Occidental Petroleum Corporation Shareholder Proposal of Benta B.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Adams Natural Resources Fund

ADAMS NATURAL RESOURCES FUND FIRST QUARTER REPORT MARCH 31, 2021 GET THE LATEST NEWS AND INFORMATION adamsfunds.com/sign-up L ETTER TO S HAREHOLDERS Dear Fellow Shareholders, Every new year brings with it the opportunity for a fresh start, resolutions for change, and hope for the future. No year in recent history has held greater expectations than 2021. We all hope to put the pandemic behind us and get back to normal. The year began with a new President in the White House and multiple vaccines already starting to be distributed. As the quarter progressed, we made significant strides towards vaccinating the most vulnerable. While we are moving closer to a return to normalcy as the availability of vaccines continues to grow, new COVID-19 variants threaten to slow progress. The economy continued to show signs of recovering as employers added more jobs in the first quarter and the unemployment rate declined to 6.0%. In February, consumer sentiment rose to its highest level since March 2020, when the COVID-19 shutdowns were just beginning. Over the past year, household savings have grown significantly and should begin to flow through the Energy was the best economy as it reopens. performing sector in the S&P 500 as oil prices The passage of a $1.9 trillion stimulus package and a rebounded. commitment of continued support from the Federal Reserve helped drive the stock market higher in the first quarter. The S&P 500 ended the quarter up 6.2%. Improved growth prospects pushed yields on 10-year Treasury notes higher and raised some concerns that the size of the stimulus could lead to higher inflation. -

EDITED TRANSCRIPT Q1 2021 Occidental Petroleum Corp Earnings Call

REFINITIV STREETEVENTS EDITED TRANSCRIPT Q1 2021 Occidental Petroleum Corp Earnings Call EVENT DATE/TIME: MAY 11, 2021 / 5:00PM GMT REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us 1 ©2021 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 11, 2021 / 5:00PM GMT, Q1 2021 Occidental Petroleum Corp Earnings Call CORPORATE PARTICIPANTS Jeff Alvarez Occidental Petroleum Corporation - VP of IR Rob Peterson Occidental Petroleum Corporation - Senior VP & CFO Vicki Hollub Occidental Petroleum Corporation - President, CEO & Director CONFERENCE CALL PARTICIPANTS Dan Boyd Mizuho Securities USA LLC, Research Division - MD & Senior Energy Equity Research Analyst Devin McDermott Morgan Stanley, Research Division - VP, Commodity Strategist for Power Markets & Equity Analyst of Power and Utilities Research Team Doug Leggate BofA Securities, Research Division - MD and Head of US Oil & Gas Equity Research Jeanine Wai Barclays Bank PLC, Research Division - Research Analyst Leo Mariani KeyBanc Capital Markets Inc., Research Division - Analyst Neal Dingmann Truist Securities, Inc., Research Division - MD Neil Mehta Goldman Sachs Group, Inc., Research Division - VP and Integrated Oil & Refining Analyst Paul Cheng Scotiabank Global Banking and Markets, Research Division - Analyst Raphaël DuBois Societe Generale Cross Asset Research - Equity Analyst PRESENTATION Operator Good afternoon, and welcome to the Occidental's First Quarter 2021 Earnings Conference Call. (Operator Instructions) Please note this event is being recorded. I would now like to turn the conference over to Jeff Alvarez, Vice President of Investor Relations. -

Occidental Petroleum Corporation

Occidental Petroleum Corporation Angela Zivkovich HSE Advisor This confidential information presentation (the "Overview") has been prepared by or on behalf of Occidental Petroleum Corporation (the "Company") solely for informational purposes. This Overview is being furnished to the recipient in connection with assessing interest in a potential transaction involving the Company or one or more of its subsidiaries or their respective assets or businesses (the "Potential Transaction"). None of the Company, its affiliates or any of their respective employees, directors, officers, contractors, advisors, members, successors, representatives or agents makes any representation or warranty as to the accuracy or completeness of this Overview, and shall have no liability for this Overview or for any representations (expressed or implied) contained in, or for any omissions from, this Overview or any other written or oral communications transmitted to the recipient in the course of its evaluation of the Potential Transaction. This Overview does not purport to contain all of the information that may be required or desirable to evaluate all of the factors that might be relevant to a potential investor, and any recipient hereof should conduct its own due diligence investigation and analysis in order to make an independent determination of the suitability and consequences of any action, including submission of a bid, in connection with the Potential Transaction. The Company reserves the right to amend, update or replace all or part of the information in this Overview at any time, but the Company shall not be under any obligation to provide any recipient of this Overview with any amended, updated or replacement information or to correct any inaccuracies herein which may become apparent. -

PROXY MEMORANDUM To: Occidental Petroleum Shareholders

PROXY MEMORANDUM To: Occidental Petroleum Shareholders Subject: 2016 Proxy Statement – Item No. 5: Stockholder Proposal Regarding Carbon Legislation Impact Assessment Date: March 31, 2016 Contact: Anita Green, Wespath Investment Management, 847-866-5287, [email protected] or Laura Campos, Nathan Cummings Foundation, 212-787-7300, [email protected] Wespath Investment Management (Wespath) and the Nathan Cummings Foundation co-filed Proxy Item No. 5, Stockholder Proposal Regarding Carbon Legislation Impact Assessment. The proposal will be voted on at the April 29, 2016 Annual Meeting of Occidental Petroleum Corporation (Occidental). Resolved Shareholders request that commencing in 2016 Occidental Petroleum Corporation, with board oversight, publishes an annual assessment of long-term portfolio impacts of public climate change policies, at reasonable cost and omitting proprietary information. The report should explain how current capital planning processes and business strategies incorporate analyses of the short- and long-term financial risks of a lower carbon economy. Specifically, the report should outline how the company is evaluating the impacts of fluctuating demand and price scenarios on the company’s existing reserves and resource portfolio - including the International Energy Agency’s “450 Scenario,” which sets out an energy pathway consistent with the internationally recognized goal of limiting the global increase in temperature to 2 degrees Celsius. Wespath and the Nathan Cummings Foundation encourage shareholders -

Construction to Start by Year's End Conocophillips Strikes $9.7B Deal

Leading Utica Producer Gulfport in Restructuring Talks with Lenders.............................2 Tuesday, October 20, 2020 - Vol. 11, No. 13 PERMIAN BASIN ConocoPhillips Strikes $9.7B Deal to Buy Concho, Create Permian Behemoth ConocoPhillips on Monday announced it is taking over Concho Resources Inc. for $9.7 billion in stock, forming a giant in the Permian Basin that would rival the output of the biggest players in the nation’s most produc- tive oilfield. Concho, a Permian pure-play, is the fifth-largest producer by volume in the massive field. The combina- tion marks the largest Lower 48 industry acquisition an- nounced since the pandemic arrived in the United States in March. The deal would elevate ConocoPhillips into a small pool of dominant players in the Permian, joining Trade Date: Oct 19; Flow Date(s): Oct 20 …cont' pg. 2 leaders such as Occidental Petroleum Corp. and Basin/Region Range Avg Chg Vol Deals Gulf Coast Barnett 2.130-2.300 2.260 0.175 198 38 BAKKEN SHALE Eagle Ford 2.650-2.850 2.685 0.270 348 57 Haynesville - E. TX 2.150-2.370 2.280 0.205 1,807 290 North Dakota Sees Oil, Natural Gas Haynesville - N. LA 2.300-2.360 2.315 0.255 162 36 Permian1 -0.750-2.100 -0.245 0.050 668 144 Production Climb in August Tuscaloosa Marine Shale 2.300-2.360 2.340 0.200 424 68 North Dakota oil and natural gas production shot up Midcontinent Arkoma - Woodford 2.100-2.280 2.200 0.160 188 32 in August along with gas capture volumes, but the produc- Cana - Woodford 2.400-2.550 2.470 0.445 64 13 tion surge is expected to fall back and continue declining Fayetteville 2.290-2.300 2.295 0.245 126 30 Granite Wash* 2.010-2.360 2.295 0.235 857 162 by the end of the year. -

The Annual Performance Indicators Summary

Occidental Petroleum Corporation 2019 2018 2017 2016 Environmental and Climate 1 Greenhouse Gas (GHG) Emissions (million metric ton CO2 equivalent)--Occidental Total GHGs (Scope 1 + 2) operated basis 28.37 23.02 22.84 22.84 Total GHGs (Scope 1 + 2) equity basis 17.82 14.46 14.65 15.26 Direct GHGs (Scope 1) operated basis 21.95 16.98 16.84 16.29 Direct GHGs (Scope 1) equity basis 13.76 10.37 10.54 10.49 Indirect GHGs (Scope 2) operated basis 6.42 6.04 6.00 6.55 Indirect GHGs (Scope 2) equity basis 4.06 4.10 4.11 4.77 2 GHG Emissions Intensity (metric tons CO2e/BOE)--Oil & Gas Direct GHG intensity (Scope 1) operated basis 0.0186 0.0262 0.0293 0.0540 Direct GHG intensity (Scope 1) equity basis 0.0186 0.0225 0.0260 0.0240 Indirect GHG intensity (Scope 2) operated basis 0.0055 0.0091 0.0099 0.0192 Indirect GHG intensity (Scope 2) equity basis 0.0055 0.0095 0.0101 0.0104 GHG Emissions Intensity (metric tons CO2e/MT)--OxyChem Direct GHG intensity (Scope 1) operated basis 0.515 0.471 0.480 0.526 Indirect GHG intensity (Scope 2) operated basis 0.164 0.176 0.186 0.251 Methane Emissions (CH4) (thousand metric tons) Methane Emissions operated basis--Occidental total1 112.05 61.04 46.75 49.93 Methane Emissions, Operated basis--Oil & Gas 72.67 60.92 46.63 49.81 Methane Emissions, Operated basis -- OxyChem 0.11 0.12 0.12 0.12 Methane Emissions, Operated basis -- Western Midstream 39.27 N/A N/A N/A Methane Emissions (CH4) Intensity Methane Emissions Intensity--Oil & Gas, operated basis (% of marketed gas)3 0.51 0.64 0.59 0.67 Methane Emissions Intensity--OxyChem -

Third Quarter Earnings Conference Call Occidental Petroleum Corporation November 05, 2019 Cautionary Statements

Third Quarter Earnings Conference Call Occidental Petroleum Corporation November 05, 2019 Cautionary Statements Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements about Occidental Petroleum Corporation’s (“Occidental”) expectations, beliefs, plans or forecasts. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties, many of which involve factors or circumstances that are beyond Occidental’s control. Actual results may differ from anticipated results, sometimes materially, and reported or expected results should not be considered an indication of future performance. Factors that could cause actual results to differ include, but are not limited to: the extent to which Occidental is able to successfully integrate Anadarko Petroleum Corporation (“Anadarko”), manage expanded operations, including Western Midstream Partners, LP (“WES”), and realize the anticipated benefits of combining Occidental and Anadarko; Occidental’s ability to successfully complete the sale of the remaining assets, liabilities, businesses and operations of the Africa assets to Total S.A. (“Total”); global commodity pricing fluctuations; supply and demand considerations for Occidental’s products; higher-than-expected costs; the regulatory approval environment; not successfully completing, or any material delay of, field -

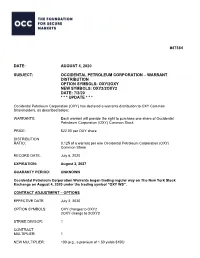

Occidental Petroleum Corporation – Warrant Distribution Option Symbols: Oxy/2Oxy New Symbols: Oxy2/2Oxy2 Date: 7/2/20 * * * Update * * *

#47384 DATE: AUGUST 4, 2020 SUBJECT: OCCIDENTAL PETROLEUM CORPORATION – WARRANT DISTRIBUTION OPTION SYMBOLS: OXY/2OXY NEW SYMBOLS: OXY2/2OXY2 DATE: 7/2/20 * * * UPDATE * * * Occidental Petroleum Corporation (OXY) has declared a warrants distribution to OXY Common Shareholders, as described below: WARRANTS: Each warrant will provide the right to purchase one share of Occidental Petroleum Corporation (OXY) Common Stock PRICE: $22.00 per OXY share DISTRIBUTION RATIO: 0.125 of a warrant per one Occidental Petroleum Corporation (OXY) Common Share RECORD DATE: July 6, 2020 EXPIRATION: August 3, 2027 GUARANTY PERIOD: UNKNOWN Occidental Petroleum Corporation Warrants began trading regular way on The New York Stock Exchange on August 4, 2020 under the trading symbol “OXY WS”. CONTRACT ADJUSTMENT – OPTIONS EFFECTIVE DATE: July 2, 2020 OPTION SYMBOLS: OXY changes to OXY2 2OXY change to 2OXY2 STRIKE DIVISOR: 1 CONTRACT MULTIPLIER: 1 NEW MULTIPLIER: 100 (e.g., a premium of 1.50 yields $150) NEW DELIVERABLE PER CONTRACT: 1) 100 Occidental Petroleum Corporation (OXY) Common Shares 2) 12 Occidental Petroleum Corporation Warrants (no longer subject to delayed settlement) 3) Cash in lieu of 0.5 fractional OXY WS Warrants SETTLEMENT ALLOCATION: OXY: 95% OXY WS: 5% CUSIPS: OXY: 674599105 OXY WS: 674599162 THE SETTLEMENT ALLOCATION OF THE TOTAL STRIKE PRICE AMOUNT IS BEING PROVIDED SOLELY FOR THE PURPOSE OF THE INTERFACE BETWEEN OCC AND THE NATIONAL SECURITY CLEARING CORPORATION (NSCC), AND IS NOT INTENDED TO BE USED FOR ANY OTHER PURPOSE, TRANSACTION OR CUSTOMER ACCOUNT STATEMENTS. PRICING Until the cash in lieu amount is determined, the underlying price for OXY2/2OXY2 will be determined as follows: OXY2 = OXY + 0.125 (OXY WS) DELAYED SETTLEMENT The OXY component of the OXY2/2OXY2 deliverable has settled through National Securities Clearing Corporation (NSCC). -

In the Court of Chancery of the State of Delaware

EFiled: May 30 2019 09:00AM EDT Transaction ID 63306110 Case No. 2019-0403- IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE HIGH RIVER LIMITED ) PARTNERSHIP, ICAHN PARTNERS ) C.A. No.: _____________ MASTER FUND LP, and ICAHN ) PARTNERS LP, ) ) Plaintiffs, ) ) v. ) ) OCCIDENTAL PETROLEUM ) CORPORATION, ) ) Defendant. ) VERIFIED COMPLAINT PURSUANT TO 8 DEL. C. § 220 Plaintiffs High River Limited Partnership, Icahn Partners Master Fund LP, and Icahn Partners LP (collectively, “Plaintiffs” or the “Icahn Parties”), upon knowledge as to themselves, and upon information and belief as to all other matters, allege for their Verified Complaint as follows: I. Introduction. 1. This is an action to inspect certain books and records of Occidental Petroleum Corporation (“Occidental” or the “Company”), relating to its fundamentally misguided and hugely overpriced acquisition of Anadarko Petroleum Corporation (“Anadarko”) after a bidding contest between the Company and Chevron Corporation (“Chevron”). Unfortunately for the stockholders of {01453621;v1 } Occidental, it won that contest even though Chevron is approximately six time’s Occidental’s size (with Anadarko being only slightly smaller than Occidental). 2. With its financial strength Chevron could have matched Occidental’s winning bid and won the contest for Anadarko (it held matching rights) but refused to do so. According to the May 10, 2019 Wall Street Journal, Chevron’s CEO acknowledged that Chevron had the resources to match Occidental’s bid, but would not do so because, “Costs and capital discipline always matter. An increased offer would have eroded value to our shareholders and it would have diminished our returns on capital.” 3. The same was true for Occidental—but the Occidental board and management took the diametrically opposed approach. -

Todd A. Stevens President and CEO California Resources Corporation

Todd A. Stevens President and CEO California Resources Corporation Todd A. Stevens is President and Chief Executive Officer and a Director of California Resources Corporation, California’s largest independent oil and natural gas producer. As CEO, Mr. Stevens focuses on strengthening the balance sheet, enhancing margins, and operating CRC’s resilient asset base. CRC’s entire workforce is Californian, and he drives the company’s commitment to the communities where employees live and CRC operates. Prior to CRC, Mr. Stevens worked for 20 years in various management positions at Occidental Petroleum Corporation and most recently served as Vice President, Corporate Development. During his career with Occidental, he led most of Occidental’s growth initiatives and his responsibilities included mergers and acquisitions, evaluating and developing finance-related strategic and business opportunities, restructuring alternatives and asset dispositions, land management activities and worldwide exploration activities. He earned a Masters of Business Administration degree from the University of Southern California after graduating from the United States Military Academy, West Point, with a Bachelor of Science degree. Mr. Stevens serves as a Director on the following boards: Boys and Girls Club of Santa Clarita Valley, Henry Mayo Newhall Hospital, Los Angeles Sports and Entertainment Commission Advisory Board, Santa Clarita Valley Economic Development Corporation, Santa Clarita Valley Sheriff’s Foundation, Val Pac (San Fernando Valley Business Political Action Committee), Southern California Leadership Council, USC Marshall School of Business Corporate Advisory Board, USC Viterbi School of Engineering Advisory Board, and the Board of Counselors, Master of Business for Veterans Programs at USC. . -

Three to Join Petroleum Hall of Fame

VOL. XXXXV No. 1 First Quarter 2017 . r n J e o , n The Petroleum Hall of Fame is s r e p u n a o dedicated to those who cherished m h b o S h w c T e the freedom to dare, and whose M o M . e l . B work and service helped develop C W h s s p e ti the Permian Basin. e r s m u o a J J C Three to Join Petroleum Hall of Fame hree pioneering Permian Basin oil men will Mewbourne lives in Tyler and is commited to children and ed - be joining 142 other members of the Petro - ucation. He provided funding for the Mewbourne Hall of Mathe - leum Hall of Fame during the induction cere - matics and Science at All Saints Episcopal School in Tyler and at St. mony on Tuesday, May 9, at the Petroleum John’s School in Houston. He has endowed seven Mewbourne Club. The Class of 2017 includes Joseph B. Chairs in Petroleum Engineering at OU, as well as the Mewbourne TMcShane, Jr., Curtis W. Mewbourne and James Cleo Thompson. Professorship in Petroleum Engineering. Mewbourne Oil Co. is the JOE MCSHANE was born in San Antonio in 1929, attended Trin - largest supporter of student scholarships and internships over the ity University and then the University of Texas, graduating with a past 25 years at OU. bachelor’s degree in petroleum engineering in 1952. He moved to JAMES CLEO THOMPSON was born in 1930 in Dallas. In 1948 West Texas where he spent his career in the petroleum industry, he entered Southern Methodist University where he studied engi - primarily in waterflood development in the Permian Basin. -

Effective Tax Rates for Oil and Gas Companies

Effective Tax Rates of Oil and Gas Companies: Cashing in on Special Treatment July 2014 Table of Contents Page Results in Brief …………………………………………………………………….. 3 Discussion ……………………………………………………………………………. 4 Conclusion …………………………………………………………………………… 6 Notes …………………………………………………………………………………… 6 U.S. Federal Effective Tax Rates, 2009-2013 …………………………… 7 Foreign Effective Tax Rates, 2009-2013 ………………………………..... 8 Deferred Tax Liabilities from Property, Plant, and Equipment in 2012 and 2013……………………………………………………………………….. 9 Appendix: Company Profiles ExxonMobil Corporation ……………………………………………......... 10 ConocoPhillips …………………………………………………………………. 12 Occidental Petroleum Corporation …………………………………….. 14 Chevron Corporation ………………………………………………………… 15 Anadarko Petroleum Corporation ………………………………………. 17 Chesapeake Energy Corporation …………………………………......... 19 EOG Resources, Inc. …………………………………………………........ 20 Devon Energy Corporation …………………………………………......... 22 Apache Corporation ………………………………………………………….. 23 Pioneer Natural Resources Company ………………………………….. 25 Continental Resources, Inc. ……………………………………………… 27 Marathon Oil Corporation …………………………………………………. 28 Hess Corporation ……………………………………………………………… 29 Range Resources Corporation ……………………………………………. 30 Plains Exploration & Production Company …………………………. 31 SandRidge Energy, Inc. ……………………………………………………. 33 Whiting Petroleum Corporation …………………………………………. 34 Denbury Resources, Inc. ………………………………………………….. 35 Noble Energy, Inc. …………………………………………………………… 36 Concho Resources Inc. …………………………………………………….. 37 Company Notes …………………………………………………………………