GENTEX CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

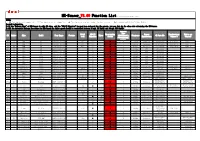

SN. Market Make Model Year Range Feature Model Code OBD

MX-Sensor_V3.09 Function List(Note:For reference only) NOTES: ● This function is supported. ○ This function is not supported. ▲ This function is a new feature in this version. Mark explaining(Red:New,Yellow:Modify) Special Declaration: 1).If the "Relearn Type" of MX-Sensor is only OBD type, and the "OBD-II Function" has not been released for the moment, you can just do the clone for relearning the MX-Sensor. 2).All the Automatic Relearn Procedure for MX-Sensor,the drive speed should be controlled between 16 mph (25 km/h) and 64 mph (100 km/h). Relearn Type Model OBD-II Programming Sensor Manufacturer Number on SN. Market Make Model Year Range Feature Tires (A=Automatic, Frequency OE Part NO. code Function Status Manufactuer Sensor # Sensor# S=Stationary, O=OBD) 103 EU BMW M5 2014/03-2016/06 F10 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 104 EU BMW M6 2014/03-2016/06 F12 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 105 EU BMW M7 2014/03-2016/06 F01 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 2906 EU BYD G5 2014/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2907 EU BYD G6 2013/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2903 EU BYD S7 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2909 EU BYD Sirui 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2904 EU BYD Song 2016/1-2016/12 ○ 4 ● S 433Mhz BYD 6B3609200 2908 EU BYD Surui 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2905 EU BYD Tang 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2939 EU Cadillac ATS-V 2016/01-2016/12 ○ 4 ● 433Mhz Schrader 20925925 60518416 20925925 2940 EU -

MOTORES CODIGOS 7E

CODIGO MAESTRO DE MOTORES Y TRANSMISIONES CREADO POR: ING. FERNER A. MORALES ABREU AGOSTO 2007-JUNIO 2017 MODEL AÑO CODIGO PETROL ENGINE DIESEL ENGINE TRANSMISION MARCA ACURA 2.5TL 95-98 UA1 2.5L G25A4 B7XA 99-03 UA4 2.5L J25A B7WA / MPYA 2004-2008 UA6 3.2L J32A3 BDGA 2009-present UA8 3.5L J35Z6 BK3A / BK4A CDX 2016-PRESENT 1.5L T 8 speed dual clutch CL 97-99 YA1 3.0L J30A1 / 2.2L F22B1 / 2.3L F23A1 A6VA / B6VA 2001-2003 YA4 3.2L J32A1 / J32A2 (type-s) MGFA CSX 2006-2011 CSX 2.0L K20Z2 / 2.0L D20Z3 (Type-S) MPMA (06-09) / SPCA (10-11) B4RA (97-00) / M4RA (97-98) / S4RA EL 97-00 MB4 1.6L D16Y8 (98-00) BDRA (99-00) 2001-2005 MB5 1.7L D17A2 B46A 1.5L LDA/LEA (hybrid) / 2.0L R20A (auto) M9DA 5 Speed (13-15) / S9FA 5 ILX 2013-Present DE1 / 2.4L K24Z7 (manual) / 2.4L K24W7 (16- speed CVT / M4JA 8 speed (16-) ) INTEGRA 86-89 DA1 1.6L D16A1 CA / P1 1.6L B16A / 1.8L B18A1 / 1.7L B17A1 90-93 DB1 RO / MPRA GS-R / 1.8L B18B1 1.8L B18B1 / 1.8L B18C5 TYPE R / 1.8L 94-99 DB7 B18C VTEC / 1.8L B18C1 / 1.8L B18C3 / MP7A / S4XA 1.8L B18C5 (USA) 2000-2001 DB8 1.8L B18B1 SKWA LEGEND 86-90 KA6 2.5L C25A / 2.7L C27A G4 / L5 / PL5X 92-95 KA8 3.2L C32A MPYA MDX 2001-2006 YD1 J35A3 / J35A5 (04-06) MDKA 2007-2012 YD2 3.7L J37A1 BDKA 2013-Present YD3 3.5L J35Y5 9HP48 (2016-) J4A4 Standard 5 Spd Honda (90-94) / NSX 1990-2005 NSX 3.0L V6 / 3.5L Twin-turbo hybrid SR8M Standard 5 Spd Honda RDX 2007-2012 TB1 2.3L K23A1 Turbo BWEA / BT3A 3.0L J30Y1 (china) / 3.5L J35Y / J35Z2 B8CA (AWD) 6 speed / B8BA 2013- TB2 (2013-2015) FWD 6speed RL 96-98 KA9 3.5L C35A M5DA 99-2004 -

Analysis of the Product Development Process for Geographically Distant Teams in Vehicle Tophat Design Phases By

Analysis of the Product Development Process for Geographically Distant Teams in Vehicle Tophat Design Phases by Antonio Del Puerto Valdez B.S. Mechanical and Electrical Engineering (2001) Instituto Tecnol6gico y de Estudios Superiores de Monterrey Submitted to the System Design and Management Program in Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management ARCHIES at the SSACHUSETTS INSTITUTE MA~ Massachusetts Institute of Technology OF TECHNOLOGY February 2010 JUN 16 2010 C 2010 Antonio Del Puerto Valdez All rights reserved LIBRARIES The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Au or Antonio Del Puerto Valdez System Design and Management Program February 2010 Certified L/ Christopher L. Magee Thesis Supervisor Professor of the Practice of Mechanical Engineering and Engineering Systems Co-Director Nineering Design and A nced Manufacturing (EDAM). MIT-Portugal Program -0 n e-7i ( Y Certified by N...J \v~ Patrick Hale Director System Design & Management Program THIS PAGE IS INTENTIONALLY LEFT BLANK To my mother. A paragonof courage and hard work Muchas gracias. THIS PAGE IS INTENTIONALLY LEFT BLANK Analysis of the Product Development Process for Geographically Distant Teams in Vehicle Tophat Design Phases by Antonio Del Puerto Valdez Submitted to the System Design and Management Program in Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management ABSTRACT The current global economic recession is putting pressure to increase model variation on the carmakers, while at the same time leveraging highly efficient and proven platforms and product development assets globally is becoming critical. -

TRB 05-1960 15 Nov 2004

Automotive CO2 Emissions Characterization by U.S. Light-Duty Vehicle Platform Revised Manuscript for TRB, 15 November 2004 Feng An,1 John DeCicco,2* and Huiming Gong1 1Energy and Transportation Technologies, LLC 42977 Ashbury Drive Novi, MI 48375 248-347-9004 [email protected] [email protected] 2Environmental Defense 6327 Todds Lane Dexter, MI 48130 734-424-3742 [email protected] *corresponding author C:\Documents\Active\CarBur\Platforms\An, DeCicco, Gong -- TRB 05-1960 (15 Nov 2004).doc An, DeCicco, and Gong -- TRB 05-1960 2 ABSTRACT Raising the fuel economy of automobiles to lower carbon dioxide (CO2) emissions affects many aspects of vehicle design. Automakers organize their production using platforms, representing shared engineering across different models. A platform level of aggregation is therefore useful when examining the opportunities for and impacts of redesign. This paper explores the CO2 emissions-related characteristics of major platforms in the U.S. market, using data for model year 2002. The top 30 platforms were found to hold 69% of sales and emit 72% of the annualized CO2 contribution of the model year 2002 new light vehicle fleet. Variations of up to 35% in vehicle weight were observed for models within a given platform. The within-platform variation of CO2 emissions rate ranged up to 45% for all platforms among the top 30, except a platform including diesel engines, which had a 67% variation. Across major platforms, average CO2 emissions rates varied by a factor of 2.3 from lowest to highest. Powertrain efficiency, as indicated by ton-miles per gallon, varied by 40% across platforms, with both the lowest and highest values being seen in truck platforms. -

Make Model Year Range Feature Model Code OBD-II

MX-Sensor_V4.08 Function List For EU Market(Note:For reference only) NOTES: ● This function is supported. ○ This function is not supported. Mark explaining(Red:New,Yellow:Modify) Special Declaration: 1).If the "Relearn Type" of MX-Sensor is only OBD type, and the "OBD-II Function" has not been released for the moment, you can just do the clone for relearning the MX-Sensor. 2).All the Automatic Relearn Procedure for MX-Sensor,the drive speed should be controlled between 16 mph (25 km/h) and 64 mph (100 km/h). Relearn Model OBD-II Programming Type(A=Automatic, Sensor Make Model Year Range Feature Frequency code Function Status S=Stationary, Manufactuer O=OBD) Alfa Romeo 169 11/2015-06/2017 N936 ○ ● 433Mhz Continental Alpina Alpina 4 01/2014-12/2016 (F32/F33/F36) F30/F32 ○ ● A 433Mhz Continental Alpina XD3 04/2014-12/2016 F25 ○ ● A 433Mhz Huf/Beru Aston Martin DB9 05/2010-12/2015 DB9 ○ ● A 433Mhz Huf/Beru Audi R8 04/2015-12/2016 ○ ● A 433Mhz Huf/Beru BMW 7 Series 07/2015-12/2016 G12 G12 ○ ● A 433Mhz Schrader Chevrolet Express Series 07/2002-12/2016 GMT610 ● ● S 433Mhz Schrader Citroen Berlingo(LCV) 05/2008-09/2013 ● ● O 433Mhz Schrader Citroen C-ZERO 10/2014-12/2016 ● ● 433Mhz Continental Citroen C8 06/2002-09/2005 V3 ● ● S 433Mhz Schrader Ferrari F430 Scuderia 07/2007-06/2012 F131 ○ ● 433Mhz Huf/Beru Fiat 1-Tonne Pickup 01/2016-06/2017 4P00 ○ ● 433Mhz Continental Fiat Fullback 01/2016-06/2017 4P00 ○ ● 433Mhz Continental Hyundai ix35 09/2013-12/2015 Lo Line LM,EL ● ● O 433Mhz TRW Hyundai Solaris 01/2014-12/2016 RB ● ● O 433Mhz Continental -

Annual Report 2002 Cover.Qxd 3/26/03 4:48 PM Page 4

Cover.qxd 3/26/03 4:48 PM Page 3 Annual Report 2002 Cover.qxd 3/26/03 4:48 PM Page 4 Financial Highlights Sales Operating Income Net Income from Operations(1) Diluted Earnings Per Share [U.S. $ Billions] [U.S. $ Millions] [U.S. $ Millions] from Operations(1) [U.S. $] 15 1,000 600 6 500 5 12 800 400 4 9 600 300 3 6 400 200 2 3 200 100 1 00 01 02 00 01 02 00 01 02 00 01 02 (1) The Company measures and presents net income from operations and diluted earnings per share from operations because they are measures that are widely used by analysts and investors in evaluating the operating performance of the Company. However, net income from operations and diluted earnings per share from operations do not have any standardized meaning under Canadian generally accepted accounting principles and are therefore unlikely to be comparable to similar measures presented by other companies. See footnote (1) on page 37 for further details. The 2003 Annual Meeting Inside of Shareholders The 2003 Annual Shareholders’ Meeting will Corporate Profile 1 be held at The Toronto Centre for the Arts, Magna at a Glance 2 Main Stage Theatre, 5040 Yonge Street, The Chairman’s Message 4 Toronto (North York), Ontario, Canada on Thursday, May 8, 2003 commencing Letter to Shareholders 6 at 10:00 a.m. Executive Management 9 Magna’s Corporate Constitution 10 The Magna Employee’s Charter 18 Automotive Operating Structure 19 Automotive Systems Groups 20 Global Vehicle Content 32 Magna Entertainment Corp. -

Gm/Fiat Imds Instructions

Document Name Date: Issue: Detailed instructions - IMDS 2003-03-11 Prel. 03 GM/FIAT IMDS INSTRUCTIONS March 11, 2003 - 1 - Document Name Date: Issue: Detailed instructions - IMDS 2003-03-11 Prel. 03 Table of Contents 1. THE NEW ELV-DIRECTIVE......................................................................................................4 2. REQUEST TO SUPPLIERS .........................................................................................................4 3. TIMING REQUIREMENTS: DELIVERY OF DATA TO GM/FIAT.....................................4 3.1. USE OF INFORMATION:...............................................................................................................5 3.2. ACCEPTANCE/REJECTION OF IMDS DATA SUBMISSIONS: .........................................................5 3.3. ALTERNATIVE REPORTING.........................................................................................................5 4. PRIORITISED PROGRAMS .......................................................................................................6 4.1. EUROPE .....................................................................................................................................6 4.2. NORTH AMERICA.......................................................................................................................7 5. EXPLANATION OF PART/MATERIAL REPORTING REQUIREMENTS FOR GM/FIAT 8 5.1. EXPLANATION OF THE REQUEST FOR “ALL DATA” FOR GM:.......................................................8 5.2. NEW: CLARIFICATION -

Automotive Communities Program Center for Automotive Research

The U.S. Automobile Industry: An Outlook FTA Revenue Estimating Conference 9-15-08 Kim Hill Associate Director, Economic and Business Group Director, Automotive Communities Program Center for Automotive Research It’s always about product….. Auto manufacturing operations in 25 states State Plants Employment MI 49 78,159 OH 25 40,976 KY 5 23,606 IN 11 22,337 TN 6 18,904 AL 5 14,119 CA 3 12,019 MO 6 11,688 IL 4 9,048 SC 1 4,500 TX 2 4,307 MS 1 3,662 WI 2 3,289 NY 3 2,911 DE 2 2,540 KS 1 1,969 LA 1 1,877 GA 2 1,476 WV 1 1,150 MN 1 1,060 OK 1 788 AR 1 600 MD 1 423 PA 1 319 VA 1 102 Total 136 261,829 Automobile parts manufacturing operations in 50 states !"#"$ %&"#'()&*+$,"& %+-(./+$," !"#"$ %&"#'()&*+$,"& %+-(./+$," Michigan !"! #$%&!'! Oregon !! $&$%' Ohio ()' )'&((* Minnesota !% $&*'' +,-./,/ $!# !"&#(' 0/,1/1 (% *&))% Tennessee #)% $"&'#* 23.45,/ !) *&6)! 07,89:;< #%$ $#&(6% Washington "' *&6%" +==.,5.1 *6! *"&%($ West Virginia #% *&#'# >/=.?53,./ 6*) *(&*'# Massachusetts (( #&!"' New York #6% **&!6$ Maryland $# #&6)( North Carolina #%$ #"&%#) Louisiana $* #&6'' 2=/@/A/ #'# #!&"*! New Hampshire #" #&6'' Wisconsin #(# #6&*!' >5=53/-5 %" #&*"" South Carolina )$ #(&6(* New Jersey %! #&''( Missouri #$) #$&6#6 North Dakota #$ )(' Pennsylvania #(% #*&(!* South Dakota #% !)( Texas *%) ##&"*# Nevada *6 6'' B753C./ ##) #'&$(% Vermont ( $!' +5D/ 6* !&%6% E7=/D/37 ( $#$ Virginia !$ 6&)%6 Maine ## *)' Mississippi %6 6&!#$ Rhode Island % *"! 23;/,1/1 (6 %&"(' Wyoming #' #6' F=53.-/ #!% (&")' Montana #( #'' >5,,7:8.:98 6' (&#') New Mexico #% #'' Utah -

Servicing Vehicles Upgraded to Onstar Generation 6 Digital-Capable System - Follow Information Below - (Apr 9, 2009)

#09-08-46-001: Servicing Vehicles Upgraded to OnStar Generation 6 Digital-Capable System - Follow Information Below - (Apr 9, 2009) Subject: Servicing Vehicles Upgraded to OnStar® Generation 6 Digital-Capable System (Follow Information Below) Models: 2000-2004 Buick LeSabre 2003-2004 Buick Rendezvous 2004 Buick Rainier, Regal 2004-2005 Buick Century 2002-2004 Cadillac DeVille, Seville 2003-2004 Cadillac CTS 2003-2004 Cadillac Escalade Models 2004-2005 Cadillac SRX, XLR 2005 Cadillac CTS, STS 2001-2004 Chevrolet Impala, Monte Carlo 2002-2004 Chevrolet TrailBlazer Models 2003-2004 Chevrolet Avalanche, Express, Silverado, Suburban, Tahoe 2003-2005 Chevrolet Cavalier, Venture 2004 Chevrolet Colorado 2004-2005 Chevrolet Malibu, Malibu Maxx 2005 Chevrolet Cobalt, Corvette, Equinox 2002-2004 GMC Envoy Models 2003-2004 GMC Savana, Sierra, Yukon Models 2004 GMC Canyon 2001-2003 Oldsmobile Aurora 2002-2004 Oldsmobile Bravada 2003-2004 Oldsmobile Silhouette 2003-2004 Pontiac Aztek 2000-2004 Pontiac Bonneville 2003-2005 Pontiac Montana, Sunfire 2004 Pontiac Grand Prix 2005 Pontiac G6, Pursuit (Canada) 2003-2004 HUMMER H2 2002-2004 Saturn VUE 2003-2004 Saturn ION 2003-2004 Saturn L-Series Equipped with OnStar® (RPO UE1) Please Refer to GMVIS Attention: This bulletin is being issued to provide dealer personnel with information and the procedures to diagnose an upgraded OnStar® Generation 6 Digital-Capable system. Program Overview Since it was launched in 1996, OnStar® has relied on an analog wireless network to provide communication to and from OnStar-equipped vehicles. As part of an industry wide change in the North American wireless telecommunications industry, wireless carriers are transitioning to digital technology and will no longer support the analog wireless network beginning early 2008. -

Low-Volume Vehicle Production

Low-Volume Vehicle Production By Manufacturing, Engineering, and Technology Group Center for Automotive Research January 2006 Sponsored by American Plastics Council ASC, Inc. Dana Corporation Diversified Tooling Company KUKA Flexible Production Systems McKinsey Consulting TATA Consulting United Tooling Coalition The statements, findings, and conclusions herein are those of the authors and do not necessarily reflect the views of the project sponsor. Acknowledgements As with any project, this report is the result of many people contributing in a number of ways. The authors of this report would like to thank Emilio Brahmst and Chris Gulis who spent many long hours researching, documenting and detailing manufacturing technologies and manufacturing processes. Mr. Gulis is responsible for the Corvette Z06 case study and contributions to several other case studies. He also analyzed many of the assembly and tooling facilities for this project. Karen Esper contributed greatly by creating and formatting the document. Her expertise and patience were critical to the project’s success. Ray Miller also contributed research and performed overall project maintenance. The authors also thank Ernst & Young, and their funding of this project through the Automotive Industry of the Future program at CAR. Their generous grant has been an important part of the research CAR has produced in recent years. Finally, we would like to thank the members of the Low-Volume Vehicle Consortium who took time to guide the authors. The members of this consortium have very strong opinions, and a great knowledge of low-volume vehicle production. Without their knowledge, this report would not have been possible. While all members offered value to the effort, the authors would especially like to thank John Basso (Diversified Tooling Co.) , Mike Powers (Dow Automotive, through participation in the APC), Glenn Mercer (McKinsey & Co), Todd Smit (ASC), and John Waraniak (TATA Consultancy) for their guidance on this project. -

In the United States Bankruptcy Court for the Eastern District of Michigan Southern Division

IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION - - - - - - - - - - - - - - - - : In re: : Chapter 11 : PLASTECH EXTERIOR SYSTEMS, INC. : Case No. 08-42423 (PJS) 22000 Garrison Street : Dearborn, MI 48124 : : Debtor. : Tax I.D. No. 34-0803150 - - - - - - - - - - - - - - - - x SCHEDULES OF ASSETS AND LIABILITIES IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION - - - - - - - - - - - - - - - - x In re: : Chapter 11 : PLASTECH ENGINEERED PRODUCTS, : Case No. 08-42417 (PJS) INC. : 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 38-2866329 - - - - - - - - - - - - - - - - x : In re: : Chapter 11 : PLASTECH ROMULUS, INC. : Case No. 08-42418 (PJS) 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 03-0396851 - - - - - - - - - - - - - - - - x : In re: : Chapter 11 : LDM HOLDING MEXICO, INC. : Case No. 08-42419 (PJS) 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 38-3311995 - - - - - - - - - - - - - - - - x : In re: : Chapter 11 : PLASTECH DECORATING SYSTEMS, : Case No. 08-42420 (PJS) INC. : 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 35-2053537 - - - - - - - - - - - - - - - - x - - - - - - - - - - - - - - - - x : Chapter 11 In re: : : PLASTECH FRENCHTOWN, INC. : Case No. 08-42421 (PJS) 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 35-2206975 - - - - - - - - - - - - - - - - x : In re: : Chapter 11 : LDM TECHNOLOGIES, INC. : Case No. 08-42422 (PJS) 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 38-2690171 - - - - - - - - - - - - - - - - x : In re: : Chapter 11 : PLASTECH EXTERIOR SYSTEMS, INC. : Case No. 08-42423 (PJS) 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. : Tax I.D. No. 34-0803150 - - - - - - - - - - - - - - - - x : In re: : Chapter 11 : MBS POLYMET, INC. : Case No. 08-42424 (PJS) 22000 GARRISON STREET : DEARBORN, MICHIGAN 48124 : : Debtor. -

United States International Trade Commission Washington, D.C

UNITED STATES INTERNATIONAL TRADE COMMISSION WASHINGTON, D.C. Before The Honorable Charles E. Bullock Chief Administrative Law Judge IN THE MATTER OF Investigation No. 337-TA-816 CERTAIN WIPER BLADES RESPONDENTS' JOINT PREHEARING STATEMENT Pursuant to Ground Rule 8.1 (Order No. 2), Respondents Corea Autoparts Producing Corp., PIAA Corp. USA and CAP America, Inc. (collectively, "CAP Respondents") and ADM21 Co., Ltd., ADM21 Co. (North America), Ltd., Cequent Consumer Products, Inc., RainEater, LLC and Daewoo International Corp. (collectively with CAP Respondents, "Respondents") hereby submit this Prehearing Statement with respect to the hearing in this Investigation. HEARING WITNESSES Pursuant to Ground Rule 8.1(a), Respondents identify the following witnesses expected to appear at the hearing, their addresses, whether they are fact or expert witnesses, and a brief outline of each witness' expected testimony. A copy of the curriculum vitae for each of Respondents' expert witnesses is attached hereto as Exhibits A to D. NAME ADDRESS FACT/ OUTLINE OF EXPERT TESTIMONY Gregory W. Davis 143 Clarmarc Dr., Expert Non-Infringement of Accused Frankenmuth, MI 48374 Wiper Blades Of The CAP Respondents; Lack of Domestic Industry (Technical Prong) Donald F. Angi 1840 Wexport Lane, Expert Invalidity of the '988 Patent Commerce Township, MI 48382 NAME ADDRESS FACT/ OUTLINE OF EXPERT TESTIMONY Walter Cempura 1757 Manse Road, Expert Non-Infringement of Accused Waterford, MI Wiper Blades Of The ADM 48328 Respondents; Invalidity of the '218 and '905 Patents; Lack of Domestic Industry (Technical Prong) James Malackowski 200 W. Madison, 37th Expert Lack of Domestic Industry Floor, Chicago, IL (Economic Prong) And 60606 Remedy Paul Wozniak 3255 W.