Hostess Brands Inc.: a Case Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DATE: 7/7/2021 Standard Distributing Co. Page 1 ALLIGATOR ICE PRODUCTS 40 CIGARS-PHILLIES 7 ANTACIDS 33 CIGARS-SWISHER SWEET 7

DATE: 7/7/2021 Standard Distributing Co. Page 1 Index ALLIGATOR ICE PRODUCTS 40 CIGARS-PHILLIES 7 ANTACIDS 33 CIGARS-SWISHER SWEET 7 AUTOMOTIVE-ADDITIVES/FLUIDS 36 CIGARS-U.S. CIGAR 7 AUTOMOTIVE-MISCELLANEOUS 36 CIGARS-WHITE OWL 7 BABY NEEDS 34 COFFEE/BEVERAGE (STORE USE) 40 BAND AIDS/ SWABS 34 COFFEE/TEA/COCOA 23 BAR SUPPLIES 35 COLD/SINUS/ALLERGY RELIEF 33 BARBEQUE/HOT SAUCE 22 CONDENSED MILK 23 BATTERIES/FLASHLIGHTS 35 CONDOMS 34 BEVERAGE, CARBONATED 30 CONVENIENCE VALET 32 BEVERAGE, MISCELLANEOUS 31 COOKIES 20 BEVERAGE, MIXERS 30 COOKING OIL 23 BLEACH/FABRIC SOFTENER 24 COUGH DROPS 33 BOTTLED WATER 32 CRACKERS 21 BOWLS/PLATES/UTENSILS 37 CUPS 36 BREAD/BUNS 27 CUPS & LIDS-COFFEE/JAVA CLASSICS 37 BREAD/DOUGH MIXES 23 CUPS & LIDS-COFFEE/REFRESH EXP 37 CAKE/FROSTING MIXES 23 CUPS & LIDS-PLASTIC 37 CANDY-BAGS 15 CUPS/PLATES/BOWLS/UTENSILS(RESELL) 24 CANDY-BAGS, SUGARFREE 17 DELI-ADV PIERRE PRODUCTS 29 CANDY-KING SIZE 13 DELI-ASIAN FOOD 29 CANDY-MISCELLANEOUS 14 DELI-BEEF PATTY,COOKED 29 CANDY-STANDARD BARS 11 DELI-BEEF/PORK, RAW 29 CANDY-XLARGE BARS 14 DELI-BREAD/DOUGH PRODUCTS FRZN 30 CANDY-45 TO 10 CENT 12 DELI-BREADED BEEF,RAW 29 CANDY-5 TO 2 CENT 13 DELI-BREADED CHICKEN,COOKED 28 CANNABIDIOL PRODUCTS 32 DELI-BREADED CHICKEN,RAW 28 CANNED FRUITS 21 DELI-BREADED VEGETABLES 29 CANNED MEATS/FISH 21 DELI-BREAKFAST FOOD 29 CANNED VEGETABLES 21 DELI-CORNDOGS 29 CAT FOOD 24 DELI-MEXICAN FOOD 29 CEREALS, COLD 23 DELI-OTHER FROZEN 29 CEREALS, HOT 23 DELI-POTATO PRODUCTS 29 CHAMPS CHKN BOXES/BAGS 41 DELI-PREPARED PIZZA 30 CHAMPS CHKN DELI 30 -

Downloaded from by IP Address 192.168.160.10 on 06/22

How new owners turned Twinkies into solid gold While Americans rejoiced when Twinkies reappeared on store shelves in the summer of 2013, nobody has had more reason for celebration than Metropoulos & Co. and Apollo Global Management LLC (together “M&A”), which purchased Hostess Brands out of bankruptcy liquidation just months earlier. The tale of Hostess’ beginning, demise (twice) and rise from the ashes is a fascinating case study of iconic brands, mismanagement and human tragedy and how “private equity”/buyout firms can make mind-boggling sums in the blink of an eye. The first Hostess cupcake was created in 1919 and the Hostess brand was founded in 1925 when Continental Baking bought Taggart bakery, the maker of Wonder Bread. Twinkies were invented by James Dewar in 1930 as a cheap bakery item during the Depression and became an instant hit. Ding Dongs and Ho Hos were introduced in 1967 and Interstate Baking Co. acquired Continental in 1995. Interstate filed for Chapter 11 bankruptcy protection in 2004. According to The Atlantic, the company was “collapsing under the weight of flagging sales, overly generous union contracts replete with ridiculous work rules and gobs of debt.” Under Chapter 11, Interstate continued to operate while attempting to “reorganize” its debts and business. Interstate emerged from bankruptcy in 2009, with private equity firm Ripplewood Holdings paying $130 million for control (and hedge funds Silver Point Capital and Monarch Alternative Capital providing $360 million of debt financing) and the company’s two major unions, the Teamsters and the Bakery, Confectionary, Tobacco Workers and Grain Millers International Union contributing $110 million in annual wage and benefit concessions. -

Deal of the Week: Hostess Sells Twinkies Brand for $410M

Deal of the Week: Hostess Sells Twinkies Brand for $410M Announcement Date March 12, 2013 Acquirer Apollo Global Management, Metropoulos & Company Acquirer Descriptions Apollo Global Management is a publicly owned investment manager C. Dean Metropoulos & Co. is a principal investment firm seeking to invest in the consumer branded products industries Target Hostess Brands (Twinkies, Ho Hos, Sno Balls, Dolly Madison Zingers) Target Description Operates as a wholesale baker and distributor of bread and snack cakes in the United States Founded in 1930 and based in Irving, Texas Target Financial Stats Mkt Cap: NM EV: $648.5 million LTM EBITDA: ($0.3) million EV / LTM EBITDA Multiple: NM Price / Consideration Price: $410 million Consideration: Cash Rationale The deal includes five Hostess factories, which the buyers hope to restart so to begin restocking store shelves by the summer. The new company will almost certainly feature the Hostess name Apollo and Metropoulos emerged from a crowded field of international food giant and private equity firm bidders for the brands. At one point, more than 100 parties had expressed interest in Twinkies Hostess Brands said private equity firms Apollo and Metropoulos set a baseline offer of $410 million to buy the company’s snack cake brands back in January, the stalking horse bid On Monday, March 11th, the deadline for submitting competing bids, Hostess notified the U.S. Bankruptcy Court for the Southern District of New York in White Plains that it had not received any other offers and would sell the brands to the stalking horse Advisers to Hostess canceled an auction scheduled for Wednesday morning and declared the winners The sale requires the approval of the federal bankruptcy judge overseeing the Chapter 11 case Comments Metropoulos & Company owns Pabst Blue Ribbon and Vlasic pickles C. -

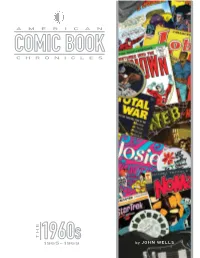

By JOHN WELLS a M E R I C a N C H R O N I C L E S

AMERICAN CHRONICLES THE 1965-1969 by JOHN WELLS Table of Contents Introductory Note about the Chronological Structure of American Comic Book Chronicles ................. 4 Note on Comic Book Sales and Circulation Data.......................................... 5 Introduction & Acknowledgements ............ 6 Chapter One: 1965 Perception................................................................8 Chapter Two: 1966 Caped.Crusaders,.Masked.Invaders.............. 69 Chapter Three: 1967 After.The.Gold.Rush.........................................146 Chapter Four: 1968 A.Hazy.Shade.of.Winter.................................190 Chapter Five: 1969 Bad.Moon.Rising..............................................232 Works Cited ...................................................... 276 Index .................................................................. 285 Perception Comics, the March 18, 1965, edition of Newsweek declared, were “no laughing matter.” However trite the headline may have been even then, it wasn’t really wrong. In the span of five years, the balance of power in the comic book field had changed dramatically. Industry leader Dell had fallen out of favor thanks to a 1962 split with client Western Publications that resulted in the latter producing comics for themselves—much of it licensed properties—as the widely-respected Gold Key Comics. The stuffily-named National Periodical Publications—later better known as DC Comics—had seized the number one spot for itself al- though its flagship Superman title could only claim the honor of -

Hostess Brands, Inc

Filed Pursuant to Rule 424(b)(3) Registration No. 333- 219149 PROSPECTUS HOSTESS BRANDS, INC. 19,000,000 Warrants to Purchase 9,500,000 Shares of Class A Common Stock 9,500,000 Shares of Class A Common Stock The selling warrantholders named in this prospectus (the “Selling Warrantholders”) may offer and sell from time to time up to 19,000,000 warrants (“Private Warrants”) to purchase shares of our Class A common stock par value $0.0001 per share (“Class A Common Stock”). The Private Warrants are exercisable to purchase an aggregate of 9,500,000 shares of Class A Common Stock at an exercise price of $5.75 per half share of Class A Common Stock. Upon the sale or distribution of the Private Warrants as described herein, the Private Warrants will become fungible with our public warrants to purchase Class A Common Stock (“Public Warrants”) and we expect these transferred Private Warrants (“Transferred Warrants”) will trade under the same CUSIP and ticker symbol as the Public Warrants on the NASDAQ Capital Market (“NASDAQ”). In addition, this prospectus relates to the issuance by us of up to 9,500,000 shares of our Class A Common Stock that are issuable upon the exercise of Transferred Warrants. We are not selling any Private Warrants in this offering and will not receive any proceeds from the sale of Private Warrants by the Selling Warrantholders pursuant to this prospectus, but will receive $5.75 per half-share upon the exercise of any Transferred Warrants. We will pay the expenses, other than any underwriting discounts and commissions, associated with the sale of Private Warrants and shares pursuant to this prospectus. -

Grocery Goliaths

HOW FOOD MONOPOLIES IMPACT CONSUMERS About Food & Water Watch Food & Water Watch works to ensure the food, water and fish we consume is safe, accessible and sustainable. So we can all enjoy and trust in what we eat and drink, we help people take charge of where their food comes from, keep clean, affordable, public tap water flowing freely to our homes, protect the environmental quality of oceans, force government to do its job protecting citizens, and educate about the importance of keeping shared resources under public control. Food & Water Watch California Office 1616 P St. NW, Ste. 300 1814 Franklin St., Ste. 1100 Washington, DC 20036 Oakland, CA 94612 tel: (202) 683-2500 tel: (510) 922-0720 fax: (202) 683-2501 fax: (510) 922-0723 [email protected] [email protected] foodandwaterwatch.org Copyright © December 2013 by Food & Water Watch. All rights reserved. This report can be viewed or downloaded at foodandwaterwatch.org. HOW FOOD MONOPOLIES IMPACT CONSUMERS Executive Summary . 2 Introduction . 3 Supersizing the Supermarket . 3 The Rise of Monolithic Food Manufacturers. 4 Intense consolidation throughout the supermarket . 7 Consumer choice limited. 7 Storewide domination by a few firms . 8 Supermarket Strategies to Manipulate Shoppers . 9 Sensory manipulation . .10 Product placement . .10 Slotting fees and category captains . .11 Advertising and promotions . .11 Conclusion and Recommendations. .12 Appendix A: Market Share of 100 Grocery Items . .13 Appendix B: Top Food Conglomerates’ Widespread Presence in the Grocery Store . .27 Methodology . .29 Endnotes. .30 Executive Summary Safeway.4 Walmart alone sold nearly a third (28.8 5 Groceries are big business, with Americans spending percent) of all groceries in 2012. -

Interstate Bakeries C O R P O R a T I

INTERSTA TE BAKERIES CORPORATION Building for the future 1999 Annual Report Interstate Bakeries Corporation is the largest wholesale baker and distributor of fresh delivered bread and snack cakes in the United States. The Company has three major divisions — the Western Division, headquartered in Phoenix, Arizona; the Central Division, headquartered in Kansas City, Missouri; and the Eastern Division, headquartered in Charlotte, North Carolina. The Company also sells dry products. The Company operates 67 bakeries throughout the United States and employs more than 34,000 people. From these strategically dispersed bakeries, the Company’s sales force delivers baked goods to more than 200,000 food outlets on approximately 11,000 delivery routes. The Company’s products are distributed throughout the United States, primarily through its direct route system and approximately 1,500 Company- operated thrift stores, and to some extent through distributors. The IBC product line is marketed under a number of well-known national and regional brands, which include Wonder, Hostess, Home Pride, Drake’s, Beefsteak, Bread du Jour, Dolly Madison, Butternut, Merita, Parisian, Colombo, Sunbeam, Millbrook, Eddy’s, Holsum, Sweetheart, Cotton’s Holsum, J.J. Nissen, Marie Callender’s and Mrs. Cubbison’s. In addition, the Company is a baker and distributor of Roman Meal and Sun Maid bread. Financial Highlights Net Sales (In Millions) $3,500 (In Thousands, Except Per Share Data) 52 Weeks Ended 52 Weeks Ended 52 Weeks Ended $3,450 May 29, 1999 May 30, 1998 May 31, -

Wait, So What Is a Hipster? by Sage Weber Schools Sports

2 For lefties only! By Megan Lance It’s a well-known while left-handed people had more trou- ing Redbird Writer fact that people ble. Lefties also were proven to be more amount used to try to force inhibited, and spend hours on basic deci- of more their children to be right-handed, even if sions. Then, worrying afterwards that acci- they weren’t. However, were they wrong they’d made the wrong choice. dents. for doing so? Is being left-handed in a We’re screwed at school! Al- Is this Volume 70 Issue 6 world that is 90% right-handed a disad- though it’s not as bad as it used to be, because Twinkie turnover December 11th, 2012 vantage? Studies show that yes, this is teachers in one day and age used to beat we’re By Alexis Boyer Depending on how far you in their career, traveling back to a fa- the case. Why? left-handed kids with paddles to get fatally Obviously, hating them is in- them to do things the “right” way, pun Redbird Writer live from the institution of your miliar place is obviously much easier grained in our culture. Well, maybe not intended. If you are right-handed, you’re I intend to choice, traveling to and from your the closer you are. home/to and from the school or to “Depending on endowments America’s culture so much as the rest of probably not aware that there are right- clumsy? Well, probably not. Think enroll in an in-state university. -

Hostess Brands, Inc. Bankruptcy

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Chapter 11 Bankruptcy Case Studies College of Law Student Work Spring 2013 Hostess Brands, Inc. Bankruptcy Kathryn K. Ganier Frederick L. Conrad III Wendy G. Patrick Follow this and additional works at: https://trace.tennessee.edu/utk_studlawbankruptcy Part of the Bankruptcy Law Commons, and the Business Law, Public Responsibility, and Ethics Commons Recommended Citation Ganier, Kathryn K.; Conrad, Frederick L. III; and Patrick, Wendy G., "Hostess Brands, Inc. Bankruptcy" (2013). Chapter 11 Bankruptcy Case Studies. https://trace.tennessee.edu/utk_studlawbankruptcy/6 This Article is brought to you for free and open access by the College of Law Student Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chapter 11 Bankruptcy Case Studies by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Hostess Brands, Inc. Bankruptcy Workouts and Reorganizations – Professor Kuney Spring 2013 Kathryn K. Ganier*, Frederick L. Conrad III**, and Wendy G. Patrick*** * Kathryn K. Ganier is a student at the University of Tennessee College of Law and a class of 2013 candidate for a Juris Doctorate with a concentration in business transactions. She received her BA in Foreign Affairs from the University of Virginia in 2006 and before law school was a manager for strategic planning at Samsung North America. Ms. Ganier and the other authors thank Dawn McCarty at Bloomberg for answering an email and assisting us with access to certain documents that we could not locate without her. ** Frederick L. Conrad III is a student at the University of Tennessee College of Law and a 2013 candidate for a Juris Doctor with a concentration in advocacy and dispute resolution. -

Rthe BIG 18SUE ISSUES I· · I I I I I Stden Ts to Lobby in Aban

Vol. XIX No. 14 Slap My Hind With A Melon Rind, But That's My Penguin State 0' Mind April 15, 1998 Nine out of ten goofy floating heads agree.. rTHE BIG 18SUE ISSUES I· · I I I I i Stden ts to Lobby in Aban By Michael Yeh posals to regulate the practices of utility compa- believe that stronger standards, faster action, and nies. NYPIRG plans to propose a $400 million more citizen participation are needed for the pro- Campus environmental activists plan to clean energy fund that will expand renewable gram to be effective. join other lobbyists in an annual pilgrimage to energy programs and increase the state's energy Lobbyists will be addressed by represen- Albany on Monday, May 11 to encourage support efficiency. Several members of the State Assembly, tatives from the Citizens' Environmental Coalition for earth-friendly legislation. including former Stony Brook professor Steven and. Environmental Advocates, as wells as the The "Earth Day, Lobby Day" event orga- Englebright, have introduced the Ratepayer chairs of the Senate and Assembly Environmental nized by the New York Public Interest Research Protection And Utility Competition Act Of 1998. Conservation Committees. After the lobby meet- Group (NYPIRG) allows students a chance to meet This act shall replace the Long Island Power ings, Governor George Pataki will host a question key legislators and to voice their concerns. "The Authority Board with an elected board in order to and answer session. dt.A ^. d-..- f .,,l*r d«/*/ o t h^^r^1P.<7 n i T-T rI\ UU=sents anIU Lac.uIty Lneeit t ltpreventl i$/llt mi1nion LILUL But for the students, this meeting with make sure that their interests bailout that may result in lawmakers offers a rare glimpse into the world of are being represented up in higher electricity rates. -

Hostess Brands Have Been in the Hearts and Bellies of American Culture Since the 30’S

! ! ! Hostess Brands have been in the hearts and bellies of American culture since the 30’s. It’s safe to bet that they're aren't too many adults or kids that haven’t sunk their teeth into the sweet, gooey, creme-filled sponge cake known as the Twinkie…or a Ho Ho…or a Devil Dog…or one of my childhood favorites, the pretty, pink, coconuty-marshmallowy Sno Ball. ! The story begins in 1919, when the world was introduced to what we now know as the Hostess® CupCake. It’s perhaps the first and most significant moment in the history of snack cakes. Six years later, Continental Baking wanted to add a line of cakes to sell alongside a hot little item they were making called Wonder® bread. This new line of sweet treats became known as Hostess and the quintessential snack brand was born.! In 1930, Continental hit the sponge cake gold mine when Jimmy Dewar invented Twinkies®. On the way to a marketing meeting, Dewar, saw a billboard for Twinkle-Toe Shoes…and the Twinkie was born. At two for a nickel, popularity skyrocketed and it soon became Hostess' best-selling snack cake.The first Twinkies were quite different from the ones we know. For one thing, they were made with banana cream filling, not vanilla. But in World War II, there was a banana shortage, and vanilla became the standard flavor. The eggs, milk and butter in early Twinkies gave them a shelf life of only two days. Dewar had his salesman replenish store shelves every other day, but the practice was expensive and the need for a longer shelf life led to many changes in the Twinkie recipe throughout the years. -

IBC Case Study

Case Study: IBC Case Study Published on Alvarez & Marsal | Management Consulting | Professional Services (https://www.alvarezandmarsal.com) May 20, 2016 A&M was engaged to assess and improve corporate real estate management, renegotiate and restructure lease commitments and to unlock trapped value by selling surplus, functionally obsolete and underutilized real properties. Client Mandate Interstate Bakeries Corporation (“IBC”), the largest wholesale baker and distributor of fresh baked food products in the U.S., with the iconic Wonder Bread and Hostess brands, entered complex bankruptcy proceedings. A&M served as interim Chief Executive Officer and Chief Restructuring Officer during the reorganization. The complexity of the engagement involved several A&M practices, including the Real Estate Advisory Services (A&M REAS). While not its core business, IBC had a large portfolio of owned and leased real estate assets spread among its business units. There was little accountability or monitoring of real estate assets and no contribution benchmarks. A&M REAS was engaged to assess and improve corporate real estate management, renegotiate and restructure lease commitments and to unlock trapped value by selling surplus, functionally obsolete and underutilized real properties. A&M’s Approach Our professionals immediately began to improve performance and reduce the financial commitment of the portfolio through the renegotiation and restructuring of lease commitments under bankruptcy protection. A&M also identified and managed the disposal of surplus, obsolete and underutilized real property across the country. The process began with A&M forging consensus within IBC on properties chosen for disposal and educating IBC on the complex requirements of sales under §363 of the Bankruptcy Code.