No Slide Title

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Helicopter Life

HELICOPTER HELICOPTER SummER 2014 LIFE COVER STORY Flight Show & Tell Guide 4 Macedonian Warrior LIFE Aviation shows and conferences. Carlo Kuit and Paul 32 www.helicopterlife.com Kievit look at the new Summer 2014 / £3.99 The Editor’s Letter 5 types of training for the Macedonian mili - including gyroplanes Aerial Forum 6 & 7 tary Letters to the Editor 10, 21 Flying Crackers 8 & 9 Whirlwind Revisited EC175 Air Test 12 & 13 Derek Jones flies the revamped Westland 40 UK ATC improvements Whirlwind and gives new technological his impression of the developments used by 11 current incarnation, the CAA for ATC while Andrew improvements Whitehouse explains how he came to buy the machine NATO Iceland Going the Distance Alan Norris 14 Mark Radcliffe 46 reports on the Iceland updates us on the Defence Meet, bring - state of his charity for ing together partici - disabled servicemen pants in the Nordic Wings4Warriors Defence Cooperation NATO and non-NATO members Russian Helicopters International News Zhanna Kiktenko 50 The state of helicopter 18 Director of the business around the HeliRussia Expo looks world at the Russian heli - copter scene, and the show held at Crocus Expo in Moscow Russia Round the Singapore Airshow David Oliver 54 World G Hunter-Jones, 26 Model News 58 talks to Michael Farikh about his R66 CAA Legislation changes 59 flight round the world with four friends Accident Reports 64 House & Helicopter 66 HELICOPTER LIFE is the HIGH LIFE HELICOPTER LIFE , Summer 2014 3 S how & T ell T he e diTor ’ S l eTTer G uide HELICOPTER n April 30 2014, EASA lighted the problem that “sixty per - (European Aviation Safety cent of helicopter air ambulance land - Agency) announced that they ing facilities in the UK are ‘inade - 2 June - 4 June 2014 LIFE O had approved certification of the quate’, something that could lead to HELIExPO UK SummER 2014 Sywell Aerodrome, Northamptonshire, UK Robinson R66. -

A Promise Delivered Opens Spares We Have Now Delivered on Our Promise”

The SHOW Daily is Published by SAP MEDIA WORLDWIDE LTD. DAY TWO WEDNESday, 20th FEBRUary, 2008 FROM THE PUBLISHERS OF INTERNATIONAL AEROSPACE Dassault Falcon A Promise Delivered Opens Spares We have now delivered on our promise”. These Centers in “were the words with which Singapore Prime Minister Lee India & China Hsien Loong officially opened assault Falcon will the inaugural Singapore Air- be opening its Falcon show 2008 on Tuesday. Dspares distribution And it was the timely centre in Shanghai, China preparation of a 82-million- and has signed an agree- Singapore dollar new site here ment for spares distribution which evoked such pride, after centre in Mumbai, India. The the Asian Aerospace show left inventory is valued at nearly for Hong Kong in 2006. US$2.2 million in Shanghai and US$1.5 million in Mum- Positive outlook bai and will be in place by Lee also said that despite high the end of March and May fuel prices and the slowdown L - R Jimmy Lau, along with Ho Ching, wife of PM Lee, respectively. in the US economy presenting with Singapore Airport officials Once operational, a stiff challenge for the aero- Dassault Falcon will have space industry, the long-term “The region is expected to said. “With China and India approximately US$8 million outlook looked positive. The lead the growth in air travel, integrating more closely into worth of Falcon spares in the Prime Minister said the signs as the industry’s centre of the global grid, demand for air Asia-Pacific region- nearly are especially encouraging in gravity shifts to the East,” Lee Contd. -

Singapore Prepares for Asia's Biggest Air Show

VOL 5, NO. 1 FEBRUARY 2008 ASIA’S ONLY COMPREHENSIVE INDEPENDENT INDUSTRY PUBLICATION Singapore prepares for Asia’s biggest air show Star Alliance welcomes FAA approves Gulfstream Airservices pursues AsianAviation | FEBRUARY 2008 1 Chinese member airlines synthetic vision green initiatives WHEN IT COMES TO EMISSIONS WE KEEP GOING LOWER AND LOWER. Nobody lowers the emission levels bar as consistently as CFM™ . Current lifetime fleet operations figures and ICAO data support it. Since introducing our high-bypass turbofan to the single aisle market, our commitment to improving fuel burn and reducing emissions has been a matter of record. We have continually lowered CO2, NOx, and noise. Our new Tech Insertion engines are certified as much as 25% below new CAEP6 standards for NOx. Thousands of engines already in service can achieve significant improvements from our ecological, economical upgrade programs. Get the full low-down. Visit CFM56.com now. CFM, CFM56 and the CFM logo are all trademarks of CFM International, a 50/50 joint company of Snecma and General Electric Co. contents >> Regulars VIEWPOINT India’s airlines restructure for profi tability ..................03 22 GENERAL NEWS Boeing’s 787 faces fresh delays ...............................06 AIR TRANSPORT Indonesia sells Merpati stake ................................... 08 DEFENCE Australia tests KC-30 refuelling ............................... 12 12 BUSINESS AVIATION Cessna announces large-cabin jet programme ........ 15 NEWS ANALYSIS Cargo carriers face the music on price fi xing ........... 16 >> Features AAPA urges airlines to boost profi tability ................. 18 29 A380 fi rst fl ight picture exclusive ............................ 22 Australia tackles pilot shortage ................................ 24 16 Singapore positions as aerospace hub ..................... 28 31 RSAF’s future procurement needs ........................... -

International Opportunities in the Aerospace and Defense Sector

International Opportunities in the Aerospace and Defense Sector Presented by Mathew D. Woodlee Senior International Trade Specialist U.S. Commercial Service – Minnesota www.export.gov/minnesota Melissa Grosso Senior International Trade Specialist Global Aerospace & Defense Team Leader U.S. Commercial Service – Connecticut www.export.gov/connecticut Why Export? . Increased sales and profits . Overcoming low growth in the domestic marketplace . Minimizing the effect of seasonal sales fluctuations . Exploiting technology and expertise in foreign markets . Achieving economies of scale . Grow your business . Keep up with the competition • 96% of all customers reside outside the USA Who’s Exporting…? Small- and medium-sized enterprises! • 97% of U.S. exporters are SME’s • Represents 30% of total export value • Most export to only 1 foreign market • Most have fewer than 20 employees U.S. Free Trade Agreements (FTAs) FTAs reduce barriers to U.S. exports, and create a more stable and transparent trading and investment environment, making it easier and cheaper for companies to export their products and services. U.S. FTA Partner Countries . Australia . Bahrain . Chile . CAFTA-DR (Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, & Nicaragua) . Colombia . Israel . Jordan . Morocco . NAFTA: Canada & Mexico . Oman . Panama . Peru . Singapore . South Korea Basic Requirements for Exporting • An exportable product or service • A competitive advantage • The finance to take it to the marketplace • A commitment in making the export project work Your International Team Must be: • Flexible • Committed to travel • Work Independently • Good “Ambassadors” • Technologically Proficient • Culturally Sensitive National Export Initiative . More exports = more jobs - Through the National Export Initiative (NEI), President Obama has announced a goal of doubling exports within five years to support two million job in America . -

Regional Aviation Soars ECN Jan 2013

January 2013 Regional aviation soars in Asia Pacific By Sarah Chew cific’s share of world gross domestic product is projected to expand from Asia, with its booming economic 28 percent today to 36 percent in 2031 growth, improved infrastructure, top with nearly half of the world’s air traf- convention and tourism destinations fic growth driven by travel to, from, or and increased spending is now the within the region. epicentre where changes in global Brisk market growth is expected mobility, operations and markets take to be sustained, as the Association of place. Today, Asia Pacific has some of Southeast Asian Nations (ASEAN) rein- the world’s largest and most efficient forces business and leisure travel ties cargo operators. with China and Taiwan. Growth will The Association of Asia Pacific also be driven by the relaxing of do- Airlines’ (AAPA) 2011 estimates show mestic market regulation within the that Asia Pacific aviation raked in $163 aforementioned countries, with im- billion in revenue with Asia Pacific proved service between capitals, all carriers accounting for 27 percent of leading to a more a cohesive aviation global passenger traffic and 41 percent market. of global cargo traffic. In 2012, airlines Complementing this transition are increased engagement for “ongoing regional air shows which have expanded Photos courtesy of Kingsmen capital investment in fleets, airports tremendously over the last decade. Ma- Asian Pacific-based airlines carriers are responsble for a growing amount of passenger and other services infrastructure” said jor air shows like Aero India, Airshow and cargo traffic each year. Andrew Herdman, director general, China, Asian Aerospace, Indodefence International Maritime and Aerospace to have a strong presence at major air AAPA. -

TCS Showcases Cutting-Edge Solutions at Paris Air Show

JUNE 2007 VOL - 1 ISSUE 2 AeromagAsia TCS showcases Cutting-edge Solutions at Paris Air Show A publication from SIATI in association with Bangalore Excelsior GermanNews_420x273_RZ 12.10.2006 16:33 Uhr Seite 1 Invest in Bavaria www.invest-in-bavaria.com Invest in � Germany’s high-tech location number one Contact State of Bavaria - India Office Mr. John Kottayil Namaste! � Home of BMW, Audi, Siemens, adidas Executive Director � Gateway to Central and Eastern Europe Address Prestige Meridian 2 12th Floor, Unit 1201 � Hosts the European headquarters of various 30, MG Road Bangalore 560 001, India Bavaria important international companies Phone +91 802 / 509-5860 � Broad base of Indian companies like WIPRO, Fax +91 802 / 509-5862 TCS, Reliance, Tata and a great number of Welcome! E-Mail [email protected] Indian midsized companies Internet www.invest-in-bavaria.com Invest in Bavaria – a joint project between the Bavarian Ministry of Economic Affairs, Infrastructure, Transport Invest in Bavaria assists Indian companies to set up their operations in Bavaria – free of charge. and Technology and Bayern International Aeromag Asia A bimonthly publication dedicated to In Aviation & Aerospace Industry Focus Cover Story: Cutting-edge Solutions for Aerospace 6 Niche in QuEST 10 BIAL CEO Albert Brunner: Targeting High Performance Standards 14 Editor’s Note Breathtaking, and truly heartwarming! We were Avi-Oil: Fluid Synergy 21 overwhelmed by the tremendous response to our inaugural issue, hogging the limelight at the Aero India 2007 – the Sixth International Aerospace and Defence Dr CG Krishnadas Nair 47th International Paris Air Show – Le Bourget 2007: Boom & Dazzle 22 Show in Bangalore. -

Singapore Airshow

The SHOW Daily is Published by SAP MEDIA WORLDWIDE LTD. DAY THREE THURSday, 21th FEBRUary, 2008 FROM THE PUBLISHERS OF INTERNATIONAL AEROSPACE Singapore Airshow Flies High Free Power for hen the Singapore Civilian Aircraft Prime Minster said irbus has success- Wthat his government fully tested a fuel cells had delivered a promise by Asystem in flight. For getting the Singapore air show the first time on a commercial off the ground and right on aircraft this innovative energy time-he was perhaps heralding source powered the aircraft’s the sentiment that’s come to back-up hydraulic and electric epitomise the show’s success. power systems. The parting of ways with The test conducted this the Asian Aerospace show has month is part of Airbus’ overall ultimately gifted Singapore with plans for an eco-efficient avia- a mega event that many say is tion industry. It supports the already a resounding success. on-going research to evaluate Raymond Francis of the the potential use and envi- Boeing Company said: “The ronmental benefits of fuel cell show has been a great suc- technology and zero emis- cess and for a first-time event sions power generation in civil organisers have done a great meet our customers and sup- Kee Sum, Eurocopter’s Inter- aviation. job. The facilities are wonder- pliers in the region and take national Media Manager:” Our According to Patrick ful and the new site is a hit. forward our relationships” relationship with the air show Gavin, Airbus Executive Vice The show is proving to be very The new site has injected President Engineering, ‘ Fuel Contd. -

Calendar of Events 2009 - 2010 a U G U St 13 – 15 Aug., Point Roberts Airpark, WA/USA Second Annual Arcport ALTO User Conference at the ARC Hangar

Page 1 of 5 25 July 2009 No. 861 CAL Calendar of Events 2009 - 2010 A u g u st 13 – 15 Aug., Point Roberts Airpark, WA/USA Second Annual ARCport ALTO User Conference at the ARC Hangar. Theme: Scientific airport operations management and planning. Details by e-mail: [email protected] 24 – 27 Aug., Kuala Lumpur/Malaysia Airports International & IQPC conference and worksops on Maximising Non-Aeronautical Revenue through Airport Services. Details online: www.airportrevenuesummit.com 24 – 27 Aug., Arlington, VA/USA 2009 ACI-NA Fall Public Safety & Security Conference organized by ACI-NA at the Ritz-Carlton Pentagon City. Details online: www.aci-na.org S ep tem b er 8 – 10 Sept., Hong Kong Asian Aerospace International Expo and Congress 2009 at the AsiaWorld-Expo complex, adjacent to, and integrated with, the world-beating Hong Kong InternationalAirport (HKIA). Details online: www.asianaerospace.com 13 - 15 Sept., Beijing/China 15th ICAO/World Bank World/Routes Development Forum, co-hosted by Beijing Capital Airports Holding Company (CAH) and Beijing Capital International Airport (BCIA). Details online: www.routesonline.com 14 – 15 Sept., Beijing/China ACED - Aviation: The Catalyst for Economic Development. Conference organized by Insight Media Ltd at the New China International Exhibition Centre (CIEC), collocated with Routes Beijing. Details online: http://www.insightgrp.co.uk/Conference_ACED-2009.html 15 - 16 Sept., Reykjavik/Iceland The Art of Profiling Seminar on behavioural analysis, passive surveillance and active questioning. Details online: www.avsec.com 14 - 16 Sept., Dallas, TX/USA IFSA Annual Conference & Exhibition at the Dallas Sheraton. Details online: www.ifsanet.com 20 – 25 Sept., Dubrovnik/Croatia AMPAP Air Transport System Course, presented in co-operation with ACI Europe and hosted by Dubrovnik International Airport. -

2018 MEDIA KIT Global Coverage

2018 MEDIA KIT Global Coverage. Global Impact. The global news leader covering defense, national security, policy and procurement. Founded in 1986, Defense News is the authoritative, independent news source for the world’s defense decision makers. Dedicated readers include top policy authorities, lawmakers, senior military staff, procurement officials and industry leaders. Through digital, print, and broadcast media as well as in-person events, Defense News provides insightful and in-depth reporting from award-winning journalists and editors from 19 countries on the business, technology, policies and politics of the global defense market. AUDIENCE The world’s senior defense decision-makers and opinion leaders rely on Defense News for independent and accurate reporting on the business, technology and politics of defense. Defense News readers include: • Military leadership and senior armed forces staff • Worldwide procurement and R&D commands • Global legislators, parliaments, and the U.S. Congress • Defense manufacturing and services industry executives • NATO, GCC, ASEAN, and key diplomatic entities • Industry financial analysts • International press corps, research and advocacy organizations • Cyber commands and directorates The Defense News audience oversees $1.76 83% Trillion in annual defense spending of Defense News readers are military and government officials from around the world. Source: Deloitte Touche Tohmatsu Global Consumer & Industrial Products Industry Group, 2015 Source: BPA Brand Report (June 2017) “I value Defense News’ in-depth reporting and intelligent analysis. Defense News’ coverage keeps me up to date on the defense community worldwide and helps me to better serve my constituents at home.” -Sen. Tim Kaine, United States Senate (D-Va.) DIGITAL DefenseNews.com provides essential and up-to-the-minute coverage on breaking events and major developments. -

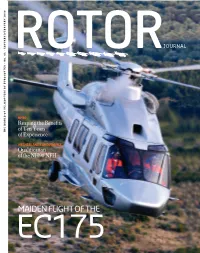

Maiden Flight of the Ec175 Helicopters That Can fly When Others Can’T

JOURNAL . 84 - january/februaryrotor 2010 o n e r - T ers by eurocop T NH90 Reaping the Benefits of Ten Years The world of helicop of Experience NETHERLANDS AND FRANCE Qualification of the NH90 NFH mAideN fLight Of the ec175 Helicopters that can fly when others can’t. Because that’s when you need them most. Fire power and self armour. All-weather capable, supreme agility and formidable nap-of-earth flight ability. Eurocopter military helicopters are built for today’s operations, taking on infiltration, evacuation and rescue missions in hostile environments throughout the world with the maximum discretion. When you think battlefield conditions, think without limits. eurocopter.com ROTOR84_UK_CB.indd 2 06/01/10 11:05 CONTENTS 03 NO.84 05. Up Above Posters 08. At a Glance Eurocopter News in Brief 10. Events Maiden Flight of the EC175 10 UH-72A Production Eurocopter at Helitech and in Dubai © Alexandre Dubath 14. Innovation EC225: An Automatic Pilot for Hover Flights 13 ROTOR 15. Life of the Range JOURNAL Operational Evaluation of the Tiger ARH Qualification of the NH90 NFH 18. NH90 Services Reaping the Benefits of Ten Years THE WORLD OF HELICOPTERS BY EUROCOPTER - NO. 84 JANUARY/FEBRUARY 2010 of Experience NH90: Benefiting from Ten Years of Experience at NETHERLANDS AND FRANCE Qualification of the NH90 NFH Helisim CAMO: New Operational Support MAIDEN FLIGHT OF THE Royal Air Force: Extending the Puma’s Service Life © Ryan Carter EC175 22. Around the World ©ROTOR8 4_UPatrickK_CB.indd 1 Penna 06/01/10 10:59 EC225: An Unforgettable Journey Buckeburg: 26th International Helicopter Forum Publication Director: Olivier Blain, Editorial Director: Monique Colonges, Editor in Chief: Monique Colonges, Assistant Editor: Regina 25. -

Rolls-Royce Opens New Facilities in Singapore

INTERNATIONAL NALYSIS 0 REVIEA & W NOV EMBER - DECEMBER 201 TM AerospaceVOl. 12 NO. 06 13 NovemberNavy 2011 Day 2010 marks DAY 60 ONE years after 1971 victory India and France to Towards Boosting the Filling the Void in Expand The Scope Combat Capabilities of Space Ties the india’s Missile of IAF Defence INTERNATIONAL INTERNATIONAL REVAIE & W NALYSIS AerospaceVOl. 13 NO. 01 JANUARY - FEBRUARY 2011 YSIS EVIEA & W NAL MARCH-APRIL 2011 R AerospaceVOl. 13 NO. 02 t C-130 J IAF Takes Delivery of Firs A SAP MEDIA PUBLICATION Unified Body to Streamline Offset Obligations Reality Show of What DAY Indian Army Is All About Aero India 2011 Supplement Gripen makes strong ONE Boeing’s P8I Lockheed Martin pitch for 11 billion NAL Aims For Saras Enters Build underlines growing dollar order Phase India presence Certification by 2013 A SAP MEDIA PUBLICATION Asian Aerospace A SAP MEDIA 2011 Supplement PUBLICATION www.showdailys.com FROM THE PUBLISHERS OF INTERNATIONAL AEROSPACE Singapore airshow Rolls-Royce opens new underlines premier status facilities in Singapore ingapore Airshow 2012, Asia’s largest olls-Royce, the global Sand one of the three power systems company, most important aerospace and Rofficially opened its defence exhibitions in the largest facilities in Asia, at Seletar world, returns from 14 - 19 Aerospace Park in Singapore. February 2012 at the Changi Constructed on a 154,000 sqm site Exhibition Centre. With new it is the first of its kind to bring and innovative showcases, advanced aerospace high-value high-level conferences, business manufacturing technology to forums and breathtaking aerial Singapore. -

Zirkular Ausgabe 02 Vom 30.04.2009

Zirkular Ausgabe 02 vom 30.04.2009 ALROUND im Messegeschäft Blickpunkte intern: Blickpunkte extern: Cocktails in flight - Tiefer Einbruch am The Air-Tender deutschen Billigflugmarkt ACCESS forscht für TITAL Kreditprogramm der Bundesregierung Inhalt Impressum �������������������������������������������������������������������� 2 Informationen aus dem Bundesministerium für Vorwort des Geschäftsführers ������������������������������������������ 3 Bildung und Forschung ������������������������������������������������ 17 Mitgliederprofil RWTH Aachen Lehrstuhl für "Standortsicherung durch Wandlungsfähige Mensch-Maschine-Interaktion ����������������������������������������� 4 Produktionssysteme" ������������������������������������������������17 Mitgliederprofil Haitec Heico Aviation & Technology AG ��5 Neues Online-Portal zur besseren Transparenz der Forschungsförderung ����������������������������������������17 ALROUND intern ����������������������������������������������������������� 6 Rückblick auf die Aicraft interiors Expo 2009 ���������������6 Informationen aus der EU �������������������������������������������� 18 Crystal Cabin Award ������������������������������������������������6 Eintragung einer Gemeinschaftsmarke wird ALROUND auf der Aircraft interiors Expo 2009 �����������7 ab 1. Mai 2009 billiger �������������������������������������������18 „Cocktails in flight“ war ein viel beachtetes Highlight EU - Vorinformation zu Ausschreibung in GMES – auf dem ALROUND-Stand �����������������������������������������7 Zugang zu Referenzdaten