The Gas Supply Chain in Eastern Aust NERA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Western Downs

Image courtesy of Shell's QGC business “We have a strong and diverse economy that is enhanced by the resource sector through employment, Traditional Resources - infrastructure and Western Downs improved services." The Western Downs is known as the “Queensland has the youngest coal- Paul McVeigh, Mayor Energy Capital of Queensland and is fired power fleet in Australia including Western Downs now emerging as the Energy Capital of the Kogan Creek Power Station, and an Regional Council. Australia. abundance of gas which will ensure the State has a reliable source of base load This reputation is due to strong energy for decades to come.” investment over the past 15 years by the Energy Production Industry - Ian Macfarlane, CEO, Mining is the second most productive (EPI) into large scale resource sector Queensland Resources Council industry in the Western Downs after developments in coal seam gas (CSG) As at June 2018, the Gross Regional construction, generating an output of 2 and coal. Product (GRP) of the Western Downs 2.23 billion in 2017/18. Gas and coal-fired power stations region has grown by 26.3% over a In 2017/18, the total value of local sales 2 feature prominently in the region with twelve-month period to reach $4 billion. was $759.2 million. Of these sales, oil a total of six active thermal power The resource industry paid $58 million and gas extraction was the highest, at 2 stations. in wages to 412 full time jobs (2017-18). 3 $615.7 million. Kogan Creek Power Station is one of The industry spent $136 million on In 2017/18 mining had the largest Australia's most efficient and technically goods and services purchased locally total exports by industry, generating advanced coal-fired power stations. -

Tarong Power Stations Enterprise Agreement 2018

Stanwell Corporation Limited (ABN: 37 078 848 674) and The Association of Professional Engineers, Scientists and Managers Australia and “The Automotive, Food, Metals, Engineering, Printing & Kindred Industries Union” known as the Australian Manufacturing Workers Union (the AMWU) and Communications, Electrical, Electronic, Energy, Information, Postal, Plumbing and Allied Services Union of Australia. Electrical Division, Queensland and Northern Territory Divisional Branch and Construction, Forestry, Mining and Energy Union (Mining and Energy Division) and The Australian Municipal, Administrative, Clerical And Services Union and Australian Institute of Marine and Power Engineers’ Union of Employees, Queensland and Australian Nursing and Midwifery Federation STANWELL CORPORATION LIMITED TARONG POWER STATIONS ENTERPRISE AGREEMENT 2018 TABLE OF CONTENTS 1. PART 1 – PRELIMINARY ............................................................................................................................... 6 1.1. TITLE ................................................................................................................................................... 6 1.2. APPLICATION OF AGREEMENT ............................................................................................................... 6 1.3. STATEMENT OF INTENT ......................................................................................................................... 6 1.4. DURATION OF AGREEMENT .................................................................................................................. -

Surat Basin Non-Resident Population Projections, 2021 to 2025

Queensland Government Statistician’s Office Surat Basin non–resident population projections, 2021 to 2025 Introduction The resource sector in regional Queensland utilises fly-in/fly-out Figure 1 Surat Basin region and drive-in/drive-out (FIFO/DIDO) workers as a source of labour supply. These non-resident workers live in the regions only while on-shift (refer to Notes, page 9). The Australian Bureau of Statistics’ (ABS) official population estimates and the Queensland Government’s population projections for these areas only include residents. To support planning for population change, the Queensland Government Statistician’s Office (QGSO) publishes annual non–resident population estimates and projections for selected resource regions. This report provides a range of non–resident population projections for local government areas (LGAs) in the Surat Basin region (Figure 1), from 2021 to 2025. The projection series represent the projected non-resident populations associated with existing resource operations and future projects in the region. Projects are categorised according to their standing in the approvals pipeline, including stages of In this publication, the Surat Basin region is defined as the environmental impact statement (EIS) process, and the local government areas (LGAs) of Maranoa (R), progress towards achieving financial close. Series A is based Western Downs (R) and Toowoomba (R). on existing operations, projects under construction and approved projects that have reached financial close. Series B, C and D projections are based on projects that are at earlier stages of the approvals process. Projections in this report are derived from surveys conducted by QGSO and other sources. Data tables to supplement the report are available on the QGSO website (www.qgso.qld.gov.au). -

Investment Conference Philosophy, Performance and Direction

Investment Conference Philosophy, Performance and Direction Citigroup – London Goldman Sachs JBWere – New York March 2007 Discussion Pack 1 Index 1 Philosophy, Performance and Direction 3 2 Sustainable Performance is driven by the Wesfarmers Model 8 3 Group Overview 16 4 2007 Half Year Results 20 Operating Divisions 30 Home Improvement 31 Coal 35 5 Insurance 40 Industrial & Safety 45 Chemicals & Fertilisers 49 Energy 53 Other Businesses 58 6 Capital Management 61 7 Investor Relations Contacts and Information 63 2 Philosophy, Performance and Direction Satisfactory returns to shareholders 1 Enhance the performance of existing businesses run our businesses at “best practice” 2 Expand existing businesses as opportunities allow 3 Manage the portfolio and balance sheet in order to enhance shareholder value 4 Pursue sustainability in both financial and non-financial terms 4 Satisfactory returns to shareholders Recent and current actions Capital Projects Curragh North Kwinana AN2 Kwinana LNG Bunnings rollout Acquisitions OAMPS Linde Aust. (Coregas) Crombie Lockwood 5 Resulting in increasing returns EPS Share (cents) Price(A$) 40.00 350 35.00 30.00 250 25.00 20.00 150 15.00 10.00 50 5.00 0.00 -50 -5.00 86 87 939291908988 94 95 96 97 98 99 00 01 02 03 04 05 06 1H07 EPS (AIFRS) EPS (AGAAP) Girrah EPS Landmark EPS ARG EPS Wesfarmers Share Price $1,000 invested on listing is now worth around $165,000… compared to a market return of around $18,000 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 WES TSR - since listing All Ordinaries -

2019 Annual Report 1 2019 the YEAR in REVIEW

Wesfarmers Annual Report Annual Wesfarmers 2019 2019 WESFARMERS ANNUAL REPORT ABOUT WESFARMERS ABOUT THIS REPORT All references to ‘Indigenous’ people are intended to include Aboriginal and/or From its origins in 1914 as a Western This annual report is a summary Torres Strait Islander people. Australian farmers’ cooperative, Wesfarmers of Wesfarmers and its subsidiary Wesfarmers is committed to reducing the has grown into one of Australia’s largest companies’ operations, activities and environmental footprint associated with listed companies. With headquarters in financial performance and position as at the production of this annual report and Perth, Wesfarmers’ diverse businesses in this 30 June 2019. In this report references to printed copies are only posted to year’s review cover: home improvement; ‘Wesfarmers’, ‘the company’, ‘the Group’, shareholders who have elected to receive apparel, general merchandise and office ‘we’, ‘us’ and ‘our’ refer to Wesfarmers a printed copy. This report is printed on supplies; an Industrials division with Limited (ABN 28 008 984 049), unless environmentally responsible paper businesses in chemicals, energy and otherwise stated. manufactured under ISO 14001 fertilisers and industrial safety products. Prior References in this report to a ‘year’ are to environmental standards. to demerger and divestment, the Group’s the financial year ended 30 June 2019 businesses also included supermarkets, unless otherwise stated. All dollar figures liquor, hotels and convenience retail; and are expressed in Australian -

Available East Coast Gas Study

Available East Coast Gas Study An independent report prepared by EnergyQuest for Marathon Resources Limited 8 November 2014 Contents List of figures ....................................................................................................... 2 List of tables ........................................................................................................ 3 Terms of reference .............................................................................................. 4 Key points ...........................................................................................................4 Eastern Australia gas demand and supply context ............................................. 5 Gas demand ..................................................................................................................... 5 Gas supply ........................................................................................................................ 6 Interstate trade ................................................................................................................. 8 Gas prices ........................................................................................................................ 9 LNG project impact ......................................................................................................... 10 Oil price........................................................................................................................... 11 LNG projects starting to ramp up .................................................................................. -

Delivering Today. Value Tomorrow

A CENTURY OF PROGRESS Delivering today. Value tomorrow. Wesfarmers | Annual Report 2014 WorldReginfo - 0b28c54e-452e-499f-aaaa-5f8681972bd6 A CENTURY OF PROGRESS WorldReginfo - 0b28c54e-452e-499f-aaaa-5f8681972bd6 2 A century of progress. In this our one hundredth year, we celebrate our strong commitment to performance that has seen our business consistently deliver value to our shareholders, employees, customers and the communities in which we operate. As we look towards the future we continue to focus on the core values that form the foundation of our success – integrity, openness, accountability, and boldness. Despite many changes over the past 100 years, it is our steadfast commitment to these values that ensures we provide a satisfactory return to shareholders; look after our employees and ensure they have a safe environment in which to work; provide excellent products and services to our customers; look after and care for the environment; and make a contribution to the communities in which we operate. WorldReginfo - 0b28c54e-452e-499f-aaaa-5f8681972bd6 WESFARMERS ANNUAL REPORT 2014 1 A CENTURY OF PROGRESS Contents About Wesfarmers About this report From its origins in 1914 as a Western Australian farmers’ This annual report is a summary of Wesfarmers’ and its cooperative, Wesfarmers has grown into one of Australia’s largest subsidiary companies’ operations, activities and financial listed companies. With headquarters in Western Australia, its position as at 30 June 2014. In this report references to diverse business operations cover: supermarkets; department ‘Wesfarmers’, ‘the company’, ‘the Group’, ‘we’, ‘us’ and stores; home improvement and office supplies; coal production and ‘our’ refer to Wesfarmers Limited (ABN 28 008 984 049) export; chemicals, energy and fertilisers; and industrial and safety unless otherwise stated. -

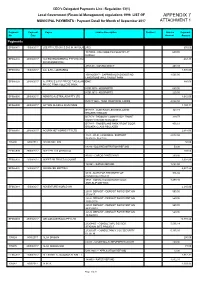

APPENDIX 7 MUNICIPAL PAYMENTS - Payment Detail for Month of September 2017 ATTACHMENT 1

CEO's Delegated Payments List - Regulation 13(1) Local Government (Financial Management) regulations 1996 LIST OF APPENDIX 7 MUNICIPAL PAYMENTS - Payment Detail for Month of September 2017 ATTACHMENT 1 Payment Payment Payee Invoice Description Contract Invoice Payment No Date Amount Amount Payments EF065874 15/09/2017 2SE PTY LTD (W.I.S.D.O.M. IN YOUR LIFE) 650.00 7170004 - WELCOME TO COUNTRY AT 650.00 NAIDOC EF066334 29/09/2017 360 ENVIRONMENTAL PTY LTD (360 463.38 ENVIRONMENTAL) 2353-00 - CONSULTANCY 463.38 EF065882 15/09/2017 A A & R L LOMBARDO 1,595.00 100 06/09/17 - CAPPING ALONG EXISTING 1,595.00 LIMESTONE WALL TALBOT PARK EF066328 29/09/2017 A.J PRYCE & P.F PRYCE T/AS ALAN JONE 880.00 PRYCE PTNR COLLEGE PARK KS013578 - KIDSPORTS 660.00 KS013615 - KIDSPORTS 220.00 EF066005 29/09/2017 ABNOTE AUSTRALASIA PTY LTD 4,042.50 IN00171622 - TEAR DROP RFID CARDS 4,042.50 EF066000 29/09/2017 ACTION GLASS & ALUMINIUM 1,100.11 B57167 - DUNCRAIG LEIS REGLAZING 323.73 BROKEN WINDOW B57179 - PADBURY COMM KINDY: FRONT 319.77 DOOR WINDOW REGLAZED B57187 - TIMBERLANE PARK FRONT DOOR 456.61 BROKEN GLASS REGLAZED EF066010 29/09/2017 ACURIX NETWORKS PTY LTD 2,018.50 1421 - WI-FI, LICENSING, SUPPORT 2,018.50 SERVICE SEP 17 IT 105608 8/09/2017 ADAM COLLINS 50.00 08310 - DOG REGISTRATION REFUND 50.00 EF065999 29/09/2017 ADELPHI TAILORING CO 209.00 41019 - CARGO PANTS NAVY 209.00 EF065837 15/09/2017 ADEPT PM TRUST ACCOUNT 1,028.00 122951 - RATES REFUND 1,028.00 EF065838 15/09/2017 ADVANCED MATTING 4,407.22 5849 - MATS FOR THE ENTRY OF 916.92 DUNCRAIG LIBRARY -

Power System Incident Report Trip of 8811 Calvale – Tarong 275Kv Line

POWER SYSTEM INCIDENT REPORT TRIP OF 8811 CALVALE – TARONG 275KV LINE, TARONG UNIT 2 AND COLUMBOOLA 132KV CB 73562 ON 05 NOVEMBER 2009 PREPARED BY: ESOPP DOCUMENT NO: 1.0 VERSION NO: 1.0 FINAL 1. INTRODUCTION At approximately 17:49hrs on Thursday 5th of November 2009, severe thunderstorms were experienced in the vicinity of Calvale – Tarong 275kV lines (Bureau of Meteorology - BOM issued a Severe Thunderstorm Warning) and one of the Calvale – Tarong lines - 8811 experienced a single phase trip and auto-reclose. The No.2 generating unit at Tarong Power Station (TPS) tripped from 350MW of load at around the same time. At approximately 17:50hrs, one of the 132kV feeders from T194 Columboola substation (Ergon Energy) to Condamine power station also tripped but there was no generation at Condamine power station at the time1. This report has been prepared under clause 4.8.15 of the National Electricity Rules to assess the adequacy of the provision and response of facilities and services and the appropriateness of actions taken to restore or maintain power system security. Information for this report has been provided by Powerlink, Tarong Energy, Ergon Energy and QGC Sales Pty. Ltd. Additional information has been obtained from AEMO’s Energy Management System and Market Management System. All references to time in this report refer to Market time (Australian Eastern Standard Time). 2. SUMMARY OF EVENTS At approximately 17:49hrs on Thursday 5th of November, severe thunderstorms were experienced in the vicinity of Calvale – Tarong 275kV lines. A market notice was issued at 13:47 hrs, reclassifying loss of 8810 & 8811 Calvale – Tarong double circuit 275kV lines as a credible contingency from 1345 hrs onwards. -

QGC Operations Bulletin

OPERATIONS BULLETIN ISSUE 20. DECEMBER 2016 QGC’s 200th cargo sets sail p QGC’s 200th export cargo sets sail. The Gaslog Gibraltar departed Gladstone on Thursday 15 December 2016. QGC’s 200th cargo set sail from our LNG plant on Curtis Island The ship, Gaslog Gibraltar, arrived in Gladstone on Tuesday near Gladstone on Thursday 15 December 2016. 13 December. About 15 QGC staff, all Gladstone based, worked to load the LNG ship so it could depart the following evening. Shell’s Vice President QGC Tony Nunan said the joint venture was proud that it had been able to make such a significant Production Technician Ben Cook, a Gladstone local, has been contribution to Queensland’s regional economy. with QGC since the construction of the LNG plant. “I am so proud to be part of the team to deliver the 200th cargo,” Ben said. “This 200th export cargo shows that workers living in regional Queensland can be part of a reliable and successful export The QGC LNG plant produces enough LNG to load around project that supplies gas to overseas customers, all while selling 10 vessels a month, which is equivalent to exporting around Queensland gas to Victoria and New South Wales,” Tony said. 8 million tonnes a year. The vessels also use the LNG as fuel. “Exporting energy, food and fibres are the Australian jobs of the QGC has exported to markets throughout Asia and the future, and the success of Shell’s QGC project is just one example Middle East. of these new industries.” COMMUNITY INFORMATION LINE 1800 030 443 (24-HOUR-TOLL-FREE) PAGE 1 OPERATIONS BULLETIN ISSUE 20. -

Hydrogen Industry in the Illawarra, Nsw

HYDROGEN INDUSTRY IN THE ILLAWARRA, NSW A Joint Submission by Regional Development Australia (RDA) Illawarra & RDA Sydney Source: Commonwealth of Australia Australia's National Hydrogen Strategy Regional Development Australia – Illawarra and Sydney Executive Summary The Illawarra is ideally positioned for the creation of a Hydrogen Hub for NSW, as part of Australia’s National Hydrogen Strategy. An Illawarra Hydrogen Hub will leverage existing infrastructure for the production and distribution of hydrogen at Port Kembla, initially building and servicing domestic demand whilst delivering export capacity and capability by 2030. CSIRO has identified fifty-six Australian hydrogen-related projects; of these, only four are currently operating, nine are under construction and 43 are in planning or feasibility stages and may never come to fruition. By comparison, Port Kembla has been at the centre of industry and transport for over a century and has a 30- year history in the generation of hydrogen, through the existing Coregas facility. The Port of Port Kembla is a major gateway to and from Greater Sydney and will be only 60 minutes travel time from the new Western Sydney Airport. The Wilton Growth Area – just 30 minutes from Port Kembla – has a rapidly growing population and need for energy, connectivity and employment. The proximity of Port Kembla to Sydney allows fast and easy access to the largest transport market in NSW, as well as renewable energy stakeholders, key peak industry bodies and major events - providing a chance to connect, target and convert international investors into partners for NSW and the Illawarra. NUW Energy is already capitalising on this proximity through a collaboration of the best researchers from UNSW Sydney, the University of Wollongong and the University of Newcastle who are exploring our energy future. -

Shire of Carnarvon Agenda Papers Ordinary Meeting Of

SHIRE OF CARNARVON AGENDA PAPERS ORDINARY MEETING OF COUNCIL TUESDAY 23RD JANUARY 2018 Council Chambers, Stuart Street CARNARVON, West Australia Phone: (08) 9941 0000 Fax: ((08) 9941 1099 Website – www.carnarvon.wa.gov.au Ordinary Council Agenda 23 January 2018 1 NOTICE OF MEETING Notice is hereby given Shire of Carnarvon Ordinary Council Meeting will be held on Tuesday 23RD January 2018 in the Shire Council Chambers, Stuart Street Carnarvon, commencing at 8.30am Mark Dacombe ACTING CHIEF EXECUTIVE OFFICER DISCLAIMER No responsibility whatsoever is implied or accepted by the Shire of Carnarvon for any act, omission or statement or intimation occurring during Council/Committee Meetings or during formal/informal conversations with Staff or Councillors. The Shire of Carnarvon disclaims any liability for any loss whatsoever and howsoever caused arising out of reliance by any person or legal entity on any such act, omission or statement or intimation occurring during Council/Committee Meetings or discussions. Any person or legal entity who acts or fails to act in reliance upon any statement does so at that person's or legal entity's own risk. In particular and without derogating in any way from the broad disclaimer above, in any discussion regarding any planning application or application for a licence, any statement or limitation of approval made by a member or officer of the Shire of Carnarvon during the course of any meeting is not intended to be and is not taken as notice of approval from the Shire of Carnarvon. The Shire of Carnarvon warns that anyone who has an application lodged with the Shire of Carnarvon must obtain and only should rely on WRITTEN CONFIRMATION of the outcome of the application, and any conditions attaching to the decision made by the Shire of Carnarvon in respect of the application.