Customs and Border Protection (CBP). A carrier is required to be signatory to an agreement in order to transport aliens seeking admission as nonimmigrant visitors under the VWP (Title 8, U.S.C. § 1187(a)(5). The carriers listed below are currently signatory to the VWP and can transport passengers under the program. The date indicates the expiration of the current signed agreement. Agreements are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. -

Aeroflot Group C Apital Markets Day 2017

AEROFLOT GROUP C APITAL MARKETS DAY 2017 Moscow, 21 December 2017 Disclaimer 232 Chart Colours 235 240 This document has been prepared by PJSC “Aeroflot” (the “Company”). By attending the meeting where the presentation is made, or by reading the presentation slides, 182 you agree to the following. 196 204 This document does not constitute or form part of any advertisement of securities, any offer or invitation to sell or issue or any solicitation of any offer to purchase or subscribe for, any securities of the Company in any jurisdiction, nor shall it or any part of it nor the fact of its presentation or distribution form the basis of, or be relied on 135 in connection with, any contract or investment decision. 157 179 No reliance may be placed for any purpose whatsoever on the information contained in this document or on assumptions made as to its completeness. No representation or warranty, express or implied, is given by the Company, its subsidiaries or any of their respective advisers, officers, employees or agents, as to the 0 accuracy of the information or opinions or for any loss howsoever arising, directly or indirectly, from any use of this presentation or its contents. 112 192 This document may include forward-looking statements. These forward-looking statements include matters that are not historical facts or statements regarding the Company’s intentions, beliefs or current expectations concerning, among other things, the Company’s results of operations, financial condition, liquidity, prospects, 59 growth, strategies, and the market in which the Company operates. By their nature, forwarding-looking statements involve risks and uncertainties because they relate to 100 events and depend on circumstances that may or may not occur in the future. -

Washington Aviation Summary November 2015 Edition

WASHINGTON AVIATION SUMMARY NOVEMBER 2015 EDITION CONTENTS I. REGULATORY NEWS .............................................................................................. 1 II. AIRPORTS ................................................................................................................ 4 III. SECURITY AND DATA PRIVACY ............................................................................ 5 IV. E-COMMERCE AND TECHNOLOGY ....................................................................... 6 V. ENERGY AND ENVIRONMENT ................................................................................ 8 VI. U.S. CONGRESS .................................................................................................... 10 VII. BILATERAL AND STATE DEPARTMENT NEWS ................................................... 12 VIII. EUROPE/AFRICA ................................................................................................... 14 IX. ASIA/PACIFIC/MIDDLE EAST ................................................................................ 18 X. AMERICAS ............................................................................................................. 21 For further information, including documents referenced, contact: Joanne W. Young Kirstein & Young PLLC 1750 K Street NW Suite 200 Washington, D.C. 20006 Telephone: (202) 331-3348 Fax: (202) 331-3933 Email: [email protected] http://www.yklaw.com The Kirstein & Young law firm specializes in representing U.S. and foreign airlines, airports, leasing companies, -

Mott Macdonald Report Template

Annual Analyses of the EU Air Transport Market 2015 Statistical Annexes February 2016 European Commission Annual Analyses of the EU Air Transport Market 2015 328131 ITD ITA 1 F Annual Analyses of the EU Air Transport Market 2013 March 2015 Final Report – Statistical Annexes Annual Analyses of the EU Air Transport Market 2013 Final Report February 2016 European Commission European Commission Disclaimer and copyright: This report has been carried out for the Directorate General for Mobility and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract MOVE/E1/SER/2013- 365/SI2.669187. These views have not been adopted or in any way approved by the European Commission and should not be relied upon as a statement of the European Commission's or the Mobility and Energy DG's views. The European Commission does not guarantee the accuracy of the information given in the report, nor does it accept responsibility for any use made thereof. Copyright in this report is held by the European Communities. Persons wishing to use the contents of this report (in whole or in part) for purposes other than their personal use are invited to submit a written request to the following address :European Commission - DG MOVE - Library (DM28, 0/36) - B-1049 Brussels e-mail (http://ec.europa.eu/transport/contact/index_en.htm) Mott MacDonald, Mott MacDonald House, 8-10 Sydenham Road, Croydon CR0 2EE, United Kingdom T +44 (0)20 8774 2000 F +44 (0)20 8681 5706 W www.mottmac.com Issue and revision record Revision Date Originator Checker Approver Description Standard A 29.02.16 Various K. -

Die Folgende Liste Zeigt Alle Fluggesellschaften, Die Über Den Flugvergleich Von Verivox Buchbar Sein Können

Die folgende Liste zeigt alle Fluggesellschaften, die über den Flugvergleich von Verivox buchbar sein können. Aufgrund von laufenden Updates einzelner Tarife, technischen Problemen oder eingeschränkten Verfügbarkeiten kann es vorkommen, dass einzelne Airlines oder Tarife nicht berechnet oder angezeigt werden können. 1 Adria Airways 2 Aegean Airlines 3 Aer Arann 4 Aer Lingus 5 Aeroflot 6 Aerolan 7 Aerolíneas Argentinas 8 Aeroméxico 9 Air Algérie 10 Air Astana 11 Air Austral 12 Air Baltic 13 Air Berlin 14 Air Botswana 15 Air Canada 16 Air Caraibes 17 Air China 18 Air Corsica 19 Air Dolomiti 20 Air Europa 21 Air France 22 Air Guinee Express 23 Air India 24 Air Jamaica 25 Air Madagascar 26 Air Malta 27 Air Mauritius 28 Air Moldova 29 Air Namibia 30 Air New Zealand 31 Air One 32 Air Serbia 33 Air Transat 34 Air Asia 35 Alaska Airlines 36 Alitalia 37 All Nippon Airways 38 American Airlines 39 Arkefly 40 Arkia Israel Airlines 41 Asiana Airlines 42 Atlasglobal 43 Austrian Airlines 44 Avianca 45 B&H Airlines 46 Bahamasair 47 Bangkok Airways 48 Belair Airlines 49 Belavia Belarusian Airlines 50 Binter Canarias 51 Blue1 52 British Airways 53 British Midland International 54 Brussels Airlines 55 Bulgaria Air 56 Caribbean Airlines 57 Carpatair 58 Cathay Pacific 59 China Airlines 60 China Eastern 61 China Southern Airlines 62 Cimber Sterling 63 Condor 64 Continental Airlines 65 Corsair International 66 Croatia Airlines 67 Cubana de Aviacion 68 Cyprus Airways 69 Czech Airlines 70 Darwin Airline 71 Delta Airlines 72 Dragonair 73 EasyJet 74 EgyptAir 75 -

List of Attendees

MRO Russia & CIS 11th international conference & exhibition February 25–26, 2016, Moscow, World Trade Center List of Attendees Company Name Position 3TOP Aviation Services Matthew Marshall Regional Manager Business Development and Sales 3TOP Aviation Services Vladislav Slyusar Executive A J Walter Aviation Natalja Dimitrova Senior Sales Executive A J Walter Aviation Tolkyn Rymkulova VP Sales & Marketing for CIS A J Walter Aviation Roger Wolstenholme Regional Director A J Walter Aviation Tommy Guttman Executive VP Regional A J Walter Aviation Evgeny Shuravin AJW Moscow Manager A J Walter Aviation Junaid Baig Engine Material Sales Manager, Engines Sales & Marketing Manager, Russia & A J Walter Aviation Natasha Meerman CIS AAR Aircraft Component Sales Manager, Aircraft Component Services Amsterdam Ed Muller Services - AMS AAR Aviation Supply Chain Elena Gontsarova Sales Support AAR Aviation Supply Chain Ana Marian Regional Sales Manager AAR Aviation Supply Chain Pascal Parant Vice President Corporate Marketing ABS Jets Pavel Hrdlicka Sales&Business Development Manager Manager Technical Marketing and Adria Airways Pavel Prhavc Material Support Adria Airways Tehnika Maksimiljan Pele CEO Adria Airways Tehnika Mirjana Tratnjek Ceh Deputy CEO AEM Limited Sandy Basu Business Development Manager AEM Limited Andrew Wheeler Commercial Director AerCap Andrej Belotelov Vice President Technical AerCap Joe Millar Vice President, Technical AerFin Ltd Nicholas Filce Director AERO BRAVO INTERNATIONAL B.V. Dennis Bravo CEO AERO INSTRUMENT AND AVIONICS Carl -

Turkish Airlines

Key operational indicators 14 264 732 PAX (+11.0%) 147 415 ATM’s (+7.2%) Key facts and figures 2013 2014 73 airlines 70 airlines 164 destinations 159 destinations 12 new destinations 3 new carriers 70 airlines domestic — 24 international — 33 CIS — 13 PAX traffic distribution 9% 41% 50% Domestic International CIS PAX 8 000 000 +22.9% 7 000 000 +3.6% 6 000 000 5 000 000 4 000 000 2013 3 000 000 2014 2 000 000 -8.4% 1 000 000 0 Dom Int CIS Top 10 airlines in PAX traffic 1,6% Rossiya 1,9% 24% Aeroflot 2,1% Transaero S7 2,8% Utair 2,9% 36% Ural Airlines Lufthansa 4,1% Orenair 4,3% Donavia 9,8% Nordavia 10,4% Others Airlines 300 000 + PAX PAX number, thnd Rossiya 5 094 Aeroflot 1 486 Transaero 1 398 S7 Group 608 Utair 587 Ural Airlines 418 Lufthansa 399 Orenair 302 Airlines 50 000 - 300 000 PAX PAX number, thnd Donavia 230 238 Nordavia 224 260 Uzbekistan Airways 144 095 Emirates 139 847 Air Berlin 136 494 Turkish Airlines 129 132 Air France 124 020 Nordstar 116 235 Nordwind Airlines 108 020 SWISS 107 016 SAS 101 672 KLM 98 023 Belavia 97 388 UIA 91 497 Yamal 91 271 Rusline 86 555 Aegean 85 124 British airways 84 683 Air Baltic 83 372 CSA 72 092 Austrian Airlines 68 419 Finnair 63 664 Ak Bars Aero 63 092 Vueling 63 052 Kolavia 62 610 Air Astana 61 964 Air Moldova 57 192 Alitalia 54 941 Bulgaria Air 53 285 Airlines 10 000 - 50 000 PAX PAX number, thnd Hainan Airlines 47 289 Somon Air 47 272 AZAL 46 210 Severstal 44 886 Avia Traffic 44 774 Nouvelair Tunisie 43 483 EL AL 40 910 Tajik Air 31 333 LOT 28 722 Izhavia 27 466 Polet 25 994 Pskovavia 25 -

Whatever Happened to Aeroflot?

Whatever Happened to Aeroflot? Remember Aeroflot? The rather ominous airline of the Soviet Union. What happened to it? Well... Aeroflot is one of the oldest airlines in the world, tracing its history back to 1923. During the Soviet era, Aeroflot was the Soviet national airline and the largest airline in the world. Following the dissolution of the USSR, the carrier has been transformed from a state-run enterprise into a semi-privatized company which ranked 19th most profitable in the world in 2007. Aeroflot is still considered the de facto national airline of Russia. It is 51%-owned by the Russian Government. As of September 2013, the Aeroflot Group had 30,328 employees. In February 2010, the Russia announced that all regional airlines owned by the state through the holding company Rostechnologii would be consolidated with the national carrier Aeroflot in order to increase the airlines' financial viability. The merger was completed in late November 2011 in a deal worth US $81 million. Aeroflot's sister company Aeroflot-Finance became the major shareholder of Vladivostok Avia, Saravia and Rossiya Airlines, and the sole shareholder of both SAT Airlines and Orenair. In June 2013, during the World Airline Awards which took place at the 50th Le Bourget air show, Aeroflot was awarded the international prize as the best air carrier in Eastern Europe. In October, the company introduced an affiliated low-cost carrier (LCC), Dobrolet. It started in June 2014; it ceased on 4 August (owing to EU sanctions over launching flights to Crimea. In late August 2014, Aeroflot announced the launch of a new LCC to replace Dobrolet; the new LCC, named Pobeda, started in December 2014. -

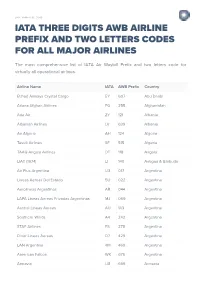

Iata Three Digits Awb Airline Prefix and Two Letters Codes for All Major Airlines

SEPTEMBER 18, 2019 IATA THREE DIGITS AWB AIRLINE PREFIX AND TWO LETTERS CODES FOR ALL MAJOR AIRLINES The most comprehensive list of IATA Air Waybill Prefix and two letters code for virtually all operational airlines. Airline Name IATA AWB Prefix Country Etihad Airways Crystal Cargo EY 607 Abu Dhabi Ariana Afghan Airlines FG 255 Afghanistan Ada Air ZY 121 Albania Albanian Airlines LV 639 Albania Air Algerie AH 124 Algeria Tassili Airlines SF 515 Algeria TAAG Angola Airlines DT 118 Angola LIAT (1974) LI 140 Antigua & Barbuda Air Plus Argentina U3 017 Argentina Lineas Aereas Del Estado 5U 022 Argentina Aerolineas Argentinas AR 044 Argentina LAPA Lineas Aereas Privadas Argentinas MJ 069 Argentina Austral Lineas Aereas AU 143 Argentina Southern Winds A4 242 Argentina STAF Airlines FS 278 Argentina Dinar Lineas Aereas D7 429 Argentina LAN Argentina 4M 469 Argentina American Falcon WK 676 Argentina Armavia U8 669 Armenia Airline Name IATA AWB Prefix Country Armenian International Airways MV 904 Armenia Air Armenia QN 907 Armenia Armenian Airlines R3 956 Armenia Jetstar JQ 041 Australia Flight West Airlines YC 060 Australia Qantas Freight QF 081 Australia Impulse Airlines VQ 253 Australia Macair Airlines CC 374 Australia Australian Air Express XM 524 Australia Skywest Airlines XR 674 Australia Kendell Airlines KD 678 Australia East West Airlines EW 804 Australia Regional Express ZL 899 Australia Airnorth Regional TL 935 Australia Lauda Air NG 231 Austria Austrian Cargo OS 257 Austria Eurosky Airlines JO 473 Austria Air Alps A6 527 Austria Eagle -

Presentation

A EROFLOT – R USSIAN A IRLINES ACHIEVEMENTS AND GOALS Aeroflot Today – An Overview 1 #1 airline in one of the largest markets globally with leading positions on both domestic and international routes Global network with 153 unique destinations (300+ routes) 2 in 51 countries serviced by one of the youngest fleets globally 3 Multi-brand offering to appeal to a broad customer spectrum across different geographies 4 Superior product and customer experience (Aeroflot – 4-star airline by Skytrax) 5 Efficient operating model underpinned by effective yield and cost management 6 Experienced management team and international standards of corporate governance 1 Note: network statistics is based on summer 2015 schedule Transformation of the Aeroflot Group x 3.5X x 3.9X (8.6 yrs) > (20.0 %) + 8.1 p.p. >15 yrs 39.4 415.2 78% mn bn RUB >30.0 6.4 yrs 23.1 78% 11.1 106.1 mn bn RUB gr / ASK gr / ASK FLEET FUEL PASSENGER LOAD PAX REVENUE AGE COMSUMPTION FACTOR 2009 2015 Over the course of the last 7 years the Group has shown an extraordinary operational and financial transformation. Note: fleet age for 2009 as of the beginning of the year. Average age of 6.4 in 2015 is for Aeroflot Group (for comparison purposes). Aeroflot’s average fleet age is 4.3 years. 2 Russian Carrier With a Global Network One of the youngest fleets of any major airline group … … operating a global network Murmansk 4.4 Arkhangelsk Novy Urengoy St. Petersburg Syktyvkar Surgut Nizhnevartovsk Yakutsk Stockholm Magadan Ekaterinburg Tomsk Kaliningrad MOSCOW Tyumen Krasnoyarsk Omsk P.