GENTEX CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Beijing Auto Show 2010 - Carazoo.Com

Apr 26, 2010 16:01 IST The Beijing Auto Show 2010 - Carazoo.com The Beijing Auto Show 2010 has already begun and we bring to you the latest info from the auto show. There were around 2,100 companies from 16 nations and regions exhibiting their products. Today is the day. Yes, today, the event is open to the press. The auto exhibition area's 200,000 square meters are literally adorned with cars, including plenty of concept cars. A new variant of the Mercedes-Benz E-Class will be launched after this China auto show in Beijing. Car makers have already begun targeting emerging markets like Brazil and India. How can China be left behind? The new vehicle launches have already begun at the Beijing auto show in a race to capture China's fast-growing market among loose sales elsewhere. Till around 1995, there were hardly any private cars in China. But now, the scenario is different. The explosive sales growth in the emerging markets has become the highest. Watching the new long-wheelbase sedans from leading luxury brands like Audi and BMW at the Auto Show 2010 is sure going to be a treat to the eyes. An all-new high-powered Ferrari 599 GTO and a V6- powered Porsche Panamera are also going to add excitement. Lamborghini is all set to showcase the special model that it has made exclusively for the Chinese market. Ford is not going to stay behind. It will present its all-new global concept that could be sold in China, Europe or the US. -

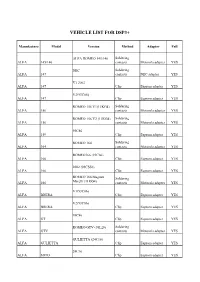

Vehicle List for Dsp3+

VEHICLE LIST FOR DSP3+ Manufacture Model Version Method Adapter Full ALFA ROMEO 145\146 Soldering ALFA 145\146 contacts Motorola adapter YES NEC Soldering ALFA 147 contacts NEC adapter YES V1 2002 ALFA 147 Clip Eeprom adapter YES V2(93C86) ALFA 147 Clip Eeprom adapter YES ROMEO 156 V1(11KG4) Soldering ALFA 156 contacts Motorola adapter YES ROMEO 156 V2 (11KG4) Soldering ALFA 156 contacts Motorola adapter YES 93C86 ALFA 159 Clip Eeprom adapter YES ROMEO 164 Soldering ALFA 164 contacts Motorola adapter YES ROMEO166 (93C66) ALFA 166 Clip Eeprom adapter YES 2002 (93CS56) ALFA 166 Clip Eeprom adapter YES ROMEO 166 Magneti Soldering ALFA 166 Marelli (11KG4) contacts Motorola adapter YES V1(93C86) ALFA BRERA Clip Eeprom adapter YES V2(93C86) ALFA BRERA Clip Eeprom adapter YES 93C86 ALFA GT Clip Eeprom adapter YES ROMEO GTV (05L28) Soldering ALFA GTV contacts Motorola adapter YES GULIETTA (24C16) ALFA GULIETTA Clip Eeprom adapter YES 24C16 ALFA MITO Clip Eeprom adapter YES ROMEO SPIDER (93C86) ALFA SPIDER Clip Eeprom adapter YES ASTON Soldering MATIN DB9 contacts Motorola adapter YES ASTON Soldering MATIN VANTAGE contacts Motorola adapter YES -2001 AUDI A2 clip Eeprom adapter YES 2001- AUDI A2 clip Eeprom adapter YES VDO -2001.7 AUDI A2 Diagnosis-plug OBD adapter YES 07-UP Soldering AUDI A3 contacts JC adapter YES CLEAR EEROR 07-UP AUDI A3 Diagnosis-plug OBD adapter YES 07-UP AUDI A3 Diagnosis-plug OBD adapter YES -2001.7 AUDI A3 Diagnosis-plug OBD adapter YES 2003-2006 AUDI A3 Diagnosis-plug OBD adapter YES MAGNETI MARELLI AUDI A3 Diagnosis-plug -

Products Catalogue

XHORSE PRODUCTS Xhorse Electronics www.xhorse.com CATALOGUE 2019 . 01 ANNUAL PRODUCT Xhorse Electronics www.xhorse.com MANUAL 2019.01 ANNUAL PRODUCT MANUAL Xhorse Electronics 2019.01 www.xhorse.com Xhorse Product Catalogue CONDOR DOLPHIN VVDI I Introduction II III V Key Cutting Machine Series Key Cutting Machine Series Universal Remote Series DOLPHIN XP-005 Company Introduction CONDOR XC-MINI Plus 39 71 VVDI KEY TOOL 03 07 (Automatic Key Cutting machine) (Automatic Key Cutting machine) DOLPHIN XP-007 74 MINI KEY TOOL Patent and software copyright 23 CONDOR XC-002 44 04 (Automatic Key Cutting machine) certificates (Manual Key Cutting machine) 77 Wireless Remote 29 CONDOR XC-003 (Manual Key Cutting machine) 78 Smarty Remote IV VVDI Series 33 CONDOR XC-008 80 Wireless Remote (Manual Key Cutting machine) 47 VVDI 2 35 CONDOR XC-009 85 Wire Remote (Manual Key Cutting machine) 51 VVDI MB TOOL 92 Garage Remote 53 VVDI BMW 95 Renew Adapter 59 VVDI PROG VI Other Product Series 105 Frequency tester 106 VVDI RKE BOX 107 46、4D、48 transponder 02 Company Introduction Certificate Patent and Software Copyright Certificates Xhorse Electronics Co., Ltd. Xhorse Electronics Co., Ltd. is a specialized company which was founded in 2010 with the aim to develop products and services based on intelligent market research and development. It is the leading brand in the automobile security industry. Xhorse has a complete system of independent Certificate NO:26918Q00142R0M Thisistocertifythat Shenzhen Xhorse Electronics Co.,Ltd. intellectual property rights and it is dedicated to providing security products and solutions Unified social credit code: 91440300553867739G Address:2009-2011,Changhong Science and Technology Building, Science Park South Twelfth Road, Nanshan District, Shenzhen, Guangdong, China Hasbeenauditedto conformto thefollowingQualitymanagementsystem worldwide. -

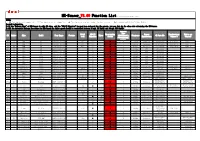

SN. Market Make Model Year Range Feature Model Code OBD

MX-Sensor_V3.09 Function List(Note:For reference only) NOTES: ● This function is supported. ○ This function is not supported. ▲ This function is a new feature in this version. Mark explaining(Red:New,Yellow:Modify) Special Declaration: 1).If the "Relearn Type" of MX-Sensor is only OBD type, and the "OBD-II Function" has not been released for the moment, you can just do the clone for relearning the MX-Sensor. 2).All the Automatic Relearn Procedure for MX-Sensor,the drive speed should be controlled between 16 mph (25 km/h) and 64 mph (100 km/h). Relearn Type Model OBD-II Programming Sensor Manufacturer Number on SN. Market Make Model Year Range Feature Tires (A=Automatic, Frequency OE Part NO. code Function Status Manufactuer Sensor # Sensor# S=Stationary, O=OBD) 103 EU BMW M5 2014/03-2016/06 F10 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 104 EU BMW M6 2014/03-2016/06 F12 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 105 EU BMW M7 2014/03-2016/06 F01 ○ 4 ● A 433Mhz Huf/Beru 36106798872 0532207017 RDE017 2906 EU BYD G5 2014/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2907 EU BYD G6 2013/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2903 EU BYD S7 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2909 EU BYD Sirui 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2904 EU BYD Song 2016/1-2016/12 ○ 4 ● S 433Mhz BYD 6B3609200 2908 EU BYD Surui 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2905 EU BYD Tang 2015/01-2015/12 ○ 4 ● S 433Mhz BYD 6B3609200 2939 EU Cadillac ATS-V 2016/01-2016/12 ○ 4 ● 433Mhz Schrader 20925925 60518416 20925925 2940 EU -

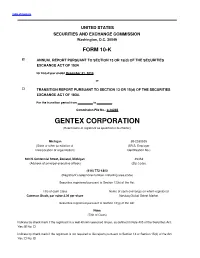

GENTEX CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for fiscal year ended December 31, 2010, or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the transition period from to . Commission File No.: 0-10235 GENTEX CORPORATION (Exact name of registrant as specified in its charter) Michigan 38-2030505 (State or other jurisdiction of (I.R.S. Employer Incorporation of organization) Identification No.) 600 N. Centennial Street, Zeeland, Michigan 49464 (Address of principal executive offices) (Zip Code) (616) 772-1800 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each Class Name of each exchange on which registered Common Stock, par value $.06 per share Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes: No: o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes: o No: Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Renault's Profit Machine Is Called Dacia

A publication from December 2012 Volume 01 | Issue 09 global www.ane-globalmonthly.com monthly Your source for everything automotive. Renault’s profit machine No-frills Dacia makes big money around the world; forces rivals to try to match its success © 2012 Crain Communications Inc. All rights reserved. Inc. Communications Crain © 2012 CEO Mulally March 2012 A publication from global monthly dAtA sees better days Volume 01 | Issue 01 for Ford in Europe New Quattroporte WESTERN EUROPE SALES BY MODEL, 9 MONTHSmarks startbrought of to you courtesy of Maserati’s rebirthwww.jato.com JATO data shows 9 months 9 months Unit Percent 9 months 9 months Unit Percent 2011 2010 change change 2011 2010 change change Europe winners Scenic/Grand Scenic ......... 116,475 137,093 –20,618 –15% A1 ................................. 73,394 6,307 +67,087 – Espace/Grand Espace ...... 12,656 12,340 +316 3% A3/S3/RS3 ..................... 107,684 135,284 –27,600 –20% in first 10 months Koleos ........................... 11,474 9,386 +2,088 22% A4/S4/RS4 ..................... 120,301 133,366 –13,065 –10% Kangoo ......................... 24,693 27,159 –2,466 –9% A6/S6/RS6/Allroad ......... 56,012 51,950 +4,062 8% Trafic ............................. 8,142 7,057 +1,085 15% A7 ................................. 14,475 220 +14,255 – Other ............................ 592 1,075 –483 –45% A8/S8 ............................ 6,985 5,549 +1,436 26% Total Renault brand ........ 747,129 832,216 –85,087 –10% TT .................................. 14,401 13,435 +966 7% RENAULT ........................ 898,644 994,894 –96,250 –10% A5/S5/RS5 ..................... 54,387 59,925 –5,538 –9% RENAULT-NISSAN ........... -

Sc7038 Control Arm 39021716 Buick/Chevrolet Buick Verano /Flagship Cruze

SC7038 CONTROL ARM 39021716 BUICK/CHEVROLET BUICK VERANO /FLAGSHIP CRUZE SC7039 CONTROL ARM 9063362 BUICK/CHEVROLET CHEVROLET CLASSICS CRUZE 15‐ SC7040 CONTROL ARM 9063363 BUICK/CHEVROLET CHEVROLET CLASSICS CRUZE 15‐ SC7041 CONTROL ARM BUICK/CHEVROLET GL8 17 SC7042 CONTROL ARM BUICK/CHEVROLET GL8 17 SC7043 CONTROL ARM 26252503 BUICK/CHEVROLET GL6 SC7044 CONTROL ARM 26252504 BUICK/CHEVROLET GL6 SC7045 CONTROL ARM 22730775 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7046 CONTROL ARM 22730776 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7047 CONTROL ARM 22924235 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7048 CONTROL ARM 22924236 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7049 CONTROL ARM 26249755 BUICK 18 EXCELLE GT SC7050 CONTROL ARM 26249756 BUICK 18 EXCELLE GT SC7051 CONTROL ARM 88955493 CADILLAC SRX 10‐ SC7052 CONTROL ARM 88955494 CADILLAC SRX 10‐ SC7053SATISFACTION CONTROL ARM 22833483 CADILLAC SRX 10‐ SC7054 CONTROL ARM 22833484 CADILLAC SRX 10‐ SC7055 CONTROL ARMWARRANTY 22905357 CADILLAC XTS SC7056 CONTROL ARM 22905358 CADILLAC XTS SC7057 CONTROL ARM 20759935 CADILLAC ATS/ATS L/NEW CTS 127 SC7058 CONTROL ARM 20759936 CADILLAC ATS/ATS L/NEW CTS SC7059 CONTROL ARM 20759980 CADILLAC ATS/ATS L/NEW CTS SC7060 CONTROL ARM 20759981 CADILLAC ATS/ATS L/NEW CTS SC7061 CONTROL ARM 25752929 CADILLAC CTS 05‐07 SC7062 CONTROL ARM 25752930 CADILLAC CTS 05‐07 SC7063 CONTROL ARM 25758282 CADILLAC CTS 05‐07 SC7064 CONTROL ARM 25758283 CADILLAC CTS 05‐07 SC7065 CONTROL ARM 15219467 CADILLAC CTS 08‐13 SC7066 CONTROL ARM 15219468 CADILLAC CTS -

MOTORES CODIGOS 7E

CODIGO MAESTRO DE MOTORES Y TRANSMISIONES CREADO POR: ING. FERNER A. MORALES ABREU AGOSTO 2007-JUNIO 2017 MODEL AÑO CODIGO PETROL ENGINE DIESEL ENGINE TRANSMISION MARCA ACURA 2.5TL 95-98 UA1 2.5L G25A4 B7XA 99-03 UA4 2.5L J25A B7WA / MPYA 2004-2008 UA6 3.2L J32A3 BDGA 2009-present UA8 3.5L J35Z6 BK3A / BK4A CDX 2016-PRESENT 1.5L T 8 speed dual clutch CL 97-99 YA1 3.0L J30A1 / 2.2L F22B1 / 2.3L F23A1 A6VA / B6VA 2001-2003 YA4 3.2L J32A1 / J32A2 (type-s) MGFA CSX 2006-2011 CSX 2.0L K20Z2 / 2.0L D20Z3 (Type-S) MPMA (06-09) / SPCA (10-11) B4RA (97-00) / M4RA (97-98) / S4RA EL 97-00 MB4 1.6L D16Y8 (98-00) BDRA (99-00) 2001-2005 MB5 1.7L D17A2 B46A 1.5L LDA/LEA (hybrid) / 2.0L R20A (auto) M9DA 5 Speed (13-15) / S9FA 5 ILX 2013-Present DE1 / 2.4L K24Z7 (manual) / 2.4L K24W7 (16- speed CVT / M4JA 8 speed (16-) ) INTEGRA 86-89 DA1 1.6L D16A1 CA / P1 1.6L B16A / 1.8L B18A1 / 1.7L B17A1 90-93 DB1 RO / MPRA GS-R / 1.8L B18B1 1.8L B18B1 / 1.8L B18C5 TYPE R / 1.8L 94-99 DB7 B18C VTEC / 1.8L B18C1 / 1.8L B18C3 / MP7A / S4XA 1.8L B18C5 (USA) 2000-2001 DB8 1.8L B18B1 SKWA LEGEND 86-90 KA6 2.5L C25A / 2.7L C27A G4 / L5 / PL5X 92-95 KA8 3.2L C32A MPYA MDX 2001-2006 YD1 J35A3 / J35A5 (04-06) MDKA 2007-2012 YD2 3.7L J37A1 BDKA 2013-Present YD3 3.5L J35Y5 9HP48 (2016-) J4A4 Standard 5 Spd Honda (90-94) / NSX 1990-2005 NSX 3.0L V6 / 3.5L Twin-turbo hybrid SR8M Standard 5 Spd Honda RDX 2007-2012 TB1 2.3L K23A1 Turbo BWEA / BT3A 3.0L J30Y1 (china) / 3.5L J35Y / J35Z2 B8CA (AWD) 6 speed / B8BA 2013- TB2 (2013-2015) FWD 6speed RL 96-98 KA9 3.5L C35A M5DA 99-2004 -

Analysis of the Product Development Process for Geographically Distant Teams in Vehicle Tophat Design Phases By

Analysis of the Product Development Process for Geographically Distant Teams in Vehicle Tophat Design Phases by Antonio Del Puerto Valdez B.S. Mechanical and Electrical Engineering (2001) Instituto Tecnol6gico y de Estudios Superiores de Monterrey Submitted to the System Design and Management Program in Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management ARCHIES at the SSACHUSETTS INSTITUTE MA~ Massachusetts Institute of Technology OF TECHNOLOGY February 2010 JUN 16 2010 C 2010 Antonio Del Puerto Valdez All rights reserved LIBRARIES The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Au or Antonio Del Puerto Valdez System Design and Management Program February 2010 Certified L/ Christopher L. Magee Thesis Supervisor Professor of the Practice of Mechanical Engineering and Engineering Systems Co-Director Nineering Design and A nced Manufacturing (EDAM). MIT-Portugal Program -0 n e-7i ( Y Certified by N...J \v~ Patrick Hale Director System Design & Management Program THIS PAGE IS INTENTIONALLY LEFT BLANK To my mother. A paragonof courage and hard work Muchas gracias. THIS PAGE IS INTENTIONALLY LEFT BLANK Analysis of the Product Development Process for Geographically Distant Teams in Vehicle Tophat Design Phases by Antonio Del Puerto Valdez Submitted to the System Design and Management Program in Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management ABSTRACT The current global economic recession is putting pressure to increase model variation on the carmakers, while at the same time leveraging highly efficient and proven platforms and product development assets globally is becoming critical. -

TRB 05-1960 15 Nov 2004

Automotive CO2 Emissions Characterization by U.S. Light-Duty Vehicle Platform Revised Manuscript for TRB, 15 November 2004 Feng An,1 John DeCicco,2* and Huiming Gong1 1Energy and Transportation Technologies, LLC 42977 Ashbury Drive Novi, MI 48375 248-347-9004 [email protected] [email protected] 2Environmental Defense 6327 Todds Lane Dexter, MI 48130 734-424-3742 [email protected] *corresponding author C:\Documents\Active\CarBur\Platforms\An, DeCicco, Gong -- TRB 05-1960 (15 Nov 2004).doc An, DeCicco, and Gong -- TRB 05-1960 2 ABSTRACT Raising the fuel economy of automobiles to lower carbon dioxide (CO2) emissions affects many aspects of vehicle design. Automakers organize their production using platforms, representing shared engineering across different models. A platform level of aggregation is therefore useful when examining the opportunities for and impacts of redesign. This paper explores the CO2 emissions-related characteristics of major platforms in the U.S. market, using data for model year 2002. The top 30 platforms were found to hold 69% of sales and emit 72% of the annualized CO2 contribution of the model year 2002 new light vehicle fleet. Variations of up to 35% in vehicle weight were observed for models within a given platform. The within-platform variation of CO2 emissions rate ranged up to 45% for all platforms among the top 30, except a platform including diesel engines, which had a 67% variation. Across major platforms, average CO2 emissions rates varied by a factor of 2.3 from lowest to highest. Powertrain efficiency, as indicated by ton-miles per gallon, varied by 40% across platforms, with both the lowest and highest values being seen in truck platforms. -

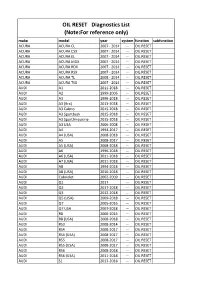

OIL RESET Diagnostics List

OIL RESET Diagnostics List (Note:For reference only) make model year system function subfunction ACURA ACURA CL 2007 - 2014 -- OIL RESET ACURA ACURA CSX 2007 - 2014 -- OIL RESET ACURA ACURA EL 2007 - 2014 -- OIL RESET ACURA ACURA MDX 2007 - 2014 -- OIL RESET ACURA ACURA RDX 2007 - 2014 -- OIL RESET ACURA ACURA RSX 2007 - 2014 -- OIL RESET ACURA ACURA TL 2008 - 2014 -- OIL RESET ACURA ACURA TSX 2007 - 2014 -- OIL RESET AUDI A1 2011-2018 -- OIL RESET AUDI A2 1999-2006 -- OIL RESET AUDI A3 1996-2018 -- OIL RESET AUDI A3 (Bra) 2013-2018 -- OIL RESET AUDI A3 Cabrio 2015-2018 -- OIL RESET AUDI A3 Sportback 2015-2018 -- OIL RESET AUDI A3 Sportlimousine 2015-2018 -- OIL RESET AUDI A3 USA 2006-2008 -- OIL RESET AUDI A4 1994-2017 -- OIL RESET AUDI A4 (USA) 2008-2018 -- OIL RESET AUDI A5 2008-2017 -- OIL RESET AUDI A5 (USA) 2008-2018 -- OIL RESET AUDI A6 1996-2018 -- OIL RESET AUDI A6 (USA) 2011-2018 -- OIL RESET AUDI A7 (USA) 2011-2018 -- OIL RESET AUDI A8 1994-2018 -- OIL RESET AUDI A8 (USA) 2010-2018 -- OIL RESET AUDI Cabriolet 2002-2009 -- OIL RESET AUDI Q1 2017 -- OIL RESET AUDI Q2 2017-2018 -- OIL RESET AUDI Q3 2012-2018 -- OIL RESET AUDI Q5 (USA) 2009-2018 -- OIL RESET AUDI Q7 2005-2016 -- OIL RESET AUDI Q7 USA 2007-2018 -- OIL RESET AUDI R8 2006-2016 -- OIL RESET AUDI R8 (USA) 2008-2018 -- OIL RESET AUDI RS3 2008-2014 -- OIL RESET AUDI RS4 2008-2017 -- OIL RESET AUDI RS4 (USA) 2008-2017 -- OIL RESET AUDI RS5 2008-2017 -- OIL RESET AUDI RS5 (USA) 2008-2017 -- OIL RESET AUDI RS6 2008-2018 -- OIL RESET AUDI RS6 (USA) 2011-2018 -- OIL RESET -

Electric Vehicles | CHINA

Electric vehicles | CHINA INDUSTRIALS / AUTOS & AUTO PARTS NOMURA INTERNATIONAL (HK) LIMITED NEW Yankun Hou +852 2252 6234 [email protected] THEME Action Stocks in focus We believe that various electric vehicles (xEV) are the ultimate solution for the We believe the EV theme will sustainability of the global auto industry. We think current EV technology is not support BYD’s share price, although sophisticated enough to compete with the internal combustion engine, but can be we find it difficult to see upside from applied to niche markets. Penetration in niche markets will probably depend on here without clearer milestones; CSR government policy. We are cutting our rating for BYD to NEUTRAL (from Buy) on could benefit due to its strong R&D possible slower sales of EV products in 2011 and a demanding valuation. We think ability in EV buses. WATG, Tianneng Power, A123, Ningbo Yunsheng and CSR (NEUTRAL) have exposure to the EV theme. Price Catalysts Stock Rating Price target BYD (1211 HK) NEUTRAL 42.75 40.00 Government policies on EV; auto sales volume. CSR (1766 HK) NEUTRAL 10.78 11.20 Anchor themes Downgrading from Buy. Cutting PT. We think the niche auto market, including buses, taxis, and LSEVs, provides the Closing prices as of 12 January 2011; local currency first entry point for EV producers. So near and yet so far Analysts Yankun Hou +852 2252 6234 Technology ready to take off as a niche product [email protected] We believe the current EV technology cannot compete with the conventional internal combustion engine (ICE) on driving experience, but that it is ready to be Ming Xu applied to niche markets, though the speed of penetration depends on government +852 2252 1569 commitment.