Welsh Government Summary of Events Following The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welsh Tribal Law and Custom in the Middle Ages

THOMAS PETER ELLIS WELSH TRIBAL LAW AND CUSTOM IN THE MIDDLE AGES IN 2 VOLUMES VOLUME I1 CONTENTS VOLUME I1 p.1~~V. THE LAWOF CIVILOBLIGATIONS . I. The Formalities of Bargaining . .a . 11. The Subject-matter of Agreements . 111. Responsibility for Acts of Animals . IV. Miscellaneous Provisions . V. The Game Laws \TI. Co-tillage . PARTVI. THE LAWOF CRIMESAND TORTS. I. Introductory . 11. The Law of Punishtnent . 111. ' Saraad ' or Insult . 1V. ' Galanas ' or Homicide . V. Theft and Surreption . VI. Fire or Arson . VII. The Law of Accessories . VIII. Other Offences . IX. Prevention of Crime . PARTVIl. THE COURTSAND JUDICIARY . I. Introductory . 11. The Ecclesiastical Courts . 111. The Courts of the ' Maerdref ' and the ' Cymwd ' IV. The Royal Supreme Court . V. The Raith of Country . VI. Courts in Early English Law and in Roman Law VII. The Training and Remuneration of Judges . VIII. The Challenge of Judges . IX. Advocacy . vi CONTENTS PARTVIII. PRE-CURIALSURVIVALS . 237 I. The Law of Distress in Ireland . 239 11. The Law of Distress in Wales . 245 111. The Law of Distress in the Germanic and other Codes 257 IV. The Law of Boundaries . 260 PARTIX. THE L4w OF PROCEDURE. 267 I. The Enforcement of Jurisdiction . 269 11. The Law of Proof. Raith and Evideilce . , 301 111. The Law of Pleadings 339 IV. Judgement and Execution . 407 PARTX. PART V Appendices I to XI11 . 415 Glossary of Welsh Terms . 436 THE LAW OF CIVIL OBLIGATIONS THE FORMALITIES OF BARGAINING I. Ilztroductory. 8 I. The Welsh Law of bargaining, using the word bargain- ing in a wide sense to cover all transactions of a civil nature whereby one person entered into an undertaking with another, can be considered in two aspects, the one dealing with the form in which bargains were entered into, or to use the Welsh term, the ' bond of bargain ' forming the nexus between the parties to it, the other dealing with the nature of the bargain entered int0.l $2. -

IV. the Cantrefs of Morgannwg

; THE TRIBAL DIVISIONS OF WALES, 273 Garth Bryngi is Dewi's honourable hill, CHAP. And Trallwng Cynfyn above the meadows VIII. Llanfaes the lofty—no breath of war shall touch it, No host shall disturb the churchmen of Llywel.^si It may not be amiss to recall the fact that these posses- sions of St. David's brought here in the twelfth century, to re- side at Llandduw as Archdeacon of Brecon, a scholar of Penfro who did much to preserve for future ages the traditions of his adopted country. Giraldus will not admit the claim of any region in Wales to rival his beloved Dyfed, but he is nevertheless hearty in his commendation of the sheltered vales, the teeming rivers and the well-stocked pastures of Brycheiniog.^^^ IV. The Cantrefs of Morgannwg. The well-sunned plains which, from the mouth of the Tawe to that of the Wye, skirt the northern shore of the Bristol Channel enjoy a mild and genial climate and have from the earliest times been the seat of important settlements. Roman civilisation gained a firm foothold in the district, as may be seen from its remains at Cardiff, Caerleon and Caerwent. Monastic centres of the first rank were established here, at Llanilltud, Llancarfan and Llandaff, during the age of early Christian en- thusiasm. Politically, too, the region stood apart from the rest of South Wales, in virtue, it may be, of the strength of the old Silurian traditions, and it maintained, through many vicissitudes, its independence under its own princes until the eve of the Norman Conquest. -

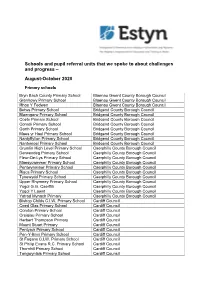

Schools and Pupil Referral Units That We Spoke to Autumn Term 2020

Schools and pupil referral units that we spoke to about challenges and progress – August-October 2020 Primary schools Bryn Bach County Primary School Blaenau Gwent County Borough Council Glanhowy Primary School Blaenau Gwent County Borough Council Rhos Y Fedwen Blaenau Gwent County Borough Council Betws Primary School Bridgend County Borough Council Blaengarw Primary School Bridgend County Borough Council Coety Primary School Bridgend County Borough Council Corneli Primary School Bridgend County Borough Council Garth Primary School Bridgend County Borough Council Maes yr Haul Primary School Bridgend County Borough Council Nantyffyllon Primary School Bridgend County Borough Council Nantymoel Primary School Bridgend County Borough Council Crumlin High Level Primary School Caerphilly County Borough Council Derwendeg Primary School Caerphilly County Borough Council Fleur-De-Lys Primary School Caerphilly County Borough Council Maesycwmmer Primary School Caerphilly County Borough Council Pentwynmawr Primary School Caerphilly County Borough Council Risca Primary School Caerphilly County Borough Council Tynewydd Primary School Caerphilly County Borough Council Upper Rhymney Primary School Caerphilly County Borough Council Ysgol G.G. Caerffili Caerphilly County Borough Council Ysgol Y Lawnt Caerphilly County Borough Council Ystrad Mynach Primary Caerphilly County Borough Council Bishop Childs C.I.W. Primary School Cardiff Council Coed Glas Primary School Cardiff Council Coryton Primary School Cardiff Council Creigiau Primary School Cardiff Council Herbert Thompson Primary Cardiff Council Mount Stuart Primary Cardiff Council Pentyrch Primary School Cardiff Council Pen-Y-Bryn Primary School Cardiff Council St Fagans C.I.W. Primary School Cardiff Council St Philip Evans R.C. Primary School Cardiff Council Thornhill Primary School Cardiff Council Tongwynlais Primary School Cardiff Council Ysgol Gymraeg Treganna Cardiff Council Ysgol-Y-Wern Cardiff Council Brynamman Primary School Carmarthenshire County Council Cefneithin C.P. -

Schools and Pupil Referral Units That We Spoke to September

Schools and pupil referral units that we spoke to about challenges and progress – August-December 2020 Primary schools All Saints R.C. Primary School Blaenau Gwent County Borough Council Blaen-Y-Cwm C.P. School Blaenau Gwent County Borough Council Bryn Bach County Primary School Blaenau Gwent County Borough Council Coed -y- Garn Primary School Blaenau Gwent County Borough Council Deighton Primary School Blaenau Gwent County Borough Council Glanhowy Primary School Blaenau Gwent County Borough Council Rhos Y Fedwen Blaenau Gwent County Borough Council Sofrydd C.P. School Blaenau Gwent County Borough Council St Illtyd's Primary School Blaenau Gwent County Borough Council St Mary's Roman Catholic - Brynmawr Blaenau Gwent County Borough Council Willowtown Primary School Blaenau Gwent County Borough Council Ysgol Bro Helyg Blaenau Gwent County Borough Council Ystruth Primary Blaenau Gwent County Borough Council Afon-Y-Felin Primary School Bridgend County Borough Council Archdeacon John Lewis Bridgend County Borough Council Betws Primary School Bridgend County Borough Council Blaengarw Primary School Bridgend County Borough Council Brackla Primary School Bridgend County Borough Council Bryncethin Primary School Bridgend County Borough Council Bryntirion Infants School Bridgend County Borough Council Cefn Glas Infant School Bridgend County Borough Council Coety Primary School Bridgend County Borough Council Corneli Primary School Bridgend County Borough Council Cwmfelin Primary School Bridgend County Borough Council Garth Primary School Bridgend -

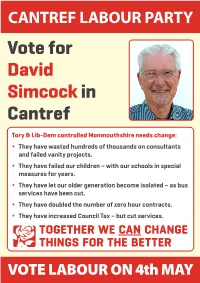

Vote for David Simcock in Cantref

CANTREF LABOUR PARTY Vote for David Simcock in Cantref Tory & Lib-Dem controlled Monmouthshire needs change: y They have wasted hundreds of thousands on consultants and failed vanity projects. y They have failed our children – with our schools in special measures for years. y They have let our older generation become isolated – as bus services have been cut. y They have doubled the number of zero hour contracts. y They have increased Council Tax – but cut services. TOGETHER WE CAN CHANGE THINGS FOR THE BETTER VOTE LABOUR ON 4th MAY CANTREF LABOUR PARTY DAVID SIMCOCK Abergavenny has been my home for 20 years and I am proud to be the first Labour Councillor in Cantref for many years. As a Councillor I have worked on the Town Council and its Committees. I now also want to be part of a Labour-led County Council targeting the issues that really matter: y Making schools better y Improving the state of roads and pavements y Making public transport more convenient y Providing better support for lonely and isolated residents I support the Labour values of integrity, fairness, accountability and good governance. Please vote for me as both your Town and County Councillor! A Labour Monmouthshire in a Labour Wales gives you a real say LABOUR LABOUR Don’t forget – if you vote you get TORY But if you vote you get [email protected] 01873 857033 www.monmouthlabour.org VOTE LABOUR ON 4th MAY Printed by SAXOPRINT Ltd, 1 Bedford Row, London WC1R 4BZ. Published by Roger Harris, on behalf of David Simcock, both of The Hamlet, Llwynddu, Abergavenny NP7 7HY.. -

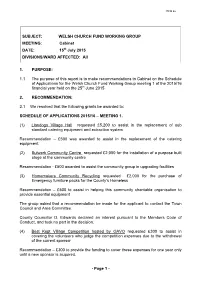

Allocation Criteria for the Welsh Church Fund Working Group

ITEM 4iv SUBJECT: WELSH CHURCH FUND WORKING GROUP MEETING: Cabinet DATE: 15th July 2015 DIVISIONS/WARD AFFECTED: All 1. PURPOSE: 1.1 The purpose of this report is to make recommendations to Cabinet on the Schedule of Applications for the Welsh Church Fund Working Group meeting 1 of the 2015/16 financial year held on the 25th June 2015 2. RECOMMENDATION: 2.1 We resolved that the following grants be awarded to: SCHEDULE OF APPLICATIONS 2015/16 – MEETING 1. (1) Llandogo Village Hall requested £5,200 to assist in the replacement of sub standard catering equipment and extraction system Recommendation – £500 was awarded to assist in the replacement of the catering equipment (2) Bulwark Community Centre requested £2,000 for the installation of a purpose built stage at the community centre Recommendation - £500 awarded to assist the community group in upgrading facilities (3) Homemakers Community Recycling requested £2,000 for the purchase of Emergency furniture packs for the County’s Homeless Recommendation – £500 to assist in helping this community charitable organisation to provide essential equipment The group asked that a recommendation be made for the applicant to contact the Town Council and Area Committee. County Councillor D. Edwards declared an interest pursuant to the Members Code of Conduct, and took no part in the decision. (4) Best Kept Village Competition hosted by GAVO requested £300 to assist in covering the volunteers who judge the competition expenses due to the withdrawal of the current sponsor Recommendation – £300 to provide the funding to cover these expenses for one year only until a new sponsor is acquired. -

Towards an Independent Wales

TOWARDS AN INDEPENDENT WALES TOWARDS AN INDEPENDENT WALES Report of the Independence Commission September 2020 First impression: 2020 © The Independence Commission & Y Lolfa Cyf., 2020 This book is subject to copyright and may not be reproduced by any means except for review purposes without the prior written consent of the publishers. Cover design: Y Lolfa Cover picture: FfotoNant ISBN: 978-1-80099-000-5 Published and printed in Wales on paper from well-maintained forests by Y Lolfa Cyf., Talybont, Ceredigion SY24 5HE e-mail [email protected] website www.ylolfa.com tel 01970 832 304 fax 832 782 Contents Introduction 11 Executive summary 16 Main recommendations 20 Chapter 1: Building the road 29 The 20th century 29 The 21st century 32 Chapter 2: Public attitudes 43 Welsh identity 43 Independence 45 Independence: the referendum question 45 Chapter 3: A Welsh jurisdiction 52 Asymmetric devolution 53 The single England and Wales jurisdiction 54 Why Wales needs a separate jurisdiction 54 5 T OWARDS AN INDEPENDENT WALES A virtual legal jurisdiction 58 Justice powers 59 Implications of a distinct Welsh jurisdiction 60 The way ahead 63 Recommendations 66 Chapter 4: Effective Government and the civil service 67 Twenty years of evolution 68 The civil service culture 71 A Welsh public service 76 Recommendations 80 Chapter 5: Addressing the fiscal gap 82 A better model 86 The Welsh balance-sheet 88 Paying our way 90 A different sort of union 92 Welsh taxes 96 A UK common market 98 A middle way 101 Recommendations 102 6 Contents Chapter 6: Wales -

UC Berkeley UC Berkeley Electronic Theses and Dissertations

UC Berkeley UC Berkeley Electronic Theses and Dissertations Title Visions and Revisions: Gerald of Wales, Authorship, and the Construction of Political, Religious, and Legal Geographies in Twelfth and Thirteenth Century Britain Permalink https://escholarship.org/uc/item/5905x7t1 Author Sargent, Amelia Publication Date 2011 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California Visions and Revisions: Gerald of Wales, Authorship, and the Construction of Political, Religious, and Legal Geographies in Twelfth and Thirteenth Century Britain by Amelia Lynn Borrego Sargent A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Comparative Literature in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Frank Bezner, Chair Professor Maura Nolan Professor Joseph Duggan SPRING 2011 Visions and Revisions: Gerald of Wales, Authorship, and the Construction of Political, Religious, and Legal Geographies in Twelfth and Thirteenth Century Britain © 2011 by Amelia Lynn Borrego Sargent Abstract Visions and Revisions: Gerald of Wales, Authorship, and the Construction of Political, Religious, and Legal Geographies in Twelfth and Thirteenth Century Britain by Amelia Lynn Borrego Sargent Doctor of Philosophy in Comparative Literature University of California, Berkeley Professor Frank Bezner, Chair Gerald of Wales revised his Topographia Hibernica and Itinerarium Kambriae multiple times over the course -

Judgement Under the Law of Wales

05 Smith SC39 18/1/06 1:26 pm Page 63 STUDIA CELTICA, XXXIX (2005), 63–103 Judgement under the Law of Wales J. BEVERLEY SMITH Aberystwyth Tres diversi iudices sunt in Kambria secundum legem Howel Da: scilicet, iudex curie principalis per servitoriam, id est, swyt, cum rege semper de Dinewr vel Aberffraw; et unus solus iudex kymwd vel cantreff per swyt in qualibet curia de placitis in Gwynet et Powys; et iudex per dignitatem terre in qualibet curia kymwd vel cantref de Deheubarth, scilicet, quisque possessor terre. In its discussion of judges in Wales and the means by which judgements were given in court the text of Bodleian Rawlinson MS C821, Latin D, makes a distinction between three kinds of judges.1 The first was the judge (iudex) of each of the principal courts of Dinefwr and Aberffraw, who judged by virtue of office; second, there were judges (iudices) by virtue of office in the court of law of each commote or cantref in Gwynedd and Powys; and, third, there were judges (iudices) by privilege of land in each court of a commote or cantref in Deheubarth, namely every possessor of land.2 Judgements were distinguished in the same way, namely those of the king’s court, those of a judge by virtue of office in each commote or cantref in Gwynedd or Powys, and those of a judge not by virtue of office but by privilege of land in Deheubarth.3 The judge first identified in these passages, the judge of the court (ynad llys, brawdwr llys or iudex curie), looms large in the legal liter- ature as one of the principal officers of the king’s household, but the functions of his office, which have been examined elsewhere, stand apart from the subject matter of the present work and will not be noticed further.4 This study is concerned rather with the implications of the clear differentiation made in the text of Latin D between two species of judge and two forms of judgement that could be recognized in the courts of the princes’ territories, one associated with the courts of Gwynedd and Powys and the other with those of Deheubarth. -

Dilynwch Ni Ar Twitter / Darganfyddwch Ni Ar Facebook

From: PMO To: Wylfa Newydd Subject: RE: IACC Deadline 2 Submission : Local Impact Report - Welsh Language and Culture (email 17) Date: 04 December 2018 19:50:49 Attachments: image001.png image002.png image003.png Annex 9C-9G (Batch 4 of 4).zip Please note, a number of emails will follow in relation to the LIR – we will confirm the final e- mail. Pnawn Da/ Good afternoon, Gweler ynghlwm cynrychiolaeth CSYM mewn perthynas â'r uchod / Please see IACC’s representation in respect of the above. Bydd fersiwn Gymraeg yn cael ei ddarparu cyn gynted a phosib / A Welsh version of the submission will be provided in due course. Cofion/ Regards, Manon Swyddfa Rhaglen Ynys Ynni / Energy Island Programme Office 01248 752435 / 2431 [email protected] www.ynysynnimon.co.uk / www.angleseyenergyisland.co.uk Dilynwch ni ar Twitter / Darganfyddwch ni ar Facebook Follow us on Twitter / Find us on Facebook Mae'r neges e-bost hon a'r ffeiliau a drosglwyddyd ynghlwm gyda hi yn gyfrinachol ac efallai bod breintiau cyfreithiol ynghlwm wrthynt. Yr unig berson sydd 'r hawl i'w darllen, eu copio a'u defnyddio yw'r person y bwriadwyd eu gyrru nhw ato. Petaech wedi derbyn y neges e-bost hon mewn camgymeriad yna, os gwelwch yn dda, rhowch wybod i'r Rheolwr Systemau yn syth gan ddefnyddio'r manylion isod, a pheidiwch datgelu na chopio'r cynnwys i neb arall. Mae cynnwys y neges e-bost hon yn cynrychioli sylwadau'r gyrrwr yn unig ac nid o angenrheidrwydd yn cynrychioli sylwadau Cyngor Sir Ynys Mon. Mae Cyngor Sir Ynys Mon yn cadw a diogelu ei hawliau i fonitro yr holl negeseuon e-bost trwy ei rwydweithiau mewnol ac allanol. -

Press Release

Monmouth Labour Party Labour’s David Simcock wins Abergavenny Town Council election 17 August 2015 Labour candidate David Simcock has won the Abergavenny Town Council by-election which took place on 13 August. The election for the Cantref Ward came about because of the resignation of a Conservative Councillor. After the count David said: “I'd like to thank voters for giving me the opportunity serve Cantref and to work with fellow Councillors to improve things for the town as a whole. This is a fantastic result for Cantref and for the great team who worked with me on the campaign. Now the really hard work begins. “Talking to me on the doorstep, people have been keen to voice their ideas about improving Abergavenny. The Town Council’s decisions should take those ideas into account. It's good to live in a place where people care so much about the future of the town.” A Cantref Ward resident in Mount Street said, “I’m pleased David won the election. He has knocked on many doors during the past month, so we know he is willing to work hard. I can't remember when we last had a Labour person representing people in Cantref Ward, either on the Town Council or on the County Council. This is good news”. A resident of Orchard Street said: “I voted for David Simcock because he has good ideas and has put in a lot of effort”. Votes cast were as follows: David Simcock (Labour): 198, Roger Fury (Conservative): 170, Christopher Copner (Independent): 69. Voter turnout at 26.5% was relatively high for a Town Council election. -

Pembrokeshire County Council Joint Housing Land Availability Study for 2018 Which Presents the Housing Land Supply for the Area at the Base Date of 1St April 2018

PEMBROKESHIRE COUNTY COUNCIL JOINT HOUSING LAND AVAILABILITY STUDY 2018 BETWEEN PEMBROKESHIRE COUNTY COUNCIL LPA AND THE STUDY GROUP: THE HOME BUILDERS FEDERATION PEMBROKESHIRE COAST NATIONAL PARK AUTHORITY PERSIMMON HOMES WEST WALES PEMBROKESHIRE HOUSING ASSOCIATION TAI CANTREF AND DWR CYMRU WELSH WATER PUBLICATION DATE: 14th January 2019 1 Table of Contents 1.0 Introduction ...................................................................................................................... 3 2.0 Housing Land Supply ....................................................................................................... 4 Appendix 1: Site Schedules .................................................................................................... 6 Appendix 2 – Past Completion Data ..................................................................................... 11 Appendix 3 – Previous Land Supply Data ............................................................................ 11 Appendix 4 – Planning Inspectorate’s Recommendation ..................................................... 12 2 1.0 Introduction 1.1 This is the Pembrokeshire County Council Joint Housing Land Availability Study for 2018 which presents the housing land supply for the area at the base date of 1st April 2018. It replaces the report for the previous base date of 1st April 2017. 1.2 The JHLAS has been prepared in accordance with the requirements of Planning Policy Wales and Technical Advice Note 1 (TAN 1). Please refer to these documents for details of the